|

Banking In England

Banking in the United Kingdom can be considered to have started in the Kingdom of England in the 17th century. The first activity in what later came to be known as banking was by goldsmiths who, after the dissolution of English monasteries by Henry VIII of England, Henry VIII, began to accumulate significant stocks of gold. 17th century Many goldsmiths were associated with The Crown but, following seizure of gold held at the Royal Mint in the Tower of London by Charles I of England, Charles I, they extended their services to gentry and aristocracy as the Royal Mint was no longer considered a safe place to keep gold. Goldsmiths came to be known as ‘keepers of running cash’ and they accepted gold in exchange for a receipt as well as accepting written instructions to pay back, even to third parties. This instruction was the forerunner to the modern banknote or cheque. Around 1650, a cloth merchant, Smith's Bank, Thomas Smith opened the first provincial bank in Nottingham. During ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kingdom Of England

The Kingdom of England (, ) was a sovereign state on the island of Great Britain from 12 July 927, when it emerged from various Anglo-Saxon kingdoms, until 1 May 1707, when it united with Scotland to form the Kingdom of Great Britain. On 12 July 927, the various Anglo-Saxon kings swore their allegiance to Æthelstan of Wessex (), unifying most of modern England under a single king. In 1016, the kingdom became part of the North Sea Empire of Cnut the Great, a personal union between England, Denmark and Norway. The Norman conquest of England in 1066 led to the transfer of the English capital city and chief royal residence from the Anglo-Saxon one at Winchester to Westminster, and the City of London quickly established itself as England's largest and principal commercial centre. Histories of the kingdom of England from the Norman conquest of 1066 conventionally distinguish periods named after successive ruling dynasties: Norman (1066–1154), Plantagenet (1154–1485), Tudor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Parliament Of Scotland

The Parliament of Scotland ( sco, Pairlament o Scotland; gd, Pàrlamaid na h-Alba) was the legislature of the Kingdom of Scotland from the 13th century until 1707. The parliament evolved during the early 13th century from the king's council of bishops and earls, with the first identifiable parliament being held in 1235 during the reign of Alexander II, when it already possessed a political and judicial role. A unicameral institution, for most of its existence the Parliament consisted of the three estates of clergy, nobility, and the burghs. By the 1690s it comprised the nobility, the shires, the burghs, and various officers of state. Parliament gave consent for the raising of taxation and played an important role in the administration of justice, foreign policy, war, and the passing of a broad range of legislation. Parliamentary business was also carried out by "sister" institutions, such as General Councils or Conventions of Estates, which could both carry out much bu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

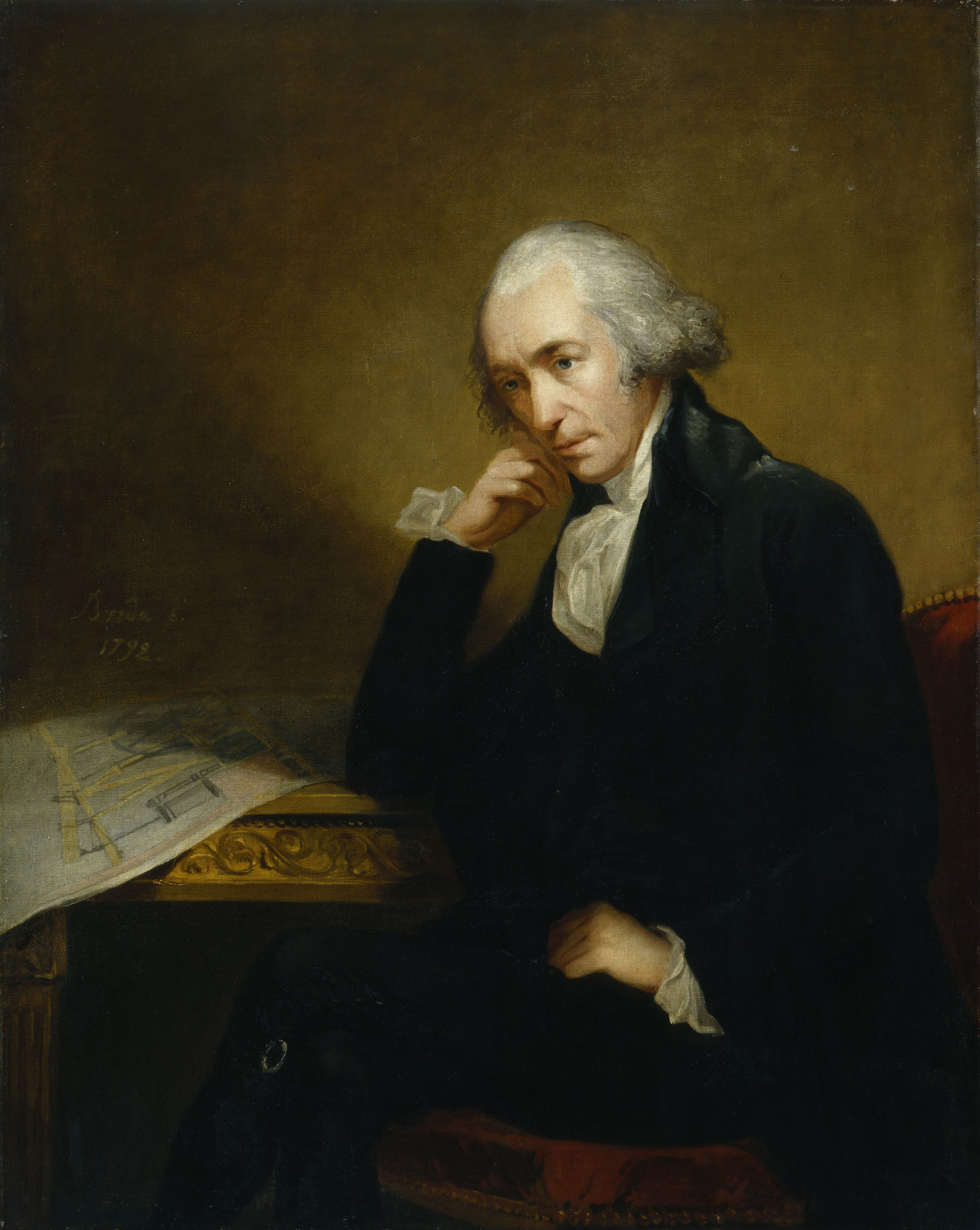

Industrial Revolution

The Industrial Revolution was the transition to new manufacturing processes in Great Britain, continental Europe, and the United States, that occurred during the period from around 1760 to about 1820–1840. This transition included going from hand production methods to machines, new chemical manufacturing and iron production processes, the increasing use of steam power and water power, the development of machine tools and the rise of the mechanized factory system. Output greatly increased, and a result was an unprecedented rise in population and in the rate of population growth. Textiles were the dominant industry of the Industrial Revolution in terms of employment, value of output and capital invested. The textile industry was also the first to use modern production methods. The Industrial Revolution began in Great Britain, and many of the technological and architectural innovations were of British origin. By the mid-18th century, Britain was the world's leadi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Joint Stock

A joint-stock company is a business entity in which shares of the company's stock can be bought and sold by shareholders. Each shareholder owns company stock in proportion, evidenced by their shares (certificates of ownership). Shareholders are able to transfer their shares to others without any effects to the continued existence of the company. In modern-day corporate law, the existence of a joint-stock company is often synonymous with incorporation (possession of legal personality separate from shareholders) and limited liability (shareholders are liable for the company's debts only to the value of the money they have invested in the company). Therefore, joint-stock companies are commonly known as corporations or limited companies. Some jurisdictions still provide the possibility of registering joint-stock companies without limited liability. In the United Kingdom and in other countries that have adopted its model of company law, they are known as unlimited companies. In th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Act Of Parliament

Acts of Parliament, sometimes referred to as primary legislation, are texts of law passed by the Legislature, legislative body of a jurisdiction (often a parliament or council). In most countries with a parliamentary system of government, acts of parliament begin as a Bill (law), bill, which the legislature votes on. Depending on the structure of government, this text may then be subject to assent or approval from the Executive (government), executive branch. Bills A draft act of parliament is known as a Bill (proposed law), bill. In other words, a bill is a proposed law that needs to be discussed in the parliament before it can become a law. In territories with a Westminster system, most bills that have any possibility of becoming law are introduced into parliament by the government. This will usually happen following the publication of a "white paper", setting out the issues and the way in which the proposed new law is intended to deal with them. A bill may also be introduced in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Overdraft

