|

American Homeowner Preservation

American Homeowner Preservation (also known as AHP) is an online real estate crowdfunding platform which purchases pools of nonperforming loans from banks and other lenders and then offers borrowers who want to stay in their homes debt restructuring options with reduced payments and discounted principal balances. If homes are vacant or families want to move, AHP offers deficiency waivers and incentive payments to cooperate with short sales in order to put the homes back into service. Founded in 2008 as a 501c nonprofit in Cincinnati, Ohio, AHP pioneered the short sale leaseback as a foreclosure prevention operation to assist struggling homeowners. Faced with resistance from many banks which insisted that families vacate their homes in order to have their short sales approved, AHP changed their strategy in early 2011 and now operates as a for-profit headquartered in Chicago. In October 2013, AHP became an online real estate crowdfunding platform offering investment opportunities to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Non-performing Loan

A non-performing loan (NPL) is a bank loan that is subject to late repayment or is unlikely to be repaid by the borrower in full. Non-performing loans represent a major challenge for the banking sector, as it reduces the profitability of banks, and is often presented as preventing banks from lending more to businesses and consumers, which in turn slows down economic growth (although this theory is disputed). In the European Union, the management of the NPLs resulting of the global financial crisis of 2008 has become a politically sensitive topic, culminating in 2017 with the decision by the Council to task the European Commission to launch an action plan to tackle NPLs. The action plan supports the fostering of a secondary market for NPLs and the creation of Asset Management Companies (aka bad bank). In December 2020, this action plan was revised in the wake of the Covid19 pandemic crisis. Definition Non-performing loans are generally recognised as per the following criteria: * Pay ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

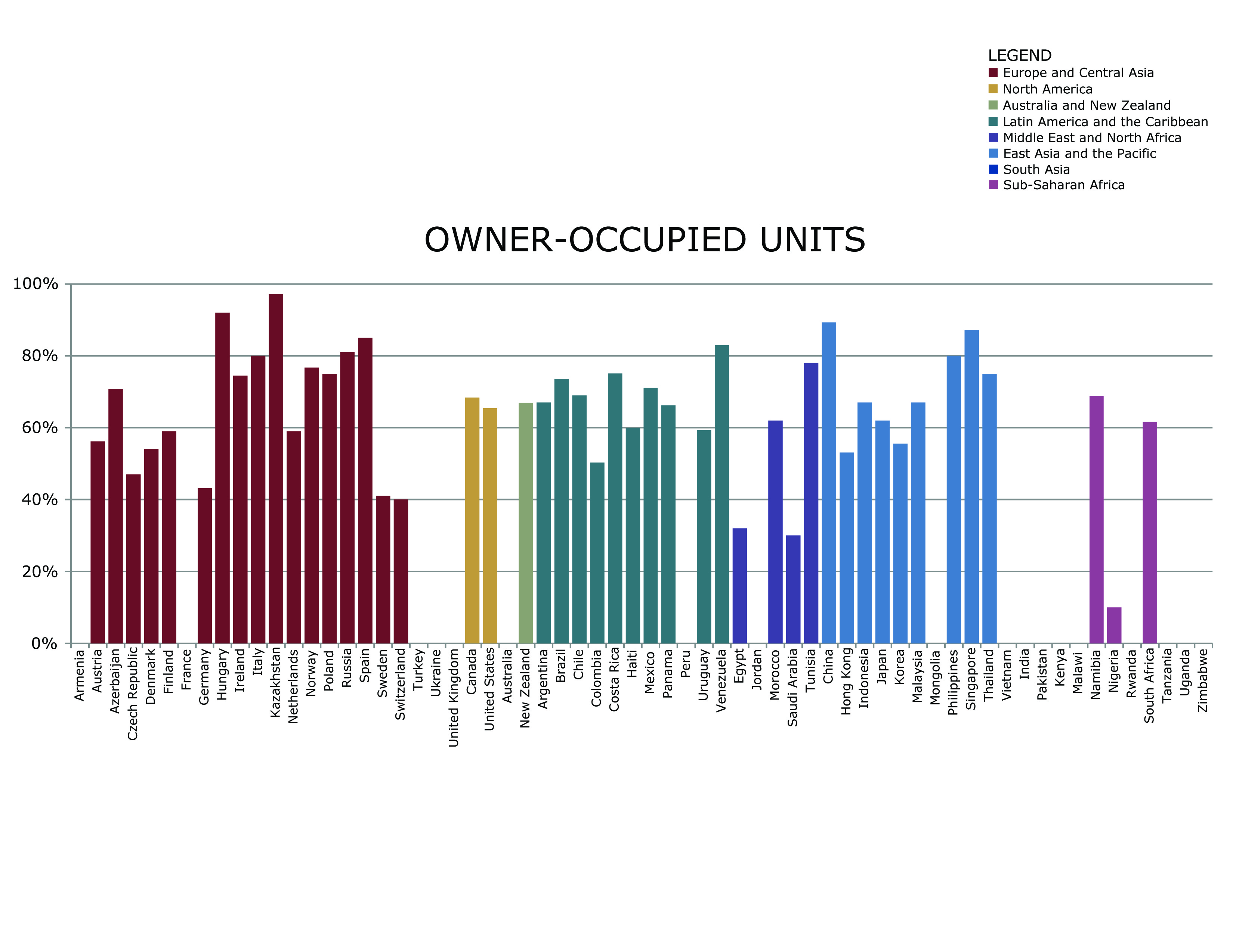

Homeowner

Owner-occupancy or home-ownership is a form of housing tenure in which a person, called the owner-occupier, owner-occupant, or home owner, owns the home in which they live. The home can be a house, such as a single-family detached home, single-family house, an apartment, condominium, or a housing cooperative. In addition to providing housing, owner-occupancy also functions as a real estate investing, real estate investment. Acquisition Some homes are constructed by the owners with the intent to occupy. Many are inheritance, inherited. A large number are purchased, as new homes from a real estate development, real estate developer or as an existing home from a previous landlord or owner-occupier. A house is usually the most expensive single purchase an individual or family makes, and often costs several times the annual household income. Given the high cost, most individuals do not have enough saving, savings on hand to pay the entire amount outright. In developed countries, mor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equity Stripping

Equity stripping, also known as equity skimming, is a type of foreclosure rescue scheme. Often considered a form of predatory lending, equity stripping became increasingly widespread in the early 2000s. In an equity stripping scheme an investor buys the property from a homeowner facing foreclosure and agrees to lease the home to the homeowner who may remain in the home as a tenant. Often, these transactions take advantage of uninformed, low-income homeowners; because of the complexity of the transaction, victims are often unaware that they are giving away their property and equity. Several states have taken steps to confront the more unscrupulous practices of equity stripping. Although "foreclosure re-conveyance" schemes can be beneficial and ethically conducted in some circumstances, many times the practice relies on fraud and egregious or unmeetable terms. Term and definition The term "equity stripping" has sometimes referred to lending refinance practices that charge excessive f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deed In Lieu Of Foreclosure

A deed in lieu of foreclosure is a deed instrument in which a mortgagor (i.e. the borrower) conveys all interest in a real property to the mortgagee (i.e. the lender) to satisfy a loan that is in default and avoid foreclosure proceedings. The deed in lieu of foreclosure offers several advantages to both the borrower and the lender. The principal advantage to the borrower is that it immediately releases him/her from most or all of the personal indebtedness associated with the defaulted loan. The borrower also avoids the public notoriety of a foreclosure proceeding and may receive more generous terms than he/she would in a formal foreclosure. Another benefit to the borrower is that it hurts his/her credit less than a foreclosure does. Advantages to a lender include a reduction in the time and cost of a repossession, lower risk of borrower revenge (metal theft and vandalism of the property before sheriff eviction), and additional advantages if the borrower subsequently files for b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

311 Foreclosure Prevention Programs

The City of Chicago and Neighborhood Housing Services (NHS) of Chicago pioneered the 311 Foreclosure Prevention Program as a consumer counseling and information service which helps homeowners at risk of losing their homes to foreclosure, credit counseling and advocacy services.http://www.311foreclosure.com Recently, the cities of Baltimore, and Dallas Dallas () is the List of municipalities in Texas, third largest city in Texas and the largest city in the Dallas–Fort Worth metroplex, the List of metropolitan statistical areas, fourth-largest metropolitan area in the United States at 7.5 ... started similar programs to assist at-risk homeowners and protect the integrity of their neighborhoods. References Mortgage industry of the United States Foreclosure Real estate in the United States Real property law in the United States {{real-estate-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Incentive

In general, incentives are anything that persuade a person to alter their behaviour. It is emphasised that incentives matter by the basic law of economists and the laws of behaviour, which state that higher incentives amount to greater levels of effort and therefore, higher levels of performance. Divisions Incentives can be broken down into two categories; intrinsic incentives and extrinsic incentives. The motivation of people's behaviour comes from within. In activities, they are often motivated by the task itself or the internal reward rather than the external reward. There are many internal rewards, for example, participating in activities can satisfy people's sense of achievement and bring them positive emotions. An intrinsic incentive is when a person is motivated to act in a certain way for their own personal satisfaction. This means that when a person is intrinsically incentivised, they perform a certain task to please themselves and are not seeking any external reward, nor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debt

Debt is an obligation that requires one party, the debtor, to pay money or other agreed-upon value to another party, the creditor. Debt is a deferred payment, or series of payments, which differentiates it from an immediate purchase. The debt may be owed by sovereign state or country, local government, company, or an individual. Commercial debt is generally subject to contractual terms regarding the amount and timing of repayments of principal and interest. Loans, bonds, notes, and mortgages are all types of debt. In financial accounting, debt is a type of financial transaction, as distinct from equity. The term can also be used metaphorically to cover moral obligations and other interactions not based on a monetary value. For example, in Western cultures, a person who has been helped by a second person is sometimes said to owe a "debt of gratitude" to the second person. Etymology The English term "debt" was first used in the late 13th century. The term "debt" comes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payments

A payment is the voluntary tender of money or its equivalent or of things of value by one party (such as a person or company) to another in exchange for goods, or services provided by them, or to fulfill a legal obligation. The party making the payment is commonly called the payer, while the payee is the party receiving the payment. Payments can be effected in a number of ways, for example: * the use of money, cheque, or debit, credit, or bank transfers, whether through mobile payment or otherwise * the transfer of anything of value, such as stock, or using barter, the exchange of one good or service for another. In general, payees are at liberty to determine what method of payment they will accept; though normally laws require the payer to accept the country's legal tender up to a prescribed limit. Payment is most commonly effected in the local currency of the payee unless the parties agree otherwise. Payment in another currency involves an additional foreign exchange transactio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Value (economics)

In economics, economic value is a measure of the benefit provided by a goods, good or service (economics), service to an Agent (economics), economic agent. It is generally measured through units of currency, and the interpretation is therefore "what is the maximum amount of money a specific actor is Willingness to pay, willing and able to pay for the good or service"? Among the competing schools of economic theory there are differing Theory of value (economics), theories of value. Economic value is ''not'' the same as Price, market price, nor is economic value the same thing as market value. If a consumer is willing to buy a good, it implies that the customer places a higher value on the good than the market price. The difference between the value to the consumer and the market price is called "Economic surplus, consumer surplus". It is easy to see situations where the actual value is considerably larger than the market price: purchase of drinking water is one example. Overvi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Crowdfunding

Crowdfunding is the practice of funding a project or venture by raising money from a large number of people, typically via the internet. Crowdfunding is a form of crowdsourcing and alternative finance. In 2015, over was raised worldwide by crowdfunding. Although similar concepts can also be executed through mail-order subscriptions, benefit events, and other methods, the term crowdfunding refers to internet-mediated registries. This modern crowdfunding model is generally based on three types of actors – the project initiator who proposes the idea or project to be funded, individuals or groups who support the idea, and a moderating organization (the "platform") that brings the parties together to launch the idea. Crowdfunding has been used to fund a wide range of for-profit, entrepreneurial ventures such as artistic and creative projects, medical expenses, travel, and community-oriented social entrepreneurship projects. Although crowdfunding has been suggested to be highly li ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Institutional Investors

An institutional investor is an entity which pools money to purchase securities, real property, and other investment assets or originate loans. Institutional investors include commercial banks, central banks, credit unions, government-linked companies, insurers, pension funds, sovereign wealth funds, charities, hedge funds, REITs, investment advisors, endowments, and mutual funds. Operating companies which invest excess capital in these types of assets may also be included in the term. Activist institutional investors may also influence corporate governance by exercising voting rights in their investments. In 2019, the world's top 500 asset managers collectively managed $104.4 trillion in Assets under Management (AuM). Although institutional investors appear to be more sophisticated than retail investors, it remains unclear if professional active investment managers can reliably enhance risk-adjusted returns by an amount that exceeds fees and expenses of investment management, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

High-net-worth Individual

High-net-worth individual (HNWI) is a term used by some segments of the financial services industry to designate persons whose investible wealth (assets such as stocks and bonds) exceeds a given amount. Typically, these individuals are defined as holding financial assets (excluding their primary residence) with a value greater than US$1 million. "Very-HNWI" (VHNWI) can refer to someone with a net worth of at least US$5 million. The Capgemini World Wealth Report 2020 defines an additional class of ultra-high-net-worth individuals (UHNWIs), those with US$30 million in investible assets. According to The Knight Frank Wealth Report, HNWI can refer to someone with a net worth of at least US$1 million while UHNWI can refer to someone with a net worth of at least US$30 million. , there were estimated to be just over 15 million HNWIs in the world according to the Global Citizens Report by Henley & Partners. The United States had the highest number of HNWIs (5,325,000) of any countr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |