In

economics

Economics () is a behavioral science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services.

Economics focuses on the behaviour and interac ...

and

econometrics

Econometrics is an application of statistical methods to economic data in order to give empirical content to economic relationships. M. Hashem Pesaran (1987). "Econometrics", '' The New Palgrave: A Dictionary of Economics'', v. 2, p. 8 p. 8 ...

, the Cobb–Douglas production function is a particular functional form of the

production function

In economics, a production function gives the technological relation between quantities of physical inputs and quantities of output of goods. The production function is one of the key concepts of mainstream economics, mainstream neoclassical econ ...

, widely used to represent the technological relationship between the amounts of two or more inputs (particularly physical capital and labor) and the amount of output that can be produced by those inputs. The Cobb–Douglas form was developed and tested against statistical evidence by

Charles Cobb and

Paul Douglas between 1927 and 1947; according to Douglas, the functional form itself was developed earlier by

Philip Wicksteed

Philip Henry Wicksteed (25 October 1844 – 18 March 1927) was an English scholar and Unitarian theologian known for his contributions to classics, medieval studies and economics. He was also a Georgist and literary critic.

Family background

...

.

Formulation

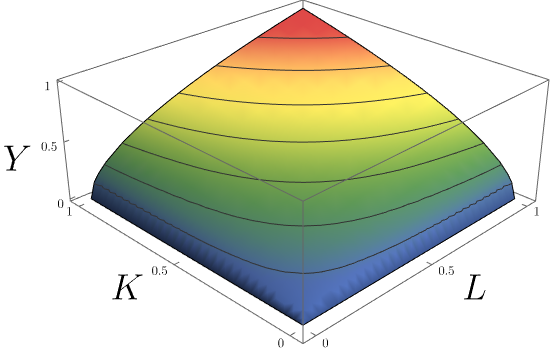

In its most standard form for production of a single good with two factors, the function is given by:

:

where:

* ''Y'' = total production (the real value of all goods produced in a year or 365.25 days)

* ''L'' =

labour input (person-hours worked in a year or 365.25 days)

* ''K'' =

capital input (a measure of all machinery, equipment, and buildings; the value of capital input divided by the price of capital)

* ''A'' =

total factor productivity

In economics, total-factor productivity (TFP), also called multi-factor productivity, is usually measured as the ratio of aggregate output (e.g., GDP) to aggregate inputs. Under some simplifying assumptions about the production technology, growt ...

*

and

are the

output elasticities of capital and labor, respectively. These values are constants determined by available technology.

Capital and labour are the two "factors of production" of the Cobb–Douglas production function.

History

Paul Douglas explained that his first formulation of the Cobb–Douglas production function was developed in 1927; when seeking a functional form to relate estimates he had calculated for workers and capital, he spoke with mathematician and colleague

Charles Cobb, who suggested a function of the form , previously used by

Knut Wicksell

Johan Gustaf Knut Wicksell (December 20, 1851 – May 3, 1926) was a Swedish economist of the Stockholm school. He was professor at Uppsala University and Lund University.

He made contributions to theories of population, value, capital and mon ...

,

Philip Wicksteed

Philip Henry Wicksteed (25 October 1844 – 18 March 1927) was an English scholar and Unitarian theologian known for his contributions to classics, medieval studies and economics. He was also a Georgist and literary critic.

Family background

...

, and

Léon Walras

Marie-Esprit-Léon Walras (; 16 December 1834 – 5 January 1910) was a French mathematical economics, mathematical economist and Georgist. He formulated the Marginalism, marginal theory of value (independently of William Stanley Jevons and Carl ...

, although Douglas only acknowledges Wicksteed and Walras for their contributions. Not long after

Knut Wicksell

Johan Gustaf Knut Wicksell (December 20, 1851 – May 3, 1926) was a Swedish economist of the Stockholm school. He was professor at Uppsala University and Lund University.

He made contributions to theories of population, value, capital and mon ...

's death in 1926,

Paul Douglas and

Charles Cobb implemented the Cobb–Douglas function in their work covering the subject manner of producer theory for the first time. Estimating this using

least squares

The method of least squares is a mathematical optimization technique that aims to determine the best fit function by minimizing the sum of the squares of the differences between the observed values and the predicted values of the model. The me ...

, he obtained a result for the exponent of labour of 0.75—which was subsequently confirmed by the

National Bureau of Economic Research

The National Bureau of Economic Research (NBER) is an American private nonprofit research organization "committed to undertaking and disseminating unbiased economic research among public policymakers, business professionals, and the academic co ...

to be 0.741. Later work in the 1940s prompted them to allow for the exponents on ''K'' and ''L'' to vary, resulting in estimates that subsequently proved to be very close to improved measure of productivity developed at that time.

A major criticism at the time was that estimates of the production function, although seemingly accurate, were based on such sparse data that it was hard to give them much credibility. Douglas remarked "I must admit I was discouraged by this criticism and thought of giving up the effort, but there was something which told me I should hold on."

The breakthrough came in using

US census data, which was

cross-sectional and provided a large number of observations. Douglas presented the results of these findings, along with those for other countries, at his 1947 address as president of the

American Economic Association

The American Economic Association (AEA) is a learned society in the field of economics, with approximately 23,000 members. It publishes several peer-reviewed journals, including the Journal of Economic Literature, American Economic Review, an ...

. Shortly afterwards, Douglas went into politics and was stricken by ill health—resulting in little further development on his side. However, two decades later, his production function was widely used, being adopted by economists such as

Paul Samuelson

Paul Anthony Samuelson (May 15, 1915 – December 13, 2009) was an American economist who was the first American to win the Nobel Memorial Prize in Economic Sciences. When awarding the prize in 1970, the Swedish Royal Academies stated that he "h ...

and

Robert Solow

Robert Merton Solow, GCIH (; August 23, 1924 – December 21, 2023) was an American economist who received the 1987 Nobel Memorial Prize in Economic Sciences, and whose work on the theory of economic growth culminated in the exogenous growth ...

.

The Cobb–Douglas production function is especially notable for being the first time an aggregate or economy-wide production function had been developed, estimated, and then presented to the profession for analysis; it marked a landmark change in how economists approached macroeconomics from a microeconomics perspective.

Positivity of marginal products

The marginal product of a factor of production is the change in output when that factor of production changes, holding constant all the other factors of production as well as the total factor productivity.

The marginal product of capital,

corresponds to the first derivative of the production function with respect to capital:

:

Because

(and

as well), we find out that the marginal product of capital is always positive; that is, increasing capital leads to an increase in output.

We also find that increasing the total factor productivity

increases the marginal product of capital.

An analogous reasoning holds for labor.

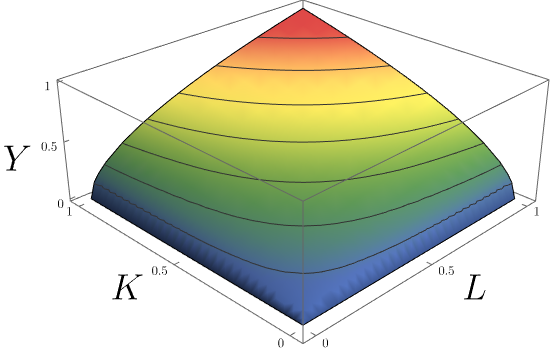

Law of diminishing returns

Taking the derivative of the marginal product of capital with respect to capital (i.e., taking the second derivative of the production function with respect to capital), we have:

:

Because

, then

and so

.

Thus, this function satisfies the law of "diminishing returns"; that is, the marginal product of capital, while always positive, is declining. As capital increases (holding labor and total factor productivity constant), the output increases but at a diminishing rate.

A similar reasoning holds for labor.

Cross derivatives

We can study what happens to the marginal product of capital when labor increases by taking the partial derivative of the marginal product of capital with respect to labor, that is, the cross-derivative of output with respect to capital and labor:

Since

, an increase in labor raises the marginal product of capital.

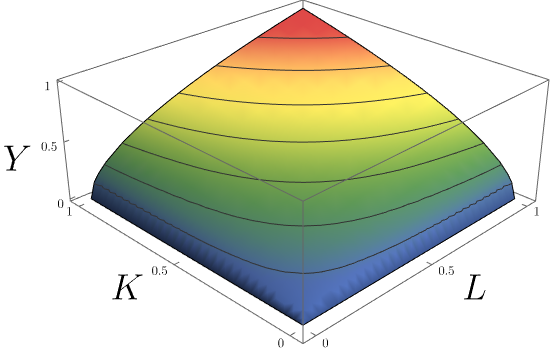

Returns to scale

Output elasticity measures the responsiveness of output to a change in levels of either labor or capital used in production,

ceteris paribus

' (also spelled ') (Classical ) is a Latin phrase, meaning "other things equal"; some other English translations of the phrase are "all other things being equal", "other things held constant", "all else unchanged", and "all else being equal". ...

. For example, if , a increase in capital usage would lead to approximately a increase in output.

Sometimes the term has a more restricted meaning, requiring that the function display

constant returns to scale

In economics, the concept of returns to scale arises in the context of a firm's production function. It explains the long-run linkage of increase in output (production) relative to associated increases in the inputs (factors of production).

In th ...

, meaning that increasing capital ''K'' and labor ''L'' by a factor ''k'' also increases output ''Y'' by the same factor, that is,

. This holds if

.

If

, then returns to scale are decreasing, meaning that an increase of capital ''K'' and labor ''L'' by a factor ''k'' will produce an increase in output ''Y'' smaller than a factor ''k'', that is

In

In  In

In