|

Colonial First State

Colonial First State (CFS), is an Australian wealth management group that provides investment, superannuation and retirement products to individuals and corporate and superannuation fund investors. History The company was established in 1988 when the State Bank of New South Wales created First State Fund Management as a subsidiary. In 1994, Colonial Mutual acquired the State Bank of New South Wales from the NSW Government, and on 23 September 1996 the merged entity was rebranded as Colonial State Bank, with First State Fund Management being branded as "Colonial First State" (CFS). CFS demutualised in 1997 and in 2000, it was acquired by the Commonwealth Bank, with the Colonial State Bank division being merged into the Commonwealth Bank. In May 2020, owner Commonwealth Bank announced that, subject to gaining approval from the Australian Prudential Regulation Authority and Foreign Investment Review Board The Australian Foreign Investment Review Board (FIRB), "examines proposa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sydney

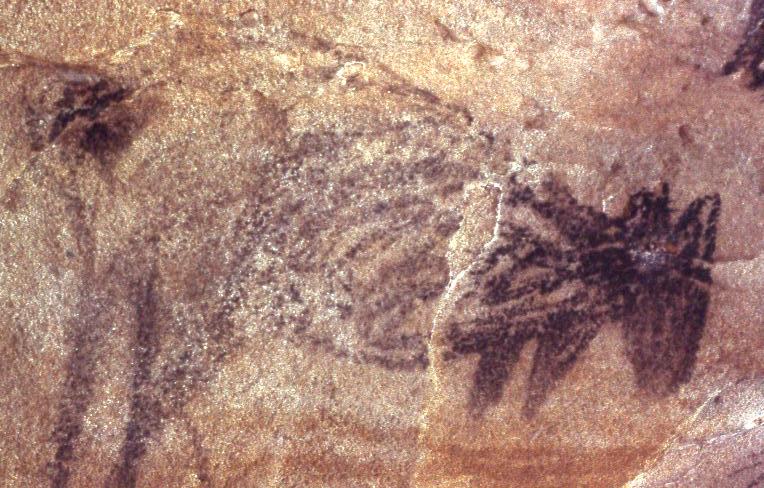

Sydney ( ) is the capital city of the state of New South Wales, and the most populous city in both Australia and Oceania. Located on Australia's east coast, the metropolis surrounds Sydney Harbour and extends about towards the Blue Mountains to the west, Hawkesbury to the north, the Royal National Park to the south and Macarthur to the south-west. Sydney is made up of 658 suburbs, spread across 33 local government areas. Residents of the city are known as "Sydneysiders". The 2021 census recorded the population of Greater Sydney as 5,231,150, meaning the city is home to approximately 66% of the state's population. Estimated resident population, 30 June 2017. Nicknames of the city include the 'Emerald City' and the 'Harbour City'. Aboriginal Australians have inhabited the Greater Sydney region for at least 30,000 years, and Aboriginal engravings and cultural sites are common throughout Greater Sydney. The traditional custodians of the land on which modern Sydney stands ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commonwealth Bank

The Commonwealth Bank of Australia (CBA), or CommBank, is an Australian multinational bank with businesses across New Zealand, Asia, the United States and the United Kingdom. It provides a variety of financial services including retail, business and institutional banking, funds management, superannuation, insurance, investment and broking services. The Commonwealth Bank is the largest Australian listed company on the Australian Securities Exchange as of August 2015 with brands including Bankwest, Colonial First State Investments, ASB Bank (New Zealand), Commonwealth Securities (CommSec) and Commonwealth Insurance (CommInsure). Its former constituent parts were the Commonwealth Trading Bank of Australia, the Commonwealth Savings Bank of Australia, and the Commonwealth Development Bank. Founded in 1911 by the Australian Government and fully privatised in 1996, the Commonwealth Bank is one of the " big four" Australian banks, with the National Australia Bank (NAB), ANZ and We ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Superannuation

A pension (, from Latin ''pensiō'', "payment") is a fund into which a sum of money is added during an employee's employment years and from which payments are drawn to support the person's retirement from work in the form of periodic payments. A pension may be a " defined benefit plan", where a fixed sum is paid regularly to a person, or a " defined contribution plan", under which a fixed sum is invested that then becomes available at retirement age. Pensions should not be confused with severance pay; the former is usually paid in regular amounts for life after retirement, while the latter is typically paid as a fixed amount after involuntary termination of employment before retirement. The terms "retirement plan" and "superannuation" tend to refer to a pension granted upon retirement of the individual. Retirement plans may be set up by employers, insurance companies, the government, or other institutions such as employer associations or trade unions. Called ''retirement pla ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

State Bank Of New South Wales

The State Bank of New South Wales, from 1933 until 1981 known as the Rural Bank of New South Wales, was a bank that was owned by the Government of New South Wales. It existed from 1933 until 1994, when it was taken over by the Colonial State Bank and then the Commonwealth Bank in 2000. History of operations Founding and growth By early 1931, the Government Savings Bank was in financial trouble in the midst of the Great Depression, and on 22 April 1931 the Bank suspended payments after a drain on its cash resources. On 15 December 1931, the majority of the Government Savings Bank was amalgamated into the Commonwealth Savings Bank. The Rural Bank and Advance Homes Departments of the Government Savings Bank were not taken over by the Commonwealth Savings Bank, and continued to operate. In late 1932, the NSW Government led by Assistant Treasurer Eric Spooner introduced legislation to reconstitute what remained of the Government Savings Bank into a new "Rural Bank of New South Wales ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Colonial Mutual

The Colonial Mutual Life Assurance Society Limited, later Colonial Limited, and commonly known as Colonial Mutual, Colonial Mutual Life, and/or CML, was a diverse international financial services company headquartered in Melbourne, Australia. Colonial's core businesses were life and general insurance, retirement savings, banking and funds management. The company operated in the United Kingdom, New Zealand and the Fiji Islands for more than a century. It was a mutual society for most of its history, and demutualised in 1997. In 1994, Colonial acquired the State Bank of New South Wales, including the bank's First State investment management business. Colonial was acquired by Commonwealth Bank in 2000. The Colonial name lives on in the Colonial First State subsidiary of the Commonwealth Bank. History Colonial was founded in Melbourne in 1873. The first President of the Society was Sir Redmond Barry. The first Chief Manager was Thomas Jacques Martin. In the 1980s, Jacques ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Demutualised

Demutualization is the process by which a customer-owned mutual organization (''mutual'') or co-operative changes legal form to a joint stock company. It is sometimes called stocking or privatization. As part of the demutualization process, members of a mutual usually receive a "windfall" payout, in the form of shares in the successor company, a cash payment, or a mixture of both. Mutualization or mutualisation is the opposite process, wherein a shareholder-owned company is converted into a mutual organization, typically through takeover by an existing mutual organization. Furthermore, re-mutualization depicts the process of aligning or refreshing the interest and objectives of the members of the mutual society. The mutual traditionally raises capital from its customer members in order to provide services to them (for example building societies, where members' savings enable the provision of mortgages to members). It redistributes some profits to its members. By contrast, a jo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Australian Prudential Regulation Authority

The Australian Prudential Regulation Authority (APRA) is a statutory authority of the Australian Government and the prudential regulator of the Australian financial services industry. APRA was established on 1 July 1998 in response to the recommendations of the Wallis Inquiry. APRA's authority and scope is determined pursuant to the . Regulatory scope APRA was established on 1 July 1998. It oversees banks, credit unions, building societies, friendly societies, general insurance, health insurance, reinsurance, and life insurance companies, and most members of the superannuation industry. It ensures that these institutions keep their financial promises; that is, that they will remain financially sound and able to meet their obligations to depositors, fund members and policy holders. APRA currently supervises institutions holding A$8.6 trillion in assets for Australian depositors, policyholders and superannuation fund members. APRA is largely funded by levies on the fina ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreign Investment Review Board

The Australian Foreign Investment Review Board (FIRB), "examines proposals by foreign persons to invest in Australia and makes recommendations to the Treasurer on those subject to the Foreign Acquisitions and Takeovers Act 1975 and Australia's foreign investment policy. The FIRB is independent but is assisted by the executive to the treasury." Their functions include: *Evaluating foreign investment proposals *Pushing Australian equity participation in new investors who want to invest in Australia *Monitor foreign-controlled businesses in Australia *Review and approval of the purchase of property in Australia by non-residents *Liaise with state and local governments References Commonwealth Government agencies of Australia Investment in Australia Government agencies established in 1976 1976 establishments in Australia {{Australia-gov-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services Companies Based In Sydney

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Companies Of Australia

Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time. Investment requires a sacrifice of some present asset, such as time, money, or effort. In finance, the purpose of investing is to generate a return from the invested asset. The return may consist of a gain (profit) or a loss realized from the sale of a property or an investment, unrealized capital appreciation (or depreciation), or investment income such as dividends, interest, or rental income, or a combination of capital gain and income. The return may also include currency gains or losses due to changes in the foreign currency exchange rates. Investors generally expect higher returns from riskier investments. When a low-risk investment is made, the return is also generally low. Similarly, high risk comes with a chance of high losses. Investors, particularly novices, are often advised to diversify their portfolio. Diversification has the statistical effect ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |