|

Alternative Beta

framed, In traditional investments, the volatile ( beta) investments are managed to balance risk and return. For alternative investments, this management is called "alternative beta". Alternative beta is the concept of managing volatile "alternative investments", often through the use of hedge funds. Alternative beta is often also referred to as "alternative risk premia". Researcher Lars Jaeger says that the return from an investment mainly results from exposure to systematic risk factors. These exposures can take two basic forms: long only "buy and hold" exposures and exposures through the use of alternative investment techniques such as long/short investing, the use of derivatives (non-linear payout profiles), or the employment of leverage) Background Alternative investments Although alternative investment is a general term, (commonly defined as any investment other than stocks, bonds or cash), alternative beta relates to the use of hedge funds. At its most basic, a hedge f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Beta (finance)

In finance, the beta (β or market beta or beta coefficient) is a measure of how an individual asset moves (on average) when the overall stock market increases or decreases. Thus, beta is a useful measure of the contribution of an individual asset to the risk of the market portfolio when it is added in small quantity. Thus, beta is referred to as an asset's non-diversifiable risk, its systematic risk, market risk, or hedge ratio. Beta is ''not'' a measure of idiosyncratic risk. Interpretation of values By definition, the value-weighted average of all market-betas of all investable assets with respect to the value-weighted market index is 1. If an asset has a beta above (below) 1, it indicates that its return moves more (less) than 1-to-1 with the return of the market-portfolio, on average. In practice, few stocks have negative betas (tending to go up when the market goes down). Most stocks have betas between 0 and 3. Treasury bills (like most fixed income instruments) a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment

Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time. Investment requires a sacrifice of some present asset, such as time, money, or effort. In finance, the purpose of investing is to generate a return from the invested asset. The return may consist of a gain (profit) or a loss realized from the sale of a property or an investment, unrealized capital appreciation (or depreciation), or investment income such as dividends, interest, or rental income, or a combination of capital gain and income. The return may also include currency gains or losses due to changes in the foreign currency exchange rates. Investors generally expect higher returns from riskier investments. When a low-risk investment is made, the return is also generally low. Similarly, high risk comes with a chance of high losses. Investors, particularly novices, are often advised to diversify their portfolio. Diversification has the statistical effec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hedge Fund Replication

Hedge fund replication is the collective name given to a number of different methods that attempt to replicate hedge fund returns. The hedge fund industry has boomed over recent years and various studies by investment banks as well as academic papers have shown that hedge funds may be nearing an alpha generating capacity constraint. This means hedge funds can no longer produce alpha in aggregate. Replication has been claimed to remove the illiquidity, transparency and fraud risk associated with direct investment in hedge funds. With the belief that the pursuit of alpha is a zero-sum game, more investors are looking to simply add "Hedge Fund Beta" to their portfolio. These early investors have been rewarded as the replicators outperformed their direct investment cousins in 2008 due to their greater liquidity and lower use of leverage. Leading hedge fund industry professionals that study risk exposures, such as Israel Cohen and Lars Jaeger, contend that while most hedge fund clai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

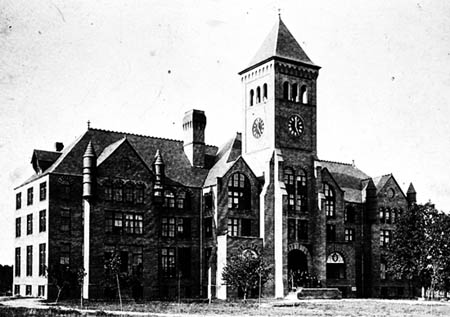

Duke University

Duke University is a private research university in Durham, North Carolina. Founded by Methodists and Quakers in the present-day city of Trinity in 1838, the school moved to Durham in 1892. In 1924, tobacco and electric power industrialist James Buchanan Duke established The Duke Endowment and the institution changed its name to honor his deceased father, Washington Duke. The campus spans over on three contiguous sub-campuses in Durham, and a marine lab in Beaufort. The West Campus—designed largely by architect Julian Abele, an African American architect who graduated first in his class at the University of Pennsylvania School of Design—incorporates Gothic architecture with the Duke Chapel at the campus' center and highest point of elevation, is adjacent to the Medical Center. East Campus, away, home to all first-years, contains Georgian-style architecture. The university administers two concurrent schools in Asia, Duke-NUS Medical School in Singapore (established in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fuqua School Of Business

The Fuqua School of Business (pronounced ) is the business school of Duke University in Durham, North Carolina. It enrolls more than 1,300 students in degree-seeking programs. Duke Executive Education also offers non-degree business education and professional development programs. Its MBA program was ranked the 9th best business school in the US by ''The Economist'' in 2019, and 13th in the US by ''The Financial Times'' in 2022. Fuqua is also currently ranked 6th for having the lowest acceptance rate and 10th for having the highest application yield (percentage that matriculated after being accepted) across the top 50 MBA programs in the US. History Formed in 1969, the Graduate School of Business Administration enrolled its first class of 20 students in 1970. In 1974, Thomas F. Keller, a 1953 Duke graduate, became the graduate school's new dean. In three years, Keller's capital campaign raised $24 million, $10 million of which came from businessman and philanthropist J. B. Fuqua. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

London Business School

London Business School (LBS) is a business school and a constituent college of the federal University of London. LBS was founded in 1964 and awards post-graduate degrees (Master's degrees in management and finance, MBA and PhD). Its motto is "To have a profound impact on the way the world does business". LBS is consistently ranked amongst the world's best business schools. The main campus is located at Sussex Place in London, adjacent to Regent's Park. In 2012, the school acquired the Marylebone Town Hall and spent £60 million to refurbish it with the objective of expanding its teaching facilities by 70% - the new building is called The Sammy Ofer Centre. In 2017, it was announced that LBS had also acquired the site of the Royal College of Obstetricians and Gynaecologists, who vacated the building in November 2019. LBS has a secondary campus in Dubai that is dedicated to Executive Education and the Dubai EMBA. History Foundation London Business School was founded in 1964 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bond (finance)

In finance, a bond is a type of security under which the issuer ( debtor) owes the holder ( creditor) a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time. The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Thus, a bond is a form of loan or IOU. Bonds provide the borrower with external funds to finance long-term investments or, in the case of government bonds, to finance current expenditure. Bonds and stocks are both securities, but the major difference between the two is that (capital) stockholders have an equity stake in a company (i.e. they are owners), whereas bondholders have a creditor stake in a company (i.e. they are lenders). As creditors, bondholders have priority over stockholders. This means they will be repaid in advance of stockholders, but will rank behind s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock

In finance, stock (also capital stock) consists of all the shares by which ownership of a corporation or company is divided.Longman Business English Dictionary: "stock - ''especially AmE'' one of the shares into which ownership of a company is divided, or these shares considered together" "When a company issues shares or stocks ''especially AmE'', it makes them available for people to buy for the first time." (Especially in American English, the word "stocks" is also used to refer to shares.) A single share of the stock means fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the shareholder (stockholder) to that fraction of the company's earnings, proceeds from liquidation of assets (after discharge of all senior claims such as secured and unsecured debt), or voting power, often dividing these up in proportion to the amount of money each stockholder has invested. Not all stock is necessarily equal, as certain classe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Thomas Schneeweis

Thomas Schneeweis, professor of finance at the School of Management, University of Massachusetts Amherst, Amherst, MA, is also the director of the Center for International Securities and Derivatives Markets there. He is president of Alternative Investment Analytics, LLC, which he established in 2005, as a consultancy in the fields of multi-advisor hedge fund creation and asset allocation. He is a frequent speaker at academic and financial-services industry events and is often quoted press (i.e. the Financial Times, Business Week and the Wall Street Journal ''The Wall Street Journal'' is an American business-focused, international daily newspaper based in New York City, with international editions also available in Chinese and Japanese. The ''Journal'', along with its Asian editions, is published .... References External links {{DEFAULTSORT:Schneeweis, Thomas University of Massachusetts Amherst faculty Living people Year of birth missing (living people) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mutual Fund

A mutual fund is a professionally managed investment fund that pools money from many investors to purchase securities. The term is typically used in the United States, Canada, and India, while similar structures across the globe include the SICAV in Europe ('investment company with variable capital') and open-ended investment company (OEIC) in the UK. Mutual funds are often classified by their principal investments: money market funds, bond or fixed income funds, stock or equity funds, or hybrid funds. Funds may also be categorized as index funds, which are passively managed funds that track the performance of an index, such as a stock market index or bond market index, or actively managed funds, which seek to outperform stock market indices but generally charge higher fees. Primary structures of mutual funds are open-end funds, closed-end funds, unit investment trusts. Open-end funds are purchased from or sold to the issuer at the net asset value of each share as of the close ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)