|

Trading Book

The Fundamental Review of the Trading Book (FRTB), is a set of proposals by the Basel Committee on Banking Supervision for a new market risk-related capital requirement for banks. Background The reform, which is part of Basel III, is one of the initiatives taken to strengthen the financial system, noting that the previous proposals (Basel II) did not prevent the 2008 financial crisis. It was first published as a ''Consultative Document'' in October 2013. Following feedback received on the consultative document, an initial proposal was published in January 2016, which was revised in January 2019. Key features The FRTB revisions address deficiencies relating to the existing ''International Convergence of Capital Measurement and Capital Standards'' Basel Committee on Banking Supervisio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Basel Committee On Banking Supervision

The Basel Committee on Banking Supervision (BCBS) is a committee of banking supervisory authorities that was established by the central bank governors of the Group of Ten (G10) countries in 1974. The committee expanded its membership in 2009 and then again in 2014. As of 2019, the BCBS has 45 members from 28 jurisdictions, consisting of central banks and authorities with responsibility of banking regulation. The committee agrees on standards for bank capital, liquidity and funding. Those standards are non-binding high-level principles. Members are expected but not obliged to undertake effort to implement them e.g. through domestic regulation. Overview The committee provides a forum for regular cooperation on banking supervisory matters. Its objective is to enhance understanding of key supervisory issues and improve the quality of banking supervision worldwide. The committee frames guidelines and standards in different areas – some of the better known among them are the inte ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Liquidity

In business, economics or investment, market liquidity is a market's feature whereby an individual or firm can quickly purchase or sell an asset without causing a drastic change in the asset's price. Liquidity involves the trade-off between the price at which an asset can be sold, and how quickly it can be sold. In a liquid market, the trade-off is mild: one can sell quickly without having to accept a significantly lower price. In a relatively illiquid market, an asset must be discounted in order to sell quickly. A liquid asset is an asset which can be converted into cash within a relatively short period of time, or cash itself, which can be considered the most liquid asset because it can be exchanged for goods and services instantly at face value. Overview A liquid asset has some or all of the following features: it can be sold rapidly, with minimal loss of value, anytime within market hours. The essential characteristic of a liquid market is that there are always ready and wil ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Regulation

Banking regulation and supervision refers to a form of financial regulation which subjects banks to certain requirements, restrictions and guidelines, enforced by a financial regulatory authority generally referred to as banking supervisor, with semantic variations across jurisdictions. By and large, banking regulation and supervision aims at ensuring that banks are safe and sound and at fostering market transparency between banks and the individuals and corporations with whom they conduct business. Its main component is prudential regulation and supervision whose aim is to ensure that banks are viable and resilient ("safe and sound") so as to reduce the likelihood and impact of bank failures that may trigger systemic risk. Prudential regulation and supervision requires banks to control risks and hold adequate capital as defined by capital requirements, liquidity requirements, the imposition of concentration risk (or large exposures) limits, and related reporting and public di ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk (magazine)

''Risk'' is an English financial industry trade magazine that specializes in financial risk management, regulation, and asset management. Since its establishment in 1987 by Peter Field, it has undergone ownership changes, transitioning from the Risk Waters Group to Incisive Media and now to Infopro Digital. The magazine's editorial team includes Kris Devasabai as editor-in-chief. Additionally, Risk organizes industry events and has a sister publication, Asia Risk. The magazine shifted to a digital-only format in June 2022 and is accessible through its website and app. Risk.net Risk.net is a news and analysis website covering the financial industry, with a particular focus on regulation, derivatives, risk management, asset management, and commodities. Risk.net publishes widely reported stories and analytical articles. Risk.net's financial coverage includes operational risk, accounting, Fundamental Review of the Trading Book, structured products, valuation adjustments, financial ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Palgrave Macmillan

Palgrave Macmillan is a British academic and trade publishing company headquartered in the London Borough of Camden. Its programme includes textbooks, journals, monographs, professional and reference works in print and online. It maintains offices in London, New York City, New York, Shanghai, Melbourne, Sydney, Hong Kong, Delhi and Johannesburg. Palgrave Macmillan was created in 2000 when St. Martin's Press in the US united with Macmillan Publishers in the UK to combine their worldwide academic publishing operations. The company was known simply as Palgrave until 2002, but has since been known as Palgrave Macmillan. It is a subsidiary of Springer Nature. Until 2015, it was part of the Macmillan Publishers, Macmillan Group and therefore wholly owned by the German publishing company Holtzbrinck Publishing Group (which still owns a controlling interest in Springer Nature). As part of Macmillan, it was headquartered at the Macmillan campus in Kings Cross, London with other Macmilla ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Default Risk

Credit risk is the chance that a borrower does not repay a loan or fulfill a loan obligation. For lenders the risk includes late or lost interest and principal payment, leading to disrupted cash flows and increased collection costs. The loss may be complete or partial. In an efficient market, higher levels of credit risk will be associated with higher borrowing costs. Because of this, measures of borrowing costs such as yield spreads can be used to infer credit risk levels based on assessments by market participants. Losses can arise in a number of circumstances, for example: * A consumer may fail to make a payment due on a mortgage loan, credit card, line of credit, or other loan. * A company is unable to repay asset-secured fixed or floating charge debt. * A business or consumer does not pay a trade invoice when due. * A business does not pay an employee's earned wages when due. * A business or government bond issuer does not make a payment on a coupon or principal paymen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stress Test (financial)

In finance, a stress test is an analysis or simulation designed to determine the ability of a given financial instrument or financial institution to deal with an economic crisis. Instead of doing financial projection on a "best estimate" basis, a company or its regulators may do stress testing where they look at how robust a financial instrument is in certain crashes, a form of scenario analysis. They may test the instrument under, for example, the following stresses: * What happens if unemployment rate rises to v% in a specific year? * What happens if equity markets crash by more than w% this year? * What happens if GDP falls by x% in a given year? * What happens if interest rates go up by at least y%? * What if half the instruments in the portfolio terminate their contracts in the fifth year? * What happens if oil prices rise by z%? * What happens if there is a polar vortex event in a particular region? This type of analysis has become increasingly widespread, and has been taken ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Duration Gap

In Finance, and accounting, and particularly in asset and liability management (ALM), the duration gap measures how well matched are the timings of Cash flow, cash inflows (from assets) and cash outflows (from liabilities), and is then one of the primary asset–liability mismatches considered in the ALM process. The term is typically used by banks, pension funds, or other financial institutions to measure, and manage, their risk due to changes in the interest rate: by duration matching, that is creating a "zero duration gap", the firm becomes immunization (finance), immunized against interest rate risk. See . Frederic S. Mishkin and Apostolos Serletis (2004)Duration Gap Analysis Staff (2020)Risk Management for Changing Interest Rates: Asset-Liability Management and Duration Techniques analystprep.com Measurement Formally, the duration gap is the difference between the Bond duration, duration - i.e. the Bond_duration#Modified_duration, average ''maturity'' - of assets and liab ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Convexity (finance)

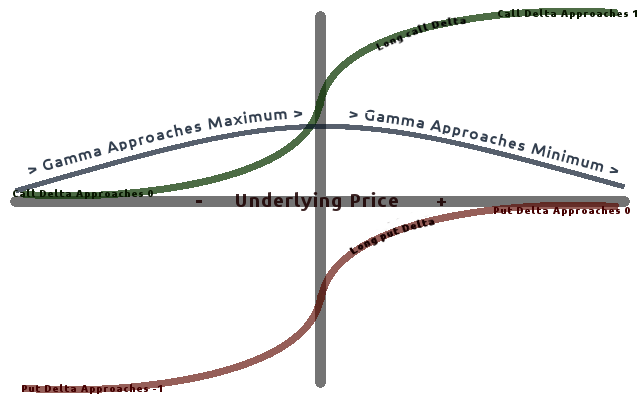

In mathematical finance, convexity refers to non-linearities in a financial model. In other words, if the price of an underlying variable changes, the price of an output does not change linearly, but depends on the second derivative (or, loosely speaking, higher-order terms) of the modeling function. Geometrically, the model is no longer flat but curved, and the degree of curvature is called the convexity. Terminology Strictly speaking, convexity refers to the second derivative of output price with respect to an input price. In derivative pricing, this is referred to as Gamma (Γ), one of the Greeks. In practice the most significant of these is bond convexity, the second derivative of bond price with respect to interest rates. As the second derivative is the first non-linear term, and thus often the most significant, "convexity" is also used loosely to refer to non-linearities generally, including higher-order terms. Refining a model to account for non-linearities is referred ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Greeks (finance)

In mathematical finance, the Greeks are the quantities (known in calculus as partial derivatives; first-order or higher) representing the sensitivity of the price of a derivative instrument such as an option to changes in one or more underlying parameters on which the value of an instrument or portfolio of financial instruments is dependent. The name is used because the most common of these sensitivities are denoted by Greek letters (as are some other finance measures). Collectively these have also been called the risk sensitivities, risk measures or hedge parameters. Use of the Greeks The Greeks are vital tools in risk management. Each Greek measures the sensitivity of the value of a portfolio to a small change in a given underlying parameter, so that component risks may be treated in isolation, and the portfolio rebalanced accordingly to achieve a desired exposure; see for example delta hedging. The Greeks in the Black–Scholes model (a relatively simple idealised mode ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Value At Risk

Value at risk (VaR) is a measure of the risk of loss of investment/capital. It estimates how much a set of investments might lose (with a given probability), given normal market conditions, in a set time period such as a day. VaR is typically used by firms and regulators in the financial industry to gauge the amount of assets needed to cover possible losses. For a given portfolio, time horizon, and probability ''p'', the ''p'' VaR can be defined informally as the maximum possible loss during that time after excluding all worse outcomes whose combined probability is at most ''p''. This assumes mark-to-market pricing, and no trading in the portfolio. For example, if a portfolio of stocks has a one-day 5% VaR of $1 million, that means that there is a 0.05 probability that the portfolio will fall in value by $1 million or more over a one-day period if there is no trading. Informally, a loss of $1 million or more on this portfolio is expected on 1 day out of 20 days (because of 5% p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |