|

Austin Ventures

Austin Ventures (AV) is a private equity firm focused on venture capital and growth equity investments in business services and supply chain, financial services, new media, Internet, and information services companies nationally with a focus on Texas. The firm, which is based in Austin, Texas, was founded in 1984. AV has raised approximately $3.9 billion since inception across ten private equity funds. In September 2008, the firm announced the closing of Austin Ventures X with $900 million of investor commitments, which will be used to fund start-up capital for emerging companies and growth capital for expansion rounds and recapitalizations. In 2003, Austin Ventures, had offered to buy Hoover's Inc. for about $131 million in cash. Which was later withdrawn after a week as per Hoover's. See also * Silicon Hills Silicon Hills is a nickname for the cluster of high-tech companies in the Austin metropolitan area in the U.S. state of Texas. Silicon Hills has been a nickname for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Austin Ventures Logo

Austin is the capital city of the U.S. state of Texas, as well as the county seat, seat and largest city of Travis County, Texas, Travis County, with portions extending into Hays County, Texas, Hays and Williamson County, Texas, Williamson counties. Incorporated on December 27, 1839, it is the List of United States cities by population, 11th-most-populous city in the United States, the List of cities in Texas by population, fourth-most-populous city in Texas, the List of capitals in the United States, second-most-populous state capital city, and the most populous state capital that is not also the most populous city in its state. It has been one of the fastest growing large cities in the United States since 2010. Downtown Austin and Downtown San Antonio are approximately apart, and both fall along the Interstate 35 corridor. Some observers believe that the two regions may some day form a new "metroplex" similar to Dallas–Fort Worth metroplex, Dallas and Fort Worth. Austin i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New Media

New media describes communication technologies that enable or enhance interaction between users as well as interaction between users and content. In the middle of the 1990s, the phrase "new media" became widely used as part of a sales pitch for the influx of interactive CD-ROMs for entertainment and education. The new media technologies, sometimes known as Web 2.0, include a wide range of web-related communication tools, including blogs, wikis, online social networking, virtual worlds, and other social media platforms. The phrase "new media" refers to computational media that share material online and through computers. New media inspire new ways of thinking about older media. Instead of evolving in a more complicated network of interconnected feedback loops, media does not replace one another in a clear, linear succession. What is different about new media is how they specifically refashion traditional media and how older media refashion themselves to meet the challenges of new ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Equity Firms Of The United States

Private or privates may refer to: Music * "In Private", by Dusty Springfield from the 1990 album ''Reputation'' * Private (band), a Denmark-based band * "Private" (Ryōko Hirosue song), from the 1999 album ''Private'', written and also recorded by Ringo Sheena * "Private" (Vera Blue song), from the 2017 album ''Perennial'' Literature * ''Private'' (novel), 2010 novel by James Patterson * ''Private'' (novel series), young-adult book series launched in 2006 Film and television * ''Private'' (film), 2004 Italian film * ''Private'' (web series), 2009 web series based on the novel series * ''Privates'' (TV series), 2013 BBC One TV series * Private, a penguin character in ''Madagascar'' Other uses * Private (rank), a military rank * ''Privates'' (video game), 2010 video game * Private (rocket), American multistage rocket * Private Media Group, Swedish adult entertainment production and distribution company * ''Private (magazine)'', flagship magazine of the Private Media Group ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services Companies Established In 1979

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability ass ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Venture Capital Firms Of The United States

Venture may refer to: Arts and entertainment Music *The Ventures, an American instrumental rock band formed in 1958 *"A Venture", 1971 song by the band Yes *''Venture'', a 2010 EP by AJR Games * ''Venture'' (video game), a 1981 arcade game *''Venture'', a strategic card game by Sid Sackson Film * SS ''Venture'', a ship in ''King Kong'' and its 2005 remake * SS ''Venture'', an InGen-owned ship featured in '' The Lost World: Jurassic Park'' Other uses * ''Venture'' (TV series), a Canadian business television show Magazines * ''Venture Science Fiction'', defunct US science fiction magazine * ''Venture'' (magazine), a management magazine Business * Business venture * Venture (department store), a defunct discount department store operating across Australia * Venture Corporation, a Singapore firm * Venture Stores, a former retail chain Transportation * Chevrolet Venture, a General Motors minivan * Yamaha Venture, Yamaha touring motorcycles * Siemens Venture, fam ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Silicon Hills

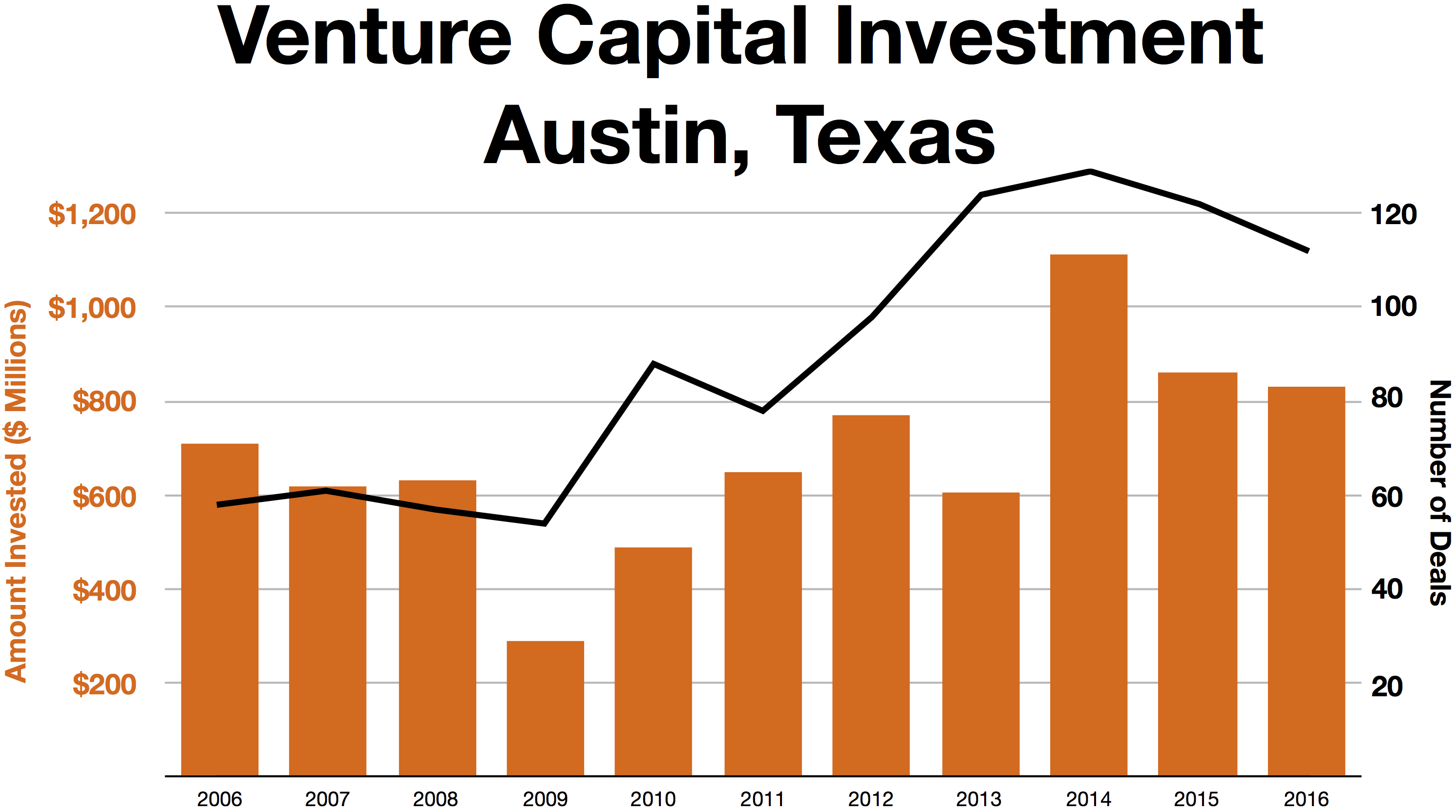

Silicon Hills is a nickname for the cluster of high-tech companies in the Austin metropolitan area in the U.S. state of Texas. Silicon Hills has been a nickname for Austin since the mid-1990s. The name is analogous to Silicon Valley, but refers to the hilly terrain on the west side of Austin. High tech industries in the area include enterprise software, semiconductors, corporate R&D, biotechnology, the video game industry, and a variety of startup companies. Technology companies with offices in the area include Advanced Micro Devices, Amazon.com, Apple Inc., ARM Holdings, Cisco, eBayESO Facebook, Google, IBM, Indeed, Intel, NXP Semiconductors, PayPal, Procore, Silicon Labs, Texas Instruments, Oracle Corporation, Visa, VMWare, and many others. Dell's worldwide headquarters are located in Round Rock, a suburb of Austin. Venture capital, incubators and accelerators Austin was one of the top areas for venture capital with investors investing $621 million in 2013 (43% of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

D&B Hoovers

D&B Hoovers was founded by Gary Hoover and Patrick Spain in 1990Solomon, Steve.The Dynamic Duo" '' Inc.''. October 15, 1997. Retrieved on April 7, 2014. as an American business research company that provided information on companies and industries through their primary product platform named "Hoover's". In 2003, it was acquired by Dun & Bradstreet and operated for a time as a wholly owned subsidiary. In 2017, the Hoover's product was re-branded D&B Hoovers. Dun & Bradstreet is headquartered in Short Hills, New Jersey, US. D&B Hoovers has sales, marketing and development resources in Austin, Texas, US. Origins and expansion Hoovers was started in 1990 by Gary Hoover, Patrick J. Spain, Alan Chai, and Alta Campbell. Leading up to this, Hoover had founded the Bookstop book store chain, ultimately purchase by Barnes & Noble. itation neededHoover's initially was called The Reference Press as it published reference books about companies. The company grew rapidly under a business t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Equity Fund

A private equity fund (abbreviated as PE fund) is a collective investment scheme used for making investments in various equity (and to a lesser extent debt) securities according to one of the investment strategies associated with private equity. Private equity funds are typically limited partnerships with a fixed term of 10 years (often with annual extensions). At inception, institutional investors make an unfunded commitment to the limited partnership, which is then drawn over the term of the fund. From the investors' point of view, funds can be traditional (where all the investors invest with equal terms) or asymmetric (where different investors have different terms).Metrick, Andrew, and Ayako Yasuda. "The economics of private equity funds."Review of Financial Studies (2010): hhq020. A private equity fund is raised and managed by investment professionals of a specific private-equity firm (the general partner and investment advisor). Typically, a single private-equity firm wil ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Growth Equity

Growth capital (also called expansion capital and growth equity) is a type of private equity investment, usually a Minority interest, minority investment, in relatively mature companies that are looking for capital to expand or restructure operations, enter new markets or finance a significant acquisition without a change of control of the business. Companies that seek growth capital will often do so to finance a transformational event in their lifecycle. These companies are likely to be more mature than venture capital funded companies, able to generate revenue and profit but unable to generate sufficient cash to fund major expansions, acquisitions or other investments. Because of this lack of scale, these companies generally can find few alternative finance, alternative conduits to secure capital for growth, so access to growth equity can be critical to pursue necessary facility expansion, sales and marketing initiatives, equipment purchases, and new product development. Growth ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Company

A privately held company (or simply a private company) is a company whose shares and related rights or obligations are not offered for public subscription or publicly negotiated in the respective listed markets, but rather the company's stock is offered, owned, traded, exchanged privately, or Over-the-counter (finance), over-the-counter. In the case of a closed corporation, there are a relatively small number of shareholders or company members. Related terms are closely-held corporation, unquoted company, and unlisted company. Though less visible than their public company, publicly traded counterparts, private companies have major importance in the world's economy. In 2008, the 441 list of largest private non-governmental companies by revenue, largest private companies in the United States accounted for ($1.8 trillion) in revenues and employed 6.2 million people, according to ''Forbes''. In 2005, using a substantially smaller pool size (22.7%) for comparison, the 339 companies on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Venture Capital

Venture capital (often abbreviated as VC) is a form of private equity financing that is provided by venture capital firms or funds to startups, early-stage, and emerging companies that have been deemed to have high growth potential or which have demonstrated high growth (in terms of number of employees, annual revenue, scale of operations, etc). Venture capital firms or funds invest in these early-stage companies in exchange for equity, or an ownership stake. Venture capitalists take on the risk of financing risky start-ups in the hopes that some of the firms they support will become successful. Because startups face high uncertainty, VC investments have high rates of failure. The start-ups are usually based on an innovative technology or business model and they are usually from high technology industries, such as information technology (IT), clean technology or biotechnology. The typical venture capital investment occurs after an initial "seed funding" round. The first ro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Equity Firm

A private equity firm is an investment management company that provides financial backing and makes investments in the private equity of startup or operating companies through a variety of loosely affiliated investment strategies including leveraged buyout, venture capital, and growth capital. Often described as a financial sponsor, each firm will raise funds that will be invested in accordance with one or more specific investment strategies. Typically, a private equity firm will raise pools of capital, or private-equity funds that supply the equity contributions for these transactions. Private equity firms will receive a periodic management fee as well as a share in the profits earned (carried interest) from each private-equity fund managed. Private equity firms, with their investors, will acquire a controlling or substantial minority position in a company and then look to maximize the value of that investment. Private-equity firms generally receive a return on their investme ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |