|

Deleveraging

At the microeconomics, micro-economic level, deleveraging refers to the reduction of the leverage ratio, or the percentage of debt in the balance sheet of a single economic entity, such as a household or a firm. It is the opposite of leverage (finance), leveraging, which is the practice of borrowing money to acquire assets and multiply gains and losses. At the macroeconomics, macro-economic level, deleveraging of an economy refers to the simultaneous reduction of debt levels in multiple sectors, including private sectors and the government sector. It is usually measured as a decline of the total debt to nominal GDP, GDP ratio in the national accounts. The deleveraging of an economy following a financial crisis has significant macro-economic consequences and is often associated with severe recessions. In microeconomics While leverage (finance), leverage allows a borrower to acquire assets and multiply gains in good times, it also leads to multiple losses in bad times. During a mark ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Great Recession

The Great Recession was a period of market decline in economies around the world that occurred from late 2007 to mid-2009.“US Business Cycle Expansions and Contractions” United States NBER, or National Bureau of Economic Research, updated March 14, 2023. This government agency dates the Great Recession as starting in December 2007 and bottoming-out in June 2009. The scale and timing of the recession varied from country to country (see map). At the time, the International Monetary Fund (IMF) concluded that it was the most severe economic and financial meltdown since the Great Depression. The causes of the Great Recession include a combination of vulnerabilities that developed in the financial system ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Recession

In economics, a recession is a business cycle contraction that occurs when there is a period of broad decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various events, such as a financial crisis, an external trade shock, an adverse supply shock, the bursting of an economic bubble, or a large-scale Anthropogenic hazard, anthropogenic or natural disaster (e.g. a pandemic). There is no official definition of a recession, according to the International Monetary Fund, IMF. In the United States, a recession is defined as "a significant decline in economic activity spread across the market, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales." The European Union has adopted a similar definition. In the United Kingdom and Canada, a recession is defined as negative economic growth for two consecutive qu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Debt

A country's gross government debt (also called public debt or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit occurs when a government's expenditures exceed revenues. Government debt may be owed to domestic residents, as well as to foreign residents. If owed to foreign residents, that quantity is included in the country's external debt. In 2020, the value of government debt worldwide was $87.4 US trillion, or 99% measured as a share of gross domestic product (GDP). Government debt accounted for almost 40% of all debt (which includes corporate and household debt), the highest share since the 1960s. The rise in government debt since 2007 is largely attributable to stimulus measures during the Great Recession, and the COVID-19 recession. Governments may take on debt when the government's spending desires do not match government revenue flows. Taking deb ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Leverage Cycle

Leverage is defined as the ratio of the asset value to the cash needed to purchase it. The leverage cycle can be defined as the procyclical expansion and contraction of leverage over the course of the business cycle. The existence of procyclical leverage amplifies the effect on asset prices over the business cycle. Why is leverage significant? Conventional economic theory suggests that interest rates determine the demand and supply of loans. This convention does not take into account the concept of default and hence ignores the need for collateral. When an investor buys an asset, they may use the asset as a collateral and borrow against it, however the investor will not be able to borrow the entire amount. The investor has to finance with their own capital the difference between the value of the collateral and the asset price, known as the margin. Thus the asset becomes leveraged. The need to partially finance the transaction with the investor's own capital implies that their ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Emerging Markets

An emerging market (or an emerging country or an emerging economy) is a market that has some characteristics of a developed market, but does not fully meet its standards. This includes markets that may become developed markets in the future or were in the past. The term "frontier market" is used for Developing country, developing countries with smaller, riskier, or more illiquid capital markets than "emerging". As of 2006, the economies of Economy of China, China and Economy of India, India are considered to be the largest emerging markets. According to ''The Economist'', many people find the term outdated, but no new term has gained traction. Emerging market hedge fund capital reached a record new level in the first quarter of 2011 of $121 billion. Emerging market economies’ share of global PPP-adjusted GDP has risen from 27 percent in 1960 to around 53 percent by 2013. The ten largest emerging economies by List of countries by GDP (nominal), nominal GDP are 4 of the 9 BRICS cou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Sector

The public sector, also called the state sector, is the part of the economy composed of both public services and public enterprises. Public sectors include the public goods and governmental services such as the military, law enforcement, public infrastructure, public transit, public education, along with public health care and those working for the government itself, such as elected officials. The public sector might provide services that a non-payer cannot be excluded from (such as street lighting), services which benefit all of society rather than just the individual who uses the service. Public enterprises, or state-owned enterprises, are self-financing commercial enterprises that are under public ownership which provide various private goods and services for sale and usually operate on a commercial basis. Organizations that are not part of the public sector are either part of the private sector or voluntary sector. The private sector is composed of the economic sec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

US Private Debt To GDP By Sector

US or Us most often refers to: * ''Us'' (pronoun), the objective case of the English first-person plural pronoun ''we'' * US, an abbreviation for the United States US, U.S., Us, us, or u.s. may also refer to: Arts and entertainment Albums * ''Us'' (Brother Ali album) or the title song, 2009 * ''Us'' (Empress Of album), 2018 * ''Us'' (Mull Historical Society album), 2003 * ''Us'' (Peter Gabriel album), 1992 * ''Us'' (EP), by Moon Jong-up, 2021 * ''Us'', by Maceo Parker, 1974 * ''Us'', mini-album by Peakboy, 2019 Songs * "Us" (James Bay song), 2018 * "Us" (Jennifer Lopez song), 2018 * "Us" (Regina Spektor song), 2004 * "Us" (Gracie Abrams song), 2024 * "Us", by Azealia Banks from '' Fantasea'', 2012 * "Us", by Celine Dion from ''Let's Talk About Love'', 1997 * "Us", by Gucci Mane from '' Delusions of Grandeur'', 2019 * "Us", by Spoon from '' Hot Thoughts'', 2017 Other media * US Festival, two 1980s California music festivals organized by Steve Wozniak * ''Us'' (1991 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Share (finance)

In finance, financial markets, a share (sometimes referred to as stock or Equity (finance), equity) is a unit of Equity (finance), equity ownership in the Stock, capital stock of a corporation. It can refer to units of mutual funds, limited partnerships, and real estate investment trusts. Share capital refers to all of the shares of an enterprise. The owner of shares in a company is a shareholder (or stockholder) of the corporation. A share expresses the ownership relationship between the company and the shareholder. The denominated value of a share is its face value, and the total of the face value of issued shares represent the Financial capital, capital of a company, which may not reflect the market value of those shares. The income received from the ownership of shares is a dividend. There are different types of shares such as equity shares, preference shares, deferred shares, redeemable shares, bonus shares, right shares, and employee stock option plan shares. Terminology ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equity (finance)

In finance, equity is an ownership interest in property that may be subject to debts or other liabilities. Equity is measured for accounting purposes by subtracting liabilities from the value of the assets owned. For example, if someone owns a car worth $24,000 and owes $10,000 on the loan used to buy the car, the difference of $14,000 is equity. Equity can apply to a single asset, such as a car or house, or to an entire business. A business that needs to start up or expand its operations can sell its equity in order to raise cash that does not have to be repaid on a set schedule. When liabilities attached to an asset exceed its value, the difference is called a deficit and the asset is informally said to be "underwater" or "upside-down". In government finance or other non-profit settings, equity is known as "net position" or "net assets". Origins The term "equity" describes this type of ownership in English because it was regulated through the system of equity law that devel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Market

A capital market is a financial market in which long-term debt (over a year) or equity-backed securities are bought and sold, in contrast to a money market where short-term debt is bought and sold. Capital markets channel the wealth of savers to those who can put it to long-term productive use, such as companies or governments making long-term investments. Financial regulators like Securities and Exchange Board of India (SEBI), Bank of England (BoE) and the U.S. Securities and Exchange Commission (SEC) oversee capital markets to protect investors against fraud, among other duties. Transactions on capital markets are generally managed by entities within the financial sector or the treasury departments of governments and corporations, but some can be accessed directly by the public. As an example, in the United States, any American citizen with an internet connection can create an account with TreasuryDirect and use it to buy bonds in the primary market. However, sales to in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

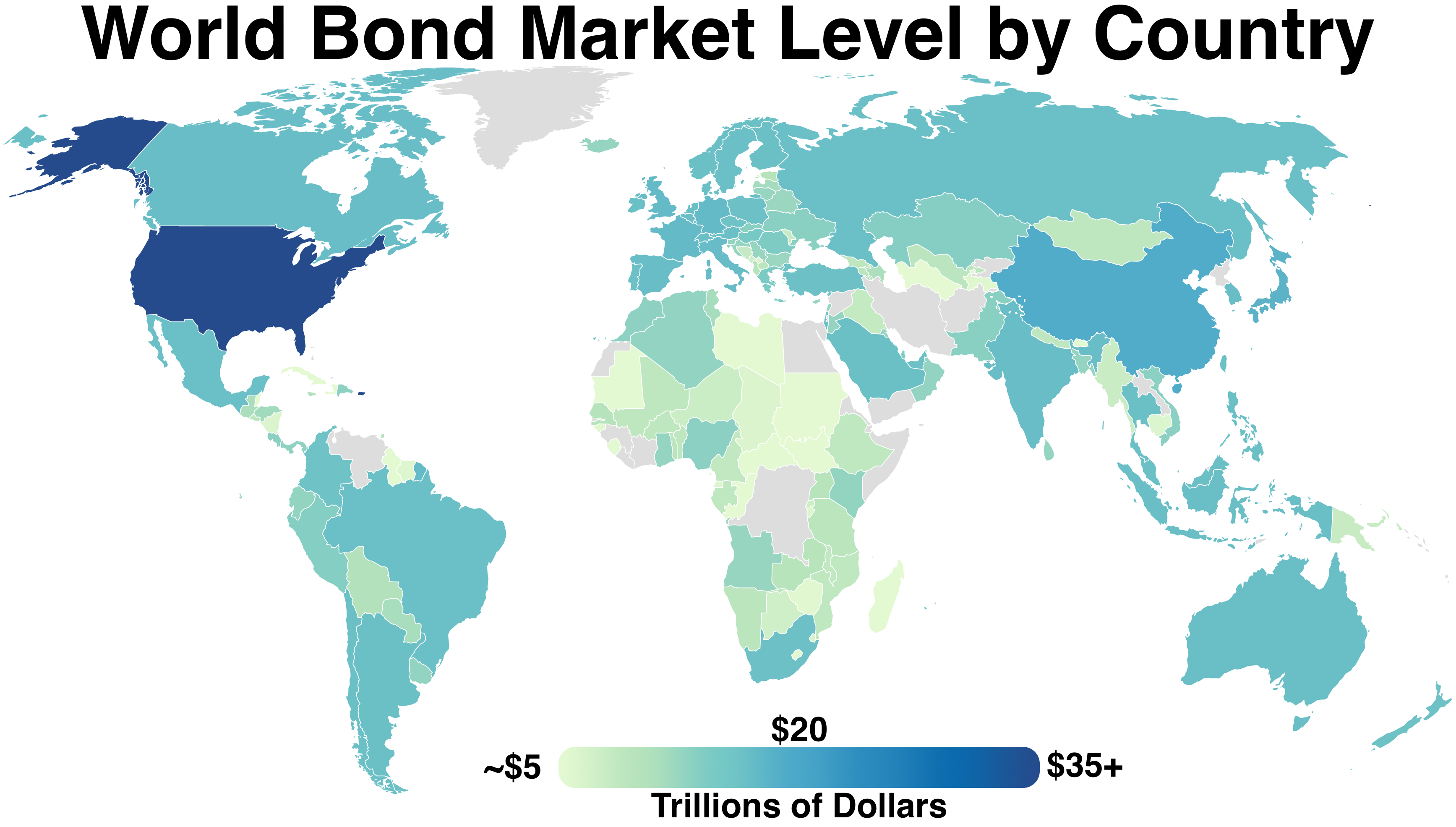

Credit Market

The bond market (also debt market or credit market) is a financial market in which participants can issue new debt, known as the primary market, or buy and sell debt securities, known as the secondary market. This is usually in the form of bonds, but it may include notes, bills, and so on for public and private expenditures. The bond market has largely been dominated by the United States, which accounts for about 39% of the market. In 2021, the size of the bond market (total debt outstanding) was estimated to be $119 trillion worldwide and $46 trillion for the US market, according to the Securities Industry and Financial Markets Association (SIFMA). Bonds and bank loans form what is known as the ''credit market''. The global credit market in aggregate is about three times the size of the global equity market. Bank loans are not securities under the U.S. Securities and Exchange Act, but bonds typically are and are therefore more highly regulated. Bonds are typically not secured ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Security (finance)

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition. In some jurisdictions the term specifically excludes financial instruments other than equity and fixed income instruments. In some jurisdictions it includes some instruments that are close to equities and fixed income, e.g., equity warrants. Securities may be represented by a certificate or, more typically, they may be "non-certificated", that is in electronic ( dematerialized) or " book entry only" form. Certificates may be ''bearer'', meaning they entitle the holder to rights under the security merely by holding the security, or ''registered'', meaning they entitle the holder to rights only if they appear on a securi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |