|

AEA Investors

AEA Investors is an American middle market private equity firm. The firm focuses on leveraged buyout, growth capital, and mezzanine capital investments in manufacturing, service, distribution, specialty chemicals, consumer product, and business services companies in the middle market. The firm makes investments primarily in the US and Europe, and periodically invests in Asia as well. AEA was founded in 1968 to make investments on behalf of S.G. Warburg & Co. as well as the Rockefeller, Mellon, and Harriman families. AEA was formally founded as American European Associates. AEA is headquartered in New York City with offices in Stamford, Connecticut, London, Munich, and Shanghai. From 1998 until 2011, the firm was chaired by Vincent Mai. John Garcia is the current CEO and Chairman. Fund raising Since 1983, the firm has raised more than $15 billion of capital from high-net-worth individuals and institutional investors across its private equity and debt funds. Middle Market ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Company

A privately held company (or simply a private company) is a company whose shares and related rights or obligations are not offered for public subscription or publicly negotiated in the respective listed markets, but rather the company's stock is offered, owned, traded, exchanged privately, or Over-the-counter (finance), over-the-counter. In the case of a closed corporation, there are a relatively small number of shareholders or company members. Related terms are closely-held corporation, unquoted company, and unlisted company. Though less visible than their public company, publicly traded counterparts, private companies have major importance in the world's economy. In 2008, the 441 list of largest private non-governmental companies by revenue, largest private companies in the United States accounted for ($1.8 trillion) in revenues and employed 6.2 million people, according to ''Forbes''. In 2005, using a substantially smaller pool size (22.7%) for comparison, the 339 companies on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stamford, Connecticut

Stamford () is a city in the U.S. state of Connecticut, outside of Manhattan. It is Connecticut's second-most populous city, behind Bridgeport. With a population of 135,470, Stamford passed Hartford and New Haven in population as of the 2020 census. It is in the Bridgeport-Stamford-Norwalk-Danbury metropolitan statistical area, which is part of the New York City metropolitan area (specifically, the New York–Newark, NY–NJ–CT–PA Combined Statistical Area). As of 2019, Stamford is home to nine Fortune 500 companies and numerous divisions of large corporations. This gives it the largest financial district in the New York metropolitan region outside New York City and one of the nation's largest concentrations of corporations. Dominant sectors of Stamford's economy include financial services, tourism, information technology, healthcare, telecommunications, transportation, and retail. Its metropolitan division is home to colleges and universities including UConn Stamford ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Private Equity Firms

Below is a list of notable private-equity firms. Largest private-equity firms by PE capital raised Each year Private Equity International publishes the PEI 300, a ranking of the largest private-equity firms by how much capital they have raised for private-equity investment in the last five years: List of investment banking private-equity groups ^ Defunct banking institution Notable private-equity firms Americas * 3G Capital * ABS Capital * Accel-KKR * Advent International * AEA Investors * American Securities * Angelo, Gordon & Co. * Apollo Management * Ares Management * Arlington Capital Partners * Auldbrass Partners * Avenue Capital Group * Avista Capital Partners * Bain Capital * BDT Capital Partners * Berkshire Partners * Blackstone Group * Blum Capital * Brentwood Associates * Brockway Moran & Partners * Brookfield * Bruckmann, Rosser, Sherrill & Co. * Brynwood Partners * Brysam Global Partners * Caisse de dépôt et placement du Québec * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jack's

Jack's Family Restaurants, LP (Trade name, doing business as Jack's) is an American fast food restaurant chain, headquartered and based in Birmingham, Alabama, Birmingham, and is owned by AEA Investors. Restaurants feature sit-down dining, drive-thrus and Take-out, takeout service. The menu features primarily burgers, fried chicken, breakfast and various other fast food items including french fries and soft drinks. , there were 202 Jack's restaurants in operation; all corporate owned. The company opens new locations at a rate of 15 per year. History Jack's was founded on November 21, 1960, by Jack Caddell as a single walk-up stand in Homewood, Alabama, a suburb of Birmingham, Alabama, Birmingham. This location still operates today after several remodels, the most recent in 2019, and is the chain's flagship store. The original menu featured items such as fifteen-cent hamburgers and fries, twenty-cent shakes, and a twenty-cent "Fish-On-A-Bun." Jack's rapidly expanded and by t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

24 Hour Fitness

24 Hour Fitness is a privately owned and operated fitness center chain headquartered in Carlsbad, California. It is the second largest fitness chain in the United States based on revenue after LA Fitness, and the fourth in number of clubs (behind LA Fitness, Anytime Fitness & Gold's Gym), operating 287 clubs across 11 U.S. states. The company was originally founded by Mark S. Mastrov and was sold to Forstmann Little & Co in 2005, and then to AEA investors and Ontario Teachers Pension Plan in 2014. After COVID-19 forced gym closures ravaged the fitness industry in 2020, the company filed for bankruptcy in June 2020, closed over 100 clubs and successfully emerged from bankruptcy under with new owners Sculptor Capital Investments LLC, Monarch Alternative Capital LP and Cyrus Capital Partners LP in December, 2020. History Early history and founding 24 Hour Fitness was founded in 1983 by Mark Mastrov. Mastrov had been using a local gym for rehab after a knee injury, and turned the g ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

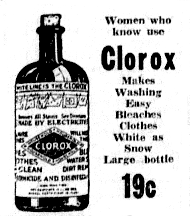

Clorox

The Clorox Company (formerly Clorox Chemical Company) is an American global manufacturer and marketer of consumer and professional products. As of 2020 the Oakland, California based company had approximately 8,800 employees worldwide. Net sales for 2020 fiscal year were US$6.7 billion. Ranked annually since 2000, Clorox was named number 474 on Fortune (magazine), ''Fortune'' magazine's 2020 Fortune 500 list. Clorox products are sold primarily through mass merchandisers, retail outlets, e-commerce channels, distributors, and medical supply providers. Clorox brands include its namesake bleach and cleaning products, as well as Burt's Bees, Formula 409, Glad Trash Bags, Glad, Hidden Valley Ranch, Hidden Valley, Kingsford (charcoal), Kingsford, Kitchen Bouquet, KC Masterpiece, Liquid-Plumr, Brita (company), Brita (in the Americas), Mistolin, Pine-Sol, Poett, Green Works Cleaning Products, Soy Vay, RenewLife, Rainbow Light, Natural Vitality, Neocell, Tilex, S.O.S., and Fresh Step, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Burt's Bees

Burt's Bees is an American multinational, personal care product company. The company is a subsidiary of Clorox that describes itself as an " Earth-friendly, Natural Personal Care Company" making products for personal care, health, beauty and personal hygiene. Its products are distributed globally. Burt's Bees manufactures products with natural ingredients, using minimal processing, such as distillation/condensation, extraction/steamed distillation/pressure cooking, and hydrolysis, to maintain the purity of ingredients. In addition, every product has a "natural bar" which gives a percentage of natural ingredients in that product, often with detailed ingredient descriptions. History 1984–89: Founding Originating in Maine in the 1980s, the business began when co-founder Roxanne Quimby started making candles from Burt Shavitz's leftover beeswax. The first headquarters was an abandoned one-room schoolhouse rented from a friend for $150 a year. This eventually led to the bottli ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Acosta Inc

Acosta is a Spanish and Portuguese surname. Originally it was used to refer to a person who lived by the seashore or was from the mountains (''encostas''). It comes from the Portuguese da Costa (cognate of English "coast", literally translates as "of the coast"), which in Spanish became de Acosta; the exact Spanish counterpart of da Costa is "de la Costa". Notable people with the surname include: * Agustín Acosta (baseball), Cuban baseball player *Alberto Acosta (born 1966), Argentine footballer *Rene Alexander Acosta (born 1969), American attorney and United States Secretary of Labor 2017–2019 * Alda Ribiero Acosta (contemporary), American terrorist in Uruguay * Allan Acosta, American engineer *Armando Acosta (contemporary), doom metal drummer, former member of the band Saint Vitus *Bertrand Blanchard Acosta (1895–1954), American aviator who flew in the Spanish Civil War *Beto Acosta (born 1977), Uruguayan footballer *Carlos Acosta (contemporary), Cuban ballet dancer * Cecilio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Equity

In the field of finance, the term private equity (PE) refers to investment funds, usually limited partnerships (LP), which buy and restructure financially weak companies that produce goods and provide services. A private-equity fund is both a type of ownership of assets ( financial equity) and is a class of assets (debt securities and equity securities), which function as modes of financial management for operating private companies that are not publicly traded in a stock exchange. Private-equity capital is invested into a target company either by an investment management company (private equity firm), or by a venture capital fund, or by an angel investor; each category of investor has specific financial goals, management preferences, and investment strategies for profiting from their investments. Each category of investor provides working capital to the target company to finance the expansion of the company with the development of new products and services, the restructuring ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Institutional Investors

An institutional investor is an entity which pools money to purchase securities, real property, and other investment assets or originate loans. Institutional investors include commercial banks, central banks, credit unions, government-linked companies, insurers, pension funds, sovereign wealth funds, charities, hedge funds, REITs, investment advisors, endowments, and mutual funds. Operating companies which invest excess capital in these types of assets may also be included in the term. Activist institutional investors may also influence corporate governance by exercising voting rights in their investments. In 2019, the world's top 500 asset managers collectively managed $104.4 trillion in Assets under Management (AuM). Although institutional investors appear to be more sophisticated than retail investors, it remains unclear if professional active investment managers can reliably enhance risk-adjusted returns by an amount that exceeds fees and expenses of investment management, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

High-net-worth Individual

High-net-worth individual (HNWI) is a term used by some segments of the financial services industry to designate persons whose investible wealth (assets such as stocks and bonds) exceeds a given amount. Typically, these individuals are defined as holding financial assets (excluding their primary residence) with a value greater than US$1 million. "Very-HNWI" (VHNWI) can refer to someone with a net worth of at least US$5 million. The Capgemini World Wealth Report 2020 defines an additional class of ultra-high-net-worth individuals (UHNWIs), those with US$30 million in investible assets. According to The Knight Frank Wealth Report, HNWI can refer to someone with a net worth of at least US$1 million while UHNWI can refer to someone with a net worth of at least US$30 million. , there were estimated to be just over 15 million HNWIs in the world according to the Global Citizens Report by Henley & Partners. The United States had the highest number of HNWIs (5,325,000) of any countr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |