|

Vintage Year

Vintage year in the private equity and venture capital industries refers to the year in which a fund began making investments or, more specifically, the date in which capital was deployed to a particular company or project. This metric is useful for benchmarking, identifying trends, estimating the holding period, and controlling returns for the effect of business cycles. Origin Most likely, the term ''vintage year'' is borrowed from the winemaking industry, where it is also used to divide wines in comparable classes. Overview The year of investing is an important and widely used metric to compare performance of the investments financed in the year in question against that of the investments financed in other years or against that of the general market (S&P 500). As the external market conditions change following the overall business cycle Business cycles are intervals of expansion followed by recession in economic activity. These changes have implications for the welfare of th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Equity

In the field of finance, the term private equity (PE) refers to investment funds, usually limited partnerships (LP), which buy and restructure financially weak companies that produce goods and provide services. A private-equity fund is both a type of ownership of assets ( financial equity) and is a class of assets (debt securities and equity securities), which function as modes of financial management for operating private companies that are not publicly traded in a stock exchange. Private-equity capital is invested into a target company either by an investment management company (private equity firm), or by a venture capital fund, or by an angel investor; each category of investor has specific financial goals, management preferences, and investment strategies for profiting from their investments. Each category of investor provides working capital to the target company to finance the expansion of the company with the development of new products and services, the restruct ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Venture Capital

Venture capital (often abbreviated as VC) is a form of private equity financing that is provided by venture capital firms or funds to start-up company, startups, early-stage, and emerging companies that have been deemed to have high growth potential or which have demonstrated high growth (in terms of number of employees, annual revenue, scale of operations, etc). Venture capital firms or funds invest in these early-stage companies in exchange for Equity (finance), equity, or an ownership stake. Venture capitalists take on the risk of financing risky Startup company, start-ups in the hopes that some of the firms they support will become successful. Because Startup company, startups face high uncertainty, VC investments have high rates of failure. The start-ups are usually based on an innovation, innovative technology or business model and they are usually from high technology industries, such as information technology (IT), clean technology or biotechnology. The typical venture c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Benchmarking

Benchmarking is the practice of comparing business processes and performance metrics to industry bests and best practices from other companies. Dimensions typically measured are quality, time and cost. Benchmarking is used to measure performance using a specific indicator (cost per unit of measure, productivity per unit of measure, cycle time of x per unit of measure or defects per unit of measure) resulting in a metric of performance that is then compared to others. Also referred to as "best practice benchmarking" or "process benchmarking", this process is used in management in which organizations evaluate various aspects of their processes in relation to best-practice companies' processes, usually within a peer group defined for the purposes of comparison. This then allows organizations to develop plans on how to make improvements or adapt specific best practices, usually with the aim of increasing some aspect of performance. Benchmarking may be a one-off event, but is often t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Cycle

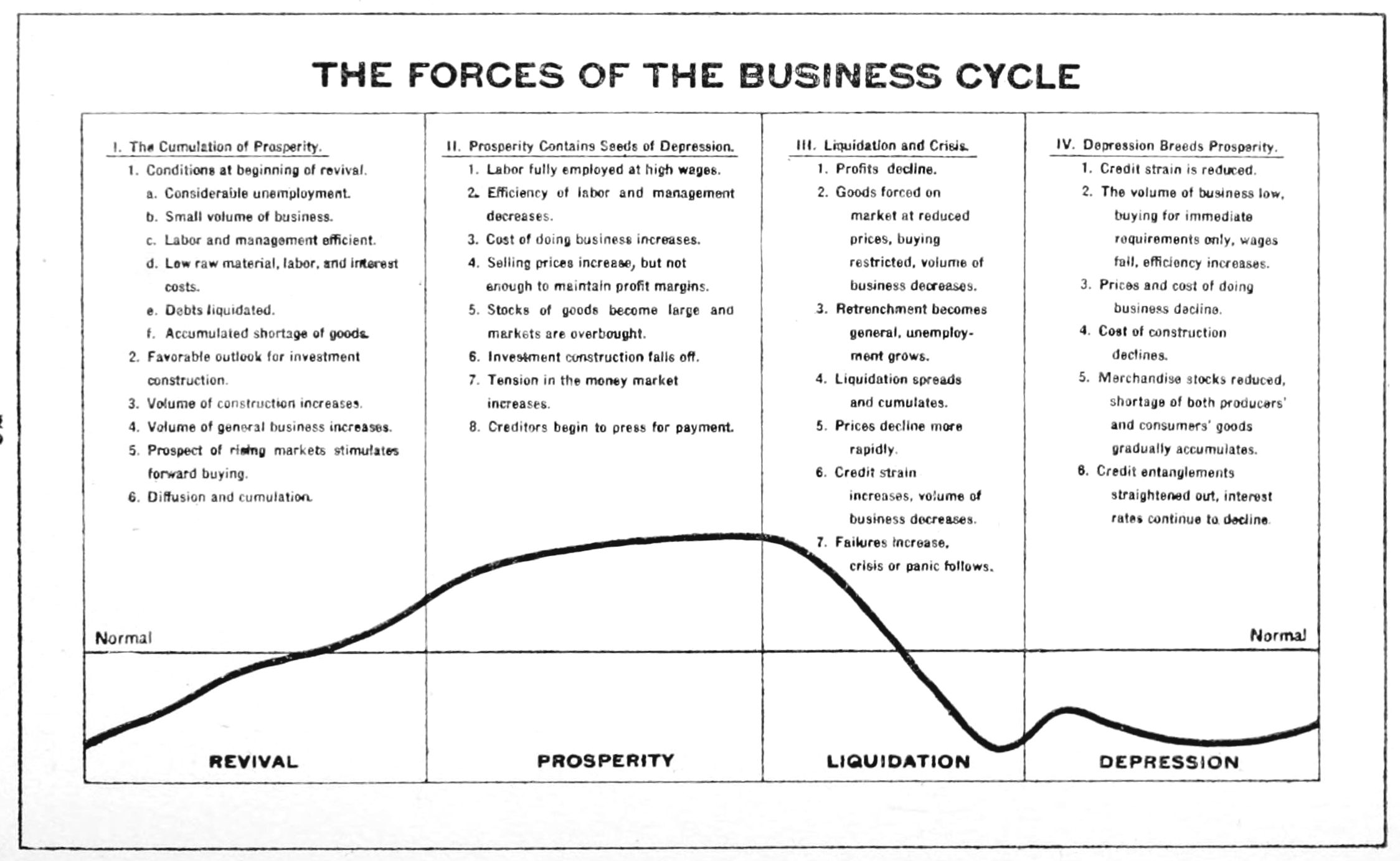

Business cycles are intervals of expansion followed by recession in economic activity. These changes have implications for the welfare of the broad population as well as for private institutions. Typically business cycles are measured by examining trends in a broad economic indicator such as Real Gross Domestic Production. Business cycle fluctuations are usually characterized by general upswings and downturns in a span of macroeconomic variables. The individual episodes of expansion/recession occur with changing duration and intensity over time. Typically their periodicity has a wide range from around 2 to 10 years (the technical phrase "stochastic cycle" is often used in statistics to describe this kind of process.) As in arvey, Trimbur, and van Dijk, 2007, ''Journal of Econometrics'' such flexible knowledge about the frequency of business cycles can actually be included in their mathematical study, using a Bayesian statistical paradigm. There are numerous sources of busines ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Winemaking

Winemaking or vinification is the production of wine, starting with the selection of the fruit, its fermentation into alcohol, and the bottling of the finished liquid. The history of wine-making stretches over millennia. The science of wine and winemaking is known as oenology. A winemaker may also be called a vintner. The growing of grapes is viticulture and there are many varieties of grapes. Winemaking can be divided into two general categories: still wine production (without carbonation) and sparkling wine production (with carbonation – natural or injected). Red wine, white wine, and rosé are the other main categories. Although most wine is made from grapes, it may also be made from other plants. (See fruit wine.) Other similar light alcoholic drinks (as opposed to beer or Liquor, spirits) include mead, made by fermenting Honey#Fermentation, honey and water, cider ("apple cider"), made by fermenting the Apple juice, juice of apples, and perry ("pear cider"), made ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Cycle

Business cycles are intervals of expansion followed by recession in economic activity. These changes have implications for the welfare of the broad population as well as for private institutions. Typically business cycles are measured by examining trends in a broad economic indicator such as Real Gross Domestic Production. Business cycle fluctuations are usually characterized by general upswings and downturns in a span of macroeconomic variables. The individual episodes of expansion/recession occur with changing duration and intensity over time. Typically their periodicity has a wide range from around 2 to 10 years (the technical phrase "stochastic cycle" is often used in statistics to describe this kind of process.) As in arvey, Trimbur, and van Dijk, 2007, ''Journal of Econometrics'' such flexible knowledge about the frequency of business cycles can actually be included in their mathematical study, using a Bayesian statistical paradigm. There are numerous sources of busines ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Equity

In the field of finance, the term private equity (PE) refers to investment funds, usually limited partnerships (LP), which buy and restructure financially weak companies that produce goods and provide services. A private-equity fund is both a type of ownership of assets ( financial equity) and is a class of assets (debt securities and equity securities), which function as modes of financial management for operating private companies that are not publicly traded in a stock exchange. Private-equity capital is invested into a target company either by an investment management company (private equity firm), or by a venture capital fund, or by an angel investor; each category of investor has specific financial goals, management preferences, and investment strategies for profiting from their investments. Each category of investor provides working capital to the target company to finance the expansion of the company with the development of new products and services, the restruct ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |