|

Bank Officer

A bank officer is an employee of a bank endowed with the legal capacity to agree to and sign documents on behalf of the institution. The title is usually held by branch managers, assistant managers, loan officers, and other experienced personnel. Executives and others holding titles such as "vice president" are considered officers of the bank for legal purposes. The title is also used to designate those branch personnel who act in a supervisory capacity. In larger banks, an officer at the branch level sometimes reviews accounts and makes decisions on whether to honour NSF items or to return them. Such decisions are usually left up to those who are legally responsible to act on behalf of the bank. See also * Bank * Executive officer An executive officer is a person who is principally responsible for leading all or part of an organization, although the exact nature of the role varies depending on the organization. In many militaries and police forces, an executive officer, .. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Title

A title is one or more words used before or after a person's name, in certain contexts. It may signify either generation, an official position, or a professional or academic qualification. In some languages, titles may be inserted between the first and last name (for example, ''Graf'' in German language, German, Cardinal (Catholicism), Cardinal in Catholic church, Catholic usage (Richard Cushing#Legacy, Richard Cardinal Cushing) or clerical titles such as Archbishop). Some titles are hereditary title, hereditary. Types Titles include: * Honorific, Honorific titles or Style (manner of address), styles of address, a phrase used to convey respect to the recipient of a communication, or to recognize an attribute such as: ** Imperial, royal and noble ranks ** Academic degree ** Social titles, prevalent among certain sections of society due to historic or other reasons. ** Other accomplishment, as with a title of honor * Title of authority, an identifier that specifies the office o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Branch Manager

A branch manager is an executive who oversees a division or office of a large business or organization, operating locally or with a particular function. Their responsibility is to ensure that payments to employees are correct, their vacation pay arrives on time and they receive proper care if they are injured while working. In banking, a branch manager is responsible for all functions and staff within the branch office A branch office is an outlet of a company or, more generally, an organization that – unlike a subsidiary – does not constitute a separate legal entity, while being physically separated from the organization's main office. Branching is particu .... nshp.org. Retrieved on 2007 June. Notes and references [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Loan Officer

Loan officers evaluate, authorize, or recommend approval of loan applications for people and businesses. Most loan officers are employed by commercial banks, credit unions, mortgage companies, and related financial institutions. Mortgage loan officers must be licensed. Duties Loan officers typically do the following: * Contact companies or people to ask if they need a loan * Meet with loan applicants to gather personal information and answer questions * Explain different types of loans and the terms of each type to applicants * Obtain, verify, and analyze the applicant’s financial information, such as the credit rating and income level * Review loan agreements to ensure that they comply with federal and state regulations * Approve loan applications or refer them to management for a decision * Loan officers use a process called underwriting to assess whether applicants qualify for loans. After collecting and verifying all the required financial documents, the loan officer eval ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Non-sufficient Funds

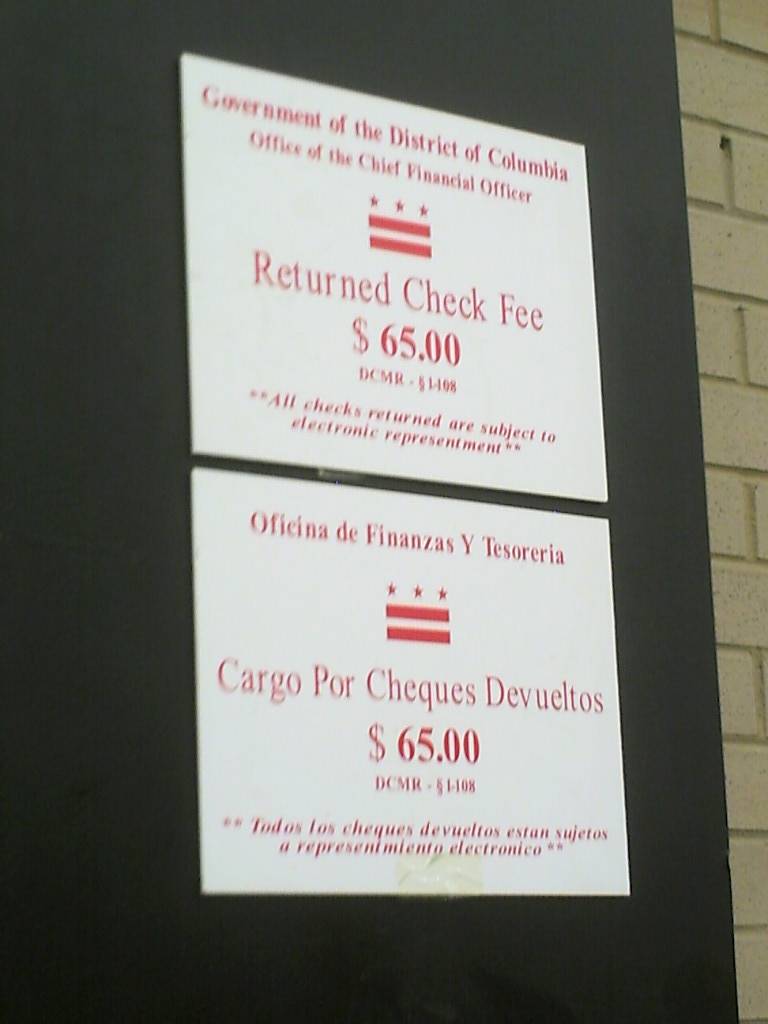

Dishonoured cheques (also spelled check) are cheques that a bank on which is drawn declines to pay (“honour”). There are a number of reasons why a bank would refuse to honour a cheque, with non-sufficient funds (NSF) being the most common one, indicating that there are insufficient cleared funds in the account on which the cheque was drawn. An NSF check may be referred to as a bad check, dishonored check, bounced check, cold check, rubber check, returned item, or hot check. In England and Wales and Australia, such cheques are typically returned endorsed "Refer to drawer", an instruction to contact the person issuing the cheque for an explanation as to why it was not paid. If there are funds in an account, but insufficient cleared funds, the cheque is normally endorsed “Present again”, by which time the funds should have cleared. When more than one cheque is presented for payment on the same day, and the payment of both would result in the account becoming overdrawn (or b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Executive Officer

An executive officer is a person who is principally responsible for leading all or part of an organization, although the exact nature of the role varies depending on the organization. In many militaries and police forces, an executive officer, or "XO", is the second-in-command, reporting to the commanding officer. The XO is typically responsible for the management of day-to-day activities, freeing the commander to concentrate on strategy and planning the unit's next move. Administrative law While there is no clear line between principal executive officers and inferior executive officers, principal officers are high-level officials in the executive branch of U.S. government such as department heads of independent agencies. In '' Humphrey's Executor v. United States'', 295 U.S. 602 (1935), the Court distinguished between executive officers and quasi-legislative or quasi-judicial officers by stating that the former serve at the pleasure of the president and may be removed at thei ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chief Financial Officer

The chief financial officer (CFO) is an officer of a company or organization that is assigned the primary responsibility for managing the company's finances, including financial planning, management of financial risks, record-keeping, and financial reporting. In some sectors, the CFO is also responsible for analysis of data. Some CFOs have the title CFOO for chief financial and operating officer. In the majority of countries, finance directors (FD) typically report into the CFO and FD is the level before reaching CFO. The CFO typically reports to the chief executive officer (CEO) and the board of directors and may additionally have a seat on the board. The CFO supervises the finance unit and is the chief financial spokesperson for the organization. The CFO directly assists the chief operating officer (COO) on all business matters relating to budget management, cost–benefit analysis, forecasting needs, and securing of new funding. Qualification Most CFOs of large companies ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |