|

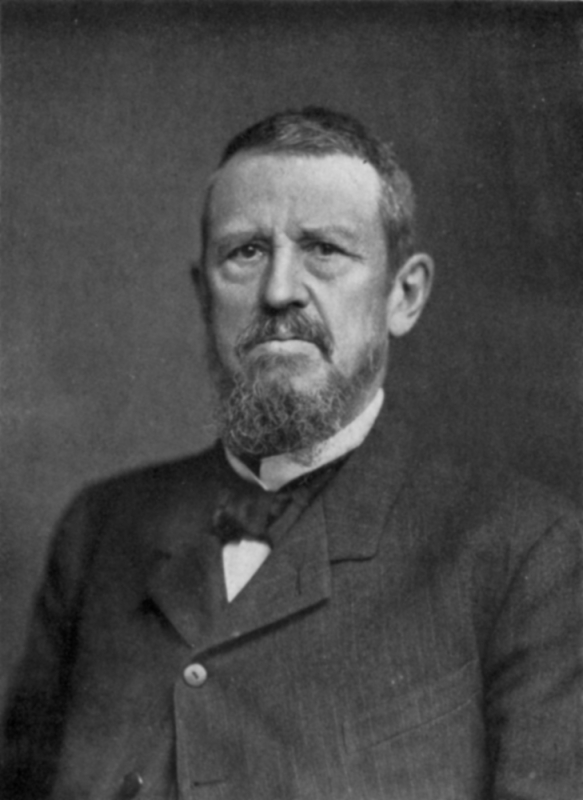

Alex Edmans

Alex Edmans is professor of finance at London Business School and the current Mercers' School Memorial Professor of Business at Gresham College. Since 2017 he has been the Managing Editor of the Review of Finance, the leading academic finance journal in Europe. He gave the TED talWhat to Trust in a Post-Truth World on confirmation bias and the importance of being discerning with evidence. In 2021 he was named Professor of the Year by Poets & Quants. Education and early career Edmans received a BA from Merton College, Oxford and a PhD from MIT Sloan School of Management as a Fulbright scholar. After two stints at Morgan Stanley, his first academic position was at Wharton School of the University of Pennsylvania. He was awarded tenure in 2013 and then moved to London Business School as a full professor of finance. Research Edmans' research is on corporate governance, executive pay, responsible business, and behavioral finance, and has been cited over 12,500 times. His wo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

London Business School

London Business School (LBS) is a business school and a constituent college of the federal University of London. LBS was founded in 1964 and awards post-graduate degrees (Master's degrees in management and finance, MBA and PhD). Its motto is "To have a profound impact on the way the world does business". LBS is consistently ranked amongst the world's best business schools. The main campus is located at Sussex Place in London, adjacent to Regent's Park. In 2012, the school acquired the Marylebone Town Hall and spent £60 million to refurbish it with the objective of expanding its teaching facilities by 70% - the new building is called The Sammy Ofer Centre. In 2017, it was announced that LBS had also acquired the site of the Royal College of Obstetricians and Gynaecologists, who vacated the building in November 2019. LBS has a secondary campus in Dubai that is dedicated to Executive Education and the Dubai EMBA. History Foundation London Business School was founded in 1964 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wharton School Of The University Of Pennsylvania

The Wharton School of the University of Pennsylvania ( ; also known as Wharton Business School, the Wharton School, Penn Wharton, and Wharton) is the business school of the University of Pennsylvania, a Private university, private Ivy League research university in Philadelphia. Generally considered to be one of the most prestigious business schools in the world, the Wharton School is the world's oldest collegiate business school, having been established in 1881 through a donation from Joseph Wharton. The Wharton School awards the Bachelor of Science with a school-specific economics major (academic), major, with concentrations in over 18 disciplines in Wharton's academic departments. The degree is a general business degree focused on core business skills. At the graduate level, the Master of Business Administration (MBA) program can be pursued standalone or offers dual studies leading to a joint degree from other schools (e.g., law, engineering, government). Similarly, in addition ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Living People

Related categories * :Year of birth missing (living people) / :Year of birth unknown * :Date of birth missing (living people) / :Date of birth unknown * :Place of birth missing (living people) / :Place of birth unknown * :Year of death missing / :Year of death unknown * :Date of death missing / :Date of death unknown * :Place of death missing / :Place of death unknown * :Missing middle or first names See also * :Dead people * :Template:L, which generates this category or death years, and birth year and sort keys. : {{DEFAULTSORT:Living people 21st-century people People by status ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Year Of Birth Missing (living People)

A year or annus is the orbital period of a planetary body, for example, the Earth, moving in its orbit around the Sun. Due to the Earth's axial tilt, the course of a year sees the passing of the seasons, marked by change in weather, the hours of daylight, and, consequently, vegetation and soil fertility. In temperate and subpolar regions around the planet, four seasons are generally recognized: spring, summer, autumn and winter. In tropical and subtropical regions, several geographical sectors do not present defined seasons; but in the seasonal tropics, the annual wet and dry seasons are recognized and tracked. A calendar year is an approximation of the number of days of the Earth's orbital period, as counted in a given calendar. The Gregorian calendar, or modern calendar, presents its calendar year to be either a common year of 365 days or a leap year of 366 days, as do the Julian calendars. For the Gregorian calendar, the average length of the calendar year (the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Franklin Allen

Franklin Allen, (born 6 March 1956) is a British economist and academic. Since 2014, he has been professor of finance and economics, and executive director of the Brevan Howard Centre at Imperial College London. He was the Nippon Life Professor of Finance and Economics at the Wharton School of the University of Pennsylvania. He is most active in the research areas of financial innovations, asset price bubbles, the comparison of financial systems, and financial crises. Early life and education He was educated at Merchant Taylors' School, Northwood and Norwich City College. He graduated from the University of East Anglia with a first class bachelor's degree in 1977 and completed his doctorate in economics at Nuffield College, Oxford in 1980. Academic career Allen was associate professor of finance and associate professor of finance and economics at the Wharton School from 1980 to 1990, when he became vice dean and director of the Wharton Doctoral Programs and Professor of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stewart Myers

Stewart Clay Myers is the Robert C. Merton Professor of Financial Economics at the MIT Sloan School of Management. He is notable for his work on capital structure and innovations in capital budgeting and valuation, and has had a "remarkable influence" on both the theory and practice of corporate finance. Myers, in fact, coined the term "real option". He is the co-author with Richard A. Brealey and Franklin Allen of ''Principles of Corporate Finance'', a widely used and cited business school textbook, now in its 11th edition. He is also the author of dozens of research articles. Career He holds a Ph.D. and MBA from Stanford University and an A.B. from Williams College. He began teaching at MIT Sloan School of Management in 1966. His contributions are seen as falling into three main categories: *Work on capital structure, focusing on "debt overhang" and "pecking order theory". *Contributions to capital budgeting that complement his research on capital structure. He is notable ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Richard Brealey

__NOTOC__ Richard A. Brealey is a British economist and author. He is an emeritus professor at the London Business School and a Fellow of the British Academy. He co-authored ''Principles of Corporate Finance'' with Stewart C. Myers and Franklin Allen (now in its thirteenth edition). He was a full-time faculty member of the London Business School from 1968-1998. He has held the posts of Director of the American Finance Association and president of the European Finance Association. He is a member of the editorial boards of the ''Journal of Applied Corporate Finance'', '' Journal of Empirical Finance'', Journal of Empirical Finance and '' European Finance Review''. Professo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Principles Of Corporate Finance

''Principles of Corporate Finance'' is a reference work on the corporate finance theory edited by Richard Brealey, Stewart Myers, Franklin Allen, and Alex Edmans. The book is one of the leading texts that describes the theory and practice of corporate finance. It was initially published in October 1980 and now is available in its 14th edition. ''Principles of Corporate Finance'' has earned loyalty both as a classroom tool and as a professional reference book. Overview The book covers a wide range of aspects relevant to corporate finance, illustrated by examples and case studies. The text starts with explaining basic finance concepts of value, risk, and other principles. Then the issues become more and more complex, from project analysis and net present value calculations, to debt policy and option valuation. Other discussed topics include stakeholder theory, corporate governance, mergers and acquisitions, principal–agent problem The principal–agent problem refers to the con ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Morgan Stanley

Morgan Stanley is an American multinational investment management and financial services company headquartered at 1585 Broadway in Midtown Manhattan, New York City. With offices in more than 41 countries and more than 75,000 employees, the firm's clients include corporations, governments, institutions, and individuals. Morgan Stanley ranked No. 61 in the 2021 Fortune 500 list of the largest United States corporations by total revenue. The original Morgan Stanley, formed by J.P. Morgan & Co. partners Henry Sturgis Morgan (a grandson of J.P. Morgan), Harold Stanley, and others, came into existence on September 16, 1935, in response to the Glass–Steagall Act, which required the splitting of American commercial and investment banking businesses. In its first year, the company operated with a 24% market share (US$1.1 billion) in public offerings and private placements. The current Morgan Stanley is the result of the merger of the original Morgan Stanley with Dean Witter Reyn ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gresham Professor Of Commerce

The Professor of Business at Gresham College, London, gives free educational lectures to the general public. The college was founded for this purpose in 1597, when it appointed seven professors; this has since increased to ten and in addition the college now has visiting professors. The Mercers' School Memorial Professor of Commerce chair was created in 1985; in 2018 it was renamed the Mercers' School Memorial Professor of Business. The Professor of Business is always appointed by the Mercers' School Memorial Trust, which is administered by the Worshipful Company of Mercers. One of the early 18th-century professors, John Ward, was the author of a book about the professors, published in 1740. List of Gresham Professors of Business References External links Gresham College websiteTexts and video of recent lectures List of professors Further reading * (reissued by Johnson Reprint Corporation, New York, 1967) {{Gresham College Commerce Commerce is the large-scale organized ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fulbright Scholar

The Fulbright Program, including the Fulbright–Hays Program, is one of several United States Cultural Exchange Programs with the goal of improving intercultural relations, cultural diplomacy, and intercultural competence between the people of the United States and other countries, through the exchange of persons, knowledge, and skills. Via the program, competitively-selected American citizens including students, scholars, teachers, professionals, scientists, and artists may receive scholarships or grants to study, conduct research, teach, or exercise their talents abroad; and citizens of other countries may qualify to do the same in the United States. The program was founded by United States Senator J. William Fulbright in 1946 and is considered to be one of the most widely recognized and prestigious scholarships in the world. The program provides approximately 8,000 grants annually – roughly 1,600 to U.S. students, 1,200 to U.S. scholars, 4,000 to foreign students, 900 to f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

MIT Sloan School Of Management

The MIT Sloan School of Management (MIT Sloan or Sloan) is the business school of the Massachusetts Institute of Technology, a private university in Cambridge, Massachusetts. MIT Sloan offers bachelor's, master's, and doctoral degree programs, as well as executive education. Its degree programs are among the most selective in the world. MIT Sloan emphasizes innovation in practice and research. Many influential ideas in management and finance originated at the school, including the Black–Scholes model, the Solow–Swan model, the random walk hypothesis, the binomial options pricing model, and the field of system dynamics. The faculty has included numerous Nobel laureates in economics and John Bates Clark Medal winners. History The MIT Sloan School of Management began in 1914 as the engineering administration curriculum ("Course 15") in the MIT Department of Economics and Statistics. The scope and depth of this educational focus grew steadily in response to advances in the the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |