|

Carhart Four-factor Model

In Investment management, portfolio management, the Carhart four-factor model is an extra factor addition in the Fama–French three-factor model, proposed by Mark Carhart. The Fama-French model, developed in the 1990, argued most stock market returns are explained by three factors: risk, price (value investing, value stocks tending to outperform) and company size (smaller company stocks tending to outperform). Carhart added a Momentum (finance), momentum factor for asset pricing of stocks. The Four Factor Model is also known in the industry as the Monthly Momentum Factor (MOM). Momentum is the speed or velocity of price changes in a stock, security, or tradable instrument. Development The Monthly Momentum Factor (MOM) can be calculated by subtracting the equal weighted average of the lowest performing firms from the equal weighted average of the highest performing firms, lagged one month (Carhart, 1997). A stock would be considered to show momentum if its prior 12-month average ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Management

Investment management (sometimes referred to more generally as financial asset management) is the professional asset management of various Security (finance), securities, including shareholdings, Bond (finance), bonds, and other assets, such as real estate, to meet specified investment goals for the benefit of investors. Investors may be institutions, such as insurance companies, pension funds, corporations, charities, educational establishments, or private investors, either directly via investment contract, contracts/mandates or via collective investment schemes like mutual funds, exchange-traded funds, or REIT, Real estate investment trusts. The term ''investment management'' is often used to refer to the management of investment funds, most often specializing in private equity, private and public equity, real assets, alternative assets, and/or bonds. The more generic term ''asset management'' may refer to management of assets not necessarily primarily held for investment purpos ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Center For Research In Security Prices

The Center for Research in Security Prices, LLC (CRSP) is a provider of historical stock market and investable index data. CRSP is an affiliate of the Booth School of Business at the University of Chicago. CRSP maintains some of the largest and most comprehensive proprietary historical databases in stock market research. Academic researchers and investment professionals rely on CRSP for accurate, survivor bias-free information which provides a foundation for their research and analyses. As of 2023, CRSP claims over 600 clients. The name is usually pronounced "crisp". CRSP was founded in 1960 by James H. Lorie (professor of finance and director of research) and Lawrence Fisher (assistant professor of finance) of the University of Chicago, with a grant from Merrill Lynch, Pierce, Fenner & Smith. Its goal was to provide a source of accurate and comprehensive data that could be used to answer basic questions about the behavior of stock markets. The first effort of the Center was the p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Behavioral Finance

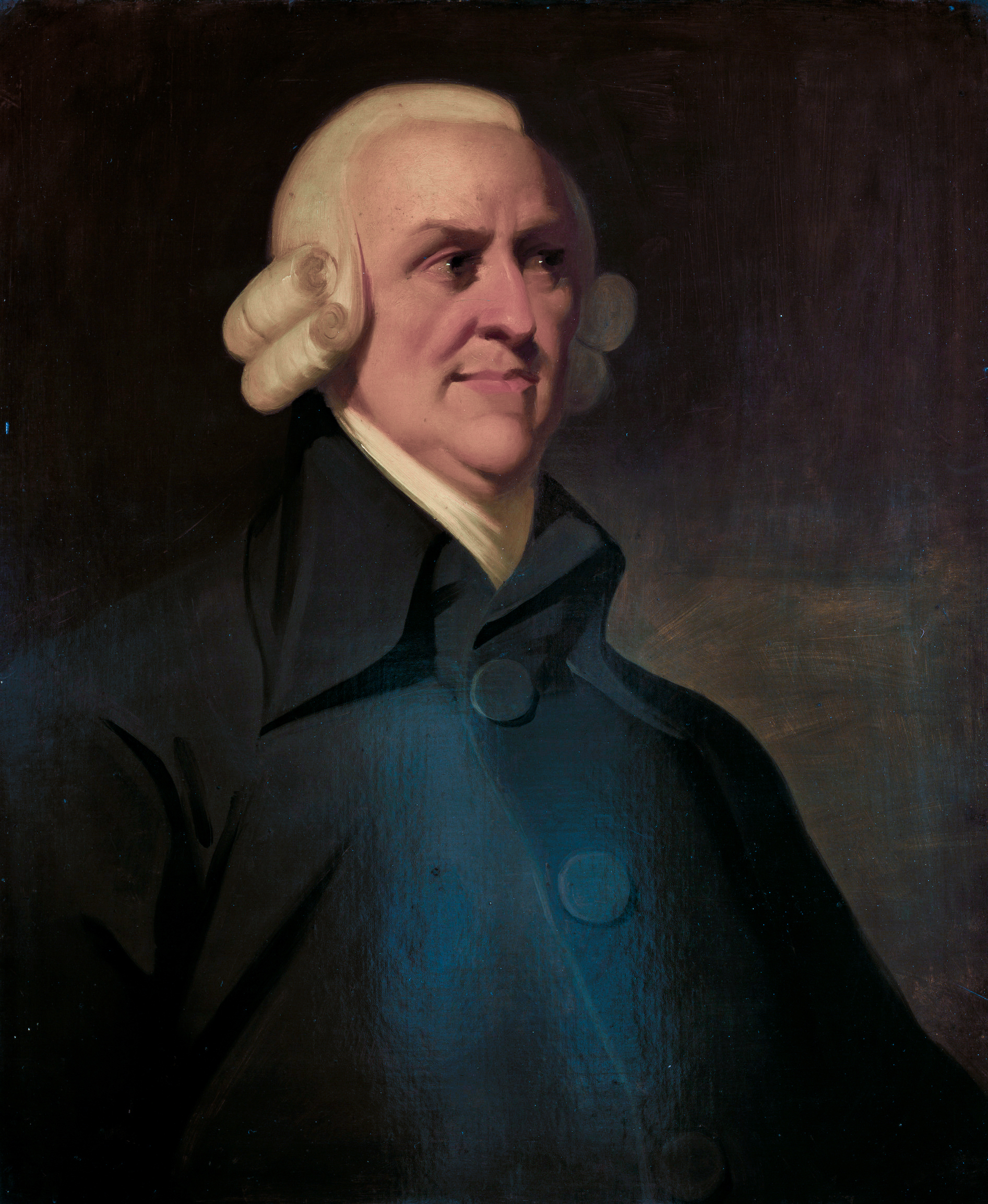

Behavioral economics is the study of the psychological (e.g. cognitive, behavioral, affective, social) factors involved in the decisions of individuals or institutions, and how these decisions deviate from those implied by traditional economic theory. Behavioral economics is primarily concerned with the bounds of rationality of economic agents. Behavioral models typically integrate insights from psychology, neuroscience and microeconomic theory. Behavioral economics began as a distinct field of study in the 1970s and 1980s, but can be traced back to 18th-century economists, such as Adam Smith, who deliberated how the economic behavior of individuals could be influenced by their desires. The status of behavioral economics as a subfield of economics is a fairly recent development; the breakthroughs that laid the foundation for it were published through the last three decades of the 20th century. Behavioral economics is still growing as a field, being used increasingly in res ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Markets

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial markets as commodities. The term "market" is sometimes used for what are more strictly ''exchanges'', that is, organizations that facilitate the trade in financial securities, e.g., a stock exchange or commodity exchange. This may be a physical location (such as the New York Stock Exchange (NYSE), London Stock Exchange (LSE), Bombay Stock Exchange (BSE) or Johannesburg Stock Exchange (JSE Limited)) or an electronic system such as NASDAQ. Much trading of stocks takes place on an exchange; still, corporate actions (mergers, spinoffs) are outside an exchange, while any two companies or people, for whatever reason, may agree to sell the stock from the one to the other without using an exchange. Trading of currencies and bonds is largely on a bi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Size Premium

The size premium is the historical tendency for the stocks of firms with smaller market capitalizations to outperform the stocks of firms with larger market capitalizations. It is one of the factors in the Fama–French three-factor model. See also * Liquidity premium *Risk premium

A risk premium is a measure of excess return that is required by an individual to compensate being sub ...

[...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Returns-based Style Analysis

Returns-based style analysis (RBSA) is a statistical technique used in finance to deconstruct the returns of investment strategies using a variety of explanatory variables. The model results in a strategy's exposures to asset classes or other factors, interpreted as a measure of a fund or portfolio manager's investment style. While the model is most frequently used to show an equity mutual fund’s style with reference to common style axes (such as large/small and value/growth), recent applications have extended the model’s utility to model more complex strategies, such as those employed by hedge funds. History William F. Sharpe first presented the model in his 1988 article "Determining a Fund’s Effective Asset Mix". Under the name RBSA, this model was made available in commercial software soon after and retains a consistent presence in mutual fund analysis reporting. As the investment community has expanded beyond security selection to the embrace of asset allocation as t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Factor Investing

Factor investing is an investment approach that involves targeting quantifiable firm characteristics or "factors" that can explain differences in stock returns. Security characteristics that may be included in a factor-based approach include size, low-volatility, value, momentum, asset growth, profitability, leverage, term and carry. A factor-based investment strategy involves tilting investment portfolios towards or away from specific factors in an attempt to generate long-term investment returns in excess of benchmarks. Proponents claim this approach is quantitative and based on observable data, such as stock prices and financial information, rather than on opinion or speculation. Factor premiums are also documented in corporate bonds and across all major asset classes including currencies, government bonds, equity indices, and commodities. Critics of factor investing argue the concept has flaws, such as relying heavily on data mining that does not necessarily translate to rea ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Asset Pricing Model

In finance, the capital asset pricing model (CAPM) is a model used to determine a theoretically appropriate required rate of return of an asset, to make decisions about adding assets to a Diversification (finance), well-diversified Portfolio (finance), portfolio. The model takes into account the asset's sensitivity to non-diversifiable risk (also known as systematic risk or market risk), often represented by the quantity Beta (finance), beta (β) in the financial industry, as well as the expected return of the market and the expected return of a theoretical Risk-free bond, risk-free asset. CAPM assumes a particular form of utility functions (in which only first and second Moment (mathematics), moments matter, that is risk is measured by variance, for example a quadratic utility) or alternatively asset returns whose probability distributions are completely described by the first two moments (for example, the normal distribution) and zero transaction costs (necessary for diversifi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Journal Of Finance

''The Journal of Finance'' is a peer-reviewed academic journal published by Wiley-Blackwell on behalf of the American Finance Association. It was established in 1946. The editor-in-chief is Antoinette Schoar. According to the ''Journal Citation Reports'', the journal has a 2021 impact factor of 7.870, ranking it 6th out of 111 journals in the category "Business, Finance" and 16th out of 381 journals in the category "Economics". Editors The editorial board consists of the editor, co-editors, and associate editors. The current editor is Antoinette Schoar (MIT). The following persons are or have been editor-in-chief of the journal: Awards Each year the associate editors vote for the best papers published in the journal. The Smith Breeden Prize is awarded for the best finance papers and the Brattle Prize for the best corporate finance Corporate finance is an area of finance that deals with the sources of funding, and the capital structure of businesses, the actions that managers ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fama–French Three-factor Model

In asset pricing and portfolio management, the Fama–French three-factor model is a statistical model designed in 1992 by Eugene Fama and Kenneth French to describe stock returns. Fama and French were colleagues at the University of Chicago Booth School of Business, where Fama still works. In 2013, Fama shared the Nobel Memorial Prize in Economic Sciences for his empirical analysis of asset prices. The three factors are: # Market excess return, # Outperformance of small versus big companies, and # Outperformance of high book/market versus low book/market companies There is academic debate about the last two factors. Background and development Factor models are statistical models that attempt to explain complex phenomena using a small number of underlying causes or factors. The traditional asset pricing model, known formally as the capital asset pricing model (CAPM) uses only one variable to compare the returns of a portfolio or stock with the returns of the market as a whol ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock

Stocks (also capital stock, or sometimes interchangeably, shares) consist of all the Share (finance), shares by which ownership of a corporation or company is divided. A single share of the stock means fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the shareholder (stockholder) to that fraction of the company's earnings, proceeds from liquidation of assets (after discharge of all Seniority (financial), senior claims such as secured and unsecured debt), or Voting interest, voting power, often dividing these up in proportion to the number of like shares each stockholder owns. Not all stock is necessarily equal, as certain classes of stock may be issued, for example, without voting rights, with enhanced voting rights, or with a certain priority to receive profits or liquidation proceeds before or after other classes of Shareholder, shareholders. Stock can be bought and sold over-the-counter (finance), privately or on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Asset Pricing

In financial economics, asset pricing refers to a formal treatment and development of two interrelated Price, pricing principles, outlined below, together with the resultant models. There have been many models developed for different situations, but correspondingly, these stem from either General equilibrium theory, general equilibrium asset pricing or Rational pricing, rational asset pricing, the latter corresponding to risk neutral pricing. Investment theory, which is near synonymous, encompasses the body of knowledge used to support the decision-making process of choosing investments, and the asset pricing models are then applied in determining the Required rate of return, asset-specific required rate of return on the investment in question, and for hedging. General equilibrium asset pricing Under general equilibrium theory prices are determined through Market price, market pricing by supply and demand. See, e.g., Tim Bollerslev (2019)"Risk and Return in Equilibrium: The C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |