Risk–return spectrum on:

[Wikipedia]

[Google]

[Amazon]

The risk–return spectrum (also called the risk–return tradeoff or risk–reward) is the relationship between the amount of return gained on an

All this can be visualised by plotting expected return on the vertical axis against risk (represented by standard deviation upon that expected return) on the horizontal axis. This line starts at the risk-free rate and rises as risk rises. The line will tend to be straight, and will be straight at

All this can be visualised by plotting expected return on the vertical axis against risk (represented by standard deviation upon that expected return) on the horizontal axis. This line starts at the risk-free rate and rises as risk rises. The line will tend to be straight, and will be straight at

investment

Investment is traditionally defined as the "commitment of resources into something expected to gain value over time". If an investment involves money, then it can be defined as a "commitment of money to receive more money later". From a broade ...

and the amount of risk

In simple terms, risk is the possibility of something bad happening. Risk involves uncertainty about the effects/implications of an activity with respect to something that humans value (such as health, well-being, wealth, property or the environ ...

undertaken in that investment. The more return sought, the more risk that must be undertaken.

The progression

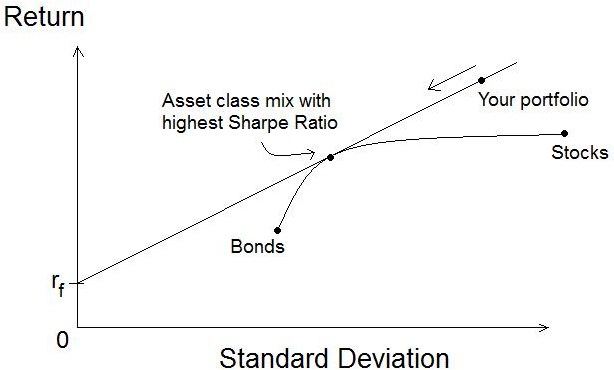

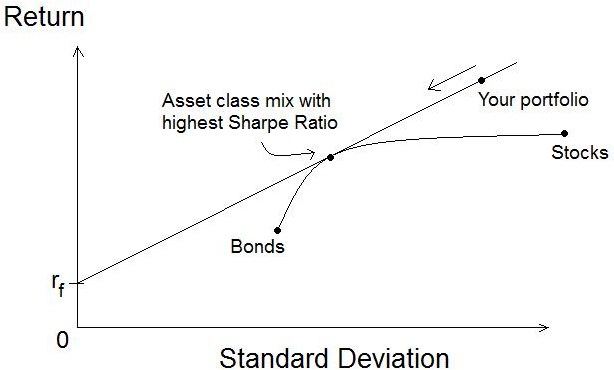

There are various classes of possible investments, each with their own positions on the overall risk-return spectrum. The general progression is: short-term debt; long-term debt; property; high-yield debt; equity. There is considerable overlap of the ranges for each investment class. All this can be visualised by plotting expected return on the vertical axis against risk (represented by standard deviation upon that expected return) on the horizontal axis. This line starts at the risk-free rate and rises as risk rises. The line will tend to be straight, and will be straight at

All this can be visualised by plotting expected return on the vertical axis against risk (represented by standard deviation upon that expected return) on the horizontal axis. This line starts at the risk-free rate and rises as risk rises. The line will tend to be straight, and will be straight at equilibrium

Equilibrium may refer to:

Film and television

* ''Equilibrium'' (film), a 2002 science fiction film

* '' The Story of Three Loves'', also known as ''Equilibrium'', a 1953 romantic anthology film

* "Equilibrium" (''seaQuest 2032'')

* ''Equilibr ...

(see discussion below on domination).

For any particular investment type, the line drawn from the risk-free rate on the vertical axis to the risk-return point for that investment has a slope called the Sharpe ratio

In finance, the Sharpe ratio (also known as the Sharpe index, the Sharpe measure, and the reward-to-variability ratio) measures the performance of an investment such as a security or portfolio compared to a risk-free asset, after adjusting for ...

.

Short-term loans to good government bodies

On the lowest end is short-dated loans to government and government-guaranteed entities (usually semi-independent government departments). The lowest of all is the risk-free rate of return. The risk-free rate has zero risk (most modern major governments will inflate and monetise their debts rather than default upon them), but the return is positive because there is still both the time-preference andinflation

In economics, inflation is an increase in the average price of goods and services in terms of money. This increase is measured using a price index, typically a consumer price index (CPI). When the general price level rises, each unit of curre ...

premium components of minimum expected rates of return that must be met or exceeded if the funding is to be forthcoming from providers. The risk-free rate is commonly approximated by the return paid upon 30-day or their equivalent, but in reality that rate has more to do with the monetary policy

Monetary policy is the policy adopted by the monetary authority of a nation to affect monetary and other financial conditions to accomplish broader objectives like high employment and price stability (normally interpreted as a low and stable rat ...

of that country's central bank

A central bank, reserve bank, national bank, or monetary authority is an institution that manages the monetary policy of a country or monetary union. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the mo ...

than the market supply conditions for credit

Credit (from Latin verb ''credit'', meaning "one believes") is the trust which allows one party to provide money or resources to another party wherein the second party does not reimburse the first party immediately (thereby generating a debt) ...

.

Mid-term and long-term loans to good government bodies

The next types of investment is longer-term loans to government, such as 3-year bonds. The range width is larger, and follows the influence of increasing risk premium required as the maturity of that debt grows longer. Nevertheless, because it is debt of good government the highest end of the range is still comparatively low compared to the ranges of other investment types discussed below. Also, if the government in question is not at the highest jurisdiction (i.e., is a state or municipal government), or the smaller that government is, the more along the risk-return spectrum that government'ssecurities

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any for ...

will be.

Short-term loans to blue-chip corporations

Following the lowest-risk investments are short-datedbills of exchange

A negotiable instrument is a document guaranteeing the payment of a specific amount of money, either on demand, or at a set time, whose payer is usually named on the document. More specifically, it is a document contemplated by or consisting of a ...

from major blue-chip corporations with the highest credit rating

A credit rating is an evaluation of the credit risk of a prospective debtor (an individual, a business, company or a government). It is the practice of predicting or forecasting the ability of a supposed debtor to pay back the debt or default. The ...

s. The further away from perfect the credit rating, the higher up the risk-return spectrum that particular investment will be.

Mid-term and long-term loans to blue-chip corporations

Overlapping the range for short-term debt is the longer term debt from those same well-rated corporations. These are higher up the range because the maturity has increased. The overlap occurs of the mid-term debt of the best rated corporations with the short-term debt of the nearly perfectly, but not perfectly rated corporations. In this arena, the debts are called investment grade by the rating agencies. The lower the credit rating, the higher the yield and thus the expected return.Rental property

Acommercial property

Commercial property, also called commercial real estate, investment property or income property, is real estate (buildings or land) intended to generate a Profit (economics), profit, either from capital gains or Renting, rental income. Commercial ...

that the investor rents out is comparable in risk or return to a low-investment grade. Industrial property has higher risk and returns, followed by residential (with the possible exception of the investor's own home).

High-yield debt

After the returns upon all classes of investment-grade debt come the returns on speculative-gradehigh-yield debt

In finance, a high-yield bond (non-investment-grade bond, speculative-grade bond, or junk bond) is a bond that is rated below investment grade by credit rating agencies. These bonds have a higher risk of default or other adverse credit even ...

(also known derisively as junk bonds). These may come from mid and low rated corporations, and less politically stable governments.

Equity

Equity returns are the profits earned by businesses after interest and tax. Even the equity returns on the highest rated corporations are notably risky. Small-cap stocks are generally riskier than large-cap; companies that primarily service governments, or provide basic consumer goods such as food or utilities, tend to be less volatile than those in other industries. Note that since stocks tend to rise when corporate bonds fall and vice versa, a portfolio containing a small percentage of stocks can be less risky than one containing only debts.Options and futures

Option and futures contracts often provide leverage on underlying stocks, bonds or commodities; this increases the returns but also the risks. Note that in some cases, derivatives can be used tohedge

A hedge or hedgerow is a line of closely spaced (3 feet or closer) shrubs and sometimes trees, planted and trained to form a barrier or to mark the boundary of an area, such as between neighbouring properties. Hedges that are used to separate ...

, decreasing the overall risk of the portfolio due to negative correlation with other investments.

Cryptocurrencies

Having no earnings and paying no coupons, rents or dividends, but instead representing stake in an entirely new monetary system of questionable potential, cryptocurrencies are generally considered to be very high-risk investments. These range from Bitcoin and Ethereum to projects of murky origin and utility which in the riskiest cases are scarcely differentiable from an unregistered security or Ponzi scheme. The maturer, larger-cap projects have had similar volatility with small cap stocks in recent years.Cause of progression

The existence of risk causes the need to incur a number of expenses. For example, the more risky the investment the more time and effort is usually required to obtain information about it and monitor its progress. For another, the importance of a loss of X amount of value is greater than the importance of a gain of X amount of value, so a riskier investment will attract a higher risk premium even if the forecast return is the same as upon a less risky investment. Risk is therefore something that must be compensated for, and the more risk the more compensation required. If an investment had a high return with low risk, eventually everyone would want to invest there. That action would drive down the actual rate of return achieved, until it reached the rate of return the market deems commensurate with the level of risk. Similarly, if an investment had a low return with high risk, all the present investors would want to leave that investment, which would then increase the actual return until again it reached the rate of return the market deems commensurate with the level of risk. That part of total returns which sets this appropriate level is called therisk premium

A risk premium is a measure of excess return that is required by an individual to compensate being subjected to an increased level of risk. It is used widely in finance and economics, the general definition being the expected risky Rate of retur ...

.

Leverage extends the spectrum

The use of leverage can extend the progression out even further. Examples of this include borrowing funds to invest in equities, or use of derivatives. If leverage is used then there are two lines instead of one. This is because although one can invest at the risk-free rate, one can only borrow at an interest rate according to one's own credit-rating. This is visualised by the new line starting at the point of the riskiest unleveraged investment (equities) and rising at a lower slope than the original line. If this new line were traced back to the vertical axis of zero risk, it will cross it at the borrowing rate.Domination

All investment types compete against each other, even though they are on different positions on the risk-return spectrum. Any of the mid-range investments can have their performances simulated by a portfolio consisting of a risk-free component and the highest-risk component. This principle, called the separation property, is a crucial feature ofmodern portfolio theory

Modern portfolio theory (MPT), or mean-variance analysis, is a mathematical framework for assembling a portfolio of assets such that the expected return is maximized for a given level of risk. It is a formalization and extension of Diversificatio ...

. The line is then called the capital market line.

If at any time there is an investment that has a higher Sharpe ratio than another then that return is said to dominate. When there are two or more investments above the spectrum line, then the one with the highest Sharpe ratio is the most dominant one, even if the risk and return on that particular investment is lower than another. If every mid-range return falls below the spectrum line, this means that the lowest-risk investment has the highest Sharpe Ratio and so dominates over all others.

If at any time there is an investment that dominates then funds will tend to be withdrawn from all others and be redirected to that dominating investment. This action will lower the return on that investment and raise it on others. The withdrawal and redirection of capital ceases when all returns are at the levels appropriate for the degrees of risk and commensurate with the opportunity cost

In microeconomic theory, the opportunity cost of a choice is the value of the best alternative forgone where, given limited resources, a choice needs to be made between several mutually exclusive alternatives. Assuming the best choice is made, ...

arising from competition with the other investment types on the spectrum, which means they all tend to end up having the same Sharpe Ratio.

See also

*Modern portfolio theory

Modern portfolio theory (MPT), or mean-variance analysis, is a mathematical framework for assembling a portfolio of assets such that the expected return is maximized for a given level of risk. It is a formalization and extension of Diversificatio ...

* Risk

In simple terms, risk is the possibility of something bad happening. Risk involves uncertainty about the effects/implications of an activity with respect to something that humans value (such as health, well-being, wealth, property or the environ ...

* Financial capital

Financial capital (also simply known as capital or equity in finance, accounting and economics) is any Economic resources, economic resource measured in terms of money used by entrepreneurs and businesses to buy what they need to make their prod ...

* Investment

Investment is traditionally defined as the "commitment of resources into something expected to gain value over time". If an investment involves money, then it can be defined as a "commitment of money to receive more money later". From a broade ...

* Credit

Credit (from Latin verb ''credit'', meaning "one believes") is the trust which allows one party to provide money or resources to another party wherein the second party does not reimburse the first party immediately (thereby generating a debt) ...

* Interest

In finance and economics, interest is payment from a debtor or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (that is, the amount borrowed), at a particular rate. It is distinct f ...

* Ownership equity

In finance, equity is an ownership interest in property that may be subject to debts or other liabilities. Equity is measured for accounting purposes by subtracting liabilities from the value of the assets owned. For example, if someone owns a ...

* Profit

Profit may refer to:

Business and law

* Profit (accounting), the difference between the purchase price and the costs of bringing to market

* Profit (economics), normal profit and economic profit

* Profit (real property), a nonpossessory inter ...

* Leverage (finance)

In finance, leverage, also known as gearing, is any technique involving borrowing funds to buy an investment.

Financial leverage is named after a lever in physics, which amplifies a small input force into a greater output force. Financial leverag ...

References

# Campbell, John Y., and Luis Viceira. The term structure of the risk-return tradeoff. No. w11119. National Bureau of Economic Research, 2005. # Lundblad, Christian. "The risk return tradeoff in the long run: 1836–2003." Journal of Financial Economics 85.1 (2007): 123-150. # Lettau, Martin, and Sydney Ludvigson. "Measuring and modeling variation in the risk-return tradeoff." Handbook of Financial Econometrics 1 (2003): 617-690. # Ghysels, Eric, Pedro Santa-Clara, and Rossen Valkanov. "There is a risk-return trade-off after all." Journal of Financial Economics 76.3 (2005): 509-548. {{finance Investment Portfolio theories