|

Direct Access Trading

In finance, an electronic trading platform, also known as an online trading platform, is a computer software program that can be used to place orders for financial products over a network with a financial intermediary. Various financial products can be traded by the trading platform, over a communication network with a financial intermediary or directly between the participants or members of the trading platform. This includes products such as stocks, bonds, currencies, commodities, derivatives and others, with a financial intermediary such as brokers, market makers, investment banks or stock exchanges. Such platforms allow electronic trading to be carried out by users from any location and are in contrast to traditional floor trading using open outcry and telephone-based trading. Sometimes the term trading platform is also used in reference to the trading software alone. Electronic trading platforms typically stream live market prices on which users can trade and may provide ad ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trading System

Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. This type of trading attempts to leverage the speed and computational resources of computers relative to human traders. In the twenty-first century, algorithmic trading has been gaining traction with both retail and institutional traders. A study in 2019 showed that around 92% of trading in the Forex market was performed by trading algorithms rather than humans. It is widely used by investment banks, pension funds, mutual funds, and hedge funds that may need to spread out the execution of a larger order or perform trades too fast for human traders to react to. However, it is also available to private traders using simple retail tools. The term algorithmic trading is often used synonymously with automated trading system. These encompass a variety of trading strategies, some of which are based on formulas and results ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Trading

Social trading is a form of investing that allows investors to observe the trading behavior of their peers and expert Trader (finance), traders. The primary objective is to follow their investment strategies using copy trading or mirror trading. Social trading requires little or no knowledge about financial markets. History One of the first social trading platforms was Collective2] which began offering a social trading functionality to retail traders as early as 2003 (preceding ZuluTrade by four years). In 2010, social trading started to achieve a greater degree of mainstream appeal with eToro, followed by Wikifolio in 2012. Europe-baseNAGA listed on Frankfurt Stock Exchange since 2017, claims more than EUR 27 billion was traded on its platform in the second half of 2019. Some of the contemporary social trading platforms other than the ones mentioned already are Trading Motion, iSystems, and FX Junction, among others. Research MIT Computer Scientist and researcher Yaniv Altshuler ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Copy Trading

Copy trading enables individuals in the financial markets to automatically copy positions opened and managed by other selected individuals. Unlike mirror trading, a method that allows traders to copy specific strategies, copy trading links a portion of the copying trader's funds to the account of the copied investor. Any trading action made thenceforth by the copied investor, such as opening a position, assigning Stop Loss and Take Profit orders, or closing a position, are also executed in the copying trader's account according to the proportion between the copied investor's account and the copying trader's allotted copy trading funds. The copying trader usually retains the ability to disconnect copied trades and manage them themselves. They can also close the copy relationship altogether, which closes all copied positions at the current market price. Copied investors, who are called leaders or signal providers, are often compensated by flat monthly subscription fees on the part ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

EToro

eToro Group Ltd. is an Israel, Israeli multi-asset Investment management, investment and social trading company focused on providing Financial trading, financial services. eToro was founded in 2007 in Tel Aviv by Yoni Assia, Ronen Assia, and David Ring. The company's headquarters are located in Central District (Israel), Central Israel, with global offices in Cyprus, United Kingdom, United States, Australia, Germany and UAE. In September 2024, eToro had 38 million registered users, and over 3.5 million funded accounts. At the beginning of 2025, the company filed for Nasdaq (U.S.) listing and went public on May 14. In 2025, the company valuation was $5.5 billion. History eToro was founded as RetailFX in 2007 in Tel Aviv, by brothers Yoni Assia and Ronen Assia together with David Ring. In 2010, the firm released the eToro OpenBook social Wrap account, investment platform. This included the CopyTrader feature, enabling users to replicate the trading strategies of top-pe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

E-Trade

E*TRADE is an investment brokerage and electronic trading platform that operates as a subsidiary of Morgan Stanley. History In 1982, physicist William A. Porter and Bernard A. Newcomb founded TradePlus in Palo Alto, California, with $15,000 in capital. In 1983, it launched its first trade via a Compuserve network. In 1992, Porter and Newcomb founded E-Trade and made electronic trading available to individual investors. On August 16, 1996, the company became a public company via an initial public offering. The company sold 5,665,000 shares of its common stock for $10.50 per share under the stock ticker "ETFC" on the NASDAQ stock exchange. The company figured prominently in the dot-com boom, as both a way to speculate in internet stocks and an internet stock itself. In October 2020, the company was acquired by Morgan Stanley. Management history In November 2007, Mitch Caplan resigned as CEO and Citadel LLC received a seat on the board of directors of the company after C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Globex Trading System

The Globex Trading System is an electronic trading platform for trading both futures contracts and options contracts that is operated by the Chicago Mercantile Exchange (CME). It was introduced in 1992 and was the first global electronic trading platform designed to handle trading of financial derivatives using electronic trading. It was developed by the Chicago Mercantile Exchange (CME) along with other technology companies and it was designed to work with the existing open outcry system at the exchange to help improve efficiencies and extend the hours of trading. Globex, or "CME Globex", offers trading approximately 23 hours a day, five days a week.Norton, Leslie P."An Exchange's Embarrassment of Riches" Barron's, 19, April 2010 . History In 1987 work began on the design of a new electronic system with the goal of enhancing futures trading at the CME. The system had gone through many iterations and enhancements throughout the next five years until 1992 when the first electronic f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Association Of Securities Dealers

The Financial Industry Regulatory Authority (FINRA) is a private American corporation that acts as a self-regulatory organization (SRO) that regulates member brokerage firms and exchange markets. FINRA is the successor to the National Association of Securities Dealers, Inc. (NASD) as well as to the member regulation, enforcement, and arbitration operations of the New York Stock Exchange. The U.S. government agency that acts as the ultimate regulator of the U.S. securities industry, including FINRA, is the U.S. Securities and Exchange Commission (SEC). Overview The Financial Industry Regulatory Authority is the largest independent regulator for all securities firms doing business in the United States. FINRA's mission is to protect investors by making sure the United States securities industry operates fairly and honestly. As of October 2023, FINRA oversaw 3,394 brokerage firms, 149,887 branch offices and approximately 612,457 registered securities representatives. FINRA has ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nasdaq

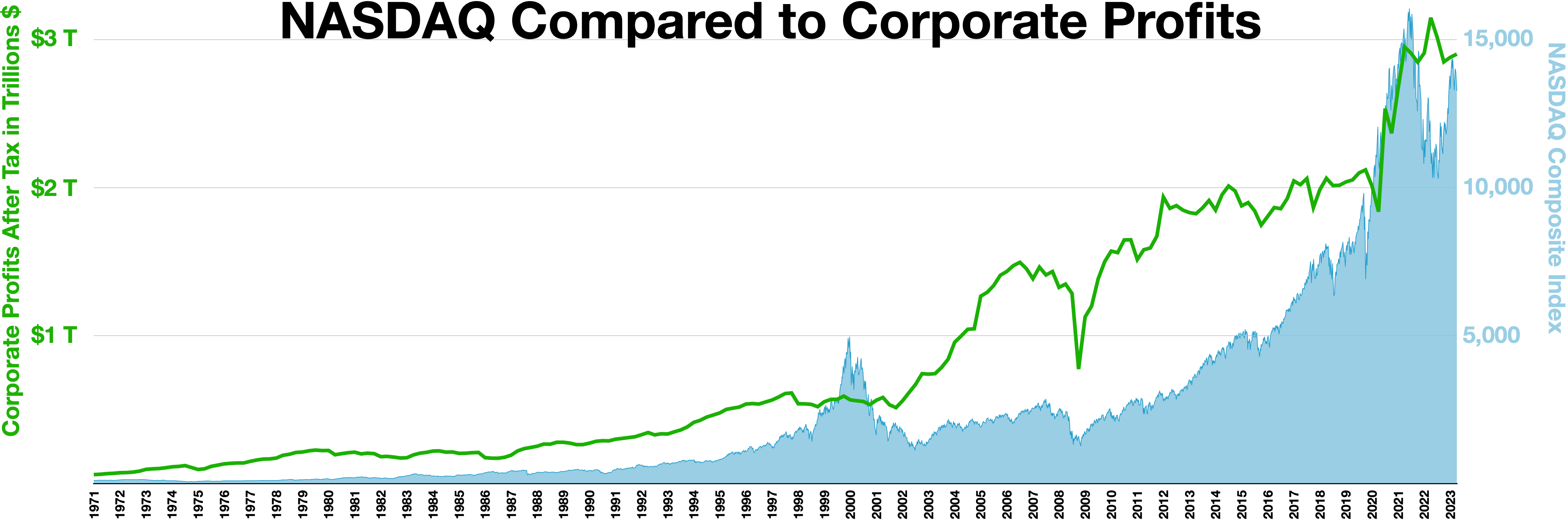

The Nasdaq Stock Market (; National Association of Securities Dealers Automated Quotations) is an American stock exchange based in New York City. It is the most active stock trading venue in the U.S. by volume, and ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc. (which the exchange also lists; ticker symbol NDAQ), which also owns the Nasdaq Nordic stock market network and several U.S.-based stock and options exchanges. Although it trades stock of healthcare, financial, media, entertainment, retail, hospitality, and food businesses, it focuses more on technology stocks. The exchange is made up of both American and foreign firms, with China and Israel being the largest foreign sources. History 1972–2000 Nasdaq, Inc. was founded in 1971 by the National Association of Securities Dealers (NASD), which is now known as the Financial Industry Regulatory A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Request For Quotation

A request for quotation (RfQ) is a business process in which a company or public entity requests a quote from a supplier for the purchase of specific products or services. RfQ generally means the same thing as Call for bids (CfB) and Invitation for bid (IfB). An RfQ typically involves more than the price per item. Information like payment terms, quality level per item or contract length may be requested during the bidding process. To receive correct quotes, RfQs often include the specifications of the items/services to make sure all the suppliers are bidding on the same item/service. Logically, the more detailed the specifications A specification often refers to a set of documented requirements to be satisfied by a material, design, product, or service. A specification is often a type of technical standard. There are different types of technical or engineering specificati ..., the more accurate the quote will be and comparable to the other suppliers. Another reason for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dumb Terminal

A computer terminal is an electronic or electromechanical hardware device that can be used for entering data into, and transcribing data from, a computer or a computing system. Most early computers only had a front panel to input or display bits and had to be connected to a terminal to print or input text through a keyboard. Teleprinters were used as early-day hard-copy terminals and predated the use of a computer screen by decades. The computer would typically transmit a line of data which would be printed on paper, and accept a line of data from a keyboard over a serial or other interface. Starting in the mid-1970s with microcomputers such as the Sphere 1, Sol-20, and Apple I, display circuitry and keyboards began to be integrated into personal and workstation computer systems, with the computer handling character generation and outputting to a CRT display such as a computer monitor or, sometimes, a consumer TV, but most larger computers continued to require termin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dark Pool

In finance, a dark pool (also black pool) is a private forum ( alternative trading system or ATS) for trading securities, derivatives, and other financial instruments."The New Financial Industry" (March 30, 2014). 65 ''Alabama Law Review'' 567 (2014); Temple University Legal Studies Research Paper No. 2014-11; via SSRN. Liquidity on these markets is called dark pool liquidity. The bulk of dark pool trades represent large trades by s that are offered away from pub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |