|

Tax Expenditures

A tax is a mandatory financial charge or levy imposed on an individual or legal entity by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax compliance refers to policy actions and individual behavior aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax relief. The first known taxation occurred in Ancient Egypt around 3000–2800 BC. Taxes consist of direct or indirect taxes and may be paid in money or as labor equivalent. All countries have a tax system in place to pay for public, common societal, or agreed national needs and for the functions of government. Some countries levy a flat percentage rate of taxation on personal annual income, but most scale taxes are progressive based on brackets of yearly income amounts. Most countries charge a tax on an individual's income and corporate income. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Legal Person

In law, a legal person is any person or legal entity that can do the things a human person is usually able to do in law – such as enter into contracts, lawsuit, sue and be sued, ownership, own property, and so on. The reason for the term "''legal'' person" is that some legal persons are not human persons: Company, companies and corporations (i.e., business entities) are ''persons'', legally speaking (they can legally do most of the things an ordinary person can do), but they are not, in a literal sense, human beings. Legal personhood is a prerequisite to capacity (law), legal capacity (the ability of any legal person to amend – i.e. enter into, transfer, etc. – rights and Law of obligations, obligations): it is a prerequisite for an international organization being able to sign treaty, international treaties in its own legal name, name. History The concept of legal personhood for organizations of people is at least as old as Ancient Rome: a variety of Coll ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sales Tax

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase. When a tax on goods or services is paid to a governing body directly by a consumer, it is usually called a use tax. Often laws provide for the Tax exemption, exemption of certain goods or services from sales and use tax, such as food, education, and medicines. A value-added tax (VAT) collected on goods and services is related to a sales tax. See Value-added tax#Comparison with sales tax, Comparison with sales tax for key differences. Types Conventional or retail sales tax is levied on the sale of a good to its final good, final end-user and is charged every time that item is sold retail. Sales to businesses that later resell the goods are not charged the tax. A purchaser who is not an end-user is usually issued a "resale certificate" by the taxing authority and required to provide the cer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Service

A public service or service of general (economic) interest is any service intended to address the needs of aggregate members of a community, whether provided directly by a public sector agency, via public financing available to private businesses or voluntary organisations, or by private businesses subject to government regulation. Some public services are provided on behalf of a government's residents or in the interest of its citizens. The term is associated with a social consensus (usually expressed through democratic elections) that certain services should be available to all, regardless of income, physical ability or mental acuity. Examples of such services include the fire services, police, air force, paramedics and public service broadcasting. Even where public services are neither publicly provided nor publicly financed, they are usually subject to regulation beyond that applying to most economic sectors for social and political reasons. Public policy, when made ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Good (economics)

In economics, a public good (also referred to as a social good or collective good)Oakland, W. H. (1987). Theory of public goods. In Handbook of public economics (Vol. 2, pp. 485–535). Elsevier. is a commodity, product or service that is both non-excludable and non-rivalrous and which is typically provided by a government and paid for through taxation. Use by one person neither prevents access by other people, nor does it reduce availability to others, so the good can be used simultaneously by more than one person. This is in contrast to a common good, such as wild fish stocks in the ocean, which is non-excludable but rivalrous to a certain degree. If too many fish were harvested, the stocks would deplete, limiting the access of fish for others. A public good must be valuable to more than one user, otherwise, its simultaneous availability to more than one person would be economically irrelevant. Capital goods may be used to produce public goods or services that are "...ty ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Excess Burden Of Taxation

In economics, the excess burden of taxation is one of the economic losses that society suffers as the result of taxes or subsidies. Economic theory posits that distortions change the amount and type of economic behavior from that which would occur in a free market without the tax. Excess burdens can be measured using the average cost of funds or the marginal cost of funds (MCF). Excess burdens were first discussed by Adam Smith. An equivalent kind of inefficiency can also be caused by subsidies (which technically can be viewed as taxes with negative rates). Economic losses due to taxes have been evaluated to be as low as 2.5 cents per dollar of revenue, and as high as 30 cents per dollar of revenue (on average), and even much higher at the margins. Measures of the excess burden The cost of a distortion is usually measured as the amount that would have to be paid to the people affected by its supply, the greater the excess burden. The second is the tax rate: as a general ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiscal Multiplier

In economics, the fiscal multiplier (not to be confused with the money multiplier) is the ratio of change in national income arising from a change in government spending. More generally, the exogenous spending multiplier is the ratio of change in national income arising from any autonomous change in spending (including private investment spending, consumer spending, government spending, or spending by foreigners on the country's exports). When this multiplier exceeds one, the enhanced effect on national income may be called the multiplier effect. The mechanism that can give rise to a multiplier effect is that an initial incremental amount of spending can lead to increased income and hence increased consumption spending, increasing income further and hence further increasing consumption, etc., resulting in an overall increase in national income greater than the initial incremental amount of spending. In other words, an initial change in aggregate demand may cause a change in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Welfare Definition Of Economics

The welfare definition of economics is an attempt by Alfred Marshall, a pioneer of neoclassical economics, to redefine his field of study. This definition expands the field of economic science to a larger study of humanity. Specifically, Marshall's view is that economics studies all the actions that people take in order to achieve economic welfare. In the words of Marshall, "man earns money to get material welfare." Others since Marshall have described his remark as the "welfare definition" of economics. This definition enlarged the scope of economic science by emphasizing the study of wealth and humanity together, rather than wealth alone. In his widely read textbook, '' Principles of Economics'', published in 1890, Marshall defines economics as follows: Political Economy or Economics is a study of mankind in the ordinary business of life; it examines that part of individual and social action which is most closely connected with the attainment and with the use of material requisi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Growth

In economics, economic growth is an increase in the quantity and quality of the economic goods and Service (economics), services that a society Production (economics), produces. It can be measured as the increase in the inflation-adjusted Output (economics), output of an economy in a given year or over a period of time. The rate of growth is typically calculated as List of countries by real GDP growth rate, real gross domestic product (GDP) growth rate, List of countries by real GDP per capita growth, real GDP per capita growth rate or List of countries by GNI per capita growth, GNI per capita growth. The "rate" of economic growth refers to the Exponential growth, geometric annual rate of growth in GDP or GDP per capita between the first and the last year over a period of time. This growth rate represents the trend in the average level of GDP over the period, and ignores any fluctuations in the GDP around this trend. Growth is usually calculated in "real" value, which is real v ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

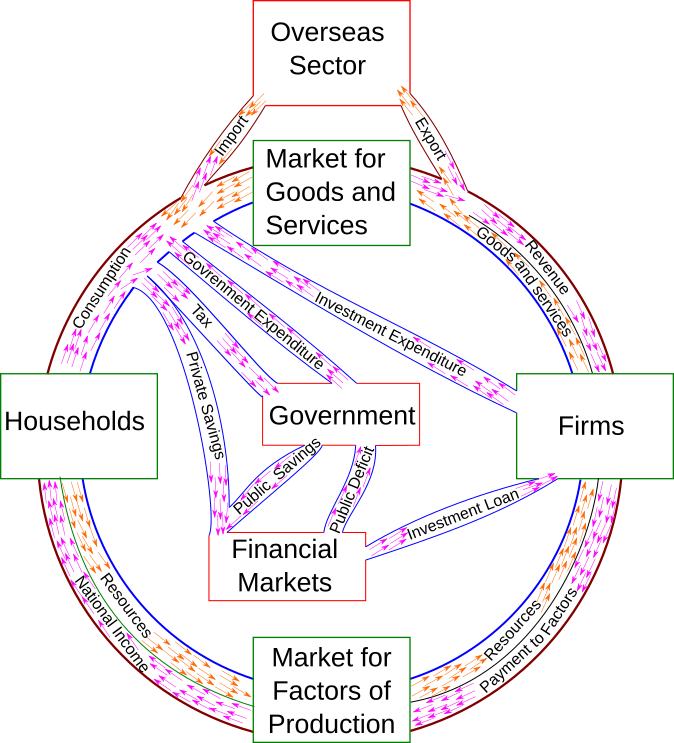

Circular Flow Of Income

The circular flow of income or circular flow is a economic model, model of the economy in which the major exchanges are represented as flows of money, Good (economics), goods and Service (economics), services, etc. between economic agents. The flows of money and goods exchanged in a closed circuit correspond in value, but run in the opposite direction. The circular flow analysis is the basis of national accounts and hence of macroeconomics. The idea of the circular flow was already present in the work of Richard Cantillon.Antoin E. Murphy. "John Law and Richard Cantillon on the circular flow of income." ''Journal of the History of Economic Thought.'' 1.1 (1993): 47–62. François Quesnay developed and visualized this concept in the so-called Tableau économique.Backhouse, Roger E., and Yann Giraud. "Circular flow diagrams." in: ''Famous Figures and Diagrams in Economics'' (2010): 221–230. Chapter 23. Important developments of Quesnay's tableau were Karl Marx's reproduction sch ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gross Receipts Tax

A gross receipts tax or gross excise tax is a tax on the total gross revenues of a company, regardless of their source. A gross receipts tax is often compared to a sales tax; the difference is that a gross receipts tax is levied upon the seller of goods or services, while a sales tax is nominally levied upon the buyer (although both are usually collected and paid to the government by the seller). This is compared to other taxes listed as separate line items on billings, are not directly included in the listed price of the item, and are not a factor in markup or profit on company sales. A gross receipts tax has a pyramid effect that increases the actual taxable percentage as it passes through the product or service lifecycle. Another pyramid effect of the tax comes from the fact that such a tax by definition is levied against itself (in the sense that a business subject to a gross receipts tax will raise its prices to compensate, which in turn increases its gross revenue, which in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tariff

A tariff or import tax is a duty (tax), duty imposed by a national Government, government, customs territory, or supranational union on imports of goods and is paid by the importer. Exceptionally, an export tax may be levied on exports of goods or raw materials and is paid by the exporter. Besides being a source of revenue, import duties can also be a form of regulation of International trade, foreign trade and policy that burden foreign products to encourage or safeguard domestic industry. Protective tariffs are among the most widely used instruments of protectionism, along with import quotas and export quotas and other non-tariff barriers to trade. Tariffs can be fixed (a constant sum per unit of imported goods or a percentage of the price) or variable (the amount varies according to the price). Tariffs on imports are designed to raise the price of imported goods to discourage consumption. The intention is for citizens to buy local products instead, which, according to support ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Duty (economics)

In economics, a duty is a target-specific form of tax levied by a state or other political entity. It is often associated with customs, in which context they are also known as tariffs or dues. The term is often used to describe a tax on certain items purchased abroad. A duty is levied on specific commodities, financial transactions, estates, etc. rather than being a direct imposition on individuals or corporations such income or property taxes. Examples include customs duty, excise duty, stamp duty, estate duty, and gift duty. Customs duty A customs duty or due is the indirect tax levied on the import or export of goods in international trade. In economics a duty is also a kind of consumption tax. A duty levied on goods being imported is referred to as an 'import duty', and one levied on exports an 'export duty'. Estate duty An estate duty (in the U.S. inheritance tax) is a tax levied on the estate of a deceased person in many jurisdictions or on the inheritance ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |