|

Acquirer

An acquiring bank (also known simply as an acquirer) is a bank or financial institution that processes credit or debit card payments on behalf of a merchant. The acquirer allows merchants to accept credit card payments from the card-issuing banks within a card association, such as Visa, MasterCard, Discover, China UnionPay, American Express. The acquiring bank enters into a contract with a merchant and offers it a merchant account. This arrangement provides the merchant with a line of credit. Under the agreement, the acquiring bank exchanges funds with issuing banks on behalf of the merchant and pays the merchant for its daily payment-card activity's net balance — that is, gross sales minus reversals, interchange fees, and acquirer fees. Acquirer fees are an additional markup added to association interchange fees by the acquiring bank, and those fees vary at the acquirer's discretion. Risks The acquiring bank accepts the risk that the merchant will remain solvent. The main ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Card

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt (i.e., promise to the card issuer to pay them for the amounts plus the other agreed charges). The card issuer (usually a bank or credit union) creates a revolving account and grants a line of credit to the cardholder, from which the cardholder can borrow money for payment to a merchant or as a cash advance. There are two credit card groups: consumer credit cards and business credit cards. Most cards are plastic, but some are metal cards (stainless steel, gold, palladium, titanium), and a few gemstone-encrusted metal cards. A regular credit card is different from a charge card, which requires the balance to be repaid in full each month or at the end of each statement cycle. In contrast, credit cards allow the consumers to build a continuing balance of debt, subject to interest being charged. A credit car ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chargeback

A chargeback is a return of money to a payer of a transaction, especially a credit card transaction. Most commonly the payer is a consumer. The chargeback reverses a money transfer from the consumer's bank account, line of credit, or credit card. The chargeback is ordered by the bank that issued the consumer's payment card. In the distribution industry, a chargeback occurs when the supplier sells a product at a higher price to the distributor than the price they have set with the end user. The distributor submits a chargeback to the supplier so they can recover the money lost in the transaction. United States overview The chargeback mechanism exists primarily for consumer protection. Holders of credit cards issued in the United States are afforded reversal rights by Regulation Z of the Truth in Lending Act. United States debit card holders are guaranteed reversal rights by Regulation E of the Electronic Fund Transfer Act. Similar rights extend globally, pursuant to the rule ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payment Card Industry Data Security Standard

The Payment Card Industry Data Security Standard (PCI DSS) is an information security standard used to handle credit cards from major card brands. The standard is administered by the Payment Card Industry Security Standards Council and its use is mandated by the card brands. The standard was created to better control cardholder data and reduce credit card fraud. Validation of compliance is performed annually or quarterly, by a method suited to the volume of transactions handled: * Self-Assessment Questionnaire (SAQ) * Firm-specific Internal Security Assessor (ISA) * External Qualified Security Assessor (QSA) History Originally, the major card brands started five different security programs: *Visa's Cardholder Information Security Program * MasterCard's Site Data Protection *American Express's Data Security Operating Policy *Discover's Information Security and Compliance * JCB's Data Security Program The intentions of each were roughly similar: to create an additional level of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interchange Fee

Interchange fee is a term used in the payment card industry to describe a fee paid between banks for the acceptance of card-based transactions. Usually for sales/services transactions it is a fee that a merchant's bank (the "acquiring bank") pays a customer's bank (the "issuing bank"). In a credit card or debit card transaction, the card-issuing bank in a payment transaction deducts the interchange fee from the amount it pays the acquiring bank that handles a credit or debit card transaction for a merchant. The acquiring bank then pays the merchant the amount of the transaction minus both the interchange fee and an additional, usually smaller, fee for the acquiring bank or independent sales organization (ISO), which is often referred to as a discount rate, an add-on rate, or passthru. For cash withdrawal transactions at ATMs, however, the fees are paid by the card-issuing bank to the acquiring bank (for the maintenance of the machine). Overview These fees are set by the c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Merchant Account

A merchant account is a type of bank account that allows businesses to accept payments in multiple ways, typically debit or credit cards. A merchant account is established under an agreement between an acceptor and a merchant acquiring bank for the settlement of payment card transactions. In some cases a payment processor, independent sales organization (ISO), or member service provider (MSP) is also a party to the merchant agreement. Whether a merchant enters into a merchant agreement directly with an acquiring bank or through an aggregator, the agreement contractually binds the merchant to obey the operating regulations established by the card associations. A high-risk merchant account is a business account or merchant account that allows the business to accept online payments though they are considered to be of high-risk nature by the banks and credit card processors. The industries that possess this account are adult industry, travel, Forex trading business, multilevel market ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Merchant Services

Merchant services is a broad category of financial services intended for use by businesses. In its most specific use, it usually refers to merchant processing services that enables a business to accept a transaction payment through a secure (encrypted) channel using the customer's credit card or debit card or NFC/RFID enabled device. More generally, the term may include: * Credit and debit cards payment processing * Check guarantee and check conversion services * Automated clearing house check drafting and payment services * Gift card and loyalty programs * Payment gateway * Merchant cash advances * Online transaction processing * Point of sale (POS) systems * Electronic benefit transfer programs, such as ration stamps (called ''food stamps'' in the U.S.). Merchant service providers work as an intermediary between the bank, a person or organisation wanting to receive funds and the person or organisation looking to purchase goods or services. The merchant service provider will ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Merchant Account

A merchant account is a type of bank account that allows businesses to accept payments in multiple ways, typically debit or credit cards. A merchant account is established under an agreement between an acceptor and a merchant acquiring bank for the settlement of payment card transactions. In some cases a payment processor, independent sales organization (ISO), or member service provider (MSP) is also a party to the merchant agreement. Whether a merchant enters into a merchant agreement directly with an acquiring bank or through an aggregator, the agreement contractually binds the merchant to obey the operating regulations established by the card associations. A high-risk merchant account is a business account or merchant account that allows the business to accept online payments though they are considered to be of high-risk nature by the banks and credit card processors. The industries that possess this account are adult industry, travel, Forex trading business, multilevel market ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payment Gateway

A payment gateway is a merchant service provided by an e-commerce application service provider that authorizes credit card or direct payments processing for e-businesses, online retailers, bricks and clicks, or traditional brick and mortar. The payment gateway may be provided by a bank to its customers, but can be provided by a specialised financial service provider as a separate service, such as a payment service provider. A payment gateway facilitates a payment transaction by the transfer of information between a payment portal (such as a website, mobile phone or interactive voice response service) and the front end processor or acquiring bank. Payment gateways are a service that helps merchants initiate ecommerce, in-app, and point of sale payments for a broad variety of payment methods. The gateway is not directly involved in the money flow; typically it is a web server to which a merchant's website or POS system is connected. A payment gateway often connects several acquirin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debit Card

A debit card, also known as a check card or bank card is a payment card that can be used in place of cash to make purchases. The term '' plastic card'' includes the above and as an identity document. These are similar to a credit card, but unlike a credit card, the money for the purchase must be in the cardholder's bank account at the time of a purchase and is immediately transferred directly from that account to the merchant's account to pay for the purchase. Some debit cards carry a stored value with which a payment is made (prepaid card), but most relay a message to the cardholder's bank to withdraw funds from the cardholder's designated bank account. In some cases, the payment card number is assigned exclusively for use on the Internet and there is no physical card. This is referred to as a virtual card. In many countries, the use of debit cards has become so widespread they have overtaken checks in volume, or have entirely replaced them; in some instances, debit cards ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banking Terms

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the anc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

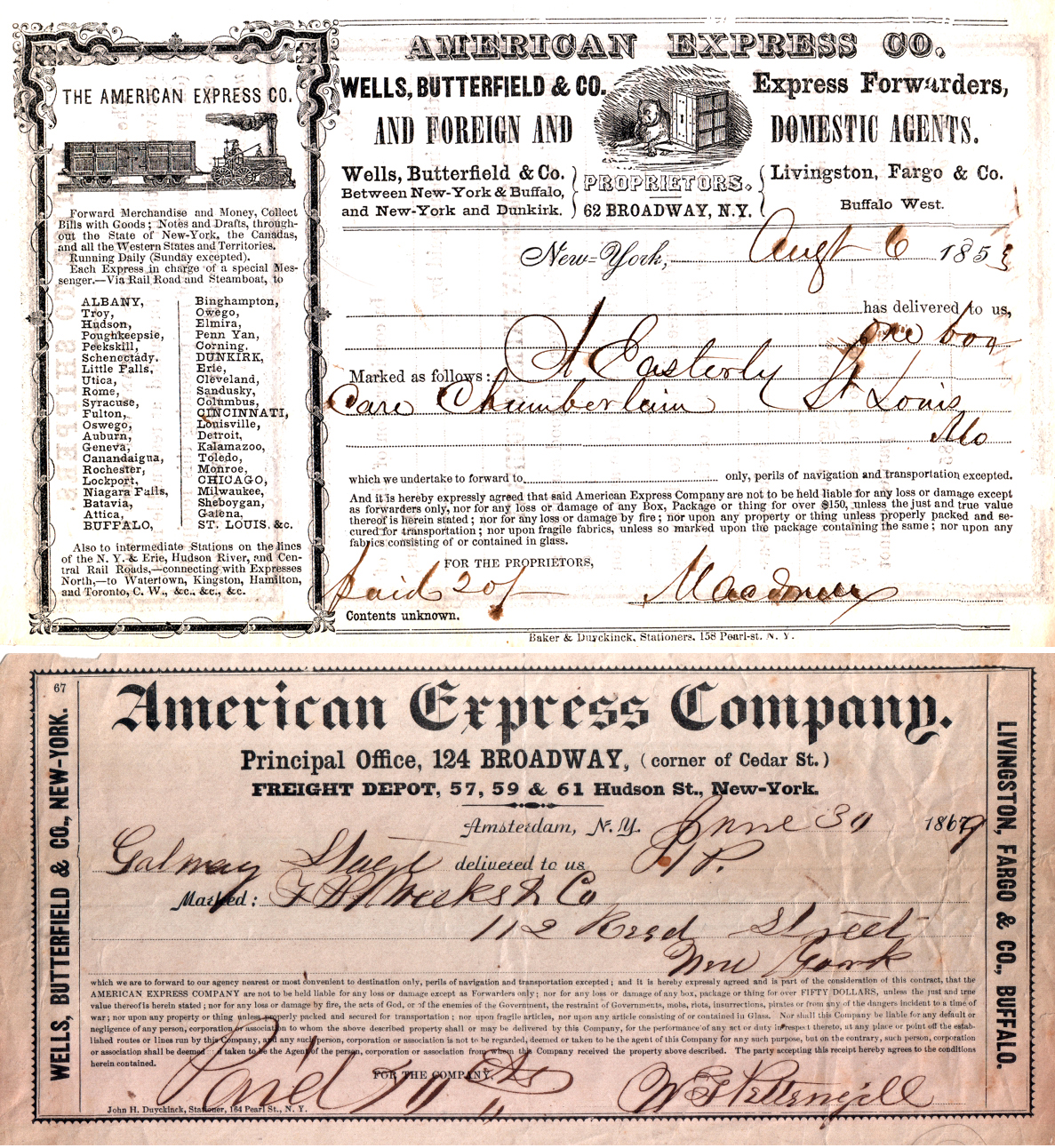

American Express

American Express Company (Amex) is an American multinational corporation specialized in payment card services headquartered at 200 Vesey Street in the Battery Park City neighborhood of Lower Manhattan in New York City. The company was founded in 1850 and is one of the 30 components of the Dow Jones Industrial Average. The company's logo, adopted in 1958, is a gladiator or centurion whose image appears on the company's well-known traveler's cheques, charge cards, and credit cards. During the 1980s, Amex invested in the brokerage industry, acquiring what became, in increments, Shearson Lehman Hutton and then divesting these into what became Smith Barney Shearson (owned by Primerica) and a revived Lehman Brothers. By 2008 neither the Shearson nor the Lehman name existed. In 2016, credit cards using the American Express network accounted for 22.9% of the total dollar volume of credit card transactions in the United States. , the company had 121.7million cards in force, includ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)