|

Geoist

Georgism, in modern times also called Geoism, and known historically as the single tax movement, is an economic ideology holding that people should own the value that they produce themselves, while the economic rent derived from land—including from all natural resources, the commons, and urban locations—should belong equally to all members of society. Developed from the writings of American economist and social reformer Henry George, the Georgist paradigm seeks solutions to social and ecological problems based on principles of land rights and public finance that attempt to integrate economic efficiency with social justice. Georgism is concerned with the distribution of economic rent caused by land ownership, natural monopolies, pollution rights, and control of the commons, including title of ownership for natural resources and other contrived privileges (e.g., intellectual property). Any natural resource that is inherently limited in supply can generate economic rent, bu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

FREE TRADE FREE LAND FREE MEN (Georgist Campaign Button)

Free may refer to: Concept * Freedom, the ability to act or change without constraint or restriction * Emancipate, attaining civil and political rights or equality * Free (gratis), Free (''gratis''), free of charge * Gratis versus libre, the difference between the two common meanings of the adjective "free". Computing * Free (programming), a function that releases dynamically allocated memory for reuse * Free software, software usable and distributable with few restrictions and no payment *, an emoji in the Enclosed Alphanumeric Supplement block. Mathematics * Free object ** Free abelian group ** Free algebra ** Free group ** Free module ** Free semigroup * Free variable People * Free (surname) * Free (rapper) (born 1968), or Free Marie, American rapper and media personality * Free, a pseudonym for the activist and writer Abbie Hoffman * Free (active 2003–), American musician in the band FreeSol Arts and media Film and television * Free (film), ''Free'' (film), a 200 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Efficiency

In microeconomics, economic efficiency, depending on the context, is usually one of the following two related concepts: * Allocative or Pareto efficiency: any changes made to assist one person would harm another. * Productive efficiency: no additional output of one good can be obtained without decreasing the output of another good, and production proceeds at the lowest possible average total cost. These definitions are not equivalent: a market or other economic system may be allocatively but not productively efficient, or productively but not allocatively efficient. There are also other definitions and measures. All characterizations of economic efficiency are encompassed by the more general engineering concept that a system is efficient or optimal when it maximizes desired outputs (such as utility) given available inputs. Standards of thought There are two main standards of thought on economic efficiency, which respectively emphasize the distortions created by ''governme ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

David Ricardo

David Ricardo (18 April 1772 – 11 September 1823) was a British political economist, politician, and member of Parliament. He is recognized as one of the most influential classical economists, alongside figures such as Thomas Malthus, Adam Smith and James Mill. Ricardo was born in London as the third surviving child of a successful stockbroker and his wife. He came from a Sephardic Jewish family of Portuguese origin. At 21, he eloped with a Quaker and converted to Unitarianism, causing estrangement from his family. He made his fortune financing government borrowing and later retired to an estate in Gloucestershire. Ricardo served as High Sheriff of Gloucestershire and bought a seat in Parliament as an earnest reformer. He was friends with prominent figures like James Mill, Jeremy Bentham, and Thomas Malthus, engaging in debates over various topics. Ricardo was also a member of The Geological Society, and his youngest sister was an author. As MP for Portarlington, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Adam Smith

Adam Smith (baptised 1723 – 17 July 1790) was a Scottish economist and philosopher who was a pioneer in the field of political economy and key figure during the Scottish Enlightenment. Seen by some as the "father of economics"——— or the "father of capitalism".———— He is known for two classic works: ''The Theory of Moral Sentiments'' (1759) and ''The Wealth of Nations, An Inquiry into the Nature and Causes of the Wealth of Nations'' (1776). The latter, often abbreviated as ''The Wealth of Nations'', is regarded as his ''magnum opus'', marking the inception of modern economic scholarship as a comprehensive system and an academic discipline. Smith refuses to explain the distribution of wealth and power in terms of divine will and instead appeals to natural, political, social, economic, legal, environmental and technological factors, as well as the interactions among them. The work is notable for its contribution to economic theory, particularly in its exposition o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Thomas Paine

Thomas Paine (born Thomas Pain; – In the contemporary record as noted by Conway, Paine's birth date is given as January 29, 1736–37. Common practice was to use a dash or a slash to separate the old-style year from the new-style year. In the old calendar, the new year began on March 25, not January 1. Paine's birth date, therefore, would have been before New Year, 1737. In the new style, his birth date advances by eleven days and his year increases by one to February 9, 1737. The Old Style and New Style dates, O.S. link gives more detail if needed. – June 8, 1809) was an English-born American Founding Fathers of the United States, Founding Father, French Revolutionary, inventor, and political philosophy, political philosopher. He authored ''Common Sense'' (1776) and ''The American Crisis'' (1776–1783), two of the most influential pamphlets at the start of the American Revolution, and he helped to inspire the Colonial history of the United States, colonial era Patriot ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Baruch Spinoza

Baruch (de) Spinoza (24 November 163221 February 1677), also known under his Latinized pen name Benedictus de Spinoza, was a philosopher of Portuguese-Jewish origin, who was born in the Dutch Republic. A forerunner of the Age of Enlightenment, Spinoza significantly influenced modern biblical criticism, 17th-century rationalism, and Dutch intellectual culture, establishing himself as one of the most important and radical philosophers of the early modern period. Influenced by Stoicism, Thomas Hobbes, René Descartes, Ibn Tufayl, and heterodox Christians, Spinoza was a leading philosopher of the Dutch Golden Age. Spinoza was born in Amsterdam to a Marrano family that fled Portugal for the more tolerant Dutch Republic. He received a traditional Jewish education, learning Hebrew and studying sacred texts within the Portuguese Jewish community, where his father was a prominent merchant. As a young man, Spinoza challenged rabbinic authority and questioned Jewish doctrines, leadi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

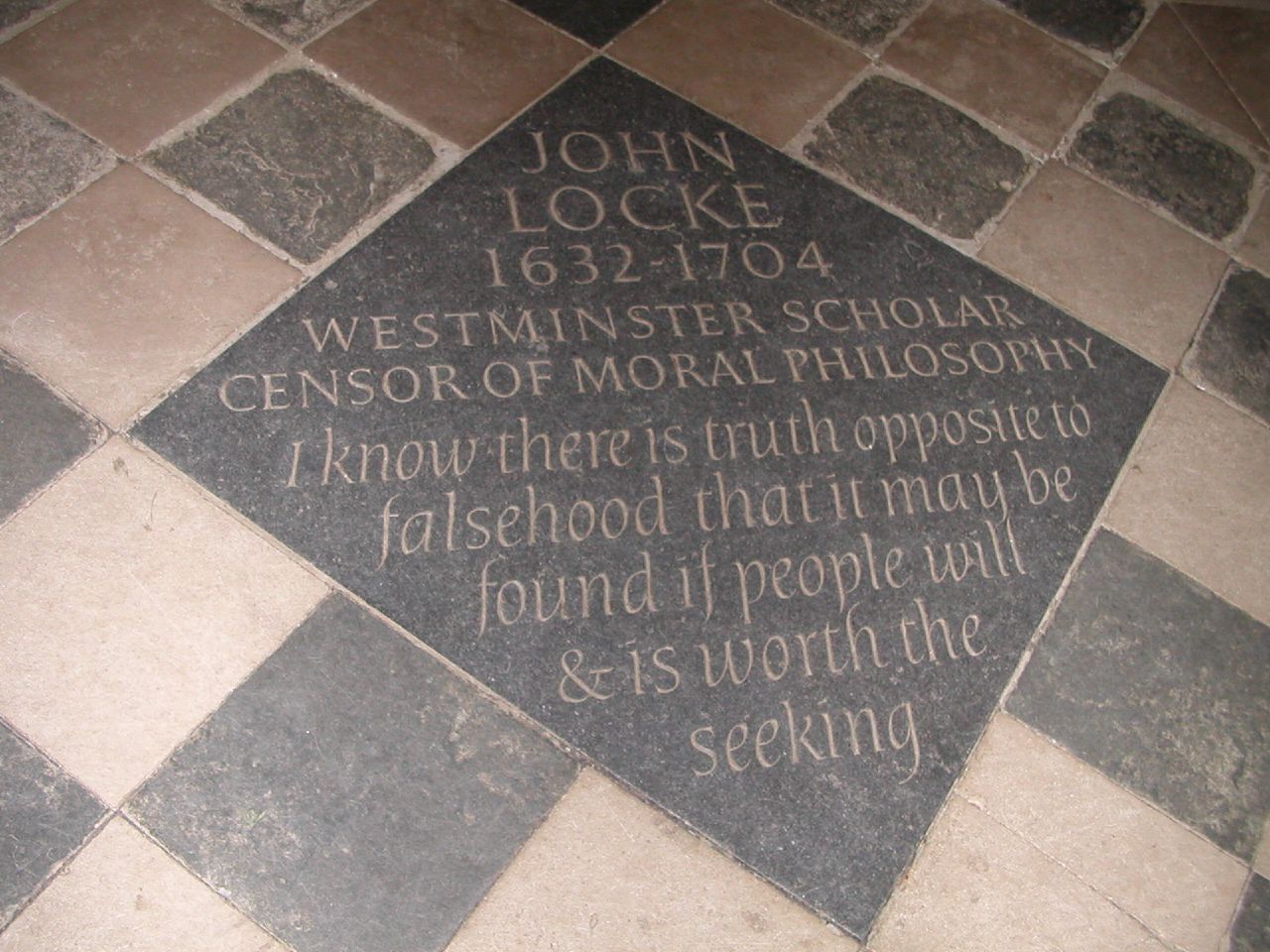

John Locke

John Locke (; 29 August 1632 (Old Style and New Style dates, O.S.) – 28 October 1704 (Old Style and New Style dates, O.S.)) was an English philosopher and physician, widely regarded as one of the most influential of the Enlightenment thinkers and commonly known as the "father of liberalism". Considered one of the first of the British empiricists, following the tradition of Francis Bacon, Locke is equally important to social contract theory. His work greatly affected the development of epistemology and political philosophy. His writings influenced Voltaire and Jean-Jacques Rousseau, and many Scottish Enlightenment thinkers, as well as the American Revolutionaries. His contributions to classical republicanism and liberal theory are reflected in the United States Declaration of Independence. Internationally, Locke's political-legal principles continue to have a profound influence on the theory and practice of limited representative government and the protection of basic right ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Progress And Poverty

''Progress and Poverty: An Inquiry into the Cause of Industrial Depressions and of Increase of Want with Increase of Wealth: The Remedy'' is an 1879 book by social theorist and economist Henry George. It is a treatise on the questions of why poverty accompanies economic and technological progress and why economies exhibit a tendency toward cyclical boom and bust. George uses history and deductive logic to argue for a radical solution focusing on the capture of economic rent from natural resource and land titles. ''Progress and Poverty'', George's first book, sold several million copies, becoming one of the highest selling books of the late 1800s. It helped spark the Progressive Era and a worldwide social reform movement around an ideology now known as Georgism. Jacob Riis, for example, explicitly marks the beginning of the Progressive Era awakening as 1879 because of the date of this publication. The Princeton historian Eric F. Goldman wrote this about the influence of '' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Citizen's Dividend

Citizen's dividend is a proposed policy based upon the Georgist principle that the natural world is the Commons, common property of all people. It is proposed that all citizens receive regular payments (dividends) from revenue raised by leasing or taxing the monopoly of valuable land (economics), land and other natural resources. History A concept akin to a citizen's dividend was known in Classical Athens. In 483 BC, a massive new seam of silver was found in the Athenian silver mines at Laurium.PlutarchThemistocles 4/ref> The dispersal of this provoked great debate. The statesman Aristides proposed the profit from this should be distributed among the Athenian citizens.Holland, pp. 219–222 However he was opposed by Themistocles, who proposed the money be spent building warships for the Athenian navy. In the end, Themistocles' policy was the one adopted. In the United Kingdom and United States, the idea can be traced back to Thomas Paine's essay, ''Agrarian Justice' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Basic Income

Universal basic income (UBI) is a social welfare proposal in which all citizens of a given population regularly receive a minimum income in the form of an unconditional transfer payment, i.e., without a means test or need to perform Work (human activity), work. In contrast, a ''guaranteed minimum income'' is paid only to those who do not already receive an income that is enough to live on. A UBI would be received independently of any other income. If the level is sufficient to meet a person's basic needs (i.e., at or above the poverty line), it is considered a ''full basic income''; if it is less than that amount, it is called a ''partial basic income''. As of 2025, no country has implemented a full UBI system, but two countries—Mongolia and Iran—have had a partial UBI in the past. There have been Universal basic income pilots, numerous pilot projects, and the idea Universal basic income around the world, is discussed in many countries. Some have labelled UBI as utopian du ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sales Tax

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase. When a tax on goods or services is paid to a governing body directly by a consumer, it is usually called a use tax. Often laws provide for the Tax exemption, exemption of certain goods or services from sales and use tax, such as food, education, and medicines. A value-added tax (VAT) collected on goods and services is related to a sales tax. See Value-added tax#Comparison with sales tax, Comparison with sales tax for key differences. Types Conventional or retail sales tax is levied on the sale of a good to its final good, final end-user and is charged every time that item is sold retail. Sales to businesses that later resell the goods are not charged the tax. A purchaser who is not an end-user is usually issued a "resale certificate" by the taxing authority and required to provide the cer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tariff

A tariff or import tax is a duty (tax), duty imposed by a national Government, government, customs territory, or supranational union on imports of goods and is paid by the importer. Exceptionally, an export tax may be levied on exports of goods or raw materials and is paid by the exporter. Besides being a source of revenue, import duties can also be a form of regulation of International trade, foreign trade and policy that burden foreign products to encourage or safeguard domestic industry. Protective tariffs are among the most widely used instruments of protectionism, along with import quotas and export quotas and other non-tariff barriers to trade. Tariffs can be fixed (a constant sum per unit of imported goods or a percentage of the price) or variable (the amount varies according to the price). Tariffs on imports are designed to raise the price of imported goods to discourage consumption. The intention is for citizens to buy local products instead, which, according to support ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |