Class C share on:

[Wikipedia]

[Google]

[Amazon]

In

This is the most common way to value a stock. It is represented by the stock price divided by the company’s most recent

This is the most common way to value a stock. It is represented by the stock price divided by the company’s most recent

The P/B ratio is calculated using a company’s current market value divided by its

The P/B ratio is calculated using a company’s current market value divided by its

The D/E ratio is a leverage ratio which determines how much debt a company uses to finance its assets. It evaluates the company’s financial leverage by dividing total liabilities by shareholder equity. This ratio is used in

The D/E ratio is a leverage ratio which determines how much debt a company uses to finance its assets. It evaluates the company’s financial leverage by dividing total liabilities by shareholder equity. This ratio is used in

finance

Finance refers to monetary resources and to the study and Academic discipline, discipline of money, currency, assets and Liability (financial accounting), liabilities. As a subject of study, is a field of Business administration, Business Admin ...

, a Class B share or Class C share is a designation for a share class

In finance, a share class or share classification are different types of Share (finance), shares in company share capital that have different levels of voting rights. For example, a company might create two classes of shares class A share and a cla ...

of a common

Common may refer to:

As an Irish surname, it is anglicised from Irish Gaelic surname Ó Comáin.

Places

* Common, a townland in County Tyrone, Northern Ireland

* Boston Common, a central public park in Boston, Massachusetts

* Cambridge Com ...

or preferred stock

Preferred stock (also called preferred shares, preference shares, or simply preferreds) is a component of share capital that may have any combination of features not possessed by common stock, including properties of both an equity and a debt ins ...

that typically has strengthened voting rights or other benefits compared to a Class A share

In finance, a class A share refers to a share classification of common or preferred stock that typically has enhanced benefits with respect to dividends, asset sales, or voting rights compared to Class B or Class C shares. There may be restri ...

that may have been created. The equity structure, or how many types of shares are offered, is determined by the corporate charter

A charter is the grant of authority or rights, stating that the granter formally recognizes the prerogative of the recipient to exercise the rights specified. It is implicit that the granter retains superiority (or sovereignty), and that the ...

.

B share can also refer to various terms relating to stock classes:

* B share (mainland China) B shares (, officially Domestically Listed Foreign Investment Shares) on the Shanghai and Shenzhen stock exchanges refers to those that are traded in foreign currencies. Shares that are traded on the two mainland Chinese stock exchanges in Renminbi ...

, a class of stock on the Shanghai

Shanghai, Shanghainese: , Standard Chinese pronunciation: is a direct-administered municipality and the most populous urban area in China. The city is located on the Chinese shoreline on the southern estuary of the Yangtze River, with the ...

and Shenzhen

Shenzhen is a prefecture-level city in the province of Guangdong, China. A Special economic zones of China, special economic zone, it is located on the east bank of the Pearl River (China), Pearl River estuary on the central coast of Guangdong ...

stock exchanges

* B share (NYSE), a class of stock on the New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District, Manhattan, Financial District of Lower Manhattan in New York City. It is the List of stock exchanges, largest stock excha ...

Most of the time, Class B shares may have lower repayment priorities in the event a company declares bankruptcy

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the deb ...

. Each company’s classes of stock differs and more information is often included in the company’s prospectus. If held long term, Class B shares may also be converted to Class A shares. There are also different reasons for creating Class B shares within a company—there are, however, similar arrangements which companies seem to use when it comes to equity structure.

Class B common shares can be invested in through mutual fund

A mutual fund is an investment fund that pools money from many investors to purchase Security (finance), securities. The term is typically used in the United States, Canada, and India, while similar structures across the globe include the SICAV in ...

s, or through the public market

A marketplace, market place, or just market, is a location where people regularly gather for the purchase and sale of provisions, livestock, and other goods. In different parts of the world, a marketplace may be described as a '' souk'' (from ...

(stock exchange). There are also Class B shares which are referred to as preferred shares in certain companies. Before investing in the shares, investors will look at different financial ratio

A financial ratio or accounting ratio states the relative magnitude of two selected numerical values taken from an enterprise's financial statements. Often used in accounting, there are many standard ratios used to try to evaluate the overall fin ...

s which will help them value the share and aid in the decision of investing in the stock.

Definition and Application

A share is defined as anownership

Ownership is the state or fact of legal possession and control over property, which may be any asset, tangible or intangible. Ownership can involve multiple rights, collectively referred to as '' title'', which may be separated and held by dif ...

of equity in a corporation. Class B shares are known as a type of classification of common stock

Common stock is a form of corporate equity ownership, a type of security. The terms voting share and ordinary share are also used frequently outside of the United States. They are known as equity shares or ordinary shares in the UK and other C ...

which may have more or fewer voting rights

Suffrage, political franchise, or simply franchise is the right to vote in representative democracy, public, political elections and referendums (although the term is sometimes used for any right to vote). In some languages, and occasionally in ...

as compared to Class A shares. In the event of bankruptcy

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the deb ...

, Class B shares may have a lower repayment priority as well.

Class B shares are financial instrument

Financial instruments are monetary contracts between parties. They can be created, traded, modified and settled. They can be cash (currency), evidence of an ownership, interest in an entity or a contractual right to receive or deliver in the form ...

s which represent ownership in a company and proportionate claims on its asset

In financial accounting, an asset is any resource owned or controlled by a business or an economic entity. It is anything (tangible or intangible) that can be used to produce positive economic value. Assets represent value of ownership that can b ...

s. They exist in companies with dual-class structures or with multiple classes of stock with differences in their voting rights attached to each class. The creation of multiple classes are designed to allow founders

Founder or Founders may refer to:

Places

*Founders Park, a stadium in South Carolina, formerly known as Carolina Stadium

* Founders Park, a waterside park in Islamorada, Florida

Arts, entertainment, and media

* Founders (''Star Trek''), the ali ...

of the company to maintain ownership over their company as well as to control the company’s direction. Additionally, having different share classes can be a way for companies to reward early investor

An investor is a person who allocates financial capital with the expectation of a future Return on capital, return (profit) or to gain an advantage (interest). Through this allocated capital the investor usually purchases some species of pr ...

s: For example, certain companies may designate Class B shareholder

A shareholder (in the United States often referred to as stockholder) of corporate stock refers to an individual or legal entity (such as another corporation, a body politic, a trust or partnership) that is registered by the corporation as the ...

s as those who invested with the company before a certain period, thus the investors may enjoy benefits such as higher dividend

A dividend is a distribution of profits by a corporation to its shareholders, after which the stock exchange decreases the price of the stock by the dividend to remove volatility. The market has no control over the stock price on open on the ex ...

s compared to those in other share classes. These details will be illustrated clearly in the company’s bylaws.

Like shares in other share classes, investors can invest in Class B shares through the stock market

A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on businesses; these may include ''securities'' listed on a public stock exchange a ...

. Stock markets are secondary markets

The secondary market, also called the aftermarket and follow on public offering, is the financial market in which previously issued financial instruments such as stock, bonds, options, and futures are bought and sold. The initial sale of the ...

where current shareholders can transact with potential investors. Another way to invest in Class B shares is through regulated

Regulation is the management of complex systems according to a set of rules and trends. In systems theory, these types of rules exist in various fields of biology and society, but the term has slightly different meanings according to context. Fo ...

over-the-counter

Over-the-counter (OTC) drugs are medicines sold directly to a consumer without a requirement for a prescription from a healthcare professional, as opposed to prescription drugs, which may be supplied only to consumers possessing a valid pres ...

(OTC) exchanges. However, the shares listed there tend to be riskier because they tend to list companies which have failed to meet to more stringent listing criteria of larger exchanges. Additionally, stocks traded OTC usually belong to smaller companies which do not have the resources

''Resource'' refers to all the materials available in our environment which are Technology, technologically accessible, Economics, economically feasible and Culture, culturally Sustainability, sustainable and help us to satisfy our needs and want ...

to be listed on formal exchanges.

The price of the Class B shares fluctuates perpetually as investors reassess the intrinsic value of shares. The decision investors makes as to whether to buy, sell, or hold the stock is based on whether they believe that the stock is undervalued, overvalued, or valued correctly. The price at which someone wishes to buy any share, be it Class B or other classes, is called a bid price

A bid price is the highest price that a buyer (i.e., bidder) is willing to pay for some goods. It is usually referred to simply as the "bid". In bid and ask, the bid price stands in contrast to the ask price or "offer", and the difference betw ...

. On the other hand, the price at which someone wishes to sell, is known as an ask price

Ask price (also called offer price, offer, selling price, asking price, or simply ask) is the price a seller states they will accept.

The seller may qualify the stated asking price as firm or negotiable. Firm means the seller is implying that th ...

or offer. For popular stocks, buyers and sellers will be on each side bidding and asking for new prices consistently. The price of the bid will go up if the demand

In economics, demand is the quantity of a goods, good that consumers are willing and able to purchase at various prices during a given time. In economics "demand" for a commodity is not the same thing as "desire" for it. It refers to both the desi ...

is more than the supply

Supply or supplies may refer to:

*The amount of a resource that is available

**Supply (economics), the amount of a product which is available to customers

**Materiel, the goods and equipment for a military unit to fulfill its mission

*Supply, as ...

. On the contrary, if the supply is more than the demand, the bid price will go down.

History of Class B Shares

Berkshire Hathaway

Berkshire Hathaway

Berkshire Hathaway Inc. () is an American multinational conglomerate holding company headquartered in Omaha, Nebraska. Originally a textile manufacturer, the company transitioned into a conglomerate starting in 1965 under the management of c ...

was the first company to introduce 517,500 new Class B shares into the market in 1996. The company demonstrated the differences between Class A and B shares clearly—stating that the Class B common stock has the economic interests equivalent to 1/30th of a Class A common stock, but has only 1/200th of the voting rights of a Class A common stock. This meant that each share of Class A stock could initially be converted to 30 shares of Class B stock at the option of the holder.

Warren Buffett

Warren Edward Buffett ( ; born August 30, 1930) is an American investor and philanthropist who currently serves as the chairman and CEO of the conglomerate holding company Berkshire Hathaway. As a result of his investment success, Buffett is ...

, the CEO

A chief executive officer (CEO), also known as a chief executive or managing director, is the top-ranking corporate officer charged with the management of an organization, usually a company or a nonprofit organization.

CEOs find roles in variou ...

of Berkshire Hathaway, said at the 1996 annual meeting that the intended purpose of Class B shares was made to match the demand for those shares, and was aimed to prevent false inducements. Additionally, unequal voting shares are created so that owners of the company do not have to give up control, but can still tap into the public equity market

A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on businesses; these may include ''securities'' listed on a public stock exchange a ...

for financing. Furthermore, the price of the new Class B shares attracted many small investors, whilst making Berkshire accessible to the people with modest amounts of capital. Additionally, his intention was to market Class B shares as a type of long-term investment

Investment is traditionally defined as the "commitment of resources into something expected to gain value over time". If an investment involves money, then it can be defined as a "commitment of money to receive more money later". From a broade ...

to prevent prices from fluctuating from supply concerns. Mr Buffett also refused to a stock split

A stock split or stock divide increases the number of shares in a company. For example, after a 2-for-1 split, each investor will own double the number of shares, and each share will be worth half as much.

A stock split causes a decrease of mar ...

and claimed that the high price of Class A shares created an intentional barrier to entry

In theories of competition in economics, a barrier to entry, or an economic barrier to entry, is a fixed cost that must be incurred by a new entrant, regardless of production or sales activities, into a market that incumbents do not have or hav ...

. He added that the company wishes to attract investment-oriented shareholders with long-term horizons.

Ever since, many companies, such as Meta, Groupon

Groupon, Inc. is an American global e-commerce marketplace connecting subscribers with local merchants by offering activities, travel, goods and services in 13 countries. Based in Chicago, Groupon was launched there in November 2008, launching ...

, and Alibaba, have incorporated the dual-class stock structure to ensure owners have control over their company while still being able to reach out to many more potential investors at more attractive share prices.

Valuation Metrics of Class B Shares

There are a few things to take into account before analysts value the Class B shares of a company. Valuation of the shares must account for all of its economic rights. These rights include: liquidations preference, dividend rights, conversion rights, redemption rights, participation rights as well as anti-dilution rights. Like other shares, the intrinsic value of a Class B share helps investors decide if they want to buy a stock. Intrinsic value refers to the fundamental and objective value in the asset. This value is different from themarket value

Market value or OMV (open market valuation) is the price at which an asset would trade in a competitive auction setting. Market value is often used interchangeably with ''open market value'', ''fair value'' or '' fair market value'', although t ...

of a Class B share, if the market price is below the intrinsic value, it may be a good buy. Otherwise, it may be a good sale.

Before investing in Class B shares, investors may value the shares using different metrics to find out which stocks the market has undervalued. Financial ratio

A financial ratio or accounting ratio states the relative magnitude of two selected numerical values taken from an enterprise's financial statements. Often used in accounting, there are many standard ratios used to try to evaluate the overall fin ...

s are used to analyse a company’s fundamentals. Here are some popular financial metrics used by investors to determine the value of a stock.

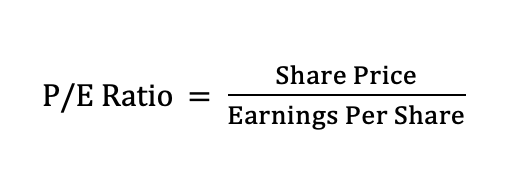

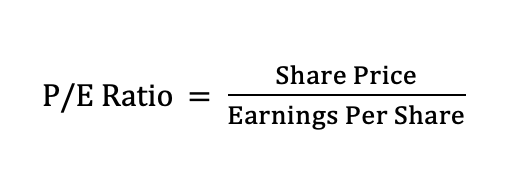

Price-to-Earnings Ratio (P/E Ratio)

This is the most common way to value a stock. It is represented by the stock price divided by the company’s most recent

This is the most common way to value a stock. It is represented by the stock price divided by the company’s most recent earnings per share

Earnings per share (EPS) is the monetary value of earnings per outstanding share of common stock for a company during a defined accounting period, period of time, often a year. It is a key measure of corporate profitability, focusing on the inte ...

(EPS). The lower the P/E ratio, the more attractive the amount of value for the share.

This is because a high P/E ratio indicates that a stock’s price is expensive whereas a low P/E ratio indicates that the stock price is cheaper compared to its earnings. This ratio is important as it helps determine whether a stock is overvalued or , undervalued.

Price-to-Book Ratio (P/B Ratio)

The P/B ratio is calculated using a company’s current market value divided by its

The P/B ratio is calculated using a company’s current market value divided by its book value

In accounting, book value (or carrying value) is the value of an asset according to its balance sheet account balance. For assets, the value is based on the original cost of the asset less any depreciation, amortization or impairment costs made ...

. The balance sheet

In financial accounting, a balance sheet (also known as statement of financial position or statement of financial condition) is a summary of the financial balances of an individual or organization, whether it be a sole proprietorship, a business ...

of the company will inform decision-makers on the company’s book value.

This ratio shows investors the difference between the Class B’s market value and the book value of the stock.

Similar to the P/E ratio, a P/B ratio is generally better if it is lower. A P/B ratio of 0.95, 1 or 1.1 shows that the stock is being traded at what its worth. Hence, investors are more drawn to lower P/B values as it implies that the Class B share is undervalued.

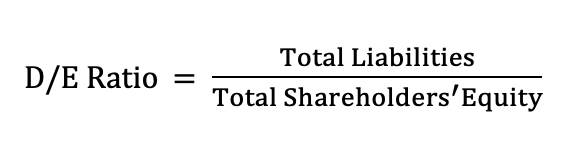

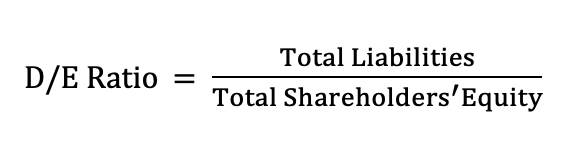

Debt-to-Equity Ratio (D/E Ratio)

The D/E ratio is a leverage ratio which determines how much debt a company uses to finance its assets. It evaluates the company’s financial leverage by dividing total liabilities by shareholder equity. This ratio is used in

The D/E ratio is a leverage ratio which determines how much debt a company uses to finance its assets. It evaluates the company’s financial leverage by dividing total liabilities by shareholder equity. This ratio is used in corporate finance

Corporate finance is an area of finance that deals with the sources of funding, and the capital structure of businesses, the actions that managers take to increase the Value investing, value of the firm to the shareholders, and the tools and analy ...

as it measures the degree the company is financing its operations through debt or their own funding. It also gives insight on the ability of shareholder equity to cover outstanding debt

Debt is an obligation that requires one party, the debtor, to pay money Loan, borrowed or otherwise withheld from another party, the creditor. Debt may be owed by a sovereign state or country, local government, company, or an individual. Co ...

in case the business fails.

A higher risk is often associated with a high D/E ratio. This is because it shows that the company has an aggressive approach when it comes to financing its growth with debt. Additionally, when the D/E ratio gets too high, the cost of borrowing is dramatically increased which may eventually drive down the Class B’s share price of the firm. However, it may also be good as it shows that a firm can easily repay its debt obligations and is using leverage to increase the amount of equity returns.

Differences Between Class A and Class B Shares

General Investments

Different companies have detailed descriptions of their different classes of stock written in their prospectus,bylaws

A by-law (bye-law, by(e)law, by(e) law), is a set of rules or law established by an organization or community so as to regulate itself, as allowed or provided for by some higher authority. The higher authority, generally a legislature or some other ...

, and charter

A charter is the grant of authority or rights, stating that the granter formally recognizes the prerogative of the recipient to exercise the rights specified. It is implicit that the granter retains superiority (or sovereignty), and that the ...

. When there are a few classes of stock in a company, they are usually designated as Class A and Class B – where Class A shares carry more voting rights than Class B shares. The percentage difference in voting rights depends on how the company wishes to structure its stock. However, companies are not legally obliged to structure their classes this way – there are some companies which offer more voting rights for their Class B shares instead.

Class B shares are also usually lower in payment priority as compared to Class A shares. When a company goes bankrupt and is forced to be liquidated, Class A shareholders are likely to be paid faster than Class B shareholders. Class A shareholders also usually have dividend priority, which means that companies distribute dividends to Class A shareholders first.

Technology Arrangement

The technology class arrangement derived its name from its popularity amongsttechnology companies

A technology company (or tech company) is a company that focuses primarily on the manufacturing, support, research and development of—most commonly computing, telecommunication and consumer electronics–based—technology-intensive products and ...

. It usually involves insiders of a company having control over their Class B shares. The Class B shares have about 10 times the voting power of Class A shares, and are not traded on public exchanges. These shares are called "super-voting shares" as they give key company insiders larger control over the company which includes its board and is usually the deciding factor for corporate actions

A corporate action is an event initiated by a public company that brings or could bring an actual change to the debt securities— equity or debt—issued by the company. Corporate actions are typically agreed upon by a company's board of dire ...

. Hence, the "super-voting shares" are usually not publicly traded. One popular example would be the "Google Share Class Structure". The purpose of this structure is argued to ensure stability of the company and prevent the board and management from feeling short-term pressure, which in turn allows them to focus on long-term goals.

High-Priced Arrangement

Some companies value their Class A shares at extremely high prices. Although these Class A shares are publicly owned and traded on the market, they are generally out of reach for the typical investor. In these cases, firms create Class B shares which trade at a mere fraction of the Class A’s share. The Class B share, however, has only a small fraction of voting power. These companies create both share classes in a way where price and voting power are not proportional. One example of this arrangement is the Berkshire Hathaway structure.Mutual Funds

Inmutual funds

A mutual fund is an investment fund that pools money from many investors to purchase securities. The term is typically used in the United States, Canada, and India, while similar structures across the globe include the SICAV in Europe ('investmen ...

, there are a few differences which set the share classes apart. In terms of fees, Class A share funds charge a “front load”, meaning that a percentage of the purchase amount has to be paid each time shares are bought as commission for the mutual fund’s managers.

These front loads can go up to 5% or even higher. On the other hand, Class B share funds charge a “back-end load”, also known as a “contingent deferred sales charge” (CSDC). This means that when the investor chooses to sell, a percentage of the dollar value of shares sold has to be paid. This back-end load, however, decreases directly proportional to the holding period of the fund, and is eventually eliminated. Class B shares can also automatically be converted to Class A shares after a specific holding period, which is beneficial because Class A shares have a lower yearly expense ratio

The expense ratio of a stock or asset fund is the total percentage of fund assets used for administrative, management, advertising (12b-1), and all other expenses. An expense ratio of 1% per annum means that each year 1% of the fund's total assets ...

.

Class B mutual fund shares are seen to be a good investment if investors have less cash and a longer time horizon. To avoid the exit fee, an investor should typically remain in the fund for five to eight years.

Why Companies Create Class B Shares

Companies choose to create Class B shares and dual-class structures to allow founders, and other corporate insiders to gain almost complete voting control over the company. This is crucial in the early years of apublic company

A public company is a company whose ownership is organized via shares of share capital, stock which are intended to be freely traded on a stock exchange or in over-the-counter (finance), over-the-counter markets. A public (publicly traded) co ...

because founders are able to execute their own vision without disruption while being able to tap into the public market’s financing, and being able to enjoy the perks of being a public company.

Companies choose to mitigate the risk of exposing their governance and assets to the public market by defining different classes of shares to ensure corporate insiders are in control of the voting rights. With Class B shares in a company, authorities are able to assign different rights to different classes of stockholders. They use different classifications to address issues such as voting authority, dividends, as well as rights to capital and assets.

Meta

An example is the company Meta, formerly known as Facebook.Mark Zuckerberg

Mark Elliot Zuckerberg (; born May 14, 1984) is an American businessman who co-founded the social media service Facebook and its parent company Meta Platforms, of which he is the chairman, chief executive officer, and controlling sharehold ...

, the CEO of Meta, owns 360 million Class B shares which gives him complete voting power over other shareholders. Additionally, through agreements with other Class B shareholders, he also controls the votes of 32 other million Class B shares. This gives him control of about 392 million Class B shares, amounting to a total of around 90% of Class B shares available. This amounts to 58% of Meta's vote in total. The ownership of majority of the shares has allowed Zuckerberg to act independently in his decision. One example is his decision to purchase Instagram

Instagram is an American photo sharing, photo and Short-form content, short-form video sharing social networking service owned by Meta Platforms. It allows users to upload media that can be edited with Social media camera filter, filters, be ...

for US$1 billion, which was made without consulting other Class B shareholders. The company's board has also rejected proposals which aim to weaken Zuckerberg's grip on the company which includes removing the Class B shares in Meta.

Alibaba Group

Another reason for having the founders maintain absolute control of their company is that founders are able to focus on the long-term strategic development of their company. TheExecutive Chairman

The chair, also chairman, chairwoman, or chairperson, is the presiding officer of an organized group such as a board, committee, or deliberative assembly. The person holding the office, who is typically elected or appointed by members of the gro ...

of Alibaba Group, Jack Ma

Ma Yun (; born 10 September 1964), or more commonly referred as Jack Ma, is a Chinese businessman and philanthropist. He is the founder of the Jack Ma Foundation, and co-founder of Alibaba Group and Yunfeng Capital. As of May 2025, Ma's ne ...

, has added that his company’s voting structure aims to preserve the firm’s culture whilst avoiding short-term behaviour at the expense of long-term development. The company is controlled by 28 " partners", including insiders and Ma himself. With this structure, Ma's dictatorship blocks the possibility of any contested election. This means that shareholders will not be able to have a say no matter how the equity ownership evolves in the future.

Google LLC

Google

Google LLC (, ) is an American multinational corporation and technology company focusing on online advertising, search engine technology, cloud computing, computer software, quantum computing, e-commerce, consumer electronics, and artificial ...

had similar intentions in releasing their Class B shares to make it harder for the public to influence the company’s strategic decisions through their voting rights. Their company’s Class A stock has one vote per share. On the other hand, Google's Class B stock, which is owned and split amongst CEO Eric Schmidt

Eric Emerson Schmidt (born April 27, 1955) is an American businessman and former computer engineer who was the chief executive officer of Google from 2001 to 2011 and the company's chairman, executive chairman from 2011 to 2015. He also was the ...

and founders Larry Page

Lawrence Edward Page (born March 26, 1973) is an American businessman, computer engineer and computer scientist best known for co-founding Google with Sergey Brin.

Page was chief executive officer of Google from 1997 until August 2001 when ...

and Sergey Brin

Sergey Mikhailovich Brin (; born August 21, 1973) is an American computer scientist and businessman who co-founded Google with Larry Page. He was the president of Google's parent company, Alphabet Inc., until stepping down from the role on D ...

, was created to have 10 votes per share. Although the three of them only own 31.3% of the total outstanding shares

Shares outstanding are all the shares of a corporation that have been authorized, issued and purchased by investors and are held by them. They are distinguished from treasury shares, which are shares held by the corporation itself, thus representi ...

and 86 million Class B shares, because of the voting ratio, the trio controls 66.2% of Google's voting power. Google’s CEO said that the purpose of creating Class B shares was to make it easier for management to follow a “long-term, innovation-based growth strategy”.

Conversion of Share Classes

Shareholders may be able to convert their Class A shares into Class B shares or vice versa depending on what is stated in their bylaws and charter. Fees will also be collected by the company which helps draft legal documents for the conversion of shares in addition to other services in the process such as reviewing, drafting and also updating articles. Reasons for changing share classes include: * Opportunities to change the management of the company * Dividend allocation and capital distribution * Alteration of voting rights In order to change share classes, members of the company must pass an ordinary resolution with the following details: # Name of shareholder # Number of shares changed # Previous class of shares # New class of shares Shareholders with Class A shares registered under the name of another nominee must contact the nominee to request a conversion. After approving the resolution, the company will have to submit a form to the regulatory authority in the country, where the process is given full validation. Later on, new share certificates will be issued to the shareholders who have converted their shares. The application is also normally binding and cannot be revoked.Shares of Class B Preferred Stock

Some companies may refer to their Class B shares as preferred stock. These stocks are described as a hybrid between bonds and common stock as it has features of both securities. These dividends which come with these shares are paid to shareholders before common shareholders when a company goes bankrupt. Preferred stockholders tend to have a higher claim on asset distributions or dividends compared to common stockholders. This is because of the higher risk assumed with the shares. More information on the preferred stock are dependent on the company and written in the company’s bylaws and charter. Preferred Class B shares generate income which gets preferential tax treatment, and most companies do not give preferred shareholders voting rights. These shares may also be convertible to a predetermined number of common stock, depending on the company’s bylaws. Shareholders’ dividends from these stocks usually yield more than common stock and are paid monthly or quarterly. When preferred shares are issued, issuers avoid dilution of control as there are limited or no voting rights which come with the shares. Companies can also buy back the preferred stock and if the price is above the par value, investors may receive a profit from the stock.See also

*H share

H shares () refer to the shares of companies incorporated in mainland China that are traded on the Hong Kong Stock Exchange. Many companies float their shares simultaneously on the Hong Kong market and one of the two mainland Chinese stock excha ...

* Red chip

Red chip stocks () are the stocks of mainland China companies incorporated outside mainland China and listed in Hong Kong. It refers to businesses based in mainland China and with (majority) shares controlled either directly or indirectly by a ...

* P chip

The term P chip () refers to Chinese companies listed on the Hong Kong Stock Exchange which are incorporated in the Cayman Islands, Bermuda and the British Virgin Islands with operations in mainland China, and are run by private sector Chinese bus ...

* S chip

S chips () are Chinese companies listed on the Singapore Exchange. Their shares are known as S shares. S chips are incorporated in Singapore, the British Virgin Islands, the Cayman Islands and Bermuda and have their business operations in mainland ...

* N share

N-Shares () refers to Chinese companies listed on the NYSE, NASDAQ, or the NYSE MKT. The term stands for New York. They may or may not be incorporated in China, but they have their main business operations in mainland China. Most of them are incorp ...

* L share L-Shares () refers to Chinese companies listed on the London Stock Exchange. The listed companies are incorporated in the Cayman Islands, Bermuda, British Virgin Islands and Jersey, but they have their main business operations in mainland China.

...

* G share

G shares () refers to shares traded in the stock exchanges of mainland China that belong to companies that have accomplished stock right division reforms, and have regained business on the market. Owing to the provisional designation of the letter ...

* China Concepts Stock

References

{{reflist, colwidth=30em Equity securities