|

Geolibertarians

Geolibertarianism is a political and economic ideology that integrates libertarianism with Georgism. It favors a taxation system based (as in Georgism) on income derived from land and natural resources instead of on labor, coupled with a minimalist model of government, as in libertarianism. The term was coined by the late economist Fred Foldvary in 1981. Geolibertarians recognize the right to private ownership of land, but only if fair recompense is paid to the community for the loss of access to that land. Some geolibertarians broaden out the tax base to include resource depletion, environmental damage, and other ancillaries to land use. A succinct summary of this philosophy can be found in Thomas Paine's 1797 pamphlet '' Agrarian Justice'': "Men did not make the earth. It is the value of the improvements only, and not the earth itself, that is individual property. Every proprietor owes to the community a ground rent for the land which he holds". Overview Geolibertarians mai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Libertarianism In The United States

In the United States, libertarianism is a political philosophy promoting individual liberty. According to common meanings of Conservatism in the United States, conservatism and Modern liberalism in the United States, liberalism in the United States, libertarianism has been described as ''Fiscal conservatism, conservative'' on economic issues (fiscal conservatism) and ''Cultural liberalism, liberal'' on personal freedom (cultural liberalism),Boaz, David; Kirby, David (October 18, 2006). ''The Libertarian Vote''. Cato Institute. though this is disputed. The movement is often associated with a foreign policy of non-interventionism.Olsen, Edward A. (2002). ''US National Defense for the Twenty-First Century: The Grand Exit Strategy''. Taylor & Francisp. 182. . Broadly, there are four principal traditions within libertarianism, namely the libertarianism that developed in the mid-20th century out of the revival tradition of classical liberalism in the United States after liberalism ass ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Free Market

In economics, a free market is an economic market (economics), system in which the prices of goods and services are determined by supply and demand expressed by sellers and buyers. Such markets, as modeled, operate without the intervention of Forms of government, government or any other external authority. Proponents of the free market as a normative ideal contrast it with a regulated market, in which a government intervenes in supply and demand by means of various methods such as taxes or regulations. In an idealized free market economy, prices for goods and services are set solely by the bids and offers of the participants. Scholars contrast the concept of a free market with the concept of a Coordinated market economy, coordinated market in fields of study such as political economy, new institutional economics, economic sociology, and political science. All of these fields emphasize the importance in currently existing market systems of rule-making institutions external to th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

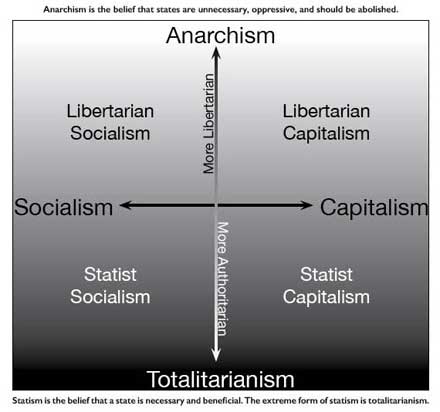

List Of Political Ideologies

In political science, a political ideology is a certain set of Ethics, ethical Ideal (ethics), ideals, principles, doctrines, myths or symbols of a social movement, institution, class or Social group, large group that explains how society should work and offers some political and cultural blueprint for a certain social order. A political ideology largely concerns itself with how to allocate Power (sociology), power and to what ends it should be used. Some political parties follow a certain ideology very closely while others may take broad inspiration from a group of related ideologies without specifically embracing any one of them. An ideology's popularity is partly due to the influence of moral entrepreneurs, who sometimes act in their own interests. Political ideologies have two dimensions: (1) goals: how society should be organized; and (2) methods: the most appropriate way to achieve this goal. An ideology is a collection of ideas. Typically, each ideology contains certai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Rent

In economics, economic rent is any payment to the owner of a factor of production in excess of the costs needed to bring that factor into production. In classical economics, economic rent is any payment made (including imputed value) or benefit received for non-produced inputs such as location (land) and for assets formed by creating official privilege over natural opportunities (e.g., patents). In the moral economy of neoclassical economics, assuming the market is natural, and does not come about by state and social contrivance, economic rent includes income gained by labor or state beneficiaries or other "contrived" exclusivity, such as labor guilds and unofficial corruption. Overview In the moral economy of the economics tradition broadly, economic rent is distinct from producer surplus, or normal profit, both of which are theorized to involve productive human action. Economic rent is also independent of opportunity cost, unlike economic profit, where opportunity c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Labour (economics)

Labour economics seeks to understand the functioning and dynamics of the Market (economics), markets for wage labour. Labour (human activity), Labour is a commodity that is supplied by labourers, usually in exchange for a wage paid by demanding firms. Because these labourers exist as parts of a social, institutional, or political system, labour economics must also account for social, cultural and political variables. Labour markets or job markets function through the interaction of workers and employers. Labour economics looks at the suppliers of labour services (workers) and the demanders of labour services (employers), and attempts to understand the resulting pattern of wages, employment, and income. These patterns exist because each individual in the market is presumed to make rational choices based on the information that they know regarding wage, desire to provide labour, and desire for leisure. Labour markets are normally geographically bounded, but the rise of the internet ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Right-libertarianism

Right-libertarianism,Rothbard, Murray (1 March 1971)"The Left and Right Within Libertarianism". ''WIN: Peace and Freedom Through Nonviolent Action''. 7 (4): 6–10. Retrieved 14 January 2020.Goodway, David (2006). '' Anarchist Seeds Beneath the Snow: Left-Libertarian Thought and British Writers from William Morris to Colin Ward''. Liverpool: Liverpool University Pressp. 4. "The problem with the term 'libertarian' is that it is now also used by the Right. ..In its moderate form, right libertarianism embraces ''laissez-faire'' liberals like Robert Nozick who call for a minimal State, and in its extreme form, anarcho-capitalists like Murray Rothbard and David Friedman who entirely repudiate the role of the State and look to the market as a means of ensuring social order".Carlson, Jennifer D. (2012). "Libertarianism". In Miller, Wilburn R., ed. ''The Social History of Crime and Punishment in America''. London: Sage Publicationsp. 1006. . also known as libertarian capitalism, or righ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ecotax

An environmental tax, ecotax (short for ecological taxation), or green tax is a tax levied on activities which are considered to be harmful to the environment and is intended to promote environmentally friendly alternatives via economic incentives. One notable example is a carbon tax. Such a policy can complement or avert the need for regulatory ( command and control) approaches. Often, an ecotax policy proposal may attempt to maintain overall tax revenue by proportionately reducing other taxes (e.g. taxes on wages and income or property taxes); such proposals are known as a green tax shift towards ecological taxation. Ecotaxes address the failure of free markets to consider environmental impacts. Ecotaxes are examples of Pigouvian taxes, which are taxes on goods whose production or consumption creates external costs or externalities. An example might be philosopher Thomas Pogge's proposed Global Resources Dividend. Categories of Environmental Taxes The term, environmenta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Resource Depletion

Resource depletion occurs when a natural resource is consumed faster than it can be replenished. The value of a resource depends on its availability in nature and the cost of extracting it. By the law of supply and demand, the Scarcity, scarcer the resource the more valuable it becomes. There are several types of resource depletion, including but not limited to: wetland and ecosystem degradation, soil erosion, aquifer depletion, and overfishing. The depletion of wildlife populations is called ''defaunation''. It is a matter of research and debate how humanity will be impacted and what the future will look like if resource consumption continues at the current rate, and when specific resources will be completely exhausted. History of resource depletion The depletion of resources has been an issue since the beginning of the 19th century amidst the Industrial Revolution, First Industrial Revolution. The extraction of both renewable and non-renewable resources increased drasticall ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Severance Tax

Severance taxes are taxes imposed on the removal of natural resources within a taxing jurisdiction. Severance taxes are most commonly imposed in oil producing states within the United States. Resources that typically incur severance taxes when extracted include oil, natural gas, coal, uranium, and timber. Some jurisdictions use other terms like gross production tax. Note that severance taxes are used in jurisdictions where most resource extraction occurs on privately owned land and/or where sub-surface minerals are privately owned (for example, the United States). Where the resources are publicly owned to begin with (for example, in most Commonwealth and European Union countries), it is not a tax but rather a resource royalty that is paid. In the case of the forestry industry, this royalty is called " stumpage". Oil and natural gas Severance taxes are set and collected at the state level. States usually calculate the tax based on the value and/or volume produced; sometime ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pigovian Tax

A Pigouvian tax (also spelled Pigovian tax) is a tax on any market activity that generates negative externalities (i.e., external costs incurred by third parties that are not included in the market price). It is a method that tries to internalize negative externalities to achieve the Nash equilibrium and optimal Pareto efficiency. The tax is normally set by the government to correct an undesirable or inefficient market outcome (a market failure) and does so by being set equal to the external marginal cost of the negative externalities. In the presence of negative externalities, social cost includes private cost and external cost caused by negative externalities. This means the social cost of a market activity is not covered by the private cost of the activity. In such a case, the market outcome is not efficient and may lead to over-consumption of the product. Often-cited examples of negative externalities are environmental pollution and increased public healthcare costs assoc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Natural And Legal Rights

Some philosophers distinguish two types of rights, natural rights and legal rights. * Natural rights are those that are not dependent on the laws or customs of any particular culture or government, and so are ''universal'', ''fundamental rights, fundamental'' and ''inalienable'' (they cannot be repealed by human laws, though one can forfeit their enjoyment through one's actions, such as by violating someone else's rights). Natural law is the law of natural rights. * Legal rights are those bestowed onto a person by a given legal system (they can be modified, repealed, and restrained by human laws). The concept of positive law is related to the concept of legal rights. Natural law first appeared in ancient Greek philosophy, and was referred to by Roman philosopher Cicero. It was subsequently alluded to in the Bible, and then developed in the Middle Ages by Catholic philosophers such as Albert the Great, his pupil Thomas Aquinas, and Jean Gerson in his 1402 work "''De Vita Spiritua ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

State Ownership

State ownership, also called public ownership or government ownership, is the ownership of an Industry (economics), industry, asset, property, or Business, enterprise by the national government of a country or State (polity), state, or a public body representing a community, as opposed to an individual or Private property, private party. Public ownership specifically refers to industries selling goods and services to consumers and differs from Public good, public goods and government services financed out of a Government budget, government's general budget. Public ownership can take place at the Central government, national, regional government, regional, local government, local, or municipal levels of government; or can refer to non-governmental public ownership vested in autonomous public enterprises. Public ownership is one of the three major forms of property ownership, differentiated from private, Collective ownership, collective/cooperative, and common ownership. In marke ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |