|

Tax Breaks

Tax break also known as tax preferences, tax concession, and tax relief, are a method of reduction to the tax liability of taxpayers. Government usually applies them to stimulate the economy and increase the solvency of the population. By this fiscal policy act, government favourable behaving of population sample or general behaving. By announcing a new tax break state budget possibly deprecate some of their revenues from collecting taxes. On the other hand, a new tax break stimulates the economy of subjects in the state, which could possibly strengthen the increase of outcomes that will be taxed. Every tax break must go through the legislative system to be accepted by authorized institutions to become valid. Most of the countries pledge this position to the ministry of finance, which approves new tax breaks as tax law. Whether for validation is needed an agreement with other constitutional officials depends on state legislative. However, in the same manner, could the tax break be ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Relief

Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons, property, income, or transactions. Tax-exempt status may provide complete relief from taxes, reduced rates, or tax on only a portion of items. Examples include exemption of charitable organizations from property taxes and income taxes, veterans, and certain cross-border or multi-jurisdictional scenarios. A tax exemption is distinct and different from a tax exclusion and a tax deduction, all of which are different types of tax expenditures. A tax exemption is an income stream on which no tax is levied, such as interest income from state and local bonds, which is often exempt from federal income tax. Additionally, certain qualifying non-profit organizations are exempt from federal income tax. A tax exclusion refers to a dollar amount (or proportion of taxable income) that can be legally excluded from the taxable base income prior to as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Incentives

A tax incentive is an aspect of a government's taxation policy designed to incentivize or encourage a particular economic activity by reducing tax payments. Tax incentives can have both positive and negative impacts on an economy. Among the positive benefits, if implemented and designed properly, tax incentives can attract investment to a country. Other benefits of tax incentives include increased employment, higher number of capital transfers, research and technology development, and also improvement to less developed areas. Though it is difficult to estimate the effects of tax incentives, they can, if done properly, raise the overall economic welfare through increasing economic growth and government tax revenue (after the expiration of the tax holiday/incentive period). However, tax incentives can cause negative effects on a government's financial condition, among other negative effects, if they are not properly designed and implemented. According to a 2020 study of tax ince ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Horizontal Inequality

Horizontal inequality is the inequality—economical, social or other—that does not follow from a difference in an inherent quality such as intelligence, attractiveness or skills for people or profitability for corporations. In sociology, this is particularly applicable to forced inequality between different subcultures living in the same society, i.e. inequalities between culturally formed groups, not economically formed ones. In economics, horizontal inequality is seen when people of similar origin, intelligence, etc. still do not have equal success and have different status, income and wealth Wealth is the abundance of valuable financial assets or physical possessions which can be converted into a form that can be used for transactions. This includes the core meaning as held in the originating Old English word , which is from an .... Traditional economic theory predicts that horizontal inequality should not exist in a free market. However, horizontal inequality is ob ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Growth

In economics, economic growth is an increase in the quantity and quality of the economic goods and Service (economics), services that a society Production (economics), produces. It can be measured as the increase in the inflation-adjusted Output (economics), output of an economy in a given year or over a period of time. The rate of growth is typically calculated as List of countries by real GDP growth rate, real gross domestic product (GDP) growth rate, List of countries by real GDP per capita growth, real GDP per capita growth rate or List of countries by GNI per capita growth, GNI per capita growth. The "rate" of economic growth refers to the Exponential growth, geometric annual rate of growth in GDP or GDP per capita between the first and the last year over a period of time. This growth rate represents the trend in the average level of GDP over the period, and ignores any fluctuations in the GDP around this trend. Growth is usually calculated in "real" value, which is real v ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Natural Disaster

A natural disaster is the very harmful impact on a society or community brought by natural phenomenon or Hazard#Natural hazard, hazard. Some examples of natural hazards include avalanches, droughts, earthquakes, floods, heat waves, landslides - including submarine landslides, tropical cyclones, volcanism, volcanic activity and wildfires. Additional natural hazards include blizzards, dust storms, firestorms, hails, ice storms, sinkholes, thunderstorms, tornadoes and tsunamis. A natural disaster can cause list of natural disasters by death toll, loss of life or property damage, damage property. It typically causes economic damage. How bad the damage is depends on how well people are Emergency management, prepared for disasters and how strong the buildings, roads, and other Infrastructure, structures are. Scholars have argued the term "natural disaster" is unsuitable and should be abandoned. Instead, the simpler term ''disaster'' could be used. At the same time, the type of haz ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

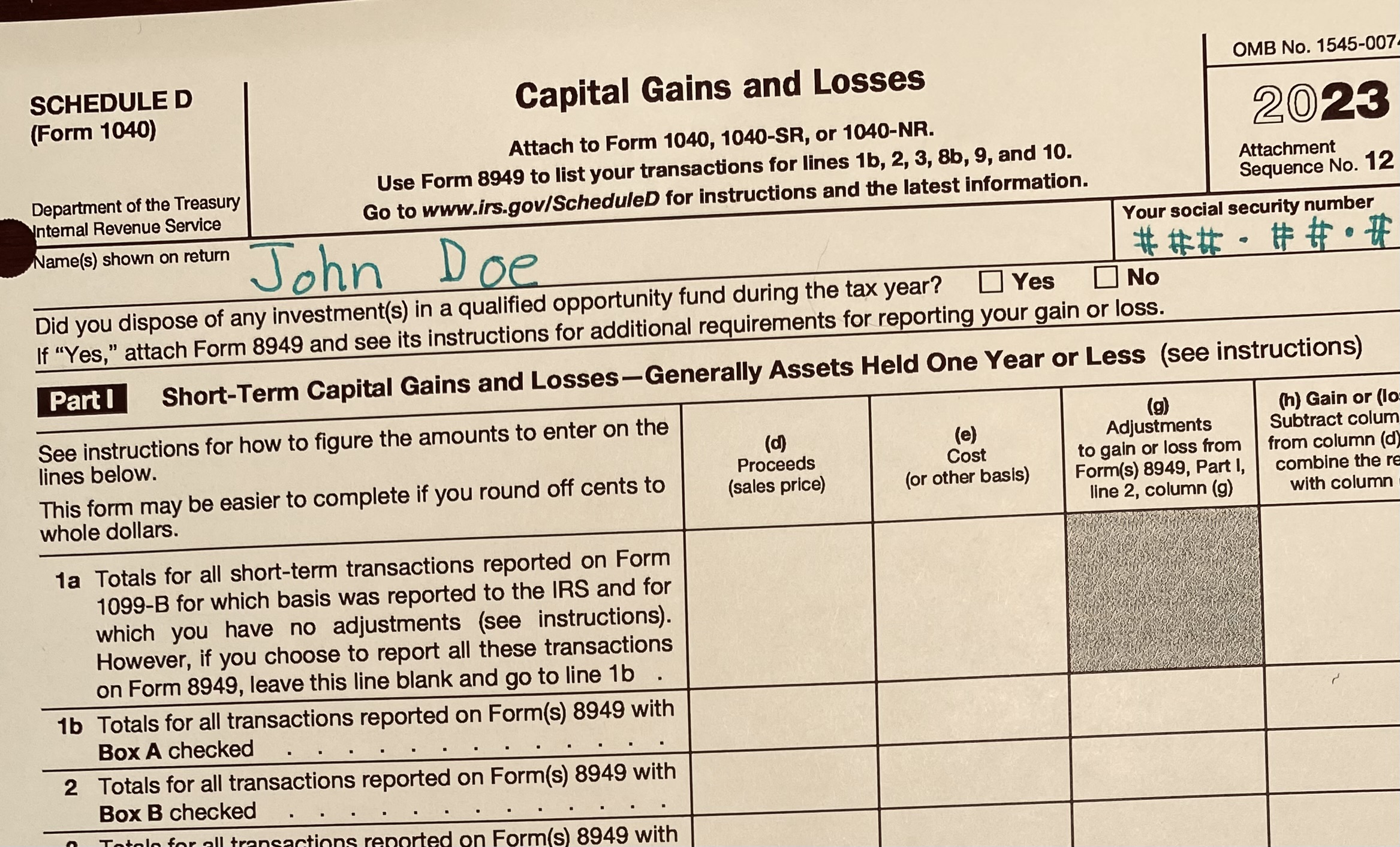

Tax Returns

A tax return is a form on which a person or organization presents an account of income and circumstances, used by the tax authorities to determine liability for tax. Tax returns are usually processed by each country's tax authority, known as a revenue service, such as the Internal Revenue Service in the United States, the State Taxation Administration in China, and HM Revenue and Customs in the United Kingdom. Preparing the tax return A tax return reports income, expenses, tax payments made during the year and other relevant information to the taxing authority. It helps to determine whether a tax refund is due. This will depend on whether a person has overpaid on taxes, or was late in paying tax for previous years. A person or organization may not be required to file a tax return depending on circumstances, which are different in each country. Generally, a tax return does not need to be filed if income is less than a certain amount, but other factors such as the type of inco ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Exemption

Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons, property, income, or transactions. Tax-exempt status may provide complete relief from taxes, reduced rates, or tax on only a portion of items. Examples include exemption of charitable organizations from property taxes and income taxes, veterans, and certain cross-border or multi-jurisdictional scenarios. A tax exemption is distinct and different from a tax exclusion and a tax deduction, all of which are different types of tax expenditures. A tax exemption is an income stream on which no tax is levied, such as interest income from state and local bonds, which is often exempt from federal income tax. Additionally, certain qualifying non-profit organizations are exempt from federal income tax. A tax exclusion refers to a dollar amount (or proportion of taxable income) that can be legally excluded from the taxable base income prior to a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Credit

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. It may also be a credit granted in recognition of taxes already paid or a form of state "discount" applied in certain cases. Another way to think of a tax credit is as a rebate. Refundable vs. non-refundable A refundable tax credit is one which, if the credit exceeds the taxes due, the government pays back to the taxpayer the difference. In other words, it makes possible a negative tax liability. For example, if a taxpayer has an initial tax liability of $100 and applies a $300 tax credit, then the taxpayer ends with a liability of –$200 and the government refunds to the taxpayer that $200. With a non-refundable tax credit, if the credit exceeds the taxes due then the taxpayer pays nothing but does not receive the difference. In this case, the taxpayer from the example would end with a tax liability of $0 (i.e. they could ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

HM Treasury

His Majesty's Treasury (HM Treasury or HMT), and informally referred to as the Treasury, is the Government of the United Kingdom’s economic and finance ministry. The Treasury is responsible for public spending, financial services policy, Tax system, taxation, Infrastructure, state infrastructure, and economic growth. It is led by the Chancellor of the Exchequer, chancellor of the exchequer, currently Rachel Reeves since 5 July 2024. The Treasury's main offices are located in London and Darlington, with additional offices in Edinburgh and Norwich. It is one of the smallest government departments in terms of staff numbers, but widely considered the most powerful. History The origins of the Treasury of England have been traced by some to an individual known as Henry the Treasurer, a servant to King William the Conqueror. This claim is based on an entry in the Domesday Book showing the individual Henry "the treasurer" as a landowner in Winchester, where the royal treasure was sto ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

March 2021 United Kingdom Budget

The March 2021 United Kingdom budget, officially known as Protecting the Jobs and Livelihoods of the British People was a budget delivered by Rishi Sunak, the Chancellor of the Exchequer in March 2021. It was expected to be delivered in autumn 2020, but was postponed because of the COVID-19 pandemic. It succeeds the budget held in March 2020, and the summer statement and Winter Economy Plan held in summer and autumn 2020, respectively. The budget is the second under Boris Johnson's government, also the second to be delivered by Sunak and the second since Britain's withdrawal from the European Union. The budget was the first for government expenditure in the United Kingdom to exceed £1 trillion. It was confirmed on the previous day that the Coronavirus Job Retention Scheme and the Self Employment Income Support Scheme had been extended to 30 September 2021. Key measures In his budget speech, Rishi Sunak emphasized the effect the COVID-19 pandemic has had on the economy, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Deduction

A tax deduction or benefit is an amount deducted from taxable income, usually based on expenses such as those incurred to produce additional income. Tax deductions are a form of tax incentives, along with exemptions and tax credits. The difference between deductions, exemptions, and credits is that deductions and exemptions both reduce taxable income, while credits reduce tax. Above and below the line Above and below the line refers to items above or below adjusted gross income, which is item 37 on the tax year 2017 1040 tax form. Tax deductions above the line lessen adjusted gross income, while deductions below the line can only lessen taxable income if the aggregate of those deductions exceeds the standard deduction, which in tax year 2018 in the U.S., for example, was $12,000 for a single taxpayer and $24,000 for married couple. Limitations Often, deductions are subject to conditions, such as being allowed only for expenses incurred that produce current benefits. Capital ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Solvency

Solvency, in finance or business, is the degree to which the current assets of an individual or entity exceed the current liabilities of that individual or entity. Solvency can also be described as the ability of a corporation to meet its long-term fixed expenses and to accomplish long-term expansion and growth. This is best measured using the net liquid balance (NLB) formula. In this formula, solvency is calculated by adding cash and cash equivalents to short-term investments, then subtracting notes payable. There exist cryptographic schemes for both proofs of liabilities and assets, especially in the blockchain space. See also * Accounting liquidity * Debt ratio * Going concern * Insolvency * Quick ratio Notes References * * * * * External links *{{Wiktionary-inline Financial economics ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |