|

Gharar

''Gharar'' () literally means uncertainty, hazard, chance or risk. It is a negative element in ''mu'amalat'' ''fiqh'' (transactional Islamic jurisprudence), like ''riba'' (usury) and '' maisir'' (gambling). One Islamic dictionary (''A Concise Dictionary of Islamic Terms'') describes it as "the sale of what is not present" — such as fish not yet caught, crops not yet harvested. Similarly, author Muhammad Ayub says that "in the legal terminology of jurists", ''gharar'' is "the sale of a thing which is not present at hand, or the sale of a thing whose ''aqibah'' (consequence) is not known, or a sale involving hazard in which one does not know whether it will come to be or not". Definitions, fiqh According to Sami Al-Suwailem, "researchers in Islamic finance" do not agree on the "precise meaning" of gharar, although there is not necessarily great difference among the Islamic schools of jurisprudence ( madhab) in the term's definition. The ''Hanafi'' legal school defines ''gharar'' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sharia And Securities Trading

Sharia and securities trading is the impact of conventional financial markets activity for those following the islamic religion and particularly sharia law. Sharia practices ban ''riba'' (earning interest) and involvement in ''haram''. It also forbids gambling (''maisir'') and excessive risk (''bayu al- gharar''). Farooq, ''Riba-Interest Equation and Islam'', 2005: p. 3–6 Khan, ''What Is Wrong with Islamic Economics?'', 2013: p. 216–226 This, however has not stopped some in Islamic finance industry from using some of these instruments and activities, but their permissibility is a subject of "heated debate" within the religion. Of particular interest are financial markets activities such as margin trading, short selling, day trading and derivative trading including futures, options and swaps which are considered by some as ''haram'' or forbidden. History The Islamic banking and finance movement that developed in the late 20th century as part of Islamic schools and branc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Islamic Banking And Finance

Islamic banking, Islamic finance ( ''masrifiyya 'islamia''), or Sharia-compliant finance is banking or Finance, financing activity that complies with Sharia (Islamic law) and its practical application through the development of Islamic economics. Some of the modes of Islamic finance include ''Profit and loss sharing#Mudarabah, mudarabah'' (profit-sharing and loss-bearing), ''wadiah'' (safekeeping), ''musharaka'' (joint venture), ''murabahah'' (cost-plus), and ''ijarah'' (leasing). Sharia prohibits ''riba'', or usury, generally defined as interest paid on all loans of money (although some Muslims dispute whether there is a consensus that interest is equivalent to ''riba''). Investment in businesses that provide goods or services considered contrary to Islamic Value (personal and cultural), principles (e.g. pork or alcohol) is also ''haram'' ("sinful and prohibited"). These prohibitions have been applied historically in varying degrees in Muslim countries/communities to prevent ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Islamic Banking

Islamic banking, Islamic finance ( ''masrifiyya 'islamia''), or Sharia-compliant finance is banking or financing activity that complies with Sharia (Islamic law) and its practical application through the development of Islamic economics. Some of the modes of Islamic finance include '' mudarabah'' (profit-sharing and loss-bearing), '' wadiah'' (safekeeping), '' musharaka'' (joint venture), '' murabahah'' (cost-plus), and '' ijarah'' (leasing). Sharia prohibits ''riba'', or usury, generally defined as interest paid on all loans of money (although some Muslims dispute whether there is a consensus that interest is equivalent to ''riba''). Investment in businesses that provide goods or services considered contrary to Islamic principles (e.g. pork or alcohol) is also ''haram'' ("sinful and prohibited"). These prohibitions have been applied historically in varying degrees in Muslim countries/communities to prevent un-Islamic practices. In the late 20th century, as part of the revi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Takaful

Takaful (, sometimes translated as "solidarity" or mutual guarantee) Khan, ''What Is Wrong with Islamic Economics?'', 2013: p.403 is a co-operative system of reimbursement or repayment in case of loss, organized as an Islamic or ''sharia''-compliant alternative to conventional insurance, which contains ''riba'' (usury) and '' gharar'' (excessive uncertainty). Khan, ''What Is Wrong with Islamic Economics?'', 2013: p.402 Under takaful, people and companies concerned about hazards make regular contributions ("donations") to be reimbursed or repaid to members in the event of loss, and managed on their behalf by a takaful operator. Like other Islamic finance products, Takaful is grounded in Islamic '' Muamalat'' (commercial and civil acts or dealings branch of Islamic law). In 2018, the takaful industry had grown to a size of $27.7 billion of "contributions" (from a 2011 figure of $12 billion). The movement has been praised as providing "superior alternatives" to insurance that "r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Islamic Economics

Islamic economics () refers to the knowledge of economics or economic activities and processes in terms of Islamic principles and teachings. Islam has a set of specific moral norms and values about individual and social economic behavior. Therefore, it has its own economic system, which is based on its philosophical views and is compatible with the Islamic organization of other aspects of human behavior: social and political systems. Islamic economics is a broad field, related to the more specific subset of Islamic commercial jurisprudence (, '' fiqh al-mu'āmalāt''). It is also an ideology of economics similar to the labour theory of value, which is "labour-based exchange and exchange-based labour".. While there are differences between the two, Islamic economics still tends to be closer to labor theory rather than subjective theory. Islamic commercial jurisprudence entails the rules of transacting finance or other economic activity in a ''Shari'a'' compliant manner, i.e., a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banking Terms

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. As banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional-reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but, in many ways, functioned as a continuation of ideas and concepts of credit and lending that had their roots in the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit

Credit (from Latin verb ''credit'', meaning "one believes") is the trust which allows one party to provide money or resources to another party wherein the second party does not reimburse the first party immediately (thereby generating a debt), but promises either to repay or return those resources (or other materials of equal value) at a later date. The resources provided by the first party can be either property, fulfillment of promises, or performances. In other words, credit is a method of making reciprocity formal, legally enforceable, and extensible to a large group of unrelated people. The resources provided may be financial (e.g. granting a loan), or they may consist of goods or services (e.g. consumer credit). Credit encompasses any form of deferred payment. Credit is extended by a creditor, also known as a lender, to a debtor, also known as a borrower. Etymology The term "credit" was first used in English in the 1520s. The term came "from Middle French crédit (1 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Maisir

In Islam, gambling ( or ''qimâr'') is forbidden (). ''Maisir'' is totally prohibited by Islamic law () on the grounds that "the agreement between participants is based on immoral inducement provided by entirely wishful hopes in the participants' minds that they will gain by mere chance, with no consideration for the possibility of loss". Definitions Both ''qimar'' and ''maisir'' refer to games of chance, but ''qimar'' is a kind (or subset) of ''maisir''. Author Muhammad Ayub defines ''maisir'' as "wishing something valuable with ease and without paying an equivalent compensation for it or without working for it, or without undertaking any liability against it by way of a game of chance", Another source, Faleel Jamaldeen, defines it as "the acquisition of wealth by chance (not by effort)". Ayub defines ''qimar'' as "also mean ngreceipt of money, benefit or usufruct at the cost of others, having entitlement to that money or benefit by resorting to chance"; Jamaldeen as "any game ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

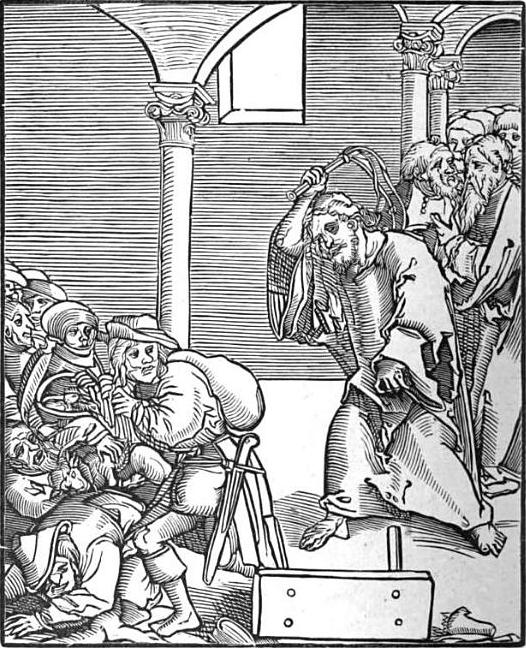

Usury

Usury () is the practice of making loans that are seen as unfairly enriching the lender. The term may be used in a moral sense—condemning taking advantage of others' misfortunes—or in a legal sense, where an interest rate is charged in excess of the maximum rate that is allowed by law. A loan may be considered usurious because of excessive or abusive interest rates or other factors defined by the laws of a state. Someone who practices usury can be called a ''usurer'', but in modern colloquial English may be called a ''loan shark''. In many historical societies including ancient Christian, Jewish, and Islamic societies, usury meant the charging of interest of any kind, and was considered wrong, or was made illegal. During the Sutra period in India (7th to 2nd centuries BC) there were laws prohibiting the highest castes from practicing usury. Similar condemnations are found in religious texts from Buddhism, Judaism ('' ribbit'' in Hebrew), Christianity, and Islam (''rib ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Maslahah

''Maslaha'' or ''maslahah'' (, ) is a concept in Sharia (Islamic divine law) regarded as a basis of law.I. Doi, Abdul Rahman. (1995). "Mașlahah". In John L. Esposito. ''The Oxford Encyclopedia of the Modern Islamic World''. Oxford: Oxford University Press. It forms a part of extended methodological principles of Islamic jurisprudence (''uṣūl al-fiqh'') and denotes prohibition or permission of something, according to necessity and particular circumstances, on the basis of whether it serves the public interest of the Muslim community (''ummah''). In principle, ''maslaha'' is invoked particularly for issues that are not regulated by the Qur'an, the ''sunnah'' (the teachings and practices of the Islamic prophet Muhammad), or ''qiyas'' (analogy). The concept is acknowledged and employed to varying degrees depending on the jurists and schools of Islamic jurisprudence (''madhhab''). The application of the concept has become more important in modern times because of its increasing rele ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Halal

''Halal'' (; ) is an Arabic word that translates to in English. Although the term ''halal'' is often associated with Islamic dietary laws, particularly meat that is slaughtered according to Islamic guidelines, it also governs ethical practices in business, finance (such as the prohibition of interest or ''riba''), and daily living. It encompasses broader ethical considerations, including fairness, social justice, and the treatment of animals. The concept of ''halal'' is central to Islamic practices and is derived from the Quran and the Sunnah (the teachings and practices of the Prophet Muhammad). In the Quran, the term ''halal'' is contrasted with the term ''haram'' (). The guidelines for what is considered ''halal'' or ''haram'' are laid out in Islamic jurisprudence (''fiqh''), and scholars interpret these guidelines to ensure compliance with Islamic principles. This binary opposition was elaborated into a more complex classification known as "Ahkam, the five decisions": Fard, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ahadith

Hadith is the Arabic word for a 'report' or an 'account f an event and refers to the Islamic oral tradition of anecdotes containing the purported words, actions, and the silent approvals of the Islamic prophet Muhammad or his immediate circle ( companions in Sunni Islam, Ahl al-Bayt in Shiite Islam). Each hadith is associated with a chain of narrators ()—a lineage of people who reportedly heard and repeated the hadith from which the source of the hadith can be traced. The authentication of hadith became a significant discipline, focusing on the ''isnad'' (chain of narrators) and '' matn'' (main text of the report). This process aimed to address contradictions and questionable statements within certain narrations. Beginning one or two centuries after Muhammad's death, Islamic scholars, known as muhaddiths, compiled hadith into distinct collections that survive in the historical works of writers from the second and third centuries of the Muslim era ( 700−1000 CE). For ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |