|

Checkwriter

A checkwriter may refer to: Occupation A person who physically writes a check or cheque. The check writer is also known as the "payor", "signer", "maker", the drawer, or the "account holder". The signer or presenter of the check, or person who prints and authorizes the check. In U.S. law, in Article 3 of the Uniform Commercial Code, codified in most U.S. State statutes, a check is an order (as opposed to a promise) to pay a fixed amount of money, according to §3-104(a). §3-104(f) specifies that Such an order is issued by the drawer. §3-103(a)(3) specifies that Machine A check writer (also known as a "ribbon writer", "check signer", "check protector" or "check embosser"), is a physical device for protecting a check from unauthorized alteration of either the amount or the authorizing signature. Devices of this type that use various technologies are also known as check protectors, check punches, and check perforators. A check punch punches holes in the shapes of numerals ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Money Order

A money order is a directive to pay a pre-specified amount of money from prepaid funds, making it a more trusted method of payment than a cheque. History The money order system was established by a private firm in Great Britain in 1792 and was expensive and not very successful. Around 1836 it was sold to another private firm which lowered the fees, significantly increasing the popularity and usage of the system. The Post Office noted the success and profitability, and it took over the system in 1838. Fees were further reduced and usage increased further, making the money order system reasonably profitable. The only draw-back was the need to send an advance to the paying post office before payment could be tendered to the recipient of the order. This drawback was likely the primary incentive for establishment of the Postal Order System on 1 January 1881. Usage A money order is purchased for the amount desired. In this way it is similar to a certified cheque. The main difference i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

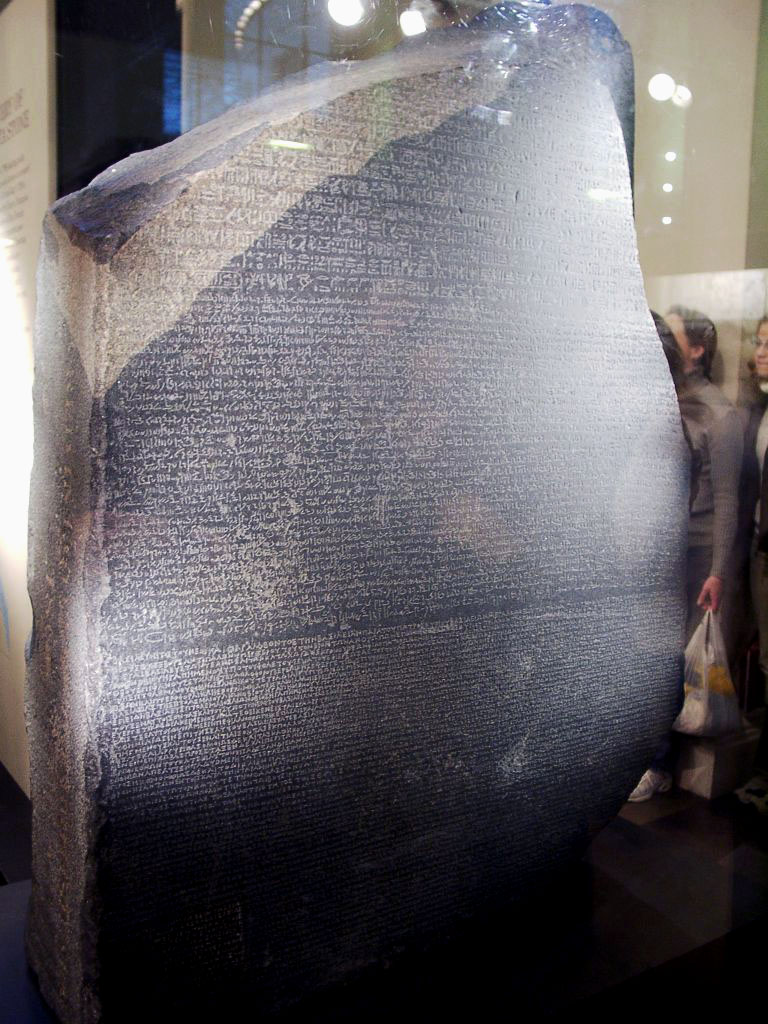

Write

Writing is a medium of human communication which involves the representation of a language through a system of physically inscribed, mechanically transferred, or digitally represented symbols. Writing systems do not themselves constitute human languages (with the debatable exception of computer languages); they are a means of rendering language into a form that can be reconstructed by other humans separated by time and/or space. While not all languages use a writing system, those that do can complement and extend capacities of spoken language by creating durable forms of language that can be transmitted across space (e.g. written correspondence) and stored over time (e.g. libraries or other public records). It has also been observed that the activity of writing itself can have knowledge-transforming effects, since it allows humans to externalize their thinking in forms that are easier to reflect on, elaborate, reconsider, and revise. A system of writing relies on many of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Demand Draft

A demand draft (DD) is a negotiable instrument similar to a bill of exchange. A bank issues a demand draft to a client (drawer), directing another bank (drawee) or one of its own branches to pay a certain sum to the specified party (payee). A demand draft can also be compared to a cheque. However, demand drafts are difficult to countermand. Demand drafts can only be made payable to a specified party, also known as pay-to-order. But, cheques can also be made payable to the bearer. Demand drafts are orders of payment by a bank to another bank, whereas cheques are orders of payment from an account holder to the bank. A Drawer has to visit the branch of the Bank and fill the DD form and pay the amount either by cash or any other mode, and Bank will issue DD emand draft A Demand Draft has a validity of three months from the date of issuance of DD. For Example, Joining in College needs an admission fee and the college can collect the amount either by cash or DD. Most Colleges won't accep ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banker's Draft

A banker's draft (also called a bank cheque, bank draft in Canada or, in the US, a teller's check) is a cheque (or check) provided to a customer of a bank or acquired from a bank for remittance purposes, that is drawn by the bank, and drawn on another bank or payable through or at a bank. A normal cheque represents an instruction to transfer a sum of money from the drawer's account to the payee's account. When the payee deposits the cheque into their account, the cheque is verified as genuine (or 'cleared', a process typically taking several days) and the transfer is performed (usually via a clearing house or similar system). Any individual or company operating a current account (or checking account) has authority to draw cheques against the funds stored in that account. However, it is impossible to predict when the cheque will be deposited after it is drawn. Because the funds represented by a cheque are not transferred until the cheque is deposited and cleared, it is possib ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cashier's Check

A cashier's check (or cashier's cheque, cashier's order) is a check guaranteed by a bank, drawn on the bank's own funds and signed by a cashier. Cashier's checks are treated as guaranteed funds because the bank, rather than the purchaser, is responsible for paying the amount. They are commonly required for real estate and brokerage transactions. Genuine cashier's checks deposited into a bank account are usually cleared the next day. The customer can request "next-day availability" when depositing a cashier's check in person. Forged cashier's checks may bounce 2 weeks after being deposited. When cashier’s checks took weeks to clear the banks, they were often forged in fraud schemes. The recipient of the check would deposit it in their account and withdraw funds under next-day availability, assuming it was legitimate. The bank might not be informed the check was fraudulent until, perhaps, weeks after the customer had withdrawn funds made available by the fraudulent deposit, by wh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Microsoft Windows

Windows is a group of several Proprietary software, proprietary graphical user interface, graphical operating system families developed and marketed by Microsoft. Each family caters to a certain sector of the computing industry. For example, Windows NT for consumers, Windows Server for servers, and Windows IoT for embedded systems. Defunct Windows families include Windows 9x, Windows Mobile, and Windows Phone. The first version of Windows was released on November 20, 1985, as a graphical operating system shell for MS-DOS in response to the growing interest in graphical user interfaces (GUIs). Windows is the most popular desktop operating system in the world, with Usage share of operating systems, 75% market share , according to StatCounter. However, Windows is not the most used operating system when including both mobile and desktop OSes, due to Android (operating system), Android's massive growth. , the most recent version of Windows is Windows 11 for consumer Personal compu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Check 21 Act

The Check Clearing for the 21st Century Act (or Check 21 Act) is a United States federal law, , that was enacted on October 28, 2003 by the 108th U.S. Congress. The Check 21 Act took effect one year later on October 28, 2004. The law allows the recipient of the original paper check to create a digital version of the original check, a process known as check truncation, into an electronic format called a " substitute check", thereby eliminating the need for further handling of the physical document. In essence, the recipient bank no longer returns the paper check, but effectively e-mails an image of both sides of the check to the bank it is drawn upon. Consumers are most likely to see the effects of this act when they notice that certain checks (or images thereof) are no longer being returned to them with their monthly statement, even though other checks are still being returned. Another effect of the law is that it is now legal for anyone to use a computer scanner or mobile pho ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Demand Draft

A demand draft (DD) is a negotiable instrument similar to a bill of exchange. A bank issues a demand draft to a client (drawer), directing another bank (drawee) or one of its own branches to pay a certain sum to the specified party (payee). A demand draft can also be compared to a cheque. However, demand drafts are difficult to countermand. Demand drafts can only be made payable to a specified party, also known as pay-to-order. But, cheques can also be made payable to the bearer. Demand drafts are orders of payment by a bank to another bank, whereas cheques are orders of payment from an account holder to the bank. A Drawer has to visit the branch of the Bank and fill the DD form and pay the amount either by cash or any other mode, and Bank will issue DD emand draft A Demand Draft has a validity of three months from the date of issuance of DD. For Example, Joining in College needs an admission fee and the college can collect the amount either by cash or DD. Most Colleges won't accep ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Software

Software is a set of computer programs and associated software documentation, documentation and data (computing), data. This is in contrast to Computer hardware, hardware, from which the system is built and which actually performs the work. At the low level language, lowest programming level, executable code consists of Machine code, machine language instructions supported by an individual Microprocessor, processor—typically a central processing unit (CPU) or a graphics processing unit (GPU). Machine language consists of groups of Binary number, binary values signifying Instruction set architecture, processor instructions that change the state of the computer from its preceding state. For example, an instruction may change the value stored in a particular storage location in the computer—an effect that is not directly observable to the user. An instruction System call, may also invoke one of many Input/output, input or output operations, for example displaying some text on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Postal Service

The United States Postal Service (USPS), also known as the Post Office, U.S. Mail, or Postal Service, is an Independent agencies of the United States government, independent agency of the executive branch of the Federal government of the United States, United States federal government responsible for providing mail, postal service in the U.S., including its insular areas and Compact of Free Association, associated states. It is one of the few government agencies Postal Clause, explicitly authorized by the U.S. Constitution. The USPS, as of 2021, has 516,636 career employees and 136,531 non-career employees. The USPS traces its roots to 1775 during the Second Continental Congress, when Benjamin Franklin was appointed the first United States Postmaster General, postmaster general; he also served a similar position for the colonies of the Kingdom of Great Britain. The United States Post Office Department, Post Office Department was created in 1792 with the passage of the Postal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cashier's Check

A cashier's check (or cashier's cheque, cashier's order) is a check guaranteed by a bank, drawn on the bank's own funds and signed by a cashier. Cashier's checks are treated as guaranteed funds because the bank, rather than the purchaser, is responsible for paying the amount. They are commonly required for real estate and brokerage transactions. Genuine cashier's checks deposited into a bank account are usually cleared the next day. The customer can request "next-day availability" when depositing a cashier's check in person. Forged cashier's checks may bounce 2 weeks after being deposited. When cashier’s checks took weeks to clear the banks, they were often forged in fraud schemes. The recipient of the check would deposit it in their account and withdraw funds under next-day availability, assuming it was legitimate. The bank might not be informed the check was fraudulent until, perhaps, weeks after the customer had withdrawn funds made available by the fraudulent deposit, by wh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |