|

Career Average

A career average pension or career average revalued earnings pension (CARE pension) is a type of occupational pension scheme, where people saving for retirement pay for a benefit after retirement where they will receive a sum that is calculated according to their average earnings over their career. Particularly in UK pensions, this model has been introduced as an alternative to both defined contribution pensions, which may run out and lead to old age poverty if they live longer, and final salary pensions which give people a benefit based on the last salary they earned before retirement. It is thought that career average pensions are fairer than final salary pensions, when people have not, for instance in their last few years of work, jumped up to management positions with much higher salaries: career average pensions mean that lower earners do not subsidise much higher pension benefits for just a few people. UK public sector CARE pensions are revalued annually in accordance with r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Occupational Pension

A pension (, from Latin ''pensiĹŤ'', "payment") is a fund into which a sum of money is added during an employee's employment years and from which payments are drawn to support the person's retirement from work in the form of periodic payments. A pension may be a "defined benefit plan", where a fixed sum is paid regularly to a person, or a "defined contribution plan", under which a fixed sum is invested that then becomes available at retirement age. Pensions should not be confused with severance pay; the former is usually paid in regular amounts for life after retirement, while the latter is typically paid as a fixed amount after involuntary termination of employment before retirement. The terms "retirement plan" and "superannuation" tend to refer to a pension granted upon retirement of the individual. Retirement plans may be set up by employers, insurance companies, the government, or other institutions such as employer associations or trade unions. Called ''retirement plans'' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

UK Pensions

Pensions in the United Kingdom, whereby United Kingdom tax payers have some of their wages deducted to save for retirement, can be categorised into three major divisions - state, occupational and personal pensions. The Sovereign state, state pension is based on years worked, with a 35-year work history yielding a pension of ÂŁ185.15 per week. It is linked to wage and price increases. Most employees and the self-employed are also enrolled in employer-subsidised and tax-efficient occupational and personal pensions which supplement this basic state-provided pension. Historically, the "Old Age Pension" was introduced in 1909 in the United Kingdom (which included all of Ireland at that time). Following the passage of the Old-Age Pensions Act 1908 a pension of 5 shillings per week (25p, equivalent, using the Consumer Price Index (United Kingdom), Consumer Price Index, to ÂŁ in present-day terms), or 7s.6d per week (equivalent to ÂŁ/week today) for a married couple, was payable to pers ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Defined Contribution

A defined contribution (DC) plan is a type of retirement plan in which the employer, employee or both make contributions on a regular basis. Individual accounts are set up for participants and benefits are based on the amounts credited to these accounts (through employee contributions and, if applicable, employer contributions) plus any investment earnings on the money in the account. In defined contribution plans, future benefits fluctuate on the basis of investment earnings. The most common type of defined contribution plan is a savings and thrift plan. Under this type of plan, the employee contributes a predetermined portion of his or her earnings (usually pretax) to an individual account, all or part of which is matched by the employer. In the United States, specifies a defined contribution plan as a "plan which provides for an individual account for each participant and for benefits based solely on the amount contributed to the participant's account, and any income, expense ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Final Salary Pension

Defined benefit (DB) pension plan is a type of pension plan in which an employer/sponsor promises a specified pension payment, lump-sum, or combination thereof on retirement that depends on an employee's earnings history, tenure of service and age, rather than depending directly on individual investment returns. Traditionally, many governmental and public entities, as well as a large number of corporations, provide defined benefit plans, sometimes as a means of compensating workers in lieu of increased pay.Lemke and Lins, ''ERISA for Money Managers'', §1:1 (Thomson West, 2013). A defined benefit plan is 'defined' in the sense that the benefit formula is defined and known in advance. Conversely, for a "defined contribution retirement saving plan," the formula for computing the employer's and employee's contributions is defined and known in advance, but the benefit to be paid out is not known in advance. In the United States, specifies a defined benefit plan to be any pension plan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

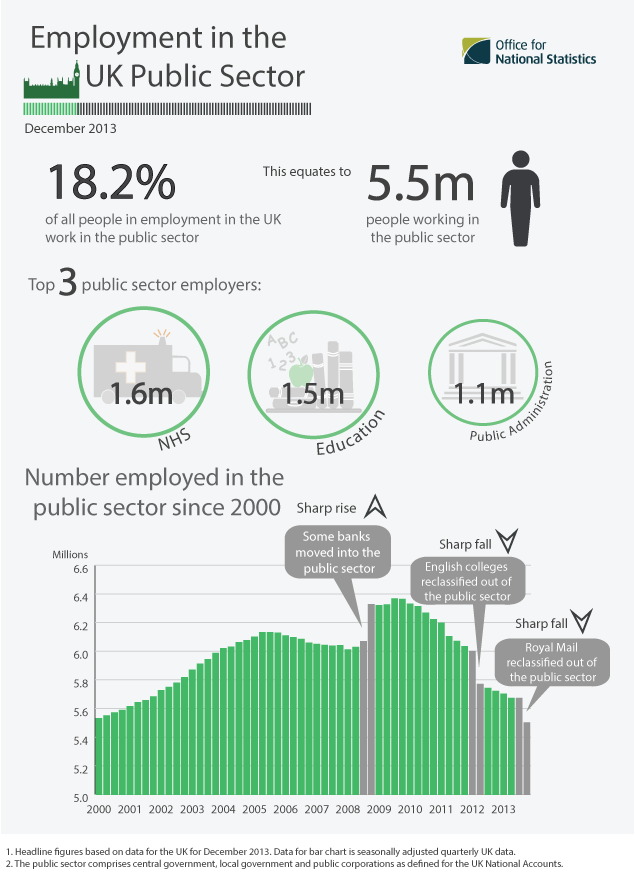

Public Sector

The public sector, also called the state sector, is the part of the economy composed of both public services and public enterprises. Public sectors include the public goods and governmental services such as the military, law enforcement, infrastructure, public transit, public education, along with health care and those working for the government itself, such as elected officials. The public sector might provide services that a non-payer cannot be excluded from (such as street lighting), services which benefit all of society rather than just the individual who uses the service. Public enterprises, or state-owned enterprises, are self-financing commercial enterprises that are under public ownership which provide various private goods and services for sale and usually operate on a commercial basis. Organizations that are not part of the public sector are either part of the private sector or voluntary sector. The private sector is composed of the economic sectors that are intende ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

His Majesty's Treasury

His Majesty's Treasury (HM Treasury), occasionally referred to as the Exchequer, or more informally the Treasury, is a department of His Majesty's Government responsible for developing and executing the government's public finance policy and economic policy. The Treasury maintains the Online System for Central Accounting and Reporting (OSCAR), the replacement for the Combined Online Information System (COINS), which itemises departmental spending under thousands of category headings, and from which the Whole of Government Accounts (WGA) annual financial statements are produced. History The origins of the Treasury of England have been traced by some to an individual known as Henry the Treasurer, a servant to King William the Conqueror. This claim is based on an entry in the Domesday Book showing the individual Henry "the treasurer" as a landowner in Winchester, where the royal treasure was stored. The Treasury of the United Kingdom thus traces its origins to the Treasury of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

UK Labour Law

United Kingdom labour law regulates the relations between workers, employers and trade unions. People at work in the UK can rely upon a minimum charter of employment rights, which are found in Acts of Parliament, Regulations, common law and equity (legal concept), equity. This includes the right to a minimum wage of ÂŁ9.50 for over-23-year-olds from April 2022 under the National Minimum Wage Act 1998. The Working Time Regulations 1998 give the right to 28 days paid holidays, breaks from work, and attempt to limit long working hours. The Employment Rights Act 1996 gives the right to leave for child care, and the right to request flexible working patterns. The Pensions Act 2008 gives the right to be automatically enrolled in a basic occupational pension, whose funds must be protected according to the Pensions Act 1995. Workers must be able to vote for trustees of their occupational pensions under the Pensions Act 2004. In some enterprises, such as universities, staff can Codetermina ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

English Trusts Law

English trust law concerns the protection of assets, usually when they are held by one party for another's benefit. Trusts were a creation of the English law of property and obligations, and share a subsequent history with countries across the Commonwealth and the United States. Trusts developed when claimants in property disputes were dissatisfied with the common law courts and petitioned the King for a just and equitable result. On the King's behalf, the Lord Chancellor developed a parallel justice system in the Court of Chancery, commonly referred as equity. Historically, trusts have mostly been used where people have left money in a will, or created family settlements, charities, or some types of business venture. After the Judicature Act 1873, England's courts of equity and common law were merged, and equitable principles took precedence. Today, trusts play an important role in financial investment, especially in unit trusts and in pension trusts (where trustees and fun ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pensions In The United Kingdom

Pensions in the United Kingdom, whereby United Kingdom tax payers have some of their wages deducted to save for retirement, can be categorised into three major divisions - state, occupational and personal pensions. The state pension is based on years worked, with a 35-year work history yielding a pension of £185.15 per week. It is linked to wage and price increases. Most employees and the self-employed are also enrolled in employer-subsidised and tax-efficient occupational and personal pensions which supplement this basic state-provided pension. Historically, the "Old Age Pension" was introduced in 1909 in the United Kingdom (which included all of Ireland at that time). Following the passage of the Old-Age Pensions Act 1908 a pension of 5 shillings per week (25p, equivalent, using the Consumer Price Index, to £ in present-day terms), or 7s.6d per week (equivalent to £/week today) for a married couple, was payable to persons with an income below £21 per annum (equivalent to  ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |