|

CARICOM Single Market

The CARICOM Single Market and Economy, also known as the Caribbean Single Market and Economy (CSME), is an integrated development strategy envisioned at the 10th Meeting of the Conference of Heads of Government of the Caribbean Community (CARICOM) which took place in July 1989 in Grand Anse, Grenada. The Grand Anse Declaration had three key Features: #Deepening economic integration by advancing beyond a common market towards a Single Market and Economy. #Widening the membership and thereby expanding the economic mass of the Caribbean Community (e.g. Suriname and Haiti were admitted as full members in 1995 and 2002 respectively). #Progressive insertion of the region into the global trading and economic system by strengthening trading links with non-traditional partners. A precursor to CARICOM and its CSME was the Caribbean Free Trade Agreement, formed in 1965 and dissolved in 1973. Single market and economy The CSME will be implemented through a number of phases, first being the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Caribbean Community

The Caribbean Community (CARICOM or CC) is an intergovernmental organization that is a political and economic union of 15 member states (14 nation-states and one dependency) throughout the Caribbean. They have primary objectives to promote economic integration and cooperation among its members, ensure that the benefits of integration are equitably shared, and coordinate foreign policy. The organization was established in 1973 with its four founding members signing the Treaty of Chaguaramas. Its primary activities involve: * Coordinating economic policies and development planning. * Devising and instituting special projects for the less-developed countries within its jurisdiction. * Operating as a regional single market for many of its members (Caricom Single Market). * Handling regional trade disputes. The secretariat headquarters is in Georgetown, Guyana. CARICOM is an official United Nations Observer beneficiary. CARICOM was established by the English-speaking parts of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Caribbean Accreditation Authority For Education In Medicine And Other Health Professions

The Caribbean Accreditation Authority for Education in Medicine and other Health Professions (CAAM-HP) is an accrediting body for the education programmes and schools of medicine, dentistry, veterinary medicine, nursing and other health professions in the 15 member nations of the Caribbean Community (CARICOM). CAAM-HP was established in 2003 and is headquartered in Kingston, Jamaica. The US Department of Education's National Committee on Foreign Medical Education and Accreditation (NCFMEA) recognizes CAAM-HP as a standard comparable to the standards used in medical schools in the United States. Background and role From 1948 until 2001, universities and colleges in the Commonwealth Caribbean could and often were accredited by the General Medical Council (GMC) of the United Kingdom. Primarily this occurred with the University of the West Indies (UWI) receiving full accreditation (with periodic visits and assessments as changes were made in medical education) and with some of the o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Floating Exchange Rate

In macroeconomics and economic policy, a floating exchange rate (also known as a fluctuating or flexible exchange rate) is a type of exchange rate regime in which a currency's value is allowed to fluctuate in response to foreign exchange market events. A currency that uses a floating exchange rate is known as a ''floating currency'', in contrast to a ''fixed currency'', the value of which is instead specified in terms of material goods, another currency, or a set of currencies (the idea of the last being to reduce currency fluctuations). In the modern world, most of the world's currencies are floating, and include the most widely traded currencies: the United States dollar, the euro, the Swiss franc, the Indian rupee, the pound sterling, the Japanese yen, and the Australian dollar. However, even with floating currencies, central banks often participate in markets to attempt to influence the value of floating exchange rates. The Canadian dollar most closely resembles a pure f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fixed Exchange Rate

A fixed exchange rate, often called a pegged exchange rate, is a type of exchange rate regime in which a currency's value is fixed or pegged by a monetary authority against the value of another currency, a basket of other currencies, or another measure of value, such as gold. There are benefits and risks to using a fixed exchange rate system. A fixed exchange rate is typically used to stabilize the exchange rate of a currency by directly fixing its value in a predetermined ratio to a different, more stable, or more internationally prevalent currency (or currencies) to which the currency is pegged. In doing so, the exchange rate between the currency and its peg does not change based on market conditions, unlike in a floating (flexible) exchange regime. This makes trade and investments between the two currency areas easier and more predictable and is especially useful for small economies that borrow primarily in foreign currency and in which external trade forms a large part of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

US Dollar

The United States dollar (symbol: $; code: USD; also abbreviated US$ or U.S. Dollar, to distinguish it from other dollar-denominated currencies; referred to as the dollar, U.S. dollar, American dollar, or colloquially buck) is the official currency of the United States and several other countries. The Coinage Act of 1792 introduced the U.S. dollar at par with the Spanish silver dollar, divided it into 100 cents, and authorized the minting of coins denominated in dollars and cents. U.S. banknotes are issued in the form of Federal Reserve Notes, popularly called greenbacks due to their predominantly green color. The monetary policy of the United States is conducted by the Federal Reserve System, which acts as the nation's central bank. The U.S. dollar was originally defined under a bimetallic standard of (0.7735 troy ounces) fine silver or, from 1837, fine gold, or $20.67 per troy ounce. The Gold Standard Act of 1900 linked the dollar solely to gold. From 1934, its equi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Eastern Caribbean Dollar

The Eastern Caribbean dollar (symbol: EC$; code: XCD) is the currency of all seven full members and one associate member of the Organisation of Eastern Caribbean States (OECS). The successor to the British West Indies dollar, it has existed since 1965, and it is normally abbreviated with the dollar sign ''$'' or, alternatively, ''EC$'' to distinguish it from other dollar-denominated currencies. The EC$ is subdivided into 100 cents. It has been pegged to the United States dollar since 7 July 1976, at the exchange rate of = .70. Circulation Six of the states using the EC$ are independent states: Antigua and Barbuda, Dominica, Grenada, Saint Kitts and Nevis, Saint Lucia, and Saint Vincent and the Grenadines. The other two, Anguilla and Montserrat, are British Overseas Territories. These states are all members of the Eastern Caribbean Currency Union. The other two associate members of the OECS do not use the Eastern Caribbean dollar as their official currency: the British Virgin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Currency Union

A currency union (also known as monetary union) is an intergovernmental agreement that involves two or more State (polity), states sharing the same currency. These states may not necessarily have any Economic integration#Stages, further integration (such as an economic and monetary union, which would have, in addition, a customs union and a single market). There are three types of currency unions: * ''Informal'' – unilateral adoption of a foreign currency. * ''Formal'' – adoption of foreign currency by virtue of bilateral or multilateral agreement with the monetary authority, sometimes supplemented by issue of local currency in currency peg regime. * ''Formal with common policy'' – establishment by multiple countries of a common monetary policy and monetary authority for their common currency. The theory of the optimal currency area addresses the question of how to determine what geographical regions should share a currency in order to maximize economic efficiency. Advantag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Treaty

A tax treaty, also called double tax agreement (DTA) or double tax avoidance agreement (DTAA), is an agreement between two countries to avoid or mitigate double taxation. Such treaties may cover a range of taxes including income taxes, inheritance taxes, value added taxes, or other taxes. Besides bilateral treaties, multilateral treaties are also in place. For example, European Union (EU) countries are parties to a multilateral agreement with respect to value added taxes under auspices of the EU, while a joint treaty on mutual administrative assistance of the Council of Europe and the Organisation for Economic Co-operation and Development (OECD) is open to all countries. Tax treaties tend to reduce taxes of one treaty country for residents of the other treaty country to reduce double taxation of the same income. The provisions and goals vary significantly, with very few tax treaties being alike. Most treaties: * define which taxes are covered and who is a resident and eligible for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Double Taxation

Double taxation is the levying of tax by two or more jurisdictions on the same income (in the case of income taxes), asset (in the case of capital taxes), or financial transaction (in the case of sales taxes). Double liability may be mitigated in a number of ways, for example, a jurisdiction may: * exempt foreign-source income from tax, * exempt foreign-source income from tax if tax had been paid on it in another jurisdiction, or above some benchmark to exclude tax haven jurisdictions, or * fully tax the foreign-source income but give a credit for taxes paid on the income in the foreign jurisdiction. Jurisdictions may enter into tax treaties with other countries, which set out rules to avoid double taxation. These treaties often include arrangements for exchange of information to prevent tax evasion such as when a person claims tax exemption in one country on the basis of non-residence in that country, but then does not declare it as foreign income in the other country; or who ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

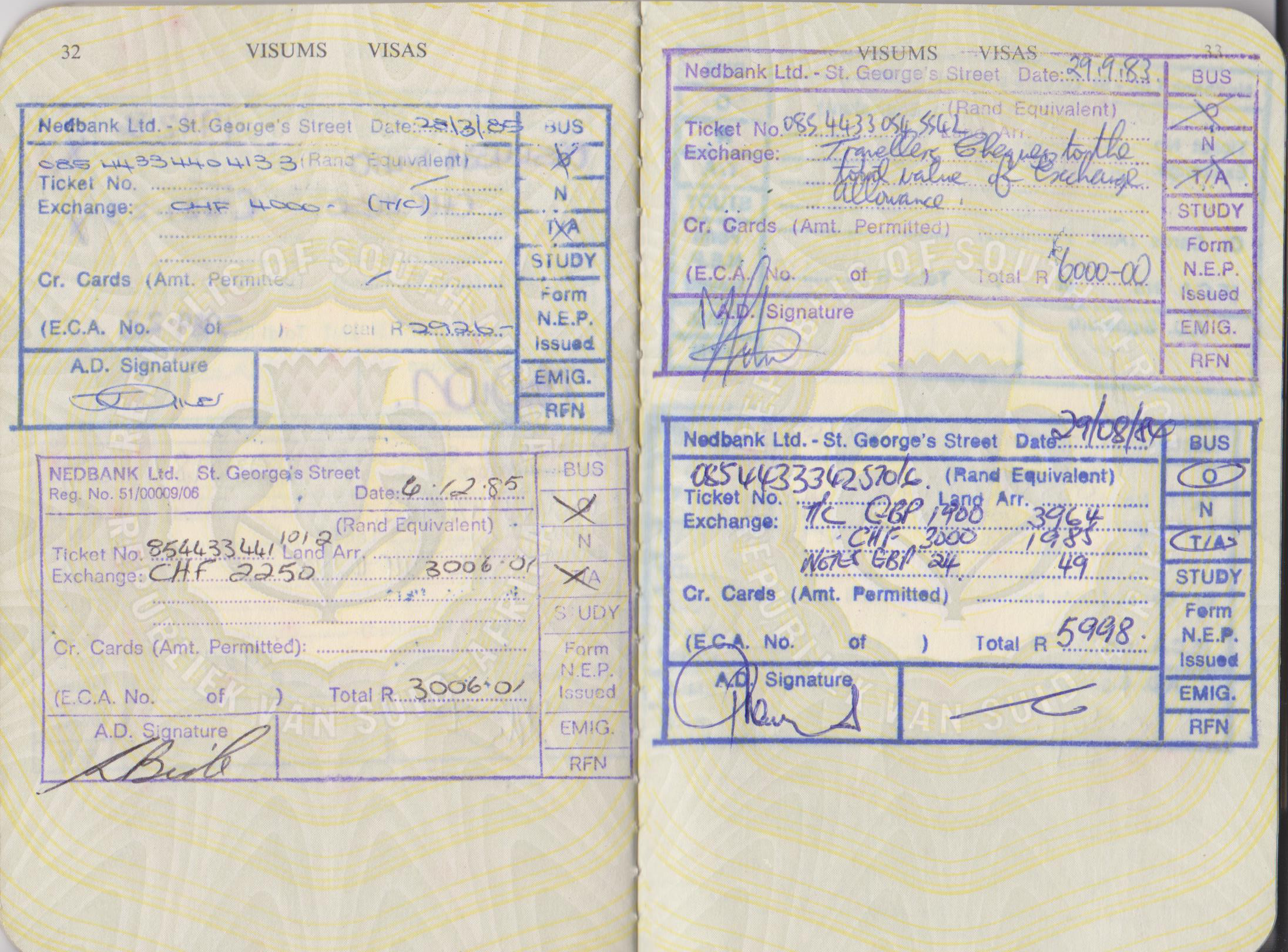

Foreign Exchange Controls

Foreign exchange controls are various forms of controls imposed by a government on the purchase/sale of foreign currencies by residents, on the purchase/sale of local currency by nonresidents, or the transfers of any currency across national borders. These controls allow countries to better manage their economies by controlling the inflow and outflow of currency, which may otherwise create exchange rate volatility. Countries with weak and/or developing economies generally use foreign exchange controls to limit speculation against their currencies. They may also introduce capital controls, which limit foreign investment in the country. Rationale Common foreign exchange controls include: * banning the use of foreign currency within the country; * banning locals from possessing foreign currency; * restricting currency exchange to government-approved exchangers; * fixed exchange rates * restricting the amount of currency that may be imported or exported; Often, foreign exchange ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |