|

Self-financing Portfolio

In financial mathematics, a self-financing portfolio is a portfolio having the feature that, if there is no exogenous infusion or withdrawal of money, the purchase of a new asset must be financed by the sale of an old one. Mathematical definition Let h_i(t) denote the number of shares of stock number 'i' in the portfolio at time t , and S_i(t) the price of stock number 'i' in a frictionless market with trading in continuous time. Let : V(t) = \sum_^ h_i(t) S_i(t). Then the portfolio (h_1(t), \dots, h_n(t)) is self-financing if : dV(t) = \sum_^ h_i(t) dS_(t). Discrete time Assume we are given a discrete filtered probability space (\Omega,\mathcal,\_^T,P), and let K_t be the solvency cone (with or without transaction costs) at time ''t'' for the market. Denote by L_d^p(K_t) = \. Then a portfolio (H_t)_^T (in physical units, i.e. the number of each stock) is self-financing (with trading on a finite set of times only) if : for all t \in \ we have that H_t - H_ \in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Mathematics

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling of financial markets. In general, there exist two separate branches of finance that require advanced quantitative techniques: derivatives pricing on the one hand, and risk and portfolio management on the other. Mathematical finance overlaps heavily with the fields of computational finance and financial engineering. The latter focuses on applications and modeling, often by help of stochastic asset models, while the former focuses, in addition to analysis, on building tools of implementation for the models. Also related is quantitative investing, which relies on statistical and numerical models (and lately machine learning) as opposed to traditional fundamental analysis when managing portfolios. French mathematician Louis Bachelier's doctoral thesis, defended in 1900, is considered the first scholarly work on mathematical fina ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Portfolio (finance)

In finance, a portfolio is a collection of investments. Definition The term “portfolio” refers to any combination of financial assets such as stocks, bonds and cash. Portfolios may be held by individual investors or managed by financial professionals, hedge funds, banks and other financial institutions. It is a generally accepted principle that a portfolio is designed according to the investor's risk tolerance, time frame and investment objectives. The monetary value of each asset may influence the risk/reward ratio of the portfolio. When determining asset allocation, the aim is to maximise the expected return and minimise the risk. This is an example of a multi-objective optimization problem: many efficient solutions are available and the preferred solution must be selected by considering a tradeoff between risk and return. In particular, a portfolio A is dominated by another portfolio A' if A' has a greater expected gain and a lesser risk than A. If no portfolio domina ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Frictionless Market

Frictionless can refer to: * Frictionless market * Frictionless continuant * Frictionless sharing * Frictionless plane The frictionless plane is a concept from the writings of Galileo Galilei. In his 1638 '' The Two New Sciences'', Galileo presented a formula that predicted the motion of an object moving down an inclined plane. His formula was based upon his past e ... * Frictionless flow {{disambiguation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Filtered Probability Space

Filtration is a physical separation process that separates solid matter and fluid from a mixture using a ''filter medium'' that has a complex structure through which only the fluid can pass. Solid particles that cannot pass through the filter medium are described as ''oversize'' and the fluid that passes through is called the ''filtrate''. Oversize particles may form a filter cake on top of the filter and may also block the filter lattice, preventing the fluid phase from crossing the filter, known as ''blinding''. The size of the largest particles that can successfully pass through a filter is called the effective ''pore size'' of that filter. The separation of solid and fluid is imperfect; solids will be contaminated with some fluid and filtrate will contain fine particles (depending on the pore size, filter thickness and biological activity). Filtration occurs both in nature and in engineered systems; there are biological, geological, and industrial forms. Filtration is al ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

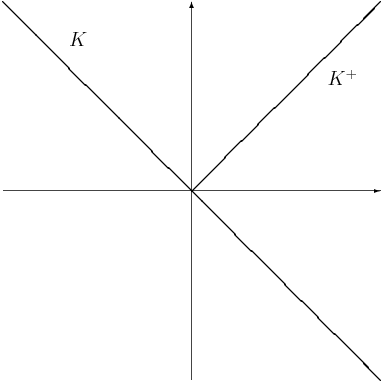

Solvency Cone

The solvency cone is a concept used in financial mathematics which models the possible trades in the Market (economics), financial market. This is of particular interest to markets with transaction costs. Specifically, it is the convex cone of portfolios that can be exchanged to portfolios of non-negative components (including paying of any transaction costs). Mathematical basis If given a bid-ask matrix \Pi for d assets such that \Pi = \left(\pi^\right)_ and m \leq d is the number of assets which with any non-negative quantity of them can be "discarded" (traditionally m = d), then the solvency cone K(\Pi) \subset \mathbb^d is the convex cone spanned by the unit vectors e^i, 1 \leq i \leq m and the vectors \pi^e^i-e^j, 1 \leq i,j \leq d. Definition A solvency cone K is any closed convex cone such that K \subseteq \mathbb^d and K \supseteq \mathbb^d_+. Uses A process of (random) solvency cones \left\_^T is a model of a financial market. This is sometimes called a market process. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Transaction Costs

In economics and related disciplines, a transaction cost is a cost in making any economic trade when participating in a market. Oliver E. Williamson defines transaction costs as the costs of running an economic system of companies, and unlike production costs, decision-makers determine strategies of companies by measuring transaction costs and production costs. Transaction costs are the total costs of making a transaction, including the cost of planning, deciding, changing plans, resolving disputes, and after-sales. Therefore, the transaction cost is one of the most significant factors in business operation and management. Oliver E. Williamson's ''Transaction Cost Economics'' popularized the concept of transaction costs. Douglass C. North argues that institutions, understood as the set of rules in a society, are key in the determination of transaction costs. In this sense, institutions that facilitate low transaction costs, boost economic growth.North, Douglass C. 1992. “Tr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Replicating Portfolio

In mathematical finance, a replicating portfolio for a given asset or series of cash flows is a portfolio of assets with the same properties (especially cash flows). This is meant in two distinct senses: static replication, where the portfolio has the same cash flows as the reference asset (and no changes need to be made to maintain this), and dynamic replication, where the portfolio does not have the same cash flows, but has the same "Greeks" as the reference asset, meaning that for small (properly, infinitesimal) changes to underlying market parameters, the price of the asset and the price of the portfolio change in the same way. Dynamic replication requires continual adjustment, as the asset and portfolio are only assumed to behave similarly at a single point (mathematically, their partial derivatives are equal at a single point). Given an asset or liability, an offsetting replicating portfolio (a "hedge") is called a static hedge or dynamic hedge, and constructing such a portfol ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |