Allocative Efficiency on:

[Wikipedia]

[Google]

[Amazon]

Allocative efficiency is a state of the economy in which production is aligned with the preferences of consumers and producers; in particular, the set of outputs is chosen so as to maximize the

''Measurement of Productivity and Efficiency: Theory and Practice''

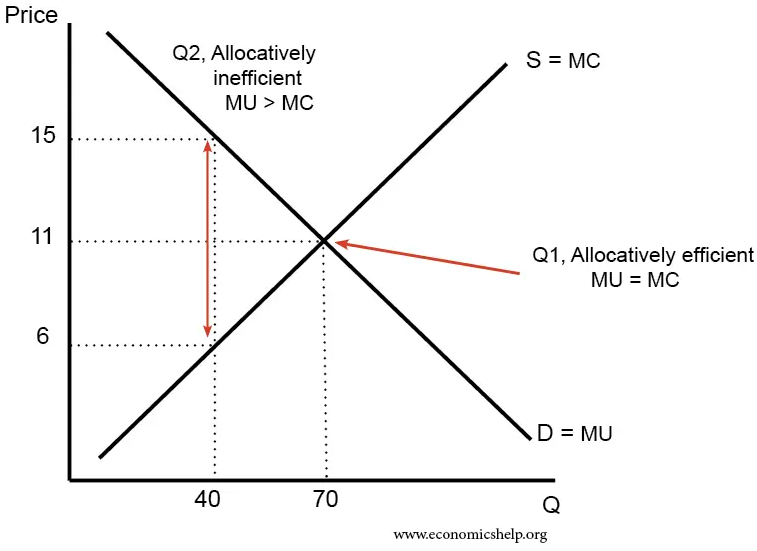

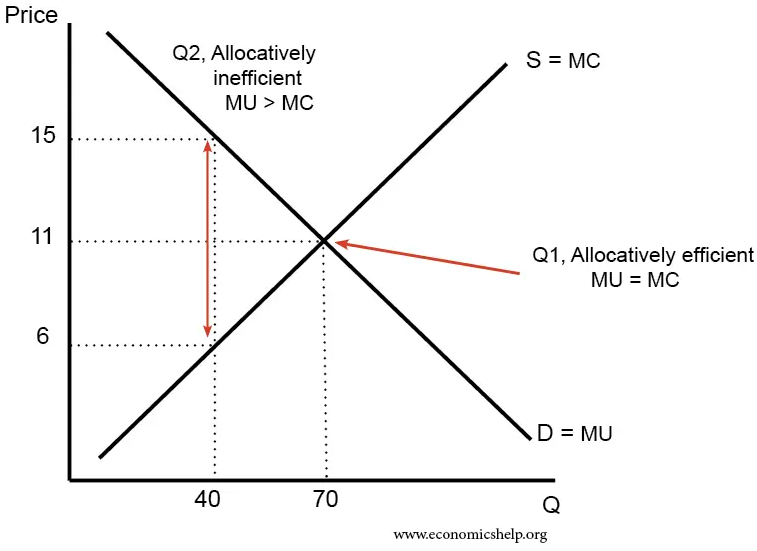

From the graph we can see that at the output of 40, the marginal cost of good is $6 while the price that consumer is willing to pay is $15. It means the marginal utility of the consumer is higher than the marginal cost. The optimal level of the output is 70, where the marginal cost equals to marginal utility. At the output of 40, this product or service is under-consumed by the society. By increasing the output to 70, the price will fall to $11. Meanwhile, the society would benefit from consuming more of the good or service.

From the graph we can see that at the output of 40, the marginal cost of good is $6 while the price that consumer is willing to pay is $15. It means the marginal utility of the consumer is higher than the marginal cost. The optimal level of the output is 70, where the marginal cost equals to marginal utility. At the output of 40, this product or service is under-consumed by the society. By increasing the output to 70, the price will fall to $11. Meanwhile, the society would benefit from consuming more of the good or service.

social welfare

Welfare spending is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance p ...

of society. This is achieved if every produced good or service has a marginal benefit

Marginal utility, in mainstream economics, describes the change in ''utility'' (pleasure or satisfaction resulting from the consumption) of one unit of a good or service. Marginal utility can be positive, negative, or zero. Negative marginal utilit ...

equal to or greater than the marginal cost

In economics, the marginal cost is the change in the total cost that arises when the quantity produced is increased, i.e. the cost of producing additional quantity. In some contexts, it refers to an increment of one unit of output, and in others it ...

of production.

Description

Ineconomics

Economics () is a behavioral science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services.

Economics focuses on the behaviour and interac ...

, allocative efficiency entails production at the point on the production possibilities frontier

Production may refer to:

Economics and business

* Production (economics)

* Production, the act of manufacturing goods

* Production, in the outline of industrial organization, the act of making products (goods and services)

* Production as a stat ...

that is optimal for society.

In contract theory

From a legal point of view, a contract is an institutional arrangement for the way in which resources flow, which defines the various relationships between the parties to a transaction or limits the rights and obligations of the parties.

From an ...

, allocative efficiency is achieved in a contract in which the skill demanded by the offering party and the skill of the agreeing party are the same.

Resource allocation efficiency includes two aspects:

# At the macro aspect, it is the allocation efficiency of social resources, which is achieved through the economic system arrangements of the entire society.

# The micro aspect is the efficient use of resources, which can be understood as the production efficiency of the organization, which can be improved through innovation and progress within the organizations.

Although there are different standards of evaluation for the concept of allocative efficiency, the basic principle asserts that in any economic system, choices in resource allocation produce both "winners" and "losers" relative to the choice being evaluated. The principles of rational choice, individual maximization, utilitarianism

In ethical philosophy, utilitarianism is a family of normative ethical theories that prescribe actions that maximize happiness and well-being for the affected individuals. In other words, utilitarian ideas encourage actions that lead to the ...

and market theory further suppose that the outcomes for winners and losers can be identified, compared, and measured. Under these basic premises, the goal of attaining allocative efficiency can be defined according to some principles where some allocations are subjectively better than others. For example, an economist might say that a policy change is an allocative improvement as long as those who benefit from the change (winners) gain more than the losers lose (see Kaldor–Hicks efficiency).

An allocatively efficient economy produces an "optimal mix" of commodities. A firm is allocatively efficient when its price is equal to its marginal costs (that is, P = MC) in a perfect market. The demand

In economics, demand is the quantity of a goods, good that consumers are willing and able to purchase at various prices during a given time. In economics "demand" for a commodity is not the same thing as "desire" for it. It refers to both the desi ...

curve coincides with the marginal utility

Marginal utility, in mainstream economics, describes the change in ''utility'' (pleasure or satisfaction resulting from the consumption) of one unit of a good or service. Marginal utility can be positive, negative, or zero. Negative marginal utilit ...

curve, which measures the (private) benefit of the additional unit, while the supply

Supply or supplies may refer to:

*The amount of a resource that is available

**Supply (economics), the amount of a product which is available to customers

**Materiel, the goods and equipment for a military unit to fulfill its mission

*Supply, as ...

curve coincides with the marginal cost

In economics, the marginal cost is the change in the total cost that arises when the quantity produced is increased, i.e. the cost of producing additional quantity. In some contexts, it refers to an increment of one unit of output, and in others it ...

curve, which measures the (private) cost of the additional unit. In a perfect market, there are no externalities, implying that the demand curve is also equal to the social benefit of the additional unit, while the supply curve measures the social cost of the additional unit. Therefore, the market equilibrium, where demand meets supply, is also where the marginal social benefit equals the marginal social costs. At this point, the net social benefit is maximized, meaning this is the allocative efficient outcome. When a market fails to allocate resources efficiently, there is said to be market failure

In neoclassical economics, market failure is a situation in which the allocation of goods and services by a free market is not Pareto efficient, often leading to a net loss of economic value.Paul Krugman and Robin Wells Krugman, Robin Wells (2006 ...

. Market failure may occur because of imperfect knowledge, differentiated goods, concentrated market power

In economics, market power refers to the ability of a theory of the firm, firm to influence the price at which it sells a product or service by manipulating either the supply or demand of the product or service to increase economic profit. In othe ...

(e.g., monopoly

A monopoly (from Greek language, Greek and ) is a market in which one person or company is the only supplier of a particular good or service. A monopoly is characterized by a lack of economic Competition (economics), competition to produce ...

or oligopoly

An oligopoly () is a market in which pricing control lies in the hands of a few sellers.

As a result of their significant market power, firms in oligopolistic markets can influence prices through manipulating the supply function. Firms in ...

), or externalities

In economics, an externality is an indirect cost (external cost) or indirect benefit (external benefit) to an uninvolved third party that arises as an effect of another party's (or parties') activity. Externalities can be considered as unpriced ...

.

In the single-price model, at the point of allocative efficiency price is equal to marginal cost. At this point the social surplus is maximized with no deadweight loss

In economics, deadweight loss is the loss of societal economic welfare due to production/consumption of a good at a quantity where marginal benefit (to society) does not equal marginal cost (to society). In other words, there are either goods ...

(the latter being the value society puts on that level of output produced minus the value of resources used to achieve that level). Allocative efficiency is the main tool of welfare analysis to measure the impact of markets and public policy upon society and subgroups being made better or worse off.

It is possible to have Pareto efficiency

In welfare economics, a Pareto improvement formalizes the idea of an outcome being "better in every possible way". A change is called a Pareto improvement if it leaves at least one person in society better off without leaving anyone else worse ...

without allocative efficiency: in such a situation, it is impossible to reallocate resources in such a way that someone gains and no one loses (hence we have Pareto efficiency), yet it would be possible to reallocate in such a way that gainers gain more than losers lose (hence with such a reallocation, we do not have allocative efficiency).

Also, for an extensive discussion of various types of allocative efficiency in a production context and their estimations see Sickles and Zelenyuk (2019, Chapter 3, etc).Sickles, R., & Zelenyuk, V. (2019)''Measurement of Productivity and Efficiency: Theory and Practice''

Cambridge

Cambridge ( ) is a List of cities in the United Kingdom, city and non-metropolitan district in the county of Cambridgeshire, England. It is the county town of Cambridgeshire and is located on the River Cam, north of London. As of the 2021 Unit ...

: Cambridge University Press

Cambridge University Press was the university press of the University of Cambridge. Granted a letters patent by King Henry VIII in 1534, it was the oldest university press in the world. Cambridge University Press merged with Cambridge Assessme ...

. doi:10.1017/9781139565981

In view of the Pareto efficiency measurement method, it is difficult to use in actual operation, including the use of human and material resources, which is hard to achieve a full range of efficiency allocation, and it is mainly to make judgments from the allocation of funds; therefore, analyzing the funds in the stock market. Allocation efficiency is used to determine the efficiency of resource allocation in the capital market.

In a perfectly competitive market, capital market resources should be allocated among capital markets under the principle of the highest marginal benefit. Therefore, the most important measurement standard in the capital market is to observe whether capital flows into the enterprise with the best operating efficiency. The most efficient companies should also get a large amount of capital investment, and the less efficient companies should get less capital investment.

There are three conditions that come with Pareto efficiency

; Best trade outcome

: Even if you trade again, individuals cannot get greater benefits from it. At this time, for any two consumers, the marginal substitution rate of any two commodities is the same, and the utility of the two consumers is maximized at the same time.

; Optimal production:

: This economy must be on the boundary of its own production possibilities. At this time, for any two producers who produce different products, the marginal technology substitution rate of the two production factors that need to be input is the same, and the output of the two consumers is maximized at the same time.

; Optimal product mix:

: The combination of products produced by the economy must reflect consumer preferences. At this time, the marginal rate of substitution between any two commodities must be the same as the marginal product conversion rate of any producer between these two commodities.

Examples

A numerical example of allocative efficiency

Allocation efficiency occurs when there is an optimal distribution of goods and services, considering consumer's preference. When the price equals marginal cost of production, the allocation efficiency is at the output level. This is because the optimal distribution is achieved when the marginal utility of good equals the marginal cost. The price that consumer is willing to pay is same as the marginal utility of the consumer. From the graph we can see that at the output of 40, the marginal cost of good is $6 while the price that consumer is willing to pay is $15. It means the marginal utility of the consumer is higher than the marginal cost. The optimal level of the output is 70, where the marginal cost equals to marginal utility. At the output of 40, this product or service is under-consumed by the society. By increasing the output to 70, the price will fall to $11. Meanwhile, the society would benefit from consuming more of the good or service.

From the graph we can see that at the output of 40, the marginal cost of good is $6 while the price that consumer is willing to pay is $15. It means the marginal utility of the consumer is higher than the marginal cost. The optimal level of the output is 70, where the marginal cost equals to marginal utility. At the output of 40, this product or service is under-consumed by the society. By increasing the output to 70, the price will fall to $11. Meanwhile, the society would benefit from consuming more of the good or service.

An example of allocation inefficiency

With the market power, the monopoly can increase the price to gain the super normal profit. The monopolies can set the price above the marginal cost of the production. In this case, the allocation is not efficient. It results in the dead weight welfare loss to the society as a whole. In real life, the government's intervention policy to monopoly enterprises will affect the allocation efficiency. Large-scale downstream companies with more efficient or better products are generally more competitive than other companies. The wholesale prices they get are much lower than those of their competitors. It is conducive to improving the efficiency of allocation. Ind erst and Shaffer (2009) found that banning prices would reduce allocation efficiency and lead to higher wholesale prices for all enterprises. More importantly, social welfare, industry profits, and consumer surplus will all be reduced.See also

* Financial market efficiency *Pareto efficiency

In welfare economics, a Pareto improvement formalizes the idea of an outcome being "better in every possible way". A change is called a Pareto improvement if it leaves at least one person in society better off without leaving anyone else worse ...

* Production-possibility frontier

* Productive efficiency

* X-inefficiency

References

{{reflist 6. Inderst, Roman, and Greg Shaffer. "Market Power, Price Discrimination, and Allocative Efficiency in Intermediate-Goods Markets." The RAND Journal of Economics 40, no. 4 (2009): 658-72. Accessed April 27, 2021. http://www.jstor.org/stable/25593732 Pareto efficiency Price controls Corporate development