|

Risk Of Longevity

A longevity risk is any potential risk attached to the increasing life expectancy of pensioners and policy holders, which can eventually result in higher pay-out ratios than expected for many pension funds and insurance companies. One important risk to individuals who are spending down savings is that they will live longer than expected, and thus exhaust their savings, dying in poverty or burdening relatives. This is also referred to as "outliving one's savings" or "outliving one's assets". Individuals Individuals often underestimate longevity risk. In the United States, most retirees do not expect to live past 85, but this is in fact the median conditional life expectancy for men at 65 (half of 65-year-old men will live to 85 or older, and more women will). Low interest rates and declining returns exacerbating longevity risk The collapse in returns on government bonds is taking place against the backdrop of a protracted fall in returns for other core assets such as blue ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

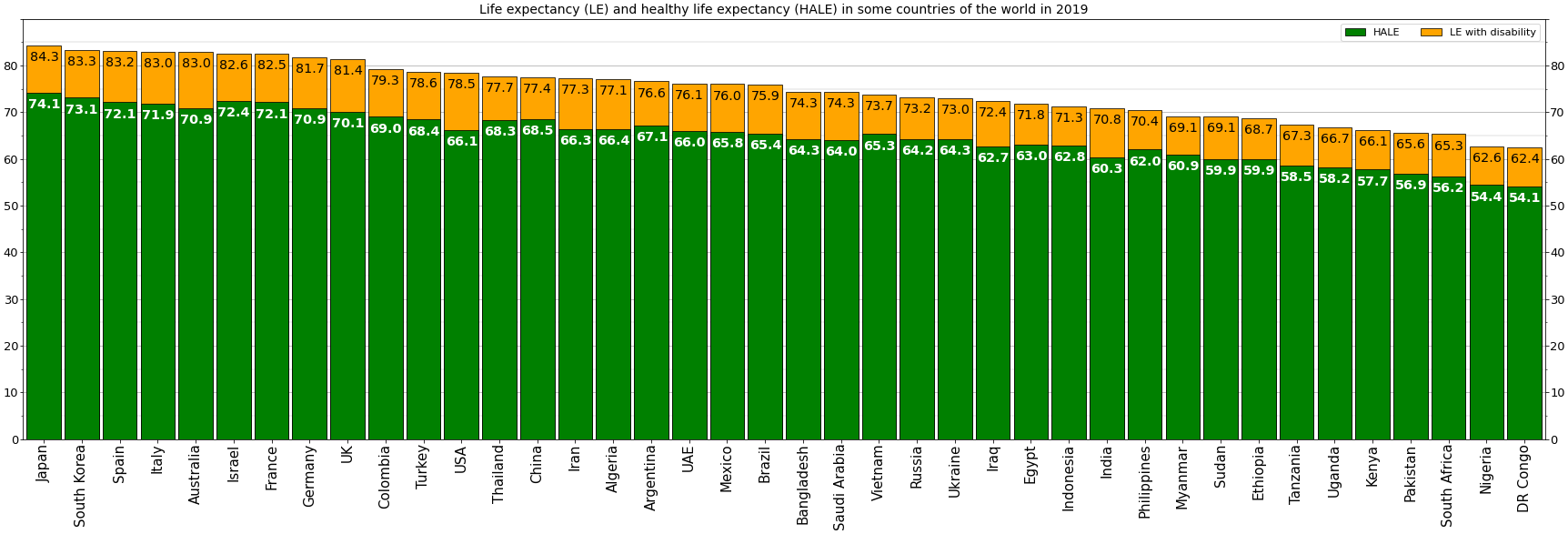

Life Expectancy

Human life expectancy is a statistical measure of the estimate of the average remaining years of life at a given age. The most commonly used measure is ''life expectancy at birth'' (LEB, or in demographic notation ''e''0, where ''e''x denotes the average life remaining at age ''x''). This can be defined in two ways. ''Cohort'' LEB is the mean length of life of a birth Cohort (statistics), cohort (in this case, all individuals born in a given year) and can be computed only for cohorts born so long ago that all their members have died. ''Period'' LEB is the mean length of life of a hypothetical cohort assumed to be exposed, from birth through death, to the mortality rates observed at a given year. National LEB figures reported by national agencies and international organizations for human populations are estimates of ''period'' LEB. Human remains from the early Bronze Age indicate an LEB of 24. In 2019, world LEB was 73.3. A combination of high infant mortality and d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pensioner

A pensioner is a person who receives a pension, most commonly because of retirement from the workforce. This is a term typically used in the United Kingdom (along with OAP, initialism of old-age pensioner), Ireland and Australia where someone of pensionable age may also be referred to as an 'old age pensioner'. In the United States, the term retiree is more common, and in New Zealand, the term superannuitant is commonly used. In many countries, increasing life expectancy has led to an expansion of the numbers of pensioners, and they are a growing political force. Political parties * 50Plus in the Netherlands * Dor, the Israeli Pensioners' Party * National Party of Retirees and Pensioners in Poland * Party of United Pensioners of Serbia * Pensioners' Party * Norwegian Pensioners Party * Scottish Senior Citizens Unity Party * Swedish Senior Citizen Interest Party Other uses * In the University of Cambridge, a pensioner is a student who is not a scholar or sizar and who p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pension Fund

A pension fund, also known as a superannuation fund in some countries, is any program, fund, or scheme which provides pension, retirement income. The U.S. Government's Social Security Trust Fund, which oversees $2.57 trillion in assets, is the world's largest public pension fund. Pension funds typically have large amounts of money to invest and are the major investors in listed and private companies. They are especially important to the stock market where large institutional investors dominate. The largest 300 pension funds collectively hold about USD$6 Trillion (short scale), trillion in assets. In 2012, PricewaterhouseCoopers estimated that pension funds worldwide hold over $33.9 trillion in assets (and were expected to grow to more than $56 trillion by 2020), the largest for any category of institutional investor ahead of mutual funds, insurance companies, currency reserves, sovereign wealth funds, hedge funds, or private equity. Classifications Open vs. closed pension fund ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Retirement Spend Down

At retirement, individuals stop working and no longer get employment earnings, and enter a phase of their lives, where they rely on the assets they have accumulated, to supply money for their spending needs for the rest of their lives. Retirement spend-down, or withdrawal rate, is the strategy a retiree follows to spend, decumulate or withdraw assets during retirement. Retirement planning aims to prepare individuals for retirement spend-down, because the different spend-down approaches available to retirees depend on the decisions they make during their working years. Actuaries and financial planners are experts on this topic. Importance More than 10,000 Post-World War II baby boomers will reach age 65 in the United States every day between 2014 and 2027. This represents the majority of the more than 78 million Americans born between 1946 and 1964. As of 2014, 74% of these people are expected to be alive in 2030, which highlights that most of them will live for many year ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Poverty

Poverty is a state or condition in which an individual lacks the financial resources and essentials for a basic standard of living. Poverty can have diverse Biophysical environment, environmental, legal, social, economic, and political causes and effects. When evaluating poverty in statistics or economics there are two main measures: ''absolute poverty'' which compares income against the amount needed to meet basic needs, basic personal needs, such as food, clothing, and Shelter (building), shelter; secondly, ''relative poverty'' measures when a person cannot meet a minimum level of living standards, compared to others in the same time and place. The definition of ''relative poverty'' varies from one country to another, or from one society to another. Statistically, , most of the world's population live in poverty: in Purchasing Power Parity, PPP dollars, 85% of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Bond

A government bond or sovereign bond is a form of Bond (finance), bond issued by a government to support government spending, public spending. It generally includes a commitment to pay periodic interest, called Coupon (finance), coupon payments'','' and to repay the face value on the Maturity (finance), maturity date. For example, a bondholder invests $20,000, called face value or principal, into a 10-year government bond with a 10% annual coupon; the government would pay the bondholder 10% interest ($2000 in this case) each year and repay the $20,000 original face value at the date of maturity (i.e. after 10 years). Government bonds can be denominated in a foreign currency or the government's domestic currency. Countries with less stable economies tend to denominate their bonds in the currency of a country with a more stable economy (i.e. a hard currency). All government bonds carry Default (finance), default risk; that is, the possibility that the government will be unable to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

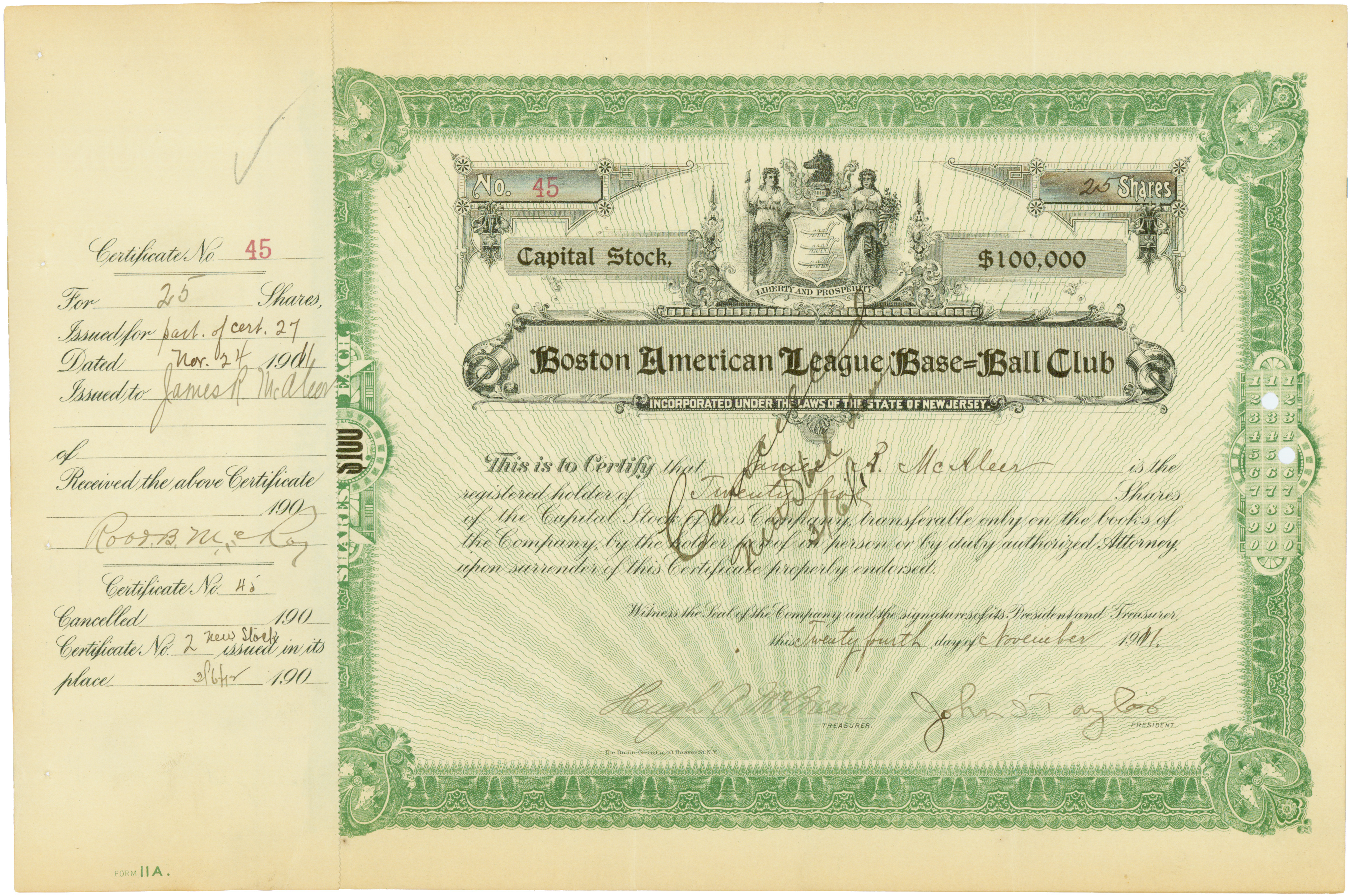

Share Capital

A corporation's share capital, commonly referred to as capital stock in the United States, is the portion of a corporation's equity that has been derived by the issue of shares in the corporation to a shareholder, usually for cash. ''Share capital'' may also denote the number and types of shares that compose a corporation's share structure. Definition In accounting, the share capital of a corporation is the nominal value of issued shares (that is, the sum of their par values, sometimes indicated on share certificates). If the allocation price of shares is greater than the par value, as in a rights issue, the shares are said to be sold at a premium (variously called share premium, additional paid-in capital or paid-in capital in excess of par). This equation shows the constituents that make up a company's real share capital: : \sum\text \times \text This is differentiated from share capital in the accounting sense, as it presents nominal share capital and does not take t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance Premium

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to protect against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

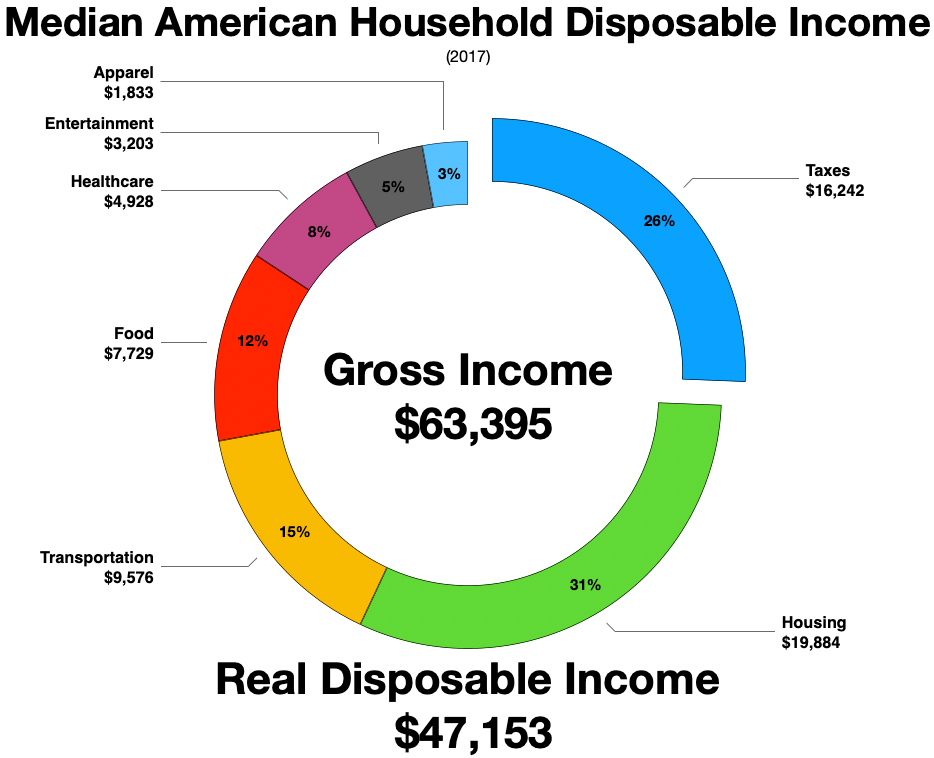

Disposable Income

Disposable income is total personal income minus current taxes on income. In national accounting, personal income minus personal current taxes equals disposable personal income or household disposable income. Subtracting personal outlays (which includes the major category of personal r privateconsumption expenditure) yields personal (or, private) savings, hence the income left after paying away all the taxes is referred to as disposable income. Restated, consumption expenditure plus savings equals disposable income after accounting for transfers such as payments to children in school or elderly parents' living and care arrangements. The marginal propensity to consume (MPC) is the fraction of a change in disposable income that is consumed. For example, if disposable income rises by $100, and $65 of that $100 is consumed, the MPC is 65%. Restated, the marginal propensity to save is 35%. For the purposes of calculating the amount of income subject to garnishments, United ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Actuarial Science

Actuarial science is the discipline that applies mathematics, mathematical and statistics, statistical methods to Risk assessment, assess risk in insurance, pension, finance, investment and other industries and professions. Actuary, Actuaries are professionals trained in this discipline. In many countries, actuaries must demonstrate their competence by passing a series of rigorous professional examinations focused in fields such as probability and predictive analysis. Actuarial science includes a number of interrelated subjects, including mathematics, probability theory, statistics, finance, economics, financial accounting and computer science. Historically, actuarial science used deterministic models in the construction of tables and premiums. The science has gone through revolutionary changes since the 1980s due to the proliferation of high speed computers and the union of stochastic actuarial models with modern financial theory. Many universities have undergraduate and gradu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |