|

2015–2016 Stock Market Selloff

The 2015–2016 stock market selloff was the period of decline in the value of stock prices globally that occurred between June 2015 to June 2016. It included the 2015–2016 Chinese stock market turbulence, in which the SSE Composite Index fell 43% in just over two months between June 2015 and August 2015, which culminated in the devaluation of the yuan. Investors sold shares globally as a result of slowing growth in the GDP of China, a fall in petroleum prices, the Greek debt default in June 2015, the effects of the end of quantitative easing in the United States in October 2014, a sharp rise in bond yields in early 2016, and finally, in June 2016, the 2016 United Kingdom European Union membership referendum, in which Brexit was voted upon. By July 2016, the Dow Jones Industrial Average (DJIA) recovered and achieved record highs. The FTSE 100 Index did not do so until later in 2016. Stock market performance in mid-2015 The DJIA closed at a record 18,312 on May 19, 2015, be ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2015–2016 Chinese Stock Market Turbulence

The Chinese stock market turbulence began with the popping of the stock market bubble on 12 June 2015 and ended in early February 2016. A third of the value of A-shares on the Shanghai Stock Exchange was lost within one month of the event. Major aftershocks occurred around 27 July and 24 August's "Black Monday". By 8–9 July 2015, the Shanghai stock market had fallen 30 percent over three weeks as 1,400 companies, or more than half listed, filed for a trading halt in an attempt to prevent further losses. Values of Chinese stock markets continued to drop despite efforts by the government to reduce the fall. After three stable weeks the Shanghai index fell again on 24 August by 8.48 percent, marking the largest fall since 2007. At the October 2015 International Monetary Fund (IMF) annual meeting of "finance ministers and central bankers from the Washington-based lender’s 188 member-countries" held in Peru, China's slump dominated discussions with participants asking if "Chi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dow Jones Industrial Average

The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow (), is a stock market index of 30 prominent companies listed on stock exchanges in the United States. The DJIA is one of the oldest and most commonly followed equity indexes. Many professionals consider it to be an inadequate representation of the overall U.S. stock market compared to a broader market index such as the S&P 500. The DJIA includes only 30 large companies. It is price-weighted, unlike stock indices which use market capitalization. Furthermore, the DJIA does not use a weighted arithmetic mean. The value of the index can also be calculated as the sum of the stock prices of the companies included in the index, divided by a factor which is currently () approximately 0.152. The factor is changed whenever a constituent company undergoes a stock split so that the value of the index is unaffected by the stock split. First calculated on May 26, 1896, the index is the second-oldest among U.S. market ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Financial Express (India)

''The Financial Express'' is an Indian English-language business newspaper owned by The Indian Express Group. It has been published by the Indian Express ''The Indian Express'' is an English-language Indian daily newspaper founded in 1932. It is published in Mumbai by the Indian Express Group. In 1999, eight years after the group's founder Ramnath Goenka's death in 1991, the group was split betw ... group since 1961. The ''Financial Express'' specialises in Indian and international business and financial news. Its editor is Shyamal Majumdar. The paper publishes 11 editions from a number of Indian cities. It also gives out two noteworthy awards - FE India's Best Bank Awards and FE-EVI Green Business Leadership Awards. References External links * ''Financial Express'' ePaper(E-Paper – Digital Replica of the newspaper) ''Financial Express Hindi'' website Business newspapers published in India Indian Express Limited Newspapers published in Kolkata English-langua ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

BSE SENSEX

The BSE SENSEX (also known as the S&P Bombay Stock Exchange Sensitive Index or simply SENSEX) is a free-float market-weighted stock market index of 30 well-established and financially sound companies listed on the Bombay Stock Exchange. The 30 constituent companies which are some of the largest and most actively traded stocks, are representative of various industrial sectors of the Indian economy. Published since 1 January 1986, the S&P BSE SENSEX is regarded as the pulse of the domestic stock markets in India. The base value of the SENSEX was taken as ''100'' on 1 April 1979 and its base year as ''1978–79''. On 25 July 2001 BSE launched DOLLEX-30, a dollar-linked version of the SENSEX. Etymology The term Sensex was coined by Deepak Mohoni, a stock market analyst in 1989. BSE Sensitive Index then was at about 750 points. it is a portmanteau of the words Sensitive and Index. Calculation The BSE has some reviews and modifies its composition to be sure it reflects current ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

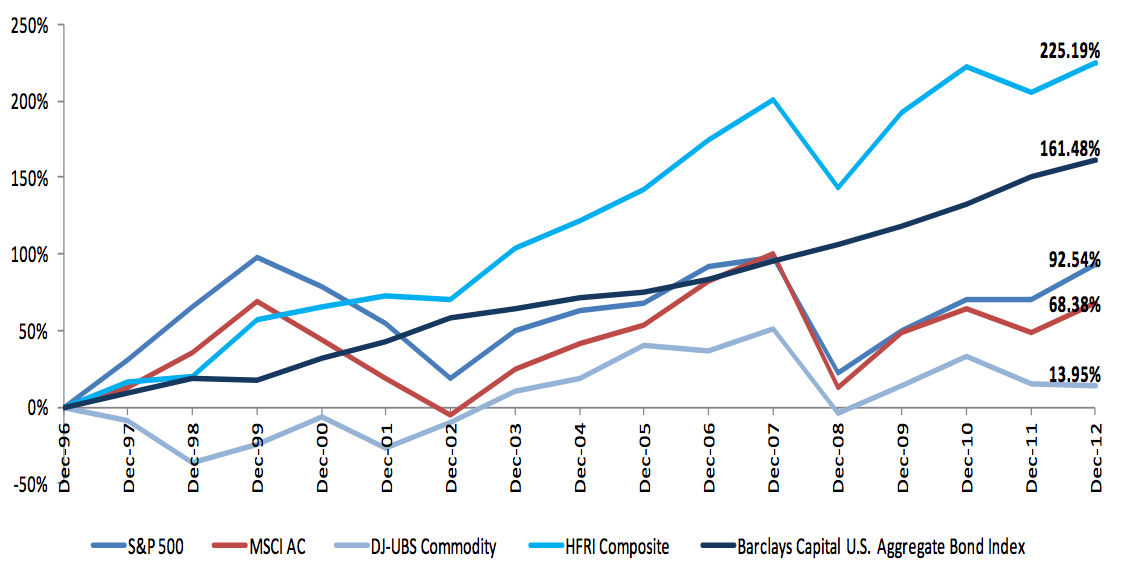

Hedge Fund

A hedge fund is a pooled investment fund that trades in relatively liquid assets and is able to make extensive use of more complex trading, portfolio-construction, and risk management techniques in an attempt to improve performance, such as short selling, leverage, and derivatives. Financial regulators generally restrict hedge fund marketing to institutional investors, high net worth individuals, and accredited investors. Hedge funds are considered alternative investments. Their ability to use leverage and more complex investment techniques distinguishes them from regulated investment funds available to the retail market, commonly known as mutual funds and ETFs. They are also considered distinct from private equity funds and other similar closed-end funds as hedge funds generally invest in relatively liquid assets and are usually open-ended. This means they typically allow investors to invest and withdraw capital periodically based on the fund's net asset value, whereas pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sensex

The BSE SENSEX (also known as the S&P Bombay Stock Exchange Sensitive Index or simply SENSEX) is a Capitalization-weighted index, free-float market-weighted stock market index of 30 well-established and financially sound companies listed on the Bombay Stock Exchange. The 30 constituent companies which are some of the largest and most actively traded stocks, are representative of various industrial sectors of the Indian economy. Published since 1 January 1986, the S&P BSE SENSEX is regarded as the pulse of the domestic stock markets in India. The base value of the SENSEX was taken as ''100'' on 1 April 1979 and its base year as ''1978–79''. On 25 July 2001 BSE launched DOLLEX-30, a dollar-linked version of the SENSEX. Etymology The term Sensex was coined by Deepak Mohoni, a stock market analyst in 1989. BSE Sensitive Index then was at about 750 points. it is a portmanteau of the words Sensitive and Index. Calculation The BSE has some reviews and modifies its composition to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Dollar

The United States dollar ( symbol: $; code: USD; also abbreviated US$ or U.S. Dollar, to distinguish it from other dollar-denominated currencies; referred to as the dollar, U.S. dollar, American dollar, or colloquially buck) is the official currency of the United States and several other countries. The Coinage Act of 1792 introduced the U.S. dollar at par with the Spanish silver dollar, divided it into 100 cents, and authorized the minting of coins denominated in dollars and cents. U.S. banknotes are issued in the form of Federal Reserve Notes, popularly called greenbacks due to their predominantly green color. The monetary policy of the United States is conducted by the Federal Reserve System, which acts as the nation's central bank. The U.S. dollar was originally defined under a bimetallic standard of (0.7735 troy ounces) fine silver or, from 1837, fine gold, or $20.67 per troy ounce. The Gold Standard Act of 1900 linked the dollar solely to gold. From 1934, it ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Japanese Yen

The is the official currency of Japan. It is the third-most traded currency in the foreign exchange market, after the United States dollar (US$) and the euro. It is also widely used as a third reserve currency after the US dollar and the euro. The New Currency Act of 1871 introduced Japan's modern currency system, with the yen defined as of gold, or of silver, and divided decimally into 100 ''sen'' or 1,000 ''rin''. The yen replaced the previous Tokugawa coinage as well as the various ''hansatsu'' paper currencies issued by feudal ''han'' (fiefs). The Bank of Japan was founded in 1882 and given a monopoly on controlling the money supply. Following World War II, the yen lost much of its prewar value. To stabilize the Japanese economy, the exchange rate of the yen was fixed at ¥360 per US$ as part of the Bretton Woods system. When that system was abandoned in 1971, the yen became undervalued and was allowed to float. The yen had appreciated to a peak of ¥271 per US$ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

World Oil Market Chronology From 2003

:''This article is a chronology of events affecting the oil market. For a discussion of the energy crisis of the same period, see 2000s energy crisis. For current fuel prices, see Gasoline usage and pricing.'' From the mid-1980s to September 2003, the inflation adjusted price of a barrel of crude oil on NYMEX was generally under $25/barrel. Then, during 2004, the price rose above $40, and then $60. A series of events led the price to exceed $60 by August 11, 2005, leading to a record-speed hike that reached $75 by the middle of 2006. Prices then dropped back to $60/barrel by the early part of 2007 before rising steeply again to $92/barrel by October 2007, and $99.29/barrel for December futures in New York on November 21, 2007. Throughout the first half of 2008, oil regularly reached record high prices. Prices on June 27, 2008, touched $141.71/barrel, for August delivery in the New York Mercantile Exchange, amid Libya's threat to cut output, and OPEC's president predicted pric ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Los Angeles Times

The ''Los Angeles Times'' (abbreviated as ''LA Times'') is a daily newspaper that started publishing in Los Angeles in 1881. Based in the LA-adjacent suburb of El Segundo since 2018, it is the sixth-largest newspaper by circulation in the United States. The publication has won more than 40 Pulitzer Prizes. It is owned by Patrick Soon-Shiong and published by the Times Mirror Company. The newspaper’s coverage emphasizes California and especially Southern California stories. In the 19th century, the paper developed a reputation for civic boosterism and opposition to labor unions, the latter of which led to the bombing of its headquarters in 1910. The paper's profile grew substantially in the 1960s under publisher Otis Chandler, who adopted a more national focus. In recent decades the paper's readership has declined, and it has been beset by a series of ownership changes, staff reductions, and other controversies. In January 2018, the paper's staff voted to unionize and final ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Apple Inc

Apple Inc. is an American multinational technology company headquartered in Cupertino, California, United States. Apple is the largest technology company by revenue (totaling in 2021) and, as of June 2022, is the world's biggest company by market capitalization, the fourth-largest personal computer vendor by unit sales and second-largest mobile phone manufacturer. It is one of the Big Five American information technology companies, alongside Alphabet, Amazon, Meta, and Microsoft. Apple was founded as Apple Computer Company on April 1, 1976, by Steve Wozniak, Steve Jobs and Ronald Wayne to develop and sell Wozniak's Apple I personal computer. It was incorporated by Jobs and Wozniak as Apple Computer, Inc. in 1977 and the company's next computer, the Apple II, became a best seller and one of the first mass-produced microcomputers. Apple went public in 1980 to instant financial success. The company developed computers featuring innovative graphical user inter ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

NASDAQ Composite

The Nasdaq Composite (ticker symbol ^IXIC) is a stock market index that includes almost all stocks listed on the Nasdaq stock exchange. Along with the Dow Jones Industrial Average and S&P 500, it is one of the three most-followed stock market indices in the United States. The composition of the NASDAQ Composite is heavily weighted towards companies in the information technology sector. The Nasdaq-100, which includes 100 of the largest non-financial companies in the Nasdaq Composite, accounts for over 90% of the movement of the Nasdaq Composite. The Nasdaq Composite is a capitalization-weighted index; its price is calculated by taking the sum of the products of closing price and index share of all of the securities in the index. The sum is then divided by a divisor which reduces the order of magnitude of the result. Investing in the Nasdaq Composite Index funds that attempt to track the Nasdaq Composite include Fidelity Investments' FNCMX mutual fund and ONEQ exchange-traded fund. I ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |