Debt levels and flows on:

[Wikipedia]

[Google]

[Amazon]

In

In

According to the IMF World Economic Outlook Database (April 2021), the level of Gross Government debt-to-GDP ratio in Canada was 116.3%, in China 66.8%, in India 89.6%, in Germany 70.3%, in France 115.2% and in the United States 132.8%.

According to the IMF World Economic Outlook Database (April 2021), the level of Gross Government debt-to-GDP ratio in Canada was 116.3%, in China 66.8%, in India 89.6%, in Germany 70.3%, in France 115.2% and in the United States 132.8%.

At the end of the 1st quarter of 2021, the

At the end of the 1st quarter of 2021, the

Federal Bank of St. Louis. Two-thirds of US public debt is owned by US citizens, banks, corporations, and the Federal Reserve Bank; approximately one-third of US public debt is held by foreign countries – particularly China and Japan. In comparison, less than 5% of Italian and Japanese public debt is held by foreign countries.

economics

Economics () is a behavioral science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services.

Economics focuses on the behaviour and interac ...

, the debt-to-GDP ratio is the ratio

In mathematics, a ratio () shows how many times one number contains another. For example, if there are eight oranges and six lemons in a bowl of fruit, then the ratio of oranges to lemons is eight to six (that is, 8:6, which is equivalent to the ...

of a country's accumulation of government debt

A country's gross government debt (also called public debt or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit occu ...

(measured in units of currency) to its gross domestic product

Gross domestic product (GDP) is a monetary measure of the total market value of all the final goods and services produced and rendered in a specific time period by a country or countries. GDP is often used to measure the economic performanc ...

(GDP) (measured in units of currency per year). A low debt-to-GDP ratio indicates that an economy produces goods and services sufficient to pay back debts without incurring further debt. Geopolitical and economic considerations – including interest rates

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, ...

, war, recession

In economics, a recession is a business cycle contraction that occurs when there is a period of broad decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be tr ...

s, and other variables – influence the borrowing practices of a nation and the choice to incur further debt

Debt is an obligation that requires one party, the debtor, to pay money Loan, borrowed or otherwise withheld from another party, the creditor. Debt may be owed by a sovereign state or country, local government, company, or an individual. Co ...

.

It should not be confused with a deficit-to-GDP ratio, which, for countries running budget deficits, measures a country's annual net fiscal loss in a given year ( government budget balance, or the net change in debt per annum) as a percentage share of that country's GDP; for countries running budget surpluses, a ''surplus-to-GDP ratio'' measures a country's annual net fiscal ''gain'' as a share of that country's GDP.

Particularly in macroeconomics

Macroeconomics is a branch of economics that deals with the performance, structure, behavior, and decision-making of an economy as a whole. This includes regional, national, and global economies. Macroeconomists study topics such as output (econ ...

, various debt-to-GDP ratios can be calculated. The most commonly used ratio is the government debt

A country's gross government debt (also called public debt or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit occu ...

divided by the gross domestic product (GDP), which reflects the government's finances, while another common ratio is the total debt to GDP, which reflects the finances of the nation as a whole.

The debt-to-GDP ratio is technically not a dimensionless quantity

Dimensionless quantities, or quantities of dimension one, are quantities implicitly defined in a manner that prevents their aggregation into unit of measurement, units of measurement. ISBN 978-92-822-2272-0. Typically expressed as ratios that a ...

, but a unit of time

Time is the continuous progression of existence that occurs in an apparently irreversible process, irreversible succession from the past, through the present, and into the future. It is a component quantity of various measurements used to sequ ...

, being equal to the amount of years over which the accumulated economic product equals the debt.

Statistics

According to the IMF World Economic Outlook Database (April 2021), the level of Gross Government debt-to-GDP ratio in Canada was 116.3%, in China 66.8%, in India 89.6%, in Germany 70.3%, in France 115.2% and in the United States 132.8%.

According to the IMF World Economic Outlook Database (April 2021), the level of Gross Government debt-to-GDP ratio in Canada was 116.3%, in China 66.8%, in India 89.6%, in Germany 70.3%, in France 115.2% and in the United States 132.8%.

At the end of the 1st quarter of 2021, the

At the end of the 1st quarter of 2021, the United States public debt

The "national debt of the United States" is the total national debt owed by the federal government of the United States to treasury security holders. The national debt at a given point in time is the face value of the then outstanding trea ...

-to-GDP ratio was 127.5%.Federal Debt: Total Public Debt as Percent of Gross Domestic ProductFederal Bank of St. Louis. Two-thirds of US public debt is owned by US citizens, banks, corporations, and the Federal Reserve Bank; approximately one-third of US public debt is held by foreign countries – particularly China and Japan. In comparison, less than 5% of Italian and Japanese public debt is held by foreign countries.

Applications

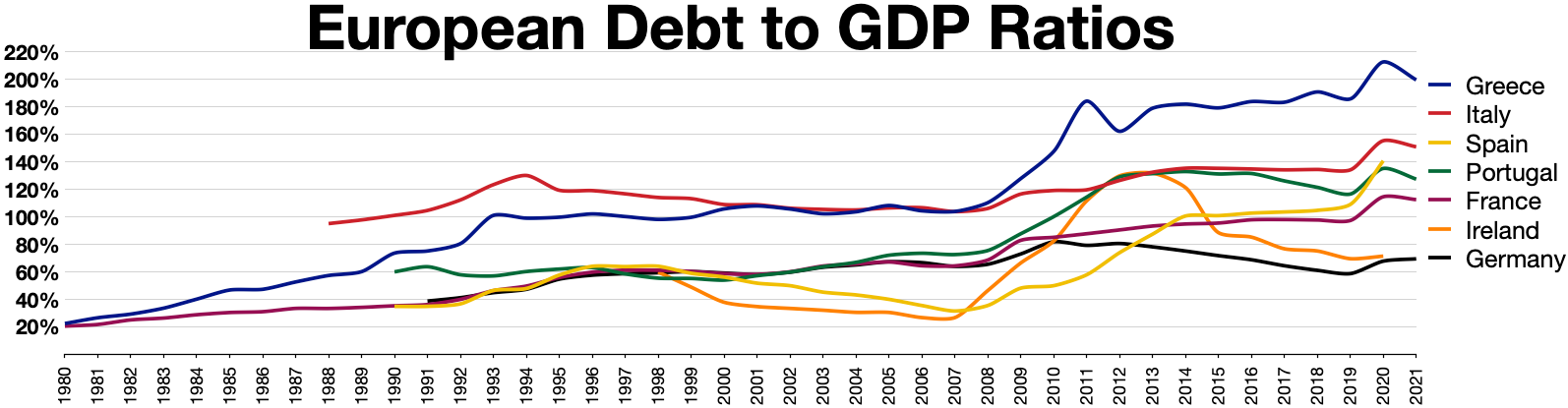

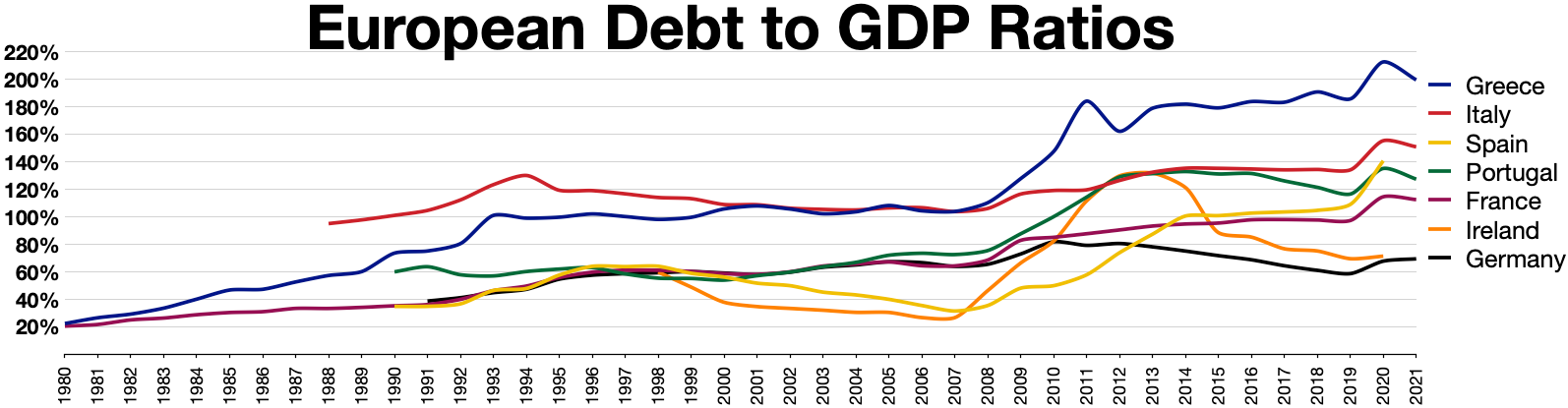

Debt-to-GDP measures the financial leverage of an economy. One of the Euro convergence criteria was that government debt-to-GDP should be below 60%. According to these two institutions, external debt sustainability can be obtained by a country "by bringing the net present value (NPV) of external public debt down to about 150 percent of a country's exports or 250 percent of a country's revenues". High external debt is believed to have harmful effects on an economy. The United Nations Sustainable Development Goal 17, an integral part of the 2030 Agenda has a target to address the external debt of highly indebted poor countries to reduce debt distress. In 2013 Herndon, Ash, and Pollin reviewed an influential, widely cited research paper entitled, " Growth in a Time of Debt", by two Harvard economists Carmen Reinhart and Kenneth Rogoff. Herndon, Ash and Pollin argued that "coding errors, selective exclusion of available data, and unconventional weighting of summary statistics lead to serious errors that inaccurately represent the relationship between public debt and GDP growth among 20 advanced economies in the post-war period". Correcting these basic computational errors undermined the central claim of the book that too much debt causes recession. Rogoff and Reinhardt claimed that their fundamental conclusions were accurate, despite the errors. There is a difference between external debt denominated in domestic currency, and external debt denominated in foreign currency. A nation can service external debt denominated in domestic currency by tax revenues, but to service foreign currency debt it has to convert tax revenues in theforeign exchange market

The foreign exchange market (forex, FX, or currency market) is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. By trading volume, ...

to foreign currency, which puts downward pressure on the value of its currency.

Changes

The change of debt-to-GDP ratio can be represented as: , where is the debt-to-GDP at the end of the period , and is the debt-to-GDP ratio at the end of the previous period (−1). The left side of the equation shows the ''change'' in the debt-to-GDP ratio. The right hand side of the equation separates the effect of real interest rate andeconomic growth

In economics, economic growth is an increase in the quantity and quality of the economic goods and Service (economics), services that a society Production (economics), produces. It can be measured as the increase in the inflation-adjusted Outp ...

on previous debt-to-GDP, and the new debt or government budget balance-to-GDP ratio.

If the government has the ability of money creation, and therefore monetizing debt the change in debt-to-GDP ratio becomes:

The term is the change in money supply-to-GDP ratio. The effect that an increase in nominal money balances has on seigniorage

Seigniorage , also spelled seignorage or seigneurage (), is the increase in the value of money due to money creation minus the cost of producing the additional money. Monetary seigniorage is where government bonds are exchanged for newly create ...

is ambiguous, as while it increases the amount of money within the economy, the real value of each unit of money decreases due to inflationary effects. This inflationary effect from money printing is called an inflation tax.

See also

* Debt crisis **European debt crisis

The euro area crisis, often also referred to as the eurozone crisis, European debt crisis, or European sovereign debt crisis, was a multi-year debt crisis and financial crisis in the European Union (EU) from 2009 until, in Greece, 2018. The e ...

* Debt ratio, for companies

* Debt-to-income ratio, for households

* Deficit spending

Within the budgetary process, deficit spending is the amount by which spending exceeds revenue over a particular period of time, also called simply deficit, or budget deficit, the opposite of budget surplus. The term may be applied to the budg ...

* Economic bubble

An economy is an area of the Production (economics), production, Distribution (economics), distribution and trade, as well as Consumption (economics), consumption of Goods (economics), goods and Service (economics), services. In general, it is ...

* Heavily indebted poor countries

* Leverage (finance)

In finance, leverage, also known as gearing, is any technique involving borrowing funds to buy an investment.

Financial leverage is named after a lever in physics, which amplifies a small input force into a greater output force. Financial leverag ...

* List of countries by external debt

* List of countries by government budget

This is the list of countries by government budget. The list includes sovereign states and self-governing dependent territory, dependent territories based upon the International Organization for Standardization, ISO standard ISO 3166-1.

The f ...

* List of sovereign states by tax revenue to GDP ratio

* Unfunded mandate

** Pensions crisis

The pensions crisis or pensions timebomb is the predicted difficulty in paying for corporate or government employment retirement pensions in various countries, due to a difference between pension obligations and the resources set aside to fund th ...

References

{{Finance country lists Debt-to-GDP ratio