financial modelling on:

[Wikipedia]

[Google]

[Amazon]

Financial modeling is the task of building an abstract representation (a

In

In

, European Spreadsheet Risks Interest Group "Spreadsheet risk" is increasingly studied and managed; see

, Prof. Sam Savage,

Quantifying Corporate Financial Risk

archived 2010-07-17. cash flow analytics, corporate financing activity prediction problems, and risk analysis in capital investment *

''On Becoming a Quant''

. such as the

model

A model is an informative representation of an object, person, or system. The term originally denoted the plans of a building in late 16th-century English, and derived via French and Italian ultimately from Latin , .

Models can be divided in ...

) of a real world financial

Finance refers to monetary resources and to the study and Academic discipline, discipline of money, currency, assets and Liability (financial accounting), liabilities. As a subject of study, is a field of Business administration, Business Admin ...

situation. This is a mathematical model

A mathematical model is an abstract and concrete, abstract description of a concrete system using mathematics, mathematical concepts and language of mathematics, language. The process of developing a mathematical model is termed ''mathematical m ...

designed to represent (a simplified version of) the performance of a financial asset or portfolio of a business, project

A project is a type of assignment, typically involving research or design, that is carefully planned to achieve a specific objective.

An alternative view sees a project managerially as a sequence of events: a "set of interrelated tasks to be ...

, or any other investment.

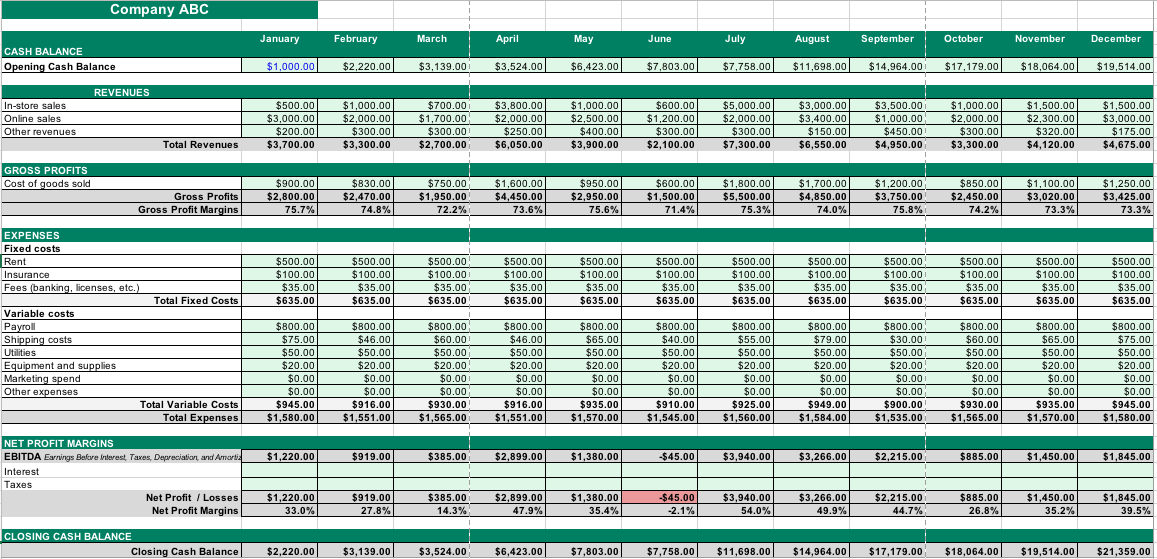

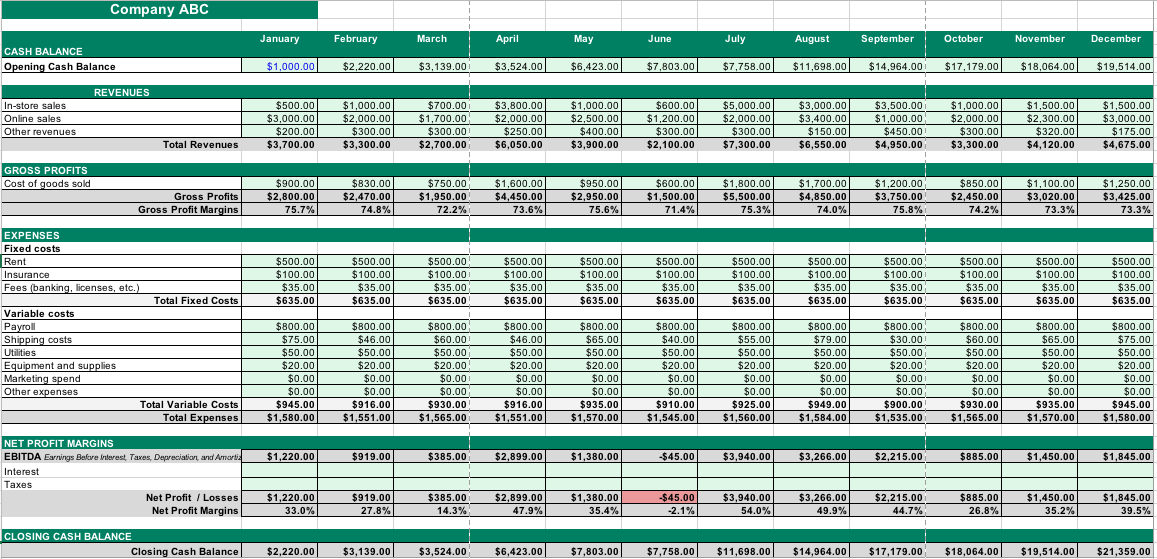

Typically, then, financial modeling is understood to mean an exercise in either asset pricing or corporate finance, of a quantitative nature. It is about translating a set of hypotheses about the behavior of markets or agents into numerical predictions. At the same time, "financial modeling" is a general term that means different things to different users; the reference usually relates either to accounting and corporate finance

Corporate finance is an area of finance that deals with the sources of funding, and the capital structure of businesses, the actions that managers take to increase the Value investing, value of the firm to the shareholders, and the tools and analy ...

applications or to quantitative finance

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling in the financial field.

In general, there exist two separate branches of finance that requ ...

applications.

Accounting

In

In corporate finance

Corporate finance is an area of finance that deals with the sources of funding, and the capital structure of businesses, the actions that managers take to increase the Value investing, value of the firm to the shareholders, and the tools and analy ...

and the accounting

Accounting, also known as accountancy, is the process of recording and processing information about economic entity, economic entities, such as businesses and corporations. Accounting measures the results of an organization's economic activit ...

profession, ''financial modeling'' typically entails financial statement forecasting; usually the preparation of detailed company-specific models used for decision making purposes, valuation and financial analysis

Financial analysis (also known as financial statement analysis, accounting analysis, or analysis of finance) refers to an assessment of the viability, stability, and profitability of a business, sub-business, project or investment.

It is per ...

.

Applications include:

*Business valuation

Business valuation is a process and a set of procedures used to estimate the economic value of an owner's interest in a business. Here various valuation techniques are used by financial market participants to determine the price they are willing ...

, stock valuation

Stock valuation is the method of calculating theoretical values of companies and their stocks. The main use of these methods is to predict future market prices, or more generally, potential market prices, and thus to profit from price movement � ...

, and project valuation - especially via discounted cash flow

The discounted cash flow (DCF) analysis, in financial analysis, is a method used to value a security, project, company, or asset, that incorporates the time value of money.

Discounted cash flow analysis is widely used in investment finance, re ...

, but including other valuation approaches

*Scenario planning

Scenario planning, scenario thinking, scenario analysis, scenario prediction and the scenario method all describe a strategic planning method that some organizations use to make flexible long-term plans. It is in large part an adaptation and gen ...

, FP&A

Financial planning and analysis (FP&A), in accounting and business, refers to the various integrated financial planning, planning, financial analysis, analysis, and Financial_modeling#Accounting, modeling activities aimed decision support, at sup ...

and management decision making ("what is"; "what if"; "what has to be done" §39 "Corporate Planning Models". See also, §294 "Simulation Model".)

*Budgeting

A budget is a calculation plan, usually but not always financial plan, financial, for a defined accounting period, period, often one year or a month. A budget may include anticipated sales volumes and revenues, resource quantities including tim ...

: revenue forecasting and analytics

Analytics is the systematic computational analysis of data or statistics. It is used for the discovery, interpretation, and communication of meaningful patterns in data, which also falls under and directly relates to the umbrella term, data sc ...

; production budget

Production budget is a term used specifically in film production and, more generally, in business.

A "film production budget" determines how much will be spent on the entire film project.

This involves identifying the elements and then estimatin ...

ing; operations budgeting

*Capital budgeting

Capital budgeting in corporate finance, corporate planning and accounting is an area of capital management that concerns the planning process used to determine whether an organization's long term capital investments such as new machinery, repla ...

, including cost of capital

In economics and accounting, the cost of capital is the cost of a company's funds (both debt and equity), or from an investor's point of view is "the required rate of return on a portfolio company's existing securities". It is used to evaluate ne ...

(i.e. WACC) calculations

*Cash flow forecasting

Cash flow forecasting is the process of obtaining an estimate of a company's future cash levels, and its financial position more generally. A cash flow forecast is a key financial management tool, both for large corporates, and for smaller entr ...

; working capital- and treasury management

Treasury management (or treasury operations) entails management of an enterprise's financial holdings, focusing on the firm's liquidity, and mitigating its financial-, operational- and reputational risk.

Treasury Management's scope thus inclu ...

; asset and liability management

Asset and liability management (often abbreviated ALM) is the term covering tools and techniques used by a bank or other corporate to minimise exposure to market risk and liquidity risk through holding the optimum combination of assets and liabili ...

*Financial statement analysis

Financial statement analysis (or just financial analysis) is the process of reviewing and analyzing a company's financial statements to make better economic decisions to earn income in future. These statements include the income statement, bala ...

/ ratio analysis

In mathematics, a ratio () shows how many times one number contains another. For example, if there are eight oranges and six lemons in a bowl of fruit, then the ratio of oranges to lemons is eight to six (that is, 8:6, which is equivalent to the ...

(including of operating- and finance lease

A finance lease (also known as a capital lease or a sales lease) is a type of lease in which a finance company is typically the legal owner of the asset for the duration of the lease, while the lessee not only has operating control over the asset ...

s, and R&D)

* Transaction analytics: M&A, PE, VC, LBO, IPO

An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail (individual) investors. An IPO is typically underwritten by one or more investment ...

, Project finance

Project finance is the long-term financing of infrastructure and industrial projects based upon the projected cash flows of the project rather than the balance sheets of its sponsors. Usually, a project financing structure involves a number of eq ...

, P3

*Credit decisioning: Credit analysis, Consumer credit risk

:''The following article is based on UK market; other countries may differ.''

Consumer credit risk (also retail credit risk) is the risk of loss due to a consumer's failure or inability to repay ( default) on a consumer credit product, such as a m ...

; impairment- and provision

Provision(s) may refer to:

* Provision (accounting), a term for liability in accounting

* Provision (contracting), a term for a procurement condition

* ''Provision'' (album), an album by Scritti Politti

* A term for the distribution, storing and/ ...

-modeling

*Management accounting: Activity-based costing

Activity-based costing (ABC) is a costing method that identifies activities in an organization and assigns the cost of each activity to all products and services according to the actual consumption by each. Therefore, this model assigns more ind ...

, Profitability analysis

In cost accounting, profitability analysis is an analysis of the profitability of an organisation's output. Output of an organisation can be grouped into products, customers, locations, channels and/or transactions.

Description

In order to per ...

, Cost analysis

Cost is the value of money that has been used up to produce something or deliver a service, and hence is not available for use anymore. In business, the cost may be one of acquisition, in which case the amount of money expended to acquire it is ...

, Whole-life cost

Whole-life cost is the total cost of ownership over the life of an asset. The concept is also known as life-cycle cost (LCC) or lifetime cost, and is commonly referred to as "cradle to grave" or "womb to tomb" costs. Costs considered include the ...

, Managerial risk accounting

Managerial Risk Accounting is concerned with the generation, dissemination and use of risk related accounting information to managers within organisations to enable them to judge and shape the risk situation of the organisation according to the obj ...

* Public sector procurement

To generalize as to the nature of these models:

firstly, as they are built around financial statement

Financial statements (or financial reports) are formal records of the financial activities and position of a business, person, or other entity.

Relevant financial information is presented in a structured manner and in a form which is easy to un ...

s, calculations and outputs are monthly, quarterly or annual;

secondly, the inputs take the form of "assumptions", where the analyst ''specifies'' the values that will apply in each period for external / global variables (exchange rate

In finance, an exchange rate is the rate at which one currency will be exchanged for another currency. Currencies are most commonly national currencies, but may be sub-national as in the case of Hong Kong or supra-national as in the case of ...

s, tax

A tax is a mandatory financial charge or levy imposed on an individual or legal entity by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax co ...

percentage, etc....; may be thought of as the model ''parameter

A parameter (), generally, is any characteristic that can help in defining or classifying a particular system (meaning an event, project, object, situation, etc.). That is, a parameter is an element of a system that is useful, or critical, when ...

s''), and for internal / company specific ''variables'' (wages

A wage is payment made by an employer to an employee for work done in a specific period of time. Some examples of wage payments include compensatory payments such as ''minimum wage'', '' prevailing wage'', and ''yearly bonuses,'' and remune ...

, unit cost

The unit cost is the price incurred by a company

A company, abbreviated as co., is a Legal personality, legal entity representing an association of legal people, whether Natural person, natural, Juridical person, juridical or a mixture ...

s, etc....). Correspondingly, both characteristics are reflected (at least implicitly) in the mathematical form of these models:

firstly, the models are in discrete time

In mathematical dynamics, discrete time and continuous time are two alternative frameworks within which variables that evolve over time are modeled.

Discrete time

Discrete time views values of variables as occurring at distinct, separate "poi ...

;

secondly, they are deterministic

Determinism is the metaphysical view that all events within the universe (or multiverse) can occur only in one possible way. Deterministic theories throughout the history of philosophy have developed from diverse and sometimes overlapping mo ...

.

For discussion of the issues that may arise, see below; for discussion as to more sophisticated approaches sometimes employed, see and .

Modelers are often designated "financial analyst

A financial analyst is a professional undertaking financial analysis for external or internal clients as a core feature of the job.

tongue in cheek

Tongue-in-cheek is an idiom that describes a humorous or sarcastic statement expressed in a serious manner.

History

The phrase originally expressed contempt, but by 1842 had acquired its modern meaning. Early users of the phrase include Sir Walte ...

, as "number crunchers"). Typically, the modeler will have completed an MBA

A Master of Business Administration (MBA) is a professional degree focused on business administration. The core courses in an MBA program cover various areas of business administration; elective courses may allow further study in a particular a ...

or MSF with (optional) coursework in "financial modeling". Accounting qualifications and finance certifications such as the CIIA and CFA generally do not provide direct or explicit training in modeling.''The MiF can offer an edge over the CFA''Financial Times

The ''Financial Times'' (''FT'') is a British daily newspaper printed in broadsheet and also published digitally that focuses on business and economic Current affairs (news format), current affairs. Based in London, the paper is owned by a Jap ...

, June 21, 2015. At the same time, numerous commercial training courses are offered, both through universities and privately.

For the components and steps of business modeling here, see ; see also for further discussion and considerations.

Although purpose-built business software

Business software (or a business application) is any software or set of computer programs used by business users to perform various business functions. These business applications are used to increase productivity, measure productivity, and per ...

does exist, the vast proportion of the market is spreadsheet

A spreadsheet is a computer application for computation, organization, analysis and storage of data in tabular form. Spreadsheets were developed as computerized analogs of paper accounting worksheets. The program operates on data entered in c ...

-based; this is largely since the models are almost always company-specific. Also, analysts will each have their own criteria and methods for financial modeling. Microsoft Excel

Microsoft Excel is a spreadsheet editor developed by Microsoft for Microsoft Windows, Windows, macOS, Android (operating system), Android, iOS and iPadOS. It features calculation or computation capabilities, graphing tools, pivot tables, and a ...

now has by far the dominant position, having overtaken Lotus 1-2-3

Lotus 1-2-3 is a discontinued spreadsheet program from Lotus Software (later part of IBM). It was the first killer application of the IBM PC, was hugely popular in the 1980s, and significantly contributed to the success of IBM PC-compatibles ...

in the 1990s. Spreadsheet-based modelling can have its own problems, and several standardizations and "best practice

A best practice is a method or technique that has been generally accepted as superior to alternatives because it tends to produce superior results. Best practices are used to achieve quality as an alternative to mandatory standards. Best practice ...

s" have been proposed.Best Practice, European Spreadsheet Risks Interest Group "Spreadsheet risk" is increasingly studied and managed; see

model audit

A model audit is the colloquial term for the tasks performed when conducting due diligence on a financial model, in order to eliminate spreadsheet error. Model audits are sometimes referred to as model reviews, primarily to avoid confusion with ...

.

One critique here, is that model ''outputs'', i.e. line items, often inhere "unrealistic implicit assumptions" and "internal inconsistencies". (For example, a forecast for growth in revenue but without corresponding increases in working capital

Working capital (WC) is a financial metric which represents operating liquidity available to a business, organisation, or other entity, including governmental entities. Along with fixed assets such as plant and equipment, working capital is consi ...

, fixed assets

Fixed assets (also known as long-lived assets or property, plant and equipment; PP&E) is a term used in accounting for assets and property that may not easily be converted into cash. They are contrasted with current assets, such as cash, bank acc ...

and the associated financing, may imbed unrealistic assumptions about asset turnover

In finance, asset turnover (ATO), total asset turnover, or asset turns is a financial ratio that measures the efficiency of a company's use of its assets in generating sales revenue or sales income to the company. Asset turnover is considered to b ...

, debt level and/or equity financing

In finance, equity is an ownership interest in property that may be subject to debts or other liabilities. Equity is measured for accounting purposes by subtracting liabilities from the value of the assets owned. For example, if someone owns ...

. See .) What is required, but often lacking, is that all key elements are explicitly and consistently forecasted.

Related to this, is that modellers often additionally "fail to identify crucial assumptions" relating to ''inputs'', "and to explore what can go wrong". Here, in general, modellers "use point values and simple arithmetic instead of probability distributions and statistical measures"

— i.e., as mentioned, the problems are treated as deterministic in nature — and thus calculate a single value for the asset or project, but without providing information on the range, variance and sensitivity of outcomes;

The Flaw of Averages, Prof. Sam Savage,

Stanford University

Leland Stanford Junior University, commonly referred to as Stanford University, is a Private university, private research university in Stanford, California, United States. It was founded in 1885 by railroad magnate Leland Stanford (the eighth ...

.

see .

A further, more general critique relates to the lack of basic computer programming

Computer programming or coding is the composition of sequences of instructions, called computer program, programs, that computers can follow to perform tasks. It involves designing and implementing algorithms, step-by-step specifications of proc ...

concepts amongst modelers,

with the result that their models are often poorly structured, and difficult to maintain. Serious criticism is also directed at the nature of budgeting, and its impact on the organization.

Quantitative finance

Inquantitative finance

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling in the financial field.

In general, there exist two separate branches of finance that requ ...

, ''financial modeling'' entails the development of a sophisticated mathematical model

A mathematical model is an abstract and concrete, abstract description of a concrete system using mathematics, mathematical concepts and language of mathematics, language. The process of developing a mathematical model is termed ''mathematical m ...

.See discussion here: Models here deal with asset prices, market movements, portfolio returns and the like.

Relatedly, applications include:

*Option pricing

In finance, a price (premium) is paid or received for purchasing or selling options.

The calculation of this premium will require sophisticated mathematics.

Premium components

This price can be split into two components: intrinsic value, and ...

and calculation of their "Greeks" ( accommodating volatility surface

Volatility smiles are implied volatility patterns that arise in pricing financial options. It is a parameter (implied volatility) that is needed to be modified for the Black–Scholes formula to fit market prices. In particular for a given ex ...

s - via local

Local may refer to:

Geography and transportation

* Local (train), a train serving local traffic demand

* Local, Missouri, a community in the United States

Arts, entertainment, and media

* ''Local'' (comics), a limited series comic book by Bria ...

/ stochastic volatility

In statistics, stochastic volatility models are those in which the variance of a stochastic process is itself randomly distributed. They are used in the field of mathematical finance to evaluate derivative securities, such as options. The name ...

models - and multi-curves)

*Other derivatives, especially interest rate derivative

In finance, an interest rate derivative (IRD) is a derivative whose payments are determined through calculation techniques where the underlying benchmark product is an interest rate, or set of different interest rates. There are a multitude of dif ...

s, credit derivative

In finance, a credit derivative refers to any one of "various instruments and techniques designed to separate and then transfer the ''credit risk''"The Economist ''Passing on the risks'' 2 November 1996 or the risk of an event of default of a corp ...

s and exotic derivatives

An exotic derivative, in finance, is a derivative (finance), derivative which is more complex than commonly traded "vanilla" products. This complexity usually relates to determination of payoff; see option style.

The category may also include de ...

*Credit valuation adjustment

A Credit valuation adjustment (CVA),

in financial mathematics, is an "adjustment" to a derivative's price, as charged by a bank to a counterparty to compensate it for taking on the credit risk of that counterparty during the life of the tran ...

, CVA, as well as the various XVA

X-Value Adjustment (XVA, xVA) is an hyponymy and hypernymy, umbrella term referring to a number of different "valuation adjustments" that banks must make when assessing the value of derivative (finance), derivative contracts that they have entered ...

*Modeling the term structure of interest rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, ...

s (bootstrapping

In general, bootstrapping usually refers to a self-starting process that is supposed to continue or grow without external input. Many analytical techniques are often called bootstrap methods in reference to their self-starting or self-supporting ...

/ multi-curves, short-rate model

A short-rate model, in the context of interest rate derivatives, is a mathematical model that describes the future evolution of interest rates by describing the future evolution of the short rate, usually written r_t \,.

The short rate

Under a sh ...

s, HJM framework) and any related credit spread

*Credit risk

Credit risk is the chance that a borrower does not repay a loan

In finance, a loan is the tender of money by one party to another with an agreement to pay it back. The recipient, or borrower, incurs a debt and is usually required to pay ...

, counterparty credit risk

Credit risk is the chance that a borrower does not repay a loan or fulfill a loan obligation. For lenders the risk includes late or lost interest and principal payment, leading to disrupted cash flows and increased collection costs. The loss ...

, and regulatory capital

A capital requirement (also known as regulatory capital, capital adequacy or capital base) is the amount of capital a bank or other financial institution has to have as required by its financial regulator. This is usually expressed as a capital ...

: EAD, PD, LGD, PFE, EE; Jarrow–Turnbull model, Merton model

Merton may refer to:

People

* Merton (surname)

* Merton (given name)

* Merton (YouTube), American YouTube personality

Fictional characters

* Merton Matowski, an alternate name for "Moose" Mason, an Archie Comics character

* Richard Grey, ...

, KMV model

Kavminvodyavia (KMV Avia) was an airline based in Mineralnye Vody in the North Caucasus, Russia. It operated scheduled services to over 20 destinations in the northern Caucasus region and abroad, as well as charter services. Its main base was M ...

*Portfolio optimization

Portfolio optimization is the process of selecting an optimal portfolio (asset distribution), out of a set of considered portfolios, according to some objective. The objective typically maximizes factors such as expected return, and minimizes c ...

and Quantitative investing

Quantitative analysis is the use of mathematical and statistical methods in finance and investment management. Those working in the field are quantitative analysts (quants). Quants tend to specialize in specific areas which may include derivative ...

more generally; see further re optimization methods employed.

*Credit scoring

A credit score is a numerical expression based on a level analysis of a person's credit files, to represent the creditworthiness of an individual. A credit score is primarily based on a credit report, information typically sourced from credit bur ...

and provisioning

Provisioning may refer to:

* Provisioning (technology), the equipping of a telecommunications network or IT resources

* Provisioning (cruise ship), supplying a vessel for an extended voyage

** Provisioning of USS ''Constitution''

* Provisionin ...

; Credit scorecards A credit score is a numerical expression representing the creditworthiness of an individual. A credit score is primarily based on a credit report, information typically sourced from credit bureaus.

Lenders, such as banks and credit card companies, ...

and

* Structured product design and manufacture

*Financial risk modeling

Financial risk modeling is the use of formal mathematical and econometric techniques to measure, monitor and control the market risk, credit risk, and operational risk on a firm's balance sheet, on a bank's accounting ledger of tradeable financial ...

: value at risk

Value at risk (VaR) is a measure of the risk of loss of investment/capital. It estimates how much a set of investments might lose (with a given probability), given normal market conditions, in a set time period such as a day. VaR is typically us ...

( parametric- and / or historical

History is the systematic study of the past, focusing primarily on the human past. As an academic discipline, it analyses and interprets evidence to construct narratives about what happened and explain why it happened. Some theorists categ ...

, CVaR, EVT), stress testing

Stress testing is a form of deliberately intense or thorough testing, used to determine the stability of a given system, critical infrastructure or entity. It involves testing beyond normal operational capacity, often to a breaking point, in orde ...

, "sensitivities" analysis (Greeks

Greeks or Hellenes (; , ) are an ethnic group and nation native to Greece, Greek Cypriots, Cyprus, Greeks in Albania, southern Albania, Greeks in Turkey#History, Anatolia, parts of Greeks in Italy, Italy and Egyptian Greeks, Egypt, and to a l ...

, duration, convexity, DV01

In finance, the duration of a financial asset that consists of fixed cash flows, such as a bond, is the weighted average of the times until those fixed cash flows are received.

When the price of an asset is considered as a function of yield, d ...

, KRD, CS01, JTD)

*Corporate finance applications:See David Shimko (2009)Quantifying Corporate Financial Risk

archived 2010-07-17. cash flow analytics, corporate financing activity prediction problems, and risk analysis in capital investment *

Real options

Real options valuation, also often termed real options analysis,Adam Borison (Stanford University)''Real Options Analysis: Where are the Emperor's Clothes?''

(ROV or ROA) applies option (finance), option Valuation of options, valuation technique ...

* Actuarial applications: Dynamic financial analysis (DFA), UIBFM, investment modeling

These problems are generally stochastic Stochastic (; ) is the property of being well-described by a random probability distribution. ''Stochasticity'' and ''randomness'' are technically distinct concepts: the former refers to a modeling approach, while the latter describes phenomena; i ...

and continuous

Continuity or continuous may refer to:

Mathematics

* Continuity (mathematics), the opposing concept to discreteness; common examples include

** Continuous probability distribution or random variable in probability and statistics

** Continuous ...

in nature, and models here thus require complex algorithms, entailing computer simulation

Computer simulation is the running of a mathematical model on a computer, the model being designed to represent the behaviour of, or the outcome of, a real-world or physical system. The reliability of some mathematical models can be determin ...

, advanced numerical methods

Numerical analysis is the study of algorithms that use numerical approximation (as opposed to symbolic manipulations) for the problems of mathematical analysis (as distinguished from discrete mathematics). It is the study of numerical methods t ...

(such as numerical differential equations

Numerical may refer to:

* Number

* Numerical digit

* Numerical analysis

Numerical analysis is the study of algorithms that use numerical approximation (as opposed to symbolic computation, symbolic manipulations) for the problems of mathematical ...

, numerical linear algebra

Numerical linear algebra, sometimes called applied linear algebra, is the study of how matrix operations can be used to create computer algorithms which efficiently and accurately provide approximate answers to questions in continuous mathemati ...

, dynamic programming) and/or the development of optimization models. The general nature of these problems is discussed under , while specific techniques are listed under .

For further discussion here see also: Brownian model of financial markets

The Brownian motion models for financial markets are based on the work of Robert C. Merton and Paul A. Samuelson, as extensions to the one-period market models of Harold Markowitz and William F. Sharpe, and are concerned with defining the concep ...

; Martingale pricing Martingale pricing is a pricing approach based on the notions of martingale and risk neutrality. The martingale pricing approach is a cornerstone of modern quantitative finance and can be applied to a variety of derivatives contracts, e.g. optio ...

; Financial models with long-tailed distributions and volatility clustering Financial models with long-tailed distributions and volatility clustering have been introduced to overcome problems with the realism of classical financial models. These classical models of financial time series typically assume homoskedasticity and ...

; Extreme value theory

Extreme value theory or extreme value analysis (EVA) is the study of extremes in statistical distributions.

It is widely used in many disciplines, such as structural engineering, finance, economics, earth sciences, traffic prediction, and Engin ...

; Historical simulation (finance)

Historical simulation in finance's value at risk (VaR) analysis is a procedure for predicting the value at risk by 'simulating' or constructing the cumulative distribution function (CDF) of assets returns over time assuming that future returns will ...

.

Modellers are generally referred to as "quants", i.e. quantitative analyst

Quantitative analysis is the use of mathematical and statistical methods in finance and investment management. Those working in the field are quantitative analysts (quants). Quants tend to specialize in specific areas which may include derivative ...

s (or "rocket scientists") and typically have advanced ( Ph.D. level) backgrounds in quantitative disciplines such as statistics

Statistics (from German language, German: ', "description of a State (polity), state, a country") is the discipline that concerns the collection, organization, analysis, interpretation, and presentation of data. In applying statistics to a s ...

, physics

Physics is the scientific study of matter, its Elementary particle, fundamental constituents, its motion and behavior through space and time, and the related entities of energy and force. "Physical science is that department of knowledge whi ...

, engineering

Engineering is the practice of using natural science, mathematics, and the engineering design process to Problem solving#Engineering, solve problems within technology, increase efficiency and productivity, and improve Systems engineering, s ...

, computer science

Computer science is the study of computation, information, and automation. Computer science spans Theoretical computer science, theoretical disciplines (such as algorithms, theory of computation, and information theory) to Applied science, ...

, mathematics

Mathematics is a field of study that discovers and organizes methods, Mathematical theory, theories and theorems that are developed and Mathematical proof, proved for the needs of empirical sciences and mathematics itself. There are many ar ...

or operations research

Operations research () (U.S. Air Force Specialty Code: Operations Analysis), often shortened to the initialism OR, is a branch of applied mathematics that deals with the development and application of analytical methods to improve management and ...

.

Alternatively, or in addition to their quantitative background, they complete a finance masters with a quantitative orientation, Mark S. Joshi''On Becoming a Quant''

. such as the

Master of Quantitative Finance

A master's degree in quantitative finance is a postgraduate degree focused on the application of mathematical methods to the solution of problems in financial economics. There are several like-titled degrees which may further focus on financial e ...

, or the more specialized Master of Computational Finance

Master, master's or masters may refer to:

Ranks or titles

In education:

*Master (college), head of a college

*Master's degree, a postgraduate or sometimes undergraduate degree in the specified discipline

*Schoolmaster or master, presiding office ...

or Master of Financial Engineering; the CQF certificate is increasingly common.

Although spreadsheets are widely used here also (almost always requiring extensive VBA);

custom C++, Fortran or Python

Python may refer to:

Snakes

* Pythonidae, a family of nonvenomous snakes found in Africa, Asia, and Australia

** ''Python'' (genus), a genus of Pythonidae found in Africa and Asia

* Python (mythology), a mythical serpent

Computing

* Python (prog ...

, or numerical-analysis software such as MATLAB

MATLAB (an abbreviation of "MATrix LABoratory") is a proprietary multi-paradigm programming language and numeric computing environment developed by MathWorks. MATLAB allows matrix manipulations, plotting of functions and data, implementat ...

, are often preferred, particularly where stability or speed is a concern.

MATLAB is often used at the research or prototyping stage because of its intuitive programming, graphical and debugging tools, but C++/Fortran are preferred for conceptually simple but high computational-cost applications where MATLAB is too slow;

Python is increasingly used due to its simplicity, and large standard library

In computer programming, a standard library is the library (computing), library made available across Programming language implementation, implementations of a programming language. Often, a standard library is specified by its associated program ...

/ available applications, including QuantLib

QuantLib is an open-source software library which provides tools for software developers and practitioners interested in financial instrument valuation and related subjects. QuantLib is written in C++.

History

The QuantLib project was started ...

.

Additionally, for many (of the standard) derivative and portfolio applications, commercial software

Commercial software,

or, seldom, payware, is a computer software that is produced for sale or that serves commercial purposes. Commercial software can be proprietary software or free and open-source software.

Background and challenge

While ...

is available, and the choice as to whether the model is to be developed in-house, or whether existing products are to be deployed, will depend on the problem in question.

See .

The complexity of these models may result in incorrect pricing or hedging or both. This ''Model risk

In finance, model risk is the risk of loss resulting from using insufficiently accurate models to make decisions, originally and frequently in the context of valuing financial securities.

Here, Rebonato (2002) defines model risk as "the risk of ...

'' is the subject of ongoing research by finance academics, and is a topic of great, and growing, interest in the risk management

Risk management is the identification, evaluation, and prioritization of risks, followed by the minimization, monitoring, and control of the impact or probability of those risks occurring. Risks can come from various sources (i.e, Threat (sec ...

arena.

Criticism

Criticism is the construction of a judgement about the negative or positive qualities of someone or something. Criticism can range from impromptu comments to a written detailed response. , ''the act of giving your opinion or judgment about the ...

of the discipline (often preceding the 2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

by several years) emphasizes the differences between finance and the mathematical / physical sciences, and stresses the resultant caution to be applied by modelers, and by traders and risk managers using their models. Notable here are Emanuel Derman

Emanuel Derman (born 1945) is a South African-born academic, businessman and writer. He is best known as a quantitative analyst, and author of the book ''My Life as a Quant: Reflections on Physics and Finance''.

He is a co-author of Black–D ...

and Paul Wilmott

Paul Wilmott (born 8 November 1959) is an English people, English researcher, consultant and lecturer in quantitative finance.Financial Modelers' Manifesto The Financial Modelers' Manifesto was a proposal for more responsibility in risk management and quantitative finance written by quantitative finance, financial engineers Emanuel Derman and Paul Wilmott. The manifesto includes a Modelers' Hippocratic ...

''. Some go further and question whether the mathematical- and statistical modeling

A statistical model is a mathematical model that embodies a set of statistical assumptions concerning the generation of sample data (and similar data from a larger population). A statistical model represents, often in considerably idealized form ...

techniques usually applied to finance are at all appropriate (see the assumptions made for options and for portfolios).

In fact, these may go so far as to question the "empirical and scientific validity... of modern financial theory".

Notable here are Nassim Taleb

Nassim Nicholas Taleb (; alternatively ''Nessim ''or'' Nissim''; born 12 September 1960) is a Lebanese-American essayist, mathematical statistician, former option trader, risk analyst, and aphorist. His work concerns problems of randomness ...

and Benoit Mandelbrot

Benoit B. Mandelbrot (20 November 1924 – 14 October 2010) was a Polish-born French-American mathematician and polymath with broad interests in the practical sciences, especially regarding what he labeled as "the art of roughness" of phy ...

.

See also , and .

Competitive modeling

Several financial modeling competitions exist, emphasizing speed and accuracy in modeling. TheMicrosoft

Microsoft Corporation is an American multinational corporation and technology company, technology conglomerate headquartered in Redmond, Washington. Founded in 1975, the company became influential in the History of personal computers#The ear ...

-sponsored ModelOff Financial Modeling World Championships were held annually from 2012 to 2019, with competitions throughout the year and a finals championship in New York or London. After its end in 2020, several other modeling championships have been started, including the Financial Modeling World Cup and Microsoft Excel Collegiate Challenge

The Microsoft Excel Collegiate Challenge (MECC) is a Microsoft Excel esports competition.

Background

The MECC started in 2022 and combines elements of the Financial Modeling World Cup and the Microsoft Excel World Championship, targeting coll ...

, also sponsored by Microsoft

Microsoft Corporation is an American multinational corporation and technology company, technology conglomerate headquartered in Redmond, Washington. Founded in 1975, the company became influential in the History of personal computers#The ear ...

.

Philosophy of financial modeling

Philosophy of financial modeling is a branch of philosophy concerned with the foundations, methods, and implications of modeling science. In the philosophy of financial modeling, scholars have more recently begun to question the generally-held assumption that financial modelers seek to represent any "real-world" or actually ongoing investment situation. Instead, it has been suggested that the task of the financial modeler resides in demonstrating the possibility of a transaction in a prospective investment scenario, from a limited base of possibility conditions initially assumed in the model.See also

*All models are wrong

"All models are wrong" is a common aphorism and anapodoton in statistics. It is often expanded as "All models are wrong, but some are useful". The aphorism acknowledges that statistical models always fall short of the complexities of reality but ca ...

* Asset pricing model

*Economic model

An economic model is a theoretical construct representing economic processes by a set of variables and a set of logical and/or quantitative relationships between them. The economic model is a simplified, often mathematical, framework designed ...

*Financial engineering

Financial engineering is a multidisciplinary field involving financial theory, methods of engineering, tools of mathematics and the practice of programming. It has also been defined as the application of technical methods, especially from mathe ...

*Financial forecast

A financial forecast is an estimate of future financial outcomes for a company or project, usually applied in budgeting, capital budgeting and/or valuation. Depending on context, the term may also refer to listed company (quarterly) earnings gui ...

*Financial Modelers' Manifesto The Financial Modelers' Manifesto was a proposal for more responsibility in risk management and quantitative finance written by quantitative finance, financial engineers Emanuel Derman and Paul Wilmott. The manifesto includes a Modelers' Hippocratic ...

*Financial models with long-tailed distributions and volatility clustering Financial models with long-tailed distributions and volatility clustering have been introduced to overcome problems with the realism of classical financial models. These classical models of financial time series typically assume homoskedasticity and ...

*Financial planning

In general usage, a financial plan is a comprehensive evaluation of an individual's current pay and future financial state by using current known variables to predict future income, asset values and withdrawal plans. This often includes a budg ...

*Integrated business planning

Integrated business planning (IBP) is a business management process that aims to align strategic, operational, and financial planning into a single, integrated process.

Objective

Integrated business planning (IBP) is used by organizations to i ...

*Model audit

A model audit is the colloquial term for the tasks performed when conducting due diligence on a financial model, in order to eliminate spreadsheet error. Model audits are sometimes referred to as model reviews, primarily to avoid confusion with ...

*Modeling and analysis of financial markets

Financial modeling is the task of building an abstract representation (a model) of a real world financial situation. This is a mathematical model designed to represent (a simplified version of) the performance of a financial asset or portfolio o ...

*

*

*Profit model

The profit model is the linear, deterministic algebraic model used implicitly by most cost accountants. Starting with, profit equals sales minus costs, it provides a structure for modeling cost elements such as materials, losses, multi-products, ...

* Return on modeling effort

*

References

Bibliography

General * * * * * * * * Corporate finance * * * * * * * * * * * * * * * * * * * Quantitative finance * * * * * * * * * * * * * * * * * * * * * * * * * {{Corporate finance and investment banking Financial models Actuarial science Mathematical finance Corporate finance Computational fields of study