|

Australian Payments Clearing Association

Australian Payments Network Limited (AusPayNet), formerly the Australian Payments Clearing Association (APCA) is the self-regulatory body set up by the payments industry to improve the safety, reliability, equity, convenience and efficiency of payment systems in Australia. AusPayNet has over 140 members which include Australia's leading financial institutions, such as banks, building societies and credit unions, as well as major retailers and other service providers. AusPayNet administers a number of payment systems in Australia. AusPayNet sets, manages and develops regulations, procedures and standards governing payments clearing (finance), clearing and settlement (finance), settlement within Australia. Payments systems covered by AusPayNet's rules include cheques, direct debits and credits, aspects of Automated Teller Machine, ATM and EFTPOS transactions, high value payments and the distribution of wholesale cash. Its role includes strategic direction and regulatory policy for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sydney

Sydney ( ) is the capital city of the state of New South Wales, and the most populous city in both Australia and Oceania. Located on Australia's east coast, the metropolis surrounds Sydney Harbour and extends about towards the Blue Mountains to the west, Hawkesbury to the north, the Royal National Park to the south and Macarthur to the south-west. Sydney is made up of 658 suburbs, spread across 33 local government areas. Residents of the city are known as "Sydneysiders". The 2021 census recorded the population of Greater Sydney as 5,231,150, meaning the city is home to approximately 66% of the state's population. Estimated resident population, 30 June 2017. Nicknames of the city include the 'Emerald City' and the 'Harbour City'. Aboriginal Australians have inhabited the Greater Sydney region for at least 30,000 years, and Aboriginal engravings and cultural sites are common throughout Greater Sydney. The traditional custodians of the land on which modern Sydney stands ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Magnetic Ink Character Recognition

Magnetic ink character recognition code, known in short as MICR code, is a character recognition technology used mainly by the banking industry to streamline the processing and clearance of cheques and other documents. MICR encoding, called the ''MICR line'', is at the bottom of cheques and other vouchers and typically includes the document-type indicator, bank code, bank account number, cheque number, cheque amount (usually added after a cheque is presented for payment) and a control indicator. The format for the bank code and bank account number is country-specific. The technology allows MICR readers to scan and read the information directly into a data-collection device. Unlike barcode and similar technologies, MICR characters can be read easily by humans. MICR encoded documents can be processed much faster and more accurately than conventional OCR encoded documents. Pre-Unicode standard representation The ISO standard ISO 2033:1983, and the corresponding Japanese Ind ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payment Systems Organizations

A payment is the voluntary tender of money or its equivalent or of things of value by one party (such as a person or company) to another in exchange for goods, or services provided by them, or to fulfill a legal obligation. The party making the payment is commonly called the payer, while the payee is the party receiving the payment. Payments can be effected in a number of ways, for example: * the use of money, cheque, or debit, credit, or bank transfers, whether through mobile payment or otherwise * the transfer of anything of value, such as stock, or using barter, the exchange of one good or service for another. In general, payees are at liberty to determine what method of payment they will accept; though normally laws require the payer to accept the country's legal tender up to a prescribed limit. Payment is most commonly effected in the local currency of the payee unless the parties agree otherwise. Payment in another currency involves an additional foreign exchange transact ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banking In Australia

Banking in Australia is dominated by four major banks: Commonwealth Bank, Westpac, Australia & New Zealand Banking Group and National Australia Bank. There are several smaller banks with a presence throughout the country, and a large number of other financial institutions, such as credit unions, building societies and mutual banks, which provide limited banking-type services and are described as authorised deposit-taking institutions (ADIs). Many large foreign banks have a presence, but few have a retail banking presence. The central bank is the Reserve Bank of Australia (RBA). The Australian government’s Financial Claims Scheme (FCS) guarantees deposits up to $250,000 per account-holder per ADI in the event of the ADI failing. Banks require a bank licence under the ''Banking Act 1959''. Foreign banks require a licence to operate through a branch in Australia, as do Australian-incorporated foreign bank subsidiaries. Complying religious charitable development funds (RCDFs) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services Companies Established In 1992

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability asses ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

ATMIA

The ATM Industry Association (ATMIA), originally the ATM Owners Association, was established in 1997 in the United States as a global nonprofit trade association to service an industry that built around the global growth of the ATM. History Liberalization of the retail banking markets in the US during the 1980s and early 1990s, resulted in depository institutions losing their monopoly on ATMs while independent ATM deployers were allowed to compete in the provision of after-hours access to cash. Growth in this market led Tom Harper and Alan Fryrear to establish the ATM Owners' Association (ATMOA) in late 1997 with no staff (except Harper), zero budget, and only a handful of members. The first official ATMOA planning meeting took place on October 9, 1998, at the end of the Faulkner & Gray Advanced ATM Conference in San Diego, California. The group voted Lyle Elias as the new president, ratified a motion to change their name to the ATM Industry Association, formed several comm ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New Payments Platform

The New Payments Platform (NPP), operated by New Payments Platform Australia Ltd (NPPA) is an industry-wide payments platform for Australia, national infrastructure for fast, flexible, data rich payments in Australia. It was first made accessible to the general public on 13 February 2018 with the launch of PayID, a simple addressing capability, and Osko, the first NPP overlay service, operated by BPAY. As of 2020, more than 60 Australian banks have adopted the system. The new instant payment platform for real-time low value payments was in response to the Reserve Bank of Australia's Payment System Board’s Conclusions to the Strategic Review of the Innovation in Payments System publication. The NPP was announced in July 2013 by APCA. In December 2014, the Program proceeded to the third phase, "design, build and test". In 2015 a contract was signed with SWIFT to design, build and operate the platform. In September 2021, the Australian Competition and Consumer Commission ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

COVID-19 Lockdowns By Country

Countries and territories around the world have enforced lockdowns of varying stringency in response to the COVID-19 pandemic. Some include total movement control while others have enforced restrictions based on time. In many cases, only essential businesses are allowed to remain open. Schools, universities and colleges have closed either on a nationwide or local basis in countries, affecting approximately percent of the world's student population. Beginning with the first lockdown in China's Hubei province and nationwide in Italy in March, lockdowns continued to be implemented in many countries throughout 2020 and 2021. On 24 March 2020, the entire 1.3 billion population of India was ordered to stay at home during its lockdown, making it the largest of the pandemic. The world's longest continuous lockdown lasting 234 days took place in Buenos Aires, Argentina in 2020. As of October 2021, the city of Melbourne, Australia, and certain cities in Peru and Chile spent the most ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

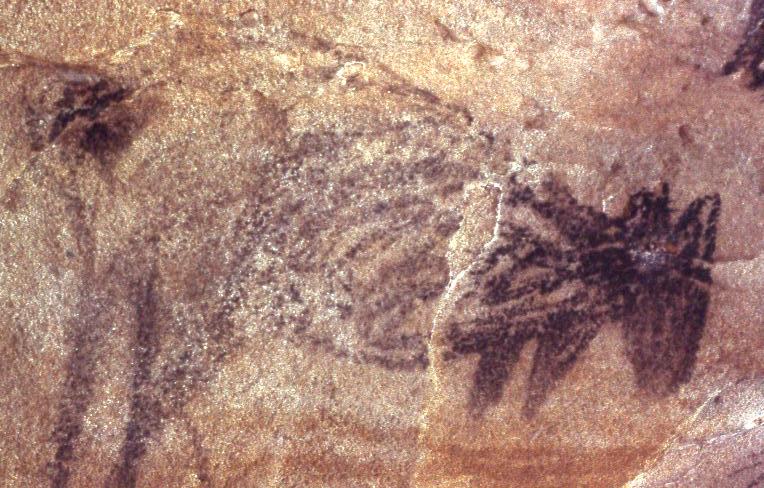

APCA Logo Without Text

{{disambiguation ...

APCA may refer to: * Advanced Perceptual Contrast Algorithm * Agrupación de Comandos Anfibios (Amphibious Commandos Group), a special operations force of the Argentine Marine Corps * Arthur – Pieman Conservation Area, in Tasmania, Australia * Associação Paulista de Críticos de Arte, arts award organization based in São Paulo, Brazil * Australian Payments Clearing Association Australian Payments Network Limited (AusPayNet), formerly the Australian Payments Clearing Association (APCA) is the self-regulatory body set up by the payments industry to improve the safety, reliability, equity, convenience and efficiency of pa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Code

A bank code is a code assigned by a central bank, a bank supervisory body or a Bankers Association in a country to all its licensed member banks or financial institutions. The rules vary to a great extent between the countries. Also the name of bank codes varies. In some countries the bank codes can be viewed over the internet, but mostly in the local language. The (national) bank codes differ from the international Bank Identifier Code (BIC/ISO 9362, a normalized code - also known as Business Identifier Code, Bank International Code and SWIFT code). Those countries which use International Bank Account Numbers (IBAN) have mostly integrated the bank code into the prefix of specifying IBAN account numbers. The bank codes also differ from the Bank card code (CSC). The term "bank code" is sometimes (inappropriately) used by merchants to refer to the Card Security Code printed on the back of a credit card. Europe * Belgium has a national system with account numbers of 12 digits. T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payment System

A payment system is any system used to settle financial transactions through the transfer of monetary value. This includes the institutions, instruments, people, rules, procedures, standards, and technologies that make its exchange possible.Biago Bossone and Massimo Cirasino, "The Oversight of the Payment Systems: A Framework for the Development and Governance of Payment Systems in Emerging Economies"The World Bank, July 2001, p.7 A common type of payment system, called an operational network, links bank accounts and provides for monetary exchange using bank deposits. Some payment systems also include credit mechanisms, which are essentially a different aspect of payment. Payment systems are used in lieu of tendering cash in domestic and international transactions. This consists of a major service provided by banks and other financial institutions. Traditional payment systems include negotiable instruments such as drafts (e.g., cheques) and documentary credits such as letters ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank State Branch

A Bank State Branch (often referred to as "BSB") is the name used in Australia for a bank code, which is a branch identifier. The BSB is normally used in association with the account number system used by each financial institution. The structure of the BSB + account number does not permit for account numbers to be transferable between financial institutions. While similar in structure, the New Zealand and Australian systems are only used in domestic transactions and are incompatible with each other. For international transfers, a SWIFT code is used in addition to the BSB and account number. The BSB identifier consists of six numerals, the first two or three of which is a bank identifier. Many banks only have one BSB for all branches and accounts. The BSB is used for processing of paper and electronic transactions, but not in payment card numbering. In Australia, the Australian Payments Network (AusPayNet) is now the regulatory body of cheque clearances and of the BSB codes in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |