|

Global Depository Receipt

A global depository receipt (GDR and sometimes spelled ''depositary'') is a general name for a depositary receipt where a certificate issued by a depository bank, which purchases Share (finance), shares of foreign companies, creates a Security (finance), security on a local Stock exchange, exchange backed by those shares. They are the global equivalent of the original American depositary receipts (ADR) on which they are based. GDRs represent ownership of an underlying number of shares of a foreign company and are commonly used to invest in companies from developing or emerging markets by investors in developed markets. Prices of global depositary receipt are based on the values of related shares, but they are traded and settled independently of the underlying share. Typically, 1 GDR is equal to 10 underlying shares, but any ratio can be used. It is a negotiable instrument which is denominated in some freely convertible currency. GDRs enable a company, the issuer, to access invest ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Depositary Receipt

A depositary receipt (DR) is a negotiable financial instrument issued by a bank to represent a foreign company's Public company, publicly traded Security (finance), securities. The depositary receipt trades on a local stock exchange. Depositary receipts facilitates buying shares in foreign companies, because the shares do not have to leave the home country. Depositary receipts that are listed and traded in the United States are American depositary receipts (ADRs). European banks issue European depositary receipts (EDRs), and other banks issue global depository receipts (GDRs). How it works A depositary receipt typically requires a company to meet a stock exchange’s specific rules before listing its stock for sale. For example, a company must transfer shares to a brokerage house in its home country. Upon receipt, the brokerage uses a custodian bank, custodian connected to the international stock exchange for selling the depositary receipts. This connection ensures that the shar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Bank Of New York Mellon

The Bank of New York Mellon Corporation, commonly known as BNY, is an American international financial services company headquartered in New York City. It was established in its current form in July 2007 by the merger of the Bank of New York and Mellon Financial Corporation. Through the lineage of Bank of New York, which was founded in 1784 by a group that included Alexander Hamilton, BNY is regarded as one of the three oldest banks in the United States and among the oldest in the world. It was the first company listed on the New York Stock Exchange. In 2024, it was ranked 130th on the ''Fortune'' 500 list of the largest U.S. corporations by total revenue. As of 2024, it is the 13th-largest bank in the United States by total assets and the 83rd-largest in the world. BNY is considered a systemically important financial institution by the Financial Stability Board. BNY provides a wide range of financial services, including asset management, custody and securities services, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cross Listing

Cross-listing (or multi-listing, or interlisting) of shares is when a firm lists its equity shares on one or more foreign stock exchange in addition to its domestic exchange. To be cross-listed, a company must thus comply with the requirements of all the stock exchanges in which it is listed, such as filing. Cross-listing should not be confused with other methods that allow a company's stock to be traded in two different exchanges, such as: * Dual listed companies, where two distinct companies (with separate stocks listed on different exchanges) function as one company. * Depositary receipts, which are only a representation of the stock, issued by a third-party bank rather than by the company itself. However, in practice the two terms are often used interchangeably. * ''Admitted for trading'', where a foreign share is accessible in a different market through an exchange convention and not actually registered within that different market. Generally such a company's primary listin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Indian Depository Receipt

Indian Depository Receipt (IDR) is a financial instrument denominated in Indian Rupees in the form of a depository receipt. The IDR is a specific Indian version of the similar global depository receipts. It is created by a Domestic Depository (custodian of securities registered with the Securities and Exchange Board of India) against the underlying equity of issuing company to enable foreign companies to raise funds from the Indian securities Markets.Issues by foreign companies in India (Indian Depository Receipts)(IDRs) Securities and Exchange Board of India (SEBI) The foreign company IDRs will deposit shares to an Indian depository. The depository would issue receipts to indian investors against these shares. The benefit of the underlying shares (like bonus, dividends etc. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Depositary Receipt

A European depositary receipt (EDR) represents ownership in the shares of a non-European company that trades in European financial markets. It is a European equivalent of the original American depositary receipts (ADR). The EDR is issued by a bank in Europe representing stocks traded on an exchange outside of the bank’s home country. The stock of some non-European companies trade on European stock exchanges like London Stock Exchange through the use of EDRs. EDRs enable European investors to buy shares in foreign companies without the hazards or inconveniences of cross-border and cross-currency transactions. EDRs can be issued in any currency, but euro is the most common currency for this type of security. If the EDR is issued in euros, it pays dividends in euros and can be traded like the shares of European companies. See also * Depositary receipt * American depositary receipt * Global depositary receipt * Cross listing Cross-listing (or multi-listing, or interlisting ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Depositary Receipt

A depositary receipt (DR) is a negotiable financial instrument issued by a bank to represent a foreign company's Public company, publicly traded Security (finance), securities. The depositary receipt trades on a local stock exchange. Depositary receipts facilitates buying shares in foreign companies, because the shares do not have to leave the home country. Depositary receipts that are listed and traded in the United States are American depositary receipts (ADRs). European banks issue European depositary receipts (EDRs), and other banks issue global depository receipts (GDRs). How it works A depositary receipt typically requires a company to meet a stock exchange’s specific rules before listing its stock for sale. For example, a company must transfer shares to a brokerage house in its home country. Upon receipt, the brokerage uses a custodian bank, custodian connected to the international stock exchange for selling the depositary receipts. This connection ensures that the shar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Exchange

A stock exchange, securities exchange, or bourse is an exchange where stockbrokers and traders can buy and sell securities, such as shares of stock, bonds and other financial instruments. Stock exchanges may also provide facilities for the issue and redemption of such securities and instruments and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as "continuous auction" markets with buyers and sellers consummating transactions via open outcry at a central location such as the floor of the exchange or by using an electronic system to process financial transactions. To be able to trade a security on a particular stock exchange, the security must be listed there. Usually, there is a central location for record keeping, but trade is increasingly less linked to a physical place as mod ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

London Stock Exchange

The London Stock Exchange (LSE) is a stock exchange based in London, England. the total market value of all companies trading on the LSE stood at US$3.42 trillion. Its current premises are situated in Paternoster Square close to St Paul's Cathedral. Since 2007, it has been part of the London Stock Exchange Group (LSEG, which the exchange also lists (ticker symbol LSEG)). Despite a post-Brexit exodus of stock listings from the LSE, it was the most valued stock exchange in Europe as of 2023. According to the 2020 Office for National Statistics report, approximately 12% of UK-resident individuals reported having investments in stocks and shares. According to a 2020 Financial Conduct Authority report, approximately 15% of British adults reported having investments in stocks and shares. History Coffee House The Royal Exchange, London, Royal Exchange had been founded by the English financier Thomas Gresham and Sir Richard Clough on the model of the The Belgian bourse of Antwerp, An ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Luxembourg Stock Exchange

The Luxembourg Stock Exchange, LuxSE () is based in Luxembourg City at 35A boulevard Joseph II. The chairman of the board is Alain Kinsch and the chief executive officer is Julie Becker. History A law establishing a stock exchange in Luxembourg was passed on 30 January 1927. The company was incorporated as ''Société Anonyme'''' de la Bourse de Luxembourg'' on 5 April 1928, with an initial issue of 7,000 shares, each valued at 1000 francs. 0/sup> In March 2014, LuxSE moved to its new headquarters – the Aurora building– erected in line with the green construction concept. In 2015, the exchange celebrated the 10th anniversary of its Euro MTF Market. Agreements with other exchanges In November 2000, LuxSE signed a cooperation agreement with Euronext. As part of the agreement, trades in Luxembourg are generated through Euronext's Universal Trading Platform (UTP) allowing existing Euronext members to activate a cross-membership status on LuxSE. On January 13, 2020 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Frankfurt Stock Exchange

The Frankfurt Stock Exchange (, former German name: , ''FWB'') is the world's 3rd oldest and 12th largest stock exchange by market capitalization. It has operations from 8:00 am to 10:00 pm ( German time). Organisation Located in Frankfurt, Germany, the Frankfurt Stock Exchange is owned and operated by Deutsche Börse AG and Börse Frankfurt Zertifikate AG. It is located in the district of Innenstadt and within the central business district known as Bankenviertel. With 90 percent of its turnover generated in Germany, namely at the two trading venues Xetra and Börse Frankfurt, the Frankfurt Stock Exchange is the largest of the seven regional securities exchanges in Germany. The trading indices are DAX, DAXplus, CDAX, DivDAX, LDAX, MDAX, SDAX, TecDAX, VDAX and EuroStoxx 50. Trading venues Xetra and Börse Frankfurt Through its Cash Market business section, Deutsche Börse AG now operates two trading venues at the Frankfurt Stock Exchange. * Xetra is the refe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

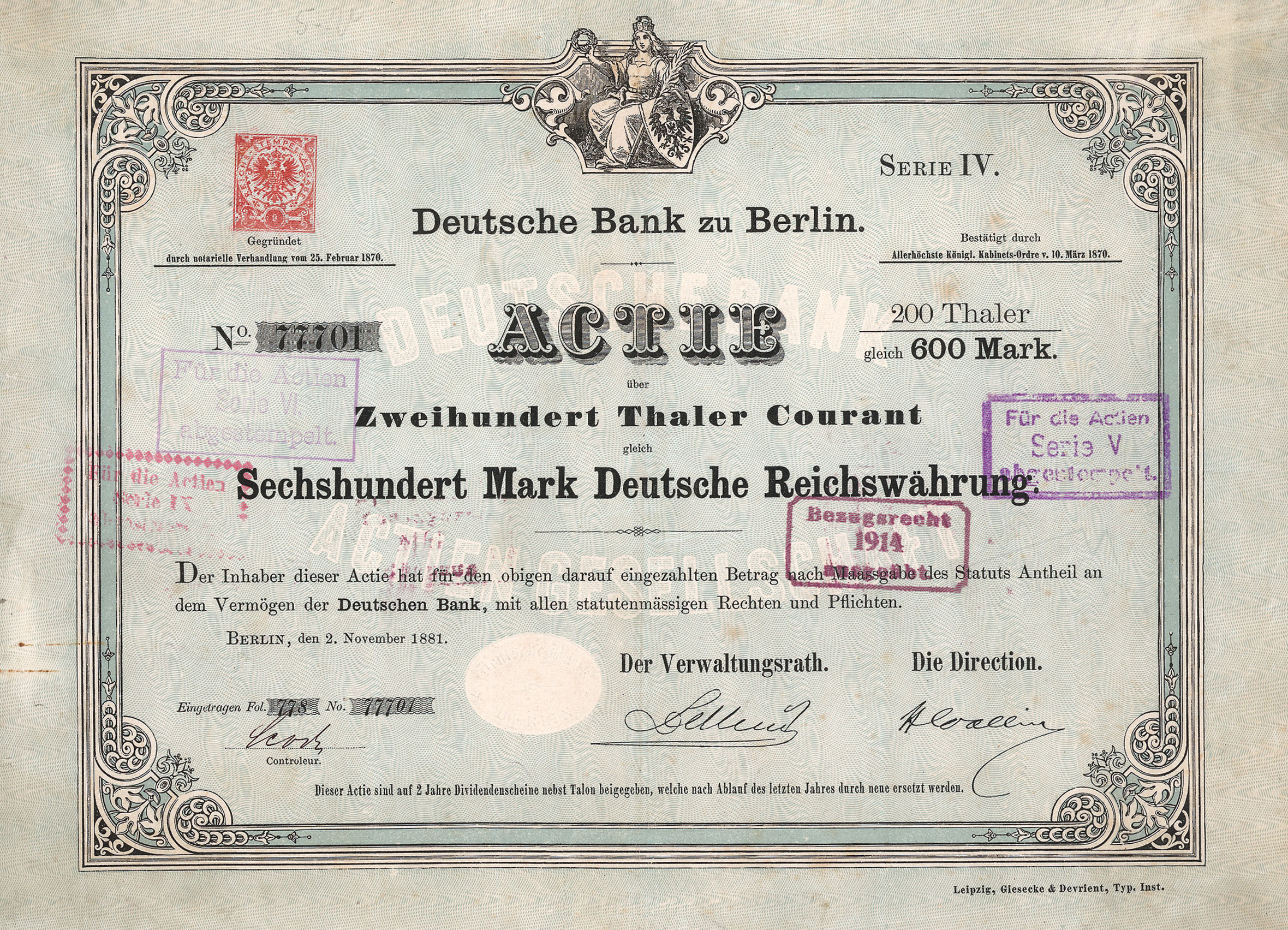

Deutsche Bank

Deutsche Bank AG (, ) is a Germany, German multinational Investment banking, investment bank and financial services company headquartered in Frankfurt, Germany, and dual-listed on the Frankfurt Stock Exchange and the New York Stock Exchange. Deutsche Bank was founded in 1870 in Berlin. From 1929 to 1937, following its merger with Disconto-Gesellschaft, it was known as ''Deutsche Bank und Disconto-Gesellschaft'' or DeDi-Bank. Other transformative acquisitions have included those of Mendelssohn & Co. in 1938, Morgan, Grenfell & Company, Morgan Grenfell in 1990, Bankers Trust in 1998, and Deutsche Postbank in 2010. As of 2018, the bank's network spanned 58 countries with a large presence in Europe, the Americas, and Asia. It is a component of the DAX stock market index and is often referred to as the List of banks in Germany, largest German banking institution, with Deutsche Bank holding the majority stake in DWS Group for combined assets of 2.2 trillion euros, rivaling even Spa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |