|

Co-operative Financial Services

Co-operative Banking Group Limited (originally Co-operative Financial Services) was a UK-based banking and insurance company and a wholly owned subsidiary of The Co-operative Group. Established in 2002, its head office was located at the CIS Tower, Miller Street, Manchester. It was mainly known through its two main subsidiaries: The Co-operative Bank (incorporating Smile, the first full internet bank in the UK) and The Co-operative Insurance. Co-operative Financial Services was formed as a holding company to bring these financial subsidiaries together under one umbrella society and to enable synergies between the businesses to be exploited. Following the Co-operative Bank's financial crisis in 2013, the group sold a majority of shares in the business, retaining a 20% stake. As a result, the group was reorganised, and the banking group structure was discontinued. History In 2007, the Group agreed to outsource its information systems to Xansa (now Sopra Steria). In 2008, Co-operativ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumer Co-operative

A consumers' co-operative is an enterprise owned by consumers and managed democratically and that aims at fulfilling the needs and aspirations of its members. Such co-operatives operate within the market system, independently of the state, as a form of mutual aid, oriented toward service rather than pecuniary profit. Consumers' cooperatives often take the form of retail outlets owned and operated by their consumers, such as food co-ops. However, there are many types of consumers' cooperatives, operating in areas such as health care, insurance, housing, utilities and personal finance (including credit unions). In some countries, consumers' cooperatives are known as cooperative retail societies or retail co-ops, though they should not be confused with retailers' cooperatives, whose members are retailers rather than consumers. Consumers' cooperatives may, in turn, form cooperative federations. These may come in the form of cooperative wholesale societies, through which consumers' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sopra Steria

Sopra Steria is a Paris-based consulting, digital services, and software development company. Sopra Steria has a new consulting wing under the “Next” brand. It employs 3,400 consultants across Europe, including 1,900 in the group’s native France. After adding the shares held directly in registered form by current and former Group employees, these proportions amount to nearl10% of the share capitaland 13% of voting rights, thereby making employees the Group’s second-largest shareholder. History Sopra was created in 1968, followed closely by the 1969 founding of Steria. SODERI (Information Research and Development Company) holds 51%, the BNP Group holds 29.5% and the Indochina Group holds 19.5%. By 1971, Sopra signed its first large global banking managed services agreement, which led to the first banking platform the following year. Steria computerized Agence France-Presse in 1973 by creating a text processing system that enables real-time information transmission. After ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Of England

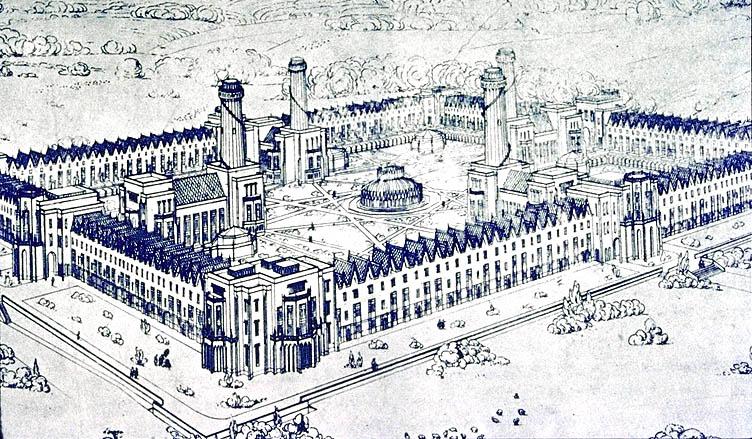

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694 to act as the English Government's banker, and still one of the bankers for the Government of the United Kingdom, it is the world's eighth-oldest bank. It was privately owned by stockholders from its foundation in 1694 until it was nationalised in 1946 by the Attlee ministry. The Bank became an independent public organisation in 1998, wholly owned by the Treasury Solicitor on behalf of the government, with a mandate to support the economic policies of the government of the day, but independence in maintaining price stability. The Bank is one of eight banks authorised to issue banknotes in the United Kingdom, has a monopoly on the issue of banknotes in England and Wales, and regulates the issue of banknotes by commercial banks in Scotland and Northern Ireland. The Bank's Monetary Policy Committee has devolved responsibility for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pound Sterling

Sterling (abbreviation: stg; Other spelling styles, such as STG and Stg, are also seen. ISO code: GBP) is the currency of the United Kingdom and nine of its associated territories. The pound ( sign: £) is the main unit of sterling, and the word "pound" is also used to refer to the British currency generally, often qualified in international contexts as the British pound or the pound sterling. Sterling is the world's oldest currency that is still in use and that has been in continuous use since its inception. It is currently the fourth most-traded currency in the foreign exchange market, after the United States dollar, the euro, and the Japanese yen. Together with those three currencies and Renminbi, it forms the basket of currencies which calculate the value of IMF special drawing rights. As of mid-2021, sterling is also the fourth most-held reserve currency in global reserves. The Bank of England is the central bank for sterling, issuing its own banknotes, and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Royal London Group

The Royal London Mutual Insurance Society Limited, along with its subsidiaries, is the largest mutual insurer in the United Kingdom, with Group funds under management of over £150 billion. Group businesses provide around nine million policies and employ 4046 people, as of June 2019. Group Royal London is the largest mutual life, pensions and investment company in the UK, while also providing protection products in Ireland. Offices Royal London is registered in England with its head office in the City of London. It has other large offices in Alderley Park and Edinburgh, with smaller offices in Glasgow, Dublin, Lichfield & Liverpool. History Founded in 1861 by Joseph Degge and Henry Ridge in a London coffee shop, Royal London was initially set up as a friendly society dedicated to serving the interest of its members and securing their financial security. Royal London became a mutual life assurance society in 1908. Other elements of the modern business are older than the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Rating

A credit rating is an evaluation of the credit risk of a prospective debtor (an individual, a business, company or a government), predicting their ability to pay back the debt, and an implicit forecast of the likelihood of the debtor defaulting. The credit rating represents an evaluation of a credit rating agency of the qualitative and quantitative information for the prospective debtor, including information provided by the prospective debtor and other non-public information obtained by the credit rating agency's analysts. Credit reporting (or credit score) – is a subset of credit rating – it is a numeric evaluation of an ''individual's'' credit worthiness, which is done by a credit bureau or consumer credit reporting agency. Sovereign credit ratings A sovereign credit rating is the credit rating of a sovereign entity, such as a national government. The sovereign credit rating indicates the risk level of the investing environment of a country and is used by investors whe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Moody's

Moody's Investors Service, often referred to as Moody's, is the bond credit rating business of Moody's Corporation, representing the company's traditional line of business and its historical name. Moody's Investors Service provides international financial research on bonds issued by commercial and government entities. Moody's, along with Standard & Poor's and Fitch Group, is considered one of the Big Three credit rating agencies. It is also included in the Fortune 500 list of 2021. The company ranks the creditworthiness of borrowers using a standardized ratings scale which measures expected investor loss in the event of default. Moody's Investors Service rates debt securities in several bond market segments. These include government, municipal and corporate bonds; managed investments such as money market funds and fixed-income funds; financial institutions including banks and non-bank finance companies; and asset classes in structured finance. In Moody's Investors Service' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Commission

The European Commission (EC) is the executive of the European Union (EU). It operates as a cabinet government, with 27 members of the Commission (informally known as "Commissioners") headed by a President. It includes an administrative body of about 32,000 European civil servants. The Commission is divided into departments known as Directorates-General (DGs) that can be likened to departments or ministries each headed by a Director-General who is responsible to a Commissioner. There is one member per member state, but members are bound by their oath of office to represent the general interest of the EU as a whole rather than their home state. The Commission President (currently Ursula von der Leyen) is proposed by the European Council (the 27 heads of state/governments) and elected by the European Parliament. The Council of the European Union then nominates the other members of the Commission in agreement with the nominated President, and the 27 members as a team are then ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lloyds Banking Group

Lloyds Banking Group is a British financial institution formed through the acquisition of HBOS by Lloyds TSB in 2009. It is one of the UK's largest financial services organisations, with 30 million customers and 65,000 employees. Lloyds Bank was founded in 1765 but the wider Group's heritage extends over 320 years, dating back to the founding of the Bank of Scotland by the Parliament of Scotland in 1695. The Group's headquarters are located at 25 Gresham Street in the City of London, while its registered office is on The Mound in Edinburgh. It also operates office sites in Birmingham, Bristol, West Yorkshire and Glasgow. The Group also has extensive overseas operations in the US, Europe, the Middle East and Asia. Its headquarters for business in the European Union is in Berlin, Germany. The business operates under a number of distinct brands, including Lloyds Bank, Halifax, Bank of Scotland and Scottish Widows. Former Chief Executive António Horta-Osório told ''The Banker' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Suisse

Credit Suisse Group AG is a global investment bank and financial services firm founded and based in Switzerland. Headquartered in Zürich, it maintains offices in all major financial centers around the world and is one of the nine global " Bulge Bracket" banks providing services in investment banking, private banking, asset management, and shared services. It is known for strict bank–client confidentiality and banking secrecy. The Financial Stability Board considers it to be a global systemically important bank. Credit Suisse is also primary dealer and Forex counterparty of the Fed. Credit Suisse was founded in 1856 to fund the development of Switzerland's rail system. It issued loans that helped create Switzerland's electrical grid and the European rail system. In the 1900s, it began shifting to retail banking in response to the elevation of the middle class and competition from fellow Swiss banks UBS and Julius Bär. Credit Suisse partnered with First Boston in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Building Societies (Funding) And Mutual Societies (Transfers) Act 2007

The Building Societies (Funding) and Mutual Societies (Transfers) Act 2007 (sometimes referred to as the Butterfill Act) is an Act of the Parliament of the United Kingdom. The Act gives building societies greater powers to merge with other companies. Passage through Parliament The Bill was introduced as a Private Members' Bill by Conservative Member of Parliament Sir John Butterfill, originally titled the Financial Mutuals Arrangements Bill. It was also known as the Butterfill Bill. Mergers under the Act There have been several high-profile mergers under the auspices of the Act. In August 2009, Britannia Building Society merged with Co-operative Financial Services (part of The Co-operative Group). Britannia initially continued as a brand, although owned by the Co-op. In February 2011, Kent Reliance Building Society pooled its assets with American private equity bank J.C. Flowers & Co.. J.C. Flowers & Co. has a 40% interest in the new bank, named OneSavings Bank plc, wit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Britannia Building Society

The Britannia Building Society was founded as the Leek & Moorlands Building Society in Leek in 1856. It expanded steadily as a regional society until the late 1950s when it began a major expansion drive, partly through branch openings but also some 55 acquisitions. The most substantial of these were the NALGO Building Society in 1960; the Westbourne Park in 1965 (becoming the Leek and Westbourne); and the Eastern Counties Building Society in 1974. The Society’s name was changed to the Britannia Building Society the following year. Following theacquisition of the Bristol & West in 2005, the Britannia became the second-largest building society in the UK (based on total assets of £36.8 billion) at 31 December 2007. It merged with The Co-operative Banking Group in 2009, and was legally dissolved as a separate organisation on 1 August that year; it has remained as a trading name of The Co-operative Bank ever since. In January 2013, the Co-operative announced that the brand would b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |