|

Chance-constrained Portfolio Selection

Chance-constrained portfolio selection is an approach to portfolio selection under Loss aversion. The formulation assumes that investor’s preferences are representable by the expected utility of final wealth, and that they require to be acceptably low, the probability of their final wealth falling below a survival or safety level. The chance-constrained portfolio problem is then to find: :Max \sum_wjE(Xj), subject to Pr(\sum_ wjXj < s) ≤ , wj = 1, wj ≥ 0 for all j, ::where s is the survival level and is the admissible probability of ruin; w is the weight and x is the value of the ''jth'' asset to be included in the portfolio. The original implementation is based on the seminal work of Abraham Charnes and [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Portfolio Optimization

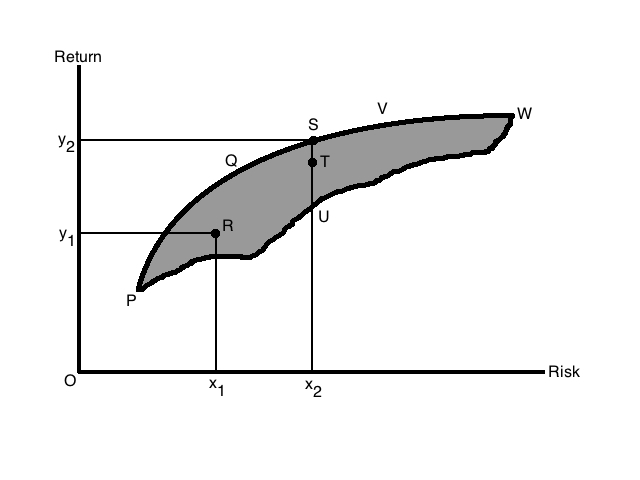

Portfolio optimization is the process of selecting the best portfolio (asset distribution), out of the set of all portfolios being considered, according to some objective. The objective typically maximizes factors such as expected return, and minimizes costs like financial risk. Factors being considered may range from tangible (such as assets, liabilities, earnings or other fundamentals) to intangible (such as selective divestment). Modern portfolio theory Modern portfolio theory was introduced in a 1952 doctoral thesis by Harry Markowitz; see Markowitz model. It assumes that an investor wants to maximize a portfolio's expected return contingent on any given amount of risk. For portfolios that meet this criterion, known as efficient portfolios, achieving a higher expected return requires taking on more risk, so investors are faced with a trade-off between risk and expected return. This risk-expected return relationship of efficient portfolios is graphically represented by a curve ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Markowitz Model

In finance, the Markowitz model ─ put forward by Harry Markowitz in 1952 ─ is a portfolio optimization model; it assists in the selection of the most efficient portfolio by analyzing various possible portfolios of the given securities. Here, by choosing securities that do not 'move' exactly together, the HM model shows investors how to reduce their risk. The HM model is also called mean-variance model due to the fact that it is based on expected returns (mean) and the standard deviation (variance) of the various portfolios. It is foundational to Modern portfolio theory. Assumptions Markowitz made the following assumptions while developing the HM model: # Risk of a portfolio is based on the variability of returns from said portfolio. # An investor is risk averse. # An investor prefers to increase consumption. # The investor's utility function is concave and increasing, due to their risk aversion and consumption preference. # Analysis is based on single period model of inv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stochastic Optimization

Stochastic optimization (SO) methods are optimization methods that generate and use random variables. For stochastic problems, the random variables appear in the formulation of the optimization problem itself, which involves random objective functions or random constraints. Stochastic optimization methods also include methods with random iterates. Some stochastic optimization methods use random iterates to solve stochastic problems, combining both meanings of stochastic optimization. Stochastic optimization methods generalize deterministic methods for deterministic problems. Methods for stochastic functions Partly random input data arise in such areas as real-time estimation and control, simulation-based optimization where Monte Carlo simulations are run as estimates of an actual system, and problems where there is experimental (random) error in the measurements of the criterion. In such cases, knowledge that the function values are contaminated by random "noise" leads natural ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Portfolio Theories

Portfolio may refer to: Objects * Portfolio (briefcase), a type of briefcase Collections * Portfolio (finance), a collection of assets held by an institution or a private individual * Artist's portfolio, a sample of an artist's work or a case used to display artwork, photographs etc. * Career portfolio, an organized presentation of an individual's education, work samples, and skills * Electronic portfolio, a collection of electronic documents * IT portfolio, in IT portfolio management, the portfolio of large classes of items of enterprise Information Technology * Patent portfolio, a collection of patents owned by a single entity * Project portfolio, in project portfolio management, the portfolio of projects in an organization * Ministry (government department), the post and responsibilities of a head of a government department Computing * Atari Portfolio, a palmtop computer * Extensis Portfolio, a digital asset manager Media * '' The Portfolio'', a British fine ar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Post Modern Portfolio Theory

Post-Modern Portfolio Theory (PMPT) is an extension of the traditional Modern Portfolio Theory (MPT), an application of mean-variance analysis (MVA). Both theories propose how rational investors can use diversification to optimize their portfolios. History Post-Modern Portfolio Theory was introduced in 1991 by software entrepreneurs Brian M. Rom and Kathleen Ferguson to differentiate the portfolio-construction software developed by their company, Investment Technologies, LLC, from those provided by the traditional modern portfolio theory. It first appeared in the literature in 1993 in an article by Rom and Ferguson in ''The Journal of Performance Measurement''. It combines the theoretical research of many authors and has expanded over several decades as academics at universities in many countries tested these theories to determine whether or not they had merit. The essential difference between PMPT and the modern portfolio theory of Markowitz and Sharpe (MPT) is that PMPT focuses on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Asset Pricing Model

In finance, the capital asset pricing model (CAPM) is a model used to determine a theoretically appropriate required rate of return of an asset, to make decisions about adding assets to a well-diversified portfolio. The model takes into account the asset's sensitivity to non-diversifiable risk (also known as systematic risk or market risk), often represented by the quantity beta (β) in the financial industry, as well as the expected return of the market and the expected return of a theoretical risk-free asset. CAPM assumes a particular form of utility functions (in which only first and second moments matter, that is risk is measured by variance, for example a quadratic utility) or alternatively asset returns whose probability distributions are completely described by the first two moments (for example, the normal distribution) and zero transaction costs (necessary for diversification to get rid of all idiosyncratic risk). Under these conditions, CAPM shows that the cost ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Expected Utility Theory

The expected utility hypothesis is a popular concept in economics that serves as a reference guide for decisions when the payoff is uncertain. The theory recommends which option rational individuals should choose in a complex situation, based on their risk appetite and preferences. The expected utility hypothesis states an agent chooses between risky prospects by comparing expected utility values (i.e. the weighted sum of adding the respective utility values of payoffs multiplied by their probabilities). The summarised formula for expected utility is U(p)=\sum u(x_k)p_k where p_k is the probability that outcome indexed by k with payoff x_k is realized, and function ''u'' expresses the utility of each respective payoff. On a graph, the curvature of u will explain the agent's risk attitude. For example, if an agent derives 0 utils from 0 apples, 2 utils from one apple, and 3 utils from two apples, their expected utility for a 50–50 gamble between zero apples and two is 0.5''u''(0 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stochastic Programming

In the field of mathematical optimization, stochastic programming is a framework for modeling optimization problems that involve uncertainty. A stochastic program is an optimization problem in which some or all problem parameters are uncertain, but follow known probability distributions. This framework contrasts with deterministic optimization, in which all problem parameters are assumed to be known exactly. The goal of stochastic programming is to find a decision which both optimizes some criteria chosen by the decision maker, and appropriately accounts for the uncertainty of the problem parameters. Because many real-world decisions involve uncertainty, stochastic programming has found applications in a broad range of areas ranging from finance to transportation to energy optimization. Two-stage problems The basic idea of two-stage stochastic programming is that (optimal) decisions should be based on data available at the time the decisions are made and cannot depend on futu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Portfolio Optimization

Portfolio optimization is the process of selecting the best portfolio (asset distribution), out of the set of all portfolios being considered, according to some objective. The objective typically maximizes factors such as expected return, and minimizes costs like financial risk. Factors being considered may range from tangible (such as assets, liabilities, earnings or other fundamentals) to intangible (such as selective divestment). Modern portfolio theory Modern portfolio theory was introduced in a 1952 doctoral thesis by Harry Markowitz; see Markowitz model. It assumes that an investor wants to maximize a portfolio's expected return contingent on any given amount of risk. For portfolios that meet this criterion, known as efficient portfolios, achieving a higher expected return requires taking on more risk, so investors are faced with a trade-off between risk and expected return. This risk-expected return relationship of efficient portfolios is graphically represented by a curve ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stephen J

Stephen or Steven is a common English first name. It is particularly significant to Christians, as it belonged to Saint Stephen ( grc-gre, Στέφανος ), an early disciple and deacon who, according to the Book of Acts, was stoned to death; he is widely regarded as the first martyr (or " protomartyr") of the Christian Church. In English, Stephen is most commonly pronounced as ' (). The name, in both the forms Stephen and Steven, is often shortened to Steve or Stevie. The spelling as Stephen can also be pronounced which is from the Greek original version, Stephanos. In English, the female version of the name is Stephanie. Many surnames are derived from the first name, including Stephens, Stevens, Stephenson, and Stevenson, all of which mean "Stephen's (son)". In modern times the name has sometimes been given with intentionally non-standard spelling, such as Stevan or Stevon. A common variant of the name used in English is Stephan ; related names that have found so ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk Aversion

In economics and finance, risk aversion is the tendency of people to prefer outcomes with low uncertainty to those outcomes with high uncertainty, even if the average outcome of the latter is equal to or higher in monetary value than the more certain outcome. Risk aversion explains the inclination to agree to a situation with a more predictable, but possibly lower payoff, rather than another situation with a highly unpredictable, but possibly higher payoff. For example, a risk-averse investor might choose to put their money into a bank account with a low but guaranteed interest rate, rather than into a stock that may have high expected returns, but also involves a chance of losing value. Example A person is given the choice between two scenarios: one with a guaranteed payoff, and one with a risky payoff with same average value. In the former scenario, the person receives $50. In the uncertain scenario, a coin is flipped to decide whether the person receives $100 or nothing. The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Numerical Solution

Numerical analysis is the study of algorithms that use numerical approximation (as opposed to symbolic manipulations) for the problems of mathematical analysis (as distinguished from discrete mathematics). It is the study of numerical methods that attempt at finding approximate solutions of problems rather than the exact ones. Numerical analysis finds application in all fields of engineering and the physical sciences, and in the 21st century also the life and social sciences, medicine, business and even the arts. Current growth in computing power has enabled the use of more complex numerical analysis, providing detailed and realistic mathematical models in science and engineering. Examples of numerical analysis include: ordinary differential equations as found in celestial mechanics (predicting the motions of planets, stars and galaxies), numerical linear algebra in data analysis, and stochastic differential equations and Markov chains for simulating living cells in medicine and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |