|

Crossing Of Cheques

A crossed cheque is a cheque that has been marked specifying an instruction on the way it is to be redeemed. A common instruction is for the cheque to be deposited directly to an account with a bank and not to be immediately cashed by the holder over the bank counter. The format and wording varies between countries, but generally, two parallel lines may be placed either vertically across the cheque or on the top left hand corner of the cheque. By using crossed cheques, cheque writers can effectively protect the instrument from being stolen or cashed by unauthorized persons. Cheques can be open (uncrossed) or crossed. Types of crossing General crossing A crossed cheque generally is a cheque that only bears two parallel transverse lines, optionally with the words 'and company' or '& Co.' (or any abbreviation of them) on the face of the cheque, between the lines, usually at the top left corner or at any place in the approximate half (in width) of the cheque. In the UK, the cross ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

English 1956 Westminster Bank Cheque Of Doris Ogilvie

English usually refers to: * English language * English people English may also refer to: Culture, language and peoples * ''English'', an adjective for something of, from, or related to England * ''English'', an Amish term for non-Amish, regardless of ethnicity * English studies, the study of English language and literature Media * ''English'' (2013 film), a Malayalam-language film * ''English'' (novel), a Chinese book by Wang Gang ** ''English'' (2018 film), a Chinese adaptation * ''The English'' (TV series), a 2022 Western-genre miniseries * ''English'' (play), a 2022 play by Sanaz Toossi People and fictional characters * English (surname), a list of people and fictional characters * English Fisher (1928–2011), American boxing coach * English Gardner (born 1992), American track and field sprinter * English McConnell (1882–1928), Irish footballer * Aiden English, a ring name of Matthew Rehwoldt (born 1987), American former professional wrestler ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cheque

A cheque (or check in American English) is a document that orders a bank, building society, or credit union, to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing the cheque, known as the ''drawer'', has a transaction banking account (often called a current, cheque, chequing, checking, or share draft account) where the money is held. The drawer writes various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the ''drawee'', to pay the amount of money stated to the payee. Although forms of cheques have been in use since ancient times and at least since the 9th century, they became a highly popular non-cash method for making payments during the 20th century and usage of cheques peaked. By the second half of the 20th century, as cheque processing became automated, billions of cheques were issued annually; these volumes peaked in or a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Transactional Account

A transaction account (also called a checking account, cheque account, chequing account, current account, demand deposit account, or share account at credit unions) is a deposit account or bank account held at a bank or other financial institution. It is available to the account owner "on demand" and is available for frequent and immediate access by the account owner or to others as the account owner may direct. Access may be in a variety of ways, such as cash withdrawals, use of debit cards, cheques and electronic transfer. In economic terms, the funds held in a transaction account are regarded as liquid funds. In accounting terms, they are considered as cash. Transaction accounts are known by a variety of descriptions, including a current account (British English), chequing account or checking account when held by a bank, share draft account when held by a credit union in North America. In the Commonwealth of Nations, United Kingdom, Hong Kong, India, Ireland, Australia, New Z ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

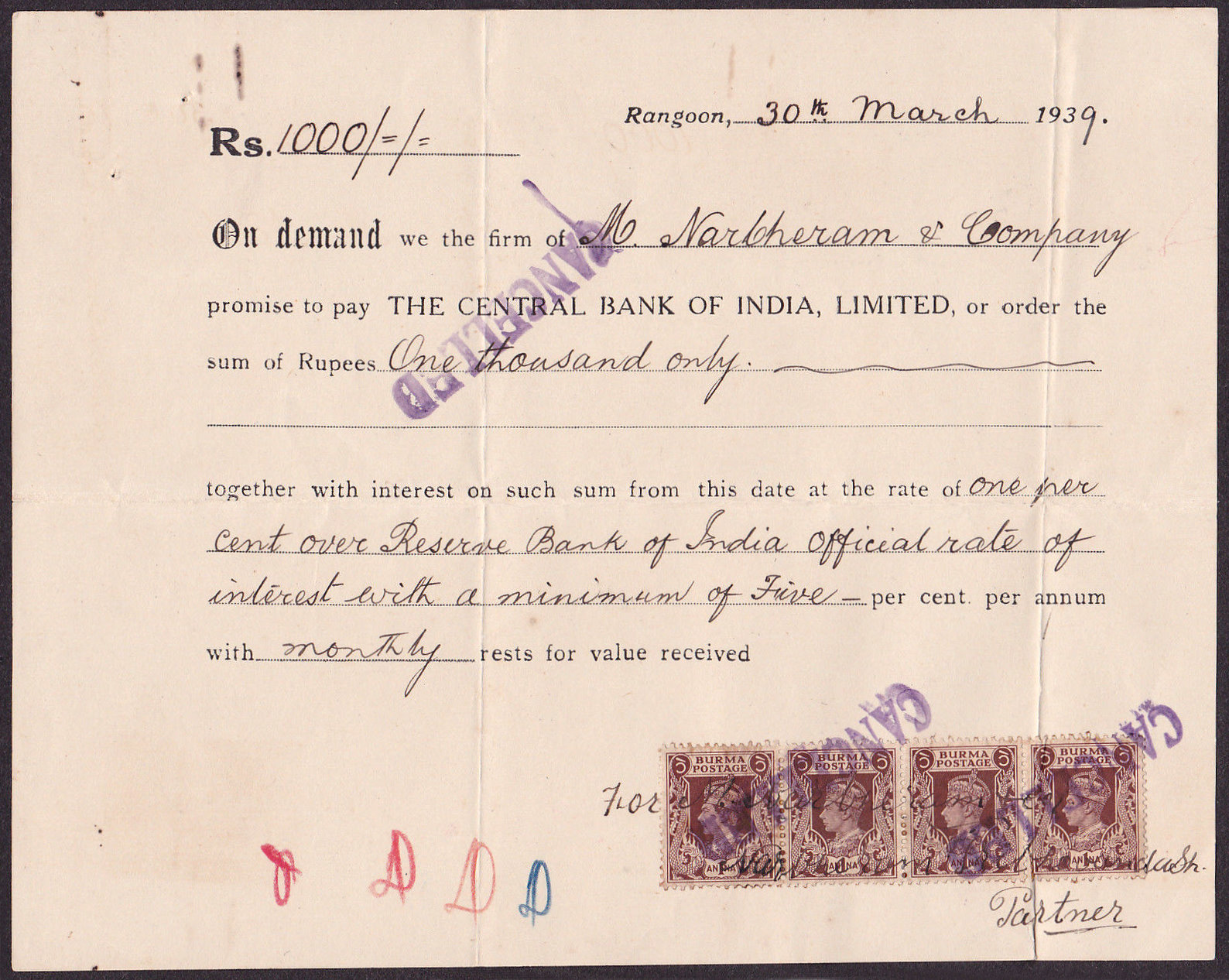

Negotiable Instrument

A negotiable instrument is a document guaranteeing the payment of a specific amount of money, either on demand, or at a set time, whose payer is usually named on the document. More specifically, it is a document contemplated by or consisting of a contract, which promises the payment of money without condition, which may be paid either on demand or at a future date. The term has different meanings, depending on its use in the application of different laws and depending on countries and contexts. The word "negotiable" refers to transferability, and " instrument" refers to a document giving legal effect by the virtue of the law. Concept of negotiability William Searle Holdsworth defines the concept of negotiability as follows: #Negotiable instruments are transferable under the following circumstances: they are transferable by delivery where they are made payable to the bearer, they are transferable by delivery and endorsement where they are made payable to order. #Consideration is p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banking

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. As banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of Bank regulation, regulation over banks. Most countries have institutionalized a system known as fractional-reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure accounting liquidity, liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but, in many ways, functioned as a continuation of ideas and concepts o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cheques

A cheque (or check in American English) is a document that orders a bank, building society, or credit union, to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing the cheque, known as the ''drawer'', has a transaction banking account (often called a current, cheque, chequing, checking, or share draft account) where the money is held. The drawer writes various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the ''drawee'', to pay the amount of money stated to the payee. Although forms of cheques have been in use since ancient times and at least since the 9th century, they became a highly popular non-cash method for making payments during the 20th century and usage of cheques peaked. By the second half of the 20th century, as cheque processing became automated, billions of cheques were issued annually; these volumes peaked in or a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |