|

Cred (company)

CRED is an Indian fintech company, based in Bangalore. Founded in 2018 by Kunal Shah, it is a reward-based credit card payments app. Cred also lets users make house rent payments and provides short-term credit lines. Cred has received criticism for being overvalued and lacking a sound monetization strategy. History Cred was founded in 2018 by Kunal Shah. By 2021, the company had onboarded over 5.9 million users and processed about 20% of all credit card bill payments in India. Kunal Shah describes Cred as being a TrustTech company rather than a FinTech, and that his motivation to start Cred comes from solving trust issues in the Indian society, which he believes is key to economic prosperity Funding and financial results Funding Cred raised funding from DST Global, Sequoia Capital (India), and Tiger Global, among other investors, through the four rounds of private funding so far. Cred posted losses of ₹360.31 crore in the 2020 fiscal year (FY20), caused primaril ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Company

A privately held company (or simply a private company) is a company whose shares and related rights or obligations are not offered for public subscription or publicly negotiated in the respective listed markets, but rather the company's stock is offered, owned, traded, exchanged privately, or Over-the-counter (finance), over-the-counter. In the case of a closed corporation, there are a relatively small number of shareholders or company members. Related terms are closely-held corporation, unquoted company, and unlisted company. Though less visible than their public company, publicly traded counterparts, private companies have major importance in the world's economy. In 2008, the 441 list of largest private non-governmental companies by revenue, largest private companies in the United States accounted for ($1.8 trillion) in revenues and employed 6.2 million people, according to ''Forbes''. In 2005, using a substantially smaller pool size (22.7%) for comparison, the 339 companies on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mergers And Acquisitions

Mergers and acquisitions (M&A) are business transactions in which the ownership of companies, other business organizations, or their operating units are transferred to or consolidated with another company or business organization. As an aspect of strategic management, M&A can allow enterprises to grow or downsize, and change the nature of their business or competitive position. Technically, a is a legal consolidation of two business entities into one, whereas an occurs when one entity takes ownership of another entity's share capital, equity interests or assets. A deal may be euphemistically called a ''merger of equals'' if both CEOs agree that joining together is in the best interest of both of their companies. From a legal and financial point of view, both mergers and acquisitions generally result in the consolidation of assets and liabilities under one entity, and the distinction between the two is not always clear. In most countries, mergers and acquisitions must co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Online Financial Services Companies Of India

In computer technology and telecommunications, online indicates a state of connectivity and offline indicates a disconnected state. In modern terminology, this usually refers to an Internet connection, but (especially when expressed "on line" or "on the line") could refer to any piece of equipment or functional unit that is connected to a larger system. Being online means that the equipment or subsystem is connected, or that it is ready for use. "Online" has come to describe activities performed on and data available on the Internet, for example: "online identity", "online predator", "online gambling", "online game", "online shopping", "online banking", and "E-learning, online learning". Similar meaning is also given by the prefixes "cyber" and "e", as in the words "cyberspace", "cybercrime", "email", and "ecommerce". In contrast, "offline" can refer to either computing activities performed while disconnected from the Internet, or alternatives to Internet activities (such as sho ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services Companies Established In 2018

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability asse ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Indian Companies Established In 2018

Indian or Indians may refer to: Peoples South Asia * Indian people, people of Indian nationality, or people who have an Indian ancestor ** Non-resident Indian, a citizen of India who has temporarily emigrated to another country * South Asian ethnic groups, referring to people of the Indian subcontinent, as well as the greater South Asia region prior to the 1947 partition of India * Anglo-Indians, people with mixed Indian and British ancestry, or people of British descent born or living in the Indian subcontinent * East Indians, a Christian community in India Europe * British Indians, British people of Indian origin The Americas * Indo-Canadians, Canadian people of Indian origin * Indian Americans, American people of Indian origin * Indigenous peoples of the Americas, the pre-Columbian inhabitants of the Americas and their descendants ** Plains Indians, the common name for the Native Americans who lived on the Great Plains of North America ** Native Americans in the Uni ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kuvera

Kubera ( sa, कुबेर, translit=Kuberā) also known as Kuvera, Kuber and Kuberan, is the god of wealth, and the god-king of the semi-divine yakshas in Hinduism. He is regarded as the regent of the north (''Dikpala''), and a protector of the world (''Lokapala''). His many epithets extol him as the overlord of numerous semi-divine species, and the owner of the treasures of the world. Kubera is often depicted with a plump body, adorned with jewels, and carrying a money-pot and a club. Originally described as the chief of evil spirits in Vedic-era texts, Kubera acquired the status of a '' deva'' (god) only in the ''Purana''s and the Hindu epics. The scriptures describe that Kubera once ruled Lanka, but was overthrown by his half-brother Ravana, later settling in the city of Alaka in the Himalayas. Descriptions of the "glory" and "splendour" of Kubera's city are found in many scriptures. Kubera has also been assimilated into the Buddhist and Jain pantheons. In Buddhism, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Startup Company

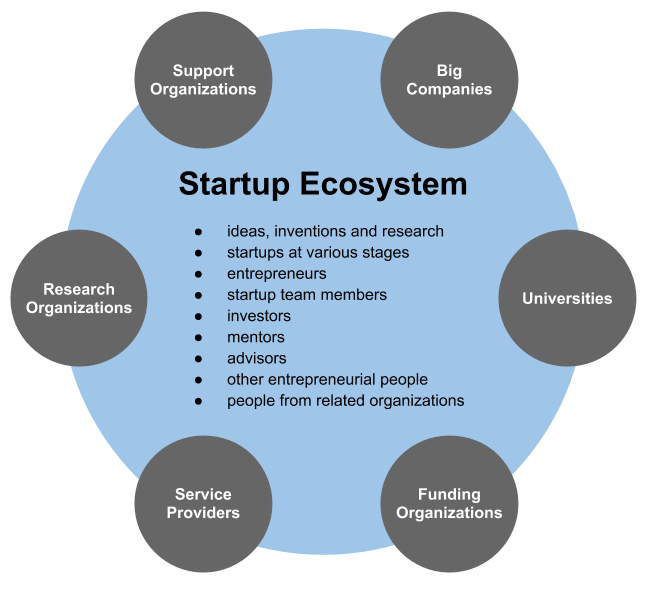

A startup or start-up is a company or project undertaken by an entrepreneur to seek, develop, and validate a scalable business model. While entrepreneurship refers to all new businesses, including self-employment and businesses that never intend to become registered, startups refer to new businesses that intend to grow large beyond the solo founder. At the beginning, startups face high uncertainty and have high rates of failure, but a minority of them do go on to be successful and influential.Erin Griffith (2014)Why startups fail, according to their founders Fortune.com, 25 September 2014; accessed 27 October 2017 Actions Startups typically begin by a founder (solo-founder) or co-founders who have a way to solve a problem. The founder of a startup will begin market validation by problem interview, solution interview, and building a minimum viable product (MVP), i.e. a prototype, to develop and validate their business models. The startup process can take a long period of time (by so ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wealth Management

Wealth management (WM) or wealth management advisory (WMA) is an investment advisory service that provides financial management and wealth advisory services to a wide array of clients ranging from affluent to high-net-worth (HNW) and ultra-high-net-worth (UHNW) individuals and families. It is a discipline which incorporates structuring and planning wealth to assist in growing, preserving, and protecting wealth, whilst passing it onto the family in a tax-efficient manner and in accordance with their wishes. Wealth management brings together tax planning, wealth protection, estate planning, succession planning, and family governance. Private wealth management Private wealth management is delivered to high-net-worth investors. Generally, this includes advice on the use of various estate planning vehicles, business-succession or stock-option planning, and the occasional use of hedging derivatives for large blocks of stock. Traditionally, the wealthiest retail clients of investment f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fintech

Fintech, a portmanteau of "financial technology", refers to firms using new technology to compete with traditional financial methods in the delivery of financial services. Artificial intelligence, blockchain, cloud computing, and big data are regarded as the "ABCD" (four key areas) of fintech. The use of smartphones for mobile banking, investing, borrowing services, and cryptocurrency are examples of technologies designed to make financial services more accessible to the general public. Fintech companies consist of both startups and established financial institutions and technology companies trying to replace or enhance the usage of financial services provided by existing financial companies. A subset of fintech companies that focus on the insurance industry are collectively known as insurtech or insuretech companies. Key areas Academics Artificial intelligence (AI), blockchain, cloud computing, and big data are considered the four key areas of FinTech. Artificial intellige ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Acqui-hiring

Acqui-hiring or Acq-hiring (a portmanteau of "acquisition" and "hiring", also called talent acquisition) is a neologism which describes the process of Mergers and acquisitions, acquiring a company primarily to recruit its employees, rather than to gain control of its products or services. Ben Zimmer traced the derivation of the phrase to a blog post in May 2005. Talent acquisitions can provide a relatively favorable exit strategy for employees, with the prestige of being bought by a larger company, combined with the typical process of hiring. A risk to talent acquisitions are employees that are not interested in working within a corporate environment — which may cause them to defect elsewhere. By the early 2010s, acqui-hiring had become increasingly common in venture capital-backed startup companies, especially within the competitive technology sector (where skilled software engineers working for startups were considered lucrative). By March 2013, Facebook was the largest perfor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lending

In finance, a loan is the lending of money by one or more individuals, organizations, or other entities to other individuals, organizations, etc. The recipient (i.e., the borrower) incurs a debt and is usually liable to pay interest on that debt until it is repaid as well as to repay the principal amount borrowed. The document evidencing the debt (e.g., a promissory note) will normally specify, among other things, the principal amount of money borrowed, the interest rate the lender is charging, and the date of repayment. A loan entails the reallocation of the subject asset(s) for a period of time, between the lender and the borrower. The interest provides an incentive for the lender to engage in the loan. In a legal loan, each of these obligations and restrictions is enforced by contract, which can also place the borrower under additional restrictions known as loan covenants. Although this article focuses on monetary loans, in practice, any material object might be lent. Acti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Expense Management

Expense management refers to the systems deployed by a business to process, pay, and audit employee-initiated expenses. These costs include, but are not limited to, expenses incurred for travel and entertainment. Expense management includes the policies and procedures that govern such spending, as well as the technologies and services utilized to process and analyze the data associated with it. Software to manage the expense claim, authorization, audit and repayment processes can be obtained from organizations that provide a licensed software, implementation and support service, or alternatively, from software as a service (SaaS) providers. SaaS providers offer on-demand web-based applications managed by a third party to improve the productivity of expense management. Steps Expense management automation has two aspects: the process an employee follows in order to complete an expense claim (for example, logging a hotel receipt or submitting mobile phone records) and the activity ac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |