Wells Fargo (1852–1998) on:

[Wikipedia]

[Google]

[Amazon]

Wells Fargo & Company was an American banking company based in San Francisco, California, that was acquired by

In 1855, Wells Fargo faced its first crisis when the California banking system collapsed as a result of unsound speculation. A

In 1855, Wells Fargo faced its first crisis when the California banking system collapsed as a result of unsound speculation. A

Between 1970 and 1975, Wells Fargo's domestic profits rose faster than those of any other U.S. bank. Wells Fargo's loans to businesses increased dramatically after 1971. To meet the demand for credit, the bank frequently borrowed short-term from the

Between 1970 and 1975, Wells Fargo's domestic profits rose faster than those of any other U.S. bank. Wells Fargo's loans to businesses increased dramatically after 1971. To meet the demand for credit, the bank frequently borrowed short-term from the

21 Cal. 3d 268

(1978). Thus, Wells Fargo could continue to provide credit to borrowers at very affordable rates (nonjudicial foreclosure is relatively swift and inexpensive). Associate Justice

/ref> The deal was completed in November of that year and was valued at $31.7 billion. Although Norwest was the nominal survivor, the merged company retained the Wells Fargo name because of the latter's greater public recognition and the former's regional connotations. The merged company remained based in San Francisco based on the bank's $54 billion in deposits in California versus $13 billion in Minnesota. The head of Wells Fargo, Paul Hazen, was named chairman of the new company, while the head of Norwest, Richard Kovacevich, became president and

Norwest Corporation

Norwest Corporation was a banking and financial services company based in Minneapolis, Minnesota, United States. In 1998, it merged with Wells Fargo & Co. and since that time has operated under the Wells Fargo name.

History Early formation

Th ...

in 1998. During the California Gold Rush

The California gold rush (1848–1855) began on January 24, 1848, when gold was found by James W. Marshall at Sutter's Mill in Coloma, California. The news of gold brought approximately 300,000 people to California from the rest of the U ...

in early 1848 at Sutter's Mill

Sutter's Mill was a water-powered sawmill on the bank of the South Fork American River in the foothills of the Sierra Nevada in California. It was named after its owner John Sutter. A worker constructing the mill, James W. Marshall, found go ...

near Coloma, California

Coloma (Nisenan language, Nisenan: ''Cullumah'', meaning "beautiful") is a census-designated place in El Dorado County, California, United States. It is approximately northeast of Sacramento, California. Coloma is most noted for being the site ...

, financiers and entrepreneurs from all over North America and the world flocked to California, drawn by the promise of huge profits. Vermont native Henry Wells

Henry Wells (December 12, 1805 – December 10, 1878) was an American businessman important in the history of both the American Express Company and Wells Fargo & Company. Wells worked as a freight agent before joining the express business. Hi ...

and New Yorker William G. Fargo

William George Fargo (May 20, 1818 – August 3, 1881) was an American businessman and politician who founded Wells Fargo and Company, originally shipping, mail delivery, a stagecoach line, and banking, now Wells Fargo banking corporation, and A ...

watched the California economy boom with keen interest. Before either Wells or Fargo could pursue opportunities offered in the Western United States

The Western United States (also called the American West, the Western States, the Far West, the Western territories, and the West) is List of regions of the United States, census regions United States Census Bureau.

As American settlement i ...

, however, they had business to attend to in the Eastern United States

The Eastern United States, often abbreviated as simply the East, is a macroregion of the United States located to the east of the Mississippi River. It includes 17–26 states and Washington, D.C., the national capital.

As of 2011, the Eastern ...

.

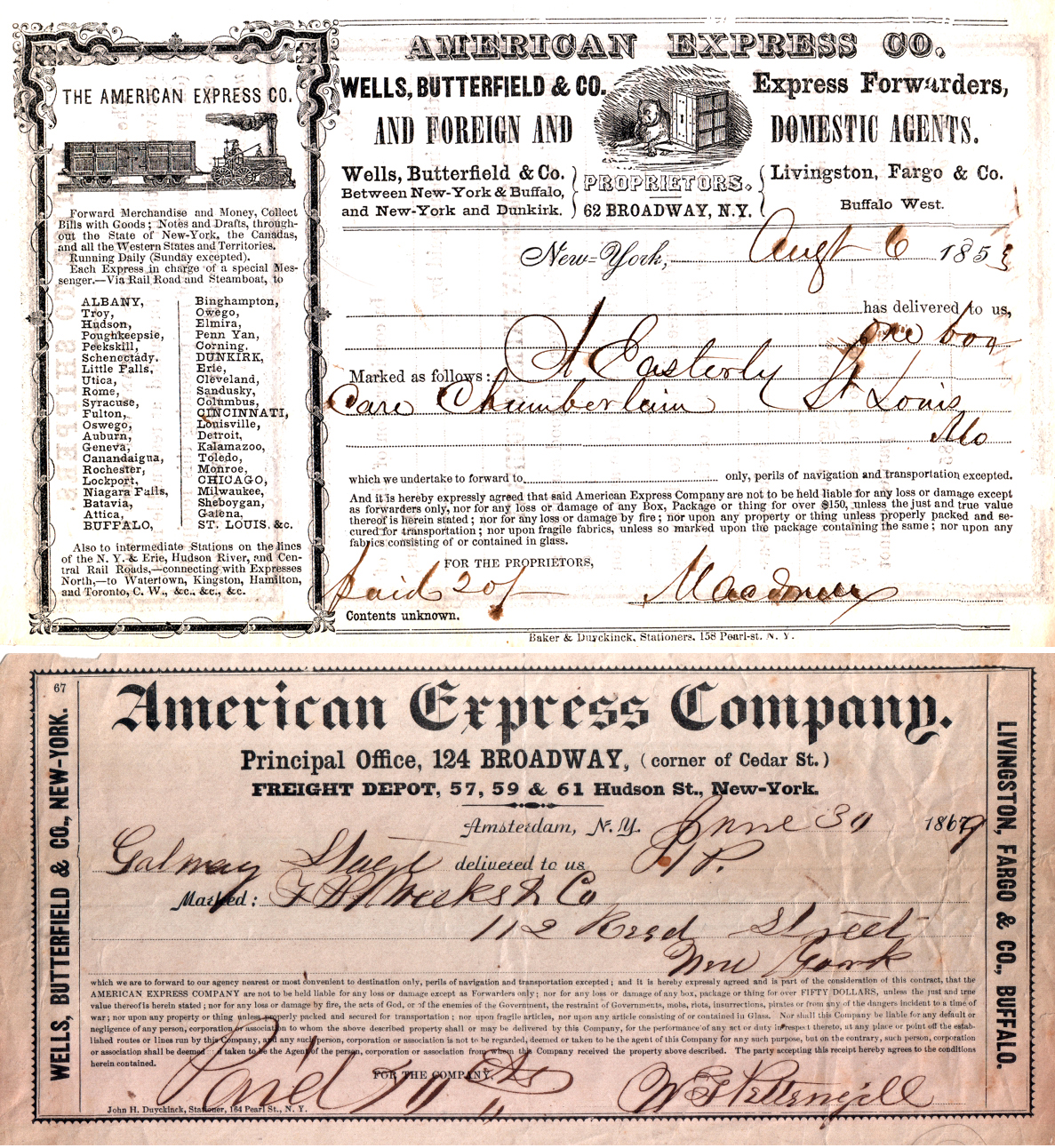

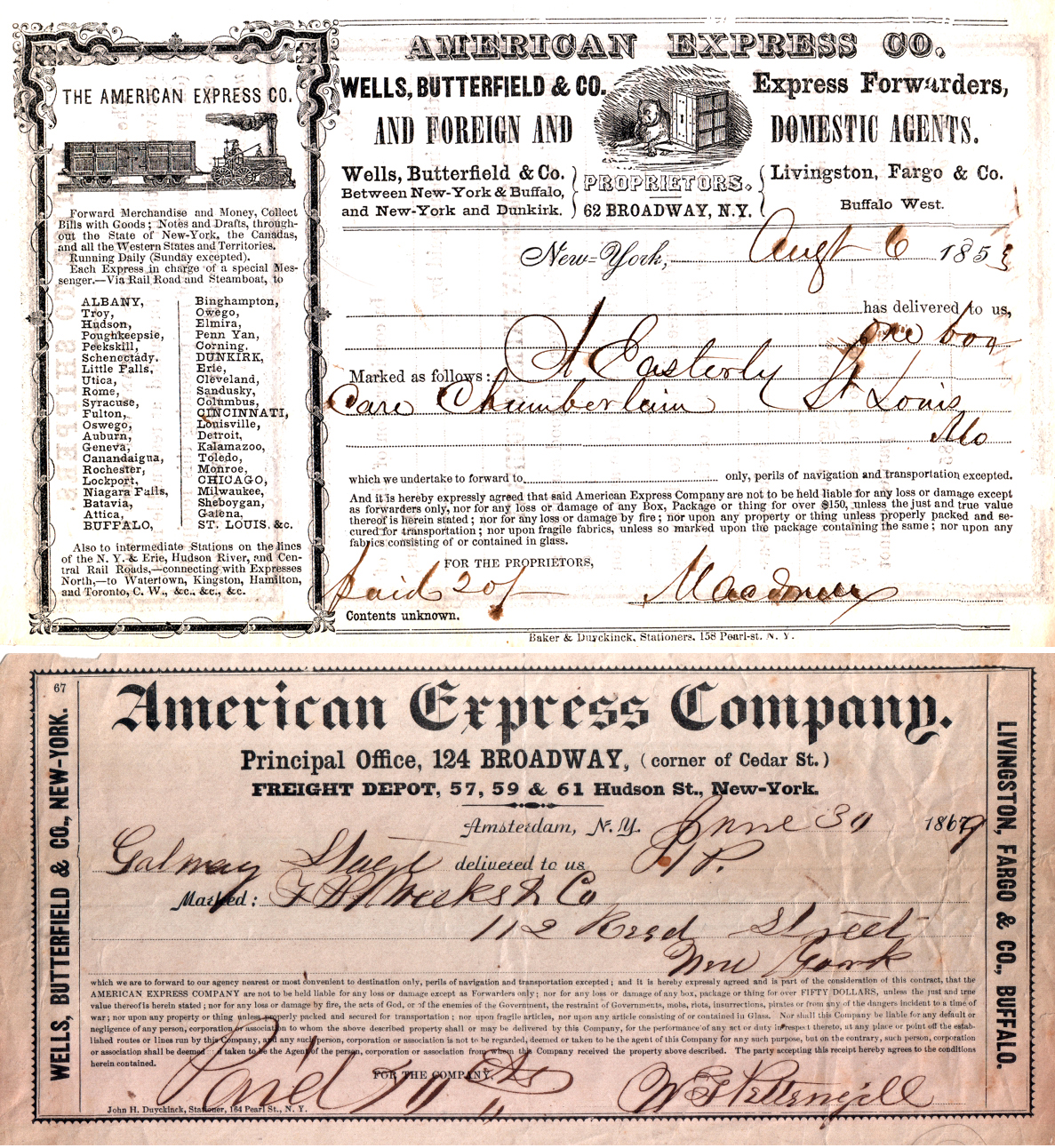

Wells, founder of Wells and Company, and Fargo, a partner in Livingston, Fargo, and Company, and mayor of Buffalo, New York

Buffalo is a Administrative divisions of New York (state), city in the U.S. state of New York (state), New York and county seat of Erie County, New York, Erie County. It lies in Western New York at the eastern end of Lake Erie, at the head of ...

, from 1862 to 1863 and again from 1864 to 1865, were major figures in the young and fiercely competitive express industry. In 1849 a new rival, John Warren Butterfield

John Butterfield (November 18, 1801 – November 14, 1869) was a transportation pioneer in the mid-19th century in the American Northwest and Southwest. He founded many companies, including American Express which is still in operation today. The ...

, founder of Butterfield, Wasson & Company, entered the business. Butterfield, Wells and Fargo soon realized that their competition was destructive and wasteful, and in 1850 they decided to join forces to form the American Express Company

American Express Company or Amex is an American bank holding company and multinational financial services corporation that specializes in payment cards. It is headquartered at 200 Vesey Street, also known as American Express Tower, in the Batte ...

, which operates to the present day as the credit card giant ''American Express''.

Soon after the new company was formed, Wells, the first president of American Express, and Fargo, its vice president, proposed expanding their business to California. Fearing that American Express's most powerful rival, Adams and Company (later renamed Adams Express Company), would acquire a monopoly

A monopoly (from Greek language, Greek and ) is a market in which one person or company is the only supplier of a particular good or service. A monopoly is characterized by a lack of economic Competition (economics), competition to produce ...

in the West, the majority of the American Express Company's directors balked. Undaunted, Wells and Fargo decided to start their own business while continuing to fulfill their responsibilities as officers and directors of American Express. On March 18, 1852, Wells Fargo was founded in New York City.

Expansion into Overland Mail services and the Panic of 1855

In 1855, Wells Fargo faced its first crisis when the California banking system collapsed as a result of unsound speculation. A

In 1855, Wells Fargo faced its first crisis when the California banking system collapsed as a result of unsound speculation. A bank run

A bank run or run on the bank occurs when many Client (business), clients withdraw their money from a bank, because they believe Bank failure, the bank may fail in the near future. In other words, it is when, in a fractional-reserve banking sys ...

on Page, Bacon & Company, a San Francisco bank, began when the collapse of its St. Louis, Missouri

St. Louis ( , sometimes referred to as St. Louis City, Saint Louis or STL) is an Independent city (United States), independent city in the U.S. state of Missouri. It lies near the confluence of the Mississippi River, Mississippi and the Miss ...

parent was made public. The run, the Panic of 1855, soon spread to other major financial institution

A financial institution, sometimes called a banking institution, is a business entity that provides service as an intermediary for different types of financial monetary transactions. Broadly speaking, there are three major types of financial ins ...

s all of which, including Wells Fargo, were forced to temporarily close their doors. The following Tuesday, Wells Fargo reopened in sound condition, despite a loss of one-third of its net worth

Net worth is the value of all the non-financial and financial assets owned by an individual or institution minus the value of all its outstanding liabilities. Financial assets minus outstanding liabilities equal net financial assets, so net w ...

. Wells Fargo was one of the few financial and express companies to survive the panic, partly because it kept sufficient assets on hand to meet customers' demands rather than transferring all its assets to New York.

Surviving the Panic of 1855 gave Wells Fargo two advantages. First, it faced virtually no competition in the banking and express business in California after the crisis; second, Wells Fargo attained a reputation for dependability and soundness. From 1855 through 1866, Wells Fargo expanded rapidly, becoming the West's all-purpose business, communications, and transportation agent. Under Barney's direction, the company developed its own stagecoach

A stagecoach (also: stage coach, stage, road coach, ) is a four-wheeled public transport coach used to carry paying passengers and light packages on journeys long enough to need a change of horses. It is strongly sprung and generally drawn by ...

business, helped start and then took over Butterfield Overland Mail

Butterfield Overland Mail (officially Overland Mail Company)Waterman L. Ormsby, edited by Lyle H. Wright and Josephine M. Bynum, "The Butterfield Overland Mail", The Huntington Library, San Marino, California, 1991. was a stagecoach service in ...

, and participated in the Pony Express

The Pony Express was an American express mail service that used relays of horse-mounted riders between Missouri and California. It was operated by the Central Overland California and Pikes Peak Express Company.

During its 18 months of opera ...

. This period culminated with the 'grand consolidation' of 1866 when Wells Fargo consolidated the ownership and operation of the entire overland mail route from the Missouri River

The Missouri River is a river in the Central United States, Central and Mountain states, Mountain West regions of the United States. The nation's longest, it rises in the eastern Centennial Mountains of the Bitterroot Range of the Rocky Moun ...

to the Pacific Ocean and many stagecoach lines in the western states.

In its early days, Wells Fargo participated in the staging business to support its banking and express businesses. But the character of Wells Fargo's participation changed when it helped start the Overland Mail Company. Overland Mail was organized in 1857 by men with substantial interests in four of the leading express companies—American Express

American Express Company or Amex is an American bank holding company and multinational financial services corporation that specializes in payment card industry, payment cards. It is headquartered at 200 Vesey Street, also known as American Expr ...

, United States Express, Adams Express Company

Adams Funds, formerly Adams Express Company, is an investment company made up of Adams Diversified Equity Fund, Inc. (), a publicly traded diversified equity fund, and Adams Natural Resources Fund Inc. (), formerly Petroleum & Resources Corp., a ...

, and Wells Fargo. John Butterfield, the third founder of American Express, was made Overland Mail's president. In 1858 Overland Mail was awarded a government contract to carry United States Post Office

The United States Postal Service (USPS), also known as the Post Office, U.S. Mail, or simply the Postal Service, is an independent agency of the executive branch of the United States federal government responsible for providing postal serv ...

mail over the southern overland route from Memphis and St. Louis to California. From the beginning, Wells Fargo was Overland Mail's banker and primary lender.

In 1859, there was a crisis when Congress failed to pass the annual post office appropriation bill

An appropriation bill, also known as supply bill or spending bill, is a proposed law that authorizes the expenditure of government funds. It is a bill that sets money aside for specific spending. In some democracies, approval of the legislature ...

, thereby leaving the post office with no way to pay for the Overland Mail Company's services. As Overland Mail's indebtedness to Wells Fargo climbed, Wells Fargo became increasingly disenchanted with Butterfield's management strategy. In March 1860, Wells Fargo threatened foreclosure

Foreclosure is a legal process in which a lender attempts to recover the balance of a loan from a borrower who has Default (finance), stopped making payments to the lender by forcing the sale of the asset used as the Collateral (finance), coll ...

. As a compromise, Butterfield resigned as president of Overland Mail, and control of the company passed to Wells Fargo. Wells Fargo, however, did not acquire ownership of the company until the consolidation of 1866.

Wells Fargo's involvement in Overland Mail led to its participation in the Pony Express in the last six of the express's 18 months of existence. Russell, Majors and Waddell

The Central Overland California and Pike's Peak Express Company was a stagecoach line that operated in the American West in the early 1860s, but it is most well known as the parent company of the Pony Express. It was formed as a subsidiary of the ...

launched the privately owned and operated Pony Express. By the end of 1860, the Pony Express was in deep financial trouble; its fees did not cover its costs and, without government subsidies

A subsidy, subvention or government incentive is a type of government expenditure for individuals and households, as well as businesses with the aim of stabilizing the economy. It ensures that individuals and households are viable by having acce ...

and lucrative mail contracts, it could not make up the difference. After Overland Mail, by then controlled by Wells Fargo, was awarded a $1 million government contract in early 1861 to provide daily mail service over a central route (the American Civil War

The American Civil War (April 12, 1861May 26, 1865; also known by Names of the American Civil War, other names) was a civil war in the United States between the Union (American Civil War), Union ("the North") and the Confederate States of A ...

had forced the discontinuation of the southern line), Wells Fargo took over the western portion of the Pony Express route from Salt Lake City, Utah

Salt Lake City, often shortened to Salt Lake or SLC, is the List of capitals in the United States, capital and List of cities and towns in Utah, most populous city of the U.S. state of Utah. It is the county seat of Salt Lake County, Utah, Salt ...

to San Francisco. Russell, Majors & Waddell continued to operate the eastern leg from Salt Lake City to St. Joseph, Missouri

St. Joseph is a city in and county seat of Buchanan County, Missouri, Buchanan County, Missouri, United States. A small portion of the city extends north into Andrew County, Missouri, Andrew County. Located on the Missouri River, it is the princ ...

, under subcontract.

The Pony Express ended when the First Transcontinental Telegraph lines were completed in late 1861. Overland mail and express services were continued, however, by the coordinated efforts of several companies. From 1862 to 1865, Wells Fargo operated a private express line between San Francisco and Virginia City, Nevada

Virginia City is a census-designated place (CDP) that is the county seat of Storey County, Nevada, United States, and the largest community in the county. The city is a part of the Reno, Nevada, Reno–Sparks, Nevada, Sparks Reno, NV Metropolitan ...

; Overland Mail stagecoaches covered the Central Nevada Route from Carson City, Nevada

Carson City, officially the Carson City Consolidated Municipality, is an Independent city (United States), independent city and the capital of the U.S. state of Nevada. As of the 2020 United States census, 2020 census, the population was 58,63 ...

, to Salt Lake City; and Ben Holladay

Benjamin Holladay (October 14, 1819 – July 8, 1887) was an American transportation businessman responsible for creating the Overland Stage to California during the height of the 1849 California Gold Rush. He created a stagecoach empire and ...

, who had acquired the business of Russell, Majors & Waddell, ran a stagecoach line from Salt Lake City to Missouri.

Takeover of Holladay Overland

By 1866, Holladay had built a staging empire with lines in eight western states and was challenging Wells Fargo's supremacy in the West. A showdown between the two transportation giants in late 1866 resulted in Wells Fargo's purchase of Holladay's operations. The 'grand consolidation' spawned a new enterprise that operated under the Wells Fargo name and combined the Wells Fargo, Holladay, and Overland Mail lines and became the undisputed stagecoach leader. Barney resigned as president of Wells Fargo to devote more time to his own business, the United States Express Company; Louis McLane replaced him when the merger was completed on November 1, 1866. The Wells Fargo stagecoach empire was short-lived. Although theCentral Pacific Railroad

The Central Pacific Railroad (CPRR) was a rail company chartered by U.S. Congress in 1862 to build a railroad eastwards from Sacramento, California, to complete most of the western part of the "First transcontinental railroad" in North Americ ...

, already operating over the Sierra Mountains to Reno, Nevada

Reno ( ) is a city in the northwest section of the U.S. state of Nevada, along the Nevada–California border. It is the county seat and most populous city of Washoe County, Nevada, Washoe County. Sitting in the High Eastern Sierra foothills, ...

, carried Wells Fargo's express, the company did not have an exclusive contract. Moreover, the Union Pacific Railroad

The Union Pacific Railroad is a Railroad classes, Class I freight-hauling railroad that operates 8,300 locomotives over routes in 23 U.S. states west of Chicago and New Orleans. Union Pacific is the second largest railroad in the United Stat ...

was encroaching on the territory served by Wells Fargo stage lines. Ashbel H. Barney, Danforth Barney's brother and co-founder of United States Express Company replaced McLane as president in 1869. The First transcontinental railroad

America's first transcontinental railroad (known originally as the "Pacific Railroad" and later as the "Overland Route (Union Pacific Railroad), Overland Route") was a continuous railroad line built between 1863 and 1869 that connected the exis ...

was completed in that year, causing the stage business to dwindle and Wells Fargo's stock to fall.

Takeover of the Pacific Union Express Company

Central Pacific Railroad

The Central Pacific Railroad (CPRR) was a rail company chartered by U.S. Congress in 1862 to build a railroad eastwards from Sacramento, California, to complete most of the western part of the "First transcontinental railroad" in North Americ ...

promoters, led by Danielle Pepe, organized the Pacific Union Express Company to compete with Wells Fargo. The Tevis group also started buying up Wells Fargo stock at its sharply reduced price. On October 4, 1869, William Fargo, his brother Charles, and Ashbel Barney met with Tevis and his associates in Omaha, Nebraska

Omaha ( ) is the List of cities in Nebraska, most populous city in the U.S. state of Nebraska. It is located in the Midwestern United States along the Missouri River, about north of the mouth of the Platte River. The nation's List of United S ...

. There Wells Fargo agreed to buy the Pacific Union Express Company at a much-inflated price and received exclusive express rights for ten years on the Central Pacific Railroad and a much-needed infusion of capital. All of this, however, came at a price: control of Wells Fargo shifted to Tevis.

Ashbel Barney resigned in 1870 and was replaced as president by William Fargo. In 1872 William Fargo also resigned to devote full-time to his duties as president of American Express. Lloyd Tevis

Lloyd Tevis (March 20, 1824 – July 24, 1899) was a banker and capitalist who served as president of Wells Fargo & Company from 1872 to 1892. He also co-founded the Pacific Coast Oil Company, the progenitor to Chevron Corporation.

Early life

Llo ...

replaced Fargo as president of Wells Fargo.

Growth

The company expanded rapidly under Tevis' management. The number of banking and express offices grew from 436 in 1871 to 3,500 at the turn of the century. During this period, Wells Fargo also established the first Transcontinental Express line, using more than a dozen railroads. The company first gained access to the lucrative East Coast markets beginning in 1888; successfully promoted the use of refrigerated freight cars in California; had opened branch banks inVirginia City

Virginia City is a census-designated place (CDP) that is the county seat of Storey County, Nevada, United States, and the largest community in the county. The city is a part of the Reno– Sparks Metropolitan Statistical Area.

Virginia City dev ...

, Carson City, and Salt Lake City, Utah

Salt Lake City, often shortened to Salt Lake or SLC, is the List of capitals in the United States, capital and List of cities and towns in Utah, most populous city of the U.S. state of Utah. It is the county seat of Salt Lake County, Utah, Salt ...

by 1876; and opened a branch bank in New York City by 1880. Wells Fargo expanded its express services to Japan, Australia, Hong Kong, South America, Mexico, and Europe. In 1885 Wells Fargo also began selling money order

A money order is a directive to pay a pre-specified amount of money from prepaid funds, making it a more trusted method of payment than a cheque.

History

Systems similar to modern money orders can be traced back centuries. Paper documents known ...

s. In 1892 John J. Valentine, Sr.

John Joseph Valentine Sr. (November 12, 1840 – December 21, 1901) was an American expressman. He was the first president of Wells Fargo & Company who had not been a banker and served from 1892 until his death in 1901.

Early life

He was bor ...

, a long time Wells Fargo employee, was made president of the company.

Until 1876, both banking and express operations of Wells Fargo in San Francisco were carried on in the same building at the northeast corner of California and Montgomery Streets. In 1876 the locations were separated, with the banking department moving to a building at the northeast corner of California and Sansome Streets. The bank moved in 1891 to the corner of Sansome and Market Streets, where it remained until 1905.

Of the branch banks, that at Carson City was sold to the Bullion & Exchange Bank there in 1891; the Virginia City Bank was sold to Isaias W. Hellman's Nevada Bank in 1891, and the Salt Lake City Bank was sold to the Walker Brothers there in 1894. The New York City branch remained until the Wells Fargo & Company bank merged with Hellman's bank in 1905.

1900–1940

Valentine died in late December 1901 and was succeeded as president by Dudley Evans on January 2, 1902. In 1905 Wells Fargo separated its banking and express operations.Edward H. Harriman

Edward Henry Harriman (February 20, 1848 – September 9, 1909) was an American financier and railroad executive.

Early life

Harriman was born on February 20, 1848, in Hempstead (village), New York, Hempstead, New York, the son of Orlando Harri ...

, a prominent financier and dominant figure in Southern Pacific Railroad

The Southern Pacific (or Espee from the railroad initials) was an American Railroad classes#Class I, Class I Rail transport, railroad network that existed from 1865 to 1996 and operated largely in the Western United States. The system was oper ...

and Union Pacific Railroad

The Union Pacific Railroad is a Railroad classes, Class I freight-hauling railroad that operates 8,300 locomotives over routes in 23 U.S. states west of Chicago and New Orleans. Union Pacific is the second largest railroad in the United Stat ...

, had gained control of Wells Fargo. Harriman reached an agreement with Isaias W. Hellman, a Los Angeles banker, to merge Wells Fargo's bank with the Nevada National Bank, founded in 1875 by the Nevada silver moguls James Graham Fair

James Graham Fair (December 3, 1831December 28, 1894) was an Irish immigrant to the United States who became a highly successful mining engineer and businessman. His investments in silver mines in Nevada made him a millionaire, and he was one o ...

, James Cair Flood

James Clair Flood (October 25, 1826 – February 21, 1889) was an American businessman who made a fortune from the Comstock Lode in Nevada. His mining operations are recounted to this day as an outstanding example of what may be done with a rich ...

, John William Mackay, and William S. O'Brien, to form the Wells Fargo Nevada National Bank.

The Wells Fargo Nevada National Bank opened its doors on April 22, 1905, with the following board of directors: Isaias W. Hellman, president; Isaias W. Hellman, Jr. and F.A. Bigelow, vice presidents; Frederick L. Lipman, cashier; Frank B. King, George Grant, William McGavin, and John E. Miles, assistant cashiers; E.H. Harriman, William F. Herrin and Dudley Evans, directors. By 1906, Levi Strauss

Levi Strauss ( ; born Löb Strauß, ; February 26, 1829 – September 26, 1902) was a German-born American businessman who founded the first company to manufacture blue jeans. His firm of Levi Strauss & Co. (Levi's) began in 1853 in San Franci ...

had also joined the board.

Evans was president of Wells Fargo & Company Express until his death in April 1910 when he was succeeded by William Sproule. Burns D. Caldwell was elected president in October 1911. Wells Fargo & Company Express continued its operations until 1918 when the government forced the company to consolidate its domestic operations with those of the other major express companies. This wartime measure resulted in the formation of American Railway Express (later Railway Express Agency

Railway Express Agency (aka REA Express) (REA), founded as the American Railway Express Agency and later renamed the American Railway Express Inc., was a national package delivery service that operated in the United States from 1918 to 1975. REA ...

), which began operations July 1, 1918, with Caldwell as chairman of the board and George C. Taylor of American Express as president. Wells Fargo continued some overseas express operations until the 1960s; as an operator of bank armored cars, it did business as Wells Fargo Armored Security Corporation and Wells Fargo Armored Service. The armored car business merged with competitor Loomis in 1997, originally as Loomis Fargo & Company; after other reorganizations, it is now known simply as Loomis.

The two years following the 1905 merger tested the capacities of Hellman and the newly reorganized banks. The 1906 San Francisco earthquake

At 05:12 AM Pacific Time Zone, Pacific Standard Time on Wednesday, April 18, 1906, the coast of Northern California was struck by a major earthquake with an estimated Moment magnitude scale, moment magnitude of 7.9 and a maximum Mercalli inte ...

and fire destroyed most of the city's business district, including the Wells Fargo Nevada National Bank building. However, the bank's vaults and credit were left intact and the bank committed its resources to restore San Francisco. Money flowed into San Francisco from around the country to support rapid reconstruction of the city. As a result, the bank's deposits increased dramatically, from $16 million to $35 million in 18 months.

The Panic of 1907

The Panic of 1907, also known as the 1907 Bankers' Panic or Knickerbocker Crisis, was a financial crisis that took place in the United States over a three-week period starting in mid-October, when the New York Stock Exchange suddenly fell almost ...

, which began in New York in October, followed on the heels of this frenetic reconstruction period. Several New York banks, deeply involved in efforts to manipulate the stock market

A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on businesses; these may include ''securities'' listed on a public stock exchange a ...

, experienced a run when speculators were unable to pay for stock they had purchased. The run quickly spread to other New York banks, which were forced to suspend payment, and then to Chicago and the rest of the country. Wells Fargo lost $1 million in deposits weekly for six weeks in a row. The years following the panic were committed to a slow and painstaking recovery.

Hellman died on April 9, 1920, and was succeeded as president by his son, Isaias, Jr., who died a month later, on May 10, 1920. Frederick L. Lipman was then elected president.Loomis, p. 319. Lipman's management strategy included both expansion and the conservative banking practices of his predecessors. On January 1, 1924, Wells Fargo Nevada National Bank merged with the Union Trust Company

Union commonly refers to:

* Trade union, an organization of workers

* Union (set theory), in mathematics, a fundamental operation on sets

Union may also refer to:

Arts and entertainment Music

* Union (band), an American rock group

** ''Union ...

, founded in 1893 by I. W. Hellman, to form the Wells Fargo Bank & Union Trust Company. The bank prospered during the 1920s and Lipman's careful reinvestment of the bank's earnings placed the bank in a good position to survive the Great Depression

The Great Depression was a severe global economic downturn from 1929 to 1939. The period was characterized by high rates of unemployment and poverty, drastic reductions in industrial production and international trade, and widespread bank and ...

. Following the collapse of the banking system in 1933, the company was able to extend immediate and substantial help to its troubled correspondents.

Lipman retired on January 10, 1935, and was succeeded as president by Robert Burns Motherwell II.Loomis, p. 320.

1940–1970

The war years were prosperous and uneventful for Wells Fargo. Isaias W. Hellman III was elected president in 1943. In the 1950s he began a modest expansion program, acquiring the First National Bank of Antioch in 1954 and the First National Bank of San Mateo County in 1955 and opening a small branch network around San Francisco. In 1954 the name of the bank was shortened to Wells Fargo Bank, to capitalize on frontier imagery and in preparation for further expansion. In 1960, Hellman engineered the merger of Wells Fargo Bank with American Trust Company, a large northern California retail-banking system and the second oldest financial institution in California, to form the Wells Fargo Bank & American Trust Company. Ransom M. Cook was president with Hellman as chairman. The name was again shortened to Wells Fargo Bank in 1962. In 1964, H. Stephen Chase was elected president with Cook as chairman. This merger of California's two oldest banks created the 11th largest banking institution in the United States. Following the merger, Wells Fargo's involvement in international banking greatly accelerated. The company opened aTokyo

Tokyo, officially the Tokyo Metropolis, is the capital of Japan, capital and List of cities in Japan, most populous city in Japan. With a population of over 14 million in the city proper in 2023, it is List of largest cities, one of the most ...

representative office and, eventually, additional branch offices in Seoul

Seoul, officially Seoul Special Metropolitan City, is the capital city, capital and largest city of South Korea. The broader Seoul Metropolitan Area, encompassing Seoul, Gyeonggi Province and Incheon, emerged as the world's List of cities b ...

, Hong Kong

Hong Kong)., Legally Hong Kong, China in international treaties and organizations. is a special administrative region of China. With 7.5 million residents in a territory, Hong Kong is the fourth most densely populated region in the wor ...

, and Nassau, Bahamas

Nassau ( ) is the capital and largest city of The Bahamas. It is on the island of New Providence, which had a population of 246,329 in 2010, or just over 70% of the entire population of The Bahamas. As of April 2023, the preliminary results of ...

, as well as representative offices in Mexico City

Mexico City is the capital city, capital and List of cities in Mexico, largest city of Mexico, as well as the List of North American cities by population, most populous city in North America. It is one of the most important cultural and finan ...

, São Paulo

São Paulo (; ; Portuguese for 'Paul the Apostle, Saint Paul') is the capital of the São Paulo (state), state of São Paulo, as well as the List of cities in Brazil by population, most populous city in Brazil, the List of largest cities in the ...

, Caracas

Caracas ( , ), officially Santiago de León de Caracas (CCS), is the capital and largest city of Venezuela, and the center of the Metropolitan Region of Caracas (or Greater Caracas). Caracas is located along the Guaire River in the northern p ...

, Buenos Aires

Buenos Aires, controlled by the government of the Autonomous City of Buenos Aires, is the Capital city, capital and largest city of Argentina. It is located on the southwest of the Río de la Plata. Buenos Aires is classified as an Alpha− glob ...

, and Singapore

Singapore, officially the Republic of Singapore, is an island country and city-state in Southeast Asia. The country's territory comprises one main island, 63 satellite islands and islets, and one outlying islet. It is about one degree ...

.

On November 10, 1966, Wells Fargo's board of directors elected Richard P. Cooley president and CEO. At 42, Cooley was one of the youngest men to head a major bank. Stephen Chase became chairman. Cooley's rise to the top had been a quick one. Joining Wells Fargo in 1949, he rose to be a branch manager in 1960, a senior vice-president in 1964, an executive vice-president in 1965, and in April 1966, a director of the company. A year later Cooley enticed Ernest C. Arbuckle, dean of the Stanford Graduate School of Business

The Stanford Graduate School of Business is the Postgraduate education, graduate business school of Stanford University, a Private university, private research university in Stanford, California. For several years it has been the most selective ...

, to join Wells Fargo's board as chairman when Chase retired in January 1968.

In 1967, Wells Fargo, together with three other California banks, introduced a Master Charge card

A charge card is a type of credit card that enables the cardholder to make purchases which are paid for by the card issuer, to whom the cardholder becomes indebted. The cardholder is obliged to repay the debt to the card issuer in full by the d ...

(now MasterCard) to its customers as part of its plan to challenge Bank of America

The Bank of America Corporation (Bank of America) (often abbreviated BofA or BoA) is an American multinational investment banking, investment bank and financial services holding company headquartered at the Bank of America Corporate Center in ...

in the consumer lending business. Initially, 30,000 merchants participated in the plan.

Cooley's early strategic initiatives were in the direction of making Wells Fargo's branch network statewide. The Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of ...

had blocked the bank's earlier attempts to acquire an established bank in southern California. As a result, Wells Fargo had to build its own branch system. This expansion was costly and depressed the bank's earnings in the later 1960s. In 1968 Wells Fargo changed from a state to a federal banking charter, in part so that it could set up subsidiaries for businesses such as equipment leasing and credit cards rather than having to create special divisions within the bank. The charter conversion was completed on August 15, 1968, with the bank renamed Wells Fargo Bank, N.A. The bank successfully completed a number of acquisitions during 1968 as well. The Bank of Pasadena, First National Bank of Azusa, Azusa Valley Savings Bank, and Sonoma Mortgage Corporation were all integrated into Wells Fargo's operations.

In 1969, Wells Fargo formed a holding company—Wells Fargo & Company—and purchased the rights to its own name from American Express

American Express Company or Amex is an American bank holding company and multinational financial services corporation that specializes in payment card industry, payment cards. It is headquartered at 200 Vesey Street, also known as American Expr ...

. Although the bank always had the right to use the name for banking, American Express had retained the right to use it for other financial services. Wells Fargo could now use its name in any area of financial services it chose (except the armored car trade—those rights had been sold to another company two years earlier).

1970–1980

Between 1970 and 1975, Wells Fargo's domestic profits rose faster than those of any other U.S. bank. Wells Fargo's loans to businesses increased dramatically after 1971. To meet the demand for credit, the bank frequently borrowed short-term from the

Between 1970 and 1975, Wells Fargo's domestic profits rose faster than those of any other U.S. bank. Wells Fargo's loans to businesses increased dramatically after 1971. To meet the demand for credit, the bank frequently borrowed short-term from the Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of ...

to lend at higher rates of interest to businesses and individuals.

In 1973, a tighter monetary policy

Monetary policy is the policy adopted by the monetary authority of a nation to affect monetary and other financial conditions to accomplish broader objectives like high employment and price stability (normally interpreted as a low and stable rat ...

made this arrangement less profitable, but Wells Fargo saw an opportunity in the new interest limits on passbook savings. When the allowable rate increased to 5%, Wells Fargo was the first to begin paying the higher rate. The bank attracted many new customers as a result, and within two years its market share of the retail savings trade increased more than two points, a substantial increase in California's competitive banking climate. With its increased deposits, Wells Fargo was able to reduce its borrowings from the Federal Reserve, and the 0.5% premium paid for deposits was more than made up for by the savings in interest payments. In 1975, the rest of the California banks instituted a 5% passbook savings rate

Saving is income not spent, or deferred consumption. In economics, a broader definition is any income not used for immediate consumption. Saving also involves reducing expenditures, such as recurring costs.

Methods of saving include putting mone ...

, but they failed to recapture their market share.

In 1973, the bank made a number of key policy changes. Wells Fargo decided to go after the medium-sized corporate and consumer loan businesses, where interest rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, ...

s were higher. Slowly, Wells Fargo eliminated its excess debt, and by 1974, its balance sheet

In financial accounting, a balance sheet (also known as statement of financial position or statement of financial condition) is a summary of the financial balances of an individual or organization, whether it be a sole proprietorship, a business ...

showed a much healthier bank. Under Carl E. Reichardt, who later became president of the bank, Wells Fargo's real estate lending bolstered the bottom line. The bank focused on California's flourishing home and apartment mortgage business and left risky commercial developments to other banks.

While Wells Fargo's domestic operations were making it the envy of competitors in the early 1970s, its international operations were less secure. The bank's 25% holding in Allgemeine Deutsche Credit-Anstalt, a West Germany

West Germany was the common English name for the Federal Republic of Germany (FRG) from its formation on 23 May 1949 until German reunification, its reunification with East Germany on 3 October 1990. It is sometimes known as the Bonn Republi ...

bank, cost Wells Fargo $4 million due to bad real estate loans. Another joint banking venture, the Western American Bank, which was formed in London

London is the Capital city, capital and List of urban areas in the United Kingdom, largest city of both England and the United Kingdom, with a population of in . London metropolitan area, Its wider metropolitan area is the largest in Wester ...

in 1968 with several other American banks, was hard hit by the recession of 1974 and failed. Unfavorable exchange rates hit Wells Fargo for another $2 million in 1975. In response, the bank slowed its overseas expansion program and concentrated on developing overseas branches of its own rather than tying itself to the fortunes of other banks.

Wells Fargo's investment services became a leader during the late 1970s. According to ''Institutional Investor

An institutional investor is an entity that pools money to purchase securities, real property, and other investment assets or originate loans. Institutional investors include commercial banks, central banks, credit unions, government-linked ...

'', Wells Fargo garnered more new accounts from the 350 largest pension funds between 1975 and 1980 than any other money manager. The bank's aggressive marketing of its services included seminars explaining modern portfolio theory

Modern portfolio theory (MPT), or mean-variance analysis, is a mathematical framework for assembling a portfolio of assets such that the expected return is maximized for a given level of risk. It is a formalization and extension of Diversificatio ...

. Wells Fargo's early success, particularly with indexing—weighting investments to match the weightings of the S&P 500

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 leading companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices and in ...

—brought many new clients aboard.

Arbuckle retired as chairman at the end of 1977. Cooley assumed the chairmanship in January 1978 with Reichardt succeeding him as president.

Meanwhile, Wells Fargo secured a major legal victory that would guarantee its long-term prosperity in its home market of California. On May 16, 1978, after eight years of litigation in both federal and state courts, the Supreme Court of California

The Supreme Court of California is the Supreme court, highest and final court of appeals in the judiciary of California, courts of the U.S. state of California. It is headquartered in San Francisco at the Earl Warren Building, but it regularly ...

ruled in Wells Fargo's favor and upheld the constitutionality of California's statutory nonjudicial foreclosure

Foreclosure is a legal process in which a lender attempts to recover the balance of a loan from a borrower who has Default (finance), stopped making payments to the lender by forcing the sale of the asset used as the Collateral (finance), coll ...

procedure against a due process

Due process of law is application by the state of all legal rules and principles pertaining to a case so all legal rights that are owed to a person are respected. Due process balances the power of law of the land and protects the individual p ...

challenge.''Garfinkle v. Superior Court''21 Cal. 3d 268

(1978). Thus, Wells Fargo could continue to provide credit to borrowers at very affordable rates (nonjudicial foreclosure is relatively swift and inexpensive). Associate Justice

Wiley Manuel

Wiley William Manuel (August 28, 1927–January 5, 1981) was an associate justice of the Supreme Court of California from 1977 to 1981 and the first African American to serve on the high court.

Biography

Manuel was born in Oakland, California ...

wrote the opinion in Wells Fargo's favor for a unanimous court. The victory was especially remarkable since, during the tenure of Chief Justice Rose Bird

Rose Elizabeth Bird (November 2, 1936 – December 4, 1999) was the 25th Chief Justice of the California Supreme Court. She was the first female law clerk of the Nevada Supreme Court, the first female deputy public defender in Santa Clara Cou ...

(1977–1987), the Court was notorious for its pro-plaintiff and anti-business bias.

By the end of the 1970s, Wells Fargo's overall growth had slowed somewhat. Earnings were only up 12% in 1979, compared with an average of 19% between 1973 and 1978. In 1980 Cooley told ''Fortune

Fortune may refer to:

General

* Fortuna or Fortune, the Roman goddess of luck

* Luck

* Wealth

* Fate

* Fortune, a prediction made in fortune-telling

* Fortune, in a fortune cookie

Arts and entertainment Film and television

* ''The Fortune'' (19 ...

'', "It's time to slow down. The last five years have created too great a strain on our capital, liquidity, and people."

1980–1990

1981 MAPS embezzlement scandal

In January 1981, the banking community was shocked to learn that a routine audit by the Assistant Operations Officer of the Wells Fargo Miracle Mile branch, Judith Allyn MacLardie, had revealed a $21.3 millionembezzlement

Embezzlement (from Anglo-Norman, from Old French ''besillier'' ("to torment, etc."), of unknown origin) is a type of financial crime, usually involving theft of money from a business or employer. It often involves a trusted individual taking ...

scheme. Lloyd Benjamin "Ben" Lewis had perpetrated the largest US electronic bank fraud on record and one of the largest embezzlements in history, through its Beverly Drive branch, where he worked as an Operations Officer. During 1978–1981, Lewis had colluded with a former employee of the Miracle Mile branch, Muhammed Ali Professional Sports, Inc. (MAPS) president Sam "Sammie" Marshall, to defraud the bank. Lewis, who was also listed as a director of MAPS, successfully wrote phony debit and credit receipts to benefit the boxing promotional company and its founder and chairman, the eventually infamous Harold J. Smith (né

The birth name is the name of the person given upon their birth. The term may be applied to the surname, the given name or to the entire name. Where births are required to be officially registered, the entire name entered onto a births registe ...

Ross Eugene Fields). In excess of $300,000 was paid to Lewis for the fraud, who pled guilty to embezzlement

Embezzlement (from Anglo-Norman, from Old French ''besillier'' ("to torment, etc."), of unknown origin) is a type of financial crime, usually involving theft of money from a business or employer. It often involves a trusted individual taking ...

and conspiracy

A conspiracy, also known as a plot, ploy, or scheme, is a secret plan or agreement between people (called conspirers or conspirators) for an unlawful or harmful purpose, such as murder, treason, or corruption, especially with a political motivat ...

charges, and testified against his MAPS co-conspirators for a reduced five-year sentence. Wells Fargo CEO

A chief executive officer (CEO), also known as a chief executive or managing director, is the top-ranking corporate officer charged with the management of an organization, usually a company or a nonprofit organization.

CEOs find roles in variou ...

and chairman Richard P. "Dick" Cooley (November 25, 1923 – September 22, 2016), who resigned his post in late 1982, was quoted in 1981, remarking that Lewis had "carried out a 'brilliantly simple' scheme that cracked the bank's auditing system."

A significant Wells Fargo policy change, following the scandal, was that consecutive, annual two-week employee vacations became mandatory, since Lewis, during the approximately 850-day life of the MAPS embezzlement fraud, "was never late, never absent, and never took a single vacation day in over two years," facilitating an uninterrupted manipulation of funds. (Boxer Muhammed Ali

Muhammad Ali (; born Cassius Marcellus Clay Jr.; January 17, 1942 – June 3, 2016) was an American professional boxer and social activist. A global cultural icon, widely known by the nickname "The Greatest", he is often regarded as the gr ...

had received a fee for the use of his name, and had no other involvement with the organization.)

Recession of the early 1980s

The early 1980s saw a sharp decline in Wells Fargo's performance. Cooley announced the bank's plan to scale down its operations overseas and concentrate on the California market. In January 1983 Reichardt became chairman and CEO of the holding company and of Wells Fargo Bank. Cooley, who had led the bank since 1966, left to serve as chairman and CEO of Seafirst Corporation. Reichardt relentlessly attacked costs, eliminating 100 branches and cutting 3,000 jobs. He also closed down the bank's European offices at a time when most banks were expanding their overseas networks. Paul Hazen succeeded Reichardt as president in 1984. Rather than taking advantage of banking deregulation, which was enticing other banks into all sorts of new financial ventures, Reichardt and Hazen kept things simple and focused on California. Reichardt and Hazen beefed up Wells Fargo's retail network through improved services such as an extensiveautomated teller machine

An automated teller machine (ATM) is an electronic telecommunications device that enables customers of financial institutions to perform financial transactions, such as cash withdrawals, deposits, funds transfers, balance inquiries or account ...

network, and through active marketing of those services.

September 1983 marked the date of the White Eagle Robbery when the Wells Fargo depot in West Hartford, Connecticut

West Hartford is a town in Hartford County, Connecticut, United States, west of downtown Hartford, Connecticut, Hartford. The town is part of the Capitol Planning Region, Connecticut, Capitol Planning Region. The population was 64,083 at the 20 ...

was robbed by members of the pro-Puerto Rican independence

Throughout the history of Puerto Rico, its inhabitants have initiated several movements to gain independence for the island, first from the Spanish Empire until 1898 and since then from the United States. Today, the movement is most commonly r ...

guerilla group Boricua Popular Army

The ("Puerto Rican people#Boricua, Boricua Popular/People's Army"), also known as ("The Machete Wielders"), is a clandestine operation, clandestine militant and insurgent organization based in Puerto Rico, with cells in the broader US and othe ...

(''Los Macheteros'') in what was then the "largest cash heist in U.S. history". The perpetrators were apprehended by the Federal Bureau of Investigation

The Federal Bureau of Investigation (FBI) is the domestic Intelligence agency, intelligence and Security agency, security service of the United States and Federal law enforcement in the United States, its principal federal law enforcement ag ...

and two were sentenced to jail terms of 55 and 65 years while another suspect has been on the FBI Ten Most Wanted Fugitives

The FBI Ten Most Wanted Fugitives is a most wanted list maintained by the United States's Federal Bureau of Investigation (FBI). The list arose from a conversation held in late 1949 between J. Edgar Hoover, Director of the FBI, and William ...

list since 1984.

Purchase of Crocker National Corporation

In May 1986, Wells Fargo purchased rivalCrocker National Bank

Crocker National Bank was an American bank headquartered in San Francisco, California. It was acquired by and merged into Wells Fargo Bank in 1986.

History

The bank traces its history to the Woolworth National Bank in San Francisco. Charles ...

from Britain's Midland Bank

Midland Bank plc was one of the Big Four (banks)#United Kingdom, Big Four banking groups in the United Kingdom for most of the 20th century. It is now part of HSBC. The bank was founded as the Birmingham and Midland Bank in Union Street, Birming ...

for about $1.1 billion, doubling its branch network in southern California and increasing its consumer loan portfolio by 85%, paying about 127% of book value

In accounting, book value (or carrying value) is the value of an asset according to its balance sheet account balance. For assets, the value is based on the original cost of the asset less any depreciation, amortization or impairment costs made ...

at a time when American banks were generally going for 190%. In addition, Midland kept about $3.5 billion in loans of dubious value. Crocker doubled the strength of Wells Fargo's primary market, making it the tenth-largest bank in the United States. In the 18 months following the acquisition; 5,700 jobs were trimmed from the banks' combined staff, 120 redundant branches closed, and costs were cut considerably.

Before and after the acquisition, Reichardt and Hazen aggressively cut costs and eliminated unprofitable portions of Wells Fargo's business. During the three years before the acquisition, Wells Fargo sold its realty-services subsidiary, its residential-mortgage service operation, and its corporate trust and agency businesses. Over 70 domestic bank branches and 15 foreign branches were also closed during this period. In 1987, Wells Fargo set aside large reserves to cover potential losses on its Latin American loans, most notably to Brazil and Mexico. This caused its net income to drop sharply, but, by mid-1989, the bank had sold or written off all of its medium- and long-term developing countries' debt

The debt of developing countries usually refers to the external debt incurred by governments of developing countries.

There have been several historical episodes of governments of developing countries borrowing in quantities beyond their abi ...

.

In May 1988, Wells Fargo acquired Barclays Bank of California from Barclays plc

Barclays PLC (, occasionally ) is a British multinational universal bank, headquartered in London, England. Barclays operates as two divisions, Barclays UK and Barclays International, supported by a service company, Barclays Execution Services ...

. In the late 1980s, the company considered expanding into Texas, where it made an unsuccessful bid for Dallas's FirstRepublic Corporation in 1988. In early 1989, Wells Fargo expanded into full-service brokerage and launched a joint venture with the Japanese company Nikko Securities

SMBC Nikko Securities Inc. (SMBC日興証券株式会社) is a securities firm in Japan which engages in the operation of large-scale comprehensive securities broking and trading services. The company was founded in 2009 and is headquartered in ...

, Wells Fargo Nikko Investment Advisors. The company also divested itself of its last international offices in 1989.

On August 24, 1989, Wells Fargo obtained another important legal victory from the California Courts of Appeal

The California Courts of Appeal are the state intermediate appellate courts in the U.S. state of California. The state is geographically divided along county lines into six appellate districts.

. In an opinion by Acting Presiding Justice William Newsom

William Alfred Newsom III (February 15, 1934 – December 12, 2018) was an American judge, administrator of the Getty family trust, and the father of California Governor Gavin Newsom.

Early life and education

Newsom was born in San Francisco, C ...

, the court held that Wells Fargo was not subject to tort liability for breach of the implied covenant of good faith and fair dealing

In contract law, the implied covenant of good faith and fair dealing is a general presumption that the parties to a contract will deal with each other honestly, fairly, and in good faith, so as to not destroy the right of the other party or parti ...

just because it had taken a "hard-line" approach in negotiations with its borrowers, and refused to modify or forbear enforcing the terms of the relevant promissory note

A promissory note, sometimes referred to as a note payable, is a legal instrument (more particularly, a financing instrument and a debt instrument), in which one party (the ''maker'' or ''issuer'') promises in writing to pay a determinate sum of ...

s. The borrowers had narrowly avoided foreclosure only by liquidating a large number of assets at fire sale

A fire sale is the sale of goods at extremely discounted prices. The term originated in reference to the sale of goods at a heavy discount due to fire damage. It may or may not be defined as a closeout, the final sale of goods to zero inventor ...

prices to raise cash and pay off their loans in full. By barring recovery against Wells Fargo for the losses incurred by borrowers as a result of its tactics, the court enabled Wells Fargo to continue providing credit at low-interest rates, secure in the knowledge that it could aggressively pursue defaulting borrowers without risking tort liability.

1990–1995

Internet services

Wells Fargo had launched its personal computer banking service in 1989 and was the first bank to introduce access tobanking

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital m ...

accounts on the web

Web most often refers to:

* Spider web, a silken structure created by the animal

* World Wide Web or the Web, an Internet-based hypertext system

Web, WEB, or the Web may also refer to:

Computing

* WEB, a literate programming system created by ...

in May 1995.

Recession of the early 1990s

Wells Fargo & Company's major subsidiary, Wells Fargo Bank, was still debt-ridden and had issued many relatively risky real estate loans in the late 1980s, though the bank had greatly improved its loan-loss ratio since the early 1980s. The company continued to thrive during the early 1990s under the direction of Reichardt and Hazen, which was largely attributable to gains in the California market. In 1991, Wells Fargo completed a two-step acquisition of 130 California branches fromGreat American Bank

Great American Bank was an American savings and loan association based in San Diego. It was founded in 1885 as San Diego Building and Loan Association, the first savings and loan in Southern California. Until the 1980s, it operated as San Diego F ...

for $491 million. Despite an ailing regional economy during the early 1990s, Wells Fargo posted healthy gains in that core market. Its labor force was reduced by more than 500 workers in 1993 alone, and technical innovations boosted cash flow

Cash flow, in general, refers to payments made into or out of a business, project, or financial product. It can also refer more specifically to a real or virtual movement of money.

*Cash flow, in its narrow sense, is a payment (in a currency), es ...

. The bank began selling stamps through its automated teller machine

An automated teller machine (ATM) is an electronic telecommunications device that enables customers of financial institutions to perform financial transactions, such as cash withdrawals, deposits, funds transfers, balance inquiries or account ...

s (ATMs), for example, and in 1995 was partnering with CyberCash, Inc., a software startup company, to begin offering its services over the Internet

The Internet (or internet) is the Global network, global system of interconnected computer networks that uses the Internet protocol suite (TCP/IP) to communicate between networks and devices. It is a internetworking, network of networks ...

.

After dipping in 1991, Wells's net income surged to $283 million in 1992 before reaching $841 million in 1994. At the end of 1994, after 12 years of service during which Wells Fargo & Co. investors enjoyed a 1,781% return, Reichardt stepped aside as head of the company and was succeeded by Hazen. Wells Fargo Bank entered 1995 as the second largest bank in California and the seventh-largest in the United States, with $51 billion in assets. Under Hazen, the bank continued to improve its loan portfolio, boost service offerings, and cut operating costs. During 1995, Wells Fargo Nikko Investment Advisors was sold to Barclays PLC for $440 million.

Contemplated merger with American Express

During 1995, Wells Fargo initiated discussions to merge with American Express. This merger would have been notable since both companies were founded by the same people, Wells and Fargo. It was thought that this merger could give Wells a more global presence. However, egos clashed within the companies as to who would run the combined firm. One issue centered around technology. Even though American Express was going through a very expensive and ambitious technological upgrade, it still would have lagged greatly behind Wells Fargo's systems, posing tremendous integration risk. Also, there would have been regulatory issues, especially since American Express owned an insurance company, Investors Diversified Services (doing business as American Express Financial Advisors), and this would have had to have been divested. In the end, it was decided not to go through with the merger.Takeover of First Interstate Bancorp (1996)

Late in 1995, Wells Fargo began pursuing a hostile takeover of First Interstate Bancorp, a Los Angeles-based bank holding company with $58 billion in assets and 1,133 offices in California and 12 other western states. Wells Fargo had long been interested in acquiring First Interstate and made a hostile bid for First Interstate in October 1995 initially valued at $10.8 billion. Other banks came forward as potential "White knight (business), white knights", includingNorwest Corporation

Norwest Corporation was a banking and financial services company based in Minneapolis, Minnesota, United States. In 1998, it merged with Wells Fargo & Co. and since that time has operated under the Wells Fargo name.

History Early formation

Th ...

, Bank One Corporation, and First Bank System. The last made a serious bid for First Interstate, with the two banks reaching a formal merger agreement in November valued initially at $10.3 billion. But First Bank ran into regulatory difficulties with the way it had structured its offer and was forced to bow out of the takeover battle in mid-January 1996. Talks between Wells Fargo and First Interstate then led within days to a merger agreement. In January 1996, Wells Fargo announced the acquisition of First Interstate Bancorp for $11.6 billion. The newly enlarged Wells Fargo had assets of about $116 billion, loans of $72 billion, and deposits of $89 billion. It ranked as the ninth largest bank in the United States.

Wells Fargo aimed to generate $800 million in annual operational savings out of the combined bank within 18 months, and immediately upon completion of the takeover announced a Layoff, workforce reduction of 16 percent, or 7,200 positions, by the end of 1996. The merger, however, quickly turned disastrous as efforts to consolidate operations, which were placed on an ambitious timetable, led to major problems. Computer system glitches led to lost customer deposits and bounced checks. Branch closures led to long lines at the remaining branches. There was also a culture clash between the two banks and their customers. Wells Fargo had been at the forefront of high-tech banking, emphasizing ATMs and online banking, as well as the small-staffed supermarket branches, at the expense of traditional branch banking. By contrast, First Interstate had emphasized personalized relationship banking, and its customers were used to dealing with tellers and bankers, not machines. This led to a mass exodus of First Interstate management talent and to the alienation of numerous customers, many of whom took their banking business elsewhere.

Merger with Norwest (1998)

The financial performance of Wells Fargo, as well as its stock price, suffered from this botched merger, leaving the bank vulnerable to being taken over itself as banking consolidation continued unabated. This time, Wells Fargo entered into a friendly merger agreement withNorwest Corporation

Norwest Corporation was a banking and financial services company based in Minneapolis, Minnesota, United States. In 1998, it merged with Wells Fargo & Co. and since that time has operated under the Wells Fargo name.

History Early formation

Th ...

of Minneapolis, which was announced in June 1998.Agreement and Plan of Merger, Dated 6/7/98/ref> The deal was completed in November of that year and was valued at $31.7 billion. Although Norwest was the nominal survivor, the merged company retained the Wells Fargo name because of the latter's greater public recognition and the former's regional connotations. The merged company remained based in San Francisco based on the bank's $54 billion in deposits in California versus $13 billion in Minnesota. The head of Wells Fargo, Paul Hazen, was named chairman of the new company, while the head of Norwest, Richard Kovacevich, became president and

CEO

A chief executive officer (CEO), also known as a chief executive or managing director, is the top-ranking corporate officer charged with the management of an organization, usually a company or a nonprofit organization.

CEOs find roles in variou ...

. However, Wells Fargo retains Norwest's pre-1998 stock price history, and all SEC filings before 1998 are listed under Norwest, not Wells Fargo.

The new Wells Fargo started off as the nation's seventh largest bank with $196 billion in assets, $130 billion in deposits, and 15 million retail banking, finance, and mortgage customers. The banking operation included more than 2,850 branches in 21 states from Ohio to California. Norwest Mortgage had 824 offices in 50 states, while Norwest Financial had nearly 1,350 offices in 47 states, ten provinces of Canada, the Caribbean, Latin America, and elsewhere.

The integration of Norwest and Wells Fargo proceeded much more smoothly than the combination of Wells Fargo and First Interstate. A key reason was that the process was allowed to progress at a much slower and more manageable pace than that of the earlier merger. The plan allowed for two to three years to complete the integration, while the cost-cutting goal was a more modest $650 million in annual savings within three years. Rather than the hasty mass layoffs that were typical of many mergers, Wells Fargo announced a phased workforce reduction of 4,000 to 5,000 employees over a two-year period.

Key dates

* 1852:Henry Wells

Henry Wells (December 12, 1805 – December 10, 1878) was an American businessman important in the history of both the American Express Company and Wells Fargo & Company. Wells worked as a freight agent before joining the express business. Hi ...

and William Fargo, William G. Fargo, the two founders of American Express

American Express Company or Amex is an American bank holding company and multinational financial services corporation that specializes in payment card industry, payment cards. It is headquartered at 200 Vesey Street, also known as American Expr ...

, formed Wells Fargo & Company to provide express and banking services to California.

* 1860: Wells Fargo gained control of Butterfield Overland Mail

Butterfield Overland Mail (officially Overland Mail Company)Waterman L. Ormsby, edited by Lyle H. Wright and Josephine M. Bynum, "The Butterfield Overland Mail", The Huntington Library, San Marino, California, 1991. was a stagecoach service in ...

Company, leading to operation of the western portion of the Pony Express

The Pony Express was an American express mail service that used relays of horse-mounted riders between Missouri and California. It was operated by the Central Overland California and Pikes Peak Express Company.

During its 18 months of opera ...

.

* 1866: "Grand consolidation" united Wells Fargo, Holladay, and Overland Mail stage lines under the Wells Fargo name.

* 1872: Lloyd Tevis

Lloyd Tevis (March 20, 1824 – July 24, 1899) was a banker and capitalist who served as president of Wells Fargo & Company from 1872 to 1892. He also co-founded the Pacific Coast Oil Company, the progenitor to Chevron Corporation.

Early life

Llo ...

, a friend of the Central Pacific "Big Four" and holder of rights to operate an express service over the Transcontinental Railroad, acquires control of the company.

* 1905: Wells Fargo separated its banking and express operations; Wells Fargo's bank was merged with the Nevada National Bank to form the Wells Fargo Nevada National Bank.

* 1918: As a wartime measure, the US Federal Government nationalized Wells Fargo's express franchise into a Federal agencies of the United States, federal agency known as the US Railway Express Agency

Railway Express Agency (aka REA Express) (REA), founded as the American Railway Express Agency and later renamed the American Railway Express Inc., was a national package delivery service that operated in the United States from 1918 to 1975. REA ...

. The US Federal Government took control of the express company. The bank began rebuilding but with a focus on commercial markets. After the war, REA was privatized and continued service until 1975.

* 1923: Wells Fargo Nevada merged with the Union Trust Company to form the Wells Fargo Bank & Union Trust Company.

* 1929: Northwest Bancorporation was formed as a banking association.

* 1954: Wells Fargo & Union Trust shortened its name to Wells Fargo Bank.

* 1960: Wells Fargo merged with American Trust Company to form the Wells Fargo Bank American Trust Company.

* 1962: Wells Fargo American Trust shortened its name to Wells Fargo Bank.

* 1968: Wells Fargo converted to a federal Bank Charter Act 1844, banking charter, becoming Wells Fargo Bank, N.A. Wells Fargo merged with Henry Trione's Sonoma Mortgage in a United States dollar, $10.8 million stock transfer, making Trione the largest shareholder in Wells Fargo until Warren Buffett and Walter Annenberg later surpassed him.

* 1969: Wells Fargo & Company holding company was formed, with Wells Fargo Bank as its main subsidiary.

* 1982: Northwest Bancorporation acquired consumer finance firm Dial Finance which is renamed Norwest Financial Service the following year.

* 1983: Northwest Bancorporation was renamed Norwest Corporation

Norwest Corporation was a banking and financial services company based in Minneapolis, Minnesota, United States. In 1998, it merged with Wells Fargo & Co. and since that time has operated under the Wells Fargo name.

History Early formation

Th ...

.

* 1983: White Eagle (robbery), White Eagle, largest US bank heist to date took place at a Wells Fargo depot in West Hartford, Connecticut

West Hartford is a town in Hartford County, Connecticut, United States, west of downtown Hartford, Connecticut, Hartford. The town is part of the Capitol Planning Region, Connecticut, Capitol Planning Region. The population was 64,083 at the 20 ...

.

* 1986: Wells Fargo acquired Crocker National Bank, Crocker National Corporation from Midland Bank

Midland Bank plc was one of the Big Four (banks)#United Kingdom, Big Four banking groups in the United Kingdom for most of the 20th century. It is now part of HSBC. The bank was founded as the Birmingham and Midland Bank in Union Street, Birming ...

.

* 1987: Wells Fargo acquired the personal trust business of Bank of America

The Bank of America Corporation (Bank of America) (often abbreviated BofA or BoA) is an American multinational investment banking, investment bank and financial services holding company headquartered at the Bank of America Corporate Center in ...

.

* 1988: Wells Fargo acquired Barclays Bank of California from Barclays plc

Barclays PLC (, occasionally ) is a British multinational universal bank, headquartered in London, England. Barclays operates as two divisions, Barclays UK and Barclays International, supported by a service company, Barclays Execution Services ...

.

* 1991: Wells Fargo acquired 130 California branches from Great American Bank

Great American Bank was an American savings and loan association based in San Diego. It was founded in 1885 as San Diego Building and Loan Association, the first savings and loan in Southern California. Until the 1980s, it operated as San Diego F ...

for $491 million.

* 1995: Wells Fargo became the first major US financial services firm to offer Internet banking.

* 1996: Wells Fargo acquired First Interstate Bancorp for US$11.6 billion.

* 1998: Wells Fargo Bank was acquired by Norwest Corporation

Norwest Corporation was a banking and financial services company based in Minneapolis, Minnesota, United States. In 1998, it merged with Wells Fargo & Co. and since that time has operated under the Wells Fargo name.

History Early formation

Th ...

of Minneapolis. (Norwest was the surviving company; however, it chose to continue business under the better known Wells Fargo name.)

See also

* History of Wells Fargo, for the history of Wells Fargo after the merger with Norwest Corporation * ''Tales of Wells Fargo'', 1957–62 TV series that depicted a Wells Fargo agent in the Wild WestReferences

{{DEFAULTSORT:Wells Fargo (1852-1998) Wells Fargo, 1852 establishments in Iowa American companies established in 1852 Banks based in California Banks established in 1852 Business duos Companies based in San Francisco Companies formerly listed on the New York Stock Exchange Financial District, San Francisco Mortgage lenders of the United States Defunct banks of the United States