A tariff or import tax is a

duty

A duty (from "due" meaning "that which is owing"; , past participle of ; , whence "debt") is a commitment or expectation to perform some action in general or if certain circumstances arise. A duty may arise from a system of ethics or morality, e ...

imposed by a national

government

A government is the system or group of people governing an organized community, generally a State (polity), state.

In the case of its broad associative definition, government normally consists of legislature, executive (government), execu ...

,

customs territory

A customs territory is a territory with uniform customs regulations and there are no internal customs or similar taxes within the territory. Customs territories may fall into several types:

* A sovereign state, including a federation

* A trade bloc ...

, or

supranational union

A supranational union is a type of international organization and political union that is empowered to directly exercise some of the powers and functions otherwise reserved to State (polity), states. A supranational organization involves a g ...

on

imports

An importer is the receiving country in an export from the sending country. Importation and exportation are the defining financial transactions of international trade. Import is part of the International Trade which involves buying and receivin ...

of goods and is paid by the importer. Exceptionally, an export tax may be levied on

exports

An export in international trade is a good produced in one country that is sold into another country or a service provided in one country for a national or resident of another country. The seller of such goods or the service provider is an ...

of goods or raw materials and is paid by the exporter. Besides being a source of

revenue

In accounting, revenue is the total amount of income generated by the sale of product (business), goods and services related to the primary operations of a business.

Commercial revenue may also be referred to as sales or as turnover. Some compan ...

, import duties can also be a form of regulation of

foreign trade

International trade is the exchange of Capital (economics), capital, goods, and Service (economics), services across international borders or territories because there is a need or want of goods or services. (See: World economy.)

In most countr ...

and policy that burden foreign products to encourage or safeguard domestic industry.

Protective tariff

Protective tariffs are tariffs that are enacted with the aim of protecting a domestic industry. They aim to make imported goods cost more than equivalent goods produced domestically, thereby causing sales of domestically produced goods to rise, ...

s are among the most widely used instruments of

protectionism

Protectionism, sometimes referred to as trade protectionism, is the economic policy of restricting imports from other countries through methods such as tariffs on imported goods, import quotas, and a variety of other government regulations ...

, along with

import quota

An import quota is a type of trade restriction that sets a physical limit on the quantity of a good that can be imported into a country in a given period of time. An import embargo or import ban is essentially a zero-level import quota. Quotas, ...

s and

export quotas and other

non-tariff barriers to trade

Non-tariff barriers to trade (NTBs; also called non-tariff measures, NTMs) are trade barriers that restrict imports or exports of goods or services through measures other than the imposition of tariffs. Such barriers are subject to controversy and ...

.

Tariffs can be fixed (a constant sum per unit of imported goods or a percentage of the price) or variable (the amount varies according to the price). Tariffs on imports are designed to raise the price of imported goods to discourage consumption. The intention is for citizens to buy local products instead, which, according to supporters, would stimulate their country's economy. Tariffs therefore provide an incentive to develop production and replace imports with domestic products. Tariffs are meant to reduce pressure from foreign competition and, according to supporters, would help reduce the

trade deficit

Balance of trade is the difference between the monetary value of a nation's exports and imports of goods over a certain time period. Sometimes, trade in services is also included in the balance of trade but the official IMF definition only consi ...

. They have historically been justified as a means to protect

infant industries

The infant industry argument is an economic rationale for trade protectionism. The core of the argument is that nascent industries often do not have the economies of scale that their older competitors from other countries may have, and thus need ...

and to allow

import substitution industrialisation (industrializing a nation by replacing imported goods with domestic production). Tariffs may also be used to rectify artificially low prices for certain imported goods, due to

dumping, export subsidies or currency manipulation. The effect is to raise the price of the goods in the destination country.

There is near unanimous consensus among economists that tariffs are self-defeating and have a negative effect on economic growth and economic welfare, while

free trade

Free trade is a trade policy that does not restrict imports or exports. In government, free trade is predominantly advocated by political parties that hold Economic liberalism, economically liberal positions, while economic nationalist politica ...

and the reduction of

trade barrier

Trade barriers are government-induced restrictions on international trade. According to the comparative advantage, theory of comparative advantage, trade barriers are detrimental to the world economy and decrease overall economic efficiency.

Most ...

s has a positive effect on

economic growth

In economics, economic growth is an increase in the quantity and quality of the economic goods and Service (economics), services that a society Production (economics), produces. It can be measured as the increase in the inflation-adjusted Outp ...

.

American economist

Milton Friedman

Milton Friedman (; July 31, 1912 – November 16, 2006) was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and ...

said of tariffs: "We call a tariff a protective measure. It does protect . . . It protects the consumer against low prices." Although

trade liberalisation

Free trade is a trade policy that does not restrict imports or exports. In government, free trade is predominantly advocated by political parties that hold economically liberal positions, while economic nationalist political parties generally ...

can sometimes result in unequally distributed losses and gains, and can, in the

short run

In economics, the long-run is a theoretical concept in which all markets are in equilibrium, and all prices and quantities have fully adjusted and are in equilibrium. The long-run contrasts with the short-run, in which there are some constraints a ...

, cause economic dislocation of workers in import-competing sectors,

the advantages of free trade are lowering costs of goods for both producers and consumers. The economic burden of tariffs falls on the importer, the exporter, and the consumer. Often intended to protect specific industries, tariffs can end up backfiring and harming the industries they were intended to protect through rising input costs and retaliatory tariffs. Import tariffs can also harm domestic exporters by disrupting their

supply chains and raising their input costs.

Etymology

The English term ''tariff'' derives from the which is itself a descendant of the which derives from . This term was introduced to the

Latin

Latin ( or ) is a classical language belonging to the Italic languages, Italic branch of the Indo-European languages. Latin was originally spoken by the Latins (Italic tribe), Latins in Latium (now known as Lazio), the lower Tiber area aroun ...

-speaking world through contact with the Turks and derives from the . This Turkish term is a

loanword

A loanword (also a loan word, loan-word) is a word at least partly assimilated from one language (the donor language) into another language (the recipient or target language), through the process of borrowing. Borrowing is a metaphorical term t ...

of the . The Persian term derives from which is the verbal noun of .

History

Ancient Greece

In the city state of

Athens

Athens ( ) is the Capital city, capital and List of cities and towns in Greece, largest city of Greece. A significant coastal urban area in the Mediterranean, Athens is also the capital of the Attica (region), Attica region and is the southe ...

, the port of

Piraeus

Piraeus ( ; ; , Ancient: , Katharevousa: ) is a port city within the Athens urban area ("Greater Athens"), in the Attica region of Greece. It is located southwest of Athens city centre along the east coast of the Saronic Gulf in the Ath ...

enforced a system of levies to raise taxes for the Athenian government. Grain was a key commodity that was imported through the port, and Piraeus was one of the main ports in the

east Mediterranean. A levy of two percent was placed on goods arriving in the market through the docks of Piraeus. The Athenian government also placed restrictions on the lending of money and transport of grain to only be allowed through the port of Piraeus.

Britain

In the 14th century,

Edward III

Edward III (13 November 1312 – 21 June 1377), also known as Edward of Windsor before his accession, was King of England from January 1327 until his death in 1377. He is noted for his military success and for restoring royal authority after t ...

took interventionist measures, such as banning the import of woollen cloth in an attempt to develop local manufacturing. Beginning in 1489,

Henry VII took actions such as increasing export duties on raw wool. The Tudor monarchs, especially

Henry VIII

Henry VIII (28 June 149128 January 1547) was King of England from 22 April 1509 until his death in 1547. Henry is known for his Wives of Henry VIII, six marriages and his efforts to have his first marriage (to Catherine of Aragon) annulled. ...

and

Elizabeth I

Elizabeth I (7 September 153324 March 1603) was List of English monarchs, Queen of England and List of Irish monarchs, Ireland from 17 November 1558 until her death in 1603. She was the last and longest reigning monarch of the House of Tudo ...

, used protectionism, subsidies, distribution of monopoly rights, government-sponsored industrial espionage and other means of government intervention to protect the wool industry.

A protectionist turning point in British economic policy came in 1721, when policies to promote manufacturing industries were introduced by

Robert Walpole

Robert Walpole, 1st Earl of Orford (; 26 August 1676 – 18 March 1745), known between 1725 and 1742 as Sir Robert Walpole, was a British Whigs (British political party), Whig statesman who is generally regarded as the ''de facto'' first Prim ...

. These included, for example, increased tariffs on imported foreign manufactured goods, export subsidies, reduced tariffs on imported raw materials used for manufactured goods and the abolition of export duties on most manufactured goods. Thus, the UK was among the first countries to pursue a strategy of large-scale infant-industry development.

Outlining his policy, Walpole declared:

Nothing contributes as much to the promotion of public welfare as the export of manufactured goods and the import of foreign raw materials.

Walpole's protectionist policies continued over the next century. Britain remained a highly protectionist country until the mid-19th century. By 1820, the UK's average tariff rate on manufactured imports was 45-55%.

Moreover, in its colonies, the UK imposed a total ban on advanced manufacturing activities that the country did not want to see developed. Walpole forced Americans to specialize in low-value-added products. The UK also banned exports from its colonies that competed with its own products at home and abroad. The country banned imports of cotton textiles from India, which at the time were superior to British products. It banned the export of woollen fabrics from its colonies to other countries (Wool Act). Finally, Britain wanted to ensure that the colonists stuck to the production of raw materials and never became a competitor to British manufacturers. Policies were established to encourage the production of raw materials in the colonies. Walpole granted export subsidies (on the American side) and abolished import taxes (on the British side) on raw materials produced in the American colonies. The colonies were thus forced to leave the most profitable industries in the hands of the United Kingdom.

In 1800, Britain, with about 10% of Europe's population, supplied 29% of all

pig iron

Pig iron, also known as crude iron, is an intermediate good used by the iron industry in the production of steel. It is developed by smelting iron ore in a blast furnace. Pig iron has a high carbon content, typically 3.8–4.7%, along with si ...

produced in Europe, a proportion that had risen to 45% by 1830. Per capita industrial production was even higher: in 1830 it was 250% higher than in the rest of Europe, up from 110% in 1800.

Protectionist industrial policies remained in place until the mid-19th century. At the beginning of that century, the average tariff on British manufactured goods was about 50%, the highest of all major European countries. Despite its growing technological lead over other nations, the UK continued its protectionist policy until the mid-19th century, maintaining very high tariffs on manufactured goods until the 1820s, two generations after the start of the

Industrial Revolution

The Industrial Revolution, sometimes divided into the First Industrial Revolution and Second Industrial Revolution, was a transitional period of the global economy toward more widespread, efficient and stable manufacturing processes, succee ...

.

Free trade in Britain began in earnest with the

repeal of the Corn Laws in 1846, which was equivalent to free trade in grain. The Corn Acts had been passed in 1815 to restrict wheat imports and to guarantee the incomes of British farmers; their repeal devastated Britain's old rural economy, but began to mitigate the effects of the

Great Famine in Ireland. Tariffs on many manufactured goods were also abolished. But while free-trade was progressing in Britain, protectionism continued on the European mainland and in the United States.

Customs duties on many manufactured goods were also abolished. The Navigation Acts were abolished in 1849 when free traders won the public debate in the UK. But while free trade progressed in the UK, protectionism continued on the Continent. The UK unilaterally pursued free trade, even as most other industrial powers retained protectionist policies. For example the USA emerged from the Civil War even more explicitly protectionist than before, Germany under

Bismarck rejected free trade, and the rest of Europe followed suit.

After the 1870s, the British economy continued to grow, but inexorably lagged behind the protectionist United States and Germany: from 1870 to 1913, industrial production grew at an average annual rate of 4.7% in the USA, 4.1% in Germany and only 2.1% in Great Britain. Thus, Britain was finally overtaken economically by the United States around 1880. British leadership in fields such as steel and textiles was eroded, and the country fell behind as new, more technologically advanced industries emerged after 1870 in other countries still practicing protectionism.

On June 15, 1903, the Secretary of State for Foreign Affairs,

Henry Petty-Fitzmaurice, 5th Marquess of Lansdowne

Henry Charles Keith Petty-Fitzmaurice, 5th Marquess of Lansdowne, (14 January 18453 June 1927), was a British statesman who served successively as Governor General of Canada, Viceroy of India, Secretary of State for War and Secretary of State ...

, made a speech in the House of Lords in which he defended fiscal retaliation against countries that applied high tariffs and whose governments subsidised products sold in Britain (known as "premium products", later called "

dumping"). The retaliation was to take the form of threats to impose duties in response to goods from that country.

Liberal unionists

The Liberal Unionist Party was a British political party that was formed in 1886 by a faction that broke away from the Liberal Party. Led by Lord Hartington (later the Duke of Devonshire) and Joseph Chamberlain, the party established a political ...

had split from the

liberals, who advocated free trade, and this speech marked a turning point in the group's slide toward

protectionism

Protectionism, sometimes referred to as trade protectionism, is the economic policy of restricting imports from other countries through methods such as tariffs on imported goods, import quotas, and a variety of other government regulations ...

. Lansdowne argued that the threat of retaliatory tariffs was similar to gaining respect in a room of gunmen by pointing a big gun (his exact words were "a gun a little bigger than everyone else's"). The "Big Revolver" became a slogan of the time, often used in speeches and cartoons.

In response to the

Great Depression

The Great Depression was a severe global economic downturn from 1929 to 1939. The period was characterized by high rates of unemployment and poverty, drastic reductions in industrial production and international trade, and widespread bank and ...

, Britain temporarily abandoned free trade in 1932. The country reintroduced large-scale tariffs.

United States

Before the

new Constitution took effect in 1789, the Congress could not levy taxesit sold land or begged money from the states. The new national government needed revenue and decided to depend upon a tax on imports with the

Tariff of 1789

The Tariff Act of 1789 was the first major piece of legislation passed in the United States after the ratification of the United States Constitution. It had three purposes: to support government, to protect manufacturing industries developing in ...

. The policy of the U.S. before 1860 was low tariffs "for revenue only" (since duties continued to fund the national government).

The

Embargo Act of 1807

The Embargo Act of 1807 was a general trade embargo on all foreign nations that was enacted by the United States Congress. Much broader than the ineffectual 1806 Non-importation Act, it represented an escalation of attempts to persuade Br ...

was passed by the U.S. Congress in that year in response to European interference with American merchant shipping. While not a tariff per se, the Act prohibited the import of all kinds of manufactured imports, resulting in a huge drop in US trade and protests from all regions of the country. However, the embargo also had the effect of launching new, emerging US domestic industries across the board, particularly the textile industry, and marked the beginning of the manufacturing system in the United States.

An attempt at imposing a high tariff occurred in 1828, but the South denounced it as a "

Tariff of Abominations

The Tariff of 1828 was a very high protective tariff that became law in the United States on May 19, 1828. It was a bill designed to fail in Congress because it was seen by free trade supporters as hurting both industry and farming, but it pa ...

" and it almost caused a rebellion in South Carolina until it was lowered.

Between 1816 and the end of the Second World War, the United States had one of the highest average tariff rates on manufactured imports in the world. According to Paul Bairoch, the United States was "the homeland and bastion of modern protectionism" during this period.

Many American intellectuals and politicians during the country's catching-up period felt that the free trade theory advocated by British classical economists was not suited to their country. They argued that the country should develop manufacturing industries and use government protection and subsidies for this purpose, as Britain had done before them. Many of the American economists of the time, until the last quarter of the 19th century, were strong advocates of industrial protection:

Daniel Raymond who influenced

Friedrich List

Daniel Friedrich List (6 August 1789 – 30 November 1846) was a German entrepreneur, diplomat, economist and political theory, political theorist who developed the Economic nationalism, nationalist theory of political economy in both Europe and t ...

,

Mathew Carey

Mathew Carey (January 28, 1760 – September 16, 1839) was an Irish-born American publisher and economist who lived and worked in Philadelphia, Pennsylvania. In Dublin, he had engaged in the cause of parliamentary reform, and in America, attract ...

and his son Henry, who was one of Lincoln's economic advisers. The intellectual leader of this movement was

Alexander Hamilton

Alexander Hamilton (January 11, 1755 or 1757July 12, 1804) was an American military officer, statesman, and Founding Fathers of the United States, Founding Father who served as the first U.S. secretary of the treasury from 1789 to 1795 dur ...

, the first Secretary of the Treasury of the United States (1789–1795). The United States rejected

David Ricardo

David Ricardo (18 April 1772 – 11 September 1823) was a British political economist, politician, and member of Parliament. He is recognized as one of the most influential classical economists, alongside figures such as Thomas Malthus, Ada ...

's

theory of comparative advantage and protected its industry. The country pursued a protectionist policy from the beginning of the 19th century until the middle of the 20th century, after the Second World War.

Report on Manufactures

In United States history, the Report on the Subject of Manufactures, generally referred to by its shortened title Report on Manufactures, is the third of four major reports, and '' magnum opus'', of American Founding Father and first U.S. T ...

, considered the first text to express modern protectionist theory, Alexander Hamilton argued that if a country wished to develop a new activity on its soil, it would have to temporarily protect it. According to him, this protection against foreign producers could take the form of import duties or, in rare cases, prohibition of imports. He called for customs barriers to allow American industrial development and to help protect infant industries, including bounties (subsidies) derived in part from those tariffs. He also believed that duties on raw materials should be generally low. Hamilton argued that despite an initial "increase of price" caused by regulations that control foreign competition, once a "domestic manufacture has attained to perfection... it invariably becomes cheaper.[ In this report, Hamilton also proposed export bans on major raw materials, tariff reductions on industrial inputs, pricing and patenting of inventions, regulation of product standards and development of financial and transportation infrastructure. The U.S. Congress adopted the tariffs but refused to grant subsidies to manufactures.][

]Alexander Hamilton

Alexander Hamilton (January 11, 1755 or 1757July 12, 1804) was an American military officer, statesman, and Founding Fathers of the United States, Founding Father who served as the first U.S. secretary of the treasury from 1789 to 1795 dur ...

and Daniel Raymond were among the first theorists to present the infant industry argument. Hamilton was the first to use the term "infant industries" and to introduce it to the forefront of economic thinking. Hamilton believed that political independence was predicated upon economic independence. Increasing the domestic supply of manufactured goods, particularly war materials, was seen as an issue of national security. And he feared that Britain's policy towards the colonies would condemn the United States to be only producers of agricultural products and raw materials.[

Britain initially did not want to industrialise the American colonies, and implemented policies to that effect (for example, banning high value-added manufacturing activities). Under British rule, America was denied the use of tariffs to protect its new industries. This explains why, after independence, the Tariff Act of 1789 was the second bill of the Republic signed by President Washington allowing Congress to impose a fixed tariff of 5% on all imports, with a few exceptions.]War of 1812

The War of 1812 was fought by the United States and its allies against the United Kingdom of Great Britain and Ireland, United Kingdom and its allies in North America. It began when the United States United States declaration of war on the Uni ...

broke out, all rates doubled to an average of 25% to account for increased government spending. The war paved the way for new industries by disrupting manufacturing imports from the UK and the rest of Europe. A major policy shift occurred in 1816, when American manufacturers who had benefited from the tariffs lobbied to retain them. New legislation was introduced to keep tariffs at the same levels —especially protected were cotton, woolen, and iron goods. The American industrial interests that had blossomed because of the tariff lobbied to keep it, and had it raised to 35 percent in 1816. The public approved, and by 1820, America's average tariff was up to 40 percent.

19th century onwards

In the 19th century, statesmen such as Senator Henry Clay

Henry Clay (April 12, 1777June 29, 1852) was an American lawyer and statesman who represented Kentucky in both the United States Senate, U.S. Senate and United States House of Representatives, House of Representatives. He was the seventh Spea ...

continued Hamilton's themes within the Whig Party under the name " American System" which consisted of protecting industries and developing infrastructure in explicit opposition to the "British system" of free trade. Before 1860 they were always defeated by the low-tariff Democrats.

From 1846 to 1861, American tariffs were lowered but this was followed by a series of recessions and the 1857 panic, which eventually led to higher demands for tariffs than President James Buchanan signed in 1861 (Morrill Tariff).[

During the American Civil War (1861–1865), agrarian interests in the South were opposed to any protection, while manufacturing interests in the North wanted to maintain it. The war marked the triumph of the protectionists of the industrial states of the North over the free traders of the South. Abraham Lincoln was a protectionist like Henry Clay of the Whig Party, who advocated the "American system" based on infrastructure development and protectionism. Once elected, Lincoln implemented a 44-percent tariff during the ]Civil War

A civil war is a war between organized groups within the same Sovereign state, state (or country). The aim of one side may be to take control of the country or a region, to achieve independence for a region, or to change government policies.J ...

—in part to pay for railroad subsidies and for the war effort, and to protect favored industries. After the war, tariffs remained at or above wartime levels. High tariffs were a policy designed to encourage rapid industrialisation and protect the high American wage rates.William McKinley

William McKinley (January 29, 1843September 14, 1901) was the 25th president of the United States, serving from 1897 until Assassination of William McKinley, his assassination in 1901. A member of the Republican Party (United States), Repub ...

was a high tariff, while the Democrats typically called for a lower tariff to help consumers but they always failed until 1913.[F.W. Taussig,. ''The Tariff History of the United States''. 8th ed. (1931)]

5th ed. 1910 is online

In the early 1860s, Europe and the United States pursued completely different trade policies. The 1860s were a period of growing protectionism in the United States, while the European free trade phase lasted from 1860 to 1892. The tariff average rate on imports of manufactured goods in 1875 was from 40% to 50% in the United States, against 9% to 12% in continental Europe at the height of free trade.Mckinley Tariff

The Tariff Act of 1890, commonly called the McKinley Tariff, was an act of the United States Congress framed by then-Representative William McKinley, that became law on October 1, 1890. The tariff raised the average duty on imports to almost 50% ...

's argument was no longer to protect "infant industries", but to maintain workers' wages, support agricultural protection and the principle of reciprocity.Political dynamics would lead people to see a link between tariffs and the economic cycle that was not there. A boom would generate enough revenue for tariffs to fall, and when the bust came pressure would build to raise them again. By the time that happened, the economy would be recovering, giving the impression that tariff cuts caused the crash and the reverse generated the recovery. Mr Irwin also methodically debunks the idea that protectionism made America a great industrial power, a notion believed by some to offer lessons for developing countries today. As its share of global manufacturing powered from 23% in 1870 to 36% in 1913, the admittedly high tariffs of the time came with a cost, estimated at around 0.5% of GDP in the mid-1870s. In some industries, they might have sped up development by a few years. But American growth during its protectionist period had more to do with its abundant resources and openness to people and ideas.

Tariffs and the Great Depression

Economist Douglas A. Irwin assesses the impact of the Smoot-Hawley Act: in the two years following the imposition of the Smoot-Hawley tariff in June 1930, the volume of U.S. imports fell by over 40%. He shows that part of this collapse in trade is attributed to the tariff itself, and not to other factors such as falling incomes or foreign retaliation. Partial and general equilibrium evaluations indicate that the Smoot-Hawley tariff reduced imports by between 4% and 8% (ceteris paribus). In addition, a counterfactual simulation suggests that almost a quarter of the observed 40% drop in imports can be attributed to the increase in the effective tariff (i.e. Smoot-Hawley plus deflation).The Economist

''The Economist'' is a British newspaper published weekly in printed magazine format and daily on Electronic publishing, digital platforms. It publishes stories on topics that include economics, business, geopolitics, technology and culture. M ...

'' observed that the Act, "which raised average tariffs on imports by around 20% and incited a tit-for-tat trade war, was devastatingly effective: global trade fell by two-thirds. It was so catastrophic global trade fell by two-thirds. It was so catastrophic for growth in America and around the world that legislators have not touched the issue since. 'Smoot-Hawley' became synonymous with disastrous policy making".

Economist Milton Friedman

Milton Friedman (; July 31, 1912 – November 16, 2006) was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and ...

argued that while the tariffs of 1930 caused harm, they were not the main cause for the Great Depression. He placed greater blame on the lack of sufficient action on the part of the Federal Reserve.

Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American New Keynesian economics, New Keynesian economist who is the Distinguished Professor of Economics at the CUNY Graduate Center, Graduate Center of the City University of New York. He ...

writes that protectionism does not lead to recessions. According to him, the decrease in imports (which can be obtained by introducing tariffs) has an expansive effect, that is, it is favourable to growth. Thus, in a trade war, since exports and imports will decrease equally, for everyone, the negative effect of a decrease in exports will be offset by the expansionary effect of a decrease in imports. Therefore, a trade war does not cause a recession. Furthermore, in his view, the Smoot–Hawley Tariff Act did not cause the Great Depression and that the decline in trade between 1929 and 1933 "was almost entirely a consequence of the Depression, not a cause. Trade barriers were a response to the Depression".

Peter Temin, an economist at the Massachusetts Institute of Technology, has agreed that the contractionary effect of the tariff was small. Other economists have contended that the record tariffs of the 1920s and early 1930s exacerbated the Great Depression in the U.S., in part because of retaliatory tariffs imposed by other countries on the United States.

Basic economic analysis

Economic analyses of tariffs generally find that tariffs distort the

Economic analyses of tariffs generally find that tariffs distort the free market

In economics, a free market is an economic market (economics), system in which the prices of goods and services are determined by supply and demand expressed by sellers and buyers. Such markets, as modeled, operate without the intervention of ...

and increase prices of both foreign and domestic products. The welfare effects of tariffs on an importing country are usually negative, even if other countries do not retaliate, as the loss of foreign competition drives up prices for domestic goods by the amount of the tariff.microeconomics

Microeconomics is a branch of economics that studies the behavior of individuals and Theory of the firm, firms in making decisions regarding the allocation of scarcity, scarce resources and the interactions among these individuals and firms. M ...

courses.

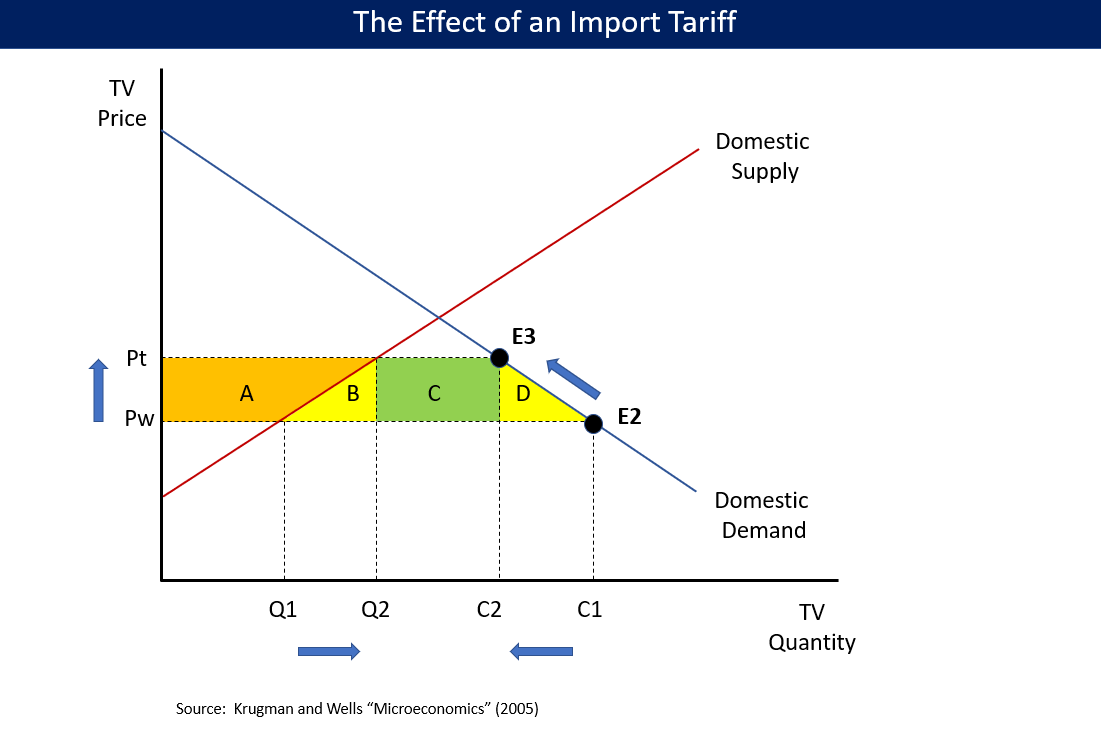

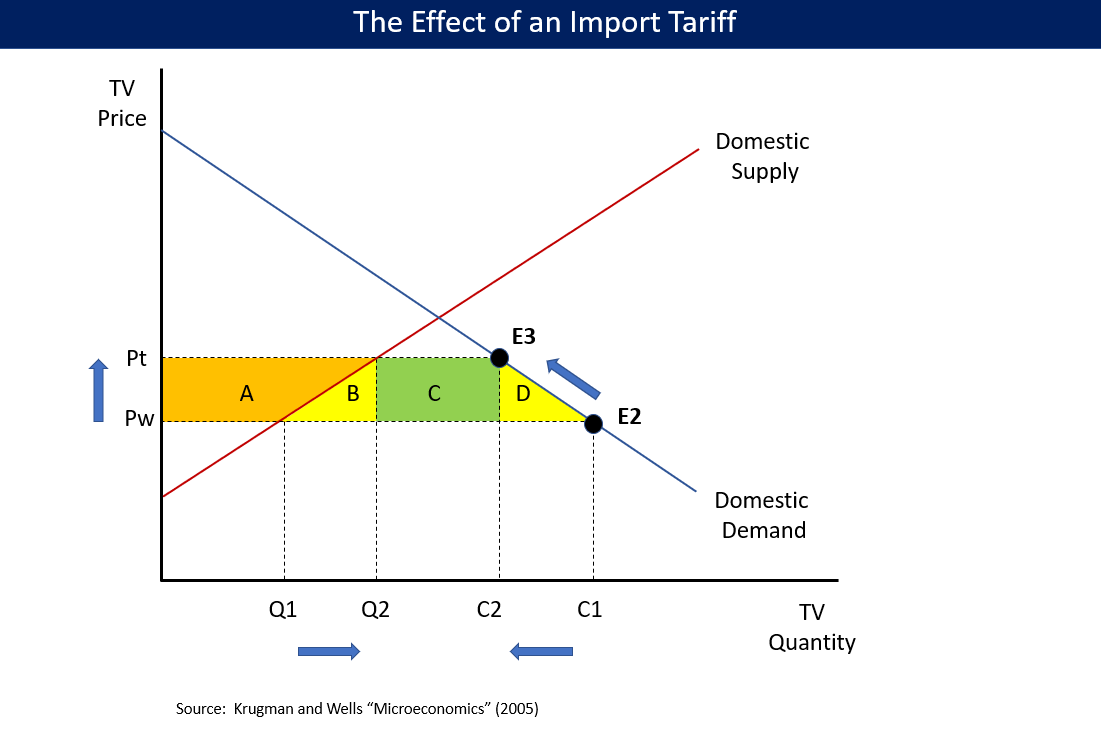

Imposing an import tariff has the following effects, shown in the first diagram in a hypothetical domestic market for televisions:

*Price rises from world price Pw to higher tariff price Pt.

*Quantity demanded by domestic consumers falls from C1 to C2, a movement along the demand curve due to higher price.

*Domestic suppliers are willing to supply Q2 rather than Q1, a movement along the supply curve due to the higher price, so the quantity imported falls from C1−Q1 to C2−Q2.

*Consumer surplus

In mainstream economics, economic surplus, also known as total welfare or total social welfare or Marshallian surplus (after Alfred Marshall), is either of two related quantities:

* Consumer surplus, or consumers' surplus, is the monetary gain ...

(the area under the demand curve but above price) shrinks by areas A+B+C+D, as domestic consumers face higher prices and consume lower quantities.

*Producer surplus

In mainstream economics, economic surplus, also known as total welfare or total social welfare or Marshallian surplus (after Alfred Marshall), is either of two related quantities:

* Consumer surplus, or consumers' surplus, is the monetary gain ...

(the area above the supply curve but below price) increases by area A, as domestic producers shielded from international competition can sell more of their product at a higher price.

*Government tax revenue equals the import quantity (C2 − Q2) multiplied by the tariff price (Pw − Pt), shown as area C.

*Areas B and D are deadweight loss

In economics, deadweight loss is the loss of societal economic welfare due to production/consumption of a good at a quantity where marginal benefit (to society) does not equal marginal cost (to society). In other words, there are either goods ...

es, surplus formerly captured by consumers that is now lost to all parties.

The overall change in welfare = Change in Consumer Surplus + Change in Producer Surplus + Change in Government Revenue = (−A−B−C−D) + A + C = −B−D. The final state after imposition of the tariff has overall welfare reduced by the areas B and D. The losses to domestic consumers are greater than the combined benefits to domestic producers and government.consumption tax

A consumption tax is a tax levied on consumption spending on goods and services. The tax base of such a tax is the money spent on Consumption (economics), consumption. Consumption taxes are usually indirect, such as a sales tax or a value-added ta ...

es.

Optimal tariff

For economic efficiency

In microeconomics, economic efficiency, depending on the context, is usually one of the following two related concepts:

* Allocative or Pareto efficiency: any changes made to assist one person would harm another.

* Productive efficiency: no addit ...

, ''free trade

Free trade is a trade policy that does not restrict imports or exports. In government, free trade is predominantly advocated by political parties that hold Economic liberalism, economically liberal positions, while economic nationalist politica ...

'' is often the best policy, however levying a tariff is sometimes ''second best''.

A tariff is called an optimal tariff if it is set to maximise the welfare of the country imposing the tariff. It is a tariff derived from the intersection

In mathematics, the intersection of two or more objects is another object consisting of everything that is contained in all of the objects simultaneously. For example, in Euclidean geometry, when two lines in a plane are not parallel, their ...

between the ''trade indifference curve

In economics, an indifference curve connects points on a graph representing different quantities of two goods, points between which a consumer is ''indifferent''. That is, any combinations of two products indicated by the curve will provide the c ...

'' of that country and the offer curve of another country. In this case, the welfare of the other country grows worse simultaneously, thus the policy is a kind of '' beggar thy neighbor policy''. If the offer curve of the other country is a line through the origin point, the original country is in the ''condition of a small country'', so any tariff worsens the welfare of the original country.

It is possible to levy a tariff as a political policy choice, and to consider a theoretical optimum tariff rate. However, imposing an optimal tariff will often lead to the foreign country increasing their tariffs as well, leading to a loss of welfare in both countries. When countries impose tariffs on each other, they will reach a position off the contract curve

In microeconomics, the contract curve or Pareto set is the set of points representing final allocations of two goods between two people that could occur as a result of mutually beneficial trading between those people given their initial allocati ...

, meaning that both countries' welfare could be increased by reducing tariffs.

Impact

Domestic output, productivity and welfare

An empirical study by Furceri et al. (2019) found that protectionist policies like raising tariffs significantly reduce domestic output and productivity. A study from 1999 by Frankel and Romer showed that, after accounting for other factors, countries with more trade tend to have higher growth and income. The effect is quantitatively large and statistically significant.

That tariffs overall reduce welfare is not controversial among economists.In a 2018 survey by the University of Chicago, about 40 top economists were asked whether new U.S. tariffs on steel and aluminum would benefit Americans. Two-thirds strongly disagreed, and the rest simply disagreed. None agreed. Several explained that these tariffs would help a small number of Americans but harm many more. This is consistent with the basic economic analysis provided above, which shows that the costs to consumers are larger than the combined gains for domestic producers and the government, resulting in net losses known as deadweight loss.

A 2021 study covering 151 countries from 1963 to 2014 found that raising tariffs leads to long-term drops in output and productivity, along with more unemployment and inequality. It also found that tariffs tend to push up the value of the currency, while trade balances stay largely unchanged.

Developing countries

Some commentators note a correlation between protectionist (mercantilist

Mercantilism is a nationalist economic policy that is designed to maximize the exports and minimize the imports of an economy. It seeks to maximize the accumulation of resources within the country and use those resources for one-sided trade. ...

) policies and strong economic growth in countries such as China, South Korea, Japan, and Taiwan. However, there is broad consensus among economists that free trade helps workers in developing countries, even if those countries have lower labor and environmental standards. This is because "the growth of manufacturing—and of the myriad other jobs that the new export sector creates—has a ripple effect throughout the economy" that creates competition among producers, lifting wages and living conditions.

Caliendo, Feenstra, Romalis, and Taylor (2015) used a global economic model covering 189 countries and 15 industries to study the impact of lower tariffs from 1990 to 2010. They found that cutting tariffs increased trade, allowed more firms to start up, and raised overall welfare. Some countries, like India and Vietnam, might have gained even more from fully open trade or even import subsidies, meaning their "optimal" tariff could be negative.

The OECD

The Organisation for Economic Co-operation and Development (OECD; , OCDE) is an international organization, intergovernmental organization with 38 member countries, founded in 1961 to stimulate economic progress and international trade, wor ...

(2005) simulated the effects of tariff reductions in 24 developing countries and showed that a well-designed combination of tariff cuts and tax reform (e.g., replacing lost tariff revenues with consumption tax

A consumption tax is a tax levied on consumption spending on goods and services. The tax base of such a tax is the money spent on Consumption (economics), consumption. Consumption taxes are usually indirect, such as a sales tax or a value-added ta ...

es) can lead to net welfare gains.

However, some studies point to possible negative effects. For instance, Topalova (2007) shows that tariff reductions in India during the 1990s were associated with slower progress in poverty reduction, particularly in areas lacking social safety nets and little labor mobility. She argues that policy changes that policymakers should implement complementary measures to ensure a fairer distribution of the gains from liberalization. In particular, reforms that enhance labor mobility, such as changes to labor market policies, can help mitigate the negative effects and reduce inequality.

Arguments used by proponents of tariffs

Protection of domestic industry

One of the most common arguments for imposing tariffs is the protection of domestic industries that are struggling to survive against foreign competition. However, most economists, particularly those adhering to the theory of comparative advantage, argue that such industries should not be maintained through protection. Instead, the resources employed in these industries should be reallocated to sectors where the country has a comparative advantage, thereby increasing overall economic efficiency. According to this view, the gains in national welfare would outweigh the losses experienced by specific groups affected by import competition, resulting in higher real national income overall.

Infant industry argument

Protectionists argue that emerging industries, especially in less-developed countries, may need temporary protection from established foreign competitors in order to develop and become competitive. Mainstream economists do acknowledge that tariffs can in the short-term help domestic industries to develop but this depends on the short-term nature of the protective tariffs and the ability of the government to pick the winners.

Unemployment

Tariffs are sometimes proposed as a means to protect domestic employment during economic downturns. However, there is near-unanimous agreement among modern economists that this approach is misguided. Tariffs may shift unemployment abroad without increasing overall output and often provoke retaliatory measures. Economists generally agree that unemployment is more effectively addressed through appropriate fiscal and monetary policies.

National defense

Industries often invoke national security to justify tariff protection, arguing that certain products are essential in times of war when imports may be disrupted. Economists generally consider this a weak argument, noting that tariffs are an inefficient way to ensure the survival of critical industries. Instead, they recommend direct subsidies as a more transparent and effective means of supporting sectors deemed vital for national defense.

Autarky

Some protectionist arguments are rooted in autarkic sentiment—the desire for national self-sufficiency and independence from global economic risks. However, there is general agreement that no modern nation, regardless of how rich and varied its resources, could really practice self-sufficiency, and attempts in that direction could produce sharp drops in real income.

Trade deficits

According to some proponents of tariffs, trade deficits are seen as inherently harmful and in need of removal, a view many economists rejected as a flawed understanding of trade.

Protection against environmental dumping

Some argue in favor of tariffs in cases of environmental dumping, where companies benefit from weaker environmental regulations than in other countries, leading to unfair competition. For example, the European Union starts its carbon border-adjustment mechanism in 2026 to level the playing field with firms not subject to European carbon pricing. In 2019, more than 3,500 U.S. economists, including 45 Nobel laureates and former Federal Reserve chairmen, signed the “ Economists' Statement on Carbon Dividends.” This statement advocates for a border carbon adjustment system that will prevent carbon leakage

Carbon leakage is a concept to quantify an increase in greenhouse gas emissions in one country as a result of an emissions reduction by a second country with stricter climate change mitigation policies. Carbon leakage is one type of spill-over ef ...

and enhance the competitiveness of American firms that are more energy-efficient that their foreign competitors.

Modern tariff practices

Russia

The Russian Federation adopted more protectionist trade measures in 2013 than any other country, making it the world leader in protectionism. It alone introduced 20% of protectionist measures worldwide and one-third of measures in the G20 countries. Russia's protectionist policies include tariff measures, import restrictions, sanitary measures, and direct subsidies to local companies. For example, the government supported several economic sectors such as agriculture, space, automotive, electronics, chemistry, and energy.

India

From 2017, as part of the promotion of its " Make in India" programme to stimulate and protect domestic manufacturing industry and to combat current account deficits, India has introduced tariffs on several electronic products and "non-essential items". This concerns items imported from countries such as China and South Korea. For example, India's national solar energy programme favours domestic producers by requiring the use of Indian-made solar cells.

Armenia

Armenia

Armenia, officially the Republic of Armenia, is a landlocked country in the Armenian Highlands of West Asia. It is a part of the Caucasus region and is bordered by Turkey to the west, Georgia (country), Georgia to the north and Azerbaijan to ...

established its custom service in 1992 after the dissolution of the Soviet Union

The Soviet Union was formally dissolved as a sovereign state and subject of international law on 26 December 1991 by Declaration No. 142-N of the Soviet of the Republics of the Supreme Soviet of the Soviet Union. Declaration No. 142-Н of ...

. When Armenia became a member of the EAEU, it was given access to the Eurasian Customs Union

The Customs Union of the Eurasian Economic Union () or EAEU Customs Union () is a customs union of 5 post-Soviet states consisting of all the member states of the Eurasian Economic Union (Armenia, Belarus, Kazakhstan, Kyrgyzstan, Russia) wh ...

in 2015; this resulted in mostly tariff-free trade with other members and an increased number of import tariffs from outside of the customs union. Armenia does not currently have export taxes. In addition, it does not declare temporary imports duties and credit on government imports or pursuant to other international assistance imports. Upon joining Eurasian Economic Union in 2015, led by Russians, Armenia

Armenia, officially the Republic of Armenia, is a landlocked country in the Armenian Highlands of West Asia. It is a part of the Caucasus region and is bordered by Turkey to the west, Georgia (country), Georgia to the north and Azerbaijan to ...

applied tariffs on its imports at a rate 0–10 percent. This rate has increased over the years, since in 2009 it was around three percent. Moreover, the tariffs increased significantly on agricultural products rather than on non-agricultural products. Armenia has committed to ultimately adopting the EAEU's uniform tariff schedule as part of its EAEU admission. Until 2022, Armenia was authorised to apply non-EAEU tariff rates, according to Decision No. 113. Some beef, pork, poultry, and dairy products; seed potatoes and peas; olives; fresh and dried fruits; some tea items; cereals, especially wheat and rice; starches, vegetable oils, margarine; some prepared food items, such as infant food; pet food; tobacco; glycerol; and gelatin are included in the list.

Membership in the EAEU is forcing Armenia to apply stricter standardisation, sanitary, and phytosanitary requirements in line with EAEUand, by extension, Russianstandards, regulations, and practices. Armenia has had to surrender control over many aspects of its foreign trade regime in the context of EAEU membership. Tariffs have also increased, granting protection to several domestic industries. Armenia is increasingly beholden to comply with EAEU standards and regulations as post-accession transition periods have, or will soon, end. All Armenian goods circulating in the territory of the EAEU must meet EAEU requirements following the end of relevant transition periods.

Armenia became a WTO member in 2003, which resulted in the Most Favored Country (MFC) benefits from the organisation. Currently, the tariffs of 2.7% implemented in Armenia are the lowest in the entire framework. The country is also a member of the World Customs Organization (WCO), resulting in a harmonised system for tariff classification.

Switzerland

In 2024, Switzerland abolished tariffs on industrial products imported into the country. Using 2016 trade figures, the Swiss government estimated the move could have economic benefits of 860 million CHF per year.

United States

In April 2025, President

President most commonly refers to:

*President (corporate title)

* President (education), a leader of a college or university

*President (government title)

President may also refer to:

Arts and entertainment Film and television

*'' Præsident ...

Donald Trump

Donald John Trump (born June 14, 1946) is an American politician, media personality, and businessman who is the 47th president of the United States. A member of the Republican Party (United States), Republican Party, he served as the 45 ...

of the United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 ...

announced a substantial increase in tariffs and a 10% base tariff on all imported products, resulting in the US trade-weighted average tariff rising from 2% to an estimated 24%, the highest level in over a century, including under the Smoot–Hawley Tariff Act of 1930.

Political analysis

The tariff has been used as a political tool to establish an independent nation; for example, the United States Tariff Act of 1789, signed specifically on July 4, was called the "Second Declaration of Independence" by newspapers because it was intended to be the economic means to achieve the political goal of a sovereign and independent United States.

The political impact of tariffs is judged depending on the political perspective; for example, the 2002 United States steel tariff imposed a 30% tariff on a variety of imported steel products for a period of three years and American steel producers supported the tariff.

Tariffs can emerge as a political issue prior to an election. The Nullification Crisis of 1832 arose from the passage of a new tariff by the United States Congress, a few months before that year's federal elections; the state of South Carolina was outraged by the new tariff, and civil war nearly resulted. In the leadup to the 2007 Australian Federal election

The 2007 Australian federal election was held in Australia on 24 November 2007. All 150 seats in the Australian House of Representatives, House of Representatives and 40 of the seats in the 76-member Australian Senate, Senate were up for electi ...

, the Australian Labor Party

The Australian Labor Party (ALP), also known as the Labor Party or simply Labor, is the major Centre-left politics, centre-left List of political parties in Australia, political party in Australia and one of two Major party, major parties in Po ...

announced it would undertake a review of Australian car tariffs if elected. The Liberal Party

The Liberal Party is any of many political parties around the world.

The meaning of ''liberal'' varies around the world, ranging from liberal conservatism on the right to social liberalism on the left. For example, while the political systems ...

made a similar commitment, while independent candidate Nick Xenophon

Nick Xenophon ( Nicholas Xenophou; ; born 29 January 1959) is an Australian lawyer and former politician who was a Australian Senate, Senator for South Australia from 2008 until 2017. As a centrist, populist, independent politician, he twice sh ...

announced his intention to introduce tariff-based legislation as "a matter of urgency".

Unpopular tariffs are known to have ignited social unrest, for example the 1905 meat riots in Chile that developed in protest against tariffs applied to the cattle imports from Argentina.[ ]

Primeros movimientos sociales chileno (1890–1920)

'. Memoria Chilena. [Benjamin S. 1997. Meat and Strength: The Moral Economy of a Chilean Food Riot. '']Cultural Anthropology

Cultural anthropology is a branch of anthropology focused on the study of cultural variation among humans. It is in contrast to social anthropology, which perceives cultural variation as a subset of a posited anthropological constant. The term ...

'', 12, pp. 234–268.

Additional information on tariffs

Calculation of customs duty

Customs duty is calculated on the determination of the 'assess-able value' in case of those items for which the duty is levied . This is often the transaction value unless a customs officer determines assess-able value in accordance with the Harmonized System

The Harmonized Commodity Description and Coding System, also known as the Harmonized System (HS) of tariff nomenclature is an internationally standardized system of names and numbers to classify traded products. It came into effect in 1988 and ha ...

.

Harmonized System of Nomenclature

For the purpose of assessment of customs duty, products are given an identification code that has come to be known as the Harmonized System

The Harmonized Commodity Description and Coding System, also known as the Harmonized System (HS) of tariff nomenclature is an internationally standardized system of names and numbers to classify traded products. It came into effect in 1988 and ha ...

code. This code was developed by the World Customs Organization

The World Customs Organization (WCO) is an intergovernmental organization headquartered in Brussels, Belgium. Notable projects include its collaboration with the WTO on trade facilitation and the implementation of the SAFE Framework of Standar ...

based in Brussels. A 'Harmonized System' code may be from four to ten digits. For example, 17.03 is the HS code for "molasses from the extraction or refining of sugar". However, within 17.03, the number 17.03.90 stands for "Molasses (Excluding Cane Molasses)".

Customs authority

The national customs authority in each country is responsible for collecting taxes on the import into or export of goods out of the country.

Evasion

Evasion of customs duties takes place mainly in two ways. In one, the trader under-declares the value so that the assessable value is lower than actual. In a similar vein, a trader can evade customs duty by understatement of quantity or volume of the product of trade. A trader may also evade duty by misrepresenting traded goods, categorizing goods as items which attract lower customs duties. The evasion of customs duty may take place with or without the collaboration of customs officials.

Duty-free goods

Many countries allow a traveller to bring goods into the country duty-free. These goods may be bought at port

A port is a maritime facility comprising one or more wharves or loading areas, where ships load and discharge cargo and passengers. Although usually situated on a sea coast or estuary, ports can also be found far inland, such as Hamburg, Manch ...

s and airport

An airport is an aerodrome with extended facilities, mostly for commercial Aviation, air transport. They usually consist of a landing area, which comprises an aerially accessible open space including at least one operationally active surf ...

s or sometimes within one country without attracting the usual government taxes and then brought into another country duty-free. Some countries specify 'duty-free allowances' which limit the number or value of duty-free items that one person can bring into the country. These restrictions often apply to tobacco

Tobacco is the common name of several plants in the genus '' Nicotiana'' of the family Solanaceae, and the general term for any product prepared from the cured leaves of these plants. More than 70 species of tobacco are known, but the ...

, wine

Wine is an alcoholic drink made from Fermentation in winemaking, fermented fruit. Yeast in winemaking, Yeast consumes the sugar in the fruit and converts it to ethanol and carbon dioxide, releasing heat in the process. Wine is most often made f ...

, spirits, cosmetics

Cosmetics are substances that are intended for application to the body for cleansing, beautifying, promoting attractiveness, or altering appearance. They are mixtures of chemical compounds derived from either Natural product, natural source ...

, gifts and souvenir

A souvenir ( French for 'a remembrance or memory'), memento, keepsake, or token of remembrance is an object a person acquires for the memories the owner associates with it. A souvenir can be any object that can be collected or purchased and trans ...

s.

Deferment of tariffs and duties

Products may sometimes be imported into a free economic zone

A free-trade zone (FTZ) is a class of special economic zone. It is a geographic area where goods may be imported, stored, handled, manufactured, or reconfigured and re- exported under specific customs regulation and generally not subjec ...

(or 'free port'), processed there, then re-exported without being subject to tariffs or duties. According to the 1999 Revised Kyoto Convention, a free zone' means a part of the territory of a contracting party where any goods introduced are generally regarded, insofar as import duties and taxes are concerned, as being outside the customs territory".

Digital goods and services

Digital goods and services generally do not pass through customs

Customs is an authority or Government agency, agency in a country responsible for collecting tariffs and for controlling International trade, the flow of goods, including animals, transports, personal effects, and hazardous items, into and out ...

, making monitoring and application of tariffs more difficult. Non-tariff barriers to trade

Non-tariff barriers to trade (NTBs; also called non-tariff measures, NTMs) are trade barriers that restrict imports or exports of goods or services through measures other than the imposition of tariffs. Such barriers are subject to controversy and ...

of services can be higher than tariffs on goods.

See also

*

*

*

*

Types

*

*

*

*

*

*

*

*

Trade dynamics

*

*

*

*

*

Trade liberalisation

* (GATT)

* (GATS)

*

*

*

References

Sources

*

*

External links

Trade and Tariff

resource by World Bank

The World Bank is an international financial institution that provides loans and Grant (money), grants to the governments of Least developed countries, low- and Developing country, middle-income countries for the purposes of economic development ...

Market Access Map, an online database of customs tariffs and market requirementsTariff Analysis Online – Detailed information on tariff and trade data

by the World Trade Organization

The World Trade Organization (WTO) is an intergovernmental organization headquartered in Geneva, Switzerland that regulates and facilitates international trade. Governments use the organization to establish, revise, and enforce the rules that g ...

{{Authority control

Customs duties

International taxation

International economics

Economic analyses of tariffs generally find that tariffs distort the

Economic analyses of tariffs generally find that tariffs distort the