Germany's Hyperinflation on:

[Wikipedia]

[Google]

[Amazon]

A loaf of bread in Berlin that cost around 160 marks at the end of 1922 cost 200 billion marks by late 1923.

By November 1923, one US dollar was worth 4.2105 trillion German marks.

A loaf of bread in Berlin that cost around 160 marks at the end of 1922 cost 200 billion marks by late 1923.

By November 1923, one US dollar was worth 4.2105 trillion German marks.

File:50000 mark aachen.jpg, 50,000 marks, Aachen, 1923

File:500000 Mark Leipzig 1923 front.jpg, 500,000 marks, Leipzig, 1923

File:5milmkbk.jpg, A 5 Million Mark coin, Westphalia, 1923

File:DAN-23-Danzig-5MIL Mark (1923).jpg, 5,000,000 marks, Danzig, 1923

File:Notgeld trier 50 millionen mark.jpg, 50,000,000 marks, Trier, 1923

File:500000000MarkDresdenAltstadt.jpg, 500,000,000 marks, Dresden, 1923

File:GER-115-Reichsbanknote-5 Billion Mark (1923).jpg, 5 billion marks, Berlin, 1923

File:50000000000Plauen1923.jpg, 50 billion marks, Plauen, 1923

File:GER-127a-Reichsbanknote-500 Billion Mark (1923).jpg, 500 billion ''(500 Milliarden)'' marks, Berlin, 1923

File:Fem biljoner Mark.jpg, 5 trillion marks, Stuttgart, 1923

File:50 Billionen Mark Stolberg Eschweiler 001.jpg, 50 trillion marks Eschweiler, 1923

File:5markcounterstamppostWWI.png,

/ref> The hyperinflation crisis led prominent economists and politicians to seek a means to stabilize German currency. In August 1923, an economist, After 12 November 1923, when

After 12 November 1923, when

Eventually, some debts were reinstated to compensate creditors partially for the catastrophic reduction in the value of debts that had been quoted in paper marks before the hyperinflation. A decree of 1925 reinstated some mortgages at 25% of face value in the new currency, effectively 25,000,000,000 times their value in the old paper marks, if they had been held for at least five years. Similarly, some government bonds were reinstated at 2.5% of face value, to be paid after reparations were paid.Fergusson, Chapter 14

Mortgage debt was reinstated at much higher rates than government bonds were. The reinstatement of some debts and a resumption of effective taxation in a still-devastated economy triggered a wave of corporate

Eventually, some debts were reinstated to compensate creditors partially for the catastrophic reduction in the value of debts that had been quoted in paper marks before the hyperinflation. A decree of 1925 reinstated some mortgages at 25% of face value in the new currency, effectively 25,000,000,000 times their value in the old paper marks, if they had been held for at least five years. Similarly, some government bonds were reinstated at 2.5% of face value, to be paid after reparations were paid.Fergusson, Chapter 14

Mortgage debt was reinstated at much higher rates than government bonds were. The reinstatement of some debts and a resumption of effective taxation in a still-devastated economy triggered a wave of corporate

* * * * * * Guttmann, William. ''The Great Inflation''. Saxon House (1975 hardback w/ sources; ) or Gordon & Cremonesi Ltd. Publ., London (1976 paperback w/o sources; ). Germany currency hyperinflation 1919–1923.

When Money Buys Little – Jerry Jensen

Study of the 1923 German postage stamps * Karsten Laursen and Jorgen Pedersen, ''The German Inflation'', North-Holland Publishing Co., Amsterdam, 1964. * * * * * *

Hyperinflation

In economics, hyperinflation is a very high and typically accelerating inflation. It quickly erodes the real versus nominal value (economics), real value of the local currency, as the prices of all goods increase. This causes people to minimiz ...

affected the German Papiermark

The Papiermark (; 'paper mark') was a derisive term for the Mark (sign: ℳ︁) after it went off the gold standard, and most specifically with the era of hyperinflation in Germany of 1922 and 1923. Formally, the same German mark was used fro ...

, the currency of the Weimar Republic

The Weimar Republic, officially known as the German Reich, was the German Reich, German state from 1918 to 1933, during which it was a constitutional republic for the first time in history; hence it is also referred to, and unofficially proclai ...

, between 1921 and 1923, primarily in 1923. The German currency had seen significant inflation during the First World War

World War I or the First World War (28 July 1914 – 11 November 1918), also known as the Great War, was a World war, global conflict between two coalitions: the Allies of World War I, Allies (or Entente) and the Central Powers. Fighting to ...

due to the way in which the German government funded its war effort through borrowing, with debts of 156 billion marks by 1918. This national debt

A country's gross government debt (also called public debt or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit occ ...

was substantially increased by 50 billion marks of reparations payable in cash and in-kind (e.g., with coal and timber) under the May 1921 London Schedule of Payments agreed after the Versailles treaty

The Treaty of Versailles was a peace treaty signed on 28 June 1919. As the most important treaty of World War I, it ended the state of war between Germany and most of the Allied Powers. It was signed in the Palace of Versailles, exactl ...

.

This inflation continued into the post-war period, particularly when in August 1921 the German central bank began buying hard cash with paper currency at any price, which they claimed was to pay reparations in hard cash, though little in the way of cash reparations payments were made until 1924. The currency stabilised in early 1922, but then hyperinflation took off: the exchange value of the mark fell from 320 marks per dollar in mid 1922 to 7,400 marks per US dollar by December 1922. This hyperinflation continued into 1923, and by November 1923, one US dollar was worth 4,210,500,000,000 marks. Various measures were introduced by German authorities to address this, including a new currency called the ''Rentenmark'', backed by mortgage bonds, later itself replaced by the Reichsmark, and the blocking of the national bank from printing further paper currency.

By 1924 the currency had stabilised and German reparations payments began again under the Dawes Plan

The Dawes Plan temporarily resolved the issue of the reparations that Germany owed to the Allies of World War I. Enacted in 1924, it ended the crisis in European diplomacy that occurred after French and Belgian troops occupied the Ruhr in re ...

. As the catastrophic fall in the value of the mark had effectively wiped out debts owed, some debts (e.g. mortgages) were revalued so that the lenders could recoup some of their money.

Hyperinflation caused considerable internal political instability in the country. Historians and economists are divided on the causes of this hyperinflation, particularly the extent to which it was caused by reparations payments.

Background

Inflation during the First World War

To pay for the large costs of theFirst World War

World War I or the First World War (28 July 1914 – 11 November 1918), also known as the Great War, was a World war, global conflict between two coalitions: the Allies of World War I, Allies (or Entente) and the Central Powers. Fighting to ...

, Germany suspended the gold standard

A gold standard is a backed currency, monetary system in which the standard economics, economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the ...

(the convertibility of its currency to gold) when the war broke out in 1914. Unlike France

France, officially the French Republic, is a country located primarily in Western Europe. Overseas France, Its overseas regions and territories include French Guiana in South America, Saint Pierre and Miquelon in the Atlantic Ocean#North Atlan ...

, which imposed its first income tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Tax ...

to pay for the war, German Emperor Wilhelm II

Wilhelm II (Friedrich Wilhelm Viktor Albert; 27 January 18594 June 1941) was the last German Emperor and King of Prussia from 1888 until Abdication of Wilhelm II, his abdication in 1918, which marked the end of the German Empire as well as th ...

and the Reichstag decided unanimously to fund the war entirely by borrowing rather than risk angering the public with new taxes.

This decision was based on the assumption that Germany would easily win the war, allowing it to impose war reparations on the defeated Allies. This was to be done by annexing resource-rich industrial territory in the west and east and imposing cash payments to Germany, similar to the French indemnity

The French indemnity was the indemnity the French Third Republic paid to the German Empire after the French defeat in the Franco-Prussian War in 1871.

Background

An armistice was concluded on 28 January 1871 to allow elections to the French Natio ...

that followed German victory over France in 1870. However, the exchange rate of the mark against the US dollar

The United States dollar (symbol: $; currency code: USD) is the official currency of the United States and several other countries. The Coinage Act of 1792 introduced the U.S. dollar at par with the Spanish silver dollar, divided it int ...

steadily devalued from 4.2 to 7.9 marks per dollar between 1914 and 1918, a preliminary warning of the extreme postwar inflation.

This strategy failed as Germany lost the war, which left the new Weimar Republic saddled with massive war debts that it could not afford: the national debt stood at 156 billion marks in 1918. The debt problem was exacerbated by the new government being forced to print money without any economic resources to back it.

John Maynard Keynes

John Maynard Keynes, 1st Baron Keynes ( ; 5 June 1883 – 21 April 1946), was an English economist and philosopher whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originall ...

characterised the inflationary policies of various wartime governments in his 1919 book ''The Economic Consequences of the Peace

''The Economic Consequences of the Peace'' (1919) is a book written and published by the British economist John Maynard Keynes. After the First World War, Keynes attended the Paris Peace Conference of 1919 as a delegate of the British Trea ...

'' as follows:

Inflation immediately after the First World War

The value of the German currency continued to fall in the immediate aftermath of the war. By late 1919, the German government had signed theTreaty of Versailles

The Treaty of Versailles was a peace treaty signed on 28 June 1919. As the most important treaty of World War I, it ended the state of war between Germany and most of the Allies of World War I, Allied Powers. It was signed in the Palace ...

, which included an agreement to pay substantial reparations to the Allied powers both in hard cash and in in-kind shipments of goods such as coal and timber. By then, 48 paper marks were required to buy a US dollar. In May 1921 the amount to be paid by the Central Powers as a whole was fixed at 132 billion gold marks under the London Schedule of payments which set quarterly deadlines for payments. Of this, 50 billion gold marks was listed in A and B bonds payable under the quarterly deadlines in the schedule; the remaining sum, about 82 billion gold marks, was listed as C bonds that were somewhat hypothetical and not payable under the schedule but instead left to an undefined future date, with the Germans being informed that they realistically would not have to pay them.

The German currency was relatively stable at about 90 marks per dollar during the first half of 1921. Because the Western Front of the war had been mostly fought in France

France, officially the French Republic, is a country located primarily in Western Europe. Overseas France, Its overseas regions and territories include French Guiana in South America, Saint Pierre and Miquelon in the Atlantic Ocean#North Atlan ...

and Belgium

Belgium, officially the Kingdom of Belgium, is a country in Northwestern Europe. Situated in a coastal lowland region known as the Low Countries, it is bordered by the Netherlands to the north, Germany to the east, Luxembourg to the southeas ...

, Germany came out of the war with most of its industrial infrastructure intact, leaving it in a better place economically than neighbouring France and Belgium.Marks, The Illusion of Peace, page 53

The first payment of one billion gold marks was made when it came due in June 1921. At this point, customs posts in the west of Germany were occupied by Allied officials, so that the schedule of payments could be enforced. However, following the first payment the Allied officials were withdrawn from everywhere but Düsseldorf

Düsseldorf is the capital city of North Rhine-Westphalia, the most populous state of Germany. It is the second-largest city in the state after Cologne and the List of cities in Germany with more than 100,000 inhabitants, seventh-largest city ...

, and whilst some payments in kind continued, only small cash payments were subsequently made for the remainder of 1921–22.

From August 1921, the president of the Reichsbank, Rudolf Havenstein

Rudolf Emil Albert Havenstein (10 March 1857 – 20 November 1923) was a German lawyer and president of the Reichsbank (German central bank) during the hyperinflation of 1921–1923.

Havenstein was born in Meseritz (Międzyrzecz), Province of P ...

, began a strategy of buying foreign currency with marks at any price, without any regard for inflation, and it only increased the speed of the collapse in value of the mark. German officials claimed this was in order to make cash payments owed to the Allies using foreign currency. British and French experts stated that this was in an effort to ruin the German currency and, as well as escaping the need for budgetary reform, avoid paying reparations altogether, a claim supported by Reich Chancellery records showing that delaying the currency and budgetary reform that could have addressed hyperinflation was seen as advantageous. Whilst ruinous to the economy and politically destabilising, hyperinflation had advantageous aspects for the German government as, although the war reparations were not listed in paper currency, domestic debts owed from the war were listed, meaning that inflation greatly reduced this debt relative to revenues.

In the first half of 1922, the mark stabilized at about 320 marks per dollar. International conferences were held. One, in June 1922, was organized by US investment banker J. P. Morgan, Jr.

John Pierpont Morgan Jr. (September 7, 1867 – March 13, 1943) was an American banker and finance executive. He inherited the family fortune and took over the business interests including J.P. Morgan & Co. after his father J. P. Morgan died in ...

The meetings produced no workable solution, and inflation erupted into hyperinflation, the mark falling to 7,400 marks per US dollar by December 1922. The cost-of-living index

A cost-of-living index is a theoretical price index that measures relative cost of living over time or regions. It is an index that measures differences in the price of goods and services, and allows for substitutions with other items as pric ...

was 41 in June 1922 and 685 in December, a nearly 17-fold increase.

After Germany failed for the thirty-fourth time in thirty-six months to pay an instalment of in-kind reparations of coal, in January 1923 French and Belgian troops occupied the Ruhr valley, Germany's main industrial region. 900 million gold marks of reparations were ultimately secured this way.

The German government's response was to order a policy of passive resistance

Nonviolent resistance, or nonviolent action, sometimes called civil resistance, is the practice of achieving goals such as social change through symbolic protests, civil disobedience, economic or political noncooperation, satyagraha, constr ...

in the Ruhr, with workers being told to do nothing which helped the French and Belgians in any way. While this policy, in practice, amounted to a general strike

A general strike is a strike action in which participants cease all economic activity, such as working, to strengthen the bargaining position of a trade union or achieve a common social or political goal. They are organised by large coalitions ...

to protest the occupation, the striking workers still had to be given financial support. The government paid these workers by printing more and more banknotes, with Germany soon being swamped with paper money, exacerbating the hyperinflation even further.

Hyperinflation

Aachen

Aachen is the List of cities in North Rhine-Westphalia by population, 13th-largest city in North Rhine-Westphalia and the List of cities in Germany by population, 27th-largest city of Germany, with around 261,000 inhabitants.

Aachen is locat ...

Stabilisation

German monetary economics was at that time heavily influenced byChartalism

In macroeconomics, chartalism is the theory of money that money originated historically with states' attempts to direct economic activity rather than as a spontaneous solution to the problems with barter or as a means with which to tokenize debt ...

and the German Historical School, which conditioned the way the hyperinflation was analysed.''Monetary Explanations of the Weimar Republic's Hyperinflation: Some Neglected Contributions in Contemporary German Literature'', David E. W. Laidler & George W. Stadler, Journal of Money, Credit and Banking, vol. 30, pp. 816, 818/ref> The hyperinflation crisis led prominent economists and politicians to seek a means to stabilize German currency. In August 1923, an economist,

Karl Helfferich

Karl Theodor Helfferich (22 July 1872 – 23 April 1924) was a German politician, economist, and financier from Neustadt an der Weinstraße in the Palatinate.

Biography

Helfferich studied law and political science at the universities of Munich ...

, proposed a plan to issue a new currency, the "Roggenmark" ("rye mark"), to be backed by mortgage bond

A mortgage loan or simply mortgage (), in civil law jurisdictions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any pur ...

s indexed to the market price

A price is the (usually not negative) quantity of payment or compensation expected, required, or given by one party to another in return for goods or services. In some situations, especially when the product is a service rather than a phy ...

of rye grain. The plan was rejected because of the greatly fluctuating price of rye in paper marks.

Agriculture Minister Hans Luther

Hans Luther () (10 March 1879 – 11 May 1962) was a German politician and Chancellor of Germany for 482 days in 1925 to 1926. As Minister of Finance he helped stabilize the Mark during the hyperinflation of 1923. From 1930 to 1933, Luther was h ...

proposed a plan that substituted gold for rye and led to the issuance of the Rentenmark

The Rentenmark (; RM) was a currency issued on 15 November 1923 to stop the hyperinflation of 1922 and 1923 in Weimar Germany, after the previously used Papiermark had become almost worthless. It was subdivided into 100 ''Rentenpfennig'' and ...

("mortgage mark"), backed by bonds indexed to the market price of gold. The gold bonds were indexed at the rate of 2,790 gold marks per kilogram of gold, the same as the pre-war gold marks. Rentenmarks were not redeemable in gold but only indexed to the gold bonds. The plan was adopted in monetary reform

Monetary reform is any movement or theory that proposes a system of supplying money and financing the economy that is different from the current system.

Monetary reformers may advocate any of the following, among other proposals:

* A return to ...

decrees on 13–15 October 1923. A new bank, the Rentenbank

The Deutsche Rentenbank was a bank established in Germany by a regulation of 15 October 1923 as a state-owned monetary authority authorised to issue Rentenmark currency notes following the collapse of the private Reichsbank's Papiermark currency. ...

, was set up by Hans Luther when he became Finance Minister.

After 12 November 1923, when

After 12 November 1923, when Hjalmar Schacht

Horace Greeley Hjalmar Schacht (); 22 January 1877 – 3 June 1970) was a German economist, banker, politician, and co-founder of the German Democratic Party. He served as the Currency Commissioner and President of the Reichsbank during the ...

became currency commissioner, Germany's central bank (the Reichsbank

The ''Reichsbank'' (; ) was the central bank of the German Empire from 1876 until the end of Nazi Germany in 1945.

Background

The monetary institutions in Germany had been unsuited for its economic development for several decades before unifica ...

) was not allowed to discount any further government Treasury bills

United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury to finance government spending as a supplement to taxation. Since 2012, the U.S. ...

, which meant the corresponding issue of paper marks also ceased. The discounting of commercial trade bills was allowed and the amount of Rentenmarks expanded, but the issue was strictly controlled to conform to current commercial and government transactions. The Rentenbank refused credit to the government and to speculators who were not able to borrow Rentenmarks, because Rentenmarks were not legal tender.Fergusson, Chapter 13

On 16 November 1923, the new Rentenmark was introduced to replace the worthless paper marks issued by the Reichsbank. Twelve zeros were cut from prices, and the prices quoted in the new currency remained stable.

When the president of the Reichsbank, Rudolf Havenstein, died on 20 November 1923, Schacht was appointed to replace him. By 30 November 1923, there were 500,000,000 Rentenmarks in circulation, which increased to 1,000,000,000 by January 1, 1924, and to 1,800,000,000 Rentenmarks by July 1924. Meanwhile, the old paper Marks continued in circulation. The total paper marks increased to 1.2 sextillion

Depending on context (e.g. language, culture, region), some large numbers have names that allow for describing large quantities in a textual form; not mathematical. For very large values, the text is generally shorter than a decimal numeric repres ...

(1,200,000,000,000,000,000,000) in July 1924 and continued to fall in value to a third of their conversion value in Rentenmarks.

On 30 August 1924, a monetary law permitted the exchange of a 1-trillion paper mark note to a new Reichsmark

The (; sign: ℛ︁ℳ︁; abbreviation: RM) was the currency of Germany from 1924 until the fall of Nazi Germany in 1945, and in the American, British and French occupied zones of Germany, until 20 June 1948. The Reichsmark was then replace ...

, worth the same as a Rentenmark. By 1924 one dollar was equivalent to 4.2 Rentenmark.

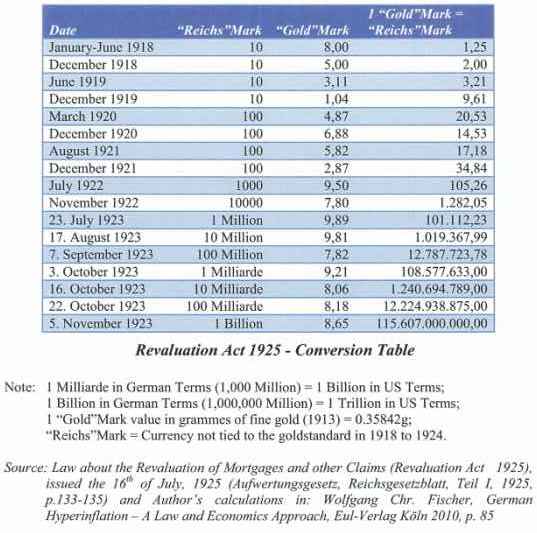

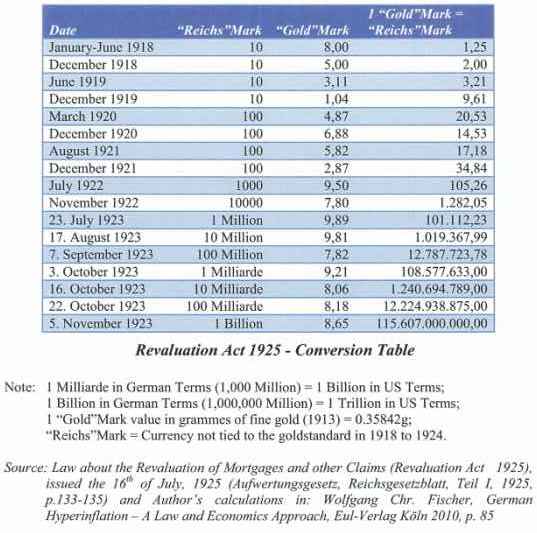

Revaluation

Eventually, some debts were reinstated to compensate creditors partially for the catastrophic reduction in the value of debts that had been quoted in paper marks before the hyperinflation. A decree of 1925 reinstated some mortgages at 25% of face value in the new currency, effectively 25,000,000,000 times their value in the old paper marks, if they had been held for at least five years. Similarly, some government bonds were reinstated at 2.5% of face value, to be paid after reparations were paid.Fergusson, Chapter 14

Mortgage debt was reinstated at much higher rates than government bonds were. The reinstatement of some debts and a resumption of effective taxation in a still-devastated economy triggered a wave of corporate

Eventually, some debts were reinstated to compensate creditors partially for the catastrophic reduction in the value of debts that had been quoted in paper marks before the hyperinflation. A decree of 1925 reinstated some mortgages at 25% of face value in the new currency, effectively 25,000,000,000 times their value in the old paper marks, if they had been held for at least five years. Similarly, some government bonds were reinstated at 2.5% of face value, to be paid after reparations were paid.Fergusson, Chapter 14

Mortgage debt was reinstated at much higher rates than government bonds were. The reinstatement of some debts and a resumption of effective taxation in a still-devastated economy triggered a wave of corporate bankruptcies

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the deb ...

.

One of the important issues of the stabilization of a hyperinflation is the ''revaluation''. The term normally refers to the raising of the exchange rate of one national currency against other currencies. As well, it can mean ''revalorization'', the restoration of the value of a currency depreciated by inflation. The German government had the choice of a revaluation law to finish the hyperinflation quickly or of allowing sprawling and the political and violent disturbances on the streets. The government argued in detail that the interests of creditors and debtors had to be fair and balanced. Neither the living standard price index nor the share price index was judged as relevant.

The calculation of the conversion relation was considerably judged to the dollar index as well as to the wholesale price index

The wholesale price index (WPI) is the price of a representative basket of wholesale goods.

The WPI is published by the Economic Adviser in the Ministry of Commerce and Industry. The Wholesale Price Index focuses on the price of goods traded ...

. In principle, the German government followed the line of market-oriented reasoning that the dollar index and the wholesale price index would roughly indicate the ''true'' price level in general over the period of high inflation and hyperinflation. In addition, the revaluation was bound on the exchange rate mark and United States dollar to obtain the value of the ''Goldmark''.

Finally, the Law on the Revaluation of Mortgages and other Claims of 16 July 1925 (' or ') included only the ratio of the paper mark to the gold mark for the period from 1 January 1918, to 30 November 1923, and the following days. The galloping inflation thus caused the end of a principle, "a mark is worth a mark", which had been recognized, the nominal value principle.

The law was challenged in the Supreme Court of the German Reich ('), but its 5th Senate ruled, on 4 November 1925, that the law was constitutional, even according to the Bill of Rights and Duties of Germans (Articles 109, 134, 152 and 153 of the Constitution). The case set a precedent for judicial review

Judicial review is a process under which a government's executive, legislative, or administrative actions are subject to review by the judiciary. In a judicial review, a court may invalidate laws, acts, or governmental actions that are in ...

in German jurisprudence.

Causes

Historians and economists differ over the causes of the German hyperinflation, particularly on the subject of whether it was caused by reparations payments. The Treaty of Versailles had imposed an undefined debt on Germany, which the London Schedule of Payments agreed in May 1921 had determined to be essentially 50 billion marks in A and B bonds payable partly in-kind with goods like coal and timber, and partly in gold and hard-cash. From June 1921, when a single payment of 1 billion gold marks was paid (roughly 1.4% of Germany's nominal 1925 GNP), until the agreement of the Dawes plan in late 1924, only relatively small cash payments were made by Germany, though partial in-kind payments continued. For example, of the 300 million gold marks due under a variable annuity in November 1921, only 13 million was paid, and of the roughly 3 billion gold marks total due under payments in 1922, only 435 million were paid in cash. Germany's leadership claimed that, with its gold depleted, inflation resulted during 1921–23 due to attempts to buy foreign currency with German currency in an effort to make cash payments as reparations. This would be equivalent to selling German currency in exchange for payment in foreign currency, but the resulting increase in the supply of German marks on the market caused the German mark to fall rapidly in value.Fergusson; ''When Money Dies''; p. 40 However, very little in the way of cash payments were actually made during the period of hyperinflation. British and French experts claimed that the German leadership were purposefully stoking inflation as a way of avoiding paying reparations, as well as a way of avoiding budgetary reforms – a view later supported by analysis of Reich Chancellery record showing that tax reform and currency stabilisation was delayed in 1922–23 in the hope of reductions in reparations. Particularly, Allied analysis of German statistics showed that printing of paper currency was being used to maintain tax rates much lower than in Allied countries, to fund relatively high levels of state expenditure, and that this effect was being worsened by unrestrictedcapital flight

Capital flight, in economics, is the rapid flow of assets or money out of a country, due to an event of economic consequence or as the result of a political event such as regime change or economic globalization. Such events could be erratic or ...

from Germany. Reparations payments continued more or less in full from 1924 to 1931 without a return of hyperinflation and, after 1930, Germany protested that reparations payments were deflation

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0% and becomes negative. While inflation reduces the value of currency over time, deflation increases i ...

ary. Inflation also enabled the German government to pay off its substantial domestic debts, particularly war debts, in devalued marks.

One point on which historians tend to agree is that the printing of cash by the German government to make payments to striking workers in the Ruhr, who were refusing to make reparations deliveries to the Allies, contributed to hyperinflation. The occupation of the Ruhr also caused German output to fall.

Regardless of the reason for the declining value of the German currency, the decline caused prices of goods to rise rapidly, increasing the cost of operating the German government, which could not be financed by raising taxes because those taxes would be payable in the ever-falling German currency. The resulting deficit was financed by some combination of issuing bonds and simply creating more money: both increasing the supply of German mark-denominated financial assets on the market and so further reducing the currency's price. When the German people realized that their money was rapidly losing value, they tried to spend it quickly. That increased monetary velocity

image:M3 Velocity in the US.png, 300px, Similar chart showing the logged velocity (green) of a broader measure of money M3 that covers M2 plus large institutional deposits. The US no longer publishes official M3 measures, so the chart only runs t ...

and caused an ever-faster increase in prices, creating a vicious cycle

A vicious circle (or cycle) is a complex chain of events that reinforces itself through a feedback loop, with detrimental results. It is a system with no tendency toward equilibrium (social, economic, ecological, etc.), at least in the short ...

.

The government and the banks had two unacceptable alternatives. If they stopped inflation, there would be immediate bankruptcies, unemployment, strikes, hunger, violence, collapse of civil order, insurrection and possibly even revolution.Fergusson; ''When Money Dies''; p. 254 If they continued the inflation, they would default on their foreign debt. However, attempting to avoid both unemployment and insolvency ultimately failed when Germany had both.

Aftermath and legacy

The hyperinflation episode in the Weimar Republic in the early 1920s was not the first or even the most severe instance of inflation in history. However, it has been the subject of the most scholarlyeconomic

An economy is an area of the Production (economics), production, Distribution (economics), distribution and trade, as well as Consumption (economics), consumption of Goods (economics), goods and Service (economics), services. In general, it is ...

analysis and debate. The hyperinflation drew significant interest, as many of the dramatic and unusual economic behaviors now associated with hyperinflation were first documented systematically: exponential

Exponential may refer to any of several mathematical topics related to exponentiation, including:

* Exponential function, also:

**Matrix exponential, the matrix analogue to the above

*Exponential decay, decrease at a rate proportional to value

* Ex ...

increases in prices and interest rates, redenomination of the currency, consumer flight from cash to hard assets and the rapid expansion of industries that produced those assets.

Since the hyperinflation, German monetary policy has retained a central concern with the maintenance of a sound currency, a concern that had an effect on the European sovereign debt crisis

The euro area crisis, often also referred to as the eurozone crisis, European debt crisis, or European sovereign debt crisis, was a multi-year debt crisis and financial crisis in the European Union (EU) from 2009 until, in Greece, 2018. The ...

. According to one study, many Germans conflate hyperinflation in the Weimar Republic with the Great Depression

The Great Depression was a severe global economic downturn from 1929 to 1939. The period was characterized by high rates of unemployment and poverty, drastic reductions in industrial production and international trade, and widespread bank and ...

, seeing the two separate events as one big economic crisis that encompassed both rapidly rising prices and mass unemployment.

The hyperinflated, worthless marks became widely collected abroad. The ''Los Angeles Times

The ''Los Angeles Times'' is an American Newspaper#Daily, daily newspaper that began publishing in Los Angeles, California, in 1881. Based in the Greater Los Angeles city of El Segundo, California, El Segundo since 2018, it is the List of new ...

'' estimated in 1924 that more of the decommissioned notes were spread about the US than existed in Germany.''Americans With Marks Out of Luck'', Cable and Associated Press, Los Angeles Times, 15 Nov 1924

Firms responded to the crisis by focusing on those elements of their information systems they identified as essential to continuing operations. In the beginning the focus was on adjusting sales and procurement arrangements, modifications to financial reporting, and the use of more nonmonetary information in internal reporting. With the continuous acceleration of inflation, human resources were redeployed to the most critical corporate functions, in particular those involved in the remuneration of labor. There is evidence that some parts of corporate accounting systems fell into disrepair, but there was also innovation.

See also

* Andreas Hermes * Zero strokeCitations

General and cited sources

* * * * Costantino Bresciani-Turroni, ''The Economics of Inflation'' (English transl.), Northampton, England: Augustus Kelly Publishers, 1937, on the German 1919–1923 inflation* * * * * * Guttmann, William. ''The Great Inflation''. Saxon House (1975 hardback w/ sources; ) or Gordon & Cremonesi Ltd. Publ., London (1976 paperback w/o sources; ). Germany currency hyperinflation 1919–1923.

When Money Buys Little – Jerry Jensen

Study of the 1923 German postage stamps * Karsten Laursen and Jorgen Pedersen, ''The German Inflation'', North-Holland Publishing Co., Amsterdam, 1964. * * * * * *

External links

* {{DEFAULTSORT:Inflation In The Weimar Republic 1910s in economic history 1920s in economic history 1923 in economic history 1923 in Germany Economy of the Weimar Republic Inflation in Germany Man-made disasters in Germany 1923 disasters in Germany 1920s disasters in GermanyWeimar

Weimar is a city in the state (Germany), German state of Thuringia, in Central Germany (cultural area), Central Germany between Erfurt to the west and Jena to the east, southwest of Leipzig, north of Nuremberg and west of Dresden. Together w ...