|

Capital Asset Pricing Model

In finance, the capital asset pricing model (CAPM) is a model used to determine a theoretically appropriate required rate of return of an asset, to make decisions about adding assets to a well-diversified portfolio. The model takes into account the asset's sensitivity to non-diversifiable risk (also known as systematic risk or market risk), often represented by the quantity beta (β) in the financial industry, as well as the expected return of the market and the expected return of a theoretical risk-free asset. CAPM assumes a particular form of utility functions (in which only first and second moments matter, that is risk is measured by variance, for example a quadratic utility) or alternatively asset returns whose probability distributions are completely described by the first two moments (for example, the normal distribution) and zero transaction costs (necessary for diversification to get rid of all idiosyncratic risk). Under these conditions, CAPM shows that the cost ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Harry Markowitz

Harry Max Markowitz (born August 24, 1927) is an American economist who received the 1989 John von Neumann Theory Prize and the 1990 Nobel Memorial Prize in Economic Sciences. Markowitz is a professor of finance at the Rady School of Management at the University of California, San Diego (UCSD). He is best known for his pioneering work in modern portfolio theory, studying the effects of asset risk, return, correlation and diversification on probable investment portfolio returns. Biography Harry Markowitz was born to a Jewish family, the son of Morris and Mildred Markowitz.Harry M. Markowitz �Autobiography The Nobel Prizes 1990, Editor Tore Frängsmyr, obel Foundation Stockholm, 1991 During high school, Markowitz developed an interest in physics and philosophy, in particular the ideas of David Hume, an interest he continued to follow during his undergraduate years at the University of Chicago. After receiving his Ph.B. in Liberal Arts, Markowitz decided to continue his ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Modern Portfolio Theory

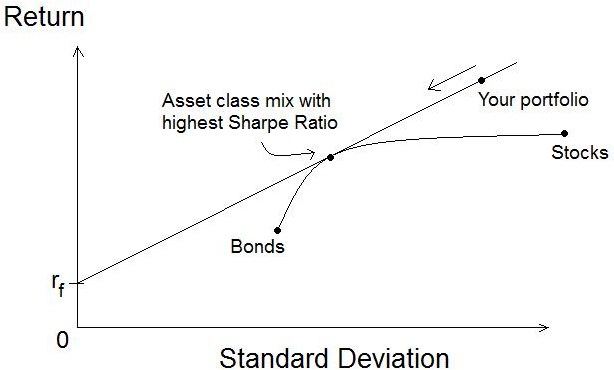

Modern portfolio theory (MPT), or mean-variance analysis, is a mathematical framework for assembling a portfolio of assets such that the expected return is maximized for a given level of risk. It is a formalization and extension of diversification in investing, the idea that owning different kinds of financial assets is less risky than owning only one type. Its key insight is that an asset's risk and return should not be assessed by itself, but by how it contributes to a portfolio's overall risk and return. It uses the variance of asset prices as a proxy for risk. Economist Harry Markowitz introduced MPT in a 1952 essay, for which he was later awarded a Nobel Memorial Prize in Economic Sciences; see Markowitz model. Mathematical model Risk and expected return MPT assumes that investors are risk averse, meaning that given two portfolios that offer the same expected return, investors will prefer the less risky one. Thus, an investor will take on increased risk only if compen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Standard Deviation

In statistics, the standard deviation is a measure of the amount of variation or dispersion of a set of values. A low standard deviation indicates that the values tend to be close to the mean (also called the expected value) of the set, while a high standard deviation indicates that the values are spread out over a wider range. Standard deviation may be abbreviated SD, and is most commonly represented in mathematical texts and equations by the lower case Greek letter σ (sigma), for the population standard deviation, or the Latin letter '' s'', for the sample standard deviation. The standard deviation of a random variable, sample, statistical population, data set, or probability distribution is the square root of its variance. It is algebraically simpler, though in practice less robust, than the average absolute deviation. A useful property of the standard deviation is that, unlike the variance, it is expressed in the same unit as the data. The standard deviation o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Correlation Coefficient

A correlation coefficient is a numerical measure of some type of correlation, meaning a statistical relationship between two variables. The variables may be two columns of a given data set of observations, often called a sample, or two components of a multivariate random variable with a known distribution. Several types of correlation coefficient exist, each with their own definition and own range of usability and characteristics. They all assume values in the range from −1 to +1, where ±1 indicates the strongest possible agreement and 0 the strongest possible disagreement. As tools of analysis, correlation coefficients present certain problems, including the propensity of some types to be distorted by outliers and the possibility of incorrectly being used to infer a causal relationship between the variables (for more, see Correlation does not imply causation). Types There are several different measures for the degree of correlation in data, depending on the kind of data ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sensitivity And Specificity

In medicine and statistics, sensitivity and specificity mathematically describe the accuracy of a test that reports the presence or absence of a medical condition. If individuals who have the condition are considered "positive" and those who do not are considered "negative", then sensitivity is a measure of how well a test can identify true positives and specificity is a measure of how well a test can identify true negatives: * Sensitivity (true positive rate) is the probability of a positive test result, conditioned on the individual truly being positive. * Specificity (true negative rate) is the probability of a negative test result, conditioned on the individual truly being negative. If the true status of the condition cannot be known, sensitivity and specificity can be defined relative to a " gold standard test" which is assumed correct. For all testing, both diagnoses and screening, there is usually a trade-off between sensitivity and specificity, such that higher sensiti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk Premium

A risk premium is a measure of excess return that is required by an individual to compensate being subjected to an increased level of risk. It is used widely in finance and economics, the general definition being the expected risky return less the risk-free return, as demonstrated by the formula below. Risk \ premium = E(r) - r_f Where E(r) is the risky expected rate of return and r_f is the risk-free return. The inputs for each of these variables and the ultimate interpretation of the risk premium value differs depending on the application as explained in the following sections. Regardless of the application, the market premium can be volatile as both comprising variables can be impacted independent of each other by both cyclical and abrupt changes. This means that the market premium is dynamic in nature and ever-changing. Additionally, a general observation regardless of application is that the risk premium is larger during economic downturns and during periods of increased ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk–return Spectrum

The risk–return spectrum (also called the risk–return tradeoff or risk–reward) is the relationship between the amount of return gained on an investment and the amount of risk undertaken in that investment. The more return sought, the more risk that must be undertaken. The progression There are various classes of possible investments, each with their own positions on the overall risk-return spectrum. The general progression is: short-term debt; long-term debt; property; high-yield debt; equity. There is considerable overlap of the ranges for each investment class. All this can be visualised by plotting expected return on the vertical axis against risk (represented by standard deviation upon that expected return) on the horizontal axis. This line starts at the risk-free rate and rises as risk rises. The line will tend to be straight, and will be straight at equilibrium - see discussion below on domination. For any particular investment type, the line drawn from the risk-f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Security Market Line

Security market line (SML) is the representation of the capital asset pricing model. It displays the expected rate of return of an individual security as a function of systematic, non-diversifiable risk. The risk of an individual risky security reflects the volatility of the return from security rather than the return of the market portfolio. The risk in these individual risky securities reflects the systematic risk. Formula The Y-intercept of the SML is equal to the risk-free interest rate. The slope of the SML is equal to the market risk premium and reflects the risk return tradeoff at a given time: :\mathrm : E(R_i) = R_f + \beta_ (R_M) - R_f, where: : is an expected return on security : is an expected return on market portfolio :''β'' is a nondiversifiable or systematic risk : is a market rate of return : is a risk-free rate When used in portfolio management, the SML represents the investment's opportunity cost (investing in a combination of the market portfolio and the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fischer Black

Fischer Sheffey Black (January 11, 1938 – August 30, 1995) was an American economist, best known as one of the authors of the Black–Scholes equation. Background Fischer Sheffey Black was born on January 11, 1938. He graduated from Harvard College in 1959 and received a PhD in applied mathematics from Harvard University in 1964. He was initially expelled from the PhD program due to his inability to settle on a thesis topic, having switched from physics to mathematics, then to computers and artificial intelligence. Black joined the consultancy Bolt, Beranek and Newman, working on a system for artificial intelligence. He spent a summer developing his ideas at the RAND corporation. He became a student of MIT professor Marvin Minsky,Perry Mehrling, "Fischer Black and the Revolutionary Idea of Finance", Wiley (2005), 400 pages, and was later able to submit his research for completion of the Harvard PhD. Black joined Arthur D. Little, where he was first exposed to economic an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Economics

Financial economics, also known as finance, is the branch of economics characterized by a "concentration on monetary activities", in which "money of one type or another is likely to appear on ''both sides'' of a trade". William F. Sharpe"Financial Economics", in Its concern is thus the interrelation of financial variables, such as share prices, interest rates and exchange rates, as opposed to those concerning the real economy. It has two main areas of focus:Merton H. Miller, (1999). The History of Finance: An Eyewitness Account, ''Journal of Portfolio Management''. Summer 1999. asset pricing, commonly known as "Investments", and corporate finance; the first being the perspective of providers of capital, i.e. investors, and the second of users of capital. It thus provides the theoretical underpinning for much of finance. The subject is concerned with "the allocation and deployment of economic resources, both spatially and across time, in an uncertain environment".See Fama ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |