|

Reciprocal Inter-insurance Exchange

A reciprocal inter-insurance exchange or simply a reciprocal is an unincorporated association in which subscribers exchange insurance policies to pool and spread risk. For consumers, reciprocal exchanges often offer similar policies to those offered by a stock company or a mutual insurance company. Large reciprocal exchanges in the United States include USAA, Farmers, and Erie. History Reciprocals began in 1881 when dry-good merchants in New York were discontent with their experience with other insurers in covering their buildings. The store owners believed that they had well-maintained buildings and were being overcharged by risk rating methodologies used by insurers at the time. Because the merchants were well-capitalized and could absorb certain losses, they decided to self-insure to lower their insurance costs. Subscribers indemnified each other when a member suffered a loss, but the process of collecting from those who did not suffer and remitting funds to those who did ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unincorporated Association

Unincorporated associations are one vehicle for people to cooperate towards a common goal. The range of possible unincorporated associations is nearly limitless, but typical examples are: :* An amateur football team who agree to hire a pitch once a week and split the cost. :* Residents of a street who agree to pay into a collective fund for street sweeping, etc. :* A co-operative. :* A trade union. :* A professional association. This article focuses on unincorporated associations in common law jurisdictions, such as the United Kingdom, Canada, and New Zealand. From a legal point of view, the most significant feature of an association is exactly that they are unincorporated: i.e., they lack legal personality. This is in contrast to some civil law jurisdictions, which confer legal personality on associations once they are suitably registered. Unincorporated associations are cheap and easy to form, requiring a bare minimum of formalities to bring them into existence. (Indeed, the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

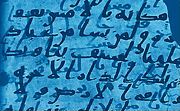

Sharia

Sharia (; ar, شريعة, sharīʿa ) is a body of religious law that forms a part of the Islamic tradition. It is derived from the religious precepts of Islam and is based on the sacred scriptures of Islam, particularly the Quran and the Hadith. In Arabic, the term ''sharīʿah'' refers to God's immutable divine law and is contrasted with ''fiqh'', which refers to its human scholarly interpretations. In the historical course, fiqh sects have emerged that reflect the preferences of certain societies and state administrations on behalf of people who are interested in the theoretical (method) and practical application ( Ahkam / fatwa) studies of laws and rules, but sharia has never been a valid legal system on its own. It has been used together with " customary (Urf) law" since Omar or the Umayyads. It may also be wrong to think that the Sharia, as a religious argument or belief, is entirely within or related to Allah's commands and prohibitions. Several non-graded crime ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mutual Insurance

A mutual insurance company is an insurance company owned entirely by its policyholders. Any profits earned by a mutual insurance company are either retained within the company or rebated to policyholders in the form of dividend distributions or reduced future premiums. In contrast, a stock insurance company is owned by investors who have purchased company stock; any profits generated by a stock insurance company are distributed to the investors without necessarily benefiting the policyholders. History The concept of mutual insurance originated in England in the late 17th century to cover losses due to fire. The mutual/casualty insurance industry began in the United States in 1752 when Benjamin Franklin established the Philadelphia Contributionship for the Insurance of Houses From Loss by Fire. Mutual property/casualty insurance companies exist now in nearly every country around the globe. The global trade association for the industry, the International Cooperative and Mutual I ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Limited Partnership

A limited partnership (LP) is a form of partnership similar to a general partnership except that while a general partnership must have at least two general partners (GPs), a limited partnership must have at least one GP and at least one limited partner. Limited partnerships are distinct from limited liability partnerships, in which all partners have limited liability. The GPs are, in all major respects, in the same legal position as partners in a conventional firm: they have management control, share the right to use partnership property, share the profits of the firm in predefined proportions, and have joint and several liability for the debts of the partnership. As in a general partnership, the GPs have actual authority, as agents of the firm, to bind the partnership in contracts with third parties that are in the ordinary course of the partnership's business. As with a general partnership, "an act of a general partner which is not apparently for carrying on in the ordinary c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Limited Liability Company

A limited liability company (LLC for short) is the US-specific form of a private limited company. It is a business structure that can combine the pass-through taxation of a partnership or sole proprietorship with the limited liability of a corporation. An LLC is not a corporation under state law; it is a legal form of a company that provides limited liability to its owners in many jurisdictions. LLCs are well known for the flexibility that they provide to business owners; depending on the situation, an LLC may elect to use corporate tax rules instead of being treated as a partnership, and, under certain circumstances, LLCs may be organized as not-for-profit. In certain U.S. states (for example, Texas), businesses that provide professional services requiring a state professional license, such as legal or medical services, may not be allowed to form an LLC but may be required to form a similar entity called a professional limited liability company (PLLC). An LLC is a hy ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

USAA

The United Services Automobile Association (USAA) is a San Antonio-based Fortune 500 diversified financial services group of companies including a Texas Department of Insurance-regulated reciprocal inter-insurance exchange and subsidiaries offering banking, investing, and insurance to people and families who serve, or served, in the United States Armed Forces. At the end of 2020, it had more than 13 million members. USAA was founded in 1922 in San Antonio by a group of 25 U.S. Army officers as a mechanism for mutual self-insurance when they were unable to secure auto insurance because of the perception that they, as military officers, were a high-risk group. USAA has since expanded to offer banking and insurance services to past and present members of the Armed Forces, officers and enlisted, and their families. The company ranked No. 96th in the 2020 Fortune 500 list of the largest United States corporations by total revenue and appeared on Fortune's 2021 Blue Ribbon list of compa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Farmers Insurance Group

Farmers Insurance Group (informally Farmers) is an American insurer group of vehicles, homes and small businesses and also provides other insurance and financial services products. Farmers Insurance has more than 48,000 exclusive and independent agents and approximately 21,000 employees. Farmers is the trade name for three reciprocal insurers, Farmers, Fire, and Truck owned by their policyholders. The non-claims activities of Farmers are managed by an attorney in fact, Farmers Group Inc, which is a wholly owned subsidiary of Swiss-based Zurich Insurance Group. History 1922 to 2000 ;1922 Farmers' future co-founders John C. Tyler and Thomas E. Leavey first met after Tyler moved to California. Tyler and Leavey had both grown up with rural backgrounds and believed that farmers and ranchers, who had better driving records than urbanites, deserved lower insurance premiums. During the 1920s, farmers across the United States were establishing their own mutual insurance firms and coope ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Erie Insurance Group

Erie Insurance, based in Erie, Pennsylvania, is a property and casualty insurance company offering auto, home, business and life insurance through a network of independent insurance agents. , Erie Insurance Group is ranked 347th on the 2021 Fortune 500 list of largest American corporations, based on total revenue for the 2020 fiscal year. Rated A+ (Superior) by A.M. Best, ERIE has more than 6 million policies in force and operates in 12 states and the District of Columbia, including Illinois, Indiana, Kentucky, Maryland, New York, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia and Wisconsin. It also owns the naming rights to the Erie Insurance Arena in downtown Erie, Pennsylvania. History Erie Insurance Exchange began in 1925 when two salesman for the Pennsylvania Indemnity Exchange, H.O. Hirt and O.G. Crawford, left to create their own insurance company. In three months and 20 days, the two convinced 90 stockholders to invest using a hand-written busin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Armed Forces Insurance

Armed Forces Insurance (AFI) is a reciprocal insurance exchange that provides property and casualty insurance to military professionals throughout the United States and overseas. AFI is headquartered in Leavenworth, Kansas, approximately 20 miles northwest of Kansas City, Missouri. About Armed Forces Insurance AFI's insurance coverages include auto, home, renter, life, business, flood, motorcycle, watercraft, motor home, pet health, umbrella, condo, mobile home, valuable items, and collector vehicle. All AFI members also receive free identity theft resolution and identity document recovery services in the event of a disaster. Another benefit of membership is a complimentary service that offers AFI members customizable, interactive tools to help increase home efficiency, save money, and inventory your personal property. AFI is a "reciprocal exchange", a type of cooperative insurer in which the policyholders bear a relationship to each other. In effect, AFI is owned by the policyhol ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Automobile Association

American Automobile Association (AAA – commonly pronounced as "Triple A") is a federation of motor clubs throughout North America. AAA is a privately held not-for-profit national member association and service organization with over 60 million members in the United States and Canada. AAA provides services to its members, including roadside assistance and others. Its national headquarters are in Heathrow, Florida. History The American Automobile Association (the "AAA" or "Triple-A") was founded on March 4, 1902, in Chicago, Illinois, in response to a lack of roads and highways suitable for automobiles.Automobile Men Organize . ''Minneapolis Daily Times''. March 5, 1902. p. 6. At that time, nine motor clubs with a total of 1,500 members banded together to form the AAA. Those individual motor clubs included the Chicago ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Takaful

Takaful ( ar, التكافل, sometimes translated as "solidarity" or mutual guarantee) Khan, ''What Is Wrong with Islamic Economics?'', 2013: p.403 is a co-operative system of reimbursement or repayment in case of loss, organized as an Islamic or ''sharia'' compliant alternative to conventional insurance, which contains ''riba'' (usury) and ''gharar'' (excessive uncertainty). Khan, ''What Is Wrong with Islamic Economics?'', 2013: p.402 Under takaful, people and companies concerned about hazards make regular contributions ("donations") to be reimbursed or repaid to members in the event of loss, and managed on their behalf by a takaful operator. Like other Islamic finance products, Takaful is grounded in Islamic '' Muamalat'' (commercial and civil acts or dealings branch of Islamic law). In 2018, the takaful industry had grown to a size of $27.7 billion of "contributions" (from a 2011 figure of $12 billion). The movement has been praised as providing "superior alternatives" to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |