Depression-era Gangsters on:

[Wikipedia]

[Google]

[Amazon]

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of

, ''Encyclopædia Britannica''

Despite the crash, the worst of the crisis did not reverberate around the world until after 1929. The crisis hit panic levels again in December 1930, with a

Despite the crash, the worst of the crisis did not reverberate around the world until after 1929. The crisis hit panic levels again in December 1930, with a

The

The

"The protectionist temptation: Lessons from the Great Depression for today"

. VOX. In a 1995 survey of American economic historians, two-thirds agreed that the

Some economic studies have indicated that just as the downturn was spread worldwide by the rigidities of the

Some economic studies have indicated that just as the downturn was spread worldwide by the rigidities of the

In most countries of the world, recovery from the Great Depression began in 1933. In the U.S., recovery began in early 1933, but the U.S. did not return to 1929 GNP for over a decade and still had an unemployment rate of about 15% in 1940, albeit down from the high of 25% in 1933.

There is no consensus among economists regarding the motive force for the U.S. economic expansion that continued through most of the Roosevelt years (and the 1937 recession that interrupted it). The common view among most economists is that Roosevelt's

In most countries of the world, recovery from the Great Depression began in 1933. In the U.S., recovery began in early 1933, but the U.S. did not return to 1929 GNP for over a decade and still had an unemployment rate of about 15% in 1940, albeit down from the high of 25% in 1933.

There is no consensus among economists regarding the motive force for the U.S. economic expansion that continued through most of the Roosevelt years (and the 1937 recession that interrupted it). The common view among most economists is that Roosevelt's

The common view among economic historians is that the Great Depression ended with the advent of

The common view among economic historians is that the Great Depression ended with the advent of

. Library of Congress. When the United States entered the war in 1941, it finally eliminated the last effects from the Great Depression and brought the U.S. unemployment rate down below 10%."Depression & WWII"

. Americaslibrary.gov. In the U.S., massive war spending doubled economic growth rates, either masking the effects of the Depression or essentially ending the Depression. Businessmen ignored the mounting

The two classic competing economic theories of the Great Depression are the

The two classic competing economic theories of the Great Depression are the

The monetarist explanation was given by American economists

The monetarist explanation was given by American economists

economic depression

An economic depression is a period of carried long-term economical downturn that is result of lowered economic activity in one major or more national economies. Economic depression maybe related to one specific country were there is some economic ...

that became evident after a major fall in stock

In finance, stock (also capital stock) consists of all the shares by which ownership of a corporation or company is divided.Longman Business English Dictionary: "stock - ''especially AmE'' one of the shares into which ownership of a company ...

prices in the United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 U.S. state, states, a Washington, D.C., federal district, five ma ...

. The economic contagion began around September and led to the Wall Street stock market crash of October 24 (Black Thursday). It was the longest, deepest, and most widespread depression of the 20th century.

Between 1929 and 1932, worldwide gross domestic product (GDP) fell by an estimated 15%. By comparison, worldwide GDP fell by less than 1% from 2008 to 2009 during the Great Recession

The Great Recession was a period of marked general decline, i.e. a recession, observed in national economies globally that occurred from late 2007 into 2009. The scale and timing of the recession varied from country to country (see map). At ...

. Some economies started to recover by the mid-1930s. However, in many countries, the negative effects of the Great Depression lasted until the beginning of World War II

World War II or the Second World War, often abbreviated as WWII or WW2, was a world war that lasted from 1939 to 1945. It involved the World War II by country, vast majority of the world's countries—including all of the great power ...

. Devastating effects were seen in both rich and poor countries with falling personal income

In economics, personal income refers to an individual's total earnings from wages, investment enterprises, and other ventures. It is the sum of all the incomes received by all the individuals or household during a given period. Personal income i ...

, prices, tax revenues, and profits. International trade fell by more than 50%, unemployment in the U.S. rose to 23% and in some countries rose as high as 33%.

Cities around the world were hit hard, especially those dependent on heavy industry

Heavy industry is an industry that involves one or more characteristics such as large and heavy products; large and heavy equipment and facilities (such as heavy equipment, large machine tools, huge buildings and large-scale infrastructure); ...

. Construction was virtually halted in many countries. Farming communities and rural areas suffered as crop prices fell by about 60%. Faced with plummeting demand and few job alternatives, areas dependent on primary sector industries suffered the most.

Economic historians usually consider the catalyst of the Great Depression to be the sudden devastating collapse of U.S. stock market prices, starting on October 24, 1929. However, some dispute this conclusion, seeing the stock crash less as a cause of the Depression and more as a symptom of the rising nervousness of investors partly due to gradual price declines caused by falling sales of consumer goods (as a result of overproduction because of new production techniques, falling exports and income inequality, among other factors) that had already been underway as part of a gradual Depression."Great Depression", ''Encyclopædia Britannica''

Overview

After theWall Street Crash of 1929

The Wall Street Crash of 1929, also known as the Great Crash, was a major American stock market crash that occurred in the autumn of 1929. It started in September and ended late in October, when share prices on the New York Stock Exchange coll ...

, where the Dow Jones Industrial Average

The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow (), is a stock market index of 30 prominent companies listed on stock exchanges in the United States.

The DJIA is one of the oldest and most commonly followed equity indexe ...

dropped from 381 to 198 over the course of two months, optimism persisted for some time. The stock market rose in early 1930, with the Dow returning to 294 (pre-depression levels) in April 1930, before steadily declining for years, to a low of 41 in 1932.

At the beginning, governments and businesses spent more in the first half of 1930 than in the corresponding period of the previous year. On the other hand, consumers, many of whom suffered severe losses in the stock market the previous year, cut expenditures by 10%. In addition, beginning in the mid-1930s, a severe drought ravaged the agricultural heartland of the U.S.

Interest rates dropped to low levels by mid-1930, but expected deflation

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0% (a negative inflation rate). Inflation reduces the value of currency over time, but sudden deflati ...

and the continuing reluctance of people to borrow meant that consumer spending and investment remained low. By May 1930, automobile sales declined to below the levels of 1928. Prices, in general, began to decline, although wages held steady in 1930. Then a deflationary spiral

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0% (a negative inflation rate). Inflation reduces the value of currency over time, but sudden deflation ...

started in 1931. Farmers faced a worse outlook; declining crop prices and a Great Plains drought crippled their economic outlook. At its peak, the Great Depression saw nearly 10% of all Great Plains farms change hands despite federal assistance.

The decline in the U.S. economy

The United States is a highly developed mixed-market economy and has the world's largest nominal GDP and net wealth. It has the second-largest by purchasing power parity (PPP) behind China. It has the world's seventh-highest per capita ...

was the factor that pulled down most other countries at first; then, internal weaknesses or strengths in each country made conditions worse or better. Frantic attempts by individual countries to shore up their economies through protectionist

Protectionism, sometimes referred to as trade protectionism, is the economic policy of restricting imports from other countries through methods such as tariffs on imported goods, import quotas, and a variety of other government regulations ...

policies – such as the 1930 U.S. Smoot–Hawley Tariff Act

The Tariff Act of 1930 (codified at ), commonly known as the Smoot–Hawley Tariff or Hawley–Smoot Tariff, was a law that implemented protectionist trade policies in the United States. Sponsored by Senator Reed Smoot and Representative Will ...

and retaliatory tariffs in other countries – exacerbated the collapse in global trade, contributing to the depression. By 1933, the economic decline pushed world trade to one third of its level compared to four years earlier.

Economic indicators

Course

Origins

Because the Great Depression began in the United States and then spread around the world, the origins of the Great Depression are examined in the context of the United States economy. In the aftermath ofWorld War I

World War I (28 July 1914 11 November 1918), often abbreviated as WWI, was List of wars and anthropogenic disasters by death toll, one of the deadliest global conflicts in history. Belligerents included much of Europe, the Russian Empire, ...

, the Roaring Twenties

The Roaring Twenties, sometimes stylized as Roaring '20s, refers to the 1920s decade in music and fashion, as it happened in Western society and Western culture. It was a period of economic prosperity with a distinctive cultural edge in the ...

had brought considerable wealth to the United States and Western Europe.George H. Soule, ''Prosperity Decade: From War to Depression: 1917–1929'' (1947) 1929 dawned with considerable economic progress in the American economy. A small stock crash occurred on March 25, 1929, but the crash was stabilized. Despite signs of economic trouble, the market continued to improve through September. Stock prices began to slump in September, and were volatile at the end of September. A large sell-off of stocks began in mid-October. Finally, on October 24, Black Thursday

Black Thursday is a term used to refer to typically negative, notable events that have occurred on a Thursday. It has been used in the following cases:

*6 February 1851, bushfires in Victoria, Australia.

*18 September 1873, during the Panic ...

, the American stock market crashed 11% at the opening bell. Actions to stabilize the market failed, and on October 28, Black Monday, the market crashed another 12%. The panic peaked the next day on Black Tuesday, when the market saw another 11% drop. Thousands of investors were ruined, and billions of dollars had been lost; many stocks could not be sold at any price. The market recovered 12% on Wednesday, but the damage had been done. Though the market recovered from November 14, until April 17, 1930, the market entered a prolonged slump. From April 17, 1930, until July 8, 1932, the market lost 89% of its value. Despite the crash, the worst of the crisis did not reverberate around the world until after 1929. The crisis hit panic levels again in December 1930, with a

Despite the crash, the worst of the crisis did not reverberate around the world until after 1929. The crisis hit panic levels again in December 1930, with a bank run

A bank run or run on the bank occurs when many clients withdraw their money from a bank, because they believe the bank may cease to function in the near future. In other words, it is when, in a fractional-reserve banking system (where banks no ...

on the Bank of United States

The Bank of United States, founded by Joseph S. Marcus in 1913 at 77 Delancey Street in New York City, was a New York City bank that failed in 1931. The bank run on its Bronx branch is said to have started the collapse of banking during the Gre ...

(privately run, no relation to the government). Unable to pay out to all of its creditors, the bank failed. Among the 608 American banks that closed in November and December 1930, the Bank of United States accounted for a third of the total $550 million deposits lost and, with its closure, bank failures reached a critical mass.

The Smoot-Hawley act and the breakdown of international trade

The

The Smoot–Hawley Tariff Act

The Tariff Act of 1930 (codified at ), commonly known as the Smoot–Hawley Tariff or Hawley–Smoot Tariff, was a law that implemented protectionist trade policies in the United States. Sponsored by Senator Reed Smoot and Representative Will ...

was passed in the United States on June 17, 1930, having been proposed the year prior. Ostensibly aimed at protecting the American economy as the Depression began to take root, it backfired enormously and may have even caused the Depression. The consensus view among economists and economic historians (including Keynesians, Monetarists and Austrian economists) is that the passage of the Smoot-Hawley Tariff exacerbated the Great Depression, although there is disagreement as to how much. In the popular view, the Smoot-Hawley Tariff was a leading cause of the depression.Barry Eichengreen, Douglas Irwin (March 17, 2009)"The protectionist temptation: Lessons from the Great Depression for today"

. VOX. In a 1995 survey of American economic historians, two-thirds agreed that the

Smoot–Hawley Tariff Act

The Tariff Act of 1930 (codified at ), commonly known as the Smoot–Hawley Tariff or Hawley–Smoot Tariff, was a law that implemented protectionist trade policies in the United States. Sponsored by Senator Reed Smoot and Representative Will ...

at least worsened the Great Depression. According to the U.S. Senate website the Smoot–Hawley Tariff Act is among the most catastrophic acts in congressional history.

Many economists have argued that the sharp decline in international trade after 1930 helped to worsen the depression, especially for countries significantly dependent on foreign trade. Most historians and economists blame the Act for worsening the depression by seriously reducing international trade and causing retaliatory tariffs in other countries. While foreign trade was a small part of overall economic activity in the U.S. and was concentrated in a few businesses like farming, it was a much larger factor in many other countries. The average ''ad valorem

An ''ad valorem'' tax (Latin for "according to value") is a tax whose amount is based on the value of a transaction or of property. It is typically imposed at the time of a transaction, as in the case of a sales tax or value-added tax (VAT). An ...

'' (value based) rate of duties on dutiable imports for 1921–1925 was 25.9% but under the new tariff it jumped to 50% during 1931–1935. In dollar terms, American exports declined over the next four years from about $5.2 billion in 1929 to $1.7 billion in 1933; so, not only did the physical volume of exports fall, but also the prices fell by about as written. Hardest hit were farm commodities such as wheat, cotton, tobacco, and lumber.

Governments around the world took various steps into spending less money on foreign goods such as: "imposing tariffs, import quotas, and exchange controls". These restrictions triggered much tension among countries that had large amounts of bilateral trade, causing major export-import reductions during the depression. Not all governments enforced the same measures of protectionism. Some countries raised tariffs drastically and enforced severe restrictions on foreign exchange transactions, while other countries reduced "trade and exchange restrictions only marginally":

* "Countries that remained on the gold standard, keeping currencies fixed, were more likely to restrict foreign trade." These countries "resorted to protectionist policies to strengthen the balance of payments and limit gold losses." They hoped that these restrictions and depletions would hold the economic decline.

* Countries that abandoned the gold standard, allowed their currencies to depreciate

In accountancy, depreciation is a term that refers to two aspects of the same concept: first, the actual decrease of fair value of an asset, such as the decrease in value of factory equipment each year as it is used and wear, and second, the ...

which caused their balance of payments to strengthen. It also freed up monetary policy so that central banks could lower interest rates and act as lenders of last resort. They possessed the best policy instruments to fight the Depression and did not need protectionism.

* "The length and depth of a country's economic downturn and the timing and vigor of its recovery are related to how long it remained on the gold standard

A gold standard is a Backed currency, monetary system in which the standard economics, economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the ...

. Countries abandoning the gold standard relatively early experienced relatively mild recessions and early recoveries. In contrast, countries remaining on the gold standard experienced prolonged slumps."

The gold standard and the spreading of global depression

Thegold standard

A gold standard is a Backed currency, monetary system in which the standard economics, economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the ...

was the primary transmission mechanism of the Great Depression. Even countries that did not face bank failures and a monetary contraction first hand were forced to join the deflationary policy since higher interest rates in countries that performed a deflationary policy led to a gold outflow in countries with lower interest rates. Under the gold standard's price–specie flow mechanism

The price–specie flow mechanism is a model developed by Scottish economist David Hume (1711–1776) to illustrate how trade imbalances can self-correct and adjust under the gold standard. Hume expounded his argument in ''Of the Balance of Trade' ...

, countries that lost gold but nevertheless wanted to maintain the gold standard had to permit their money supply to decrease and the domestic price level to decline (deflation

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0% (a negative inflation rate). Inflation reduces the value of currency over time, but sudden deflati ...

).

There is also consensus that protectionist policies, and primarily the passage of the Smoot–Hawley Tariff Act

The Tariff Act of 1930 (codified at ), commonly known as the Smoot–Hawley Tariff or Hawley–Smoot Tariff, was a law that implemented protectionist trade policies in the United States. Sponsored by Senator Reed Smoot and Representative Will ...

, helped to exacerbate, or even cause the Great Depression.

Gold standard

gold standard

A gold standard is a Backed currency, monetary system in which the standard economics, economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the ...

, it was suspending gold convertibility (or devaluing the currency in gold terms) that did the most to make recovery possible.

Every major currency left the gold standard during the Great Depression. The UK was the first to do so. Facing speculative attack In economics, a speculative attack is a precipitous selling of untrustworthy assets by previously inactive speculators and the corresponding acquisition of some valuable assets ( currencies, gold). The first model of a speculative attack was contai ...

s on the pound

Pound or Pounds may refer to:

Units

* Pound (currency), a unit of currency

* Pound sterling, the official currency of the United Kingdom

* Pound (mass), a unit of mass

* Pound (force), a unit of force

* Rail pound, in rail profile

Symbols

* Po ...

and depleting gold reserves

A gold reserve is the gold held by a national central bank, intended mainly as a guarantee to redeem promises to pay depositors, note holders (e.g. paper money), or trading peers, during the eras of the gold standard, and also as a store ...

, in September 1931 the Bank of England ceased exchanging pound notes for gold and the pound was floated on foreign exchange markets.

Japan and the Scandinavian countries joined the United Kingdom in leaving the gold standard in 1931. Other countries, such as Italy and the United States, remained on the gold standard into 1932 or 1933, while a few countries in the so-called "gold bloc", led by France and including Poland, Belgium and Switzerland, stayed on the standard until 1935–36.

According to later analysis, the earliness with which a country left the gold standard reliably predicted its economic recovery. For example, The UK and Scandinavia, which left the gold standard in 1931, recovered much earlier than France and Belgium, which remained on gold much longer. Countries such as China, which had a silver standard

The silver standard is a monetary system in which the standard economic unit of account is a fixed weight of silver. Silver was far more widespread than gold as the monetary standard worldwide, from the Sumerians 3000 BC until 1873. Following t ...

, almost avoided the depression entirely. The connection between leaving the gold standard as a strong predictor of that country's severity of its depression and the length of time of its recovery has been shown to be consistent for dozens of countries, including developing countries

A developing country is a sovereign state with a lesser developed Industrial sector, industrial base and a lower Human Development Index (HDI) relative to other countries. However, this definition is not universally agreed upon. There is al ...

. This partly explains why the experience and length of the depression differed between regions and states around the world.

German banking crisis of 1931 and British crisis

The financial crisis escalated out of control in mid-1931, starting with the collapse of theCredit Anstalt

The Creditanstalt (sometimes Credit-Anstalt, abbreviated as CA), full original name k. k. priv. Österreichische Credit-Anstalt für Handel und Gewerbe (), was a major Austrian bank, founded in 1855 in Vienna.

From its founding until 1931, th ...

in Vienna in May.William Ashworth, ''A short history of the international economy since 1850'' (2nd ed. 1962) pp. 237–244. This put heavy pressure on Germany, which was already in political turmoil. With the rise in violence of Nazi and communist movements, as well as investor nervousness at harsh government financial policies,Isabel Schnabel, "The German twin crisis of 1931". ''Journal of Economic History'' 64#3 (2004): 822–871. investors withdrew their short-term money from Germany as confidence spiraled downward. The Reichsbank lost 150 million marks in the first week of June, 540 million in the second, and 150 million in two days, June 19–20. Collapse was at hand. U.S. President Herbert Hoover called for a moratorium on Payment of war reparations. This angered Paris, which depended on a steady flow of German payments, but it slowed the crisis down, and the moratorium was agreed to in July 1931. An International conference in London later in July produced no agreements but on August 19 a standstill agreement froze Germany's foreign liabilities for six months. Germany received emergency funding from private banks in New York as well as the Bank of International Settlements and the Bank of England. The funding only slowed the process. Industrial failures began in Germany, a major bank closed in July and a two-day holiday for all German banks was declared. Business failures were more frequent in July, and spread to Romania

Romania ( ; ro, România ) is a country located at the crossroads of Central, Eastern, and Southeastern Europe. It borders Bulgaria to the south, Ukraine to the north, Hungary to the west, Serbia to the southwest, Moldova to the east, a ...

and Hungary. The crisis continued to get worse in Germany, bringing political upheaval that finally led to the coming to power of Hitler's Nazi regime in January 1933.H. V. Hodson (1938), ''Slump and Recovery, 1929–1937'' (London), pp. 64–76.

The world financial crisis now began to overwhelm Britain; investors around the world started withdrawing their gold from London at the rate of £2.5 million per day. Credits of £25 million each from the Bank of France and the Federal Reserve Bank of New York and an issue of £15 million fiduciary note slowed, but did not reverse the British crisis. The financial crisis now caused a major political crisis in Britain in August 1931. With deficits mounting, the bankers demanded a balanced budget; the divided cabinet of Prime Minister Ramsay MacDonald's Labour government agreed; it proposed to raise taxes, cut spending, and most controversially, to cut unemployment benefits 20%. The attack on welfare was unacceptable to the Labour movement. MacDonald wanted to resign, but King George V insisted he remain and form an all-party coalition "National Government A national government is the government of a nation.

National government or

National Government may also refer to:

* Central government in a unitary state, or a country that does not give significant power to regional divisions

* Federal governme ...

". The Conservative and Liberals parties signed on, along with a small cadre of Labour, but the vast majority of Labour leaders denounced MacDonald as a traitor for leading the new government. Britain went off the gold standard

A gold standard is a Backed currency, monetary system in which the standard economics, economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the ...

, and suffered relatively less than other major countries in the Great Depression. In the 1931 British election, the Labour Party was virtually destroyed, leaving MacDonald as Prime Minister for a largely Conservative coalition.Sean Glynn and John Oxborrow (1976), ''Interwar Britain : a social and economic history'', pp. 67–73.

Turning point and recovery

New Deal

The New Deal was a series of programs, public work projects, financial reforms, and regulations enacted by President Franklin D. Roosevelt in the United States between 1933 and 1939. Major federal programs agencies included the Civilian Con ...

policies either caused or accelerated the recovery, although his policies were never aggressive enough to bring the economy completely out of recession. Some economists have also called attention to the positive effects from expectations of reflation

Reflation is used to describe a return of prices to a previous rate of inflation. One usage describes an act of stimulating the economy by increasing the money supply or by reducing taxes, seeking to bring the economy (specifically the price level ...

and rising nominal interest rates that Roosevelt's words and actions portended. It was the rollback of those same reflationary policies that led to the interruption of a recession beginning in late 1937. One contributing policy that reversed reflation was the Banking Act of 1935

The ''Banking Act of 1935'' passed on August 19, 1935 and was signed into law by the president, Franklin D. Roosevelt, on August 23. The Act changed the structure and power distribution in the Federal Reserve System that began with the ''Banking ...

, which effectively raised reserve requirements, causing a monetary contraction that helped to thwart the recovery. GDP returned to its upward trend in 1938. A revisionist view among some economists holds that the New Deal prolonged the Great Depression, as they argue that National Industrial Recovery Act of 1933

The National Industrial Recovery Act of 1933 (NIRA) was a US labor law and consumer law passed by the 73rd US Congress to authorize the president to regulate industry for fair wages and prices that would stimulate economic recovery. It also ...

and National Labor Relations Act of 1935

The National Labor Relations Act of 1935, also known as the Wagner Act, is a foundational statute of United States labor law that guarantees the right of private sector employees to organize into trade unions, engage in collective bargaining, and ...

restricted competition and established price fixing. John Maynard Keynes

John Maynard Keynes, 1st Baron Keynes, ( ; 5 June 1883 – 21 April 1946), was an English economist whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originally trained in ...

did not think that the New Deal under Roosevelt single-handedly ended the Great Depression: "It is, it seems, politically impossible for a capitalistic democracy to organize expenditure on the scale necessary to make the grand experiments which would prove my case—except in war conditions."

According to Christina Romer

Christina Duckworth Romer (née Duckworth; born December 25, 1958) is the Class of 1957 Garff B. Wilson Professor of Economics at the University of California, Berkeley and a former chair of the Council of Economic Advisers in the Obama administr ...

, the money supply growth caused by huge international gold inflows was a crucial source of the recovery of the United States economy, and that the economy showed little sign of self-correction. The gold inflows were partly due to devaluation of the U.S. dollar and partly due to deterioration of the political situation in Europe. In their book, ''A Monetary History of the United States

''A Monetary History of the United States, 1867–1960'' is a book written in 1963 by Nobel Prize–winning economist Milton Friedman and Anna J. Schwartz. It uses historical time series and economic analysis to argue the then-novel proposition t ...

'', Milton Friedman

Milton Friedman (; July 31, 1912 – November 16, 2006) was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and the ...

and Anna J. Schwartz also attributed the recovery to monetary factors, and contended that it was much slowed by poor management of money by the Federal Reserve System

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a ...

. Former (2006–2014) Chairman of the Federal Reserve

The chair of the Board of Governors of the Federal Reserve System is the head of the Federal Reserve, and is the active executive officer of the Board of Governors of the Federal Reserve System. The chair shall preside at the meetings of the Boa ...

Ben Bernanke

Ben Shalom Bernanke ( ; born December 13, 1953) is an American economist who served as the 14th chairman of the Federal Reserve from 2006 to 2014. After leaving the Fed, he was appointed a distinguished fellow at the Brookings Institution. Dur ...

agreed that monetary factors played important roles both in the worldwide economic decline and eventual recovery. Bernanke also saw a strong role for institutional factors, particularly the rebuilding and restructuring of the financial system, and pointed out that the Depression should be examined in an international perspective.

Role of women and household economics

Women's primary role was as housewives; without a steady flow of family income, their work became much harder in dealing with food and clothing and medical care. Birthrates fell everywhere, as children were postponed until families could financially support them. The average birthrate for 14 major countries fell 12% from 19.3 births per thousand population in 1930, to 17.0 in 1935. In Canada, half of Roman Catholic women defied Church teachings and used contraception to postpone births. Among the few women in the labor force, layoffs were less common in the white-collar jobs and they were typically found in light manufacturing work. However, there was a widespread demand to limit families to one paid job, so that wives might lose employment if their husband was employed. Across Britain, there was a tendency for married women to join the labor force, competing for part-time jobs especially. In France, very slow population growth, especially in comparison to Germany continued to be a serious issue in the 1930s. Support for increasing welfare programs during the depression included a focus on women in the family. The Conseil Supérieur de la Natalité campaigned for provisions enacted in the Code de la Famille (1939) that increased state assistance to families with children and required employers to protect the jobs of fathers, even if they were immigrants. In rural and small-town areas, women expanded their operation of vegetable gardens to include as much food production as possible. In the United States, agricultural organizations sponsored programs to teach housewives how to optimize their gardens and to raise poultry for meat and eggs. Rural women madefeed sack dress

Feed sack dresses, flour sack dresses, or feedsack dresses were a common article of clothing in rural US and Canadian communities from the late 19th century through the mid 20th century. They were made at home, usually by women, using the cotton ...

es and other items for themselves and their families and homes from feed sacks. In American cities, African American women quiltmakers enlarged their activities, promoted collaboration, and trained neophytes. Quilts were created for practical use from various inexpensive materials and increased social interaction for women and promoted camaraderie and personal fulfillment.

Oral history provides evidence for how housewives in a modern industrial city handled shortages of money and resources. Often they updated strategies their mothers used when they were growing up in poor families. Cheap foods were used, such as soups, beans and noodles. They purchased the cheapest cuts of meat—sometimes even horse meat—and recycled the Sunday roast

A Sunday roast or roast dinner is a traditional meal of British and Irish origin. Although it can be consumed throughout the week, it is traditionally consumed on Sunday. It consists of roasted meat, roasted potatoes and accompaniment ...

into sandwiches and soups. They sewed and patched clothing, traded with their neighbors for outgrown items, and made do with colder homes. New furniture and appliances were postponed until better days. Many women also worked outside the home, or took boarders, did laundry for trade or cash, and did sewing for neighbors in exchange for something they could offer. Extended families used mutual aid—extra food, spare rooms, repair-work, cash loans—to help cousins and in-laws.

In Japan, official government policy was deflationary and the opposite of Keynesian spending. Consequently, the government launched a campaign across the country to induce households to reduce their consumption, focusing attention on spending by housewives.

In Germany, the government tried to reshape private household consumption under the Four-Year Plan of 1936 to achieve German economic self-sufficiency. The Nazi women's organizations, other propaganda agencies and the authorities all attempted to shape such consumption as economic self-sufficiency was needed to prepare for and to sustain the coming war. The organizations, propaganda agencies and authorities employed slogans that called up traditional values of thrift and healthy living. However, these efforts were only partly successful in changing the behavior of housewives.

World War II and recovery

The common view among economic historians is that the Great Depression ended with the advent of

The common view among economic historians is that the Great Depression ended with the advent of World War II

World War II or the Second World War, often abbreviated as WWII or WW2, was a world war that lasted from 1939 to 1945. It involved the World War II by country, vast majority of the world's countries—including all of the great power ...

. Many economists believe that government spending on the war caused or at least accelerated recovery from the Great Depression, though some consider that it did not play a very large role in the recovery, though it did help in reducing unemployment.Referring to the effect of World War II spending on the economy, economist John Kenneth Galbraith

John Kenneth Galbraith (October 15, 1908 – April 29, 2006), also known as Ken Galbraith, was a Canadian-American economist, diplomat, public official, and intellectual. His books on economic topics were bestsellers from the 1950s through t ...

said, "One could not have had a better demonstration of the Keynesian ideas."

The rearmament policies leading up to World War II helped stimulate the economies of Europe in 1937–1939. By 1937, unemployment in Britain had fallen to 1.5 million. The mobilization

Mobilization is the act of assembling and readying military troops and supplies for war. The word ''mobilization'' was first used in a military context in the 1850s to describe the preparation of the Prussian Army. Mobilization theories an ...

of manpower following the outbreak of war in 1939 ended unemployment."Great Depression and World War II". Library of Congress. When the United States entered the war in 1941, it finally eliminated the last effects from the Great Depression and brought the U.S. unemployment rate down below 10%."Depression & WWII"

. Americaslibrary.gov. In the U.S., massive war spending doubled economic growth rates, either masking the effects of the Depression or essentially ending the Depression. Businessmen ignored the mounting

national debt

A country's gross government debt (also called public debt, or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit o ...

and heavy new taxes, redoubling their efforts for greater output to take advantage of generous government contracts.

Causes

Keynesian

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output ...

(demand-driven) and the Monetarist

Monetarism is a school of thought in monetary economics that emphasizes the role of governments in controlling the amount of money in circulation. Monetarist theory asserts that variations in the money supply have major influences on natio ...

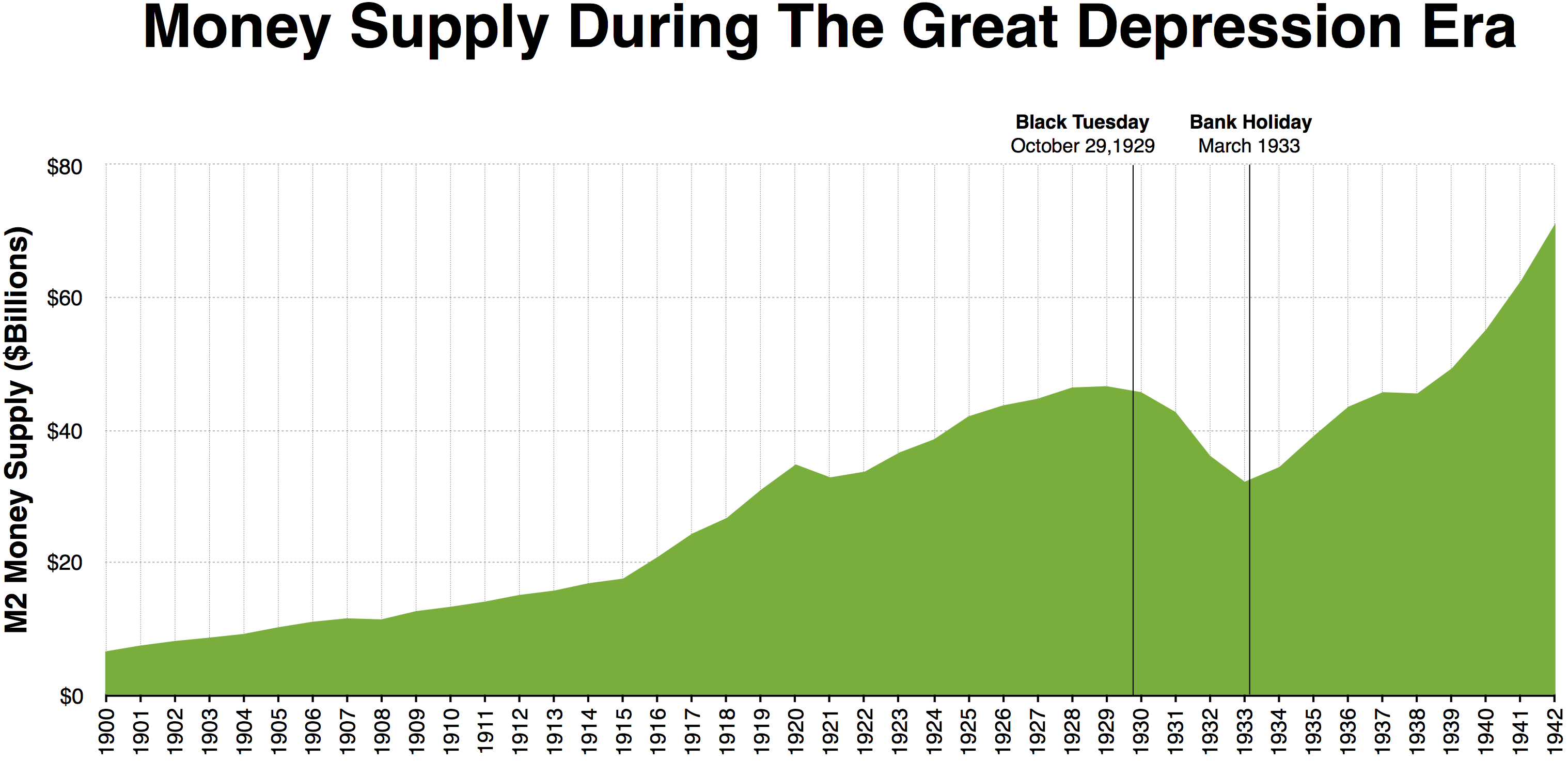

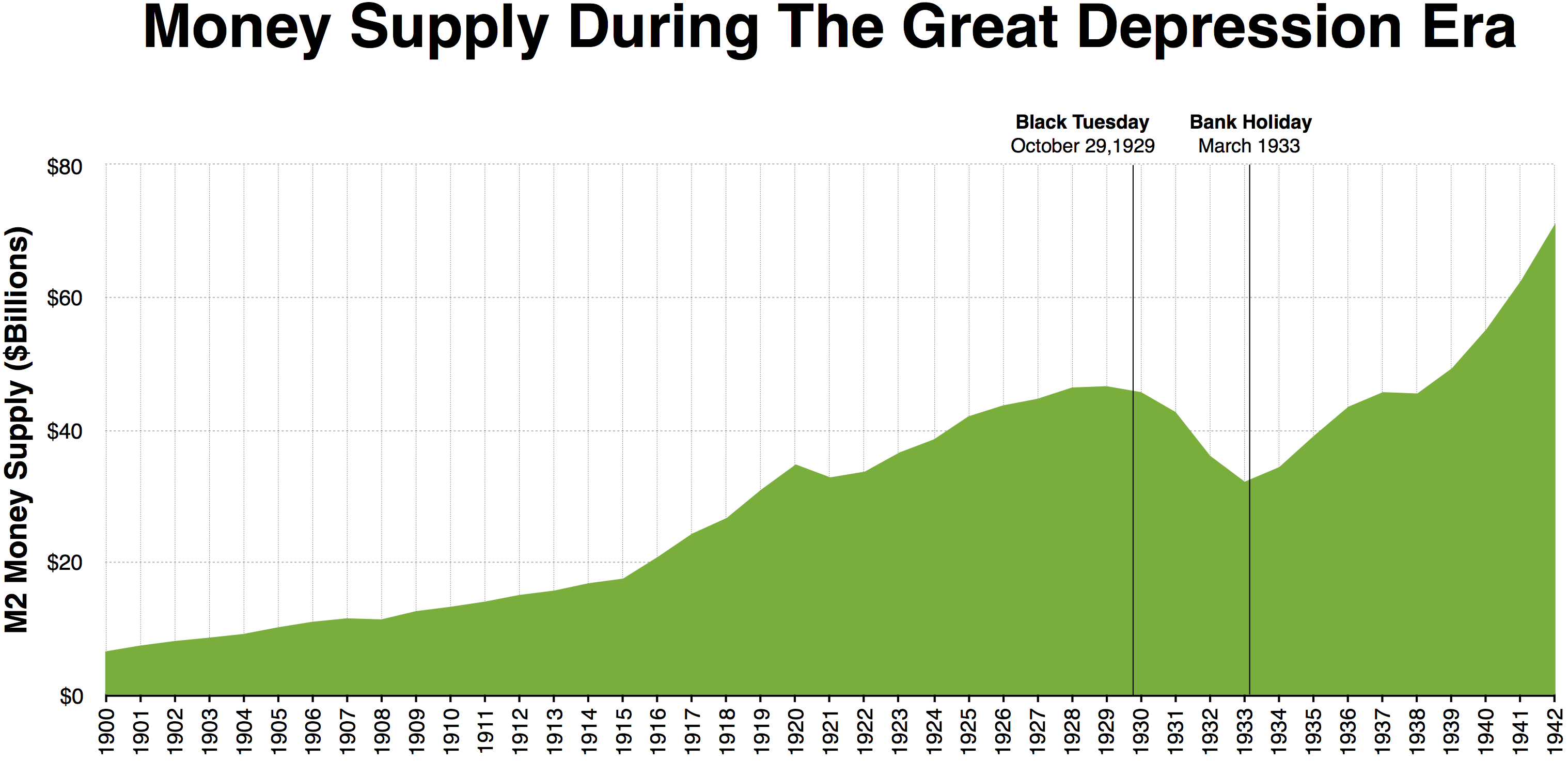

explanation. There are also various heterodox theories that downplay or reject the explanations of the Keynesians and monetarists. The consensus among demand-driven theories is that a large-scale loss of confidence led to a sudden reduction in consumption and investment spending. Once panic and deflation set in, many people believed they could avoid further losses by keeping clear of the markets. Holding money became profitable as prices dropped lower and a given amount of money bought ever more goods, exacerbating the drop in demand. Monetarists believe that the Great Depression started as an ordinary recession, but the shrinking of the money supply

In macroeconomics, the money supply (or money stock) refers to the total volume of currency held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include Circulation (curren ...

greatly exacerbated the economic situation, causing a recession to descend into the Great Depression.

Economists and economic historians are almost evenly split as to whether the traditional monetary explanation that monetary forces were the primary cause of the Great Depression is right, or the traditional Keynesian explanation that a fall in autonomous spending, particularly investment, is the primary explanation for the onset of the Great Depression. Today there is also significant academic support for the debt deflation

Debt deflation is a theory that recessions and depressions are due to the overall level of debt rising in real value because of deflation, causing people to default on their consumer loans and mortgages. Bank assets fall because of the defaults an ...

theory and the expectations hypothesis The expectations hypothesis of the term structure of interest rates (whose graphical representation is known as the yield curve) is the proposition that the long-term rate is determined purely by current and future expected short-term rates, in such ...

that — building on the monetary explanation of Milton Friedman

Milton Friedman (; July 31, 1912 – November 16, 2006) was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and the ...

and Anna Schwartz

Anna Jacobson Schwartz (pronounced ; November 11, 1915 – June 21, 2012) was an American economist who worked at the National Bureau of Economic Research in New York City and a writer for ''The New York Times''. Paul Krugman has said that Schwar ...

— add non-monetary explanations.

There is a consensus that the Federal Reserve System

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a ...

should have cut short the process of monetary deflation and banking collapse, by expanding the money supply and acting as lender of last resort

A lender of last resort (LOLR) is the institution in a financial system that acts as the provider of liquidity to a financial institution which finds itself unable to obtain sufficient liquidity in the interbank lending market when other faci ...

. If they had done this, the economic downturn would have been far less severe and much shorter.

Mainstream explanations

Modern mainstream economists see the reasons in * A money supply reduction (Monetarists

Monetarism is a school of thought in monetary economics that emphasizes the role of governments in controlling the amount of money in circulation. Monetarist theory asserts that variations in the money supply have major influences on national ...

) and therefore a banking crisis, reduction of credit, and bankruptcies.

* Insufficient demand from the private sector and insufficient fiscal spending (Keynesians

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output ...

).

* Passage of the Smoot–Hawley Tariff Act

The Tariff Act of 1930 (codified at ), commonly known as the Smoot–Hawley Tariff or Hawley–Smoot Tariff, was a law that implemented protectionist trade policies in the United States. Sponsored by Senator Reed Smoot and Representative Will ...

exacerbated what otherwise might have been a more "standard" recession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

(Both Monetarists

Monetarism is a school of thought in monetary economics that emphasizes the role of governments in controlling the amount of money in circulation. Monetarist theory asserts that variations in the money supply have major influences on national ...

and Keynesians

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output ...

).

Insufficient spending, the money supply reduction, and debt on margin led to falling prices and further bankruptcies ( Irving Fisher's debt deflation).

Monetarist view

The monetarist explanation was given by American economists

The monetarist explanation was given by American economists Milton Friedman

Milton Friedman (; July 31, 1912 – November 16, 2006) was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and the ...

and Anna J. Schwartz. They argued that the Great Depression was caused by the banking crisis that caused one-third of all banks to vanish, a reduction of bank shareholder wealth and more importantly monetary contraction of 35%, which they called "The Great Contraction

The Great Contraction is the recessionary period from 1929 until 1933, i.e., the early years of the Great Depression, as characterized by economist Milton Friedman. The phrase was the title of a chapter in the landmark 1963 book ''A Monetary Histo ...

". This caused a price drop of 33% (deflation

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0% (a negative inflation rate). Inflation reduces the value of currency over time, but sudden deflati ...

). By not lowering interest rates, by not increasing the monetary base and by not injecting liquidity into the banking system to prevent it from crumbling, the Federal Reserve passively watched the transformation of a normal recession into the Great Depression. Friedman and Schwartz argued that the downward turn in the economy, starting with the stock market crash, would merely have been an ordinary recession if the Federal Reserve had taken aggressive action. This view was endorsed in 2002 by Federal Reserve Governor Ben Bernanke

Ben Shalom Bernanke ( ; born December 13, 1953) is an American economist who served as the 14th chairman of the Federal Reserve from 2006 to 2014. After leaving the Fed, he was appointed a distinguished fellow at the Brookings Institution. Dur ...

in a speech honoring Friedman and Schwartz with this statement:

The Federal Reserve allowed some large public bank failures – particularly that of the New York Bank of United States

The Bank of United States, founded by Joseph S. Marcus in 1913 at 77 Delancey Street in New York City, was a New York City bank that failed in 1931. The bank run on its Bronx branch is said to have started the collapse of banking during the Gr ...

– which produced panic and widespread runs on local banks, and the Federal Reserve sat idly by while banks collapsed. Friedman and Schwartz argued that, if the Fed had provided emergency lending to these key banks, or simply bought government bond

A government bond or sovereign bond is a form of bond issued by a government to support public spending. It generally includes a commitment to pay periodic interest, called coupon payments'','' and to repay the face value on the maturity ...

s on the open market

The term open market is used generally to refer to an economic situation close to free trade. In a more specific, technical sense, the term refers to interbank trade in securities.

In economic theory

Economists judge the "openness" of markets a ...

to provide liquidity and increase the quantity of money after the key banks fell, all the rest of the banks would not have fallen after the large ones did, and the money supply would not have fallen as far and as fast as it did.

With significantly less money to go around, businesses could not get new loans and could not even get their old loans renewed, forcing many to stop investing. This interpretation blames the Federal Reserve for inaction, especially the New York branch.

One reason why the Federal Reserve did not act to limit the decline of the money supply was the gold standard

A gold standard is a Backed currency, monetary system in which the standard economics, economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the ...

. At that time, the amount of credit the Federal Reserve could issue was limited by the Federal Reserve Act

The Federal Reserve Act was passed by the 63rd United States Congress and signed into law by President Woodrow Wilson on December 23, 1913. The law created the Federal Reserve System, the central banking system of the United States.

The Pani ...

, which required 40% gold backing of Federal Reserve Notes issued. By the late 1920s, the Federal Reserve had almost hit the limit of allowable credit that could be backed by the gold in its possession. This credit was in the form of Federal Reserve demand notes.Frank Freidel (1973),