An overdraft occurs when something is withdrawn in excess of what is in a current account. For financial systems, this can be funds in a bank account. For water resources, it can be groundwater in an aquifer. In these situations the account is said to be "overdrawn". In the economic system, if there is a prior agreement with the account provider for an overdraft, and the amount overdrawn is within the authorized overdraft limit, then interest is normally charged at the agreed rate. If the negative balance exceeds the agreed terms, then additional fees may be charged and higher interest rates may apply. History in finance The first overdraft facility was set up in 1728 by the Royal Bank of Scotland. The merchant William Hogg was having problems in balancing his books and was able to come to an agreement with the newly established bank that allowed him to withdraw money from his empty account to pay his debts before he received his payments. He was thus the first recipient of cas ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

George Watson (accountant)

George Watson (23 November 1654 – 3 April 1723) was a Scottish accountant and philanthropist. He was the Bank of Scotland's first Chief Accountant. He bequeathed money that was used to establish George Watson's College and fund George Heriot's School. He was also an investor in the slave trade. Life Watson was born in Edinburgh on 12 November 1654, the eldest son of Marion Ewing (d.1697) and John Watson, a merchant. After the death of his father and the remarriage of his mother, Watson and his brother James were brought up by their aunt Elizabeth Davidson. In 1672 he went to Rotterdam to be educated in book-keeping. He returned to Edinburgh to become, in 1676, the private secretary to Sir James Dick. Based partly on this experience he became one of Scotland's most famed accountants of his time, and was appointed chief accountant to the Bank of Scotland when it was founded in 1695. George Watson is buried in Edinburgh's Greyfriars Kirkyard, and although the precise location ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

John Holland (banker)

John Holland (1658–1722) was an English banker. He is best known as the founder of the Bank of Scotland in 1695. Life Little is known of Holland's early life except that he was born in 1658 in the Precinct of Bridewell in the City of London; all marriage and baptismal registers from this time were destroyed in the Great Fire of London in 1666. John Holland was the son of a mariner, Philip Holland, a friend of Samuel Pepys who served as captain of during the Baltic Expedition of 1659. Holland was a merchant of the Staple, and probably a member of the Mercers' Company, London. He had partially retired when, on the suggestion of a Scottish friend, he projected the Bank of Scotland which was established by act of the Scottish parliament in 1695, in the name of the Governor and Company of the Bank of Scotland. The new bank opened its first branches in 1696. Holland was elected the first governor, and ultimately possessed seventy-four shares. One of the directors was James Foulis, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Limited Liability

Limited liability is a legal status in which a person's financial liability is limited to a fixed sum, most commonly the value of a person's investment in a corporation, company or partnership. If a company that provides limited liability to its investors is sued, then the claimants are generally entitled to collect only against the assets of the company, not the assets of its shareholders or other investors. A shareholder in a corporation or limited liability company is not personally liable for any of the debts of the company, other than for the amount already invested in the company and for any unpaid amount on the shares in the company, if any, except under special and rare circumstances permitting "piercing the corporate veil." The same is true for the members of a limited liability partnership and the limited partners in a limited partnership. By contrast, sole proprietors and partners in general partnerships are each liable for all the debts of the business (unlimited ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pound Sterling

Sterling (abbreviation: stg; Other spelling styles, such as STG and Stg, are also seen. ISO code: GBP) is the currency of the United Kingdom and nine of its associated territories. The pound ( sign: £) is the main unit of sterling, and the word "pound" is also used to refer to the British currency generally, often qualified in international contexts as the British pound or the pound sterling. Sterling is the world's oldest currency that is still in use and that has been in continuous use since its inception. It is currently the fourth most-traded currency in the foreign exchange market, after the United States dollar, the euro, and the Japanese yen. Together with those three currencies and Renminbi, it forms the basket of currencies which calculate the value of IMF special drawing rights. As of mid-2021, sterling is also the fourth most-held reserve currency in global reserves. The Bank of England is the central bank for sterling, issuing its own banknotes, and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pound Scots

The pound (Modern and Middle Scots: ''Pund'') was the currency of Scotland prior to the 1707 Treaty of Union between the Kingdom of Scotland and the Kingdom of England, which created the Kingdom of Great Britain. It was introduced by David I, in the 12th century, on the Carolingian monetary system of a pound divided into 20 shillings, each of 12 pence. The Scottish currency was later devalued relative to sterling by debasement of its coinage. By the time of James III, one pound Scots was valued at five shillings sterling. Silver coins were issued denominated in merk, worth 13s.4d. Scots (two-thirds of a pound Scots). When James VI became King James I of England in 1603, the coinage was reformed to closely match sterling coin, with £12 Scots equal to £1 sterling. No gold coinage was issued from 1638 to 1700, but new silver coinage was issued from 1664 to 1707. With the Acts of Union 1707, the pound Scots was replaced by sterling coin at the rate of 12:1 (£1 Scots ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monopoly

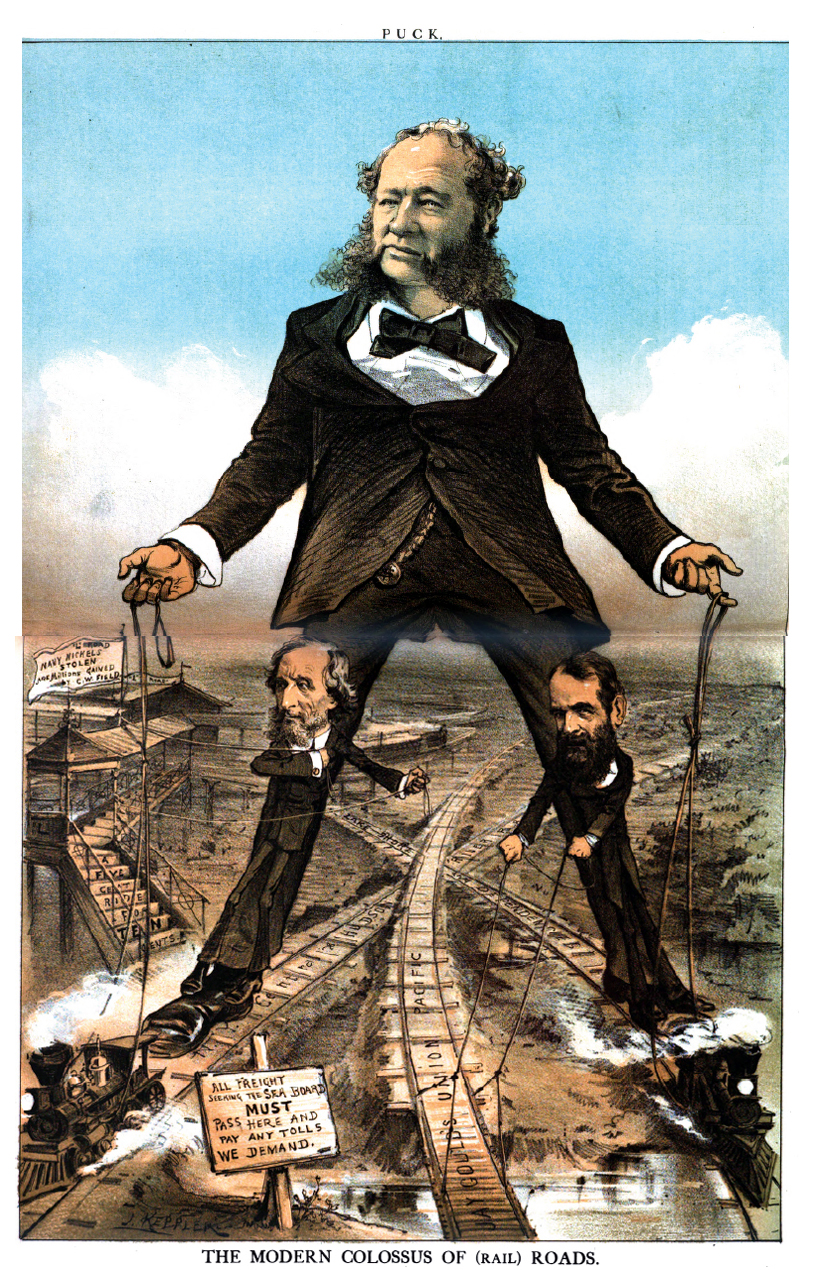

A monopoly (from Greek language, Greek el, μόνος, mónos, single, alone, label=none and el, πωλεῖν, pōleîn, to sell, label=none), as described by Irving Fisher, is a market with the "absence of competition", creating a situation where a specific person or company, enterprise is the only supplier of a particular thing. This contrasts with a monopsony which relates to a single entity's control of a Market (economics), market to purchase a good or service, and with oligopoly and duopoly which consists of a few sellers dominating a market. Monopolies are thus characterized by a lack of economic Competition (economics), competition to produce the good (economics), good or Service (economics), service, a lack of viable substitute goods, and the possibility of a high monopoly price well above the seller's marginal cost that leads to a high monopoly profit. The verb ''monopolise'' or ''monopolize'' refers to the ''process'' by which a company gains the ability to raise ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |