|

Audit Legislation

An audit is an "independent examination of financial information of any entity, whether profit oriented or not, irrespective of its size or legal form when such an examination is conducted with a view to express an opinion thereon.” Auditing also attempts to ensure that the books of accounts are properly maintained by the concern as required by law. Auditors consider the propositions before them, obtain evidence, and evaluate the propositions in their auditing report. Audits provide third-party assurance to various stakeholders that the subject matter is free from material misstatement. The term is most frequently applied to audits of the financial information relating to a legal person. Other commonly audited areas include: secretarial and compliance, internal controls, quality management, project management, water management, and energy conservation. As a result of an audit, stakeholders may evaluate and improve the effectiveness of risk management, control, and governanc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Audit Cycle

An audit is an "independent examination of financial information of any entity, whether profit oriented or not, irrespective of its size or legal form when such an examination is conducted with a view to express an opinion thereon.” Auditing also attempts to ensure that the books of accounts are properly maintained by the concern as required by law. Auditors consider the propositions before them, obtain evidence, and evaluate the propositions in their auditing report. Audits provide third-party assurance to various stakeholder (corporate), stakeholders that the subject matter is free from Materiality (auditing) , material misstatement. The term is most frequently applied to audits of the financial information relating to a legal person. Other commonly audited areas include: secretarial and compliance, internal controls, quality management, project management, water management, and energy conservation. As a result of an audit, stakeholders may evaluate and improve the effecti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Materiality (auditing)

Materiality is a concept or convention within auditing and accounting relating to the importance/significance of an amount, transaction, or discrepancy. The objective of an audit of financial statements is to enable the auditor to express an opinion whether the financial statements are prepared, in all ''material'' respects, in conformity with an identified financial reporting framework such as Generally Accepted Accounting Principles (GAAP). As a simple example, an expenditure of ten cents on paper is generally immaterial, and, if it were forgotten or recorded incorrectly, then no practical difference would result, even for a very small business. However, a transaction of many millions of dollars is almost always material, and if it were forgotten or recorded incorrectly, then financial managers, investors, and others would make different decisions as a result of this error than they would have had the error not been made. The assessment of what is material – where to draw t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Governance

Governance is the process of interactions through the laws, social norm, norms, power (social and political), power or language of an organized society over a social system (family, tribe, formal organization, formal or informal organization, a territory or across territories). It is done by the government of a state (polity), state, by a market (economics), market, or by a social network, network. It is the decision-making among the actors involved in a collective problem that leads to the creation, reinforcement, or reproduction of social norms and institutions". In lay terms, it could be described as the political processes that exist in and between formal institutions. A variety of entities (known generically as governing bodies) can govern. The most formal is a government, a body whose sole responsibility and authority is to make binding decisions in a given geopolitical system (such as a sovereign state, state) by establishing laws. Other types of governing include an o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

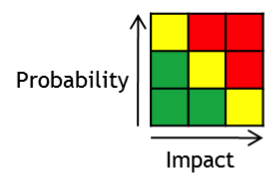

Risk-based Audit

Risk-based auditing is a style of auditing which focuses upon the analysis and management of risk. In the UK, the 1999 Turnbull Report on corporate governance required directors to provide a statement to shareholders of the significant risks to the business. This then encouraged the audit activity of studying these risks rather than just checking compliance with existing controls. Standards for risk management have included the COSO guidelines and the first international standard, AS/NZS 4360. The latter is now the basis for a family of international standards for risk management — ISO 31000. A traditional audit would focus upon the transactions which would make up financial statements such as the balance sheet In financial accounting, a balance sheet (also known as statement of financial position or statement of financial condition) is a summary of the financial balances of an individual or organization, whether it be a sole proprietorship, a business .... A risk-base ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Regulatory Compliance

In general, compliance means conforming to a rule, such as a specification, policy, standard or law. Compliance has traditionally been explained by reference to the deterrence theory, according to which punishing a behavior will decrease the violations both by the wrongdoer (specific deterrence) and by others (general deterrence). This view has been supported by economic theory, which has framed punishment in terms of costs and has explained compliance in terms of a cost-benefit equilibrium (Becker 1968). However, psychological research on motivation provides an alternative view: granting rewards (Deci, Koestner and Ryan, 1999) or imposing fines (Gneezy Rustichini 2000) for a certain behavior is a form of extrinsic motivation that weakens intrinsic motivation and ultimately undermines compliance. Regulatory compliance describes the goal that organizations aspire to achieve in their efforts to ensure that they are aware of and take steps to comply with relevant laws, policies, and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sarbanes–Oxley Act

The Sarbanes–Oxley Act of 2002 is a United States federal law that mandates certain practices in financial record keeping and reporting for corporations. The act, (), also known as the "Public Company Accounting Reform and Investor Protection Act" (in the Senate) and "Corporate and Auditing Accountability, Responsibility, and Transparency Act" (in the House) and more commonly called Sarbanes–Oxley, SOX or Sarbox, contains eleven sections that place requirements on all U.S. public company boards of directors and management and public accounting firms. A number of provisions of the Act also apply to privately held companies, such as the willful destruction of evidence to impede a federal investigation. The law was enacted as a reaction to a number of major corporate and accounting scandals, including Enron and WorldCom. The sections of the bill cover responsibilities of a public corporation's board of directors, add criminal penalties for certain misconduct, and require t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Publicly Traded

A public company is a company whose ownership is organized via shares of stock which are intended to be freely traded on a stock exchange or in over-the-counter markets. A public (publicly traded) company can be listed on a stock exchange (listed company), which facilitates the trade of shares, or not (unlisted public company). In some jurisdictions, public companies over a certain size must be listed on an exchange. In most cases, public companies are ''private'' enterprises in the ''private'' sector, and "public" emphasizes their reporting and trading on the public markets. Public companies are formed within the legal systems of particular states, and therefore have associations and formal designations which are distinct and separate in the polity in which they reside. In the United States, for example, a public company is usually a type of corporation (though a corporation need not be a public company), in the United Kingdom it is usually a public limited company (plc), in F ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Management Accountant

In management accounting or managerial accounting, managers use accounting information in decision-making and to assist in the management and performance of their control functions. Definition One simple definition of management accounting is the provision of financial and non-financial decision-making information to managers. In other words, management accounting helps the directors inside an organization to make decisions. This can also be known as Cost Accounting. This is the way toward distinguishing, examining, deciphering and imparting data to supervisors to help accomplish business goals. The information gathered includes all fields of accounting that educates the administration regarding business tasks identifying with the financial expenses and decisions made by the organization. Accountants use plans to measure the overall strategy of operations within the organization. According to the Institute of Management Accountants (IMA), "Management accounting is a profession t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cost Auditing

A cost audit represents the verification of cost accounts and checking on the adherence to cost accounting plan. Cost audit ascertains the accuracy of cost accounting records to ensure that they are in conformity with cost accounting principles, plans, procedures and objectives. A cost audit comprises the following; * Verification of the cost accounting records such as the accuracy of the cost accounts, cost reports, cost statements, cost data and costing technique * Examination of these records to ensure that they adhere to the cost accounting principles, plans, procedures and objective * To report to the government on optimum utilisation of national resources Objectives of cost audit * Prospective objective: Under which cost audit aims to identify the undue wastage or losses and ensure that costing system determines the correct and realistic cost of production. * Constructive objectives: Cost audit provides useful information to the management regarding regulating production, e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cost Accounting

Cost accounting is defined as "a systematic set of procedures for recording and reporting measurements of the cost of manufacturing goods and performing services in the aggregate and in detail. It includes methods for recognizing, classifying, allocating, aggregating and reporting such costs and comparing them with standard costs." (IMA) Often considered a subset of managerial accounting, its end goal is to advise the management on how to optimize business practices and processes based on cost efficiency and capability. Cost accounting provides the detailed cost information that management needs to control current operations and plan for the future. Cost accounting information is also commonly used in financial accounting, but its primary function is for use by managers to facilitate their decision-making. Origins of Cost Accounting All types of businesses, whether manufacturing, trading or producing services, require cost accounting to track their activities. Cost accounting h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Company Accounting Oversight Board

The Public Company Accounting Oversight Board (PCAOB) is a nonprofit corporation created by the Sarbanes–Oxley Act of 2002 to oversee the audits of public companies and other issuers in order to protect the interests of investors and further the public interest in the preparation of informative, accurate and independent audit reports. The PCAOB also oversees the audits of broker-dealers, including compliance reports filed pursuant to federal securities laws, to promote investor protection. All PCAOB rules and standards must be approved by the U.S. Securities and Exchange Commission (SEC). Purpose In creating the Public Company Accounting Oversight Board (PCAOB), the Sarbanes-Oxley Act required that auditors of U.S. public companies be subject to external and independent oversight for the first time in history. Previously, the profession was self-regulated. Congress vested the PCAOB with expanded oversight authority over the audits of brokers and dealers registered with the SE ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Qualitative Data

Qualitative properties are properties that are observed and can generally not be measured with a numerical result. They are contrasted to quantitative properties which have numerical characteristics. Some engineering and scientific properties are qualitative. A test method can result in qualitative data about something. This can be a categorical result or a binary classification Binary classification is the task of classifying the elements of a set into two groups (each called ''class'') on the basis of a classification rule. Typical binary classification problems include: * Medical testing to determine if a patient has c ... (e.g., pass/fail, go/no go, Conformity, conform/non-conform). It can sometimes be an engineering judgement. The data that all share a qualitative property form a nominal category. A variable which codes for the presence or absence of such a property is called a binary categorical variable, or equivalently a dummy variable (statistics), dummy variable. In b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |