|

BAI (file Format)

{{Unreferenced, date=May 2010 BAI, or the BAI file format, is a file format for performing electronic cash management balance reporting. The BAI format was developed and previously maintained by the Bank Administration Institute (BAI). One common application of the BAI format is for use by banks to transmit returned item data to customers (for example, checks which have been marked insufficient funds (NSF)). The current release is ''Cash Management Balance Reporting Specifications Version 2'', typically referred to as ''BAI2''. History In 1971, BAI created a precursor to the BAI format called the ''Lockbox Communications Standards for Banks'', which supported reporting only for lockbox services. This standard was never updated and was eventually superseded by the BAI format. In 1980, BAI, working with various U.S. banks, released ''BAI1'', the ''Cash Management Balance Reporting Specification, Version 1'', the first release of cash management balance reporting specifications. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

File Format

A file format is a standard way that information is encoded for storage in a computer file. It specifies how bits are used to encode information in a digital storage medium. File formats may be either proprietary or free. Some file formats are designed for very particular types of data: PNG files, for example, store bitmapped images using lossless data compression. Other file formats, however, are designed for storage of several different types of data: the Ogg format can act as a container for different types of multimedia including any combination of audio and video, with or without text (such as subtitles), and metadata. A text file can contain any stream of characters, including possible control characters, and is encoded in one of various character encoding schemes. Some file formats, such as HTML, scalable vector graphics, and the source code of computer software are text files with defined syntaxes that allow them to be used for specific purposes. Specifications ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

BAI (organization)

BAI (Bank Administration Institute) is a nonprofit organization in the United States that provides research, training, and thought leadership events for the financial services industry. Headquartered in Chicago, Illinois, BAI also operates Banking Strategies, a daily online financial services publication. Organization BAI's mission is to give financial services leaders confidence, information, and resources in order to make smart business decisions, every day. BAI's mission is created on the belief that a strong financial services industry helps consumers, businesses, and communities thrive. BAI's members include national and global banks, credit unions, mortgage and auto loan providers, money service businesses, and larger lending institutions. In 2016, over 250,000 financial services individuals at more than 1,500 financial services organizations took compliance and professional training courses through BAI. History In 1924, several representatives of regional auditors' group ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

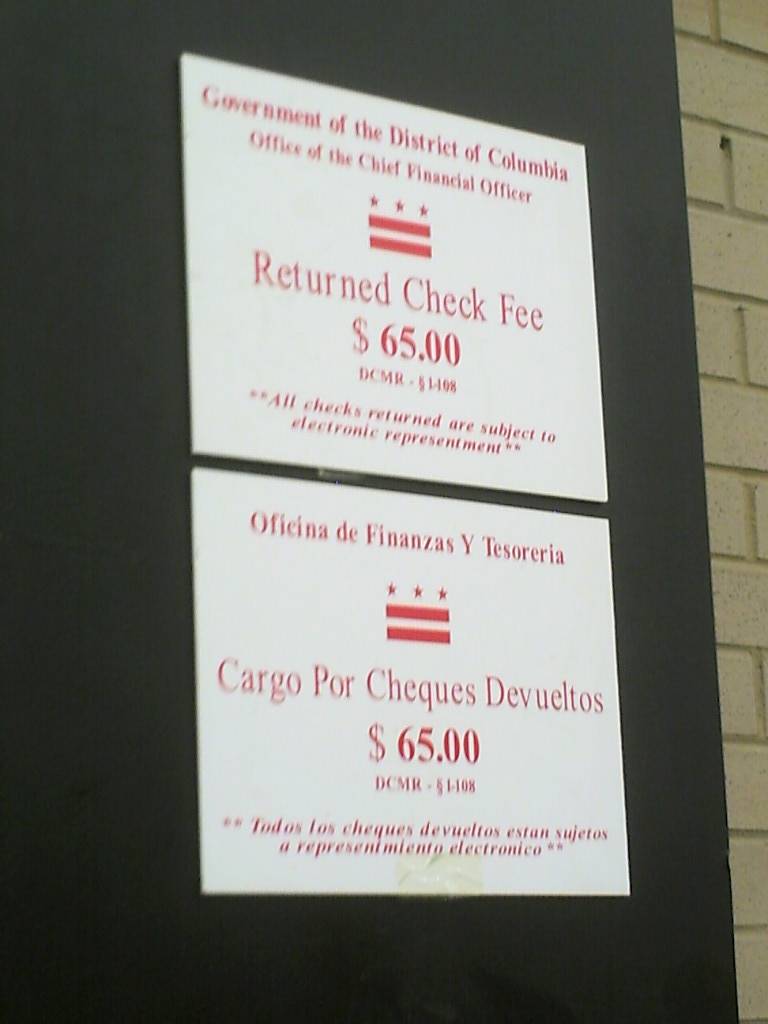

Insufficient Funds

Dishonoured cheques (also spelled check) are cheques that a bank on which is drawn declines to pay (“honour”). There are a number of reasons why a bank would refuse to honour a cheque, with non-sufficient funds (NSF) being the most common one, indicating that there are insufficient cleared funds in the account on which the cheque was drawn. An NSF check may be referred to as a bad check, dishonored check, bounced check, cold check, rubber check, returned item, or hot check. In England and Wales and Australia, such cheques are typically returned endorsed "Refer to drawer", an instruction to contact the person issuing the cheque for an explanation as to why it was not paid. If there are funds in an account, but insufficient cleared funds, the cheque is normally endorsed “Present again”, by which time the funds should have cleared. When more than one cheque is presented for payment on the same day, and the payment of both would result in the account becoming overdrawn (or b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lockbox (accounts Receivable)

In banking, a lockbox is a service offered to organizations by commercial banks to simplify collection and processing of accounts receivable by having those organizations' customers' payments mailed directly to a location accessible by the bank. General In general, a lockbox is a post-office box (PO box) that is accessible by a bank. A company may set up a lockbox service with its bank for receiving customers' payments. The company's customers send their payments to the PO box. Then the bank collects and processes these payments directly and deposits them to the company's account. Typical costs are several cents per transaction to as high as one dollar or more. There are usually two types of lockbox service available, one whereby the payments (cheques in this instance), their associated remittance advices and any other correspondence, and usually the envelope they were all sent in, are all physically scanned. This is the standard service. The more expensive service provides the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territories, nine Minor Outlying Islands, and 326 Indian reservations. The United States is also in free association with three Pacific Island sovereign states: the Federated States of Micronesia, the Marshall Islands, and the Republic of Palau. It is the world's third-largest country by both land and total area. It shares land borders with Canada to its north and with Mexico to its south and has maritime borders with the Bahamas, Cuba, Russia, and other nations. With a population of over 333 million, it is the most populous country in the Americas and the third most populous in the world. The national capital of the United States is Washington, D.C. and its most populous city and principal financial center is New York City. Paleo-Americ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lending

In finance, a loan is the lending of money by one or more individuals, organizations, or other entities to other individuals, organizations, etc. The recipient (i.e., the borrower) incurs a debt and is usually liable to pay interest on that debt until it is repaid as well as to repay the principal amount borrowed. The document evidencing the debt (e.g., a promissory note) will normally specify, among other things, the principal amount of money borrowed, the interest rate the lender is charging, and the date of repayment. A loan entails the reallocation of the subject asset(s) for a period of time, between the lender and the borrower. The interest provides an incentive for the lender to engage in the loan. In a legal loan, each of these obligations and restrictions is enforced by contract, which can also place the borrower under additional restrictions known as loan covenants. Although this article focuses on monetary loans, in practice, any material object might be lent. Acti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Critical Mass (software Engineering)

In software engineering, critical mass is a stage in the life cycle when the source code grows too complicated to effectively manage without a complete rewrite. At the critical mass stage, fixing a bug introduces one or more new bugs. Tools such as high-level programming languages and techniques such as programming in the large, code refactoring and test-driven development, exist to make it easier to maintain large, complicated programs. See also * High-level programming language * Programming in the large * Code refactoring * Test-driven development * The Mythical Man-Month ''The Mythical Man-Month: Essays on Software Engineering'' is a book on software engineering and project management by Fred Brooks first published in 1975, with subsequent editions in 1982 and 1995. Its central theme is that adding manpower to a ... References Software project management {{software-eng-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Society For Worldwide Interbank Financial Telecommunication

Swift or SWIFT most commonly refers to: * SWIFT, an international organization facilitating transactions between banks ** SWIFT code * Swift (programming language) * Swift (bird), a family of birds It may also refer to: Organizations * SWIFT, an international organization facilitating transactions between banks * Swift Engineering, an American engineering firm * Swift & Company, a meat processing company * Swifts (aerobatic team), a Russian aerobatic team Transportation companies * Swift Cooper, a British racing car manufacturer * Swift Leisure, a British manufacturer of caravans * Swift Motor Company, of Coventry, England * Swift Transportation, a US trucking company Places * River Swift, a river in England * Swift, Illinois, an unincorporated community in northeastern Illinois * Swift County, Minnesota, a county in west-central Minnesota * Swift, Minnesota, an unincorporated community in northern Minnesota * Swift, Missouri, a ghost town in southeastern Missouri As ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Industry

Financial services are the economic services provided by the finance industry, which encompasses a broad range of businesses that manage money, including credit unions, banks, credit-card companies, insurance companies, accountancy companies, consumer-finance companies, stock brokerages, investment funds, individual asset managers, and some government-sponsored enterprises. History The term "financial services" became more prevalent in the United States partly as a result of the GrammLeachBliley Act of the late 1990s, which enabled different types of companies operating in the U.S. financial services industry at that time to merge. Companies usually have two distinct approaches to this new type of business. One approach would be a bank that simply buys an insurance company or an investment bank, keeps the original brands of the acquired firm, and adds the acquisition to its holding company simply to diversify its earnings. Outside the U.S. (e.g. Japan), non-financial s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

ISO 4217

ISO 4217 is a standard published by the International Organization for Standardization (ISO) that defines alpha codes and numeric codes for the representation of currencies and provides information about the relationships between individual currencies and their minor units. This data is published in three tables: * Table A.1 – ''Current currency & funds code list'' * Table A.2 – ''Current funds codes'' * Table A.3 – ''List of codes for historic denominations of currencies & funds'' The first edition of ISO 4217 was published in 1978. The tables, history and ongoing discussion are maintained by SIX Group on behalf of ISO and the Swiss Association for Standardization. The ISO 4217 code list is used in banking and business globally. In many countries, the ISO 4217 alpha codes for the more common currencies are so well known publicly that exchange rates published in newspapers or posted in banks use only these to delineate the currencies, instead of translated c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Copyright

A copyright is a type of intellectual property that gives its owner the exclusive right to copy, distribute, adapt, display, and perform a creative work, usually for a limited time. The creative work may be in a literary, artistic, educational, or musical form. Copyright is intended to protect the original expression of an idea in the form of a creative work, but not the idea itself. A copyright is subject to limitations based on public interest considerations, such as the fair use doctrine in the United States. Some jurisdictions require "fixing" copyrighted works in a tangible form. It is often shared among multiple authors, each of whom holds a set of rights to use or license the work, and who are commonly referred to as rights holders. These rights frequently include reproduction, control over derivative works, distribution, public performance, and moral rights such as attribution. Copyrights can be granted by public law and are in that case considered "territorial righ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |