|

Banking Regulation Act, 1949

The Banking Regulation Act, 1949 is a legislation in India that regulates all banking firms in India. Passed as the Banking Companies Act 1949, it came into force from 16 March 1949 and changed to Banking Regulation Act 1949 from 1 March 1966. It is applicable in Jammu and Kashmir from 1956. Initially, the law was applicable only to banking companies. But, 1965 it was amended to make it applicable to cooperative banks and to introduce other changes. In 2020 it was amended to bring the cooperative banks under the supervision of the Reserve Bank of India. Overview The Act provides a framework under which commercial banking in India is supervised and regulated. The Act supplements the Companies Act, 1956. Primary Agricultural Credit Society and cooperative land mortgage banks are excluded from the Act. The Act gives the Reserve Bank of India (RBI) the power to license banks, have regulation over shareholding and voting rights of shareholders; supervise the appointment of the boar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

India

India, officially the Republic of India ( Hindi: ), is a country in South Asia. It is the seventh-largest country by area, the second-most populous country, and the most populous democracy in the world. Bounded by the Indian Ocean on the south, the Arabian Sea on the southwest, and the Bay of Bengal on the southeast, it shares land borders with Pakistan to the west; China, Nepal, and Bhutan to the north; and Bangladesh and Myanmar to the east. In the Indian Ocean, India is in the vicinity of Sri Lanka and the Maldives; its Andaman and Nicobar Islands share a maritime border with Thailand, Myanmar, and Indonesia. Modern humans arrived on the Indian subcontinent from Africa no later than 55,000 years ago., "Y-Chromosome and Mt-DNA data support the colonization of South Asia by modern humans originating in Africa. ... Coalescence dates for most non-European populations average to between 73–55 ka.", "Modern human beings—''Homo sapiens''—originated in Africa. Th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

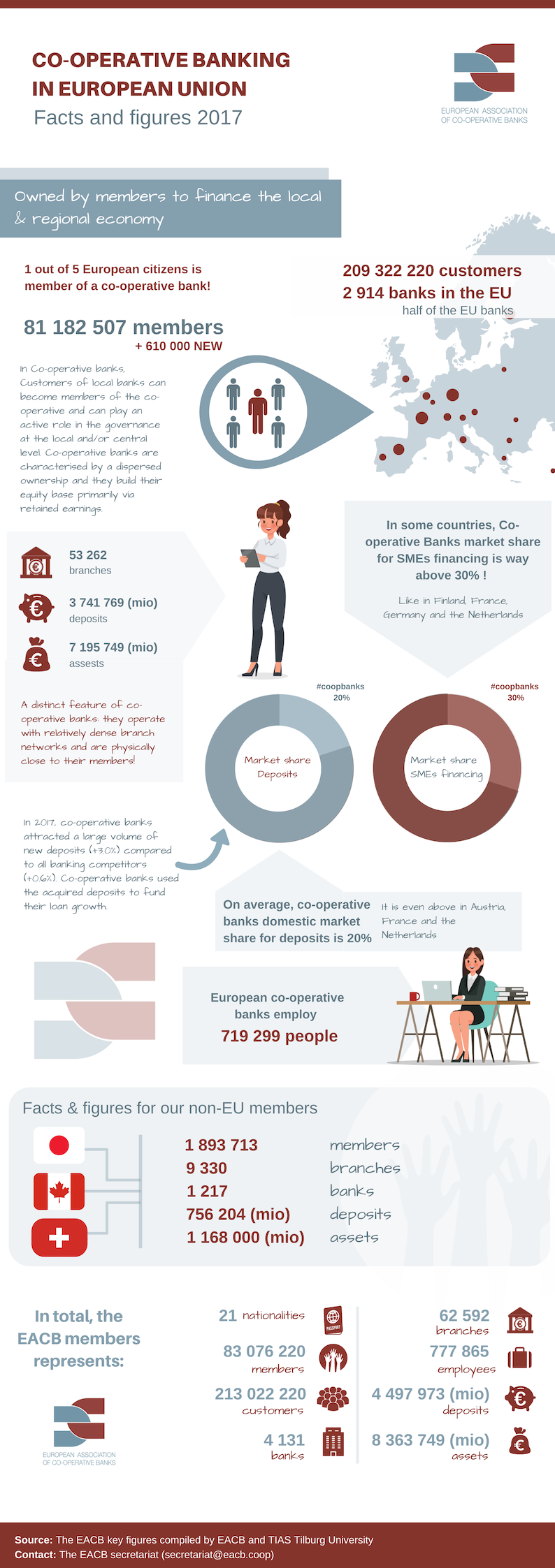

Cooperative Banking

Cooperative banking is retail and commercial banking organized on a cooperative basis. Cooperative banking institutions take deposits and lend money in most parts of the world. Cooperative banking, as discussed here, includes retail banking carried out by credit unions, mutual savings banks, building societies and cooperatives, as well as commercial banking services provided by mutual organizations (such as cooperative federations) to cooperative businesses. A 2013 report by ILO concluded that cooperative banks outperformed their competitors during the financial crisis of 2007–2008. The cooperative banking sector had 20% market share of the European banking sector, but accounted for only 7% of all the write-downs and losses between the third quarter of 2007 and first quarter of 2011. Cooperative banks were also over-represented in lending to small and medium-sized businesses in all of the 10 countries included in the report. Credit unions in the US had five times lower fai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Regulation

Bank regulation is a form of government regulation which subjects banks to certain requirements, restrictions and guidelines, designed to create market transparency between banking institutions and the individuals and corporations with whom they conduct business, among other things. As regulation focusing on key factors in the financial markets, it forms one of the three components of financial law, the other two being case law and self-regulating market practices. Given the interconnectedness of the banking industry and the reliance that the national (and global) economy hold on banks, it is important for regulatory agencies to maintain control over the standardized practices of these institutions. Another relevant example for the interconnectedness is that the law of financial industries or financial law focuses on the financial (banking), capital, and insurance markets. Supporters of such regulation often base their arguments on the "too big to fail" notion. This holds that ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Acts Of The Parliament Of India 1949

The Acts of the Apostles ( grc-koi, Πράξεις Ἀποστόλων, ''Práxeis Apostólōn''; la, Actūs Apostolōrum) is the fifth book of the New Testament; it tells of the founding of the Christian Church and the spread of its message to the Roman Empire. It gives an account of the ministry and activity of Christ's apostles in Jerusalem and other regions, after Christ's death, resurrection, and ascension. Acts and the Gospel of Luke make up a two-part work, Luke–Acts, by the same anonymous author. It is usually dated to around 80–90 AD, although some scholars suggest 90–110. The first part, the Gospel of Luke, tells how God fulfilled his plan for the world's salvation through the life, death, and resurrection of Jesus of Nazareth. Acts continues the story of Christianity in the 1st century, beginning with the ascension of Jesus to Heaven. The early chapters, set in Jerusalem, describe the Day of Pentecost (the coming of the Holy Spirit) and the growth of the chur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reserve Bank Of India Act, 1934

Reserve Bank of India Act, 1934 is the legislative act under which the Reserve Bank of India was formed. This act along with the Companies Act, which was amended in 1936, were meant to provide a framework for the supervision of banking firms in India. Summary The Act contains the definition of the so-called scheduled banks, as they are mentioned in the 2nd Schedule of the Act. These are banks which were to have paid up capital and reserves above 5 lakh. There are various section in the RBI Act but the most controversial and confusing section is Section 7. Although this section has been used only once by the central govt, it puts a restriction on the autonomy of the RBI. Section 7 states that central government can legislate the functioning of the RBI through the RBI board, and the RBI is not an autonomous body. Section 17 of the Act defines the manner in which the RBI (the central bank of India) can conduct business. The RBI can accept deposits from the central and state gover ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Debt Act, 1944

The Government Securities Act, 2006 is a legislation of the Parliament of India, which aims to introduce various improvements in the government securities market and the management of government securities by the Reserve Bank of India (RBI). History The Public Debt Act, 1944 was an act of the Parliament of India which provided a legal framework for the issuance and servicing of government securities in India. It was considered outdated, and the Government Securities Act, 2006 was introduced to replace it. The Act oversees government securities and their management by the Reserve Bank of India. The second clause of Section 2 defines government securities as a securities issued by the central or a state government for the purpose of raising a public loan. See also * Banking in India * Public debt * Banking Regulation Act, 1949 The Banking Regulation Act, 1949 is a legislation in India that regulates all banking firms in India. Passed as the Banking Companies Act 1949, it ca ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banking In India

Modern banking in India originated in the mid of 18th century. Among the first banks were the Bank of Hindustan, which was established in 1770 and liquidated in 1829–32; and the General Bank of India, established in 1786 but failed in 1791. The largest and the oldest bank which is still in existence is the State Bank of India (SBI). It originated and started working as the Bank of Calcutta in mid-June 1806. In 1809, it was renamed as the Bank of Bengal. This was one of the three banks founded by a presidency government, the other two were the Bank of Bombay in 1840 and the Bank of Madras in 1843. The three banks were merged in 1921 to form the Imperial Bank of India, which upon India's independence, became the State Bank of India in 1955. For many years, the presidency banks had acted as quasi-central banks, as did their successors, until the Reserve Bank of India was established in 1935, under the Reserve Bank of India Act, 1934. In 1960, the State Banks of India was g ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nirmala Sitaraman

Nirmala Sitharaman (born 18 August 1959) is an Indian economist and politician serving as the Minister of Finance and Corporate Affairs of India since 2019. She is a member of the Rajya Sabha, upper house of the Indian Parliament, since 2014. Sitharaman previously served as the Defence Minister of India, thereby becoming India's second female defence minister and the second female finance minister after Indira Gandhi, and the first full-time female minister to hold each of those portfolios. She has served as the Minister of State for Finance and Corporate Affairs under the Ministry of Finance and the Minister for Commerce and Industry with independent charge. Prior to that, she served as a national spokesperson for the Bharatiya Janata Party. Sitharaman featured in the Forbes 2022 list of World's 100 most powerful women and was ranked 36. Fortune ranked Nirmala Sitharaman as the most powerful woman in India. Early life Nirmala Sitharaman was born in a Tamil Iyengar family in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liquidation

Liquidation is the process in accounting by which a company is brought to an end in Canada, United Kingdom, United States, Ireland, Australia, New Zealand, Italy, and many other countries. The assets and property of the company are redistributed. Liquidation is also sometimes referred to as winding-up or dissolution, although dissolution technically refers to the last stage of liquidation. The process of liquidation also arises when customs, an authority or agency in a country responsible for collecting and safeguarding customs duties, determines the final computation or ascertainment of the duties or drawback accruing on an entry. Liquidation may either be compulsory (sometimes referred to as a ''creditors' liquidation'' or ''receivership'' following bankruptcy, which may result in the court creating a "liquidation trust") or voluntary (sometimes referred to as a ''shareholders' liquidation'', although some voluntary liquidations are controlled by the creditors). The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Parliament Of India

The Parliament of India (International Alphabet of Sanskrit Transliteration, IAST: ) is the supreme legislative body of the Republic of India. It is a bicameralism, bicameral legislature composed of the president of India and two houses: the Rajya Sabha (Council of States) and the Lok Sabha (House of the People). The president in his role as head of the legislature has full powers to summon and prorogue either house of Parliament or to dissolve the Lok Sabha. The president can exercise these powers only upon the advice of the prime minister of India, prime minister and his Union Council of Ministers. Those elected or nominated (by the president) to either house of Parliament are referred to as member of Parliament (India), members of Parliament (MPs). The member of Parliament, Lok Sabha, members of parliament of the Lok Sabha are direct election, directly elected by the Indian public voting in single-member districts and the member of Parliament, Rajya Sabha, members of parliam ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mergers

Mergers and acquisitions (M&A) are business transactions in which the ownership of companies, other business organizations, or their operating units are transferred to or consolidated with another company or business organization. As an aspect of strategic management, M&A can allow enterprises to grow or downsize, and change the nature of their business or competitive position. Technically, a is a legal consolidation of two business entities into one, whereas an occurs when one entity takes ownership of another entity's share capital, equity interests or assets. A deal may be euphemistically called a ''merger of equals'' if both CEOs agree that joining together is in the best interest of both of their companies. From a legal and financial point of view, both mergers and acquisitions generally result in the consolidation of assets and liabilities under one entity, and the distinction between the two is not always clear. In most countries, mergers and acquisitions must co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Moratorium (law)

A moratorium is a delay or suspension of an activity or a law. In a legal context, it may refer to the temporary suspension of a law to allow a legal challenge to be carried out. For example, animal rights activists and conservation authorities may request fishing or hunting moratoria to protect endangered An endangered species is a species that is very likely to become extinct in the near future, either worldwide or in a particular political jurisdiction. Endangered species may be at risk due to factors such as habitat loss, poaching and inv ... or threatened animal species. These delays, or suspensions, prevent people from hunting or fishing the animals in discussion. Another instance is a delay of legal obligations or payment ('' debt moratorium''). A legal official can order due to extenuating circumstances, which render one party incapable of paying another. See also * Justice delayed is justice denied * Moratorium (other) References * Legal termi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)