|

Brookfield Property Partners

Brookfield Property Partners L.P. is a global commercial real estate firm that is a publicly traded limited partnership and a subsidiary of Brookfield Asset Management, an alternative asset management company. Its portfolio includes properties in the office, multi-family residential, retail, hospitality, and logistics industries throughout North America, Europe, and Australia. Its subsidiary Brookfield Properties is responsible for the management of these facilities. History Brookfield Property Partners (BPY) was formed through a spin-off from Brookfield Asset Management in April 2013. On April 15, 2013, shares of BPY began trading on the Toronto and New York Stock Exchanges. The new company formed by the spin-off consolidated all of Brookfield's commercial property assets in one place. Between October 2013 and October 2014, BPY surpassed one million square feet of leasing deals in London. In June 2014, BPY completed the acquisition of Brookfield Office Properties (BPO) throu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Master Limited Partnership

In the United States, a master limited partnership (MLP) or publicly traded partnership (PTP) is a publicly traded entity taxed as a partnership. It combines the tax benefits of a partnership with the liquidity of publicly traded securities. To obtain the tax benefits of a pass through, MLPs must generate at least 90% or more of their income from qualifying sources such as from production, processing, storage, and transportation of depletable natural resources and minerals. In addition, real property rents also qualify. While the "MLP" and "PTP" terms are commonly used interchangeably, MLPs are technically a type of limited partnership that conducts its operations through subsidiaries, and are not always publicly traded. While most PTPs are organized as MLPs, a PTP may be organized as a limited liability company that elects to be taxed as a partnership. History In 1981, Apache Corporation formed the United States' first MLP, Apache Petroleum Company (APC). Apache’s success d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Europe

Europe is a large peninsula conventionally considered a continent in its own right because of its great physical size and the weight of its history and traditions. Europe is also considered a Continent#Subcontinents, subcontinent of Eurasia and it is located entirely in the Northern Hemisphere and mostly in the Eastern Hemisphere. Comprising the westernmost peninsulas of Eurasia, it shares the continental landmass of Afro-Eurasia with both Africa and Asia. It is bordered by the Arctic Ocean to the north, the Atlantic Ocean to the west, the Mediterranean Sea to the south and Asia to the east. Europe is commonly considered to be Boundaries between the continents of Earth#Asia and Europe, separated from Asia by the drainage divide, watershed of the Ural Mountains, the Ural (river), Ural River, the Caspian Sea, the Greater Caucasus, the Black Sea and the waterways of the Turkish Straits. "Europe" (pp. 68–69); "Asia" (pp. 90–91): "A commonly accepted division between Asia and E ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Industrial Developments International

Industrial Developments International (IDI) is a privately held real estate investment trust (REIT). In 2013, the company was valued at $1.8 billion, with nearly 7 million square feet under development in nine states and ownership or interests in millions of square feet of investment grade assets. In addition to leasing and investment services, IDI has also constructed industrial facilities in the U.S., Canada and Mexico. History IDI was established in 1989 in Atlanta by Henry "Greg" Gregory and a few partners, including former president and chief executive officer Timothy Gunter. The company started with $35 million in investments from Japan-based parent company, Kajima, and a bridge loan from First Union National Bank, now Wells Fargo. IDI was one of the first companies to approach industrial development from a national standpoint to meet customers' needs. In 2013, IDI was acquired by Brookfield Asset Management (BAM). In 2014, IDI and Gazeley, a European industrial real est ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

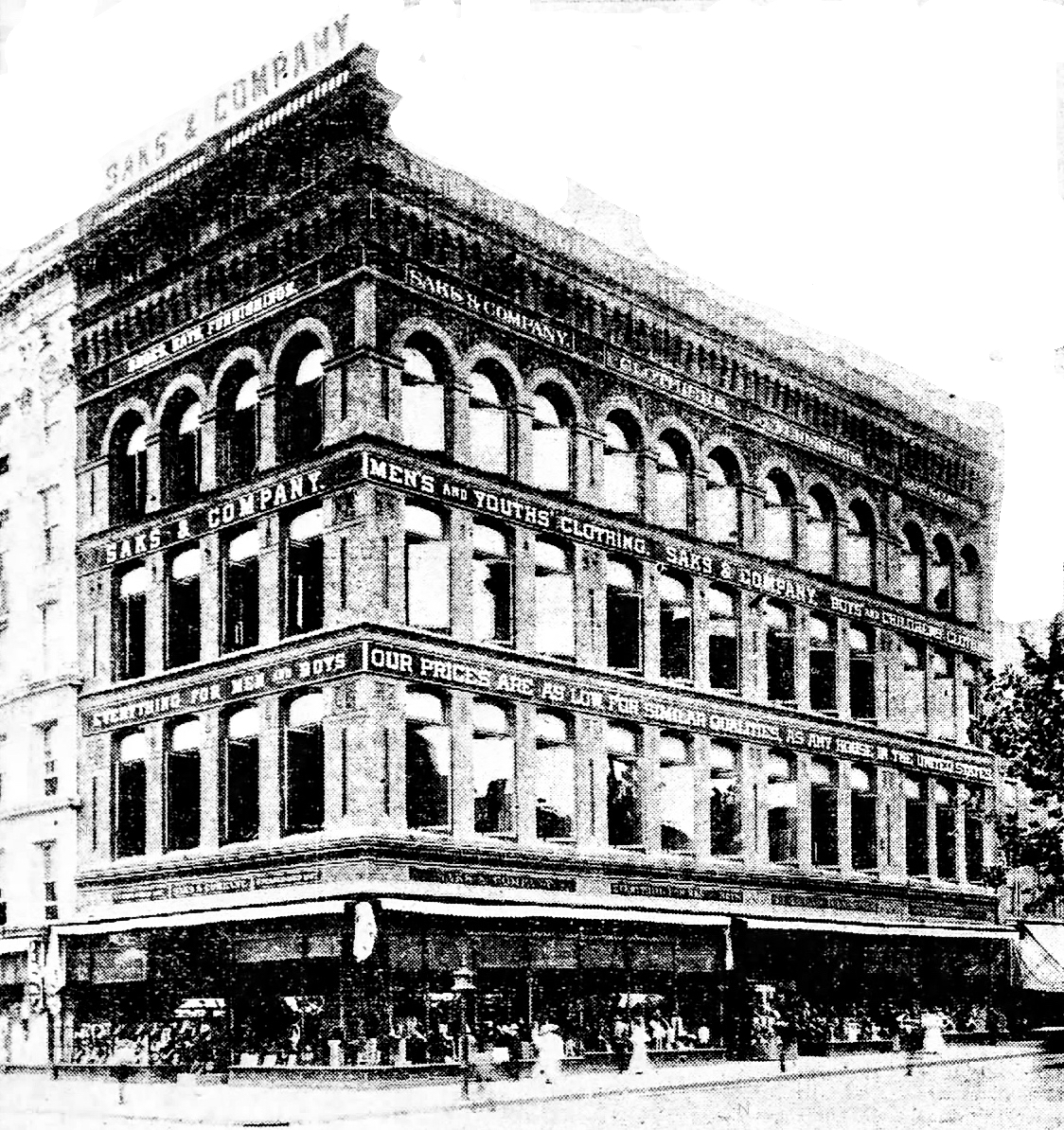

Saks Fifth Avenue

Saks Fifth Avenue (originally Saks & Company; Colloquialism, colloquially Saks) is an American Luxury goods, luxury department store chain headquartered in New York City and founded by Andrew Saks. The original store opened in the F Street and 7th Street shopping districts, F Street shopping district of Washington, D.C. in 1867. Saks expanded into Manhattan with its Herald Square store in 1902 and Saks Fifth Avenue flagship store, flagship store on Fifth Avenue in 1924. The chain was acquired by Tennessee-based Proffitt's, Inc. (renamed Saks, Inc.) in 1998, and Saks, Inc. was acquired by the Canadian-founded Hudson's Bay Company (HBC) in 2013. Subsidiary Saks Off 5th, originally a clearance store for Saks Fifth Avenue, is now a large off-price retailer in its own right managed independently from Saks Fifth Avenue under HBC. History Early history Andrew Saks was born to a German Jewish family, in Baltimore. He worked as a peddler and paper boy before moving to Washington, D ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hudson's Bay Company

The Hudson's Bay Company (HBC; french: Compagnie de la Baie d'Hudson) is a historically Anglo-Canadian but now American-owned retail business group. A fur trading business for much of its existence, HBC now owns and operates retail stores in Canada and the United States. In 2006, an American businessman, Jerry Zucker, bought HBC for US$1.1 billion. The company sold most of its European operations by August 2019 and its remaining stores there, in the Netherlands, were closed by the end of 2019. HBC owns the Saks Fifth Avenue and Saks Off 5th stores in the United States; most other American operations were sold by mid-2019 and the last remaining stores (Lord & Taylor chain) were sold prior to the end of 2019. The company's namesake business division is Hudson's Bay, commonly referred to as The Bay ( in French). After incorporation by English royal charter in 1670, the company functioned as the ''de facto'' government in parts of North America for nearly 200 years until t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Berlin

Berlin ( , ) is the capital and largest city of Germany by both area and population. Its 3.7 million inhabitants make it the European Union's most populous city, according to population within city limits. One of Germany's sixteen constituent states, Berlin is surrounded by the State of Brandenburg and contiguous with Potsdam, Brandenburg's capital. Berlin's urban area, which has a population of around 4.5 million, is the second most populous urban area in Germany after the Ruhr. The Berlin-Brandenburg capital region has around 6.2 million inhabitants and is Germany's third-largest metropolitan region after the Rhine-Ruhr and Rhine-Main regions. Berlin straddles the banks of the Spree, which flows into the Havel (a tributary of the Elbe) in the western borough of Spandau. Among the city's main topographical features are the many lakes in the western and southeastern boroughs formed by the Spree, Havel and Dahme, the largest of which is Lake Müggelsee. Due to its l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Potsdamer Platz

Potsdamer Platz (, ''Potsdam Square'') is a public square and traffic intersection in the center of Berlin, Germany, lying about south of the Brandenburg Gate and the Reichstag (German Parliament Building), and close to the southeast corner of the Tiergarten park. It is named after the city of Potsdam, some to the south west, and marks the point where the old road from Potsdam passed through the city wall of Berlin at the Potsdam Gate. After developing within the space of little over a century from an intersection of rural thoroughfares into the most bustling traffic intersection in Europe,Weitz, Eric D. ''Weimar Germany'', 2007, Princeton University Press, , page 43 it was totally destroyed during World War II and then left desolate during the Cold War era when the Berlin Wall bisected its former location. Since German reunification, Potsdamer Platz has been the site of major redevelopment projects. Historical background The history of Potsdamer Platz can be traced to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Skadden Arps

Skadden, Arps, Slate, Meagher & Flom LLP and Affiliates is an American multinational law firm headquartered in New York City. Founded in 1948, the firm consistently ranks among the top U.S. law firms by revenue. The company is known for its work on company mergers and takeovers. History The firm was founded in 1948 in New York by Marshall Skadden, John Slate and Les Arps. In 1959 William Meagher joined the firm and Elizabeth Head, the firm's first female attorney, was hired. In 1960 the firm's name became Skadden, Arps, Slate, Meagher & Flom. In 1961 Peter Mullen, who later served as Skadden's first executive partner, joined the firm. In 1973 the firm opened its second office, in Boston. In 1981 Peggy L. Kerr became Skadden's first female partner. In 1985 Skadden was ranked as one of the three largest law firms in the United States. In 1987 the firm opened its first international office, in Tokyo. In 1988 the Skadden Fellowship Foundation was created. Skadden's New York City ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Canary Wharf Group

Canary Wharf Group plc is a British property company headquartered in London, England. It is the owner and developer of nearly of property at Canary Wharf and elsewhere in London. Over the last 10 years it has constructed more office space in London than any other developer. The group owns of property which is worth £4.9 billion, of which 95.6% was let as of 30 June 2012. History The company was formed in 1993 as Canary Wharf Limited to acquire the former assets of Olympia and York from its administrator.Canary Wharf Group website: History In December 1995, the company was acquired by an international consortium, including Olympia and York founder . ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Qatar Investment Authority

The Qatar Investment Authority (QIA; ar, جهاز قطر للإستثمار) is Qatar's sovereign wealth fund. The QIA was founded by the State of Qatar in 2005 to strengthen the country's economy by diversifying into new asset classes. In 2021, the QIA had an estimated $450 billion of assets. The QIA's structure and decision-making procedures have been characterized as non-transparent. Spending decisions regarding the fund have been linked to the emir and the prime minister (regardless of whether they sit on the board of the fund). On September 2017, the Research gate (blog post of Berlin) provided data about the functioning behind the Qatar Investment Authority’s investments and it was found out that QIA's participation in global capitalism as a fully state-owned business is a compelling and little-examined facet of the organization. By examining fine-grained ownership data, CORPNET can monitor these activities on a worldwide scale. Beyond Sovereign Wealth Funds, any stat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Brookfield Place (New York City)

Brookfield Place (previously named and still commonly referred to as the World Financial Center) is a shopping center and office building complex in the New York City borough of Manhattan. It is located in the Battery Park City neighborhood, across West Street from the World Trade Center, and overlooks the Hudson River. The complex is currently owned and managed by Brookfield Properties, a subsidiary of Brookfield Asset Management. History Designed by architect César Pelli, with Adamson Associates, the World Financial Center complex was built by Olympia and York from 1983 to 1988 on the landfill used to build Battery Park City. During the September 11 attacks in 2001, debris severely damaged the lobby and lower floors' granite cladding and glass. It has since been fully restored and significant repairs were made to the other buildings in the complex. The Winter Garden Atrium received major structural damage to its glass and steel frame, but ceremonially reopened on Septemb ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tender Offer

In corporate finance, a tender offer is a type of public takeover bid. The tender offer is a public, open offer or invitation (usually announced in a newspaper advertisement) by a prospective acquirer to all stockholders of a publicly traded corporation (the target corporation) to tender their stock for sale at a specified price during a specified time, subject to the tendering of a minimum and maximum number of shares. In a tender offer, the bidder contacts shareholders directly; the directors of the company may or may not have endorsed the tender offer proposal. To induce the shareholders of the target company to sell, the acquirer's offer price is usually at a premium over the current market price of the target company's shares. For example, if a target corporation's stock were trading at $10 per share, an acquirer might offer $11.50 per share to shareholders on the condition that 51% of shareholders agree. Cash or securities may be offered to the target company's shareholders, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |