2007–10 Recession In The United States on:

[Wikipedia]

[Google]

[Amazon]

In the

Federal Reserve Chair

Federal Reserve Chair

On December 1, 2008, the National Bureau of Economic Research (NBER) declared that the United States entered a recession in December 2007, citing employment and production figures as well as the third quarter decline in GDP. The Dow Jones Industrial Average lost 679 points that same day. On January 4, 2009,

On December 1, 2008, the National Bureau of Economic Research (NBER) declared that the United States entered a recession in December 2007, citing employment and production figures as well as the third quarter decline in GDP. The Dow Jones Industrial Average lost 679 points that same day. On January 4, 2009,

On September 17, 2008, Federal Reserve chairman

On September 17, 2008, Federal Reserve chairman

The recession officially ended in the second quarter of 2009, but the nation's economy continued to be described as in an "

The recession officially ended in the second quarter of 2009, but the nation's economy continued to be described as in an "

United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 ...

, the Great Recession

The Great Recession was a period of market decline in economies around the world that occurred from late 2007 to mid-2009.

was a severe financial crisis

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with Bank run#Systemic banki ...

combined with a deep recession

In economics, a recession is a business cycle contraction that occurs when there is a period of broad decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be tr ...

. While the recession officially lasted from December 2007 to June 2009, it took many years for the economy to recover to pre-crisis levels of employment

Employment is a relationship between two party (law), parties Regulation, regulating the provision of paid Labour (human activity), labour services. Usually based on a employment contract, contract, one party, the employer, which might be a cor ...

and output

Output may refer to:

* The information produced by a computer, see Input/output

* An output state of a system, see state (computer science)

* Output (economics), the amount of goods and services produced

** Gross output in economics, the valu ...

. This slow recovery was due in part to households and financial institutions paying off debts accumulated in the years preceding the crisis along with restrained government spending following initial stimulus efforts. It followed the bursting of the housing bubble

A housing bubble (or housing price bubble) is one of several types of asset price bubbles which periodically occur in the market. The basic concept of a housing bubble is the same as for other asset bubbles, consisting of two main phases. First t ...

, the housing market correction and subprime mortgage crisis

The American subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010, contributing to the 2008 financial crisis. It led to a severe economic recession, with millions becoming unemployed and many busines ...

.

According to the Department of Labor

A ministry of labour (''British English, UK''), or labor (''American English, US''), also known as a department of labour, or labor, is a government department responsible for setting labour standards, labour dispute mechanisms, employment, workfor ...

, roughly 8.7 million jobs (about 7%) were shed from February 2008 to February 2010, and real GDP contracted by 4.2% between Q4 2007 and Q2 2009, making the Great Recession the worst economic downturn since the Great Depression

The Great Depression was a severe global economic downturn from 1929 to 1939. The period was characterized by high rates of unemployment and poverty, drastic reductions in industrial production and international trade, and widespread bank and ...

. The GDP bottom, or trough, was reached in the second quarter of 2009 (marking the technical end of the recession that is defined by "a period of falling economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales"). Real (inflation-adjusted) GDP did not regain its pre-crisis (Q4 2007) peak level until Q3 2011. Unemployment rose from 4.7% in November 2007 to peak at 10% in October 2009, before returning steadily to 4.7% in May 2016. The total number of jobs did not return to November 2007 levels until May 2014. Some areas, such as jobs in public health, have not recovered as of 2023.

Households and non-profit organizations added approximately $8 trillion in debt during the 2000–2008 period (roughly doubling it and fueling the housing bubble), then reduced their debt level from the peak in Q3 2008 until Q3 2012, the only period this debt declined since at least the 1950s. However, the debt held by the public rose from 35% GDP in 2007 to 77% GDP by 2016, as the government spent more while the private sector (e.g., households and businesses, particularly the banking sector) reduced the debt burdens accumulated during the pre-recession decade. President Barack Obama

Barack Hussein Obama II (born August 4, 1961) is an American politician who was the 44th president of the United States from 2009 to 2017. A member of the Democratic Party, he was the first African American president in American history. O ...

declared the bailout measures started under the Bush administration and continued during his administration as completed and mostly profitable as of December 2014.

Background

After the Great Depression of the 1930s, the American economy experienced robust growth, with periodic lesser recessions, for the rest of the 20th century. The federal government enforced the Securities Exchange Act (1934) and The Chandler Act (1938), which tightly regulated the financial markets. The Securities Exchange Act of 1934 regulated the trading of the secondary securities market and The Chandler Act regulated the transactions in the banking sector. There were a few investment banks, small by current standards, that expanded during the late 1970s, such as JP Morgan. The Reagan administration in the early 1980s began a thirty-year period of financial deregulation. The financial sector sharply expanded, in part because investment banks were going public, bringing them vast sums of stockholder capital. From 1978 to 2008, the average salary for workers outside of investment banking in the U.S. increased from $40k to $50k – a 25 percent salary increase - while the average salary in investment banking increased from $40k to $100k – a 150 percent salary increase. Deregulation also precipitated financial fraud - often tied to real estate investments - sometimes on a grand scale, such as thesavings and loan crisis

The savings and loan crisis of the 1980s and 1990s (commonly dubbed the S&L crisis) was the failure of approximately a third of the savings and loan associations (S&Ls or thrifts) in the United States between 1986 and 1995. These thrifts were b ...

. By the end of the 1980s, many workers in the financial sector were being jailed for fraud, but many Americans were losing their life savings. Large investment banks began merging and developing financial conglomerates; this led to the formation of the giant investment banks like Goldman Sachs.

Early suggestions

In the early months of 2008, many observers believed that a U.S.recession

In economics, a recession is a business cycle contraction that occurs when there is a period of broad decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be tr ...

had begun. The collapse of Bear Stearns

The Bear Stearns Companies, Inc. was an American investment bank, securities trading, and brokerage firm that failed in 2008 during the 2008 financial crisis and the Great Recession. After its closure it was subsequently sold to JPMorgan Chas ...

and the resulting financial market turbulence signaled that the crisis would not be mild and brief.

Alan Greenspan

Alan Greenspan (born March 6, 1926) is an American economist who served as the 13th chairman of the Federal Reserve from 1987 to 2006. He worked as a private adviser and provided consulting for firms through his company, Greenspan Associates L ...

, ex-Chairman of the Federal Reserve

The chair of the Board of Governors of the Federal Reserve System is the head of the Federal Reserve, and is the active executive officer of the Board of Governors of the Federal Reserve System. The chairman presides at meetings of the Board.

...

, stated in March 2008 that the 2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

in the United States "is likely to be judged in retrospect as the most wrenching since the end of World War II

World War II or the Second World War (1 September 1939 – 2 September 1945) was a World war, global conflict between two coalitions: the Allies of World War II, Allies and the Axis powers. World War II by country, Nearly all of the wo ...

". A chief economist at Standard & Poor's

S&P Global Ratings (previously Standard & Poor's and informally known as S&P) is an American credit rating agency (CRA) and a division of S&P Global that publishes financial research and analysis on stocks, bonds, and commodities. S&P is co ...

said in March 2008 he had projected a worst-case-scenario in which the country would endure a double-dip recession

Recession shapes or recovery shapes are used by economists to describe different types of recessions and their subsequent recoveries. There is no specific academic theory or classification system for recession shapes; rather the terminology is us ...

, in which the economy would briefly recover in the summer 2008, before plunging again. Under this scenario, the economy's total output, as measured by the gross domestic product (GDP), would drop by 2.2 percentage points, making it among the worst recessions in the post World War II period.

The former head of the National Bureau of Economic Research

The National Bureau of Economic Research (NBER) is an American private nonprofit research organization "committed to undertaking and disseminating unbiased economic research among public policymakers, business professionals, and the academic co ...

said in March 2008 that he believed the country was then in a recession, and it could be a severe one. A number of private economists generally predicted a mild recession ending in the summer of 2008 when the economic stimulus checks going to 130 million households started being spent. A chief economist at Moody's

Moody's Ratings, previously and still legally known as Moody's Investors Service and often referred to as Moody's, is the bond credit rating business of Moody's Corporation, representing the company's traditional line of business and its histo ...

predicted in March 2008 that policymakers would act in a concerted and aggressive way to stabilize the financial markets, and that the economy would suffer, but not enter a prolonged and severe recession. It takes many months before the National Bureau of Economic Research, the unofficial arbiter of when recessions begin and end, would make its own ruling.

According to numbers published by the Bureau of Economic Analysis

The Bureau of Economic Analysis (BEA) of the United States Department of Commerce is a U.S. government agency that provides official macroeconomic and industry statistics, most notably reports about the gross domestic product (GDP) of the United ...

in May 2008, the GDP growth of the previous two quarters was positive. As one common definition of a recession is negative economic growth for at least two consecutive fiscal quarters, some analysts suggested this indicates that the U.S. economy was not in a recession at the time. However, this estimate has been disputed by analysts who argue that if inflation is taken into account, the GDP growth was negative for those two quarters, making it a technical recession. In a May 9, 2008 report, the chief North American economist for investment bank Merrill Lynch

Merrill Lynch, Pierce, Fenner & Smith Incorporated, doing business as Merrill, and previously branded Merrill Lynch, is an American investment management and wealth management division of Bank of America. Along with BofA Securities, the investm ...

wrote that despite the GDP growth reported for the first quarter of 2008, "it is still reasonable to believe that the recession started some time between September and January", on the grounds that the National Bureau of Economic Research's four recession indicators all peaked during that period.

New York's budget director concluded the state of New York was officially in a recession by the summer of 2008. Governor David Paterson

David Alexander Paterson (born May 20, 1954) is an American politician and attorney who served as the 55th governor of New York, succeeding Eliot Spitzer, who resigned, and serving out nearly three years of Spitzer's term from March 2008 to ...

called an emergency economic session of the state legislature for August 19 to push a budget cut of $600 million on top of a hiring freeze and a 7 percent reduction in spending at state agencies that had already been implemented by the Governor. An August 1 report, issued by economists

An economist is a professional and practitioner in the social science discipline of economics.

The individual may also study, develop, and apply theories and concepts from economics and write about economic policy. Within this field there are ...

with Wachovia Bank

Wachovia was a diversified financial services company based in Charlotte, North Carolina. Before its acquisition by Wells Fargo and Company in 2008, Wachovia was the fourth-largest bank holding company in the United States, based on total asset ...

, said Florida was officially in a recession.

White House budget director Jim Nussle maintained at that time that the U.S. had avoided a recession, following revised GDP numbers from the Commerce Department showing a 0.2 percent contraction in the fourth quarter of 2007 down from a 0.6 percent increase, and a downward revision to 0.9 percent from 1 percent in the first quarter of 2008. The GDP for the second quarter was placed at a 1.9 percent expansion, below an expected 2 percent. On the other hand, Martin Feldstein

Martin Stuart Feldstein ( ; November 25, 1939 – June 11, 2019) was an American economist. He was the George F. Baker Professor of Economics at Harvard University and the president emeritus of the National Bureau of Economic Research. He s ...

, who headed the National Bureau of Economic Research and served on the group's recession-dating panel, said he believed the U.S. was in a very long recession and that there was nothing the Federal Reserve could do to change it.

In a CNBC interview at the end of July 2008, Alan Greenspan said he believed the U.S. was not yet in a recession, but that it could enter one due to a global economic slowdown.

A study released by Moody's found two-thirds of the 381 largest metropolitan areas

A metropolitan area or metro is a region consisting of a densely populated urban agglomeration and its surrounding territories which share industries, commercial areas, transport network, infrastructures and housing. A metropolitan area usually ...

in the United States were in a recession. The study also said 28 states were in recession, with 16 at risk. The findings were based on unemployment figures and industrial production data.

In March 2008, financier Warren Buffett

Warren Edward Buffett ( ; born August 30, 1930) is an American investor and philanthropist who currently serves as the chairman and CEO of the conglomerate holding company Berkshire Hathaway. As a result of his investment success, Buffett is ...

stated in a CNBC interview that by a "common sense definition", the U.S. economy was already in a recession. Buffett has also stated that the definition of recession is flawed and that it should be three consecutive quarters of GDP growth that is less than population growth. However, the U.S. only experienced two consecutive quarters of GDP growth less than population growth.

Causes

Federal Reserve Chair

Federal Reserve Chair Ben Bernanke

Ben Shalom Bernanke ( ; born December 13, 1953) is an American economist who served as the 14th chairman of the Federal Reserve from 2006 to 2014. After leaving the Federal Reserve, he was appointed a distinguished fellow at the Brookings Insti ...

testified in September 2010 regarding the causes of the crisis. He wrote that there were shocks or triggers (i.e., particular events that touched off the crisis) and vulnerabilities (i.e., structural weaknesses in the financial system, regulation and supervision) that amplified the shocks. Examples of triggers included: losses on subprime mortgage securities that began in 2007 and a run on the shadow banking system

The shadow banking system is a term for the collection of non-bank financial intermediaries (NBFIs) that legally provide services similar to traditional commercial banks but outside normal banking regulations. S&P Global estimates that, at end-2 ...

that began in mid-2007, which adversely affected the functioning of money markets. Examples of vulnerabilities in the ''private'' sector included: financial institution dependence on unstable sources of short-term funding such as repurchase agreements or Repos; deficiencies in corporate risk management; excessive use of leverage (borrowing to invest); and inappropriate usage of derivatives as a tool for taking excessive risks. Examples of vulnerabilities in the ''public'' sector included: statutory gaps and conflicts between regulators; ineffective use of regulatory authority; and ineffective crisis management capabilities. Bernanke also discussed "Too big to fail

"Too big to fail" (TBTF) is a theory in banking and finance that asserts that certain corporations, particularly financial institutions, are so large and so interconnected with an economy that their failure would be disastrous to the greater e ...

" institutions, monetary policy, and trade deficits.

The U.S. Financial Crisis Inquiry Commission

The Financial Crisis Inquiry Commission (FCIC) was established in 2010 in the United States to investigate the causes of the 2008 financial crisis. The commission, led by Phil Angelides, held public hearings, gathered testimony from hundreds, and r ...

reported its findings in January 2011. It concluded that "the crisis was avoidable and was caused by: Widespread failures in financial regulation, including the Federal Reserve's failure to stem the tide of toxic mortgages; Dramatic breakdowns in corporate governance including too many financial firms acting recklessly and taking on too much risk; An explosive mix of excessive borrowing and risk by households and Wall Street that put the financial system on a collision course with crisis; Key policy makers ill prepared for the crisis, lacking a full understanding of the financial system they oversaw; and systemic breaches in accountability and ethics at all levels."

Among the important catalysts of the subprime crisis were the influx of money from the private sector, the banks entering into the mortgage bond market, government policies aimed at expanding homeownership, speculation by many home buyers, and the predatory lending practices of the mortgage lenders, specifically the adjustable-rate mortgage (the 2–28 loan, with a fixed 2 years and 28 years of adjustable rates), that mortgage lenders sold directly or indirectly via mortgage brokers. On Wall Street and in the financial industry, moral hazard

In economics, a moral hazard is a situation where an economic actor has an incentive to increase its exposure to risk because it does not bear the full costs associated with that risk, should things go wrong. For example, when a corporation i ...

lay at the core of many of the causes.

Government policies

A federal inquiry found that some federal government policies (or lack of them) were responsible to a large extent for the recession in the United States and the resultant vast unemployment. Factors include: * The non-depository banking system was not subject to the same risk-taking regulations as the depository banks. The top 5 investment banks at the core of the crisis (Bear Stearns, Lehman Brothers, Merrill Lynch, Goldman Sachs, and Morgan Stanley) had accumulated approximately $4 trillion in debt by 2007 with a high leverage ratio (25:1 or higher) meaning a 4% decline in the value of their assets would render them insolvent. Many housing securities in their portfolios became worthless during the crisis. They were also vulnerable to disruptions in their short-term financing (often overnight in Repo markets). They had been encouraged to add to their debt by the SEC in a 2004 meeting. * GivingFannie Mae

The Federal National Mortgage Association (FNMA), commonly known as Fannie Mae, is a United States government-sponsored enterprise (GSE) and, since 1968, a publicly traded company. Founded in 1938 during the Great Depression as part of the New ...

& Freddie Mac

The Federal Home Loan Mortgage Corporation (FHLMC), commonly known as Freddie Mac, is an American publicly traded, government-sponsored enterprise (GSE), headquartered in Tysons, Virginia.Alt-A An Alt-A mortgage, short for Alternative A-paper, is a type of U.S. Mortgage loan, mortgage that, for various reasons, is considered riskier than A-paper, or "prime", and less risky than "subprime lending, subprime," the riskiest category. For thes ...

and subprime

In finance, subprime lending (also referred to as near-prime, subpar, non-prime, and second-chance lending) is the provision of loans to people in the United States who may have difficulty maintaining the repayment schedule. Historically, subpr ...

investments. In 2008, the sheer size of their retained portfolios and mortgage guarantees led the Federal Housing Finance Agency

The Federal Housing Finance Agency (FHFA) is an independent federal agency in the United States created as the successor regulatory agency of the Federal Housing Finance Board (FHFB), the Office of Federal Housing Enterprise Oversight (OFHEO), ...

to conclude that they would soon be insolvent. Under, GSE status Fannie Mae and Freddie Mac's debt and credit guarantees grew so large, that 90 percent of all residential mortgages are financed through Fannie and Freddie or the Federal Housing Administration

The Federal Housing Administration (FHA), also known as the Office of Housing within the Department of Housing and Urban Development (HUD), is a Independent agencies of the United States government, United States government agency founded by Pr ...

.

Role of Alan Greenspan

Alan Greenspan

Alan Greenspan (born March 6, 1926) is an American economist who served as the 13th chairman of the Federal Reserve from 1987 to 2006. He worked as a private adviser and provided consulting for firms through his company, Greenspan Associates L ...

was the Chairman of the Federal Reserve

The chair of the Board of Governors of the Federal Reserve System is the head of the Federal Reserve, and is the active executive officer of the Board of Governors of the Federal Reserve System. The chairman presides at meetings of the Board.

...

of the United States from 1987 to 2006. He was appointed by President Ronald Reagan

Ronald Wilson Reagan (February 6, 1911 – June 5, 2004) was an American politician and actor who served as the 40th president of the United States from 1981 to 1989. He was a member of the Republican Party (United States), Republican Party a ...

in August 1987 and was reappointed by President Bill Clinton

William Jefferson Clinton (né Blythe III; born August 19, 1946) is an American politician and lawyer who was the 42nd president of the United States from 1993 to 2001. A member of the Democratic Party (United States), Democratic Party, ...

in 1996. He was widely blamed, perhaps fairly or unfairly, as the individual most singly responsible for the housing bubble in the U.S.. Furthermore, he himself understood the full extent of the problem only until it was too late, saying that "I really didn't get it until very late in 2005 and 2006." Greenspan stated that the housing bubble was "fundamentally engendered by the decline in real long-term interest rates", though he also claims that long-term interest rates are beyond the control of central banks because "the market value of global long-term securities is approaching $100 trillion" and thus these and other asset markets are large enough that they "now swamp the resources of central banks".

Greenspan admitted to a congressional committee that he had been "partially wrong" in his hands-off approach towards the banking industry - "I made a mistake in presuming that the self-interests of organisations, specifically banks and others, were such that they were best capable of protecting their own shareholders and their equity in the firms," said Greenspan. That being said, the Federal Reserve did not have the power to wade into the banking sector at the time.

Recession declared by economists

Nobel Memorial Prize

The Nobel Memorial Prize in Economic Sciences, officially the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel (), commonly referred to as the Nobel Prize in Economics(), is an award in the field of economic sciences adminis ...

–winning economist Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American New Keynesian economics, New Keynesian economist who is the Distinguished Professor of Economics at the CUNY Graduate Center, Graduate Center of the City University of New York. He ...

wrote, "This looks an awful lot like the beginning of a second Great Depression."

Rise in unemployment

The Great Recession cost millions of jobs initially and high unemployment lingered for years after the official end of the recession in June 2009. One of the frightening aspects how deep the recession would go, which is one reason Congress passed and President Obama signed theAmerican Recovery and Reinvestment Act

The American Recovery and Reinvestment Act of 2009 (ARRA) (), nicknamed the Recovery Act, was a stimulus package enacted by the 111th U.S. Congress and signed into law by President Barack Obama in February 2009. Developed in response to the G ...

(ARRA) in January 2009. Known as "The Stimulus", ARRA was a roughly $800 billion mix of tax cuts (about one-third) and spending programs (about two-thirds) with the primary impact spread over three years. Many economists argued the stimulus was too small, while conservatives such as the Tea Party argued that deficit reduction was the priority.

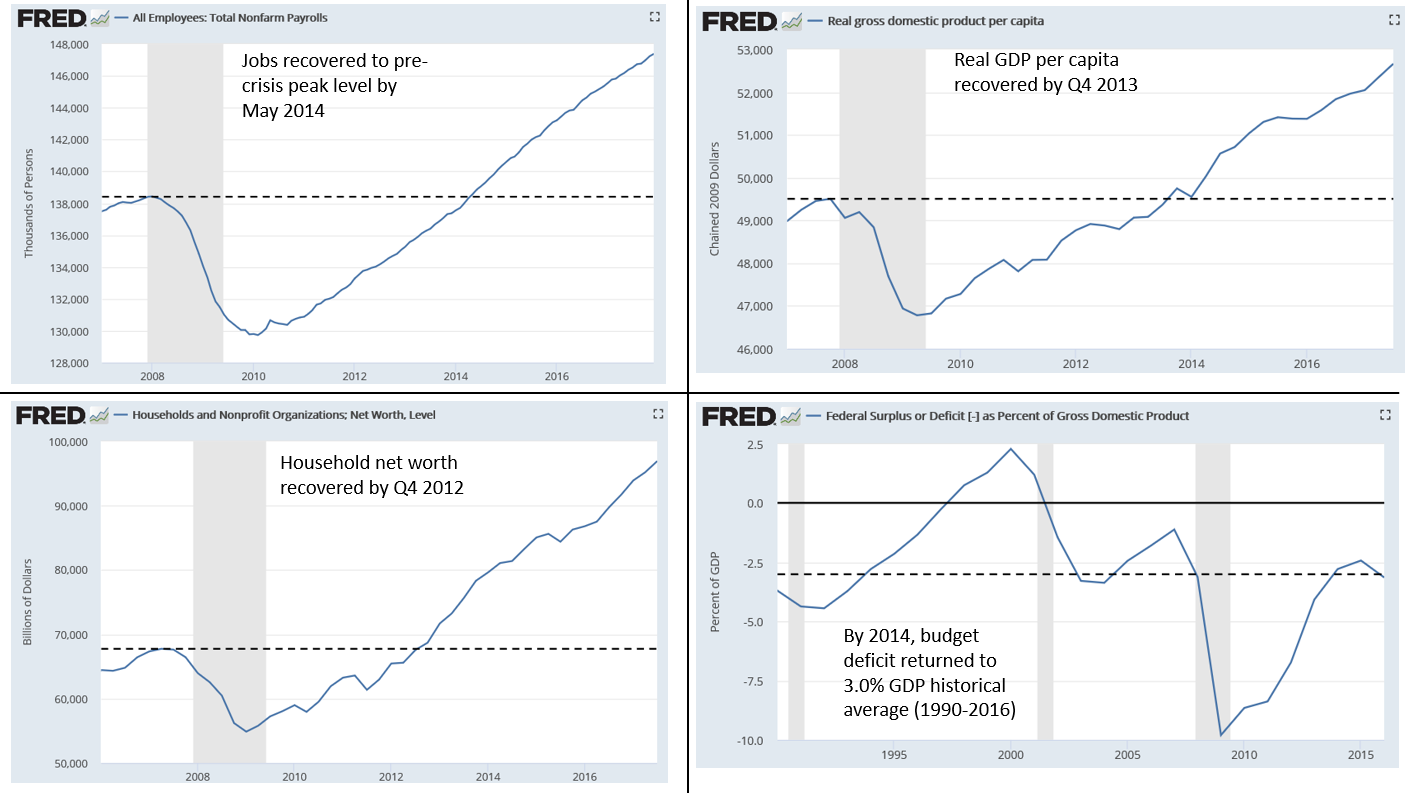

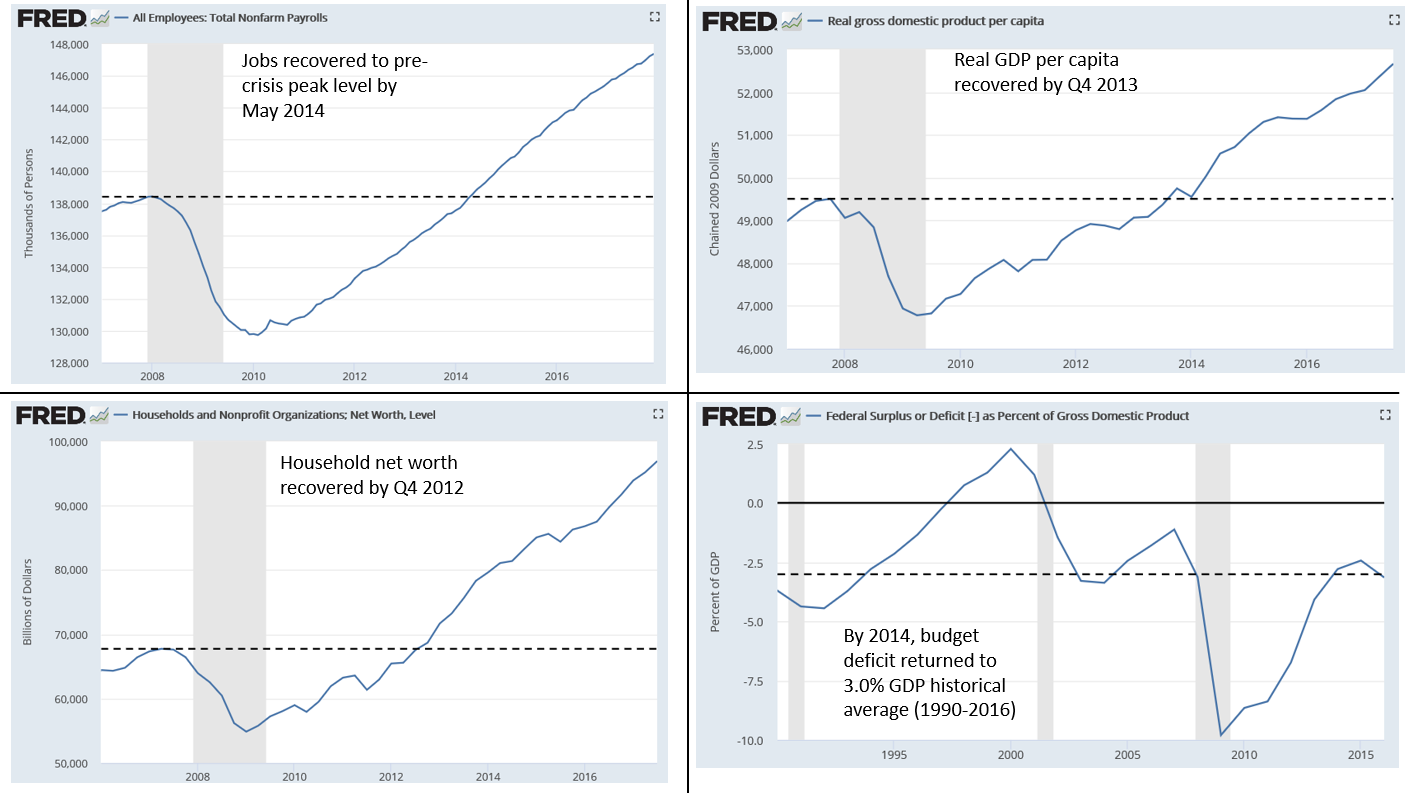

The number of jobs ("total non-farm payrolls" which includes both private sector and government jobs) reached a peak of 138.4 million in January 2008, then fell to a trough (bottom) of 129.7 million in February 2010, a decline of nearly 8.8 million jobs or 6.8%. The number of jobs did not regain the January 2008 level until May 2014. For comparison, the severe 1981-82 recession had a jobs decline of 3.2%. Full-time employment did not regain its pre-crisis level until August 2015.

The unemployment rate ("U-3") rose from the pre-recession level of 4.7% in November 2008 to a peak of 10.0% in October 2009, before steadily falling back to the pre-recession level by May 2016. One factor to consider is that the job count was artificially high and the unemployment rate was artificially low prior to the recession due to an unsustainable housing bubble

A housing bubble (or housing price bubble) is one of several types of asset price bubbles which periodically occur in the market. The basic concept of a housing bubble is the same as for other asset bubbles, consisting of two main phases. First t ...

, which had increased construction and other employment substantially. In 2003, prior to the significant expansion of subprime lending of 2004-2006, the unemployment rate was close to 6%. The wider measure of unemployment ("U-6") which includes those employed part-time for economic reasons or marginally attached to the labor force rose from 8.4% pre-crisis to a peak of 17.1% in October 2009. It did not regain the pre-crisis level until May 2017.

Bloomberg

Bloomberg may refer to:

People

* Daniel J. Bloomberg (1905–1984), audio engineer

* Georgina Bloomberg (born 1983), professional equestrian

* Michael Bloomberg (born 1942), American businessman and founder of Bloomberg L.P.; politician a ...

maintains a "dashboard" of several labor-market variables that illustrates the state of recovery of the labor market.

Liquidity crisis

The major investment banks at the core of the crisis obtained significant funding in overnight repo markets, which were disrupted during the crisis. In effect, there was a run on the essentially unregulated shadow banking (non-depository) banking system, which had grown larger than the regulated depository system. Unable to obtain financing, they merged (in the case of Bear Stearns and Merrill Lynch), declared bankruptcy (Lehman Brothers) or obtained federal depository bank charters and private loans (Goldman Sachs and Morgan Stanley). InsurerAIG

American International Group, Inc. (AIG) is an American multinational finance and insurance corporation with operations in more than 80 countries and jurisdictions. As of 2023, AIG employed 25,200 people. The company operates through three core ...

, which had guaranteed many of the liabilities of these and other banks around the globe through derivatives called credit default swaps, also was bailed out and taken over by the government at an initial cost exceeding $100 billion. The bailout of AIG was essentially a conduit for the U.S. government to bail out banks around the world, as the money was used by AIG to make good on its obligations.

A timeline of some of the significant events in the crisis from 2007 to 2008 includes:

* From late 2007 through September 2008, before the official October 3 bailout, there was a series of smaller bank rescues that occurred which totaled almost $800 billion.

* In summer 2007, Countrywide Financial drew down an $11 billion line of credit and then secured an additional $12 billion bailout in September. This may be considered the start of the crisis.

* In mid-December 2007, Washington Mutual bank cut more than 3,000 jobs and closed its sub-prime mortgage business.

* In mid-March 2008, Bear Stearns was bailed out by a gift of $29 billion non-recourse treasury bill debt assets.

* In early July 2008, depositors at the Los Angeles offices of IndyMac Bank frantically lined up in the street to withdraw their money. On July 11, IndyMac, a spinoff of Countrywide, was seized by federal regulators—and called for a $32 billion bailout—as the mortgage lender succumbed to the pressures of tighter credit, tumbling home prices and rising foreclosures. That day the financial markets plunged as investors tried to gauge whether the government would attempt to save mortgage lenders Fannie Mae

The Federal National Mortgage Association (FNMA), commonly known as Fannie Mae, is a United States government-sponsored enterprise (GSE) and, since 1968, a publicly traded company. Founded in 1938 during the Great Depression as part of the New ...

and Freddie Mac

The Federal Home Loan Mortgage Corporation (FHLMC), commonly known as Freddie Mac, is an American publicly traded, government-sponsored enterprise (GSE), headquartered in Tysons, Virginia.conservatorship

Under U.S. law, a conservatorship results from the appointment of a guardian or a protector by a judge to manage the personal or financial affairs of another person who is incapable of fully managing their own affairs due to age or physical or m ...

on September 7, 2008.

* During the weekend of September 13–14, 2008, Lehman Brothers

Lehman Brothers Inc. ( ) was an American global financial services firm founded in 1850. Before filing for bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States (behind Goldman Sachs, Morgan Stanley, and Merril ...

declared bankruptcy

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the deb ...

after failing to find a buyer; Bank of America

The Bank of America Corporation (Bank of America) (often abbreviated BofA or BoA) is an American multinational investment banking, investment bank and financial services holding company headquartered at the Bank of America Corporate Center in ...

agreed to purchase investment bank Merrill Lynch; the insurance giant AIG

American International Group, Inc. (AIG) is an American multinational finance and insurance corporation with operations in more than 80 countries and jurisdictions. As of 2023, AIG employed 25,200 people. The company operates through three core ...

sought a bridge loan from the Federal Reserve; and a consortium of 10 banks created an emergency fund of at least $70 billion to deal with the effects of Lehman's closure, similar to the consortium put forth by J.P. Morgan during the stock market panic of 1907

The Panic of 1907, also known as the 1907 Bankers' Panic or Knickerbocker Crisis, was a financial crisis that took place in the United States over a three-week period starting in mid-October, when the New York Stock Exchange suddenly fell almost ...

and the crash of 1929. Stocks on Wall Street

Wall Street is a street in the Financial District, Manhattan, Financial District of Lower Manhattan in New York City. It runs eight city blocks between Broadway (Manhattan), Broadway in the west and South Street (Manhattan), South Str ...

tumbled on Monday, September 15.

* On September 16, 2008, news emerged that the Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of ...

might give AIG an $85 billion rescue package; on September 17, 2008, this was confirmed. The terms of the package were that the Federal Reserve would receive an 80% public stake in the firm. The biggest bank failure in history occurred on September 25 when JP Morgan Chase

JPMorgan Chase & Co. (stylized as JPMorganChase) is an American multinational finance corporation headquartered in New York City and incorporated in Delaware. It is the largest bank in the United States, and the world's largest bank by mark ...

agreed to purchase the banking assets of Washington Mutual

Washington Mutual, Inc. (often abbreviated to WaMu) was an American Bank holding company, savings bank holding company based in Seattle. It was the parent company of Washington Mutual Bank, which was the largest savings and loan association in ...

.

The year 2008, as of September 17, had seen 81 public corporations file for bankruptcy in the United States, already higher than the 78 for all of 2007. The largest corporate bankruptcy in U.S. history also made 2008 a record year in terms of assets, with Lehman's size—$691 billion (~$ in ) in assets—alone surpassing all past annual totals. The year also saw the ninth-biggest bankruptcy, with the failure of IndyMac Bank.

''The Wall Street Journal'' stated that venture capital

Venture capital (VC) is a form of private equity financing provided by firms or funds to start-up company, startup, early-stage, and emerging companies, that have been deemed to have high growth potential or that have demonstrated high growth in ...

funding slowed down, which in the past had led to unemployment and slowed new job creation. The Federal Reserve took steps to feed economic expansion by lowering the prime rate

The prime rate or prime lending rate is an interest rate used by banks, typically representing the rate at which they lend to their most creditworthy customers. Some variable interest rates may be expressed as a percentage above or below prime ra ...

repeatedly during 2008.

Bailout of U.S. financial system

On September 17, 2008, Federal Reserve chairman

On September 17, 2008, Federal Reserve chairman Ben Bernanke

Ben Shalom Bernanke ( ; born December 13, 1953) is an American economist who served as the 14th chairman of the Federal Reserve from 2006 to 2014. After leaving the Federal Reserve, he was appointed a distinguished fellow at the Brookings Insti ...

advised Secretary of the Treasury Henry Paulson

Henry "Hank" Merritt Paulson Jr. (born March 28, 1946) is an American investment banker and financier who served as the 74th United States secretary of the treasury from 2006 to 2009. Prior to his role in the Department of the Treasury, Paulson ...

that a large amount of public money would be needed to stabilize the financial system. Short selling

In finance, being short in an asset means investing in such a way that the investor will profit if the market value of the asset falls. This is the opposite of the more common Long (finance), long Position (finance), position, where the inves ...

on 799 financial stocks was banned on September 19. Companies were also forced to disclose large short positions. The Treasury Secretary also indicated that money fund

A money market fund (also called a money market mutual fund) is an open-end mutual fund that invests in short-term debt securities such as US Treasury bills and commercial paper. Money market funds are managed with the goal of maintaining a hig ...

s would create an insurance pool to cover themselves against losses and that the government would buy mortgage-backed securities from banks and investment houses. Initial estimates of the cost of the Treasury bailout proposed by the Bush administration's draft legislation (as of September 19, 2008) were in the range of $700 billion to $1 trillion U.S. dollars

The United States dollar (symbol: $; currency code: USD) is the official currency of the United States and several other countries. The Coinage Act of 1792 introduced the U.S. dollar at par with the Spanish silver dollar, divided it int ...

. President George W. Bush

George Walker Bush (born July 6, 1946) is an American politician and businessman who was the 43rd president of the United States from 2001 to 2009. A member of the Bush family and the Republican Party (United States), Republican Party, he i ...

asked Congress

A congress is a formal meeting of the representatives of different countries, constituent states, organizations, trade unions, political parties, or other groups. The term originated in Late Middle English to denote an encounter (meeting of ...

on September 20, 2008 for the authority to spend as much as $700 billion (~$ in ) to purchase troubled mortgage assets and contain the 2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

. The crisis continued when the United States House of Representatives rejected the bill and the Dow Jones Dow Jones is a combination of the names of business partners Charles Dow and Edward Jones.

Dow Jones & Company

Dow, Jones and Charles Bergstresser founded Dow Jones & Company in 1882. That company eventually became a subsidiary of News Corp, an ...

took a 777-point plunge. A revised version of the bill was later passed by Congress, but the stock market continued to fall nevertheless. The first half of the bailout money was primarily used to buy preferred stock in banks, instead of troubled mortgage assets. This flew in the face of some economists' argument that buying preferred stock would be far less effective than buying common stock.

As of mid-November 2008, it was estimated that the new loans, purchases, and liabilities of the Federal Reserve, the Treasury, and FDIC, brought on by the 2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

, totalled over $5 trillion: $1 trillion in loans by the Fed to broker-dealers through the emergency discount window

Discount may refer to:

Arts and entertainment

* Discount (band), punk rock band that formed in Vero Beach, Florida in 1995 and disbanded in 2000

* ''Discount'' (film), French comedy-drama film

* "Discounts" (song), 2020 single by American rapper C ...

, $1.8 trillion in loans by the Fed through the Term Auction Facility, $700 billion to be raised by the Treasury for the Troubled Assets Relief Program, $200 billion insurance for the GSEs by the Treasury, and $1.5 trillion insurance for unsecured bank debt by FDIC.

ProPublica

ProPublica (), legally Pro Publica, Inc., is a nonprofit investigative journalism organization based in New York City. ProPublica's investigations are conducted by its staff of full-time reporters, and the resulting stories are distributed to ne ...

maintains a "bailout tracker" that indicated about $626 billion was "spent, invested or loaned" in bailouts of the financial system due to the crisis as of March 2018, while $713 billion had been repaid to the government ($390 billion in principal repayments and $323 billion in interest) indicating the bailouts generated $87 billion in profit.

United States policy responses

The Federal Reserve, Treasury, and Securities and Exchange Commission took several steps on September 19 to intervene in the crisis. To stop the potential run on money market mutual funds, the Treasury also announced on September 19 a new $50,000,000,000 ($50 billion) program to ensure the investments, similar to theFederal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation (FDIC) is a State-owned enterprises of the United States, United States government corporation supplying deposit insurance to depositors in American commercial banks and savings banks. The FDIC was cr ...

(FDIC) program. Part of the announcements included temporary exceptions to section 23A and 23B (Regulation W), allowing financial groups to more easily share funds within their group. The exceptions would expire on January 30, 2009, unless extended by the Federal Reserve Board

The Board of Governors of the Federal Reserve System, commonly known as the Federal Reserve Board, is the main governing body of the Federal Reserve System. It is charged with overseeing the Federal Reserve Banks and with helping implement the mo ...

. The Securities and Exchange Commission announced the termination of short-selling of 799 financial stocks, as well as action against naked short selling

Naked short selling, or naked shorting, is the practice of short-selling a tradable asset of any kind without first borrowing the asset from someone else or ensuring that it can be borrowed. When the seller does not obtain the asset and deli ...

, as part of its reaction to the mortgage crisis.

Recovery

The recession officially ended in the second quarter of 2009, but the nation's economy continued to be described as in an "

The recession officially ended in the second quarter of 2009, but the nation's economy continued to be described as in an "economic malaise

Economic stagnation is a prolonged period of slow economic growth (traditionally measured in terms of the GDP growth), usually accompanied by high unemployment. Under some definitions, ''slow'' means significantly slower than potential growth as ...

" during the second quarter of 2011. Some economists described the post-recession years as the weakest recovery since the Great Depression

The Great Depression was a severe global economic downturn from 1929 to 1939. The period was characterized by high rates of unemployment and poverty, drastic reductions in industrial production and international trade, and widespread bank and ...

and World War II

World War II or the Second World War (1 September 1939 – 2 September 1945) was a World war, global conflict between two coalitions: the Allies of World War II, Allies and the Axis powers. World War II by country, Nearly all of the wo ...

. The weak recovery led one commentator to call it a "Zombie Economy", so-called because it was neither dead nor alive. Household incomes, as of August 2012 continued falling after the end of the recession, eventually declining 7.2% below the December 2007 level. Additionally as of September 2012, the long-term unemployment

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is the proportion of people above a specified age (usually 15) not being in paid employment or self-employment but currently available for work dur ...

is the highest it had been since World War II, and the unemployment rate

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is the proportion of people above a specified age (usually 15) not being in paid employment or self-employment but currently available for work d ...

peaked several months after the end of the recession (10.1% in October 2009) and was above 8% until September 2012 (7.8%). The Federal Reserve kept interest rates at a historically low 0.25% from December 2008 until December 2015, when it began to raise them again.

However, the Great Recession was different in kind from all the recessions since the Great Depression, as it also involved a banking crisis and the de-leveraging (debt reduction) of highly indebted households. Research indicates recovery from financial crises can be protracted, with lengthy periods of high unemployment and substandard economic growth. Economist Carmen Reinhart

Carmen M. Reinhart (née Castellanos, born October 7, 1955) is a Cuban-American economist and the Minos A. Zombanakis Professor of the International Financial System at Harvard Kennedy School. Previously, she was the Dennis Weatherstone Senior Fe ...

stated in August 2011: "Debt de-leveraging eductiontakes about seven years ... And in the decade following severe financial crises, you tend to grow by 1 to 1.5 percentage points less than in the decade before, because the decade before was fueled by a boom in private borrowing, and not all of that growth was real. The unemployment figures in advanced economies after falls are also very dark. Unemployment remains anchored about five percentage points above what it was in the decade before."

Then-Fed Chair Ben Bernanke

Ben Shalom Bernanke ( ; born December 13, 1953) is an American economist who served as the 14th chairman of the Federal Reserve from 2006 to 2014. After leaving the Federal Reserve, he was appointed a distinguished fellow at the Brookings Insti ...

explained during November 2012 several of the economic headwinds that slowed the recovery:

* The housing sector did not rebound, as was the case in prior recession recoveries, as the sector was severely damaged during the crisis. Millions of foreclosures had created a large surplus of properties and consumers were paying down their debts rather than purchasing homes.

* Credit for borrowing and spending by individuals (or investing by corporations) was not readily available as banks paid down their debts.

* Restrained government spending following initial stimulus efforts (i.e., austerity) was not sufficient to offset private sector weaknesses.

For example, U.S. federal spending rose from 19.1% GDP in fiscal year (FY) 2007 to 24.4% GDP in FY2009 (the last year budgeted by President Bush) before falling towards to 20.4% GDP in 2014, closer to the historical average. In dollar terms, federal spending was actually higher in 2009 than in 2014, despite a historical trend of a roughly 5% annual increase. This reduced real GDP growth by approximately 0.5% per quarter on average between Q3 2010 and Q2 2014. Both households and government practicing austerity at the same time was a recipe for a slow recovery.

Several key economic variables (e.g., Job level, real GDP per capita, stock market, and household net worth) hit their low point (trough) in 2009 or 2010, after which they began to turn upward, recovering to pre-recession (2007) levels between late 2012 and May 2014 (close to Reinhart's prediction), which marked the recovery of all jobs lost during the recession. Real median household income fell to a trough of $53,331 in 2012, but recovered to an all-time high of $59,039 by 2016. However, the gains during the recovery were very unevenly distributed. Economist Emmanuel Saez

Emmanuel Saez (born November 26, 1972) is a French-American economist who is a professor of economics at the University of California, Berkeley. His work, done with Thomas Piketty and Gabriel Zucman, includes tracking the incomes of the poor, mid ...

wrote in June 2016 that the top 1% of families captured 52% of the total real income (GDP) growth per family from 2009-2015. The gains were more evenly distributed after the tax increases in 2013 on higher-income earners. According to the Federal Reserve, median family net worth had peaked at about $140,000 in 2007, fell to a low point of $84,000 in 2013, and only partially recovered to $97,000 by 2016. Middle-class families had much of their wealth in housing, driving much of the decline when the housing bubble burst.

Healthcare costs in the United States slowed in the period after the Great Recession (2008–2012). A decrease in inflation and in the number of hospital stays per population drove a reduction in the rate of growth in aggregate hospital costs at this time. Growth slowed most for surgical stays and least for maternal and neonatal stays.

President Obama declared the bailout measures started under the Bush administration and continued during his administration as completed and mostly profitable as of December 2014. As of January 2018, bailout funds had been fully recovered by the government, when interest on loans is taken into consideration. A total of $626B was invested, loaned, or granted due to various bailout measures, while $390B had been returned to the Treasury. The Treasury had earned another $323B in interest on bailout loans, resulting in an $87B profit.

Severity

The vast majority of economic historians believe the Great Recession was the second worst contraction in US history, after theGreat Depression

The Great Depression was a severe global economic downturn from 1929 to 1939. The period was characterized by high rates of unemployment and poverty, drastic reductions in industrial production and international trade, and widespread bank and ...

. Some economists, including Ben Bernanke

Ben Shalom Bernanke ( ; born December 13, 1953) is an American economist who served as the 14th chairman of the Federal Reserve from 2006 to 2014. After leaving the Federal Reserve, he was appointed a distinguished fellow at the Brookings Insti ...

, have argued that the 2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

was arguably more severe than the financial crisis that preceded the Great Depression, and that a depression was only avoided due to decisive policy actions taken by the Federal Reserve and federal government.

See also

* Timeline of the Great Recession * Causes of the Great Recession *New Deal

The New Deal was a series of wide-reaching economic, social, and political reforms enacted by President Franklin D. Roosevelt in the United States between 1933 and 1938, in response to the Great Depression in the United States, Great Depressi ...

* 1991 Indian economic crisis

* Stock market crashes in India

* 2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

* 2008–2011 bank failures in the United States

* 2008–2009 Keynesian resurgence

The 2008 financial crisis was followed by a global resurgence of interest in Keynesian economics among prominent economists and policy makers. This included discussions and implementation of economic policies in accordance with the recommendations ...

* 2010 United States foreclosure crisis

The 2010 United States foreclosure crisis, sometimes referred to as Foreclosure-gate or Foreclosuregate, refers to a widespread epidemic of improper foreclosures initiated by large banks and other lenders. The foreclosure crisis was extensively ...

* 2011 United States debt-ceiling crisis

In 2011, ongoing political debate in the United States Congress about the appropriate level Government spending in the United States, of government spending and its effect on the National debt of the United States, national debt and deficit re ...

* List of economic crises

* ''The Big Short

''The Big Short: Inside the Doomsday Machine'' is a nonfiction book by Michael Lewis about the build-up of the United States housing bubble during the 2000s. It was released on March 15, 2010, by W. W. Norton & Company. It spent 28 weeks on '' ...

''

* List of stock market crashes and bear markets

This is a list of stock market and bear markets. The difference between the two relies on speed (how fast declines occur) and length (how long they last). Stock market crashes are quick and brief, while bear markets are slow and prolonged. Those ...

References

Further reading

* * * * * {{Americas topic, Great Recession inGreat Recession in the United States

In the United States, the Great Recession was a severe financial crisis combined with a deep recession. While the recession officially lasted from December 2007 to June 2009, it took many years for the economy to recover to pre-crisis levels of ...

2000s in economic history

2010s in economic history

Economic collapses

2007 in the United States

2008 in the United States

2009 in the United States

Presidency of George W. Bush

Presidency of Barack Obama