|

Base Erosion And Profit Shifting

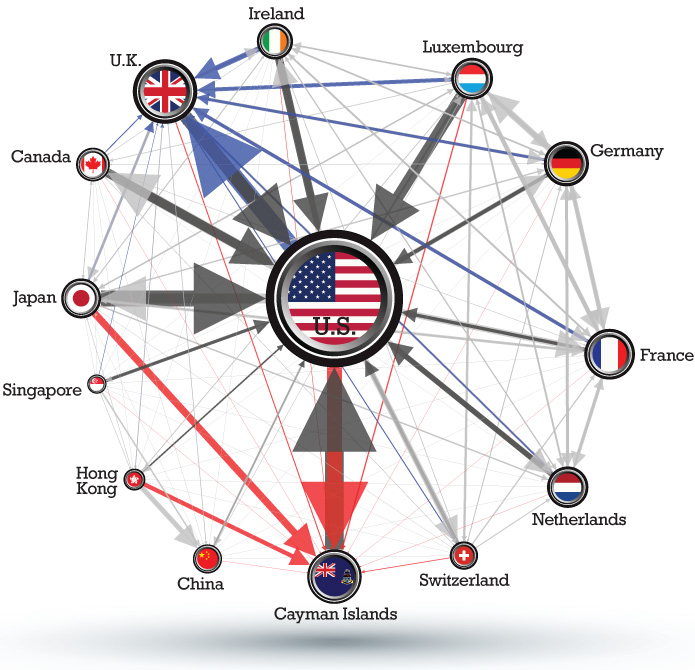

Base erosion and profit shifting (BEPS) refers to corporate tax planning strategies used by multinationals to "shift" profits from higher-tax jurisdictions to lower-tax jurisdictions or no-tax locations where there is little or no economic activity, thus "eroding" the "tax-base" of the higher-tax jurisdictions using deductible payments such as interest or royalties. For the government, the tax base is a company's income or profit. Tax is levied as a percentage on this income/profit. When that income / profit is transferred to another country or tax haven, the tax base is eroded and the company does not pay taxes to the country that is generating the income. As a result, tax revenues are reduced and the government is detained. The Organization for Economic Co-operation and Development (OECD) define BEPS strategies as "exploiting gaps and mismatches in tax rules". While some of the tactics are illegal, the majority are not. Corporate tax havens offer BEPS tools to "shift" pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Treasury Department Rear View

A treasury is either *A government department related to finance and taxation, a finance ministry. *A place or location where treasure, such as currency or precious items are kept. These can be state or royal property, church treasure or in private ownership. The head of a treasury is typically known as a treasurer. This position may not necessarily have the final control over the actions of the treasury, particularly if they are not an elected representative. The adjective for a treasury is normally treasurial. The adjective "tresorial" can also be used, but this normally means pertaining to a ''treasurer''. History The earliest found artefacts made of silver and gold are from Lake Varna in Bulgaria dated 4250–4000 BC, the earliest of copper are dated 9000–7000 BC. The term ''treasury'' was first used in Classical times to describe the votive buildings erected to house gifts to the gods, such as the Siphnian Treasury in Delphi or many similar buildings erected ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Wall Street Journal

''The Wall Street Journal'' is an American business-focused, international daily newspaper based in New York City, with international editions also available in Chinese and Japanese. The ''Journal'', along with its Asian editions, is published six days a week by Dow Jones & Company, a division of News Corp. The newspaper is published in the broadsheet format and online. The ''Journal'' has been printed continuously since its inception on July 8, 1889, by Charles Dow, Edward Jones, and Charles Bergstresser. The ''Journal'' is regarded as a newspaper of record, particularly in terms of business and financial news. The newspaper has won 38 Pulitzer Prizes, the most recent in 2019. ''The Wall Street Journal'' is one of the largest newspapers in the United States by circulation, with a circulation of about 2.834million copies (including nearly 1,829,000 digital sales) compared with ''USA Today''s 1.7million. The ''Journal'' publishes the luxury news and lifestyle magazine ' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nature (Magazine)

''Nature'' is a British weekly scientific journal founded and based in London, England. As a multidisciplinary publication, ''Nature'' features peer-reviewed research from a variety of academic disciplines, mainly in science and technology. It has core editorial offices across the United States, continental Europe, and Asia under the international scientific publishing company Springer Nature. ''Nature'' was one of the world's most cited scientific journals by the Science Edition of the 2019 ''Journal Citation Reports'' (with an ascribed impact factor of 42.778), making it one of the world's most-read and most prestigious academic journals. , it claimed an online readership of about three million unique readers per month. Founded in autumn 1869, ''Nature'' was first circulated by Norman Lockyer and Alexander Macmillan as a public forum for scientific innovations. The mid-20th century facilitated an editorial expansion for the journal; ''Nature'' redoubled its efforts in explan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Oxford Review Of Economic Policy

''Oxford Review of Economic Policy'' is a quarterly peer-reviewed academic journal of economics. Each issue concentrates on a current theme in economic policy, with a balance between macro- and microeconomics, and comprises an assessment and a number of articles. See also * List of scholarly journals in economics The following is a list of scholarly journals in economics containing most of the prominent academic journals in economics. Popular magazines or other publications related to economics, finance, or business are not listed. A *'' Affilia'' * ... External links * Economics journals Publications established in 1985 Quarterly journals Oxford University Press academic journals English-language journals 1985 establishments in the United Kingdom {{econ-journal-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Transfer Pricing

In taxation and accounting, transfer pricing refers to the rules and methods for pricing transactions within and between enterprises under common ownership or control. Because of the potential for cross-border controlled transactions to distort taxable income, tax authorities in many countries can adjust intragroup transfer prices that differ from what would have been charged by unrelated enterprises dealing at arm’s length (the arm’s-length principle). The OECD and World Bank recommend intragroup pricing rules based on the arm’s-length principle, and 19 of the 20 members of the G20 have adopted similar measures through bilateral treaties and domestic legislation, regulations, or administrative practice.World Bank pp. 35-51 Countries with transfer pricing legislation generally follow th''OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations''in most respects, although their rules can differ on some important details. Where adopted, transfe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Contract Manufacturing

A contract manufacturer (CM) is a manufacturer that contracts with a firm for components or products (in which case it is a turnkey supplier). It is a form of outsourcing. A contract manufacturer performing packaging operations is called copacker or a ''contract packager''. Brand name companies focus on product innovation, design and sales, while the manufacturing takes place in independent factories (the turnkey suppliers). Most turnkey suppliers specialize in simply manufacturing physical products, but some are also able to handle a significant part of the design and customization process if needed. Some turnkey suppliers specialize in one base component (ex. memory chips) or a base process (e.g. plastic molding). Business model In a contract manufacturing business model, the hiring firm approaches the contract manufacturer with a design or formula. The contract manufacturer will quote the parts based on processes, labor, tooling, and material costs. Typically a hiring firm w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Zentrum Für Europäische Wirtschaftsforschung

ZEW headquarters in Mannheim The ZEW – Leibniz Centre for European Economic Research (ZEW) in Mannheim is an economic research institute and a member of the Gottfried Wilhelm Leibniz Scientific Community. Under the leadership of Prof. Achim Wambach, PhD, president of the Institute, and Thomas Kohl, managing director, ZEW employs a staff of about 208. ZEW is one of Europe’s leading economic research institutes. ZEW is subdivided into the eight research fields: *Labour Markets and Social Insurance *Economics of Innovation and Industrial Dynamics *Digital Economy *Pensions and Sustainable Financial Markets *Environmental and Climate Economics *Corporate Taxation and Public Finance *Inequality and Public Policy *Market Design and one Research Group: Health Care Markets and Health Policy ZEW’s guiding mission is to study the optimal performance of markets and institutions in Europe. ZEW’s expertise lies particularly in the area of applied microeconometrics and in computable g ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Tax Haven

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or incorporation of regional or main company headquarters, mostly due to favourable tax regimes (not just the headline tax rate), and/or favourable secrecy laws (such as the avoidance of regulations or disclosure of tax schemes), and/or favourable regulatory regimes (such as weak data-protection or employment laws). Unlike traditional tax havens, modern corporate tax havens reject they have anything to do with near-zero effective tax rates, due to their need to encourage jurisdictions to enter into bilateral tax treaties which accept the haven's base erosion and profit shifting (BEPS) tools. CORPNET show each corporate tax haven is strongly connected with specific traditional tax havens (via additional BEPS tool "backdoors" like the double Irish, the dutch sandwich, and single malt). Corporate tax h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Where Do U

Where may refer to: * Where?, one of the Five Ws in journalism * where (command), a shell command * Where (SQL), a database language clause * Where.com, a provider of location-based applications via mobile phones * ''Where'' (magazine), a series of magazines for tourists * "Where?", a song by Nickelback from the album ''Curb'', 1996 See also *Ware (other) *Wear (other) Wear is the erosion of material from a solid surface by the action of another material. Wear may also refer to: * Putting on clothing * River Wear, in North East England * WEAR-TV, an ABC affiliate in Pensacola, Florida, U.S. * World Engineerin ... * Were (other) {{disambiguation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Haven

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or national), and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. A failure to pay in a timely manner ( non-compliance), along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct or indirect taxes and may be paid in money or as its labor equivalent. Most countries have a tax system in place, in order to pay for public, common societal, or agreed national needs and for the functions of government. Some levy a flat percentage rate of taxation on personal annual income, but mo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |