Mathematical economics on:

[Wikipedia]

[Google]

[Amazon]

Mathematical economics is the application of

Proponents of this approach claim that it allows the formulation of theoretical relationships with rigor, generality, and simplicity. Mathematics allows economists to form meaningful, testable propositions about wide-ranging and complex subjects which could less easily be expressed informally. Further, the language of mathematics allows economists to make specific, positive claims about controversial or contentious subjects that would be impossible without mathematics. Much of economic theory is currently presented in terms of mathematical economic models, a set of stylized and simplified mathematical relationships asserted to clarify assumptions and implications. Broad applications include: *

Abstract.

Republished with revisions from 1986, "Theoretic Models: Mathematical Form and Economic Content", ''Econometrica'', 54(6), pp

1259

-1270. * von Neumann, John, and Oskar Morgenstern (1944). '' Theory of Games and Economic Behavior''. Princeton University Press. This rapid systematizing of economics alarmed critics of the discipline as well as some noted economists.

Given two individuals, the set of solutions where both individuals can maximize utility is described by the ''contract curve'' on what is now known as an Edgeworth Box. Technically, the construction of the two-person solution to Edgeworth's problem was not developed graphically until 1924 by Arthur Lyon Bowley. The contract curve of the Edgeworth box (or more generally on any set of solutions to Edgeworth's problem for more actors) is referred to as the core of an economy.

Edgeworth devoted considerable effort to insisting that mathematical proofs were appropriate for all schools of thought in economics. While at the helm of '' The Economic Journal'', he published several articles criticizing the mathematical rigor of rival researchers, including Edwin Robert Anderson Seligman, a noted skeptic of mathematical economics. The articles focused on a back and forth over tax incidence and responses by producers. Edgeworth noticed that a monopoly producing a good that had jointness of supply but not jointness of demand (such as first class and economy on an airplane, if the plane flies, both sets of seats fly with it) might actually lower the price seen by the consumer for one of the two commodities if a tax were applied. Common sense and more traditional, numerical analysis seemed to indicate that this was preposterous. Seligman insisted that the results Edgeworth achieved were a quirk of his mathematical formulation. He suggested that the assumption of a continuous demand function and an infinitesimal change in the tax resulted in the paradoxical predictions.

Given two individuals, the set of solutions where both individuals can maximize utility is described by the ''contract curve'' on what is now known as an Edgeworth Box. Technically, the construction of the two-person solution to Edgeworth's problem was not developed graphically until 1924 by Arthur Lyon Bowley. The contract curve of the Edgeworth box (or more generally on any set of solutions to Edgeworth's problem for more actors) is referred to as the core of an economy.

Edgeworth devoted considerable effort to insisting that mathematical proofs were appropriate for all schools of thought in economics. While at the helm of '' The Economic Journal'', he published several articles criticizing the mathematical rigor of rival researchers, including Edwin Robert Anderson Seligman, a noted skeptic of mathematical economics. The articles focused on a back and forth over tax incidence and responses by producers. Edgeworth noticed that a monopoly producing a good that had jointness of supply but not jointness of demand (such as first class and economy on an airplane, if the plane flies, both sets of seats fly with it) might actually lower the price seen by the consumer for one of the two commodities if a tax were applied. Common sense and more traditional, numerical analysis seemed to indicate that this was preposterous. Seligman insisted that the results Edgeworth achieved were a quirk of his mathematical formulation. He suggested that the assumption of a continuous demand function and an infinitesimal change in the tax resulted in the paradoxical predictions.

In mathematics,

In mathematics,

Abstract.

Economics is closely enough linked to optimization by agents in an

Description

and content

preview

.

Abstract.

, ed., Palgrave Macmillan. In Russia, the mathematician Leonid Kantorovich developed economic models in partially ordered vector spaces, that emphasized the duality between quantities and prices. Kantorovich renamed ''prices'' as "objectively determined valuations" which were abbreviated in Russian as "o. o. o.", alluding to the difficulty of discussing prices in the Soviet Union. Even in finite dimensions, the concepts of functional analysis have illuminated economic theory, particularly in clarifying the role of prices as normal vectors to a hyperplane supporting a convex set, representing production or consumption possibilities. However, problems of describing optimization over time or under uncertainty require the use of infinite–dimensional function spaces, because agents are choosing among functions or stochastic processes.

Myerson, Roger B. "mechanism design.

Abstract.

_____. "revelation principle.

Abstract.

Sandholm, Tuomas. "computing in mechanism design.

Abstract.

* Nisan, Noam, and Amir Ronen (2001). "Algorithmic Mechanism Design", ''Games and Economic Behavior'', 35(1-2), pp

166–196

. * Nisan, Noam, ''et al''., ed. (2007). ''Algorithmic Game Theory'', Cambridge University Press

Description

. In 1994, Nash, John Harsanyi, and Reinhard Selten received the

Abstract

.

* Shoham, Yoav (2008). "Computer Science and Game Theory", ''Communications of the ACM'', 51(8), pp

75-79

.

* Roth, Alvin E. (2002). "The Economist as Engineer: Game Theory, Experimentation, and Computation as Tools for Design Economics", ''Econometrica'', 70(4), pp

1341–1378

Contents.

* E. Roy Weintraub, 1982. ''Mathematics for Economists'', Cambridge.

Contents

* Stephen Glaister, 1984. ''Mathematical Methods for Economists'', 3rd ed., Blackwell

Contents.

* Akira Takayama, 1985. ''Mathematical Economics'', 2nd ed. Cambridge

Contents

* Nancy L. Stokey and Robert E. Lucas with Edward Prescott, 1989. ''Recursive Methods in Economic Dynamics'', Harvard University Press

Desecription

and chapter-previe

links

* A. K. Dixit, 9761990. ''Optimization in Economic Theory'', 2nd ed., Oxford

Description

and content

preview

* Kenneth L. Judd, 1998. ''Numerical Methods in Economics'', MIT Press.

Description

and chapter-previe

links

* Michael Carter, 2001. ''Foundations of Mathematical Economics'', MIT Press

Contents

* Ferenc Szidarovszky and Sándor Molnár, 2002. ''Introduction to Matrix Theory: With Applications to Business and Economics'', World Scientific Publishing

Description

an

preview

* D. Wade Hands, 2004. ''Introductory Mathematical Economics'', 2nd ed. Oxford

Contents

* Vladimir Pokrovskii, 2018. ''Econodynamics. The Theory of Social Production'', 3th ed., Springer. * Giancarlo Gandolfo, 9972009. ''Economic Dynamics'', 4th ed., Springer.

Description

an

preview

* John Stachurski, 2009. ''Economic Dynamics: Theory and Computation'', MIT Press

an

preview

Aims & Scope

Erasmus Mundus Master QEM - Models and Methods of Quantitative Economics

The Models and Methods of Quantitative Economics - QEM {{DEFAULTSORT:Mathematical Economics Mathematical and quantitative methods (economics)

mathematical

Mathematics is a field of study that discovers and organizes methods, Mathematical theory, theories and theorems that are developed and Mathematical proof, proved for the needs of empirical sciences and mathematics itself. There are many ar ...

methods to represent theories and analyze problems in economics

Economics () is a behavioral science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services.

Economics focuses on the behaviour and interac ...

. Often, these applied methods are beyond simple geometry, and may include differential and integral calculus

Calculus is the mathematics, mathematical study of continuous change, in the same way that geometry is the study of shape, and algebra is the study of generalizations of arithmetic operations.

Originally called infinitesimal calculus or "the ...

, difference and differential equations, matrix algebra, mathematical programming, or other computational methods.TOC.Proponents of this approach claim that it allows the formulation of theoretical relationships with rigor, generality, and simplicity. Mathematics allows economists to form meaningful, testable propositions about wide-ranging and complex subjects which could less easily be expressed informally. Further, the language of mathematics allows economists to make specific, positive claims about controversial or contentious subjects that would be impossible without mathematics. Much of economic theory is currently presented in terms of mathematical economic models, a set of stylized and simplified mathematical relationships asserted to clarify assumptions and implications. Broad applications include: *

optimization

Mathematical optimization (alternatively spelled ''optimisation'') or mathematical programming is the selection of a best element, with regard to some criteria, from some set of available alternatives. It is generally divided into two subfiel ...

problems as to goal equilibrium, whether of a household, business firm, or policy maker

* static (or equilibrium) analysis in which the economic unit (such as a household) or economic system (such as a market or the economy

An economy is an area of the Production (economics), production, Distribution (economics), distribution and trade, as well as Consumption (economics), consumption of Goods (economics), goods and Service (economics), services. In general, it is ...

) is modeled as not changing

* comparative statics as to a change from one equilibrium to another induced by a change in one or more factors

* dynamic analysis, tracing changes in an economic system over time, for example from economic growth

In economics, economic growth is an increase in the quantity and quality of the economic goods and Service (economics), services that a society Production (economics), produces. It can be measured as the increase in the inflation-adjusted Outp ...

.

Formal economic modeling began in the 19th century with the use of differential calculus

In mathematics, differential calculus is a subfield of calculus that studies the rates at which quantities change. It is one of the two traditional divisions of calculus, the other being integral calculus—the study of the area beneath a curve. ...

to represent and explain economic behavior, such as utility maximization, an early economic application of mathematical optimization

Mathematical optimization (alternatively spelled ''optimisation'') or mathematical programming is the selection of a best element, with regard to some criteria, from some set of available alternatives. It is generally divided into two subfiel ...

. Economics became more mathematical as a discipline throughout the first half of the 20th century, but introduction of new and generalized techniques in the period around the Second World War

World War II or the Second World War (1 September 1939 – 2 September 1945) was a World war, global conflict between two coalitions: the Allies of World War II, Allies and the Axis powers. World War II by country, Nearly all of the wo ...

, as in game theory

Game theory is the study of mathematical models of strategic interactions. It has applications in many fields of social science, and is used extensively in economics, logic, systems science and computer science. Initially, game theory addressed ...

, would greatly broaden the use of mathematical formulations in economics.* Debreu, Gérard ( 9872008). "mathematical economics", ''The New Palgrave Dictionary of Economics'', 2nd EditionAbstract.

Republished with revisions from 1986, "Theoretic Models: Mathematical Form and Economic Content", ''Econometrica'', 54(6), pp

1259

-1270. * von Neumann, John, and Oskar Morgenstern (1944). '' Theory of Games and Economic Behavior''. Princeton University Press. This rapid systematizing of economics alarmed critics of the discipline as well as some noted economists.

John Maynard Keynes

John Maynard Keynes, 1st Baron Keynes ( ; 5 June 1883 – 21 April 1946), was an English economist and philosopher whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originall ...

, Robert Heilbroner, Friedrich Hayek and others have criticized the broad use of mathematical models for human behavior, arguing that some human choices are irreducible to mathematics.

History

The use of mathematics in the service of social and economic analysis dates back to the 17th century. Then, mainly in German universities, a style of instruction emerged which dealt specifically with detailed presentation of data as it related to public administration. Gottfried Achenwall lectured in this fashion, coining the termstatistics

Statistics (from German language, German: ', "description of a State (polity), state, a country") is the discipline that concerns the collection, organization, analysis, interpretation, and presentation of data. In applying statistics to a s ...

. At the same time, a small group of professors in England established a method of "reasoning by figures upon things relating to government" and referred to this practice as ''Political Arithmetick''. Sir William Petty wrote at length on issues that would later concern economists, such as taxation, Velocity of money and national income, but while his analysis was numerical, he rejected abstract mathematical methodology. Petty's use of detailed numerical data (along with John Graunt) would influence statisticians and economists for some time, even though Petty's works were largely ignored by English scholars.

The mathematization of economics began in earnest in the 19th century. Most of the economic analysis of the time was what would later be called classical economics

Classical economics, also known as the classical school of economics, or classical political economy, is a school of thought in political economy that flourished, primarily in Britain, in the late 18th and early-to-mid 19th century. It includ ...

. Subjects were discussed and dispensed with through algebra

Algebra is a branch of mathematics that deals with abstract systems, known as algebraic structures, and the manipulation of expressions within those systems. It is a generalization of arithmetic that introduces variables and algebraic ope ...

ic means, but calculus was not used. More importantly, until Johann Heinrich von Thünen's '' The Isolated State'' in 1826, economists did not develop explicit and abstract models for behavior in order to apply the tools of mathematics. Thünen's model of farmland use represents the first example of marginal analysis. Thünen's work was largely theoretical, but he also mined empirical data in order to attempt to support his generalizations. In comparison to his contemporaries, Thünen built economic models and tools, rather than applying previous tools to new problems.

Meanwhile, a new cohort of scholars trained in the mathematical methods of the physical sciences gravitated to economics, advocating and applying those methods to their subject, and described today as moving from geometry to mechanics

Mechanics () is the area of physics concerned with the relationships between force, matter, and motion among Physical object, physical objects. Forces applied to objects may result in Displacement (vector), displacements, which are changes of ...

.

These included W.S. Jevons who presented a paper on a "general mathematical theory of political economy" in 1862, providing an outline for use of the theory of marginal utility in political economy. In 1871, he published ''The Principles of Political Economy'', declaring that the subject as science "must be mathematical simply because it deals with quantities". Jevons expected that only collection of statistics for price and quantities would permit the subject as presented to become an exact science. Others preceded and followed in expanding mathematical representations of economic problems.

Marginalists and the roots of neoclassical economics

Augustin Cournot andLéon Walras

Marie-Esprit-Léon Walras (; 16 December 1834 – 5 January 1910) was a French mathematical economics, mathematical economist and Georgist. He formulated the Marginalism, marginal theory of value (independently of William Stanley Jevons and Carl ...

built the tools of the discipline axiomatically around utility, arguing that individuals sought to maximize their utility across choices in a way that could be described mathematically.

At the time, it was thought that utility was quantifiable, in units known as utils. Cournot, Walras and Francis Ysidro Edgeworth are considered the precursors to modern mathematical economics.

Augustin Cournot

Cournot, a professor of mathematics, developed a mathematical treatment in 1838 for duopoly—a market condition defined by competition between two sellers. This treatment of competition, first published in ''Researches into the Mathematical Principles of Wealth'', is referred to asCournot duopoly

Cournot competition is an economic model used to describe an industry structure in which companies compete on the amount of output they will produce, which they decide on independently of each other and at the same time. It is named after Antoine A ...

. It is assumed that both sellers had equal access to the market and could produce their goods without cost. Further, it assumed that both goods were homogeneous. Each seller would vary her output based on the output of the other and the market price would be determined by the total quantity supplied. The profit for each firm would be determined by multiplying their output by the per unit market price. Differentiating the profit function with respect to quantity supplied for each firm left a system of linear equations, the simultaneous solution of which gave the equilibrium quantity, price and profits. Cournot's contributions to the mathematization of economics would be neglected for decades, but eventually influenced many of the marginalists. Cournot's models of duopoly and oligopoly also represent one of the first formulations of non-cooperative games. Today the solution can be given as a Nash equilibrium but Cournot's work preceded modern game theory

Game theory is the study of mathematical models of strategic interactions. It has applications in many fields of social science, and is used extensively in economics, logic, systems science and computer science. Initially, game theory addressed ...

by over 100 years.

Léon Walras

While Cournot provided a solution for what would later be called partial equilibrium, Léon Walras attempted to formalize discussion of the economy as a whole through a theory of general competitive equilibrium. The behavior of every economic actor would be considered on both the production and consumption side. Walras originally presented four separate models of exchange, each recursively included in the next. The solution of the resulting system of equations (both linear and non-linear) is the general equilibrium. At the time, no general solution could be expressed for a system of arbitrarily many equations, but Walras's attempts produced two famous results in economics. The first is Walras' law and the second is the principle of tâtonnement. Walras' method was considered highly mathematical for the time and Edgeworth commented at length about this fact in his review of ''Éléments d'économie politique pure'' (Elements of Pure Economics). Walras' law was introduced as a theoretical answer to the problem of determining the solutions in general equilibrium. His notation is different from modern notation but can be constructed using more modern summation notation. Walras assumed that in equilibrium, all money would be spent on all goods: every good would be sold at the market price for that good and every buyer would expend their last dollar on a basket of goods. Starting from this assumption, Walras could then show that if there were n markets and n-1 markets cleared (reached equilibrium conditions) that the nth market would clear as well. This is easiest to visualize with two markets (considered in most texts as a market for goods and a market for money). If one of two markets has reached an equilibrium state, no additional goods (or conversely, money) can enter or exit the second market, so it must be in a state of equilibrium as well. Walras used this statement to move toward a proof of existence of solutions to general equilibrium but it is commonly used today to illustrate market clearing in money markets at the undergraduate level. Tâtonnement (roughly, French for ''groping toward'') was meant to serve as the practical expression of Walrasian general equilibrium. Walras abstracted the marketplace as an auction of goods where the auctioneer would call out prices and market participants would wait until they could each satisfy their personal reservation prices for the quantity desired (remembering here that this is an auction on ''all'' goods, so everyone has a reservation price for their desired basket of goods). Only when all buyers are satisfied with the given market price would transactions occur. The market would "clear" at that price—no surplus or shortage would exist. The word ''tâtonnement'' is used to describe the directions the market takes in ''groping toward'' equilibrium, settling high or low prices on different goods until a price is agreed upon for all goods. While the process appears dynamic, Walras only presented a static model, as no transactions would occur until all markets were in equilibrium. In practice, very few markets operate in this manner.Francis Ysidro Edgeworth

Edgeworth introduced mathematical elements to Economics explicitly in ''Mathematical Psychics: An Essay on the Application of Mathematics to the Moral Sciences'', published in 1881. He adoptedJeremy Bentham

Jeremy Bentham (; 4 February Dual dating, 1747/8 Old Style and New Style dates, O.S. 5 February 1748 Old Style and New Style dates, N.S.– 6 June 1832) was an English philosopher, jurist, and social reformer regarded as the founder of mo ...

's felicific calculus to economic behavior, allowing the outcome of each decision to be converted into a change in utility. Using this assumption, Edgeworth built a model of exchange on three assumptions: individuals are self-interested, individuals act to maximize utility, and individuals are "free to recontract with another independently of...any third party".

Harold Hotelling

Harold Hotelling (; September 29, 1895 – December 26, 1973) was an American mathematical statistician and an influential economic theorist, known for Hotelling's law, Hotelling's lemma, and Hotelling's rule in economics, as well as Hotelling ...

later showed that Edgeworth was correct and that the same result (a "diminution of price as a result of the tax") could occur with a discontinuous demand function and large changes in the tax rate.

Modern mathematical economics

From the later-1930s, an array of new mathematical tools from differential calculus and differential equations, convex sets, andgraph theory

In mathematics and computer science, graph theory is the study of ''graph (discrete mathematics), graphs'', which are mathematical structures used to model pairwise relations between objects. A graph in this context is made up of ''Vertex (graph ...

were deployed to advance economic theory in a way similar to new mathematical methods earlier applied to physics. The process was later described as moving from mechanics

Mechanics () is the area of physics concerned with the relationships between force, matter, and motion among Physical object, physical objects. Forces applied to objects may result in Displacement (vector), displacements, which are changes of ...

to axiomatics.

Differential calculus

Vilfredo Pareto

Vilfredo Federico Damaso Pareto (; ; born Wilfried Fritz Pareto; 15 July 1848 – 19 August 1923) was an Italian polymath, whose areas of interest included sociology, civil engineering, economics, political science, and philosophy. He made severa ...

analyzed microeconomics

Microeconomics is a branch of economics that studies the behavior of individuals and Theory of the firm, firms in making decisions regarding the allocation of scarcity, scarce resources and the interactions among these individuals and firms. M ...

by treating decisions by economic actors as attempts to change a given allotment of goods to another, more preferred allotment. Sets of allocations could then be treated as Pareto efficient (Pareto optimal is an equivalent term) when no exchanges could occur between actors that could make at least one individual better off without making any other individual worse off. Pareto's proof is commonly conflated with Walrassian equilibrium or informally ascribed to Adam Smith's Invisible hand hypothesis. Rather, Pareto's statement was the first formal assertion of what would be known as the first fundamental theorem of welfare economics.

In the landmark treatise '' Foundations of Economic Analysis'' (1947), Paul Samuelson

Paul Anthony Samuelson (May 15, 1915 – December 13, 2009) was an American economist who was the first American to win the Nobel Memorial Prize in Economic Sciences. When awarding the prize in 1970, the Swedish Royal Academies stated that he "h ...

identified a common paradigm and mathematical structure across multiple fields in the subject, building on previous work by Alfred Marshall. ''Foundations'' took mathematical concepts from physics and applied them to economic problems. This broad view (for example, comparing Le Chatelier's principle to tâtonnement) drives the fundamental premise of mathematical economics: systems of economic actors may be modeled and their behavior described much like any other system. This extension followed on the work of the marginalists in the previous century and extended it significantly. Samuelson approached the problems of applying individual utility maximization over aggregate groups with comparative statics, which compares two different equilibrium states after an exogenous change in a variable. This and other methods in the book provided the foundation for mathematical economics in the 20th century.

Linear models

Restricted models of general equilibrium were formulated byJohn von Neumann

John von Neumann ( ; ; December 28, 1903 – February 8, 1957) was a Hungarian and American mathematician, physicist, computer scientist and engineer. Von Neumann had perhaps the widest coverage of any mathematician of his time, in ...

in 1937.Neumann, J. von (1937). "Über ein ökonomisches Gleichungssystem und ein Verallgemeinerung des Brouwerschen Fixpunktsatzes", ''Ergebnisse eines Mathematischen Kolloquiums'', 8, pp. 73–83, translated and published in 1945-46, as "A Model of General Equilibrium", ''Review of Economic Studies'', 13, pp. 1–9. Unlike earlier versions, the models of von Neumann had inequality constraints. For his model of an expanding economy, von Neumann proved the existence and uniqueness of an equilibrium using his generalization of Brouwer's fixed point theorem. Von Neumann's model of an expanding economy considered the matrix pencil with nonnegative matrices and ; von Neumann sought probability

Probability is a branch of mathematics and statistics concerning events and numerical descriptions of how likely they are to occur. The probability of an event is a number between 0 and 1; the larger the probability, the more likely an e ...

vectors and , and a positive number that would solve the complementarity equation

along with two inequality systems expressing economic efficiency. In this model, the ( transposed) probability vector represents the prices of the goods, while the probability vector represents the "intensity" at which the production process would run. The unique solution represents the rate of growth of the economy, which equals the interest rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, ...

. Proving the existence of a positive growth rate and proving that the growth rate equals the interest rate were remarkable achievements, even for von Neumann. Von Neumann's results have been viewed as a special case of linear programming

Linear programming (LP), also called linear optimization, is a method to achieve the best outcome (such as maximum profit or lowest cost) in a mathematical model whose requirements and objective are represented by linear function#As a polynomia ...

, where von Neumann's model uses only nonnegative matrices. The study of von Neumann's model of an expanding economy continues to interest mathematical economists with interests in computational economics.

Input-output economics

In 1936, the Russian–born economist Wassily Leontief built his model of input-output analysis from the 'material balance' tables constructed by Soviet economists, which themselves followed earlier work by the physiocrats. With his model, which described a system of production and demand processes, Leontief described how changes in demand in one economic sector would influence production in another. In practice, Leontief estimated the coefficients of his simple models, to address economically interesting questions. In production economics, "Leontief technologies" produce outputs using constant proportions of inputs, regardless of the price of inputs, reducing the value of Leontief models for understanding economies but allowing their parameters to be estimated relatively easily. In contrast, the von Neumann model of an expanding economy allows for choice of techniques, but the coefficients must be estimated for each technology.Mathematical optimization

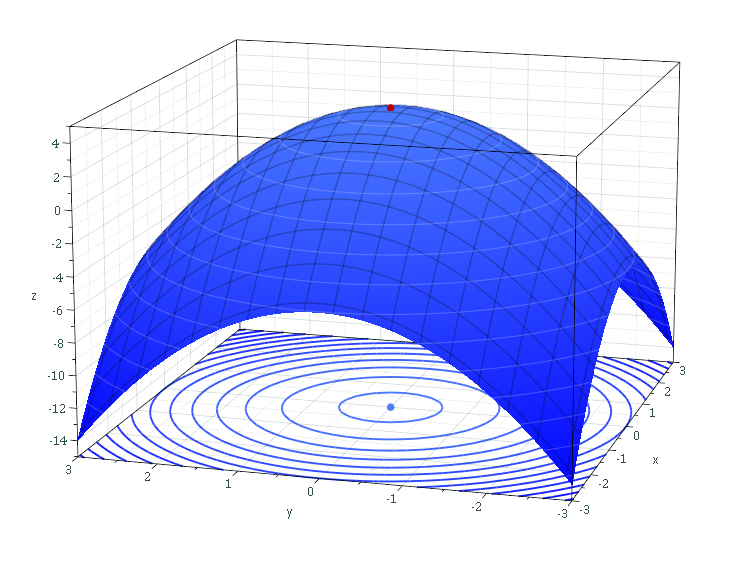

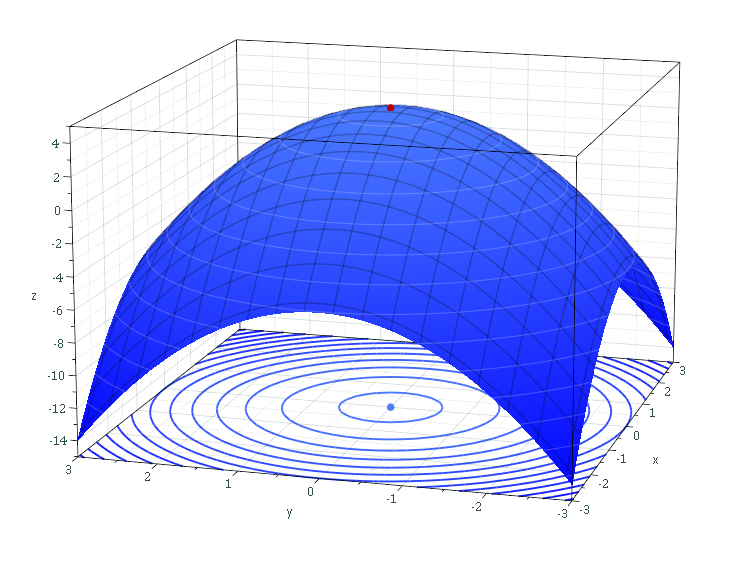

In mathematics,

In mathematics, mathematical optimization

Mathematical optimization (alternatively spelled ''optimisation'') or mathematical programming is the selection of a best element, with regard to some criteria, from some set of available alternatives. It is generally divided into two subfiel ...

(or optimization or mathematical programming) refers to the selection of a best element from some set of available alternatives. In the simplest case, an optimization problem

In mathematics, engineering, computer science and economics

Economics () is a behavioral science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goo ...

involves maximizing or minimizing a real function by selecting input values of the function and computing the corresponding values of the function. The solution process includes satisfying general necessary and sufficient conditions for optimality. For optimization problems, specialized notation may be used as to the function and its input(s). More generally, optimization includes finding the best available element of some function given a defined domain and may use a variety of different computational optimization techniques.Schmedders, Karl (2008). "numerical optimization methods in economics", ''The New Palgrave Dictionary of Economics'', 2nd Edition, v. 6, pp. 138–57.Abstract.

Economics is closely enough linked to optimization by agents in an

economy

An economy is an area of the Production (economics), production, Distribution (economics), distribution and trade, as well as Consumption (economics), consumption of Goods (economics), goods and Service (economics), services. In general, it is ...

that an influential definition relatedly describes economics ''qua'' science as the "study of human behavior as a relationship between ends and scarce means" with alternative uses. Optimization problems run through modern economics, many with explicit economic or technical constraints. In microeconomics, the utility maximization problem and its dual problem, the expenditure minimization problem for a given level of utility, are economic optimization problems. Theory posits that consumer

A consumer is a person or a group who intends to order, or use purchased goods, products, or services primarily for personal, social, family, household and similar needs, who is not directly related to entrepreneurial or business activities. ...

s maximize their utility, subject to their budget constraints and that firms maximize their profits, subject to their production functions, input costs, and market demand

In economics, demand is the quantity of a goods, good that consumers are willing and able to purchase at various prices during a given time. In economics "demand" for a commodity is not the same thing as "desire" for it. It refers to both the desi ...

. Dixit, A. K. ( 9761990). ''Optimization in Economic Theory'', 2nd ed., OxfordDescription

and content

preview

.

Economic equilibrium

In economics, economic equilibrium is a situation in which the economic forces of supply and demand are balanced, meaning that economic variables will no longer change.

Market equilibrium in this case is a condition where a market price is es ...

is studied in optimization theory as a key ingredient of economic theorems that in principle could be tested against empirical data. Newer developments have occurred in dynamic programming and modeling optimization with risk and uncertainty

Uncertainty or incertitude refers to situations involving imperfect or unknown information. It applies to predictions of future events, to physical measurements that are already made, or to the unknown, and is particularly relevant for decision ...

, including applications to portfolio theory, the economics of information, and search theory.

Optimality properties for an entire market system may be stated in mathematical terms, as in formulation of the two fundamental theorems of welfare economics and in the Arrow–Debreu model

In mathematical economics, the Arrow–Debreu model is a theoretical general equilibrium model. It posits that under certain economic assumptions (convex preferences, perfect competition, and demand independence), there must be a set of prices su ...

of general equilibrium (also discussed below). More concretely, many problems are amenable to analytical (formulaic) solution. Many others may be sufficiently complex to require numerical methods of solution, aided by software. Still others are complex but tractable enough to allow computable methods of solution, in particular computable general equilibrium models for the entire economy.

Linear and nonlinear programming have profoundly affected microeconomics, which had earlier considered only equality constraints. Many of the mathematical economists who received Nobel Prizes in Economics had conducted notable research using linear programming: Leonid Kantorovich, Leonid Hurwicz, Tjalling Koopmans, Kenneth J. Arrow

Kenneth Joseph Arrow (August 23, 1921 – February 21, 2017) was an American economist, mathematician and political theorist. He received the John Bates Clark Medal in 1957, and the Nobel Memorial Prize in Economic Sciences in 1972, along with J ...

, Robert Dorfman, Paul Samuelson

Paul Anthony Samuelson (May 15, 1915 – December 13, 2009) was an American economist who was the first American to win the Nobel Memorial Prize in Economic Sciences. When awarding the prize in 1970, the Swedish Royal Academies stated that he "h ...

and Robert Solow

Robert Merton Solow, GCIH (; August 23, 1924 – December 21, 2023) was an American economist who received the 1987 Nobel Memorial Prize in Economic Sciences, and whose work on the theory of economic growth culminated in the exogenous growth ...

.

Linear optimization

Linear programming

Linear programming (LP), also called linear optimization, is a method to achieve the best outcome (such as maximum profit or lowest cost) in a mathematical model whose requirements and objective are represented by linear function#As a polynomia ...

was developed to aid the allocation of resources in firms and in industries during the 1930s in Russia and during the 1940s in the United States. During the Berlin airlift (1948), linear programming was used to plan the shipment of supplies to prevent Berlin from starving after the Soviet blockade.

Nonlinear programming

Extensions to nonlinear optimization with inequality constraints were achieved in 1951 by Albert W. Tucker and Harold Kuhn, who considered the nonlinearoptimization problem

In mathematics, engineering, computer science and economics

Economics () is a behavioral science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goo ...

:

:Minimize subject to and where

: is the function to be minimized

: are the functions of the ''inequality constraints'' where

: are the functions of the equality constraints where .

In allowing inequality constraints, the Kuhn–Tucker approach generalized the classic method of Lagrange multipliers, which (until then) had allowed only equality constraints. The Kuhn–Tucker approach inspired further research on Lagrangian duality, including the treatment of inequality constraints. The duality theory of nonlinear programming is particularly satisfactory when applied to convex minimization problems, which enjoy the convex-analytic duality theory of Fenchel and Rockafellar; this convex duality is particularly strong for polyhedral convex functions, such as those arising in linear programming

Linear programming (LP), also called linear optimization, is a method to achieve the best outcome (such as maximum profit or lowest cost) in a mathematical model whose requirements and objective are represented by linear function#As a polynomia ...

. Lagrangian duality and convex analysis are used daily in operations research

Operations research () (U.S. Air Force Specialty Code: Operations Analysis), often shortened to the initialism OR, is a branch of applied mathematics that deals with the development and application of analytical methods to improve management and ...

, in the scheduling of power plants, the planning of production schedules for factories, and the routing of airlines (routes, flights, planes, crews).

Variational calculus and optimal control

''Economic dynamics'' allows for changes in economic variables over time, including in dynamic systems. The problem of finding optimal functions for such changes is studied in variational calculus and in optimal control theory. Before the Second World War, Frank Ramsey andHarold Hotelling

Harold Hotelling (; September 29, 1895 – December 26, 1973) was an American mathematical statistician and an influential economic theorist, known for Hotelling's law, Hotelling's lemma, and Hotelling's rule in economics, as well as Hotelling ...

used the calculus of variations to that end. Following Richard Bellman's work on dynamic programming and the 1962 English translation of L. Pontryagin ''et al''.'s earlier work, optimal control theory was used more extensively in economics in addressing dynamic problems, especially as to economic growth

In economics, economic growth is an increase in the quantity and quality of the economic goods and Service (economics), services that a society Production (economics), produces. It can be measured as the increase in the inflation-adjusted Outp ...

equilibrium and stability of economic systems, of which a textbook example is optimal consumption and saving. A crucial distinction is between deterministic and stochastic control models. Other applications of optimal control theory include those in finance, inventories, and production for example.

Functional analysis

It was in the course of proving of the existence of an optimal equilibrium in his 1937 model ofeconomic growth

In economics, economic growth is an increase in the quantity and quality of the economic goods and Service (economics), services that a society Production (economics), produces. It can be measured as the increase in the inflation-adjusted Outp ...

that John von Neumann

John von Neumann ( ; ; December 28, 1903 – February 8, 1957) was a Hungarian and American mathematician, physicist, computer scientist and engineer. Von Neumann had perhaps the widest coverage of any mathematician of his time, in ...

introduced functional analytic methods to include topology

Topology (from the Greek language, Greek words , and ) is the branch of mathematics concerned with the properties of a Mathematical object, geometric object that are preserved under Continuous function, continuous Deformation theory, deformat ...

in economic theory, in particular, fixed-point theory through his generalization of Brouwer's fixed-point theorem. Following von Neumann's program, Kenneth Arrow and Gérard Debreu formulated abstract models of economic equilibria using convex sets and fixed–point theory. In introducing the Arrow–Debreu model

In mathematical economics, the Arrow–Debreu model is a theoretical general equilibrium model. It posits that under certain economic assumptions (convex preferences, perfect competition, and demand independence), there must be a set of prices su ...

in 1954, they proved the existence (but not the uniqueness) of an equilibrium and also proved that every Walras equilibrium is Pareto efficient; in general, equilibria need not be unique. In their models, the ("primal") vector space represented ''quantities'' while the "dual" vector space represented ''prices''.Kantorovich, Leonid, and Victor Polterovich (2008). "Functional analysis", in S. Durlauf and L. Blume, ed., ''The New Palgrave Dictionary of Economics'', 2nd Edition.Abstract.

, ed., Palgrave Macmillan. In Russia, the mathematician Leonid Kantorovich developed economic models in partially ordered vector spaces, that emphasized the duality between quantities and prices. Kantorovich renamed ''prices'' as "objectively determined valuations" which were abbreviated in Russian as "o. o. o.", alluding to the difficulty of discussing prices in the Soviet Union. Even in finite dimensions, the concepts of functional analysis have illuminated economic theory, particularly in clarifying the role of prices as normal vectors to a hyperplane supporting a convex set, representing production or consumption possibilities. However, problems of describing optimization over time or under uncertainty require the use of infinite–dimensional function spaces, because agents are choosing among functions or stochastic processes.

Game theory

John von Neumann, working with Oskar Morgenstern on the theory of games, broke new mathematical ground in 1944 by extending functional analytic methods related to convex sets and topological fixed-point theory to economic analysis.Neumann, John von, and Oskar Morgenstern (1944) '' Theory of Games and Economic Behavior'', Princeton. Earlier neoclassical theory had bounded only the ''range'' of bargaining outcomes and in special cases, for example bilateral monopoly or along the contract curve of the Edgeworth box. Von Neumann and Morgenstern's results were similarly weak. Following von Neumann's program, however, John Nash used fixed–point theory to prove conditions under which the bargaining problem and noncooperative games can generate a unique equilibrium solution. Noncooperative game theory has been adopted as a fundamental aspect of experimental economics,behavioral economics

Behavioral economics is the study of the psychological (e.g. cognitive, behavioral, affective, social) factors involved in the decisions of individuals or institutions, and how these decisions deviate from those implied by traditional economi ...

, information economics, industrial organization

In economics, industrial organization is a field that builds on the theory of the firm by examining the structure of (and, therefore, the boundaries between) firms and markets. Industrial organization adds real-world complications to the per ...

, and political economy. It has also given rise to the subject of mechanism design (sometimes called reverse game theory), which has private and public-policy applications as to ways of improving economic efficiency through incentives for information sharing.* ''The New Palgrave Dictionary of Economics'' (2008), 2nd Edition: Myerson, Roger B. "mechanism design.

Abstract.

_____. "revelation principle.

Abstract.

Sandholm, Tuomas. "computing in mechanism design.

Abstract.

* Nisan, Noam, and Amir Ronen (2001). "Algorithmic Mechanism Design", ''Games and Economic Behavior'', 35(1-2), pp

166–196

. * Nisan, Noam, ''et al''., ed. (2007). ''Algorithmic Game Theory'', Cambridge University Press

Description

. In 1994, Nash, John Harsanyi, and Reinhard Selten received the

Nobel Memorial Prize in Economic Sciences

The Nobel Memorial Prize in Economic Sciences, officially the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel (), commonly referred to as the Nobel Prize in Economics(), is an award in the field of economic sciences adminis ...

their work on non–cooperative games. Harsanyi and Selten were awarded for their work on repeated games. Later work extended their results to computational methods of modeling.* Halpern, Joseph Y. (2008). "computer science and game theory", ''The New Palgrave Dictionary of Economics'', 2nd Edition.Abstract

.

* Shoham, Yoav (2008). "Computer Science and Game Theory", ''Communications of the ACM'', 51(8), pp

75-79

.

* Roth, Alvin E. (2002). "The Economist as Engineer: Game Theory, Experimentation, and Computation as Tools for Design Economics", ''Econometrica'', 70(4), pp

1341–1378

Agent-based computational economics

Agent-based computational economics (ACE) as a named field is relatively recent, dating from about the 1990s as to published work. It studies economic processes, including whole economies, as dynamic systems of interacting agents over time. As such, it falls in theparadigm

In science and philosophy, a paradigm ( ) is a distinct set of concepts or thought patterns, including theories, research methods, postulates, and standards for what constitute legitimate contributions to a field. The word ''paradigm'' is Ancient ...

of complex adaptive systems. In corresponding agent-based models, agents are not real people but "computational objects modeled as interacting according to rules" ... "whose micro-level interactions create emergent patterns" in space and time. The rules are formulated to predict behavior and social interactions based on incentives and information. The theoretical assumption of mathematical ''optimization'' by agents markets is replaced by the less restrictive postulate of agents with ''bounded'' rationality ''adapting'' to market forces.

ACE models apply numerical methods of analysis to computer-based simulations of complex dynamic problems for which more conventional methods, such as theorem formulation, may not find ready use. Starting from specified initial conditions, the computational economic system

An economic system, or economic order, is a system of production, resource allocation and distribution of goods and services within an economy. It includes the combination of the various institutions, agencies, entities, decision-making proces ...

is modeled as evolving over time as its constituent agents repeatedly interact with each other. In these respects, ACE has been characterized as a bottom-up culture-dish approach to the study of the economy. In contrast to other standard modeling methods, ACE events are driven solely by initial conditions, whether or not equilibria exist or are computationally tractable. ACE modeling, however, includes agent adaptation, autonomy, and learning. It has a similarity to, and overlap with, game theory

Game theory is the study of mathematical models of strategic interactions. It has applications in many fields of social science, and is used extensively in economics, logic, systems science and computer science. Initially, game theory addressed ...

as an agent-based method for modeling social interactions. Other dimensions of the approach include such standard economic subjects as competition

Competition is a rivalry where two or more parties strive for a common goal which cannot be shared: where one's gain is the other's loss (an example of which is a zero-sum game). Competition can arise between entities such as organisms, indi ...

and collaboration, market structure and industrial organization

In economics, industrial organization is a field that builds on the theory of the firm by examining the structure of (and, therefore, the boundaries between) firms and markets. Industrial organization adds real-world complications to the per ...

, transaction costs, welfare economics

Welfare economics is a field of economics that applies microeconomic techniques to evaluate the overall well-being (welfare) of a society.

The principles of welfare economics are often used to inform public economics, which focuses on the ...

and mechanism design, information and uncertainty, and macroeconomics

Macroeconomics is a branch of economics that deals with the performance, structure, behavior, and decision-making of an economy as a whole. This includes regional, national, and global economies. Macroeconomists study topics such as output (econ ...

.

The method is said to benefit from continuing improvements in modeling techniques of computer science

Computer science is the study of computation, information, and automation. Computer science spans Theoretical computer science, theoretical disciplines (such as algorithms, theory of computation, and information theory) to Applied science, ...

and increased computer capabilities. Issues include those common to experimental economics in general and by comparison and to development of a common framework for empirical validation and resolving open questions in agent-based modeling. The ultimate scientific objective of the method has been described as "test ngtheoretical findings against real-world data in ways that permit empirically supported theories to cumulate over time, with each researcher's work building appropriately on the work that has gone before".

Mathematicization of economics

Over the course of the 20th century, articles in "core journals" in economics have been almost exclusively written by economists inacademia

An academy (Attic Greek: Ἀκαδήμεια; Koine Greek Ἀκαδημία) is an institution of tertiary education. The name traces back to Plato's school of philosophy, founded approximately 386 BC at Akademia, a sanctuary of Athena, the go ...

. As a result, much of the material transmitted in those journals relates to economic theory, and "economic theory itself has been continuously more abstract and mathematical." A subjective assessment of mathematical techniques employed in these core journals showed a decrease in articles that use neither geometric representations nor mathematical notation from 95% in 1892 to 5.3% in 1990. A 2007 survey of ten of the top economic journals finds that only 5.8% of the articles published in 2003 and 2004 both lacked statistical analysis of data and lacked displayed mathematical expressions that were indexed with numbers at the margin of the page.

Econometrics

Ragnar Frisch coined the word "econometrics

Econometrics is an application of statistical methods to economic data in order to give empirical content to economic relationships. M. Hashem Pesaran (1987). "Econometrics", '' The New Palgrave: A Dictionary of Economics'', v. 2, p. 8 p. 8 ...

" and helped to found both the Econometric Society in 1930 and the journal '' Econometrica'' in 1933. A student of Frisch's, Trygve Haavelmo published ''The Probability Approach in Econometrics'' in 1944, where he asserted that precise statistical analysis could be used as a tool to validate mathematical theories about economic actors with data from complex sources. This linking of statistical analysis of systems to economic theory was also promulgated by the Cowles Commission (now the Cowles Foundation) throughout the 1930s and 1940s.

The roots of modern econometrics can be traced to the American economist Henry L. Moore. Moore studied agricultural productivity and attempted to fit changing values of productivity for plots of corn and other crops to a curve using different values of elasticity. Moore made several errors in his work, some from his choice of models and some from limitations in his use of mathematics. The accuracy of Moore's models also was limited by the poor data for national accounts in the United States at the time. While his first models of production were static, in 1925 he published a dynamic "moving equilibrium" model designed to explain business cycles—this periodic variation from over-correction in supply and demand curves is now known as the cobweb model. A more formal derivation of this model was made later by Nicholas Kaldor, who is largely credited for its exposition.

Application

Much of classical economics can be presented in simple geometric terms or elementary mathematical notation. Mathematical economics, however, conventionally makes use ofcalculus

Calculus is the mathematics, mathematical study of continuous change, in the same way that geometry is the study of shape, and algebra is the study of generalizations of arithmetic operations.

Originally called infinitesimal calculus or "the ...

and matrix algebra in economic analysis in order to make powerful claims that would be more difficult without such mathematical tools. These tools are prerequisites for formal study, not only in mathematical economics but in contemporary economic theory in general. Economic problems often involve so many variables that mathematics

Mathematics is a field of study that discovers and organizes methods, Mathematical theory, theories and theorems that are developed and Mathematical proof, proved for the needs of empirical sciences and mathematics itself. There are many ar ...

is the only practical way of attacking and solving them. Alfred Marshall argued that every economic problem which can be quantified, analytically expressed and solved, should be treated by means of mathematical work.

Economics has become increasingly dependent upon mathematical methods and the mathematical tools it employs have become more sophisticated. As a result, mathematics has become considerably more important to professionals in economics and finance. Graduate programs in both economics and finance require strong undergraduate preparation in mathematics for admission and, for this reason, attract an increasingly high number of mathematician

A mathematician is someone who uses an extensive knowledge of mathematics in their work, typically to solve mathematical problems. Mathematicians are concerned with numbers, data, quantity, mathematical structure, structure, space, Mathematica ...

s. Applied mathematicians apply mathematical principles to practical problems, such as economic analysis and other economics-related issues, and many economic problems are often defined as integrated into the scope of applied mathematics.

Broadly speaking, formal economic models may be classified as stochastic Stochastic (; ) is the property of being well-described by a random probability distribution. ''Stochasticity'' and ''randomness'' are technically distinct concepts: the former refers to a modeling approach, while the latter describes phenomena; i ...

or deterministic and as discrete or continuous. At a practical level, quantitative modeling is applied to many areas of economics and several methodologies have evolved more or less independently of each other.

Discussions of validity

TheAustrian school

The Austrian school is a Heterodox economics, heterodox Schools of economic thought, school of economic thought that advocates strict adherence to methodological individualism, the concept that social phenomena result primarily from the motivat ...

— while making many of the same ''normative'' economic arguments as mainstream economists from marginalist traditions, such as the Chicago school — differed ''methodologically'' from mainstream neoclassical schools of economics, in particular in their sharp critiques of the mathematization of economics. In an interview in 1999, the economic historian Robert Heilbroner stated that the use of mathematical analysis in economics had brought the feeling that it was a "data-laden science", which did not mean that it actually was a science. He added that "some/much of economics is not naturally quantitative and therefore does not lend itself to mathematical exposition."

Philosopher Karl Popper

Sir Karl Raimund Popper (28 July 1902 – 17 September 1994) was an Austrian–British philosopher, academic and social commentator. One of the 20th century's most influential philosophers of science, Popper is known for his rejection of the ...

argued that mathematical economics suffered from being tautological, meaning that it consisted merely of mathematics without connection to the real world. In other words, insofar as economics became a mathematical theory, mathematical economics ceased to rely on empirical refutation but rather relied on mathematical proof

A mathematical proof is a deductive reasoning, deductive Argument-deduction-proof distinctions, argument for a Proposition, mathematical statement, showing that the stated assumptions logically guarantee the conclusion. The argument may use othe ...

s and disproof. According to Popper, falsifiable assumptions can be tested by experiment and observation while unfalsifiable assumptions can be explored mathematically for their consequences and for their consistency with other assumptions. Milton Friedman declared that "all assumptions are unrealistic". Friedman proposed judging economic models by their predictive performance rather than by the match between their assumptions and reality.

J.M. Keynes wrote in ''The General Theory'' that the assumption that factors were strictly independent was problematic and unrealistic given the interrelatedness of factors in the real world; this undermined much research in mathematical economics.

In response to these criticisms, Paul Samuelson argued that mathematics is a language, repeating a thesis of Josiah Willard Gibbs. In economics, the language of mathematics is sometimes necessary to represent substantive problems. Moreover, mathematical economics has led to conceptual advances in economics. In particular, Samuelson gave the example of microeconomics

Microeconomics is a branch of economics that studies the behavior of individuals and Theory of the firm, firms in making decisions regarding the allocation of scarcity, scarce resources and the interactions among these individuals and firms. M ...

, writing that "few people are ingenious enough to grasp tsmore complex parts... ''without'' resorting to the language of mathematics, while most ordinary individuals can do so fairly easily ''with'' the aid of mathematics." Robert M. Solow wrote that mathematical economics was the core "infrastructure

Infrastructure is the set of facilities and systems that serve a country, city, or other area, and encompasses the services and facilities necessary for its economy, households and firms to function. Infrastructure is composed of public and pri ...

" of contemporary economics, and a technical subject in its own right.

See also

* Econophysics *Mathematical finance

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling in the financial field.

In general, there exist two separate branches of finance that req ...

References

Further reading

* Alpha C. Chiang and Kevin Wainwright, 9672005. ''Fundamental Methods of Mathematical Economics'', McGraw-Hill IrwinContents.

* E. Roy Weintraub, 1982. ''Mathematics for Economists'', Cambridge.

Contents

* Stephen Glaister, 1984. ''Mathematical Methods for Economists'', 3rd ed., Blackwell

Contents.

* Akira Takayama, 1985. ''Mathematical Economics'', 2nd ed. Cambridge

Contents

* Nancy L. Stokey and Robert E. Lucas with Edward Prescott, 1989. ''Recursive Methods in Economic Dynamics'', Harvard University Press

Desecription

and chapter-previe

links

* A. K. Dixit, 9761990. ''Optimization in Economic Theory'', 2nd ed., Oxford

Description

and content

preview

* Kenneth L. Judd, 1998. ''Numerical Methods in Economics'', MIT Press.

Description

and chapter-previe

links

* Michael Carter, 2001. ''Foundations of Mathematical Economics'', MIT Press

Contents

* Ferenc Szidarovszky and Sándor Molnár, 2002. ''Introduction to Matrix Theory: With Applications to Business and Economics'', World Scientific Publishing

Description

an

preview

* D. Wade Hands, 2004. ''Introductory Mathematical Economics'', 2nd ed. Oxford

Contents

* Vladimir Pokrovskii, 2018. ''Econodynamics. The Theory of Social Production'', 3th ed., Springer. * Giancarlo Gandolfo, 9972009. ''Economic Dynamics'', 4th ed., Springer.

Description

an

preview

* John Stachurski, 2009. ''Economic Dynamics: Theory and Computation'', MIT Press

an

preview

External links

* ''Journal of Mathematical Economics'Aims & Scope

Erasmus Mundus Master QEM - Models and Methods of Quantitative Economics

The Models and Methods of Quantitative Economics - QEM {{DEFAULTSORT:Mathematical Economics Mathematical and quantitative methods (economics)